Lifeway’s 788% shareholder return in 5 years shatters ‘bigger is better’ myth—what your farm’s missing.

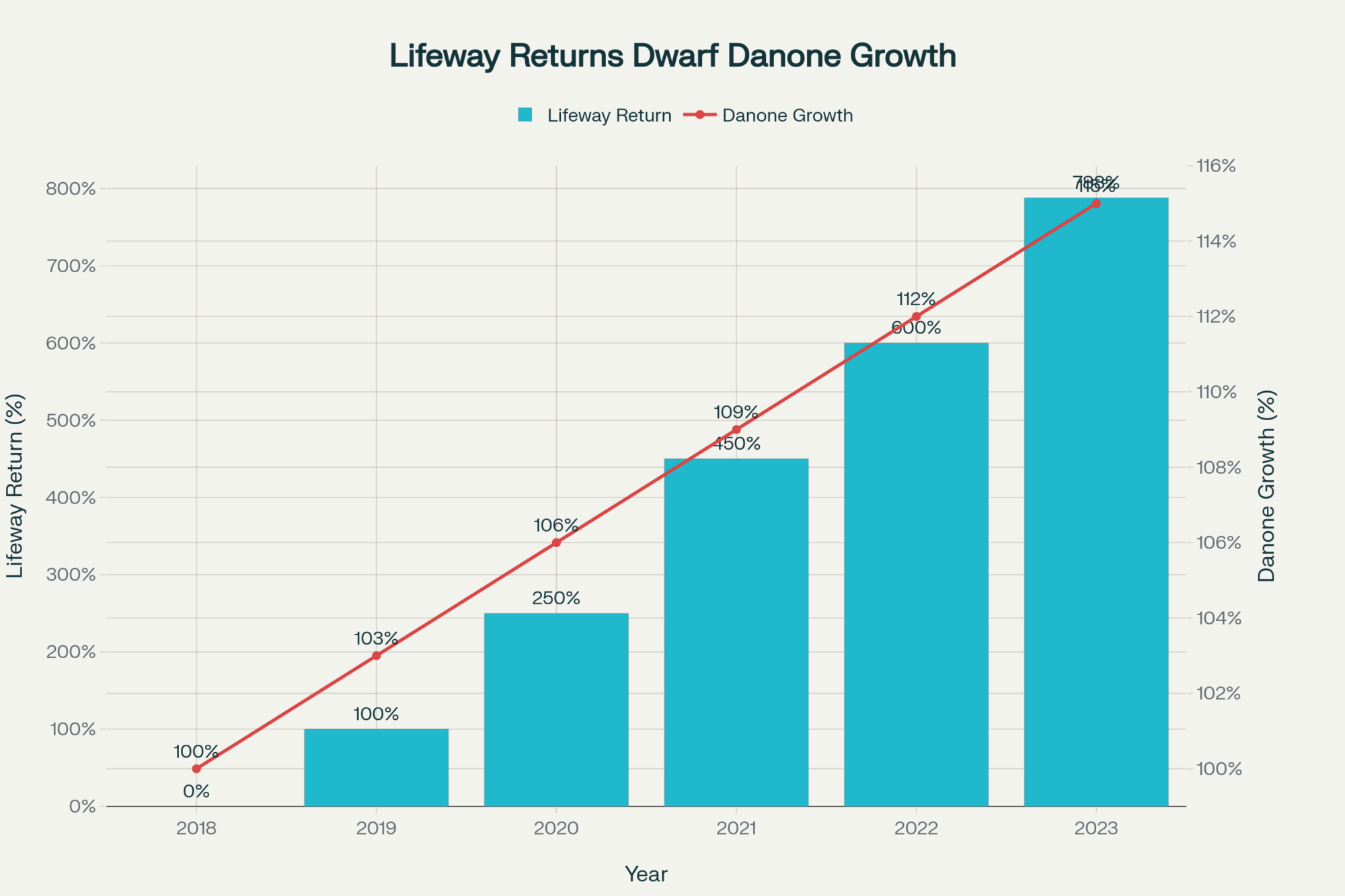

EXECUTIVE SUMMARY: Here’s what we discovered: Lifeway Foods, a modest kefir maker, turned down a $307M buyout offer, delivering an astounding 18% sales growth and 788% shareholder returns over five years, far outperforming corporate giants like Danone. While Danone labored with a mere 3% growth in North America, Lifeway’s nimble innovation—rolling out new products in 4-6 months—is redefining success in a market where the global kefir segment alone is expected to grow to over $2 billion by 2030, according to Cognitive Market Research and Grand View. This challenges dairy orthodoxy, highlighting that speed outperforms scale. Family dynamics, market strategy, and corporate consolidation tactics collide, exposing uncomfortable truths the industry hides. Dairy farmers must rethink survival—this isn’t about getting bigger; it’s about moving faster.

KEY TAKEAWAYS:

- Achieve up to 18% sales growth by innovating fast, launching quality products within 6 months (Lifeway earnings call 2025).

- Monitor shareholder returns as a key success metric—Lifeway’s 788% return over 5 years dwarfs traditional corporate benchmarks (Morningstar 2024).

