Milk at $20. Costs at $22. Some dairies are panicking. Others are building $300K in new revenue. The difference? Three moves you can make today.

Executive Summary: The $20 milk check that sustained dairy operations for years now falls $2 short of covering real production costs—and that gap isn’t closing. But while many producers wait for $25 milk that isn’t coming, successful operations are actively building $300,000 in new annual revenue from resources they already have. Beef-cross calves are commanding $1,600 each (up from $400 in 2019), feed shrink costing most farms $60,000 annually can be cut in half with basic management changes, and the Dairy Margin Coverage program is paying 495% returns to those who enroll. The catch? This window closes fast—operations implementing these strategies in Q1 2025 will capture $250,000 more value than those waiting until Q3. Based on verified data from USDA, and progressive dairy consultants, this report provides a proven 90-day roadmap that’s already helping operations transform their financial position. The difference between thriving and merely surviving isn’t about farm size or waiting for markets to improve—it’s about acting on these opportunities now.

You know that feeling when something you’ve counted on for years suddenly isn’t enough? That’s exactly where many of us find ourselves with milk prices right now.

Gary Siporski, the dairy financial consultant from Wisconsin who’s been looking at balance sheets for decades, saw this coming. His data tells quite a story. Back in 2016, his Midwest clients were breaking even around $16.50 per hundredweight. By late 2023? That number had climbed to $20.25. And now—here’s where it gets interesting—operations from California to Vermont are reporting production costs north of $22 when you factor in everything… depreciation, heifer raising, the whole nine yards.

What’s encouraging, though, is that the operations finding their way through this aren’t just sitting around waiting for milk prices in 2025 to bounce back. They’re actively building what amounts to $180,000 to $340,000 in improved financial position through some pretty creative approaches to dairy profitability.

Understanding What’s Really Driving Costs

Here’s what the latest University of Illinois Farmdoc Daily and USDA reports are showing us. Feed costs—you know, that 30 to 50 percent chunk of everyone’s budget—have actually come down from those crazy 2022-2023 peaks. Corn’s projected at $4.60 per bushel for 2025, down from $4.80. Soybean meal dropped from $330 to $290 per ton. Alfalfa? Down from $201 to $159.

Sounds like good news, right? Well… hold on a minute.

Everything else keeps climbing. Labor costs are up 3.6 percent for 2025, according to USDA’s agricultural labor report—we’re talking a record $53.5 billion across agriculture. And if you’re in Texas or other areas where the energy sector is hiring? Good luck keeping experienced workers without matching those oil field wages. Producers in these regions report wage competition they never imagined dealing with.

Then there’s interest. After hitting 16-year highs in 2023-2024, according to Federal Reserve data, borrowing costs have fundamentally changed the game. Think about it—if you’re running a 500-cow operation with somewhere between $1.2 and $1.5 million in operating loans (pretty typical these days), that four percentage point jump from 2020 means an extra $48,000 to $60,000 annually just in debt service. That’s nearly fifty cents per hundredweight before you even start milking.

And equipment? The Association of Equipment Manufacturers’ 2024 report shows machinery prices jumped 30 percent in four years. The average new tractor now costs $491,800, up from $363,000 in 2020. Some specialized equipment? We’re talking $1.2 to $1.4 million.

Brad Herkenhoff from Compeer Financial, who works with operations all across Minnesota and Wisconsin, doesn’t mince words: “There won’t be enough to cover depreciation, so capital improvements won’t be made. Bills will stretch beyond 30 days, and every month becomes a financial strain.”

What we’re dealing with is what economists call a “ratchet effect”—costs rise quickly but resist coming down. You can’t undo wage increases once they’re in place. Interest on existing debt? That’s locked in. And you’re still depreciating that nearly half-million-dollar tractor at 2023 prices. This reality is reshaping dairy profitability 2025 in fundamental ways.

The Beef-on-Dairy Window: Real Opportunity or Hype?

Now, let me share something that might be the biggest dairy profitability opportunity I’ve seen in twenty years. And I really mean that.

