Why do some dairies bank $100K+ from beef crosses while neighbors get $200 for Holstein bulls?

EXECUTIVE SUMMARY: What farmers are discovering through real-world experience is remarkable—beef-cross calves now bring around $1,370 at Pennsylvania auctions while Holstein bulls fetch maybe $200, according to recent USDA market reports. This seven-fold premium stems from three converging factors: beef cow inventory hitting its lowest point since 1961 (27.9 million head per USDA’s January report), sexed semen technology achieving 70-80% of conventional conception rates, and research from the Journal of Animal Science confirming crossbreds demonstrate superior feed conversion and carcass quality versus straight dairy steers. Nearly three-quarters of dairy operations now engage in some beef-on-dairy breeding, with leading farms, such as McCarty Family Dairy in Kansas, reporting that cattle sales represent roughly half of their monthly revenue during strong markets. Economic modeling from UW-Madison indicates profitability holds as long as crossbreds maintain at least double the value of Holstein bulls—suggesting a practical floor around $450-500 even after inevitable market corrections. Here’s what this means for your operation: implementing a conservative approach with just 15% of your herd could generate $25,000-40,000 in additional annual revenue without betting the farm. The opportunity remains open for producers willing to act with measured optimism and proper risk awareness.

I recently spoke with a producer from Pennsylvania who mentioned something that stopped me in my tracks. His beef-cross calves just brought around $1,370 at the New Holland auction, according to recent USDA market reports from September. Meanwhile, his neighbor, located in the same region and operating similarly, continues to receive roughly $200 for straight Holstein bulls on a good day.

What’s interesting here is that this isn’t just a Pennsylvania story. I’m hearing similar accounts from Wisconsin to California, Texas to Vermont, and it raises questions worth exploring. Some operations are capturing an additional $100,000 or more annually through strategic breeding decisions, while others continue with traditional approaches. The difference isn’t simply about access to information—it’s about recognizing and acting on converging opportunities.

Ken McCarty from McCarty Family Dairy in Kansas offered a particularly compelling perspective at the recent World Dairy Expo. You know what stuck with me? He recalled attempting to sell Holstein bull calves years ago, describing them as “two for $5,” with no takers. Today, as he explained to the audience, cattle sales have transformed from a budget afterthought to representing approximately half of monthly revenue during strong markets. That’s more than incremental improvement. It’s a fundamental business transformation.

I’ve noticed similar stories emerging from diverse operations lately. An Ohio producer described an identical trajectory last month—from essentially giving away bull calves to generating significant revenue through beef crosses. Then there’s this Wisconsin dairyman who runs 300 cows and became one of his region’s early adopters. Down in Georgia, a 600-cow operation told me they’re now banking an extra $120,000 annually. These aren’t isolated success stories; they represent something broader worth understanding.

When Three Industry Trends Converged

Looking at this trend, what’s particularly noteworthy is how this opportunity emerged from the convergence of three independent developments. Understanding each component helps explain why some producers captured value while others missed the signals.

The current situation of the beef industry provides essential context. USDA’s January 2025 cattle report documented approximately 27.9 million beef cows nationally—the lowest level recorded since the early 1960s. Total cattle inventory decreased to 86.7 million head, reflecting sustained pressure on beef production capacity. Three consecutive years of drought across the Great Plains forced substantial herd liquidations.

Driving through Nebraska last summer, I observed pastures that typically support cow-calf operations standing empty—a clear reminder of supply constraints affecting the entire beef complex. A rancher near North Platte told me he’d sold his entire herd rather than buy $300 hay. Can’t blame him.

Simultaneously—and this is where it gets interesting—sexed semen technology reached practical viability. By the mid-2010s, conception rates improved substantially. Under good management protocols, sexed semen often achieves 70-80% of conventional rates, according to various university studies and extension reports. While this advancement didn’t make headlines, it fundamentally altered replacement strategies. What farmers are finding is they can now generate adequate replacements from their top-performing animals—perhaps 30% of the herd—while directing remaining breedings toward terminal crosses.

