California lost farms while others made millions—the difference wasn’t technology, it was timing and scale

EXECUTIVE SUMMARY: What California’s methane compliance journey reveals isn’t just about environmental regulations—it’s a roadmap showing how dairy economics fundamentally shift when compliance costs hit different sized operations. The patterns emerging from California show operations over 3,000 cows can generate substantial revenue through digesters and carbon credits, while dairies between 500-1,000 cows face increasingly marginal economics that challenge long-term viability. Feed additives that achieve dramatic reductions in laboratory settings deliver substantially lower performance in commercial applications, highlighting the gap between promises and farm reality. Early movers who position infrastructure before regulatory deadlines consistently capture better financial terms, while those forced to react face compliance costs without offsetting revenue streams. The consolidation accelerating across the industry isn’t simply about farm size—it reflects fundamental economic thresholds where compliance costs create dramatically different outcomes based on scale. States developing their own approaches are learning from California’s experience, creating opportunities for prepared operations to capture value through strategic positioning. The message for dairy farmers is clear: understanding where your operation falls on the scale spectrum and making strategic decisions aligned with your resources determines whether environmental regulations become profit centers or existential challenges.

You know, if you’d told me five years ago that California dairies would be making serious money from methane reduction, I’d have thought you were pulling my leg. But here we are at the crossroads of environmental necessity and economic opportunity—and what’s happening out West is reshaping how we all need to think about the future of dairy, whether we’re managing herds in Wisconsin’s rolling hills, Pennsylvania’s river valleys, or anywhere in between.

I should mention upfront—I’m not here to tell anyone what to do with their operation. We all know our own farms best, our own soil, our own markets. But sharing what’s happening and what others are learning? That has always been valuable, especially when we face industry-wide changes that affect us all.