CattleFax and USDA’s July 2025 cattle inventory reports point to a 3- to 5-year window in which beef-on-dairy returns make extraordinary financial sense. We’re not talking about incremental improvements here—this could be transformative for milk prices in 2025.

Right now, in November 2025, day-old beef-cross calves are bringing $900 to $1,600 at auctions from Pennsylvania to Minnesota. Compare that to the $350 to $400 they brought in 2018-2019, according to USDA’s Agricultural Marketing Service data. That’s a premium that makes you rethink beef-on-dairy returns.

But here’s why this isn’t just a temporary spike. The U.S. cattle inventory is at a 64-year low—we haven’t seen numbers like this since 1951, per USDA’s latest report. Meanwhile, the National Association of Animal Breeders tells us nearly 4 million crossbred calves were born in 2024, and Beef Magazine projects that could hit 6 million within two years.

You might be thinking, “Won’t that flood the market?” Here’s the thing—beef production is actually declining. USDA projects it’ll drop 4 percent in 2025 and another 2 percent in 2026. The beef industry desperately needs these dairy-beef crosses just to maintain supply.

Herkenhoff’s analysis shows producers are seeing a $2.50 to $4 per hundredweight boost from the combination of better cull cow values and beef-cross calf sales. Think about what that means for dairy profitability in 2025. Data shows that, before this beef market rally, milk checks accounted for about 93 percent of total farm income. Now? That’s down to 75 to 80 percent, with cattle sales making up 20 to 25 percent.

The numbers are pretty striking when you dig in. Revenue contribution jumping from $1.12 per hundredweight in 2022 to $2.57 in 2024. That’s a 130 percent increase in two years.

Traditional vs. Diversified: The Numbers Tell the Story

Quick Financial Comparison:

Here’s what we’re seeing:

- Traditional Single-Revenue Operation (500 cows):

- Milk revenue: 93% of income

- Cattle sales: 7% of income

- Breakeven: $22-24/cwt

- Annual volatility: $150,000-$300,000

- Diversified Multi-Revenue Operation (500 cows):

- Milk revenue: 75-80% of income

- Beef-cross cattle sales: 20-25% of income

- Additional streams: 5-10% of income

- Breakeven: $18-20/cwt

- Annual volatility: $75,000-$150,000

Bottom line difference: About $200,000 in improved annual cash flow with significantly reduced risk exposure.

Feed Efficiency: The Money You’re Already Losing

Here’s something that still surprises me after all these years. Producers will negotiate feed contracts for hours, tweak rations endlessly, but meanwhile… many operations are unknowingly losing $50,000 to $180,000 annually through feed shrink and excessive refusals.

Penn State Extension and University of Wisconsin research show that average U.S. dairy silage shrinkage runs 10 to 20 percent. Poorly managed bunkers? Can hit 25 percent. And those feed refusals—should they be 2 to 3 percent, according to Journal of Dairy Science studies? I see operations running 4 to 6 percent all the time.

Real Dollar Impact per 100 Cows:

- Silage shrink reduction (15% to 10%): Saves $9,000-$18,000 annually

- Refusal reduction (5% to 3%): Recovers $5,000-$10,000 annually

- Daily face management: Cuts spoilage by 50%

- Oxygen barrier films: Pay for themselves in 6-8 months

Sources: Cornell Cooperative Extension, University of Minnesota dairy extension, Lallemand Animal Nutrition research

The key insight—and nutritionists keep hammering this point—isn’t about cutting feed quality. That’s a disaster. It’s about not throwing away the good feed you already bought.

For a 500-cow operation, even modest management improvements—basic stuff, really—can return $45,000 to $60,000 annually. That’s real money from things you’re already doing, just doing them better. This directly impacts dairy profitability in 2025 outcomes.

