Three insights that’ll change how you think about farm revenue this year

Here’s what caught my attention walking the vendor hall at World Dairy Expo last fall… while most of us were debating whether we could squeeze another tenth of a point from our butterfat numbers, this producer from the Central Valley—a quiet guy, runs about 5,500 head—mentioned he’s banking over $255 per cow annually. And for operations at the highest scale, that number can climb as high as $450, but what really got my attention is the $35 to $160 per cow now accessible to medium-sized dairies with almost no capital investment.

The room went dead silent when he said it. That kind of money? It’s coming from methane.

I know, I know. Another environmental compliance thing wrapped in fancy promises, right? Lord knows we’ve seen enough of those—carbon sequestration programs that never materialized, sustainability initiatives that cost more than they paid. But here’s the thing… this is fundamentally different. What’s happening with methane monetization isn’t some feel-good initiative. Early adopters are generating real revenue that shows up in year-end financials.

That Central Valley producer? Standard operation, nothing fancy. His anaerobic digester generates $1.4 million annually after accounting for all operating expenses. More than his milk income in most years. And here’s what really got my attention—it’s not just the mega-dairies anymore.

Medium-sized operations are seeing $35 to $160 per cow annually from feed additives that cost less than your daily Starbucks habit. We’re talking about adding 15-20% to your total income with minimal operational changes.

“The methane mitigation economy has matured from experimental concept to documented revenue opportunity. Early adopters are banking profits that make component premiums look modest by comparison.”

What strikes me about this opportunity is how it’s flying under the radar while commodity prices keep us all on edge. Feed costs are brutal—we’ve been running $400 to $450 per ton for decent TMR around here. Labor’s expensive as hell, and milk prices… well, we all know that story. Meanwhile, a parallel economy is developing, where producers are being paid for something we’ve always treated as waste.

The thing about methane markets—they’ve quietly grown up

I’ve been watching carbon markets for years, honestly expecting them to fizzle out like so many other agricultural initiatives. Remember when ethanol was going to save us all? But something fundamental has changed. The “flight to quality” that industry analysts frequently discuss… it’s real, and it’s working in our favor.

Unlike those questionable forestry offset projects that were heavily criticized in the press, dairy methane reductions are directly measurable. When you feed Bovaer to your herd, you achieve a consistent 30% reduction in enteric emissions. Period. No creative accounting, no wishful thinking. That’s why buyers are paying $30-$50 per tonne CO2e for verified dairy methane credits while other agricultural offsets are struggling to find buyers at half that price.

Revenue Potential by Carbon Price

| Carbon Price ($/tonne CO2e) | Revenue per Cow (Feed Additives) | Revenue per Cow (Digesters) |

| $30 | $36 | $250-300 |

| $40 | $48 | $350-400 |

| $50 | $60 | $400-450 |

Based on 1.2 tonnes CO2e reduction per cow from feed additives, higher reductions from digesters

Here’s where it gets interesting for your operation… each lactating cow produces about 1.2 metric tons of CO2 equivalent annually through normal digestion. At current carbon prices, that’s real money—$36 to $60 per cow yearly just from feed additives, before we even talk about digesters.

But the real game-changer is the regulatory landscape. California’s SB 1383, which mandates a 40% reduction in dairy methane by 2030, has created a blueprint that other states are eyeing. More importantly, it triggered massive corporate investment from companies like Danone, which has committed to a 30% reduction in the methane footprint of its fresh milk supply.

These aren’t feel-good corporate announcements. Nestlé and Mars are co-funding direct payments to farmers through programs like Fonterra’s climate incentives. When food giants start writing checks to reduce supply chain emissions, you know the trend has legs.

What’s happening with FDA approval changes everything—finally, a real option

The breakthrough came this past May when the FDA completed its multi-year review of Bovaer (3-nitrooxypropanol). After years of hearing about promising methane inhibitors “coming soon,” we finally have one that’s commercially available and regulatory-approved for U.S. dairies.

What’s particularly noteworthy—and this surprised me—is how straightforward the implementation really is. Bovaer comes as a powder that integrates right into your TMR or vitamin premix at the mill. No additional labor, no new equipment, no training your crew on complex protocols. For confined operations, it’s about as plug-and-play as feed additives get.

The economics work if—and this is crucial—you have access to carbon revenue through what’s called an “aggregator platform.” These are companies that bundle multiple farms together, handle the complex verification process, and sell the credits to buyers. Think of them as your gateway to the carbon market… without them, the $10,000 to $20,000 verification cost per farm would make participation economically irrational for most of us.