The third development surprised even experienced cattle feeders. Research from the Journal of Animal Science and multiple land-grant universities documented that beef-dairy crossbreds weren’t merely “improved Holstein steers.” They demonstrated measurably superior performance—better growth rates, improved feed conversion, enhanced carcass quality. Major processors report acceptance rates for these crosses now exceed 95%, with many achieving Choice grade or better. The kind of performance that makes feeding operations genuinely interested, if you know what I mean.

| Factor | Current Status | Historical Context | Impact |

| Beef Cattle Inv | 27.9m head | Lowest ’61 | Supply shortage |

| Sexed Semen Tech | 70-80% concept | Prev impact | Efficient strat |

| Crossbred Perf | Superior conv | Better Holstein | 95% acceptance |

Early Adopters: Different Thinking, Strategic Implementation

I’ve been thinking about what separated these pioneers who began beef-on-dairy breeding around 2015-2016 from their peers. It wasn’t necessarily farm size or capital resources. They approached risk and opportunity differently, somehow.

Their typical strategy involved measured experimentation rather than wholesale conversion. They’d identify maybe 50 to 75 lower-performing animals—you know, third-lactation cows with conception challenges, candidates for culling regardless. The economics were straightforward enough: with Holstein bulls bringing $50 and beef crosses potentially fetching $250 or more, even modest success rates justified the marginally higher semen costs.

What I find particularly clever about their approach was the trial design. They selected proven, easy-calving Angus genetics rather than exotic breeds. Maintained existing AI service providers. And—this is crucial—they secured buyer commitments before initiating breeding programs. Having confirmed market access before breeding decisions proved pivotal to consistent returns.

A producer in Idaho shared his early experience: “We started with 60 cows in 2016. Nothing fancy. Just wanted to see if this beef-cross thing was real. That first group of calves generated an additional $18,000. Not huge money, but enough to know we were onto something.”

Now, not every operation found immediate success. A producer in New Mexico attempted the same approach but initially struggled with buyer acceptance. “Our local market wasn’t ready for crossbreds yet,” he explained. “Took us a year to find the right buyers who understood what we were producing.” That’s an important reminder—market development varies by region. Even within Arizona, producers in Phoenix-area markets report premiums 15-20% higher than those near Tucson, reflecting different buyer bases.

Evolution from Experiment to Core Strategy

The adoption pattern followed remarkably consistent phases across different regions and operation sizes, which I find fascinating.

During the initial phase—let’s say 2015 through 2017—farms allocated 10-15% of breedings to beef bulls, typically focusing on problem breeders. Revenue impact remained modest, perhaps 2-3% of total farm income. But the learning value? That proved substantial. Which sires performed best? What specifications did buyers prefer? How should calf management protocols adapt?

The scaling phase (2018-2020) saw operations expand to 25-35% beef breeding as data accumulated and buyer relationships developed. This is when sexed semen integration became crucial. Top-tier genetics received sexed dairy semen for replacement purposes, while lower-performing animals were bred for beef production. Revenue contribution increased to 5-8% of farm income—becoming materially significant.