- Avoid undervaluing your operation—know the true valuation multiples for functional dairy products (12-15x EBITDA) versus commodity dairy (8-10x EBITDA).

- Question industry consolidation fears—independent processors and family farms are showing sustainable double-digit growth amid market shifts.

- Prioritize decision-making speed in feeding, breeding, and product development to outpace competitors—speed beats scale every time.

You know how butterfat’s tanking this fall down in Wisconsin, and fresh cow problems are popping up with these early winter chills? Well, this Lifeway-Danone saga? It hits right home like a hammer to the thumb.

Last month, I was jawing with one of those old-school dairy operators in Iowa—a guy who’s seen enough dry lot disasters to know when things are really bad out there. He looked me dead in the eye and said, “Andrew, with these long, cold winter nights rolling in, the fresh cows are giving us hell like never before.”

That made me think hard—this Lifeway story might just be the slap in the face our industry’s been needing.

Here’s the deal. Lifeway Foods, a small kefir company out of Wisconsin, flat-out told Danone to shove their $307 million offer. Yup, three hundred and seven million bucks on the table, and not a penny less, according to Dairy Reporter’s August 18th, 2025 coverage of their acquisition talks.

Now, the media’s calling Lifeway crazy for saying no. “How do you say no to that kind of dough?”

Well, honestly, don’t fall for that noise—they don’t know what’s really going on here.

Corporate ag’s been preaching for years: you gotta get bigger or get out. Lifeway just flipped that script completely on its head, and trust me, the big boys aren’t thrilled about it one bit.

This shakeup is rattling barns from Wisconsin clear over to Ohio, and the numbers… well, they tell the story clearer than any cow’s health record ever could.

Numbers That Hit Like a Cold Snap

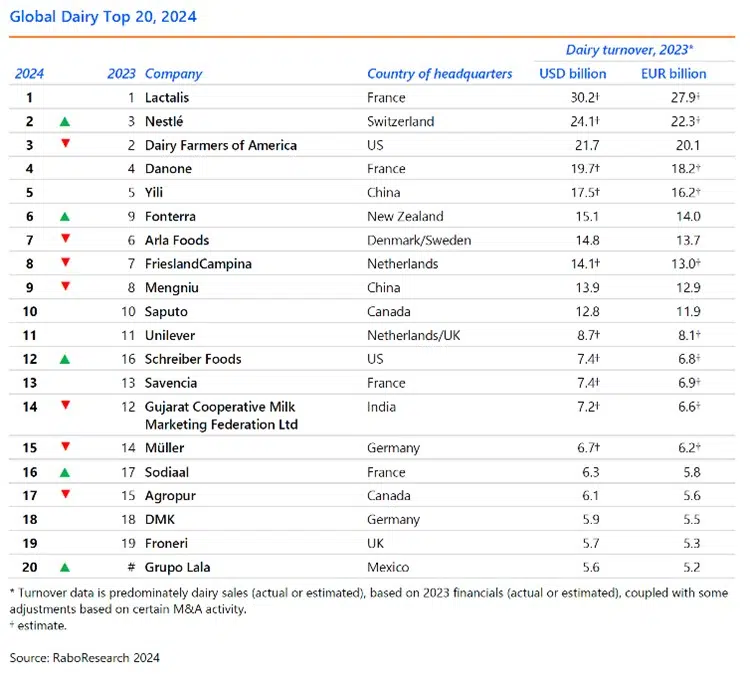

Lifeway’s Q2 2025 financials showed an 18% jump in sales, pulling in $53.9 million in volume-led growth—outperforming analyst expectations by 7.8%, as Dairy Reporter documented in their August coverage. Meanwhile, Danone’s North American division barely managed a 3% lift in the first half of 2025, according to their July H1 results.

That’s like bringing baler twine to a tractor pull.

Now, here’s what really turned my head: Morningstar data shows Lifeway shareholders have been riding a jaw-dropping 788% return over the past five years. Seven hundred and eighty-eight percent. While most of us are scraping for decent milk prices.

And Danone? Well, according to the SEC Schedule 13D/A filing from September 17th, 2025, they’ve owned exactly 22.7% of Lifeway for over 20 years, just sitting there watching this little outfit leave them in the dust quarter after quarter.

The corporate gears move slower than a tractor stuck in spring mud, I swear.

When Speed Beats Size Every Damn Time

Now get this—Lifeway’s launching new products, like collagen-infused kefir and probiotic dressings, in just 4 to 6 months from idea to store shelves, according to their August 2025 earnings call. Meanwhile, Danone’s committees take years to decide on a new flavor.

You know what that’s like? It’s like me deciding to breed my best cow and having her drop a calf before you’ve even figured out which bull to use.

Buying a company just to slow it down? That’s like buying a new sprayer and only using it to water the front lawn at half-speed.

Family Drama That Cuts Deeper Than Winter Wind

Family drama’s in full swing here—CEO Julie Smolyansky is fighting her own family members who hold 27% of shares and want her to sell, documented extensively in Dairy Reporter coverage and SEC filings throughout 2024.