The daily cost ranges from $0.26 to $0.50 per cow. For a 500-cow dairy, that’s $47,000 to $91,000 annually. Sounds steep until you realize the revenue potential: $35 to $160 per cow per year, depending on your access to carbon programs and aggregator partnerships.

“Penn State’s research confirms no negative impact on milk yield or quality, with several studies showing slight increases in milk fat concentration.”

The seaweed story—promising but not ready for prime time

You’ve probably heard about Asparagopsis seaweed and its remarkable 40-95% reduction in methane. The efficacy is genuinely impressive… but the economics are brutal. Current production costs exceed $1.00 per cow daily, and the EPA’s classification of the active compound as a probable carcinogen creates regulatory hurdles that are unlikely to be cleared anytime soon.

Here’s the reality check for 2025 planning: Asparagopsis remains a promising area of research, but not a viable commercial solution. The capital investment required to scale production is estimated to be between $132 million and $1.6 billion. Those aren’t numbers that suggest near-term availability at reasonable prices.

Technology Comparison: Ready vs. Research

| Technology | Daily Cost | Methane Reduction | Regulatory Status | Commercial Reality |

| Bovaer | $0.26-$0.50 | 30% | FDA Approved | Available Now |

| Asparagopsis | >$1.00 | 40-95% | Not Approved | Research Phase |

Bovaer stands alone as the market-ready option right now. Which brings up something I’ve been thinking about… sometimes being first to market with “good enough” technology beats waiting for the “perfect” solution that may never arrive at affordable prices. We saw this with precision agriculture—GPS guidance wasn’t perfect initially, but early adopters captured advantages while everyone else waited for better accuracy.

Here’s the thing about carbon markets—where the real money lives

What surprised me most about carbon markets is how they’ve evolved beyond the speculative trading we saw years ago. Today’s buyers want verification, permanence, and measurable impact. Dairy methane projects deliver all three, which explains the premium pricing.

Current market dynamics favor dairy operations in ways I wouldn’t have predicted five years ago. The “insetting” market—where companies buy credits directly from their supply chains—is particularly strong. When a processor like Dairy Farmers of America starts purchasing credits from member farms, that’s a fundamentally different model than selling to anonymous carbon traders.

The verification process used to be a nightmare for individual farms. Costs of $10,000 to $20,000 per project made direct participation economically irrational for most operations. But aggregator platforms like Athian have changed that equation, pooling multiple farms to socialize verification costs while taking 15-25% of the revenue.

What’s fascinating is the speed to market. Legitimate aggregator programs can enable positive cash flow within 30 days of enrollment, providing a stark contrast to other agricultural carbon projects that often take years to generate income.

“Aggregators solve this economic impasse by socializing the high fixed costs of verification across a large portfolio of participating farms.”

Let me walk you through how this actually works on your operation:

