Holstein bulls at $800. Beef‑on‑dairy at $1,750. Same cow, same calving—double the cheque. Why are you still breeding everything Holstein?

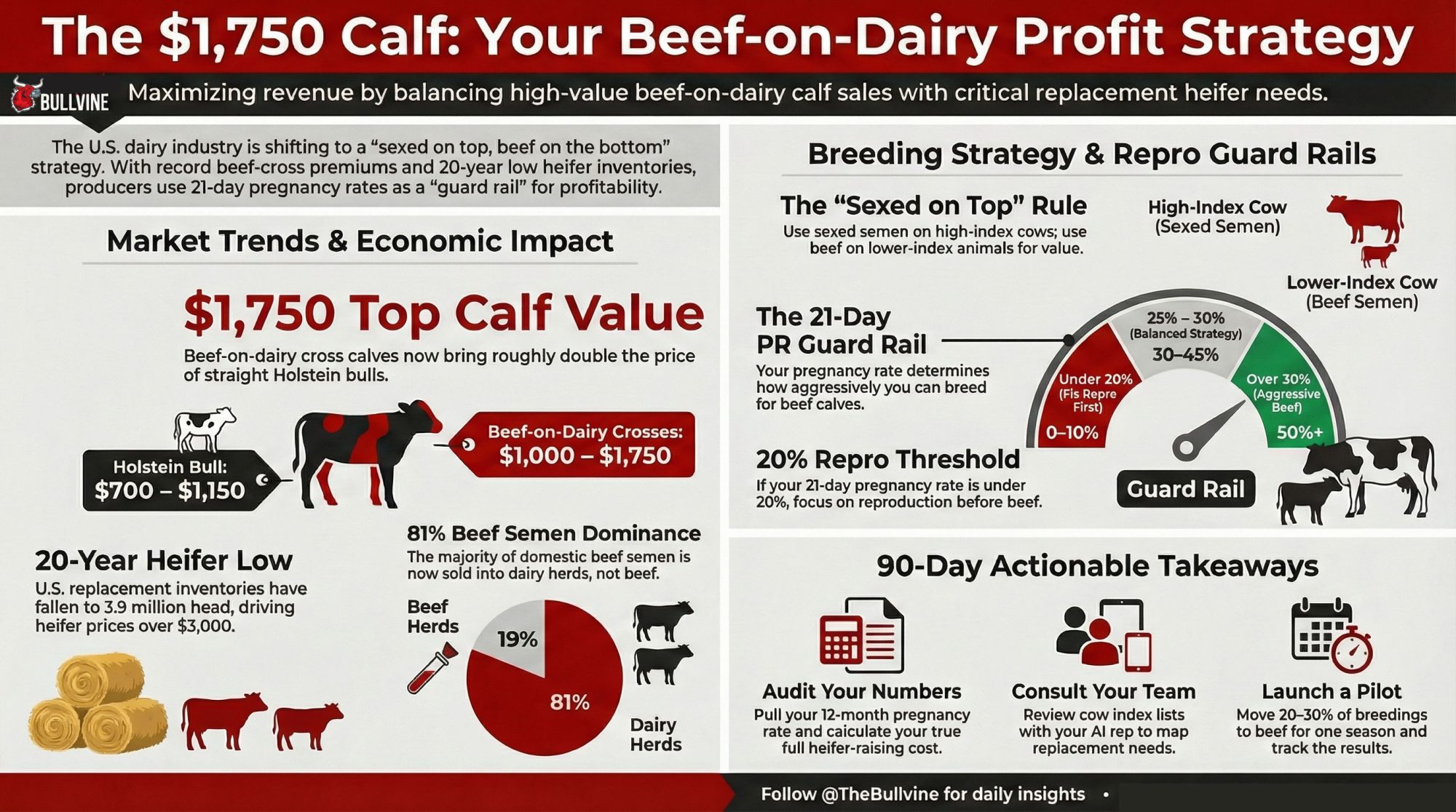

EXECUTIVE SUMMARY: In many U.S. sale barns today, Holstein bull calves that once brought $300–$450 are now commonly in the $700–$1,000 range in stronger markets, while well‑bred beef‑on‑dairy calves are cashing cheques up to about $1,750 in some auctions. At the same time, U.S. replacement heifer inventories have fallen to a 20‑year low near 3.9 million head as processors invest roughly $10 billion in new and expanded plants that will need milk to run. That combination has pushed 81% of domestic beef semen sales into dairy herds and made the “sexed on top, beef on the bottom” strategy hard to ignore. The catch is that it only pays long‑term if your 21‑day pregnancy rate stays above about 20% and you have heifers to spare, with herds in the 30–40% band able to run 50% or more of their breedings to beef while herds under 25% are usually better off fixing repro first. Three Wisconsin families—Hillview, Hiemstra, and Dornacker—show how registered Holsteins, a soil‑driven 170‑cow system, and a ProCROSS robot herd are all turning those same numbers into very different but profitable plans. By the end, you’ll know which of three breeding “paths” your own numbers put you in and what to do over the next 90 days to match sexed and beef semen to your repro, heifer, and calf markets.

In strong Wisconsin markets, beef‑on‑dairy calves are bringing up to about $1,750 a head and Holstein bull calves are often in the $800–$1,000 range, with top sales in other regions breaking the $1,000 mark as well. U.S. milk replacement heifer inventories are down to roughly 3.9 million head as of January 1, 2026—a 20‑year low—with CoBank warning they could shrink another 800,000 head before 2027. At the same time, 81% of domestic beef semen now goes into dairy cows, not beef herds. If you’re breeding cows, managing heifers, or signing milk and cattle contracts in 2026, that mix isn’t background noise. It’s the math that decides whether your breeding program keeps you ahead of the curve or leaves you short of replacements when the processor wants more milk.