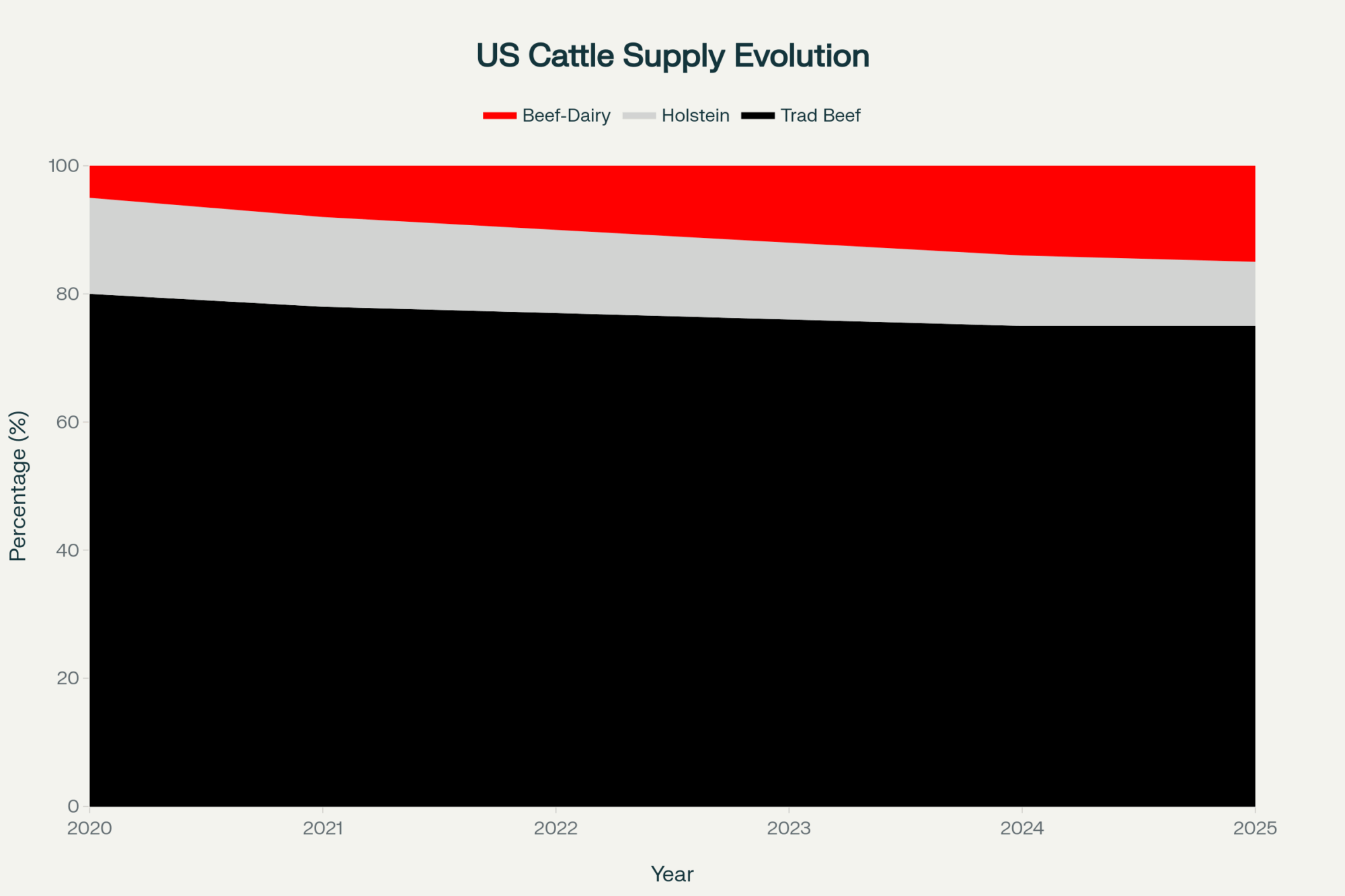

Current adoption reflects industry-wide recognition. Recent industry reporting indicates that a large majority—nearly three-quarters—of dairy operations now use some beef semen, according to the latest data from Farm Journal. For operations like McCarty’s, cattle sales can represent substantial monthly revenue during favorable market conditions. We’re talking about a complete business model evolution from a decade ago.

Labor Challenges: The Under-Discussed Constraint

Here’s something that concerns me, and I think we should discuss it more openly. Premium calf values come with management requirements that deserve careful consideration.

Crossbred calves require different protocols than traditional dairy calves, particularly during the critical first 30 days when respiratory challenges are more common. Achieving the growth rates buyers expect demands precise feeding management. And unlike Holstein bulls, which are typically marketed through single channels, beef crosses require evaluation and sorting for multiple programs.

This intensified management intersects with broader labor challenges we’re all aware of. A Texas A&M AgriLife analysis estimated that about half of the U.S. dairy workforce are immigrants, producing close to four-fifths of the nation’s milk. Current immigration uncertainties create operational risks that many producers are experiencing firsthand.

I’m hearing similar concerns from producers across multiple states. Wisconsin operations describe workers hesitant to report following nearby enforcement actions. Arizona and Idaho dairies face challenges in retaining experienced calf managers. Vermont producers express similar concerns. Even down in Florida, where you might not expect it, labor availability is constraining expansion plans. The H-2A program, while valuable for seasonal agriculture, doesn’t address year-round dairy labor needs—as we all know too well.

What worries me is that the skills required for premium calf production—health assessment, nutritional management, market timing—require experience that takes years to develop. A calf buyer recently explained that management quality can create $200-300 per head value differences. That margin? That’s the entire profit opportunity for many operations.

Understanding Market Premiums: The Hide Color Reality

Let’s address something that generates understandable frustration among producers—the $100-200 premium for black-hided calves. I know, it seems arbitrary. But the economics reflect market realities worth examining.

