Not every deduction on a milk check is math—some are politics. Here’s how U.S. farmers lost $337 million without casting a single vote

Executive Summary: In 2025, U.S. dairy farmers lost $337 million in just three months following FMMO reforms that increased processor make allowances using voluntary, unverified cost data. The change exposed a fundamental flaw: most producers never voted on the rule that reduced their pay. The American Farm Bureau Federation is now leading a campaign for modified bloc voting, restoring producers’ right to vote independently rather than through cooperative boards. At the same time, pressure is growing for USDA audits of processor costs and itemized cooperative milk checks, ensuring transparency and accountability from plant to producer. A similar structure in Canada illustrates the power of individual voice—where direct farmer ownership and votes drive protective policy outcomes. Together, these reforms mark a turning point toward verified data, fair pay, and representation that aligns with the farmers doing the milking.

You know that feeling when the milk check comes and something doesn’t line up. The herd’s healthy, butterfat performance is steady, feed costs haven’t spiked—but the final number is off. That’s been a common story across farms this year.

Earlier this fall, both the U.S. Department of Agriculture’s Agricultural Marketing Service (AMS) and the American Farm Bureau Federation (AFBF) confirmed what many suspected. The most recent Federal Milk Marketing Order (FMMO) pricing reforms shifted about $337 million from farmers to processors in just three months.

What’s striking isn’t just the number—it’s how the decision happened. Most producers never saw a ballot. And that missing vote might be the most expensive one they never got to cast.