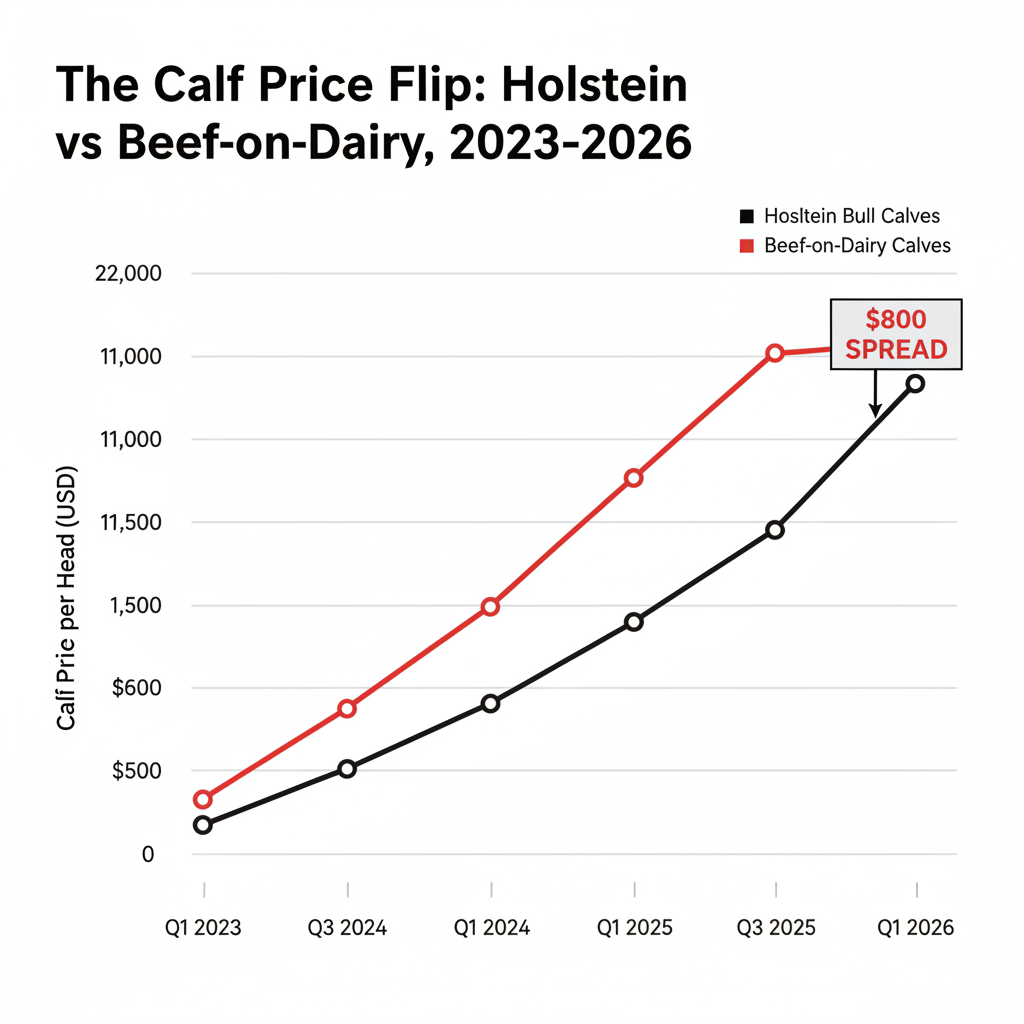

| Quarter | Holstein Bull Calf Price (USD) | Beef-on-Dairy Calf Price (USD) | Spread (USD) |

|---|---|---|---|

| Q1 2023 | $350 | $800 | $450 |

| Q3 2023 | $450 | $1,100 | $650 |

| Q1 2024 | $600 | $1,350 | $750 |

| Q3 2024 | $750 | $1,500 | $750 |

| Q1 2025 | $850 | $1,600 | $750 |

| Q3 2025 | $900 | $1,700 | $800 |

| Q1 2026 | $950 | $1,750 | $800 |

If you’re already selling calves, buying semen, and watching heifer checks climb, this is aimed squarely at you. The question isn’t “Should I try beef‑on‑dairy?” anymore. It’s: given your repro numbers and heifer pipeline, how hard can you lean into beef‑on‑dairy without blowing a hole in your future fresh pen?

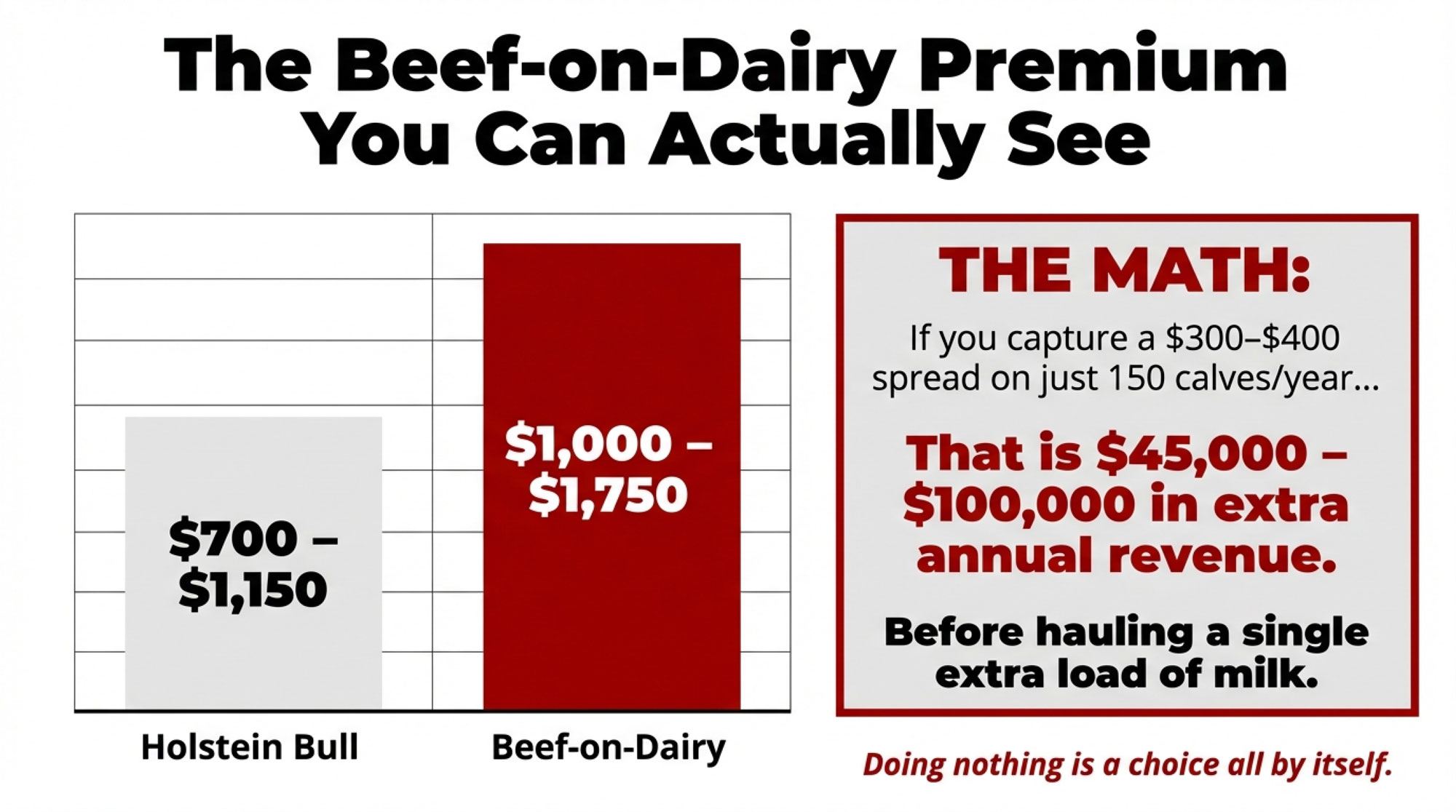

The Beef‑on‑Dairy Premium You Can Actually See

For years, bull calves were the side hustle. They helped pay a bill or two but didn’t change your year.