Analysis from organizations, including the American Angus Association, indicates black cattle demonstrate statistical advantages in marbling consistency and feed efficiency. More significantly—and this is key—black hides provide access to branded beef programs, such as Certified Angus Beef, that command harvest premiums. Although not every qualifying animal naturally achieves program standards. Recent processor data shows these programs can add substantial value at harvest.

Markets frequently pay several dollars per hundredweight more for black-hided groups, which can translate to roughly $100-200 per head on typical feeder weights. Feedlot managers consistently acknowledge this price impact.

Is this pricing structure optimal? Well… maybe not from a pure performance perspective. A Nebraska feedlot manager recently offered practical insight: “I understand a red Angus cross might perform equally well, but when I’m evaluating 300 head in 10 minutes, I rely on proven indicators.” Hard to argue with that logic. Until individual genetic data become standard for every calf, visual characteristics will continue to influence rapid market decisions.

A producer in South Dakota put it bluntly: “I don’t like that my red-hided calves bring less money. But I can complain about it, or I can breed black bulls and bank the difference. Guess which one pays better?”

Anticipating Market Evolution

Looking ahead—and I’ve been through enough cycles to know this—current premium levels will moderate. The question isn’t whether adjustment occurs, but rather its timing and magnitude.

Early indicators already emerge. Industry reports suggest that beef-on-dairy breeding decreased slightly in 2024 as operations addressed concerns about heifer inventory. Improved pasture conditions across traditional beef regions may enable herd rebuilding, though this process typically requires multiple years. We’ve seen this before.

This development suggests something important, though. Economic modeling from UW-Madison indicates profitability generally holds when beef-on-dairy calves bring at least twice the value of straight Holstein bull calves, given common assumptions. That’s the key threshold right there.

Consider potential scenarios here. If beef prices decline to $700—that’s down from current highs—while Holstein bulls remain at $250, that still represents nearly three times the value. Well above that 2x profitability threshold. Using this guideline and common Holstein bull values of around $200, viability tends to weaken if beef cross-calf values fall below the mid-$400s. That’s probably your practical floor.

Practical Implementation for October 2025

For operations currently receiving $200 for Holstein bulls, here’s what I’d suggest as a measured approach to capturing available premiums.

This week: Contact three calf buyers—your current purchaser plus two specializing in beef crosses. Start with your local livestock auction markets, which often maintain buyer lists for specialty calves. Your county extension office can provide contacts for regional beef-cross buyers. Most AI companies now maintain buyer networks specifically for their beef-on-dairy customers, and the National Association of Animal Breeders offers a directory of approved calf buyers by region. Obtain specific pricing for the October delivery of 80-100 pound black crossbred calves. Understand health protocols, volume preferences, and payment terms. Many Holstein buyers don’t purchase beef-on-dairy calves, so confirming markets in advance prevents misalignment.

Next week: Identify 50-75 lower-tier breeding candidates. You know the ones—older animals that require multiple services, typically those in the bottom quartile of producers. Source proven, easy-calving Angus genetics with birth weight EPDs around -2.0 or better. Extension sources consistently recommend choosing these mainstream genetics over exotic alternatives for better market acceptance.

Week three: Calculate replacement needs precisely. A 500-cow operation typically requires 100-110 annual replacements, with some variation. Implement sexed dairy semen on superior genetics to ensure adequate replacements while allocating remaining breedings to beef. This balance is critical for long-term sustainability. And don’t forget to factor in your typical cull rates and any expansion plans you may have. Also worth considering is that many operations now insure higher-value calves for the first 30-60 days, typically costing $15-25 per head but protecting an investment of $ 1,000 or more.

This conservative approach—involving just 15% of your herd—could generate approximately $25,000 to $ 40,000 in additional annual revenue at current premium levels. That’s meaningful income without excessive risk concentration.

Strategic Lessons for Long-Term Success

What I think distinguishes operations that will thrive versus those facing challenges involves how they treat beef-cross revenue.

Successful producers I know use these premiums strategically—paying down debt, building reserves, addressing deferred maintenance while maintaining focus on sustainable milk production. They treat beef-cross income as a bonus, not a baseline. The operations at risk are restructuring entire business models around current calf values, taking on debt, and expanding facilities based on peak pricing.