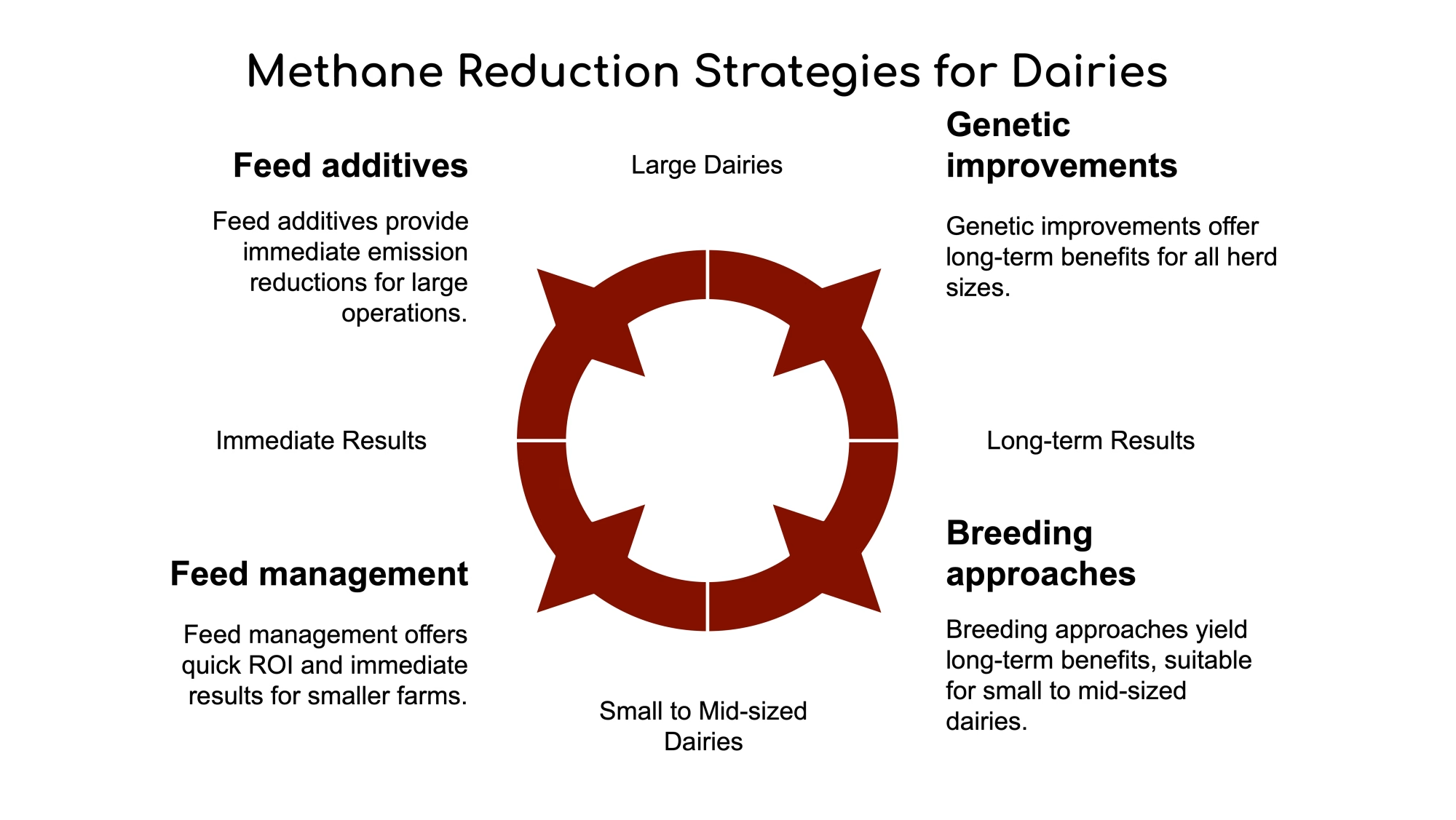

Your practical decision framework—matching scale to opportunity

The thing about methane revenue is there’s no one-size-fits-all approach. What works for a 200-cow operation in Vermont is completely different from a 5,000-head outfit in the Central Valley. Here’s how the economics break down by operation size…

Small Operations (Under 300 cows)

Focus on precision feeding improvements that boost Income Over Feed Costs while reducing methane intensity. This creates immediate ROI while positioning for future, aggregated programs when economic conditions become more favorable.

A 200-cow operation improving feed efficiency by $31 per cow annually generates $6,200 in additional profit while reducing baseline emissions for future carbon programs. Not huge money, but it’s building the foundation.

Medium Operations (300-1,000 cows)

This is the sweet spot for feed additives. Bovaer offers minimal capital investment with significant revenue potential.

For a 500-cow operation, you’re looking at:

- Annual Bovaer cost: $47,450-$91,250

- Revenue potential: $17,500-$80,000 annually (conservative estimate)

- Net outcome: Break-even to $30,000+ profit, depending on carbon price and aggregator terms

The key success factor? Choosing the right aggregator partner. I’d recommend getting quotes from at least three platforms and comparing their revenue sharing, payment timelines, and buyer access.

Large Operations (1,000+ cows)

Comprehensive digester feasibility study is essential. However, approach this as strategic diversification into energy markets, rather than farm infrastructure improvement.

Sample Economics for 2,500-Cow Digester Operation:

| Metric | Amount | Notes |

| Capital Investment | $8.6 million | Typical construction cost |

| Annual Operating Costs | $1.1 million | Plus, potential $500K transport |

| Revenue Potential | $625K-$1.1M annually | Multiple stacked revenue streams |

| Payback Period | 5-8 years | 3-5 years with government programs |

Consider third-party development to transfer capital risk while capturing revenue upside. Energy companies are actively seeking dairy partnerships and bringing sophisticated financing structures.

The Digester Opportunity—Playing at Scale

For operations running 1,000 cows or more, anaerobic digesters represent a distinct investment option from traditional farm assets. You’re essentially entering the utility-scale energy business, with returns that can exceed milk production profits.