That flipped in late 2023 and into 2024. In sale barns across Wisconsin and Pennsylvania, newborn Holstein steer calves were bringing about $300–$450 per head, while beef‑cross calves hit as high as $1,750. Since then, a string of 2024–2025 market reports has pushed both numbers higher, with 2025 coverage noting newborn beef‑cross calves topping $1,500–$1,600 in Wisconsin and Premier’s January 2026 report listing beef‑dairy cross calves at $1,000–$1,750 and most Holstein bulls at $700–$1,150.

Sale reports from central U.S. barns tell a similar story. At South Central Livestock Exchange in 2024, “baby calf” reports—a mix of dairy and dairy‑beef—showed ranges like $175–$875 and $200–$780 per head depending on quality and condition. You don’t even need a breed column to see the pattern: the top calves bring several hundred dollars more than the bottom tier.

Since those 2023–2024 reports, national summaries from CattleFax‑linked analyses have pegged average day‑old beef‑on‑dairy calves around $1,400 in some U.S. markets, more than double levels from just a few years ago, while Holstein bull calves have also climbed. Exact numbers depend on your barn, your buyer, and this week’s market. The important part is the spread between plain Holsteins and well‑sired beef‑on‑dairy calves—and that spread has stayed real.

Run that against your own numbers. If you can consistently capture even a $300–$400 per‑head spread on 150–250 calves a year by shifting from commodity Holstein bulls to well‑managed beef‑on‑dairy crosses, you’re talking roughly $45,000–$100,000 in extra annual revenue before you haul one extra load of milk. Your math will be different, but the dollars are big enough that “doing nothing” is a choice all by itself.

How Hillview Turned Beef‑on‑Dairy Into a Revenue Engine

Jauquet’s Hillview Dairy in Luxemburg, Wisconsin, is the kind of place semen companies like to put on a brochure. They milk about 650 registered Holsteins in a cross‑ventilated freestall and have already been profiled for comfort, repro, and genetics.

Herds like Hillview didn’t jump into beef‑on‑dairy for the novelty. They moved because the economics said they could get more per pregnancy. Their breeding pattern now looks a lot like what the economists have been running in their models:

- Sexed Holstein semen on the top of the herd—your highest‑index cows and heifers—to generate just the replacements you actually need.

- Beef semen on lower‑index cows and groups where making another heifer mostly adds cost, not value.

- A structured repro program (timed AI, close fresh‑cow work, and consistent heat detection) so expensive straws aren’t wasted on sloppy timing.

An October 2021 paper in JDS Communications (“Economics of using beef semen on dairy herds”) found that once your 21‑day pregnancy rate hits roughly 20% or better, and once beef‑on‑dairy calves bring at least about 2x the price of straight Holstein bull calves, this “sexed on top, beef on the bottom” approach maximizes income from calves over semen cost—even when sexed semen is more than twice the price of conventional or beef semen.

If your current repro and local calf markets look anything like that, you’re playing in the same lane as Hillview, whether you’ve admitted it yet or not.

Josh Hiemstra: Beef‑on‑Dairy as a Whole‑Farm System

Not every story here is about a big registered Holstein herd. Some are about getting every acre to pull its weight.

Hiemstra Dairy in Brandon, Wisconsin, milks about 170 cows and farms roughly 790 acres of owned and rented land in western Fond du Lac County. Josh Hiemstra farms with his family and has been profiled for his cover crops and soil‑health focus; he thinks in rotations and roots as much as in pounds and litres.

In a 2024 Farm Progress feature, Josh laid out how beef‑on‑dairy fits his plan. He’d just sold a load of beef‑on‑dairy steers and heifers that averaged 1,400 pounds and brought $1.75 per pound—about $2,450 per head. Then came the line that stuck with a lot of dairymen:

“I could have been smart and sold them as baby calves,” he admits.

He didn’t, because on his farm:

- He can push more corn through finishing cattle than through the milking herd.

- Older infrastructure—tower silos, a conventional parlor—fits a mixed dairy‑plus‑beef setup just fine.

- Cover crops and “odd” forages that don’t slot neatly into a high‑producing TMR fit nicely into beef rations.

For Hiemstra, beef‑on‑dairy isn’t a side hustle bolted onto a dairy. It’s part of a whole‑farm plan to make soil, feed, facilities, and cattle all pull in the same direction.

