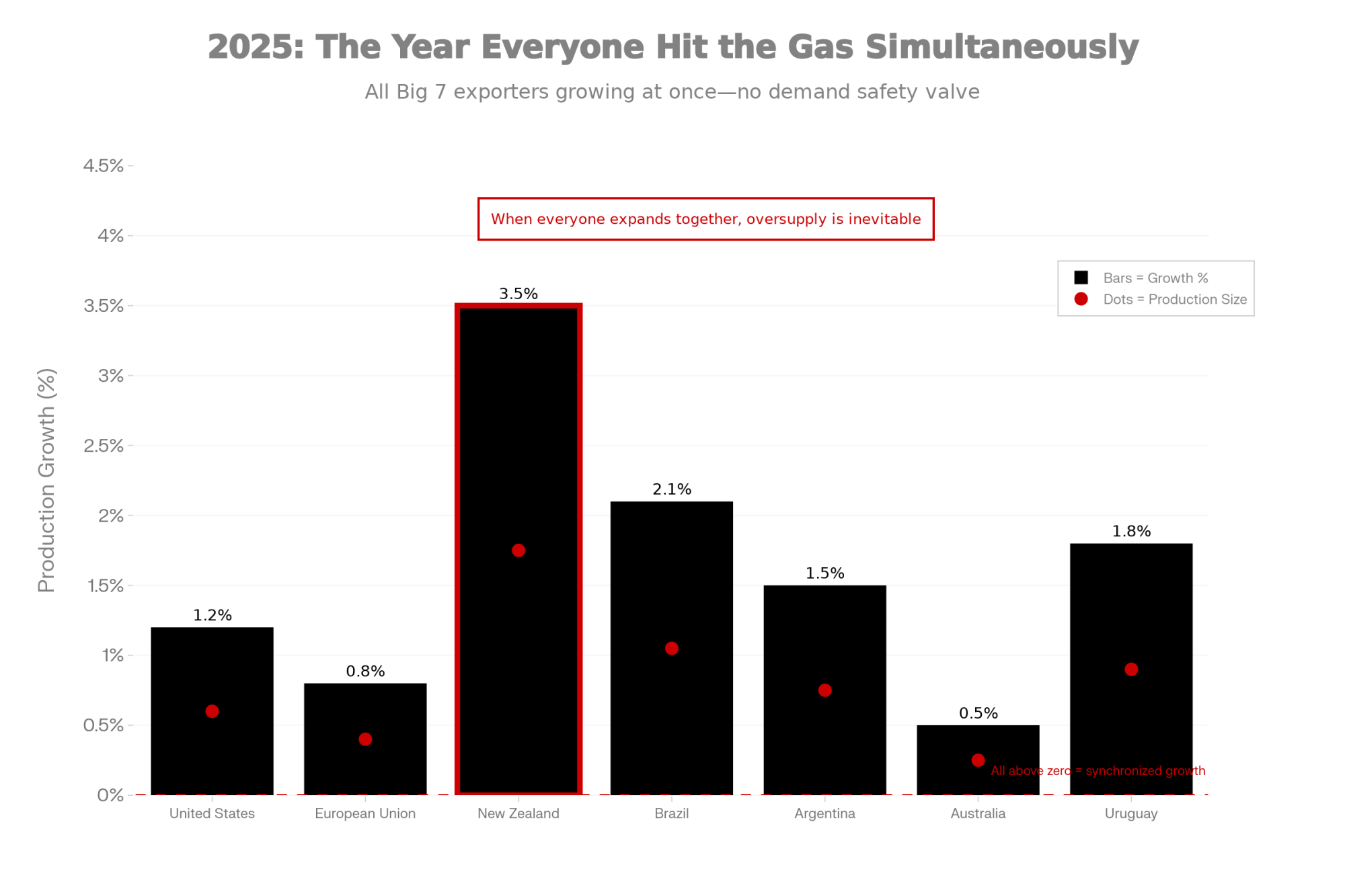

Every major dairy region is producing more milk—at the exact same time. That almost never happens. And prices are showing it.