How a Technical Rule Became a Real Pay Cut

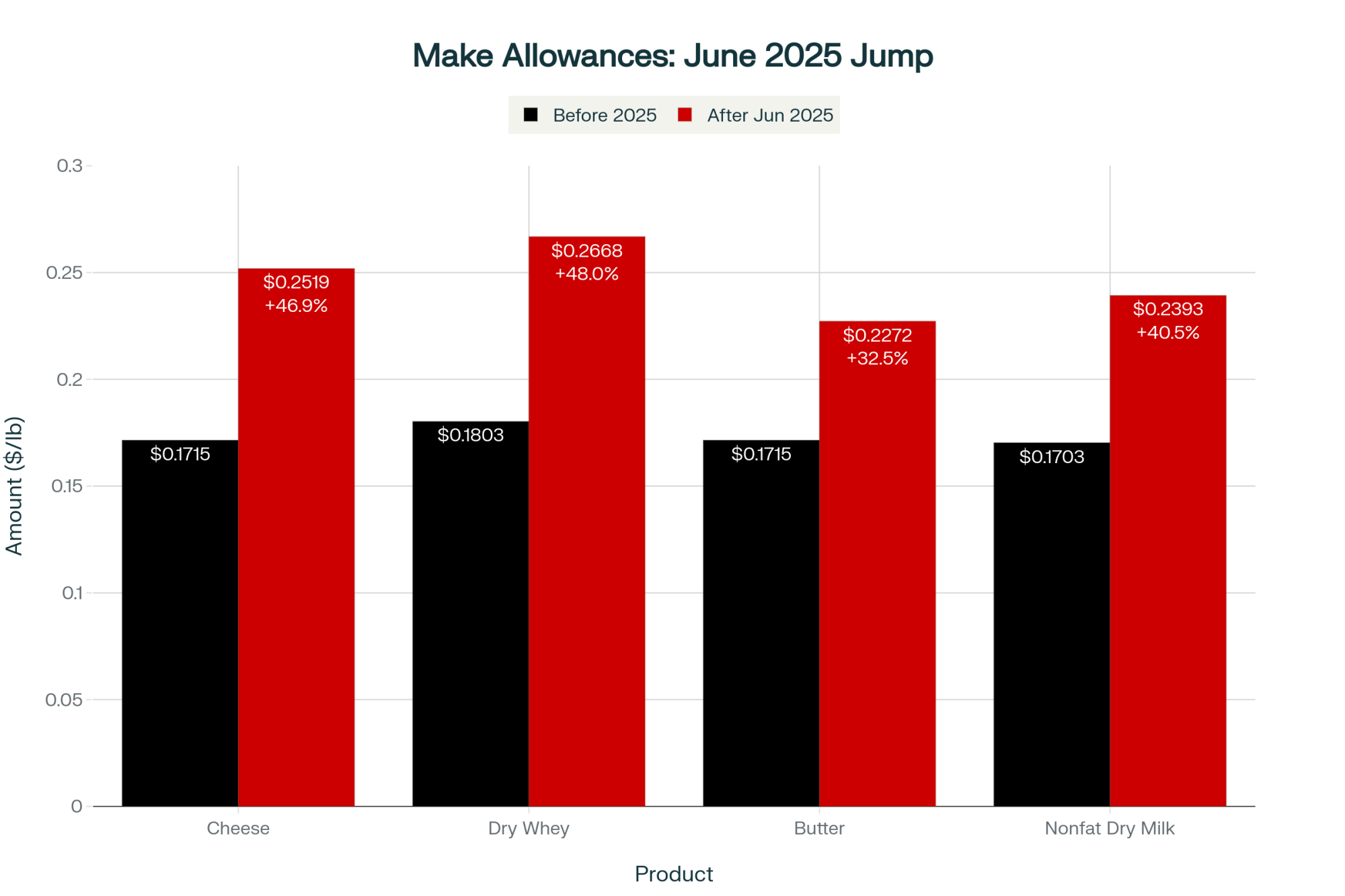

Here’s what set this off. In June, USDA raised make allowances—the assumed cost of processing milk into dairy products—by 25 to 43 percent. The reasoning was simple enough: labor, packaging, and energy costs have risen since the last review in 2008.

Here’s the part that farmers are still talking about. Those numbers came from voluntary processor surveys and not from audited financials. By law, USDA still lacks the authority to require processors to open their books under the Agricultural Marketing Agreement Act of 1937.

As AFBF dairy economist Danny Munch explained during the organization’s fall dairy policy update,

“We’re basing a national pay system on unverified numbers, and the only side that benefits is the one submitting the data.”

USDA’s Pool Settlement Reports show how fast that imbalance added up: $64 million in the Upper Midwest, $62 million in the Northeast, and $55 million in California.

For a 150-cow herd shipping about 24,000 hundredweight a year, that’s about $18,000 to $20,000 gone—roughly equivalent to this year’s surge in energy costs, or a major herd health outlay.

Regional Impact Summary (June–September 2025)

- Upper Midwest: –$64 million

- Northeast: –$62 million

- California: –$55 million

(Source: USDA AMS, Q3 2025 Pool Data)

Who Cast the Vote That Changed It?

| Aspect | Current Bloc Voting | Modified Bloc Voting (AFBF Proposal) |

|---|---|---|

| Who Controls Your Vote? | Cooperative board decides for all members | YOU decide—opt in or vote independently |

| Member Choice | None—vote cast automatically | Full choice: authorize co-op or vote direct |

| Transparency Level | Low: No individual vote tracking | High: Individual votes counted |

| Conflict of Interest | HIGH: Co-ops process AND vote | LOW: Direct farmer control |

| Individual Accountability | None—members never see ballot | Full—every producer has voice |

That question gets to the heart of a deeper issue. When FMMO proposals go out for a referendum, producers are supposed to decide. But under the current system, most never touch a ballot.

That’s because cooperatives cast bloc votes representing all their members. The idea was originally intended to save administrative time in the 1940s, when local co-ops marketed milk from small family dairies.

Fast forward 80 years. Dairy Farmers of America, Land O’ Lakes, and California Dairies Inc. now handle more than 60 percent of the nation’s milk, according to the USDA’s Economic Research Service (2024). Those organizations don’t just market milk—they process it. When processing margins rise, they gain on one side while the member pay price shrinks on the other.

That’s why AFBF, joined by several state-level farm bureaus, is pressing for modified bloc voting.

Under this approach, co-ops could still submit bloc votes, but only for members who authorize them. Others could opt out and cast their own ballots directly. It’s a small procedural shift with big implications for fairness.

As Munch told producers in Wisconsin, “If your paycheck depends on it, you should get to decide how it’s structured.”

Why Voting Reform Comes First

Some producers have asked why start with voting rights rather than mandatory audits or cost-verification reforms? It’s a logical question—but one with a simple answer.

Every major FMMO change still requires a producer vote to pass. If co-ops continue controlling those votes, the same imbalances in representation will persist—even with better data. Modified voting gives individuals a voice before the next cost survey or order amendment lands on the table.

Think of it this way: fair data means knowing the numbers are right; fair voting means knowing your opinion counts before the next decimal gets moved.

The Transparency Gap That Shows Up Every Month

For most of us, the problem isn’t hidden in Washington—it’s sitting right on the milk check.

Private processors are required to list detail on component prices, deductions, and the Producer Price Differential (PPD). Cooperatives, though, are exempt. Since they’re considered farmer-owned, they aren’t required to disclose the same payment details.

That might sound routine, but it creates an information gap. A University of Wisconsin Extension report (2024) found that 70 percent of cooperative pay statements lacked full explanations for deductions over $0.25 per hundredweight. Terms like “market adjustment” or “balancing charge” were often used without further specification.