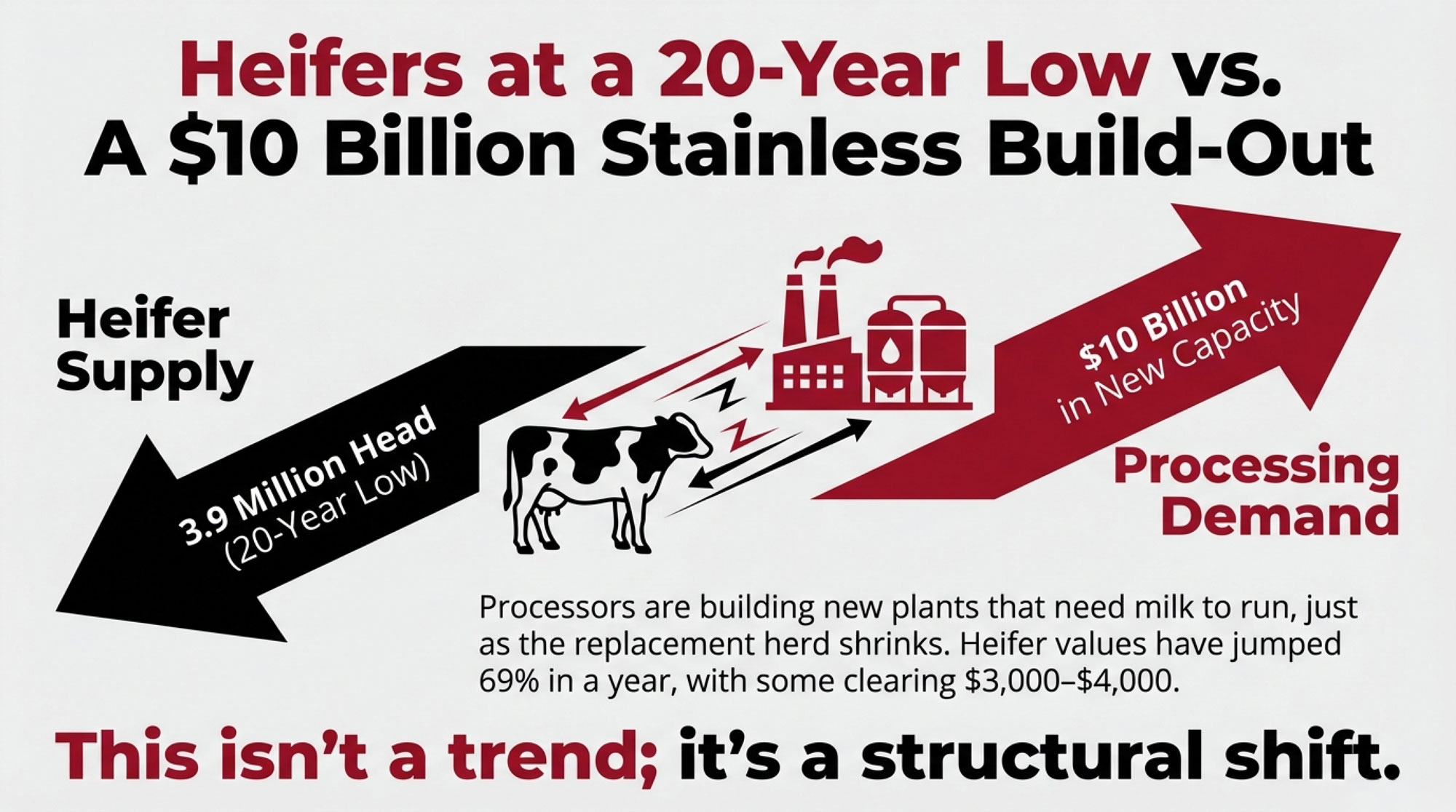

Heifers at a 20‑Year Low and a $10 Billion Stainless Build‑Out

Calf cheques feel good. Realizing you’ve starved your heifer pipeline does not.

CoBank’s August 2025 report “Dairy Heifer Inventories to Shrink Further Before Rebounding in 2027” pegs U.S. dairy replacement heifer inventories at a 20‑year low and projects they’ll shrink by another 800,000 head before they regain ground in 2027. USDA’s January 1, 2026, cattle report backs that up, putting milk replacement heifers at about 3.9 million head.

| Year | Replacement Heifer Inventory (million head) | Cumulative Processing Capacity Investment ($ billion) |

|---|---|---|

| 2020 | 4.8 | $0.5 |

| 2021 | 4.6 | $1.2 |

| 2022 | 4.4 | $2.5 |

| 2023 | 4.2 | $4.0 |

| 2024 | 4.0 | $6.5 |

| 2025 | 3.9 | $8.5 |

| 2026* | 3.7 | $10.0 |

| 2027* | 3.5 | $10.5 |

At the same time, CoBank highlights a “historic $10 billion” wave of new and expanded dairy processing capacity—cheese plants, ingredient plants, and value‑added facilities—set to come online through 2027. That’s a lot of new stainless chasing milk from a smaller pool of replacements.

On prices, CoBank’s Corey Geiger notes that heifer values “have reached record highs and could climb well above $3,000 per head.” Brownfield’s read on Wisconsin data shows replacement dairy animals jumping 69% in a year—from $1,990 in October 2023 to $2,850 in October 2024—with some Northwest sales “north of $4,000 per head.” Other 2025 coverage points to bred dairy heifers in many U.S. markets trading north of $3,000, with top strings clearing $4,000.

Every heifer you raise—or decide not to—now drags a much bigger number behind her than she did just a few years ago.

What Heifers Really Cost You

None of that means the right answer is to quit raising heifers. It does mean you should know, cold, what yours cost.

A 2019 economic analysis of pre‑weaning strategies found that:

- Feed typically accounts for about 46% of heifer‑raising costs.

- Pre‑weaning costs alone can range from roughly $259 to $583 per calf, depending on housing, milk program, and labour.

Once that calf gets to freshening, many 2024–2025 North American budgets put full heifer‑raising costs in the low‑to‑mid $2,000s per head, once you count feed, labour, interest, facilities, and death loss.

On the market side, CoBank and regional reports point to bred heifers trading around and above $3,000 per head, with special sales and select strings in some regions bringing over $4,000.

If your true cost to raise a heifer is running $2,300–$2,600, and local bred heifers are selling for $2,800–$3,200 or more, it’s perfectly rational to question the old “raise everything” reflex.

A simple rule of thumb: if your full heifer cost is consistently more than about 10–15% above the going price for solid bred heifers in your region, it’s time to pressure‑test a buy‑vs‑raise strategy with your adviser or lender instead of assuming raising is always the cheaper, safer play.

81% of Beef Semen Now Goes Into Dairy Cows

If you still think beef‑on‑dairy is a niche play for a few “progressive” herds, the semen market disagrees.

NAAB’s 2024 data shows 81% of all domestic beef semen sales now go onto dairy cows and heifers. Sexed dairy units keep climbing. Conventional dairy semen is getting squeezed from both sides.

The 2021 JDS Communications economics work predicts exactly that pattern. In its most profitable scenarios, herds:

- Use sexed Holstein semen on the top‑ranked cows and heifers to generate replacements with the genetics they want.

- Use beef semen on lower‑ranked or surplus animals, assuming beef‑on‑dairy calves bring at least about 2x the price of straight Holstein bull calves.

In other words, the semen sales chart already looks a lot like the recommended playbook: sexed for replacements, beef for value‑added calves, and conventional dairy semen steadily losing ground.