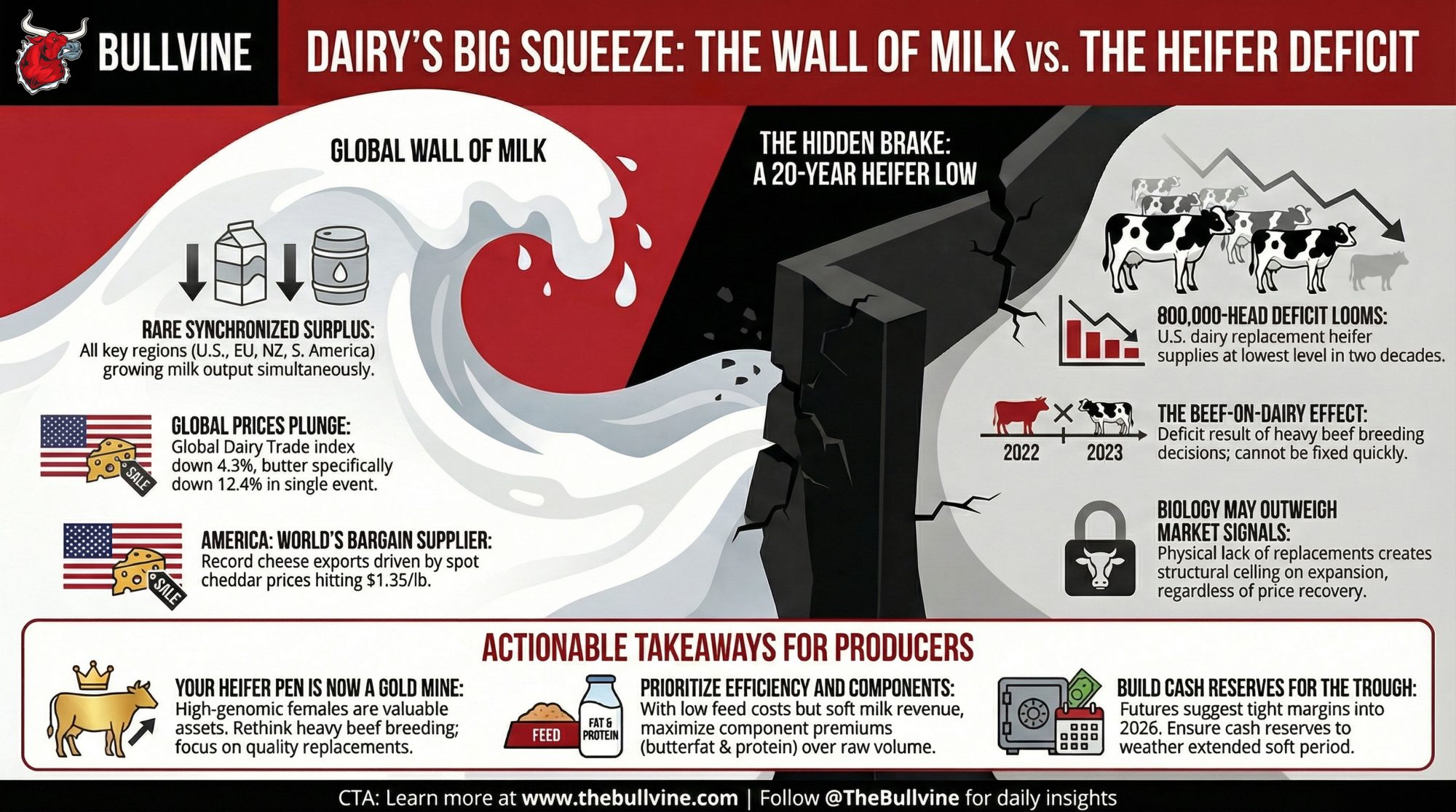

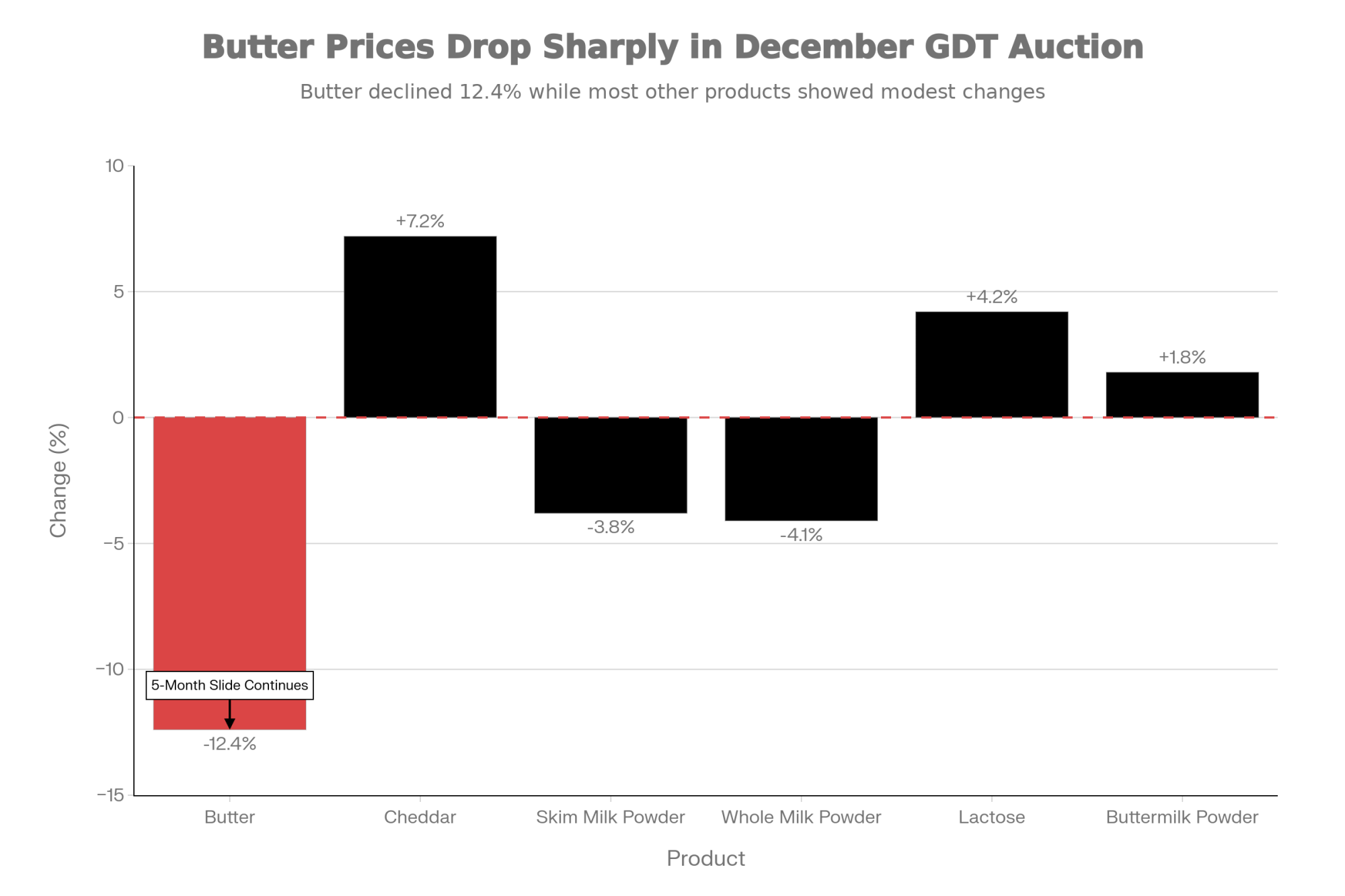

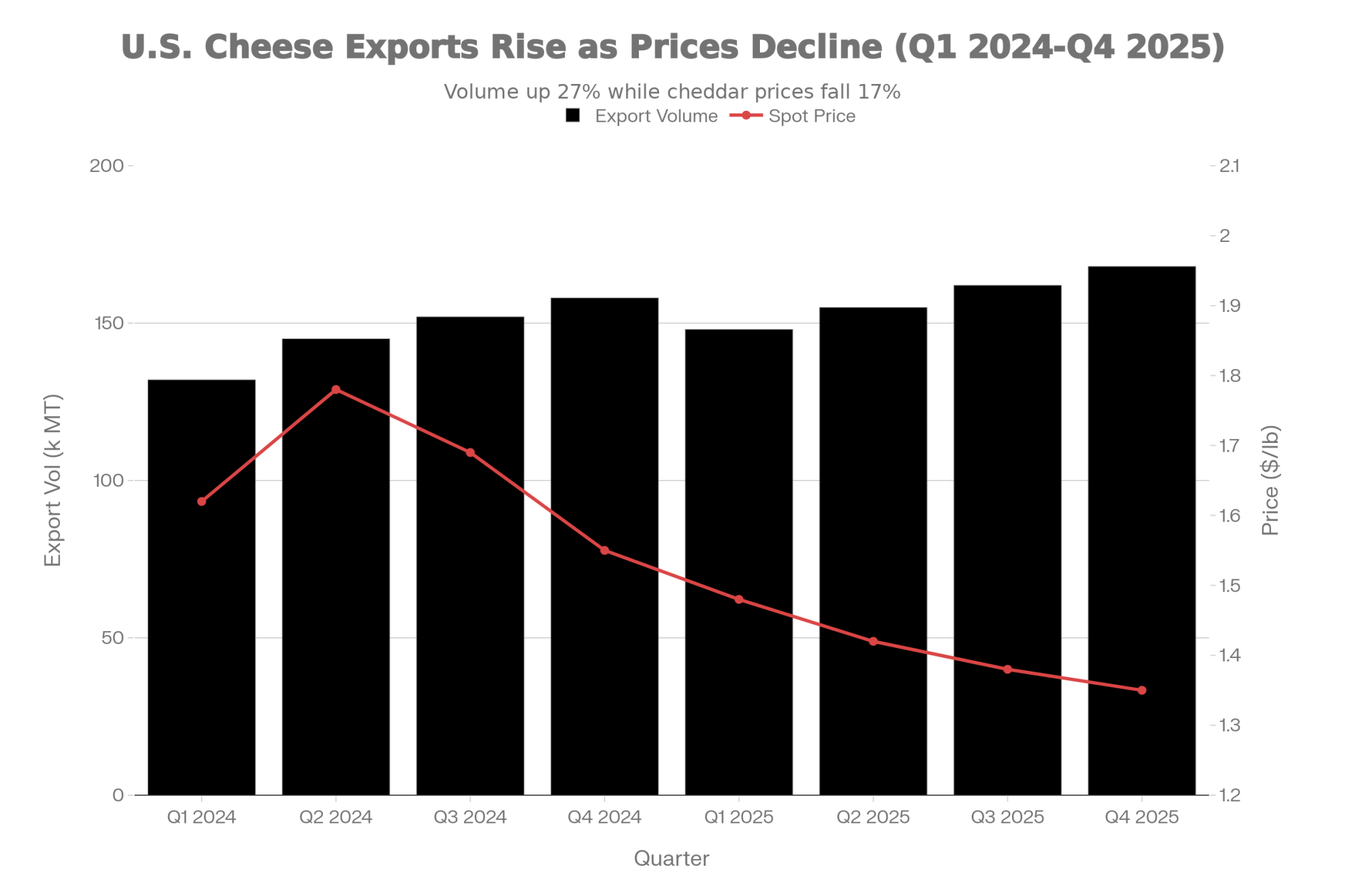

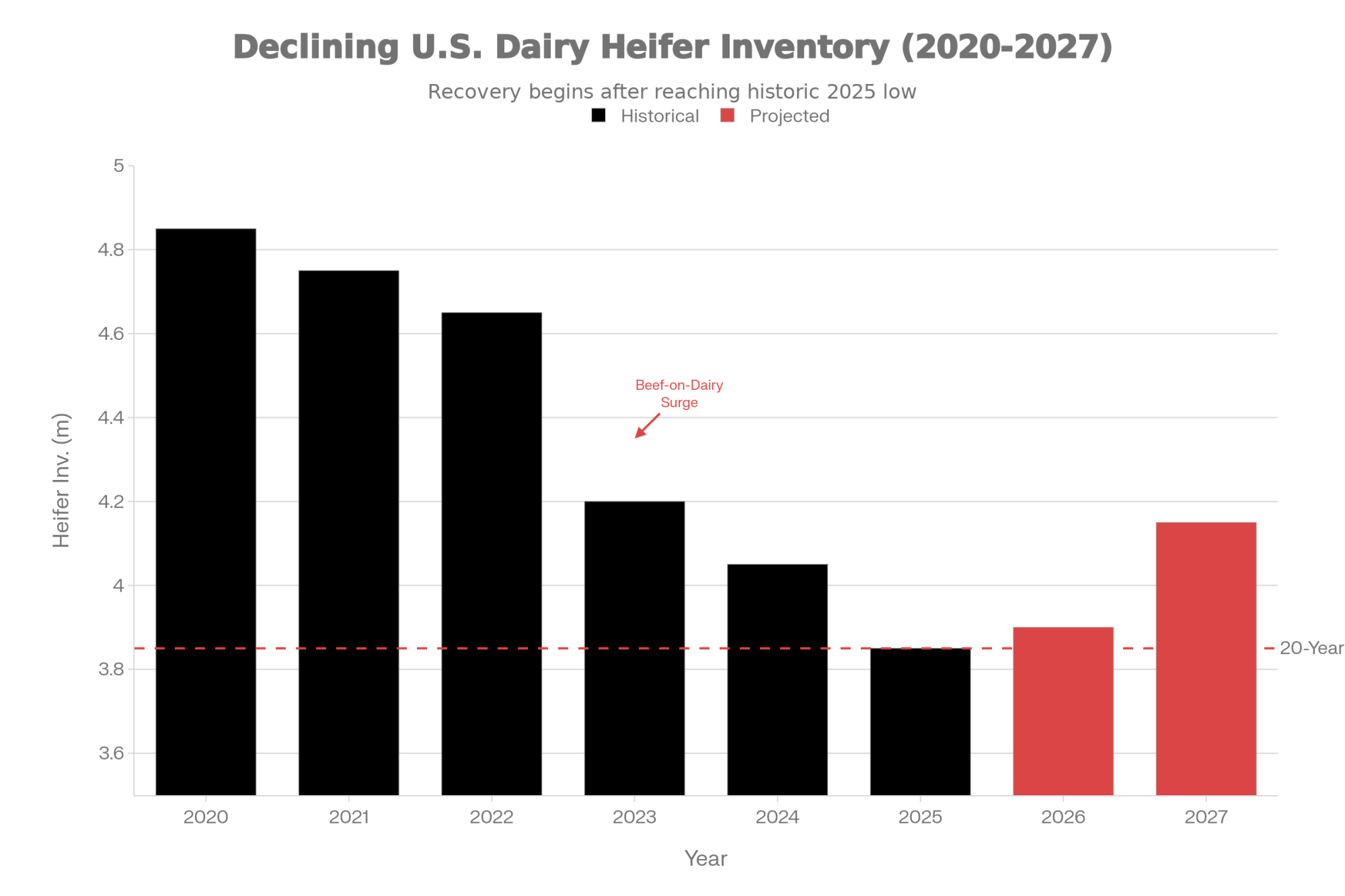

Executive Summary: The world is awash in milk. The U.S., Europe, New Zealand, and South America are all growing production simultaneously—a rare alignment that almost never occurs and has crushed the Global Dairy Trade index by 4.3%, with butter plunging 12.4% in a single auction. U.S. cheese exports are setting records, yet spot cheddar sits at just $1.35/lb; America has become the world’s bargain supplier. RaboResearch analysts don’t see meaningful price recovery through 2026, given relentless production growth. But here’s the structural twist worth watching: CoBank reports dairy heifer inventories at 20-year lows, with an 800,000-head deficit baked into the system from beef-on-dairy breeding decisions made in 2022-2023. Biology may ultimately accomplish what price signals haven’t. For farmers navigating this extended trough, the priorities are clear: cost control, component premiums, and cash reserves.

Something unusual is happening across the global dairy landscape right now—every major milk-producing region on earth is growing production at the same time. That almost never happens. And it’s reshaping price expectations heading into 2026.