Imagine having your own blood trying to sell your farm out from under you, and it’s all in writing for everyone to see. Your own family is calling you “borderline criminal” in legal documents just because you won’t cash out.

But Julie’s no quitter. She told her board, “I’ve said no to my family for years, and I’m not bowing to some suits from Europe.”

That kind of grit? That’s what you only see in farmers dealing with fresh cow problems in the dead of February.

The Valuation Shell Game They Don’t Want You to See

| Dairy Operation Type | Typical EBITDA Multiple | Lifeway’s Projected EBITDA (2027) | Estimated Value |

|---|---|---|---|

| Commodity Dairy | 8-10x | $45-50M | $360-500M |

| Functional Dairy | 12-15x | $45-50M | $540-750M |

| Danone’s Offer | 6.8x | $45M | $307M |

Here’s where it gets really dirty. Danone valued Lifeway at 8-10 times earnings—standard for commodity dairies, per industry M&A reports from 2023-2025.

But Lifeway’s not commodity swill. They’re in the premium, functional food space, where valuations often hit 12-15 times earnings according to industry valuation studies.

With a projected adjusted EBITDA of $45-50 million by 2027—straight from their own earnings call transcripts—Lifeway’s real value is much closer to half a billion dollars, not what Danone’s lowball bid suggested.

Classic corporate maneuver: buy dirt cheap, flip for billions, and crush the small operators who won’t play ball.

The Industry Scramble That Followed

Since Lifeway shut the door in September 2025, the whispered buzz in the dairy world has been that big players are ramping up deal-making, throwing cash upfront, and ditching those slow courting rituals they used to love.

Over in Europe, mergers like Arla-DMK sped up significantly, partly because of watching this situation unfold, according to recent Dairy Reporter coverage of European consolidation trends.

And get this—Hungary blocked a foreign takeover of Alföldi Tej dairy co-op in August 2025, citing food security concerns according to the Hungarian Competition Authority’s official decision. That’s homegrown dairy operations fighting back, just like Lifeway stood its ground here.

Winners and Losers in This New Game

Who’s winning this game? Independent processors hustling with real purpose, family operations growing legitimate double digits, and farmers finally getting premium prices instead of commodity pennies.

Who’s losing? The M&A sharks who built careers on easy pickings, the fearmongers who make money scaring farmers about getting left behind, and every producer stuck chasing commodity milk prices.

The Truth About Speed vs. Scale

Bottom line: scale is yesterday’s news. Speed is king now.

How fast can you pivot when feed costs spike in January? Who can flip rations or breeding plans on a dime when market conditions shift? Who launches new products before competitors even know there’s a market opportunity?

That’s what survival looks like in 2025.

Look at the global kefir market—researchers at Cognitive Market Research and Grand View Research document it growing from approximately $1.3 billion in 2025 to over $2 billion by 2030, with a steady 5-6% annual growth rate.

While the giants bicker in boardrooms about synergies, nimble operations like Lifeway are owning that growth in real time.

What You Better Start Doing Right Now

So, what do you do with all this?

First: Watch out for consultants yammering about consolidation without showing you the actual receipts that back up their claims.

Second: Make sure your milk’s priced for what it really is—premium product, not commodity swill.

Third: Time how long does it take your operation to fix problems, because if you’re slow, you’re already falling behind.

The revolution? It’s happening right now.

Poison pill consultations have surged 300% since last September, according to the Corporate Governance Legal Services Survey. Investment banks are rewriting their valuation playbooks faster than anyone expected.

But most farms can’t match Julie Smolyansky’s specific combination of 18% growth rates and that kind of ironclad grit. The next acquisition target lacking both? Gone in less than two months.

The Bottom Line

Bottom line: Lifeway’s story isn’t just about dodging a buyout. It proves the raw power of independence and speed over corporate scale.

Family farms aren’t just holding their ground—they’re rewriting the entire playbook while corporate ag is still stuck reading from the old manual.

If a tiny kefir maker from Wisconsin can outrun multinational giants, then size isn’t everything. Hell, it might not be anything.

So ask yourself this: can your farm move fast enough to stay ahead in this new game, or are you next on the menu?

Because the dairy industry just learned a $307 million lesson about moving fast and staying independent. Smart producers will put that lesson to work before their corporate neighbors figure out what just hit them.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – This article provides a tactical how-to guide on technology adoption, revealing the hidden costs and realistic ROI for robotic milking systems. It offers actionable benchmarks to ensure your investments deliver genuine labor savings and production gains, not just sticker shock.

- Europe’s Strategic Dairy Revolution: Why Cutting Herds is Making Producers Rich – Go beyond herd expansion with a strategic look at profitability through contraction. This analysis reveals how European farms are commanding 25-30% price premiums by focusing on component optimization and strategic culling, reinforcing that efficiency beats scale every time.

- The Robot Revolution: Transforming Organic Dairy Farms with Smart Tech in 2025 – This piece offers a forward-looking, innovative perspective on how emerging technologies like AI and robotics are reshaping even traditional sectors like organic dairy. It provides a deeper understanding of future-proof strategies that combine technology with core values.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.