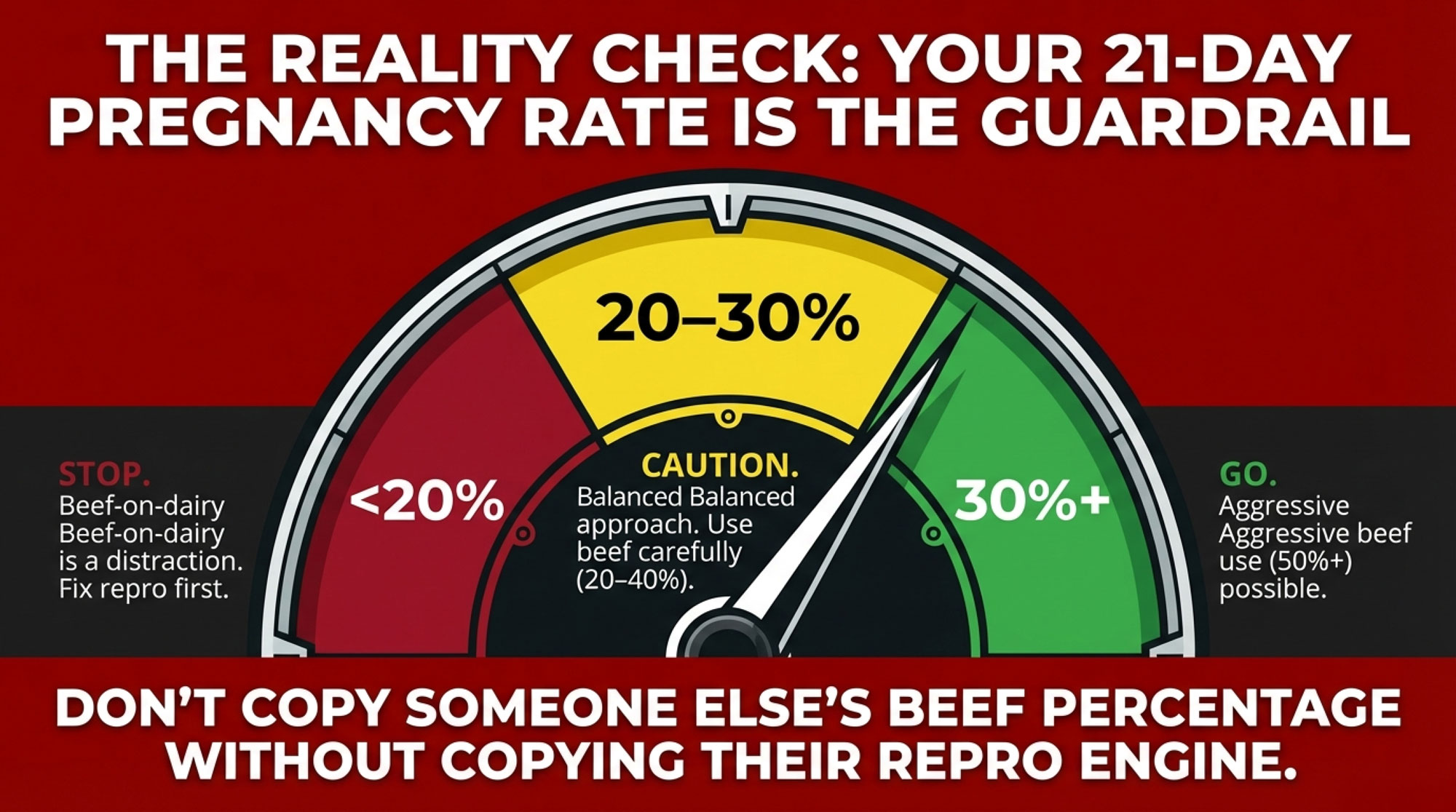

Your 21‑Day Pregnancy Rate Is the Guard Rail

Here’s where good herds quietly get themselves into trouble: copying someone else’s beef‑semen percentage without copying their repro engine.

UW–Extension work and the JDS Communications paper both land on the same idea: beef‑on‑dairy is a “spare pregnancy” business. You use pregnancies you don’t need for replacements to make higher‑value beef‑on‑dairy calves. If you’re short on pregnancies or short on heifers, chasing beef premiums can saw through your replacement pipeline fast.

High‑performing herds recognized by the Dairy Cattle Reproduction Council (DCRC) often run 21‑day pregnancy rates in the mid‑30s to low‑40s. Those herds have room to be aggressive with beef semen and still sleep at night about replacements.

If your 21‑day pregnancy rate is in the teens or low‑20s, you’re running a different race.

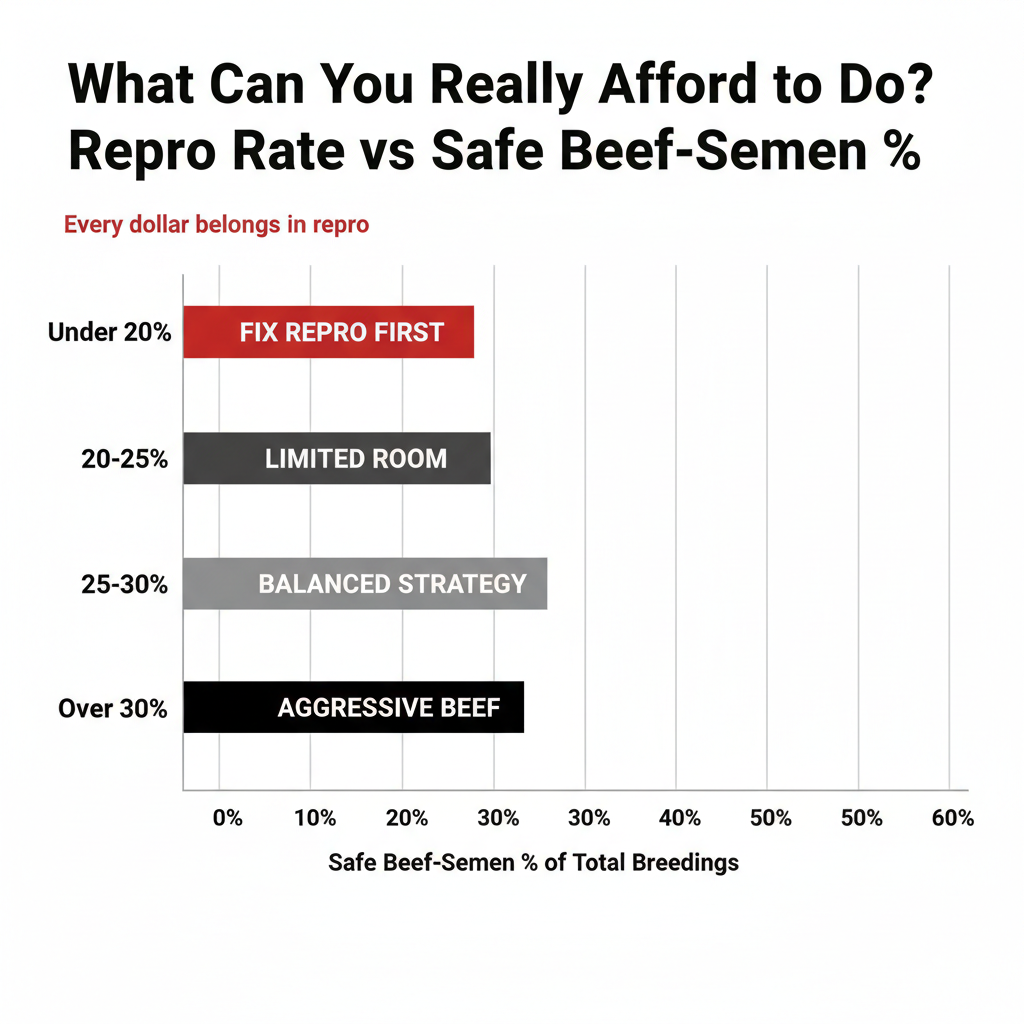

Here’s a simple frame based on the modelling and what the top repro herds actually do—not a law, but a practical starting point:

| 21‑Day Pregnancy Rate | Suggested Beef % of Breedings | What That Really Means |

| Under 20% | 0–10% | Beef‑on‑dairy is a distraction; every dollar belongs in repro first. |

| 20–25% | 20–30% | Limited room; focus on sexed semen on top cows; use beef carefully. |

| 25–30% | 30–45% | A balanced “both/and” beef‑plus‑sexed strategy is realistic. |

| Over 30% | 50%+ | Aggressive beef use can work if you tightly manage the heifer inventory. |

Those ranges line up with what the JDS Communications paper found and what DCRC‑type herds live every day. They’re guard rails, not commandments—but if your 21‑day PR is in the teens, cranking beef semen to 60% isn’t a bold strategy. It’s rolling the dice on your own replacement line.

Sexed Semen: The Old Knock vs the New Data

A lot of producers formed their opinions about sexed semen back when the technology was taking a 20‑point hit on conception. 2010 called. It wants those assumptions back.