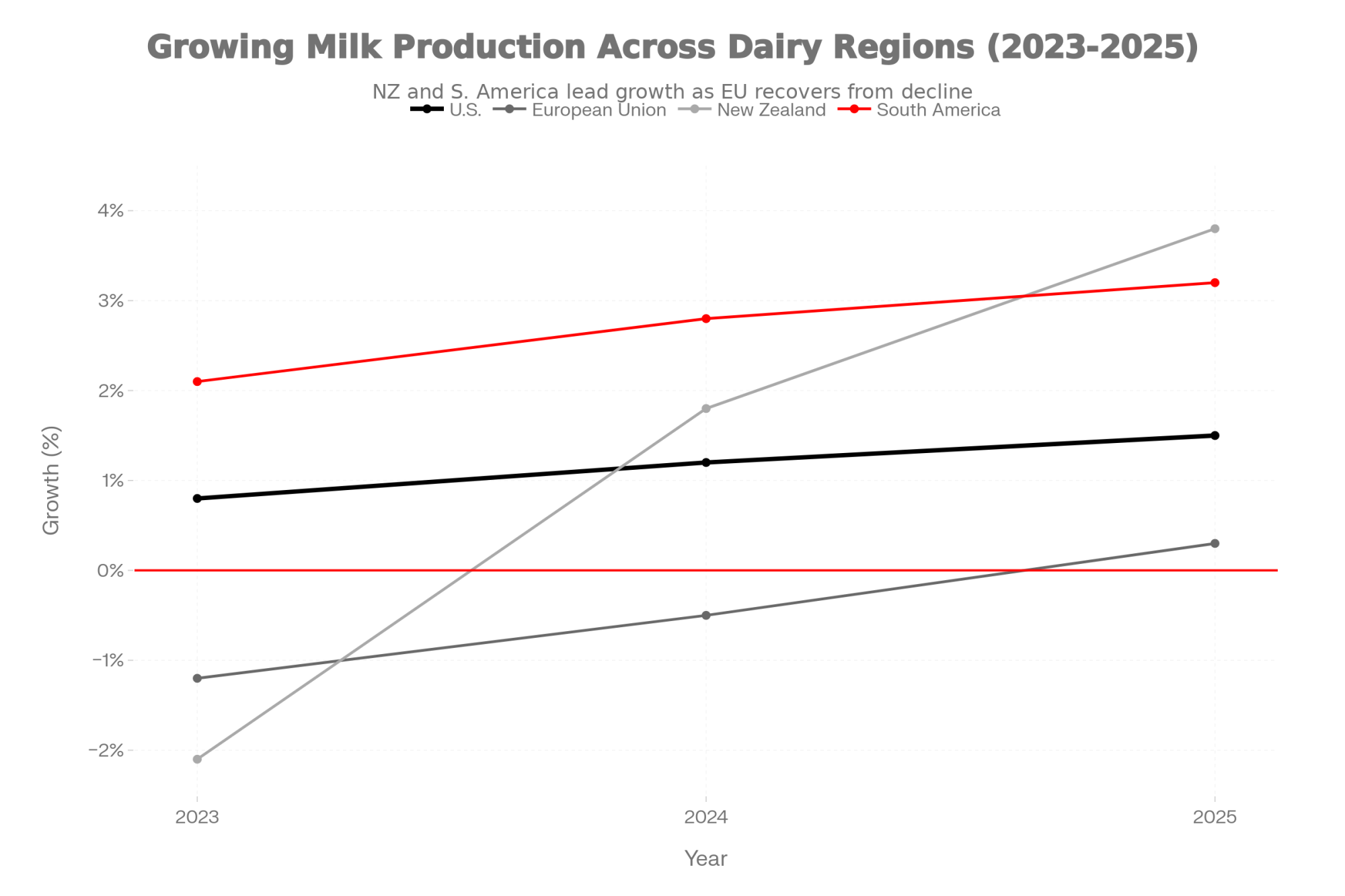

Typically, when American parlors are running full, New Zealand deals with drought. When Europe expands, South American margins collapse. But as we close out 2025, that natural counterbalancing act has broken down entirely—and the market is feeling it.

“Milk output is growing in all key exporting regions, which is not common,” explained Lucas Fuess, senior dairy analyst at RaboResearch, in a December 2025 analysis. “Typically, at least one part of the world is dealing with a limiting factor that is reducing milk growth—either weather, disease, margins, or something else. Now, the U.S., EU, New Zealand, and South America are all seeing growth—simultaneously.”

What this means practically is that the usual relief valves aren’t working. When everyone’s producing, someone has to buy—and right now, demand simply isn’t keeping pace.

Global Dairy Trade: What the December Numbers Show

The Global Dairy Trade price index fell 4.3% at the most recent auction, with most product categories posting declines. Butter took the hardest hit—down 12.4% in a single event. Only cheddar (+7.2%), lactose (+4.2%), and buttermilk powder (+1.8%) managed gains.

What strikes me about these numbers is the divergence between commodities. Butter has been sliding since May, when it reached five-year highs. Meanwhile, cheddar actually firmed at the latest auction. That kind of split tells you something important about how global buyers are thinking—they’re not avoiding dairy, they’re just getting selective about where they source it and what they’re buying.

Why U.S. Butter Became the World’s Bargain in 2025

Here’s something that deserves more attention: U.S. butter prices have sat well below European and New Zealand prices throughout all of 2025. That gap created an opportunity that global buyers noticed—and acted on.

“The US butter price has been well below the EU and NZ price throughout all of 2025,” Fuess noted. “This has driven global buyers to procure product from the US instead of other regions to recognize the value in US product.”