Agricultural lenders commonly caution against structuring long-term debt service around peak calf prices. A banker friend in Minnesota captured this perfectly: “The dairy operations that worry me aren’t the ones doing beef-on-dairy. It’s the ones borrowing against $1,400 calves like that’s permanent. When markets moderate—and they always do—those fixed costs won’t adjust with them.”

This pattern echoes previous agricultural cycles, doesn’t it? The ethanol-driven corn boom rewarded producers who banked profits while challenging those who built operations around $7 corn. The organic milk premium cycle followed similar dynamics. A producer in Vermont who lived through the organic boom told me, “Same story, different product. The ones who survive are the ones who remember it’s a cycle.”

The Sustainable Future of Beef-on-Dairy

Despite inevitable market adjustments, several structural changes appear permanent. The efficiency of producing replacements from elite genetics, while maximizing terminal cross value, will not reverse simply because prices moderate. Established infrastructure—buyer networks, marketing channels, quality programs—will persist even as margins compress. And those documented performance advantages of crossbred cattle in feeding operations remain regardless of price levels.

For producers evaluating current opportunities, perspective matters. The exceptional margins of recent years won’t persist indefinitely—we all know that. However, even at more sustainable levels—perhaps $600-$ 800 per head—beef-on-dairy offers meaningful revenue diversification for operations prepared to manage the added complexity.

The opportunity window remains open, but it continues to narrow. Producers acting now with appropriate risk awareness can still capture value. Those awaiting perfect conditions will likely miss participation entirely.

A Nebraska dairyman recently offered a valuable perspective that resonates with me: “We accepted for 20 years that bull calves had negligible value. The only worthless element was that assumption itself.”

Sometimes significant opportunities exist in plain sight, waiting for the convergence of technology, market conditions, and strategic thinking to reveal their value. For dairy producers willing to thoughtfully evaluate and act on current conditions, beef-on-dairy represents exactly such an opportunity—one where understanding both potential and limitations determines success.

What farmers are finding is that this isn’t just about catching a market trend; it’s about cultivating a lasting relationship. It’s about fundamentally rethinking what each pregnancy on your farm represents. Whether you’re in Pennsylvania, Wisconsin, or anywhere in between, the beef-on-dairy opportunity is real. But it requires clear eyes about both the potential and the pitfalls. Those who approach it with measured optimism and conservative implementation will likely find success. That shift in thinking might be the most valuable change of all.

KEY TAKEAWAYS

- Start conservatively with 15% of your herd (50-75 lower-performing cows) to capture $25,000-$ 40,000 in additional annual revenue while maintaining operational flexibility. This approach minimizes risk and proves the concept works for your specific situation.

- Secure buyers before breeding decisions by contacting local auction markets for specialty calf lists, your county extension office for regional beef-cross buyers, and AI company networks—many Holstein buyers don’t purchase crossbreds, so market confirmation prevents costly misalignment.

- Target proven, easy-calving Angus genetics with birth weight EPDs around -2.0 or better, as extension sources consistently show mainstream black-hided genetics bring $100-200 premiums per head due to branded beef program access and feedlot preferences.

- Calculate replacement needs precisely before expanding—a 500-cow operation typically requires 100-110 annual replacements, so implement sexed dairy semen on your top 30% while allocating bottom-tier cows to beef to maintain herd sustainability.

- Treat beef-cross income as windfall profit, not baseline revenue—agricultural lenders caution that operations borrowing against $1,400 calf values face serious risk when markets moderate to the sustainable $600-800 range that economic models predict.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Ultimate Guide to Finishing Beef-on-Dairy Calves for Maximum Returns – This guide reveals crucial best practices for the post-weaning phase, focusing on nutrition, health protocols, and facility management to boost feed efficiency and carcass quality, ensuring you capture maximum value from your calves at harvest.

- Mastering Beef on Dairy Programs: Strategies for Thriving in an Uncertain Future – This strategic analysis provides a high-level perspective on long-term viability, outlining how to integrate a beef-on-dairy program with sustainable practices and risk management, positioning your operation to thrive through future market volatility.

- Maximizing Dairy-Beef Potential: Grazing Strategies Boost Weight and Efficiency – A deep dive into innovative grazing strategies, this article demonstrates how to significantly reduce feedlot time and costs while improving average daily gain and overall calf health, adding another layer of profitability to your program.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.