A 2023 review in Animals pulled together results from multiple European and Irish studies on beef‑on‑dairy strategies. It found that modern sexed semen often hits 80–90% of conventional semen’s conception rates under good management, especially in heifers, not the steep penalty many people still quote from memory.

Both that review and the 2021 JDS Communications economics paper land on the same play:

- Use sexed semen on higher‑index animals so more of your replacements come from the top of the herd.

- Use beef semen on lower‑index animals to turn surplus pregnancies into calves with a better paycheque.

You may still see a few points lower conception with sexed vs conventional, depending on your handling and cow group. But if sexed semen lets you trim your heifer pipeline back to what you truly need—and frees up more pregnancies for beef‑on‑dairy calves that bring roughly double the Holstein price—the total calf‑plus‑semen line on your P&L can still climb.

So the real question isn’t “Is sexed semen good or bad?” It’s: what’s your actual cost per pregnancy with sexed, conventional, and beef semen, using your own conception rates and prices?

The Dornacker Plan: Crossbreeding, Robots, and Beef‑Ready Cows

Not every future‑proof herd is pure Holstein or built around banners.

Dornacker Prairies in Wisconsin is a fifth‑generation dairy with about 360 cows on roughly 1,000 acres, and about 90% of those acres are used to feed their own herd. Allen and Nancy Dornacker farm alongside Allen’s parents, Ralph and Arlene, and their four kids. They’ve been profiled internationally for blending robots, crossbreeding, and composting into a single system that works for their land and family.

Over the last decade, they’ve:

- Installed Lely A5 robots starting in 2018, expanding from three units to six, with room for nine.

- Adopted ProCROSS crossbreeding (Holstein × VikingRed × Montbéliarde) beginning in 2016 to improve fertility, health, and longevity.

- Implemented composting that’s cut fertilizer purchases by about 80%.

Their crossbred herd averages around 9,200 kg of milk per cow per year (about 20,000 lb), with components near 4.6% fat and 3.6% protein—numbers that stack up nicely on a component‑based paycheque.

In a herd like that, beef‑on‑dairy is one more lever, not the whole story. Crossbred cows with stronger fertility give you more room to decide which lactations get beef vs sexed dairy semen. Moderate‑sized, robot‑friendly cows fit tighter breeding programs. Beef‑on‑dairy calf revenue stacks on top of genetics and facilities built around long‑term family ownership, not just next month’s cash flow.

If your focus is banners and purebred marketing, this path comes with trade‑offs. If your focus is a resilient commercial herd your kids might actually want to run, it’s worth a serious look.

| Attribute | Hillview Dairy (Luxemburg, WI) | Hiemstra Dairy(Brandon, WI) | Dornacker Prairies(Wisconsin) |

|---|---|---|---|

| Herd Size & Type | ~650 registered Holsteins | ~170 cows, mixed dairy-beef finishing | ~360 cows, 90% crossbred (ProCROSS) |

| Key Infrastructure | Cross-ventilated freestall, high-comfort housing | Tower silos, conventional parlor, 790 acres cropland | 6 Lely A5 robots (room for 9), on-farm composting |

| Breeding Approach | Sexed Holstein on top 30% of herd + high-index heifers; beef on lower-index cows | Beef-on-dairy for finishing on-farm; corn pushed through cattle, not just milk | ProCROSS (Holstein × VikingRed × Montbéliarde) base; beef on select lactations |

| Beef-on-Dairy Strategy | Structured AI program; calving-ease beef sires; sell calves at premium | Finish beef-cross steers/heifers to ~1,400 lb at $1.75/lb(~$2,450/head) | Crossbred fertility gives “spare pregnancies”; beef semen on lower-value lactations |

| Why It Works for Them | 21-day PR 30%+(estimated); consistent heifer surplus; registered genetics pay premium | Cover crops + “odd” forages fit beef rations; old infrastructure = low overhead | Robot-friendly moderate-frame cows; strong fertility (crossbreeding); family succession plan |

| Main Constraint They Manage | Heifer inventory—must keep sexed-semen conception high | Land base & feed logistics (790 acres, finishing cattle on-site) | Balancing milk components (4.6% fat, 3.6% protein) with beef-calf revenue |

The Beef‑on‑Dairy Gold Rush Has a Downside

It’s easy to get starry‑eyed about $1,400 calf stories. Here’s the part that keeps you out of trouble.

The same 2023 Animals review that highlights beef‑on‑dairy’s upside also flags real risks when beef sires get sprayed across dairy cows without enough planning:

- Longer gestation with some beef breeds, stretching calving intervals, and tying up stalls.

- Higher dystocia and stillbirth rates in certain beef × Holstein crosses when calving ease isn’t prioritized.

- Welfare and marketing problems occur when calves don’t meet buyer expectations on growth, muscling, or carcass traits.

On the fed‑cattle side, Kansas State’s grid‑pricing work shows that cattle outside packer specs on weight, yield, or quality take meaningful discounts. Poorly planned beef‑on‑dairy crosses—wrong frame, wrong fat cover, wrong muscling—are more likely to land in those discounted buckets.

If you:

- Chase beef‑on‑dairy premiums with sires that add too much birthweight or gestation,

- Ignore calving‑ease and carcass traits when picking beef bulls for dairy cows, and

- Don’t align your calves with what your buyer, feedlot, or packer actually wants,

you can watch the “gold rush” vanish into dead calves, extra days open, and grid deductions.

The herds that will still be glad they leaned into beef‑on‑dairy five years from now are already:

- Using calving‑ease beef sires validated on dairy crosses.

- Matching sires to specific buyer or grid specs, not just grabbing “any Angus” off the sheet.

- Tracking calf health, growth, and sale prices in their own records instead of assuming every beef‑cross calf lands at the top of the market.

What This Means for Your Operation

Beef‑on‑dairy is not a yes‑or‑no question. It’s a strategy that has to fit your repro, heifers, feed base, and markets.