The Technology Reality: Lab Versus Farm

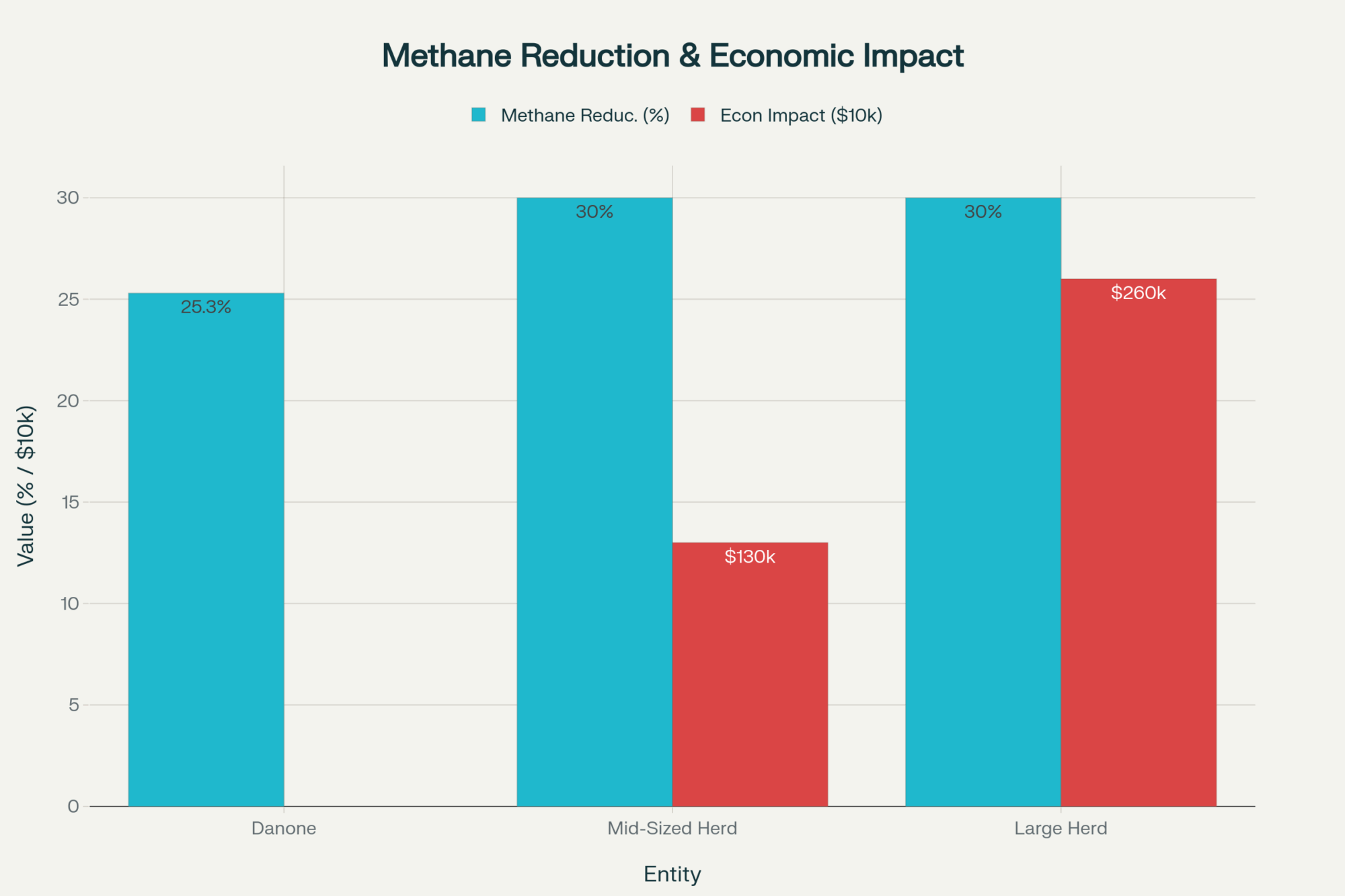

What’s particularly noteworthy is the gap between laboratory promises and on-farm reality with these methane reduction technologies. You’ve probably seen the headlines about seaweed additives—those impressive reduction numbers from controlled trials that make it sound like we’ve found the silver bullet.

University feeding trials have demonstrated significant reductions in methane emissions with the use of Asparagopsis seaweed under controlled conditions. But here’s the thing—commercial applications generally achieve substantially lower reductions than laboratory conditions. And there’s a fascinating reason for this disconnect.

The active compounds in seaweed break down faster than anyone expected once they leave controlled conditions. What works beautifully in a university feeding trial—with fresh product, immediate feeding, controlled temperatures—doesn’t always translate to the reality of your feed bunk. Especially after the product has been shipped across the country and stored in your commodity shed through a hot summer, that’s just the reality of moving from lab to farm.

This builds on what we’ve seen with other feed technologies over the years, doesn’t it? Remember when bypass protein was going to revolutionize everything? Great concept, variable field results. The same story with numerous “game-changing” innovations.

And those synthetic options like 3-NOP? Research suggests they can reduce methane emissions in total mixed ration systems, delivering more consistent results than seaweed. But effectiveness varies significantly in high-forage feeding systems, particularly in grazing-based operations common in the Northeast. The compound requires precise mixing and doesn’t distribute well in pasture situations.