Government Programs: Setting Aside the Politics

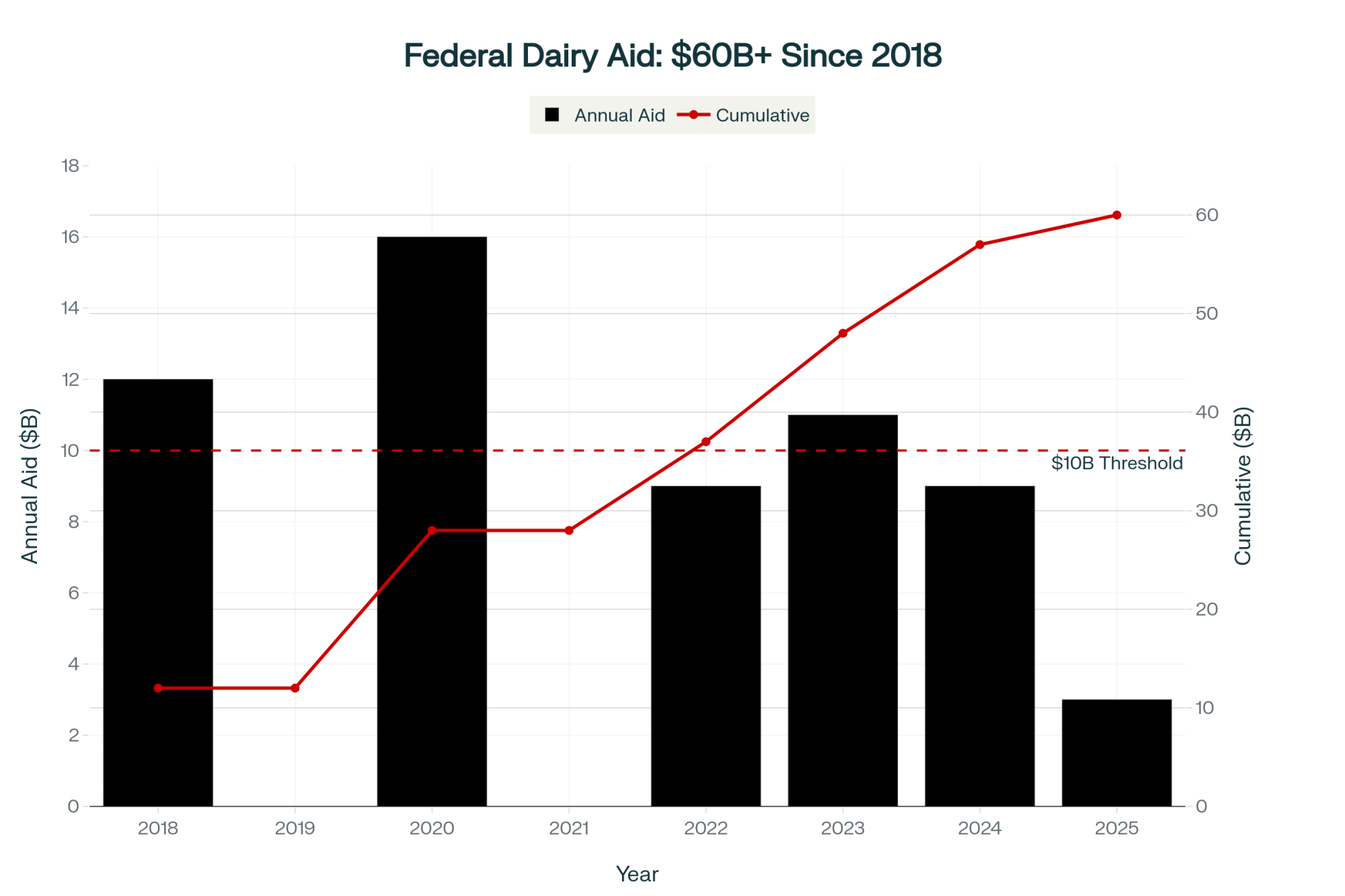

I know, I know. Half of you are already skeptical when I mention government programs. But hear me out—the USDA Farm Service Agency data on Dairy Margin Coverage is pretty compelling for dairy profitability in 2025.

In 2023, producers enrolled at the $9.50 level paid about $1,500 in premiums per million pounds. What’d they get back? According to FSA payment data, $8,926.53 per million pounds. That’s a 495 percent return. On paperwork.