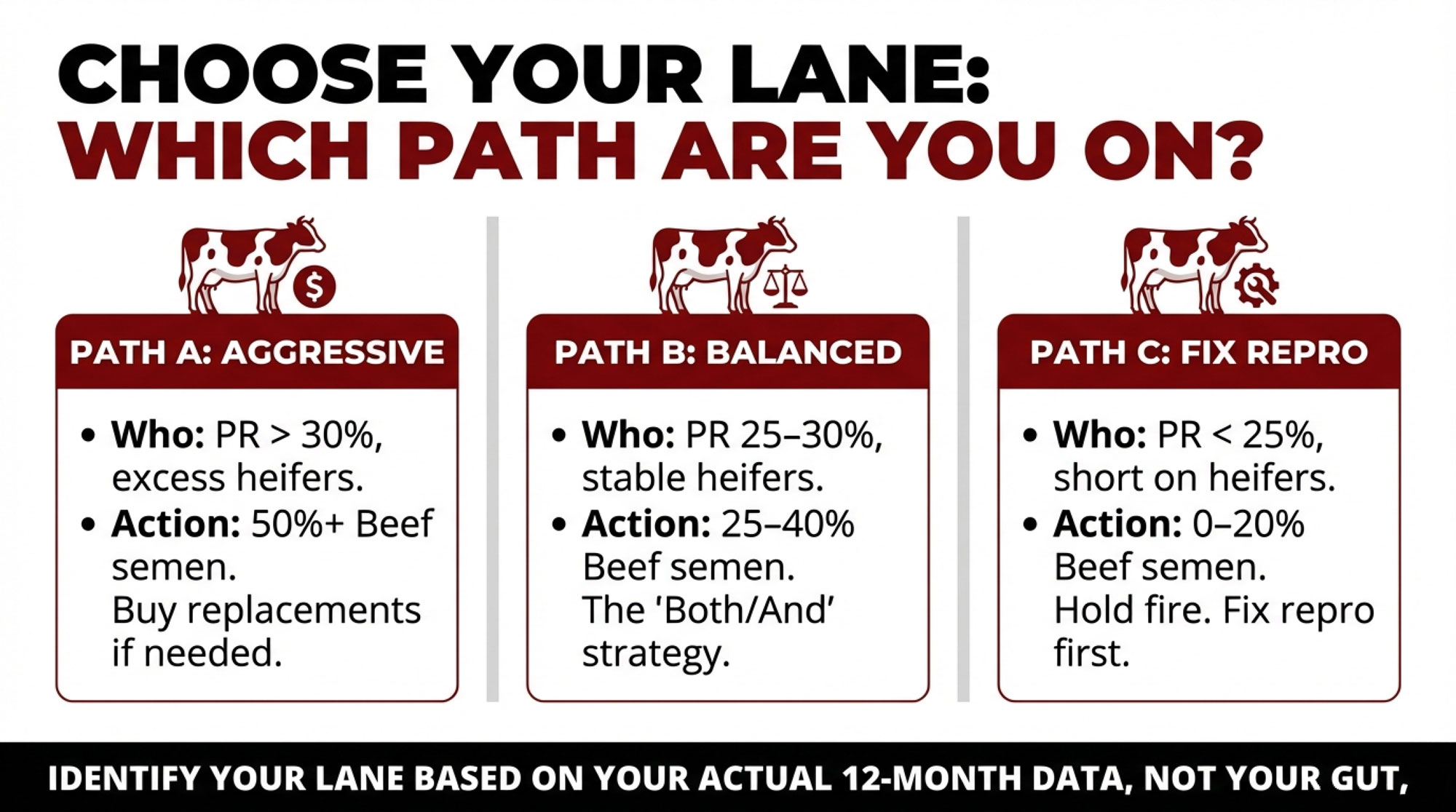

Most herds will land in one of three lanes.

Path A: Aggressive Beef (50%+ of Breedings)

You’re here if:

- Your 21‑day pregnancy rate runs around 30% or higher.

- You’ve consistently had more heifers than you truly need.

- You have reliable outlets for beef‑on‑dairy calves or your own finishing capacity.

What it looks like:

- The top 20–30% of cows and most heifers get sexed Holstein semen, selected on Net Merit, DWP$, or your index of choice.

- The bottom 50–70% of cows receive beef semen from calving‑ease, dairy‑tested sires that meet buyer specs.

- You’re willing to buy replacements when the heifer market says that beats raising every last one yourself.

Path B: Balanced Strategy (25–40% Beef)

You’re here if:

- Your 21‑day pregnancy rate sits in the 25–30% band.

- You’re mostly okay on heifers—short in some years, long in others.

- You have decent calf markets but no locked‑in premium contract.

What it looks like:

- The top 30–40% of cows and heifers get sexed dairy semen.

- The bottom 25–40% of cows go to beef.

- Conventional dairy semen still has a role where it wins on cost per pregnancy.

A lot of 300–800‑cow herds are going to live here for a while as they keep nudging repro higher.

Path C: Fix Repro First (0–20% Beef)

You’re here if:

- Your 21‑day pregnancy rate is under about 25%.

- You’re short on heifers and stretching days‑in‑milk.

- Your risk budget feels pretty thin.

What it looks like:

- Beef semen is used sparingly—older cows, obvious genetic culls, maybe a small test group.

- Most of your cash goes into repro and cow performance: transition, heat detection, cow comfort, and vet work.

If you’re in Path C, the smartest beef‑on‑dairy move may be to hold your fire. Get your repro into the mid‑20s or 30s first. The beef premiums will still be there when you’ve actually got pregnancies to spare.