Understanding the Real Economics: Scale Matters More Than Ever

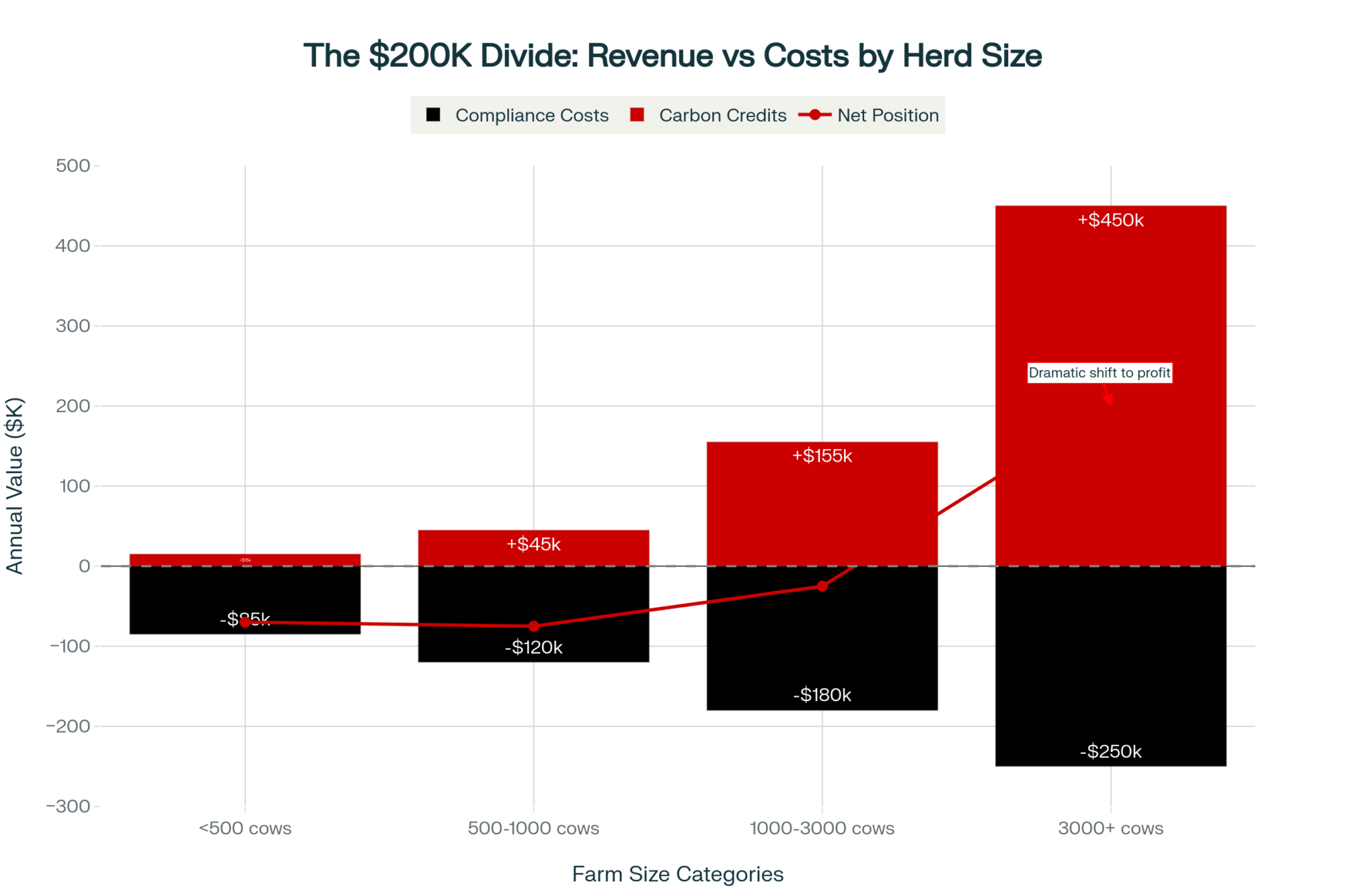

What I find most instructive is examining how the economics actually play out across different-sized operations. The patterns emerging from California show clear economic thresholds that determine viability.

For those running larger operations—let’s say over 3,000 cows—digesters can actually generate substantial revenue through carbon credits and renewable energy programs. Larger California operations report favorable payback periods when carbon credit programs are available.

Now, for operations between 1,000 and 3,000 cows—and that’s a significant portion of our industry—the economics require patient capital. Payback periods typically extend longer for medium-sized operations, and your financing structure matters enormously.

Those 500 to 1,000 cow dairies face the toughest economics. Too large for niche markets but too small for economies of scale. Economics becomes increasingly challenging at this scale, testing even the most patient and financially capable individuals.

And for dairies under 500 cows? Large-scale technologies rarely pencil out. However, creative alternatives are emerging—shared composting facilities, cooperative manure management systems, and simplified solid waste separation. These approaches require different thinking, but they can be effective.

What’s crucial to understand is how dependent these economics are on local carbon credit values and renewable energy incentives. Voluntary carbon markets typically offer lower credit values than California’s specialized programs, creating dramatically different economics depending on your location.

I’m curious to see how this plays out in states with strong traditions of grazing. Will they develop crediting systems that recognize carbon sequestration in well-managed pastures alongside methane reduction?

The Portfolio Approach: Diversification Beyond the Milk Check

| Strategy | <500 cows | 500-1,000 cows | 1,000-3,000 cows | 3,000+ cows |

| Digesters | Not viable | Marginal | Often justified | Strong ROI |

| Composting/Manure Mgmt | Viable | Viable | Viable | Viable |

| Feed Additives | Rarely economical | Economic only in confined | More effective | Best fit |

| Direct Marketing/Value Added | High potential | Possible niche | Supplementary | Auxiliary |

The most successful operations aren’t betting everything on any single technology. They’re building diversified strategies that create resilience when individual components underperform.