John Hallo, procurement business partner at Maxum Foods, offered additional context on the New Zealand correction: “New Zealand pricing had been running at a premium from the USA/EU for four months, so I could argue their price was overinflated. Along with peak season supply of NZ fat, we have inevitably seen the correction.”

The practical implication? That American price advantage is narrowing as global prices converge downward. Farmers who’ve been benefiting indirectly from strong export demand should watch these spreads closely heading into 2026.

U.S. Dairy Exports 2025: Record Cheese Volumes Meet Softening Spot Prices

The American export picture presents an interesting paradox. CME spot cheddar blocks closed the week of December 8-12 at $1.35 per pound, with butter averaging $1.4785/lb. Class III futures for December settled around $15.88/cwt, with Class IV hovering in the mid-$13s—hardly inspiring numbers for the milk check. (Daily Dairy Report, December 12, 2025)

And yet, U.S. cheese exports are having a record year. September shipments jumped 35% year-over-year, putting year-to-date volume at 453,076 metric tonnes. That’s already more cheese shipped abroad in nine months than in any full calendar year except 2024. The U.S. Dairy Export Council projects we’ll likely top 600,000 MT for the full year. (USDEC, December 11, 2025)

What I find telling is that we’re moving record cheese volumes at the exact moment spot prices are hitting 18-month lows. That disconnect reveals how global buyers think—they’re responding to relative value, not absolute price levels. When an American product is cheap compared to alternatives, they buy American. Simple as that.

Katie Burgess, dairy market advising director with Ever.Ag raised an important concern at the Oregon Dairy Farmers Convention earlier this year: “If we can’t get the cheese exported, and we’re making a lot of it, it means we’re going to need to eat a lot more cheese.”