As Mark Stevenson, emeritus policy specialist at UW–Madison, put it, “You can’t manage what you can’t measure.”

Plenty of producers can relate. Even herds with solid butterfat and protein trends are seeing unexplained adjustments that chip away at gross pay. That lack of clarity feeds the same frustration driving the broader voting reform effort: farmers want transparency, not theory.

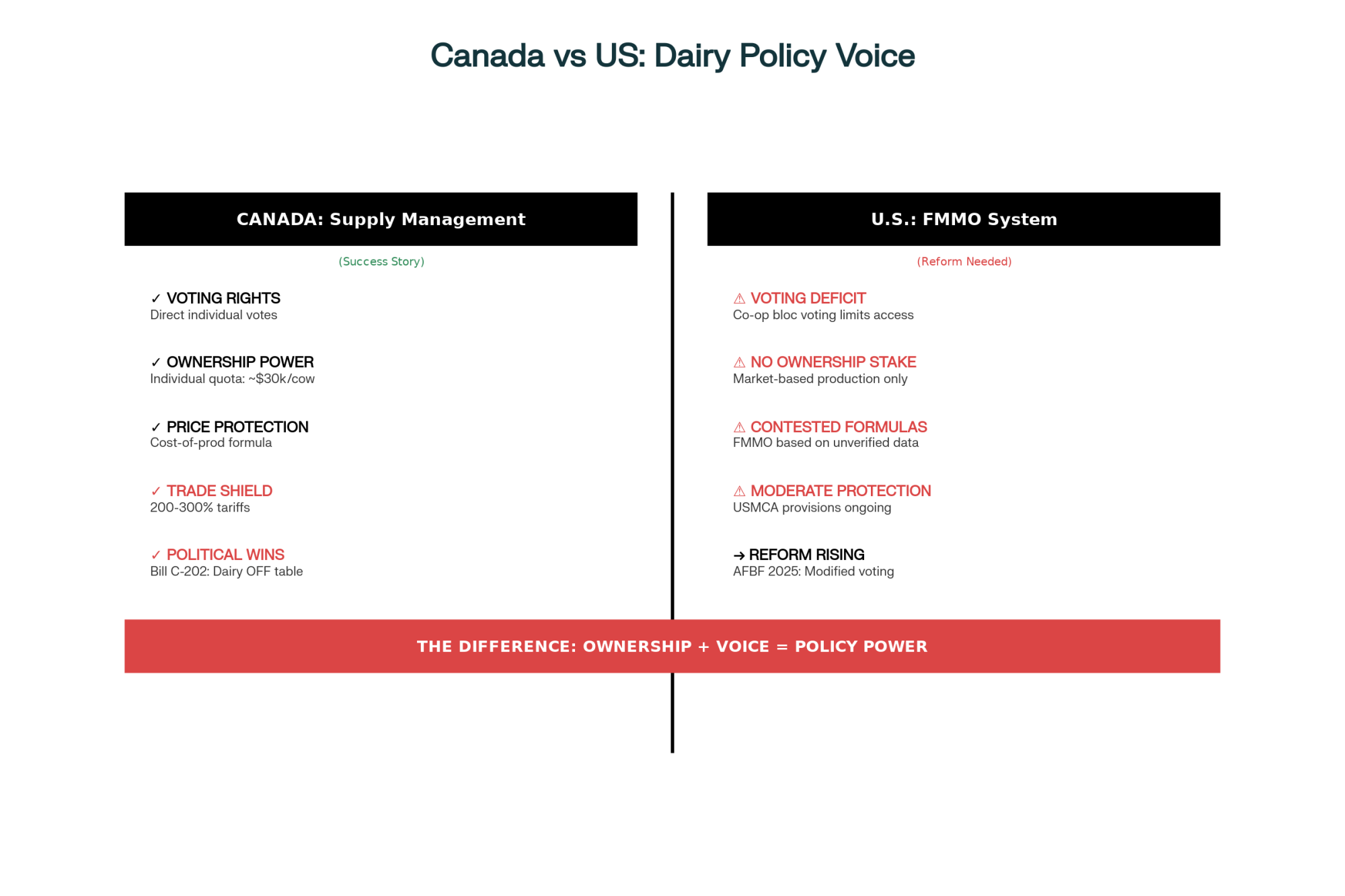

Looking North: What Canadian Quotas Tell Us About Voice

It’s worth pausing to look north for perspective. Canada operates under a supply management system that balances domestic production and demand through quotas. Each farmer owns a quota, currently worth about CA $30,000 per cow (Agriculture and Agri-Food Canada, 2025), and that ownership translates directly into control.