Production efficiency forms the foundation. Increasing production per cow significantly reduces methane intensity per unit of milk produced—without any new technology. Better heat abatement, tighter fresh cow protocols, optimizing starch levels and fiber digestibility—these improvements compound over time.

This aligns with what progressive nutritionists emphasize: good management is environmental management. Better feed efficiency, improved reproduction, lower SCC—these traditional metrics reduce environmental footprint while improving profitability.

Alternative manure management provides middle-ground solutions. Composting, separation systems, and mechanical scraping—these technologies work at various scales. New research on biochar-enhanced composting shows promise, though commercial viability remains uncertain.

Some traditional practices deserve renewed attention. Rotational grazing, well-managed pastures, and focus on cow longevity—these approaches sequester carbon while reducing emissions intensity.

Digesters work effectively when you have the right conditions: a liquid manure system, consistent feedstock, technical expertise, and sufficient scale to spread capital costs. Success depends heavily on the quality of management and local market conditions.

Feed additives continue evolving. Current products work best in confined feeding situations with precise ration control. Costs should decrease as production scales up, but these remain supplementary tools rather than complete solutions.

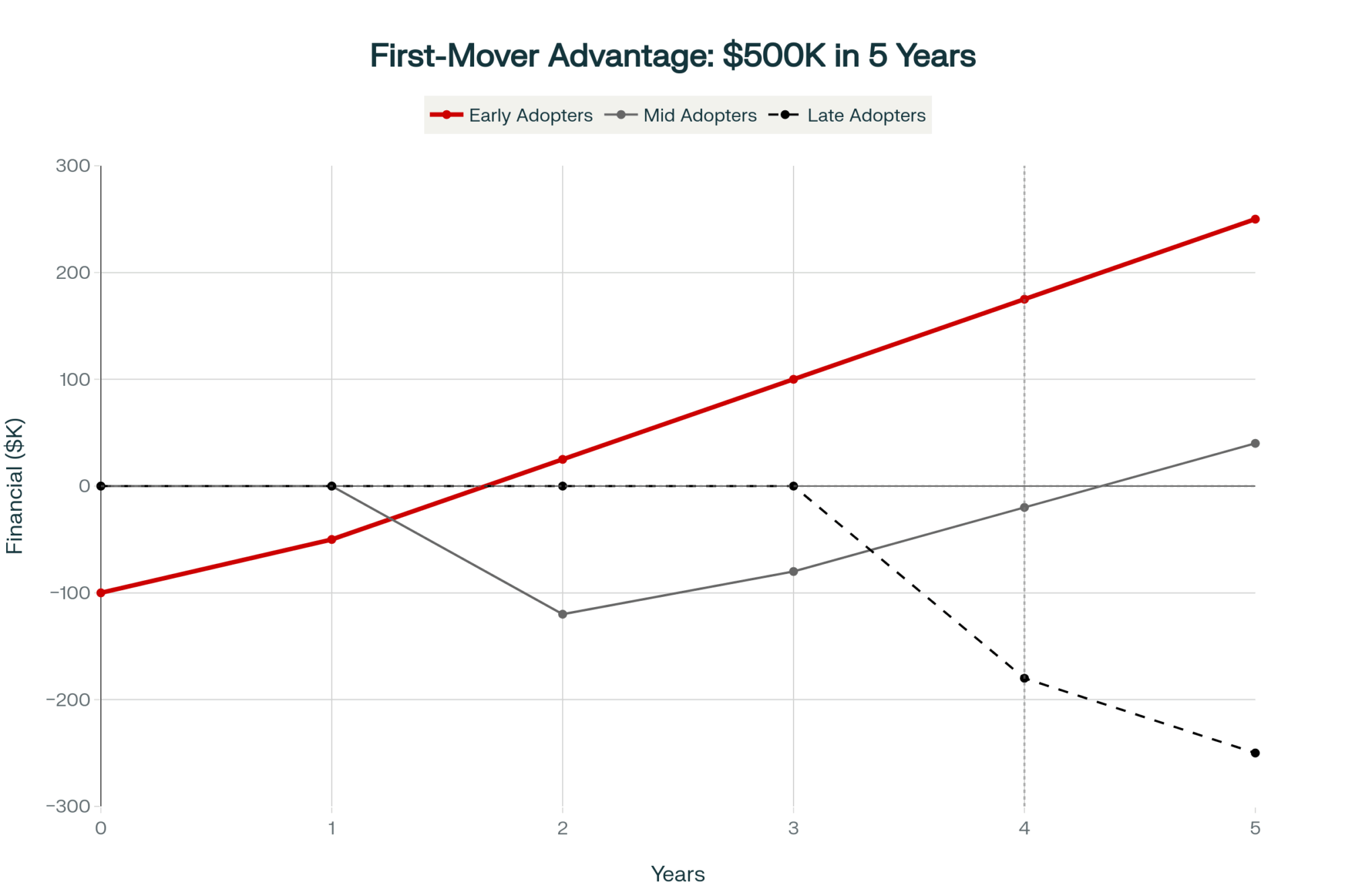

The Timeline Pressure: First-Mover Advantages and Late-Adopter Penalties

Various states are establishing different incentive structures and compliance timelines. Early movers consistently capture the best opportunities.

California’s experience proves instructive. Their programs lock in favorable terms for early infrastructure development. Miss those windows, and you face compliance costs without offsetting revenue.

Agricultural lenders see this bifurcation clearly. Early strategic movers maintain financing options. Those forced to act later find limited and expensive choices.

The pattern remains consistent: capture value by moving early, face costs by waiting. Each year of delay in regulated markets potentially sacrifices a significant portion of the lifetime project value.

Processors are increasingly factoring environmental performance into their supply relationships. Some develop sustainability programs, although the value of meaningful premiums remains uncertain.

Industry Consolidation: The Structural Reality

USDA data confirms accelerating consolidation in dairy farming, with environmental regulations adding pressure in certain regions.