The numbers are substantial: capital costs ranging from $2 million to over $10 million, but potential annual revenues of $250 to $450 per cow. That Western dairy’s $1.4 million annual revenue equates to $255 per cow, and remarkably, it exceeded its milk income during challenging market years.

What’s driving these returns? California’s Low Carbon Fuel Standard assigns extremely favorable carbon intensity scores to dairy-derived renewable natural gas. The program includes a 28x multiplier for dairy methane capture compared to CO2 reductions, recognizing the significant impact of avoiding methane emissions.

But here’s what I tell producers considering digesters: this isn’t farm infrastructure—it’s energy sector diversification. Success depends more on energy policy stability than on traditional farm metrics. Operations thriving with digesters are treating them as strategic partnerships with energy companies, not just as improved manure management.

The corporate money trail—why this has staying power

What gives me confidence in the durability of methane markets’ durability is the corporate investment patterns. When Danone commits to a 30% reduction in methane emissions from its fresh milk supply by 2030, and Nestlé starts co-funding farmer incentives, those aren’t speculative bets. These are calculated moves by companies facing investor pressure and consumer demand for supply chain sustainability.

The Global Methane Pledge—signed by over 150 countries—provides political cover for corporations to impose stricter supplier requirements. More importantly, it signals that methane reduction will likely transition from a premium attribute to a market access requirement over the next five years.

“Low-methane production will probably shift from nice-to-have to must-have for major processor contracts.”

This trend suggests something fundamental about where our industry is heading. Early adopters aren’t just capturing short-term revenue—they’re positioning for long-term market access.

I’ve been talking with processors lately, and the conversations are changing. It used to be all about butterfat, protein, and SCC; now they’re asking about carbon footprint and sustainability programs. It’s not hypothetical anymore.

Regional variations matter more than most realize

The variations I’m seeing across different dairy regions are significant, and it’s worth understanding these patterns if you’re evaluating opportunities…

Midwest and West: Midwest operations have advantages in pipeline access and lower transportation costs, while Western dairies often have better access to California’s premium LCFS markets despite higher logistics expenses.

Northeast: Producers here face stricter environmental regulations, but also have processors more willing to pay sustainability premiums. I was speaking with a producer in Vermont last month who is being contacted by processors specifically asking about his carbon footprint.

Southeast: These dairies are seeing growing interest from poultry integrators looking to diversify into dairy RNG projects. Makes sense when you think about it—they already understand the biogas business from their chicken operations.

Seasonal factors matter, too. The spring implementation of feed additives aligns naturally with typical ration adjustments as you transition from stored feeds. Summer heat complicates digester construction timelines, which is why most successful projects break ground in the fall for a spring startup—ideal timing for working through learning curves before the peak production season.

Looking ahead, what happens between now and 2030

The landscape for dairy methane mitigation will evolve rapidly through 2030, driven by converging technology, market, and policy trends. What’s particularly interesting is how quickly this has moved from experimental to mainstream…

Bovaer costs should remain stable or decrease modestly as production scales. Asparagopsis will likely remain commercially non-viable until at least 2026-27, pending breakthroughs in cultivation and regulatory clarity. The capital costs for anaerobic digesters will stay high, but financing models—particularly third-party build-own-operate agreements—will become more sophisticated.

Carbon credit pricing will continue the “flight to quality” trend, solidifying premiums for verifiable agricultural methane credits. As corporate net-zero deadlines approach in 2030, demand will likely outpace supply, potentially driving voluntary market prices beyond $50 per tonne CO2e.

Following California’s lead, other dairy-intensive states are likely to explore methane reduction mandates after 2025. The federal framework remains unlikely before 2028, but the EPA may expand reporting requirements to include enteric fermentation, which would increase demand for on-farm data and verification.

“The concept of ‘low-carbon milk’ will transition from niche premium to standard expectation for premium brands.”

Your decision point—what actually happens next

The methane mitigation economy has matured from an experimental concept to a documented revenue opportunity. Early adopters are banking profits that make component premiums look modest by comparison. The necessary infrastructure exists, markets are functioning, and returns are well-documented.

That competitive advantage window is narrowing, though. As more operations adopt these technologies and markets evolve, early adopter advantages will diminish, while implementation becomes standard practice rather than a means of differentiation.

Here’s my take on next steps, depending on your situation:

If you’re running 300-1,000 cows and tight on cash flow, start conversations with aggregator platforms. Get actual quotes, not theoretical projections. Athian, Concord Agriculture Partners, and others are actively recruiting participants. The 30-day cash flow timeline allows you to test this without incurring major risk.