DMC by the Numbers:

A 500-cow operation producing 11 million pounds:

- Paid: $16,500 in premiums

- Received: $98,192 in payments

- Net benefit: $81,692

The program distributed over $1.27 billion through October 2023, with the average enrolled operation receiving $74,453. About 17,059 operations participated—that’s 74.5 percent of those eligible. Which means roughly a quarter of producers left that money on the table.

Katie Burgess from Ever.Ag’s risk management team notes that DMC has triggered payments 57% of the time over the past 42 months at the $9.50 level. That’s better than a coin flip, and when it pays, it pays big.

The mistake I see most often? Producers are choosing catastrophic coverage at $4.00 to save on premiums. Sure, it costs less upfront, but you’re leaving massive money on the table. The $9.50 level costs more, but historically returns five to ten times as much during tight margins.

The Human Side: Why Change Is So Hard

You know, research from agricultural psychology studies—the kind published in journals like Applied Farm Management—reveals something we probably all know deep down. Resistance to change isn’t really about the data. It’s about identity.

We don’t just run dairy operations. Being a “dairy producer” is part of who we are. So when someone suggests beef-on-dairy returns or revenue diversification, it can feel like they’re asking us to fundamentally change who we are. That’s not easy.

The generational piece makes it even tougher. Iowa State Extension’s succession planning research shows 83.5 percent of family dairy operations don’t make it to the third generation. First to second generation? Only 30 percent succeed. Second to third? Just 12 percent.

We’ve all seen this—Dad won’t let go because that means confronting his own mortality, and the kids can’t make changes without feeling like they’re disrespecting everything their parents built. Meanwhile, equity slowly bleeds away.

Research from agricultural universities in New Zealand and Europe shows we’re all influenced by what our neighbors do. Nobody wants to be first, but nobody wants to be last either. So everyone waits…

I’ve heard from plenty of producers who understood the financial benefits of beef-on-dairy perfectly well but worried what the coffee shop crowd would think. Were they giving up on “real” dairy farming?

A Practical 90-Day Framework for Dairy Profitability 2025

Alright, let’s get down to brass tacks. Based on what’s working for operations that are successfully navigating this transition, here’s a framework that can improve your financial position in three months:

Month 1: Immediate Actions for Cash Flow

Week 1: Know Your Numbers

First thing—and I mean within 48 hours—calculate your working capital per cow. Current assets minus current liabilities, divided by herd size. Then figure your monthly burn rate from the last 90 days. This tells you exactly how much runway you’ve got.

If you’ve got genomic test results, pull them now. If not, consider ordering tests. Yes, it’s $40 to $50 per head—about $12,000 to $15,000 for 300 head. But you’ll know within 2 to 3 weeks exactly which cows should get beef semen for optimal beef-on-dairy returns.

Order 150 to 200 units of beef semen right away. Angus and Limousin consistently perform well in feedlots. That’s an investment of $2,250 to $5,000. Contact three calf buyers to ensure competitive pricing. Got beef-cross calves ready? Selling them this week could bring $3,600 to $6,400 in immediate cash.

DMC Enrollment: Don’t Wait

Call your FSA office—actually call them, don’t just email. The $9.50 coverage on Tier 1 (first 5 to 6 million pounds) at 95 percent often makes the most sense. Larger operations might consider catastrophic on Tier 2 to manage costs. For a 250-cow operation, you’re looking at about $7,225 in costs, with potential returns of $35,000 to $80,000 in tight-margin years.

Week 2: Strategic Culling Decisions

Review your IOFC reports, SCC data, and Days Open. Identify your bottom 10 to 15 percent—chronic health issues, SCC over 200,000, Days Open beyond 150.

With cull prices averaging $145 per hundredweight according to the USDA, strategically marketing 25 cows averaging 1,400 pounds could generate $50,000 to $62,500. Direct that straight to your operating line.

Month 2: Building Operational Efficiency

Labor Optimization

Progressive Dairy’s benchmarking shows that top operations maintain over 65 cows per full-time worker and produce over 1 million pounds of milk per worker annually. If you’re at 45 cows per worker… well, there’s your opportunity.