What University Research Is Showing About Milk Solids

Leonard Polzin, dairy markets and policy outreach specialist at the University of Wisconsin-Madison, has been tracking something important: production efficiency gains are outpacing headline milk volume. Despite modest total production growth, calculated milk solids production has increased more substantially because butterfat and protein tests keep climbing. (UW Extension Farms, 2025 Dairy Situation and Outlook)

For context, back in 2020, the average butterfat test was 3.95% and the protein test was 3.181%. Today’s tests are running notably higher than usual. This matters because it means the industry can meet demand for milk solids more quickly than raw production numbers suggest—processors get more usable product per hundredweight than they did five years ago.

Additionally, UW-Madison research highlights that Federal Milk Marketing Order reforms taking effect are expected to decrease the All Milk Price by approximately $0.30/cwt, with a more pronounced impact on Class III prices. (UW Extension Farms, February 2025) That’s not a dramatic hit, but it’s another headwind for margins already under pressure.

The Heifer Constraint Nobody’s Talking About Enough

Here’s what makes the current situation genuinely unusual: despite soft milk prices, there’s a structural ceiling on how fast production can actually grow. Talk to producers across the Upper Midwest, and you hear the same story—replacement heifers are scarce and expensive.

According to CoBank’s August 2025 sector analysis, U.S. dairy replacement heifer supplies have fallen to their lowest levels in twenty years. The research projects heifer inventories will shrink by approximately 800,000 head over the next two years before beginning to recover in 2027. (CoBank/Wisconsin Ag Connection, August 2025)

That 800,000-head deficit is already baked into the system based on breeding decisions made during 2022 and 2023 when beef-on-dairy crossbreeding surged. Biology dictates timing here—you can’t simply buy your way out of a heifer shortage when the calves weren’t born.

What this means practically: even if milk prices rose tomorrow and every producer wanted to expand, the replacement animals aren’t there to support rapid growth. It’s one reason why the supply response to current low prices may be slower than historical patterns would suggest—and why some analysts see eventual price support emerging from the supply side rather than demand.

The Bullvine Breeder’s Takeaway

The 800,000-head heifer deficit changes the math on your genetic inventory. Here’s what that means for breeding decisions:

- Your heifer pen is now a gold mine. Verified high-genomic females will likely command premium prices through 2026 as processors compete for milk to fill new capacity.

- Stop culling lightly. With replacements at 20-year lows, that “marginal” cow might be worth keeping for one more lactation.

- Inventory as asset class. Heifers are no longer just a cost center—they’re increasingly liquid assets in a supply-constrained market.

- Rethink beef-on-dairy. If you swung 70%+ to beef semen in 2023, review your genetic strategy immediately. The market is signaling a need for replacement purity, and premiums for verified dairy replacements are likely within 12 months.

European Dairy 2025: Less Milk, More Cheese

The EU situation offers its own set of complexities. USDA GAIN reports forecast milk deliveries at 149.4 million metric tonnes in 2025—down 0.2% from 2024. Low farmer margins, environmental regulations, and disease outbreaks continue pushing smaller producers out.

But here’s the nuance that matters: European processors are deliberately prioritizing cheese over butter and powder. EU cheese production is forecast to rise 0.6% to 10.8 million metric tonnes, even with less total milk available. They’re making a strategic choice about where to allocate their milk supply—and cheese is winning.

For American producers competing in export markets, this means European cheese will remain a competitive threat even as their overall milk production contracts.

New Zealand and Fonterra: Strong Collections, Cautious Outlook

New Zealand’s dairy sector continues performing well, though Fonterra’s latest forecast signals caution about where prices are heading. The cooperative narrowed its 2025/26 farmgate milk price range from NZ$9.00-$11.00 per kgMS down to NZ$9.00-$10.00 per kgMS in late November, with the midpoint dropping from NZ$10.00 to NZ$9.50. (Fonterra, November 25, 2025)

At the same time, Fonterra increased its milk collection forecast for the 2025/26 season from 1,525 million kgMS to 1,545 million kgMS—reflecting strong on-farm production conditions. Season-to-date collections through October were running 3.8% above last season. (Fonterra Global Dairy Update, November 2025)

CEO Miles Hurrell noted the cooperative has seen strong milk flows this season, “both in New Zealand and other milk-producing nations,” resulting in seven consecutive price drops at recent Global Dairy Trade events. Fonterra’s cooperative structure provides some insulation from spot-market volatility that investor-owned processors don’t enjoy, but its price guidance suggests it’s not expecting quick relief from current conditions.