Mid-sized operations (500-1,000 cows) face existential challenges. They can’t easily access niche markets or achieve the scale for technology economics. Multi-generational family farms confront difficult succession decisions under this pressure.

These operations remain profitable today, but face uncertainty about the regulatory landscape of tomorrow. This uncertainty complicates planning, financing, and family transitions.

Smaller operations encounter different challenges. Per-unit compliance costs run higher without scale advantages. However, some thrive through direct marketing, value-added processing, or agritourism—creating businesses that sidestep the pressures of the commodity market.

Custom operators navigate unique complexities working across multiple farms with varying capabilities and requirements. Standardizing practices while maintaining flexibility poses a challenge for these essential service providers.

Regional Adaptation Strategies

| Region | Avg Herd Size | Primary Strategy | Incentive $/cow | Compliance Timeline | Success Rate |

|---|---|---|---|---|---|

| California | 1,850 | Digesters + Credits | $285 | Active Now | 65% |

| Northeast | 85 | Grazing Credits | $45 | 2027 Start | 82% |

| Upper Midwest | 195 | Co-op Models | $75 | 2028 Start | 78% |

| Southwest | 2,200 | Water + Methane | $195 | 2026 Start | 71% |

| Southeast | 450 | Voluntary Programs | $35 | 2029+ Start | TBD |

States are learning from California while developing approaches suited to their conditions and farming systems.

Northeast states initially emphasize voluntary programs, recognizing their smaller average herd sizes and pasture-based systems. They’re exploring how to credit both methane reduction and soil carbon sequestration.

The Upper Midwest investigates incentive structures that value well-managed grazing systems. Some states explore digesters for medium-sized farms through cooperative models. Others examine manure-to-energy opportunities linked with existing utility infrastructure.

The Southwest links water conservation with methane reduction, recognizing their interconnected resource challenges. Different regions focus on integrating energy infrastructure or enhancing drought resilience alongside emissions reduction.

Some states are exploring how to credit both methane reduction and soil carbon sequestration—potentially game-changing for grazing operations. Others develop programs recognizing diverse farm scales and production systems.

Implementation Realities: What the Planning Documents Don’t Tell You

Field experience yields critical insights that extend beyond theoretical planning.

Infrastructure costs typically exceed initial estimates, often by a substantial amount. Beyond primary technology, you need storage modifications, handling equipment, monitoring systems, and team training. Budget extra for contingencies—you’ll need it.