If you’re operating 1,000+ cows with a decent equity position, commission a proper digester feasibility study. But interview third-party developers too. The build-own-operate model transfers risk while preserving upside. Energy companies have sophisticated financing that they’re willing to bring to dairy partnerships.

If you have fewer than 300 cows, focus on precision feeding improvements that prepare you for future carbon programs while boosting your immediate profitability. The aggregated program economics will eventually work for smaller operations, just not quite yet.

The transformation from viewing methane as waste to recognizing it as revenue represents one of the most significant strategic opportunities I’ve seen in modern dairy economics. The question isn’t whether this will work—it’s whether your operation will be positioned to benefit while the window remains wide open.

Bottom line? Can you really afford not to run the numbers when producers in your own region are already banking this kind of money? The opportunity is real, the technology is available, and the markets are paying.

Given the current cost pressures and market volatility, running the numbers seems like the prudent move, doesn’t it?

For the complete technical analysis and economic modeling referenced in this article, including detailed case studies and implementation frameworks, see The Methane Mitigation Economy: A 2025 Economic and Implementation Analysis.

KEY TAKEAWAYS

- Fast cash flow from feed additives: Medium-sized operations (300-1,000 cows) can generate positive cash flow within 30 days of enrollment through aggregator platforms like Athian, turning daily Bovaer costs of $0.26-$0.50/cow into $35-$160 annual revenue per cow—and Penn State research confirms no negative impact on milk yield or DMI.

- Digester economics finally make sense: Large dairies (1,000+ cows) are seeing 3-7 year payback periods on anaerobic digesters thanks to California’s Low Carbon Fuel Standard offering 28x multipliers for dairy methane capture, with documented returns of $250-$450 per cow annually from renewable natural gas sales.

- Precision feeding creates the foundation: Small operations should focus on feed efficiency improvements that boost Income Over Feed Costs by $31+ per cow annually while reducing baseline emissions—positioning for future aggregated carbon programs when economics improve for smaller herds in 2025-2026.

- Corporate insetting beats volatile markets: Major food companies are now directly funding on-farm methane reductions through supply chain “insetting” programs, offering more stable pricing than public carbon markets—Nestlé and Mars are co-funding direct farmer payments through programs like Fonterra’s climate incentives.

- Regional advantages vary significantly: Midwest operations benefit from pipeline access while Western dairies access California’s premium LCFS markets despite higher logistics costs, and Northeast producers are seeing processors specifically request carbon footprint data during contract negotiations—timing spring feed additive implementation with natural ration adjustments maximizes adoption success.

EXECUTIVE SUMMARY

Look, I’ve been skeptical of environmental programs as much as the next guy—remember all those carbon sequestration promises that never paid out? But here’s what’s different: methane monetization isn’t some future possibility, it’s generating documented revenue right now with producers banking $35 to $450 per cow annually depending on their approach. The FDA approved Bovaer feed additive this past May, and it’s delivering consistent 30% methane reductions at just $0.26-$0.50 per cow daily while actually improving milk fat percentages. Meanwhile, large operations are seeing transformational returns from anaerobic digesters—one 5,500-cow dairy is generating $1.4 million annually, exceeding their milk income in challenging years. With California mandating 40% methane cuts by 2030 and major processors like Danone committing to supply chain reductions, this isn’t going away… it’s just getting started. Corporate buyers are paying premium prices of $30-$50 per tonne CO2e because dairy methane reductions are directly measurable—no creative accounting like those questionable forestry projects. You should seriously run these numbers for your operation because the competitive advantage window is narrowing fast.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- How Smart Dairy Farmers Are Slashing Methane While Boosting Profits – Reveals practical strategies for immediate implementation of FDA-approved Bovaer and alternative approaches, including step-by-step implementation roadmaps and funding options that help producers start generating carbon revenue within 30 days.

- California’s $522 Million Secret: How Smart Dairy Farmers Turned Methane into Money While Saving the Planet – Demonstrates how California’s innovative policy framework created $522 million in profitable methane reduction investments, providing a blueprint for market-based environmental programs that other regions are now replicating worldwide.

- The Methane Efficiency Breakthrough: How Smart Breeding Cuts Emissions 30% While Boosting Your Bottom Line – Explores genetic selection methods that achieve long-term methane reductions of up to 30% while maintaining milk production, offering producers a permanent solution that compounds benefits over multiple generations without ongoing feed additive costs.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!