Energy Efficiency Quick Wins

Energy typically runs 400 to 1,145 kWh per cow annually. Quick improvements:

- LED lighting: 60% electrical reduction

- Variable frequency drives: 20-30% fan energy savings

- Heat recovery systems: $20-40 per cow annual savings

A 100-cow operation can save $2,000 to $4,000 annually in energy costs alone.

Component Production Focus

Here’s what’s interesting—DHI data shows operations producing over 7 pounds of components per cow daily generate about $3 more per cow at similar costs. That flows straight to the bottom line—potentially $547,500 annually for 500 cows.

Work with your nutritionist on butterfat performance and protein, not just volume. Especially valuable in the Northeast, where component premiums are strong, or the Southwest, where cheese plants pay big butterfat bonuses.

Month 3: Strategic Positioning

Additional Revenue Streams

By month three, explore these opportunities:

- Digesters: EPA’s AgSTAR database shows 270+ on dairy farms generating ~$100/cow annually

- Solar leases: $500-1,500 per acre annually in suitable locations

- Carbon credits: $10-30 per cow, emerging market

University extension case studies document operations pulling $300,000 to $400,000 annually from combined energy contracts, beef-cross premiums, and environmental programs.

Risk Management Layers

Layer additional coverage atop DMC:

- Dairy Revenue Protection for Tier 2 production

- Livestock Gross Margin for Margin Protection

- Forward contracting on favorable component premiums

Build that safety net while you can afford it.

90-Day Roadmap Summary Box:

By Day 90, a 500-cow operation typically achieves:

- Strategic culling cash: $50,000-$62,500

- Feed efficiency savings: $45,000-$60,000 (annualized)

- Beef-on-dairy pipeline: $60,000-$80,000 (9-month revenue)

- Component optimization: $30,000-$50,000 (annualized)

- DMC protection: $35,000-$80,000 (potential in tough years)

Total improved position: $220,000-$332,500 within 12 months

Regional Realities: From the Plains to the Coasts

These strategies play out differently depending on where you farm, and that’s important to understand.

Regional Strategy Highlights:

- California: Smaller feed efficiency gains but higher beef-on-dairy returns near feedlots

- Wisconsin: Focus on forage quality optimization over shrink reduction

- Northeast: Component premiums crucial—can’t match Western volume but butterfat pays

- Southeast: Triple cooling costs vs. Wisconsin—every energy efficiency gain magnified

- Plains States (Kansas/Nebraska): Uniquely positioned near feedlots AND grain—seeing the strongest beef premiums with lower feed costs

- Mountain West: Altitude affects production, but proximity to Western beef markets creates beef-on-dairy opportunities

Timing matters too. Implementing beef-on-dairy in November versus March affects breeding cycles and calf markets. Spring calves bring premiums in some areas, fall calves in others.

But the fundamental principle—diversified revenue beats single-source dependency—that holds everywhere.

What We’re Learning Industry-Wide

University extension services and farm consultants are documenting consistent patterns. Operations implementing beef-on-dairy in early 2024 project $100,000 to $150,000 additional annual revenue from crossbred calves. Those focusing on feed efficiency report recovering $50,000 to $60,000 annually. DMC participants collected $40,000 to $80,000 in 2023, depending on size and coverage.

What’s encouraging is these aren’t just huge, sophisticated operations. They’re regular farms that recognized the shift early and acted. While transitioning from traditional dairy to a diversified operation can feel uncomfortable initially, the financial results tend to validate the decision quickly.

The Bottom Line for Dairy Producers

Accept the New Reality Production costs have shifted from $16.50 per hundredweight in 2016 to over $22 today. This is structural, not temporary. Earlier acceptance means more options for dairy profitability in 2025.

Diversification Is Essential. Successful operations are building $180,000 to $340,000 in improved position through beef-on-dairy ($100,000 to $200,000 annually), feed efficiency ($45,000 to $60,000 annually), and risk management ($35,000 to $80,000 in challenging years).