In 2017, Canadian dairy farmers organized a significant voter push within the Conservative Party, ultimately flipping a leadership contest by less than 1%. This year, the Canadian Parliament passed Bill C‑202, which makes it illegal for ministers to negotiate away dairy protections in trade deals.

The U.S. doesn’t have a quota system, and few producers would want one. But here’s the takeaway: when farmers hold direct, non-negotiable voting authority, policy outcomes tend to protect producers instead of eroding them.

Where These Reforms Stand Now

For the first time in years, the groundwork for reform is visible.

A provision in the 2025 Farm Appropriations Act now gives USDA AMS the authority to conduct audited processor cost surveys. The agency plans to begin that process in 2027, replacing voluntary surveys with verifiable data collection.

Meanwhile, new proposals are emerging to standardize cooperative milk-payment statements so co-op members receive the same level of itemized transparency as proprietary producers.

And finally, AFBF’s modified bloc voting proposal continues building bipartisan traction, with several state delegations already urging USDA to schedule a hearing for 2026.

These are all incremental steps—but together, they form the backbone of a more accountable system.

What It Means for Different Dairies

Whether you milk 80 cows in New York’s Finger Lakes or 8,000 in a California dry lot, clarity is good business. Verified cost surveys stabilize Class III and IV price forecasts. Transparency builds trust and simplifies planning.

Cornell University’s Dairy Markets Research Program (2024) notes that “information symmetry improves efficiency and stability at every scale.” In simpler terms, fair data and fair governance don’t pick winners—they lift the whole market.

Co-ops That Are Already Leading

Some cooperatives aren’t waiting for regulation to catch up. Rolling Hills Dairy Cooperative in Wisconsin already provides members with detailed monthly pool and freight summaries through an online portal. Select Milk Producersin Texas publishes audited hauling and balancing charges so members can see exactly what the deductions mean.

Rolling Hills general manager Tom Larkin says the results were immediate: “Once members could see where their money went, trust followed. Transparency lined us up on the same side again.”

That kind of leadership shows reform doesn’t have to start in Washington—it can begin wherever farmers demand a clearer deal.

Five Things Producers Can Do Now

- Compare your check. Match component prices to your federal order’s monthly reports; the differences may surprise you.

- Ask for documentation. Request written breakdowns for deductions labeled “market adjustment” or “balancing.”

- Collaborate. Compare notes with neighboring farms—shared data reveals patterns.

- Engage early. Follow your state Farm Bureau updates and dairy policy hearings.

- Exercise your vote. Whether under current co-op structures or future modified voting, make sure your ballot represents your voice.

The Bottom Line

After covering dairy policy for years—and spending plenty of time around farmers who live it—I’ve noticed that most producers can handle market volatility and feed swings. What they can’t handle is opacity.

The call for reform isn’t rebellion; it’s about modernizing a system that no longer reflects how milk is marketed or how producers define ownership.

If democracy belongs anywhere, it’s in the milk check. Because when producers see the numbers, cast their own votes, and know where their dollars go, trust stops being a slogan—it becomes part of doing business.

Key Takeaways:

- $337 million disappeared from producers’ milk checks in three months following FMMO reforms based on voluntary processor cost data that USDA could not verify.

- Most farmers never voted on the rules that reduced their income, because cooperatives cast bloc votes on behalf of all members—often blending farmer and processor interests.

- AFBF’s proposed modified bloc voting system would restore the right for every producer to cast an individual ballot, bringing direct democracy back into milk pricing.

- Mandatory processor cost audits and itemized co-op pay statements are now gaining traction, opening the door to verified data, clear deductions, and accountable pay.

- Transparency isn’t anti-cooperative—it’s pro-farmer. As seen in Canada’s producer-driven system, ownership and voice together equal stability and fair value for milk.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Maximizing Your Milk Check: A Producer’s Guide to Component Pricing – While the main article details external pricing challenges, this guide provides actionable strategies for boosting the factors you can control. It reveals methods for optimizing herd nutrition and genetics to increase butterfat and protein, directly improving your bottom line.

- Navigating the Waves: Understanding and Managing Milk Price Volatility – This article expands on the financial uncertainty caused by policy flaws by offering a strategic roadmap for risk management. It demonstrates how to use tools like futures, options, and insurance to build a more resilient business model against market shocks.

- Data-Driven Dairying: How On-Farm Analytics Are Creating a Clearer Financial Picture – To combat the lack of transparency from processors, this piece explores how technology empowers producers. It provides insight into using on-farm data systems to track key performance indicators, verify inputs, and create your own undeniable proof of performance.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!