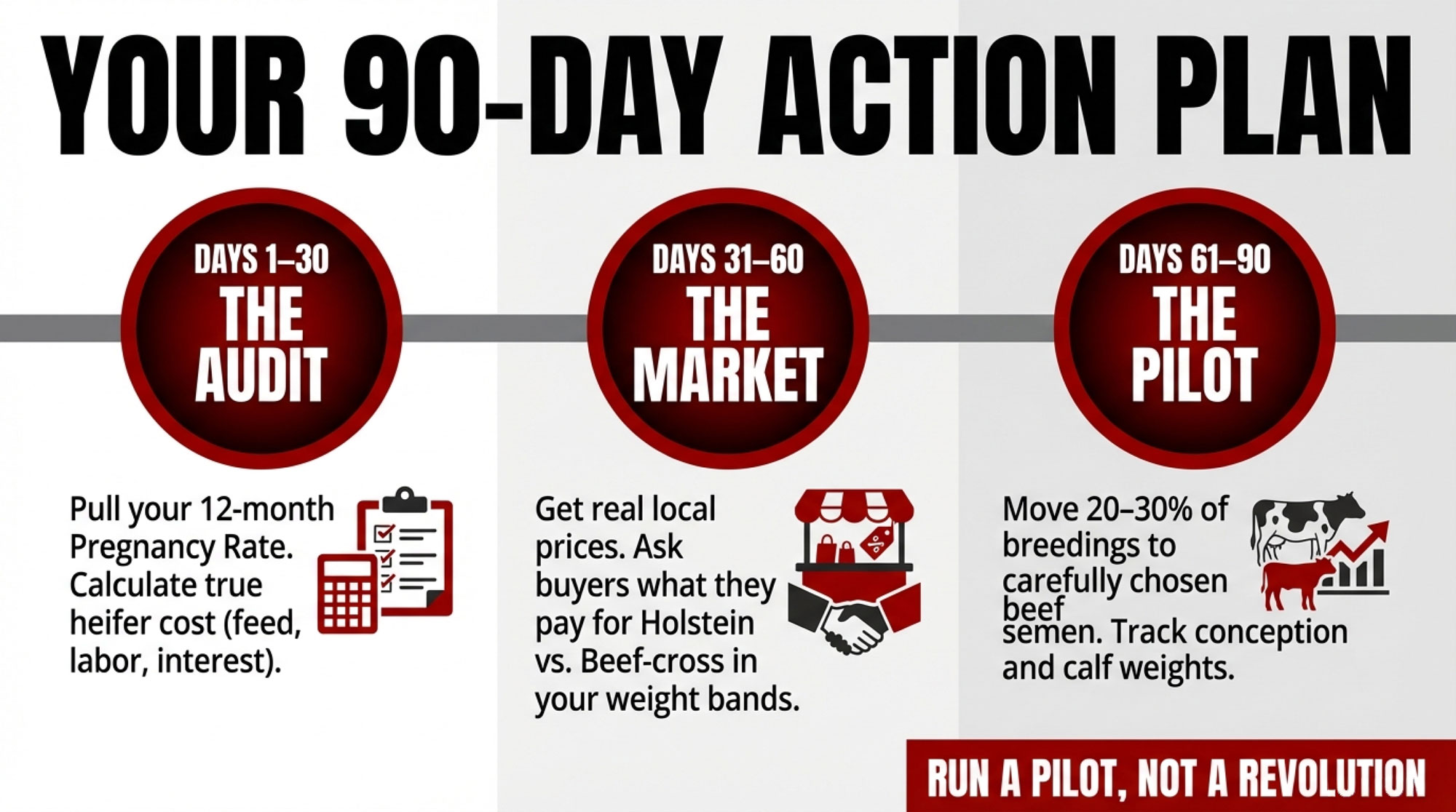

Your 90‑Day Action Plan

Here’s how you turn this from a good read into a working plan on your farm.

Next 30 days

- Pull your 12‑month 21‑day pregnancy rate.

Use your herd software or DHI reports, not a guess. That number tells you if Path A, B, or C is even on the table. - Calculate your full heifer cost.

Use your 2024 books—feed, labour, interest, bedding, facilities, and death loss. If you need a framework, start from a university heifer‑raising budget or sit down with your lender and walk through your numbers line by line.

Next 60 days

- Get real local calf price ranges.

Talk directly to your sale barn or calf buyer. Ask what they’ve actually been paying for Holstein bull calves vs beef‑on‑dairy calves in your weight bands over the last 60–90 days. Use that spread—not coffee‑shop talk—as your baseline. - Sit down with your AI and genetics rep.

Bring cow and heifer index lists, cull data, and heifer counts. Map how many replacements you truly need, and which animals can shift to beef semen without starving your fresh pen 18–24 months from now.

Next 90 days

- Run a pilot, not a revolution.

If your repro supports it, move 20–30% of breedings to carefully chosen beef semen for one breeding season. Track breedings, conceptions, calvings, calf weights, and sale prices. Let your own numbers, not somebody else’s story, tell you whether to ramp up or back off. - Check your risk tools.

USDA’s Livestock Risk Protection (LRP) program has expanded coverage options in recent years, including coverage tied to feeder cattle and calf prices in general. Talk with your insurance agent or extension specialist about whether any current LRP products fit the kind of calves you’re producing and how you market them.

While you’re at it, read your milk cheque and the fine print of your contract. If your processor is paying for components, animal care, or specific beef‑on‑dairy traits, those lines belong in the same spreadsheet as semen prices and calf bids.

| Timeline | Action Step | What to Calculate or Ask | Why It Matters |

|---|---|---|---|

| Next 30 Days(Step 1) | Pull your 21-day pregnancy rate | Use herd software or DHI—12-month rolling average, not a guess | Tells you if Path A, B, or C is even on the table; this number is your beef-semen budget |

| Next 30 Days(Step 2) | Calculate your full heifer cost | Feed + labor + interest + facilities + death loss from 2024 books | If your cost is >10–15% above local bred-heifer prices, raising every heifer is leaving money on the table |

| Next 60 Days(Step 3) | Get real local calf prices | Call sale barn or buyer: What did Holstein bulls vs beef-cross calves actually bring in last 60–90 days? | Use that spread—not coffee-shop gossip—as your baseline; if spread is <$300/head, beef-on-dairy math gets harder |

| Next 60 Days(Step 4) | Sit down with AI/genetics rep | Bring cow index lists, cull data, heifer counts; map how many replacements you truly need | Prevents the classic mistake: copying someone else’s beef-% when their repro and heifer pipeline are 20 points stronger than yours |

| Next 90 Days(Step 5) | Run a pilot, not a revolution | Move 20–30% of breedings to beef semen for one breeding season; track breedings, conceptions, calvings, calf weights, sale prices | Let your numbers tell you whether to ramp up or back off—not somebody else’s story at the sale barn |

| Next 90 Days(Step 6) | Check your risk tools | Talk to insurance agent about USDA Livestock Risk Protection (LRP) for feeder cattle/calf price coverage; read milk contract fine print for component or beef-calf incentives | If your processor pays for specific traits or your calf market swings hard, these lines belong in the same spreadsheet as semen prices |

Key Takeaways

- Beef‑on‑dairy calves are bringing several hundred dollars more per head than Holsteins in many U.S. markets—Holstein calves that used to bring $300–$450 are now commonly $700–$1,000 in strong markets, while beef‑cross calves are topping $1,500–$1,750 in parts of Wisconsin and over $1,000 in Pennsylvania and other key regions.

- Heifer economics have flipped fast. CoBank says inventories could shrink by another 800,000 head before 2027, while Wisconsin replacement values jumped 69% in a year, and many U.S.-bred heifers now sell north of $3,000, with some lots over $4,000.

- Beef‑on‑dairy works best long‑term when repro and heifer numbers are strong. Modelling shows the math starts to work above roughly 20% 21‑day PR and 2x calf price, with herds in the 30–40% band having the most flexibility.

- There’s a real downside if you pick the wrong beef sires or ignore carcass specs. Longer gestations, harder calvings, and packer grid discounts can erase calf‑price gains very quickly.

- The herds that will still be happy with beef‑on‑dairy in five years are matching sexed and beef semen to their own numbers—pregnancy rate, heifer needs, feed base, and actual buyers—not to the latest rumour at the sale barn.

The Bottom Line

You don’t have to milk 650 cows in Luxemburg or farm 790 acres in Fond du Lac County to make this work. But, like those families, you do have to pick a lane and live with the math that comes with it.

So when you look back on 2026, a year from now, do you want to say, “We finally lined up our breeding plan with our numbers,” or still be loading $700 Holstein bull calves while your buyer’s paying a lot more for the right beef‑on‑dairy cross?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Building a Beef-on-Dairy System: Capturing $360,000 in Annual Farm Profit – Stop leaving money on the table and start building a profit-driven pipeline. This breakdown delivers the exact ROI calculations and management shifts needed to capture massive annual revenue gains by aligning your breeding with real-world demand.

- The 800,000-Heifer Shortage Reshaping Dairy: Why Some Farms Will Thrive While Others Exit – Exposes the structural shifts threatening your herd’s future. This forecast arms you with the long-term positioning strategies required to navigate record-low heifer inventories and ensure your operation remains viable as processing capacity expands.

- The ProCROSS Payoff: Is It Time to Cross the Line? – Breaks down the University of Minnesota’s findings on how crossbreeding delivers a 9-13% boost in daily profit. This unconventional approach reveals how improving health and fertility traits secures your competitive advantage in a high-cost environment.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!