Time Matters The beef-on-dairy window extends 3 to 5 years based on cattle cycles, but peak premiums are now. DMC has fixed deadlines. Feed savings compound daily. Every month of delay costs money and options. This isn’t about panic—it’s about positioning.

Small Changes, Big Impact. You don’t need revolution. Reducing silage shrink 5 percent and refusals by 2 percent can generate $45,000 to $60,000 annually. These are management tweaks, not overhauls.

Use Your Network. The most resilient operations leverage their networks. Engage lenders proactively. Work with nutritionists. Use FSA resources. Going it alone makes everything harder.

Looking Ahead: Key Indicators to Watch

As we approach 2026, watch these indicators:

USDA’s quarterly cattle inventory reports matter. If beef cow numbers grow faster than Rabobank’s projected 200,000 head annually through 2026, the premium window might compress. But current dynamics suggest that’s unlikely.

Monitor your basis—what plants pay above Class III or IV. Over $5 signals strong demand. Under $2 means tight margins ahead.

The One Big Beautiful Bill Act extended DMC through 2031 and increased Tier 1 coverage to 6 million pounds starting in 2026. Details matter, so stay engaged with your co-op and industry groups.

Watch seasonal patterns. Upper Midwest operations should track winter energy costs. Southwest producers need to monitor the impacts of heat stress on components. These create opportunities for prepared operations.

The Path Forward: Your Decision Point

After looking at all the trends and talking with producers who are making it work, one thing’s clear: The operations thriving in 2028 won’t necessarily be the biggest or most sophisticated. They’ll be the ones that recognized the shift early and acted on the dairy profitability 2025 opportunities.

They understood that building $300,000 in diversified revenue through strategic changes beat waiting for $25 milk prices in 2025. They pushed through the psychological barriers and evolved from traditional dairy farmers to agricultural entrepreneurs who happen to produce milk.

The tools exist. The programs are available. The opportunities—especially beef-on-dairy returns—are real. But here’s the thing—implementing changes in Q1 2025 versus Q3 2025 could mean a $242,500 to $362,500 difference over three years. That’s not marginal. That’s the difference between thriving and surviving.

What it comes down to is this: Operations that accept reality quickly maintain options. Those waiting for more confirmation may find their options have expired when they’re ready to act.

The clock’s ticking. Beef-on-dairy returns, DMC enrollment, feed efficiency—they’re all time-sensitive. The question isn’t whether change is necessary, but whether you’ll drive it or have it forced on you.

What is the difference between those paths? About $300,000 and possibly your operation’s future.

Key Takeaways:

- Your Milk Check Will Never Be Enough Again: Production costs hit $22/cwt while prices hover at $20—this isn’t temporary, it’s the new reality requiring immediate action

- $300,000 in Hidden Revenue Exists in Your Operation Today: Beef-cross calves bringing $1,600 (vs. $400 in 2019) + recovering $60,000 in feed waste + DMC paying 495% returns = game-changing income

- The 90-Day Window That Changes Everything: Operations implementing these strategies Q1 2025 will capture $250,000 more value than those waiting until Q3—procrastination literally costs $20,000/month

- You Don’t Need Capital, You Need Courage: No expansion, no debt, no new equipment required—just the willingness to manage differently and diversify beyond the milk check

- The Math is Proven, The Choice is Yours: 500-cow operations following this roadmap achieve $220,000-$332,500 improved position in 12 months—the only variable is when you start

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The $2,500 Question: Are You Raising Too Many Heifers? – This piece reveals the massive hidden costs of surplus heifers, a key drain not detailed in the main article. It provides a strategic framework for using beef-on-dairy to optimize your replacement program and cut costs.

- Unlocking Higher Components: 7 Nutrition Tweaks for More Butterfat – Provides the tactical “how-to” for the main article’s component strategy. It details seven specific nutritional adjustments producers can make to immediately boost component pay and improve their margins.

- Beyond the BPI: How to Actually Use Genomic Data to Make Money – The main article’s 90-day plan starts with ordering genomic tests. This guide is the crucial next step, demonstrating exactly how to turn that raw data into profit-driven culling and breeding decisions.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!