Seasonal operations create challenges vendors rarely acknowledge. Winter functionality at sub-zero temperatures differs dramatically from summer operations. Heat stress impacts both cows and technology performance. Spring mud season complicates manure handling. These realities affect system design and operating costs.

Supply chains for newer technologies remain immature. Quality varies between suppliers, availability fluctuates, and prices reflect market volatility. Multiple supplier relationships provide essential backup.

You must document everything. Carbon credit verification, regulatory compliance, and management decisions all require baseline data. Start measuring before implementing changes—retroactive documentation doesn’t work.

Emerging Opportunities: Beyond Compliance

Strategic positioning creates opportunities beyond mere compliance.

Carbon credit markets evolve rapidly with significant regional variation. Some areas generate meaningful revenue streams; others offer minimal returns. Understanding your local market conditions drives decision-making.

Milk processors and food companies develop sustainability programs with potential premiums for verified low-emission milk. Whether these deliver meaningful value or just create requirements remains uncertain.

Technology continues advancing rapidly. Today’s impractical solution might become viable within a few years. Stay informed without chasing every innovation.

Taking Action: Your Next Steps

Here’s your practical roadmap:

Assess your position honestly. Evaluate your scale, resources, and timeline for major decisions. Consider retirement, succession, and expansion plans realistically.

Gather region-specific information. Attend extension meetings, engage with neighbors, and explore NRCS programs. Local knowledge is often more valuable than general advice.

Start documenting now. Begin baseline measurements even before making changes. This data becomes invaluable later.

Think strategically, not reactively. Success comes from thoughtful decisions aligned with your specific circumstances, not from following prescriptive solutions.

The Strategic Bottom Line

After observing nationwide developments across different regions and scales, success requires making thoughtful strategic decisions with available information, building adaptable systems, and maintaining flexibility.

The shifts in emissions thinking, environmental impact assessment, and value creation aren’t future considerations—they’re current realities in some regions and near-term probabilities everywhere else.

Learn from others’ experiences while recognizing your unique situation. A large New Mexico operation differs fundamentally from a smaller Vermont farm. Someone with returning children faces different decisions than someone approaching retirement.

Stay informed, think strategically about your specific operation, and make decisions aligned with your long-term goals and values. The dairy industry will look different five years from now—that’s certain.

Is change concerning? Perhaps. But it also creates opportunities for those prepared to adapt thoughtfully. The question isn’t whether change arrives—it’s how we position our operations to thrive.

Consider this as you head into another season managing the operations you’ve built. The future of dairy isn’t distant—it’s being shaped now by decisions each of us makes on our farms, in our communities, within our circumstances.

The conversation continues, and we’re all part of it.

KEY TAKEAWAYS:

- Digesters generate positive returns for 3,000+ cow operations with favorable payback periods when carbon credit programs are available, but economics become marginal below 1,000 cows and typically unviable under 500 cows

- Production efficiency improvements offer universal benefits—increasing milk per cow through better management reduces methane intensity without requiring permits, infrastructure investment, or regulatory approval

- Early strategic positioning captures value while delayed action faces costs—agricultural lenders report producers who move before regulatory deadlines maintain better financing options and terms

- Portfolio approaches outperform single technologies—combining production efficiency, manure management alternatives, and selective technology adoption creates resilience when individual solutions underperform

- Documentation starting now strengthens your position—baseline measurements before implementing changes become invaluable for carbon credit verification, regulatory compliance, and informed decision-making regardless of operation size

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Methane Efficiency Breakthrough: How Smart Breeding Cuts Emissions 30% While Boosting Your Bottom Line – This article reveals how selecting for low-methane genetics offers a permanent, compounding solution to emissions reduction, providing a direct and profitable contrast to the recurring costs and variable returns of feed additives.

- The Carbon Credit Programs Every Dairy Should Join Before 2026 – This strategic guide provides a detailed breakdown of carbon credit markets, including specific revenue splits and program types, helping you evaluate whether your operation can turn methane reduction into a consistent and profitable new revenue stream.

- California’s $522 Million Secret: How Smart Dairy Farmers Turned Methane into Money While Saving the Planet – This case study details how California’s dairy industry leveraged over $500 million in private investment by combining technology with policy, providing a powerful, real-world example of how strategic investment can transform compliance into a profitable business model.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.