China: Modest Import Recovery on the Horizon

After a brutal 17% decline in dairy imports through the first eight months of 2024, Rabobank forecasts Chinese dairy imports will improve by 2% year-on-year in 2025. Chinese farmgate milk prices have fallen to near 10-year lows, forcing herd reductions and farm exits that are constraining domestic supply. (Tridge/Rabobank, November 2024)

That said, a 2% increase helps at the margins but won’t fully absorb the global surplus on its own. The AHDB notes that most import growth is expected in the latter half of 2025 as domestic stocks weaken. (AHDB, February 2025) It’s a positive signal, not a rescue.

Feed Costs 2025: The One Clear Bright Spot

There’s genuinely good news on the cost side. March corn futures settled around $4.405/bu in mid-December, while January soybean meal closed near $302/ton. These represent meaningful relief for ration costs heading into 2026.

The catch—and there’s always a catch—is that feed savings don’t help if milk revenue falls faster. Margins are being compressed from the revenue side right now, not the cost side. Strong feed conversion efficiency and component production matter more than ever when the milk check is lean.

| Cost/Revenue Component | Mid-2024 Average | Dec 2025 Average | Change per Cow/Year |

| Corn ($/bu) | $4.85 | $4.41 | -$96 (savings) |

| Soybean Meal ($/ton) | $365 | $302 | -$142 (savings) |

| Total Feed Cost per Cow/Year | $3,420 | $3,182 | -$238 (savings) |

| Milk Price per Cwt (Class III avg) | $18.20 | $15.88 | -$522 (loss) |

| Annual Milk Revenue per Cow | $4,368 | $3,811 | -$557 (loss) |

| Net Margin Impact (Revenue – Feed) | — | — | -$319 per cow |

The Price Signal That Hasn’t Triggered Supply Response

What farmers are finding, according to Fuess, is that milk prices simply haven’t dropped far enough to trigger the supply response markets typically need.

“Milk prices have declined in the US, but total dairy farmer income likely remains higher than the cost of production for most farmers, meaning there has not yet been a strong enough price signal to tell farmers to cull cows or cut production.”

This creates a frustrating dynamic. Prices are low enough to hurt, but not low enough to force the contraction that would eventually support recovery. We may be stuck in this uncomfortable middle ground for a while—though the heifer shortage could ultimately do what price signals haven’t.

2026 Dairy Price Outlook: What Analysts Are Watching

Both Rabobank and Maxum Foods expect Europe to slip into a meaningful contraction next year, which should help ease the current oversupply.

“For the EU, there is a lag in falling farmgate price and reduction in milk production,” Hallo explained. “Coming off the back of good market conditions for farmers, the farms still produce good quantities despite falling commodity prices. This may look to correct itself mid-2026.”

For U.S. producers, Fuess offered a more sobering assessment: “While volatility is never gone from the market, it is unlikely that US milk prices will see significant growth in 2026 due to the continually growing production.”

Practical Considerations for Your Operation

Every farm faces different circumstances, but several themes emerge from the current market environment:

- Cost management becomes your primary lever. With corn affordable and milk prices soft, feed efficiency and labor productivity matter enormously. Every dollar saved drops directly to the bottom line. This isn’t the time for sloppy ration management or deferred maintenance.

- Component premiums over raw volume. High-protein, high-butterfat milk commands better prices at most plants. The Pennsylvania Dairy Producer Survey found that “increasing milk components” ranked among the highest-rated priorities across the state’s dairies in 2025. (Center for Dairy Excellence/Penn State Extension, 2025 Survey Results)Chasing volume into a surplus market amplifies the problem for everyone.

- Beef-on-dairy revenue remains strong. With beef prices at historic highs, strategic terminal breeding can supplement dairy income while managing replacement inventory. The sustained strength in beef has made this supplementary income stream increasingly important to overall farm profitability—though it’s worth remembering that heavy beef breeding during 2022-2023 contributed to the heifer shortage now constraining expansion.

- Build cash reserves for an extended trough. Futures markets suggest sub-$16 Class III and sub-$14 Class IV through early 2026. That’s not a dip—that’s a prolonged soft period. Make sure your balance sheet can absorb six more months of tight margins, because the market isn’t signaling quick relief.

One important caveat: margin pressures vary significantly by region and operation size. Upper Midwest operations face different feed cost structures than Western dry-lot dairies, and component premiums differ by processor. What works for a 150-cow grazing operation in Vermont won’t necessarily apply to a 3,000-cow confinement dairy in Texas. Consult your nutritionist, your lender, and your local extension economist about your specific situation.

The Bottom Line

The global dairy market is sending a clear message: there’s more milk than buyers need right now, and sustained low prices will likely be required to rebalance supply and demand. Some analysts believe we’re approaching a floor. History suggests inflection points are notoriously difficult to call.

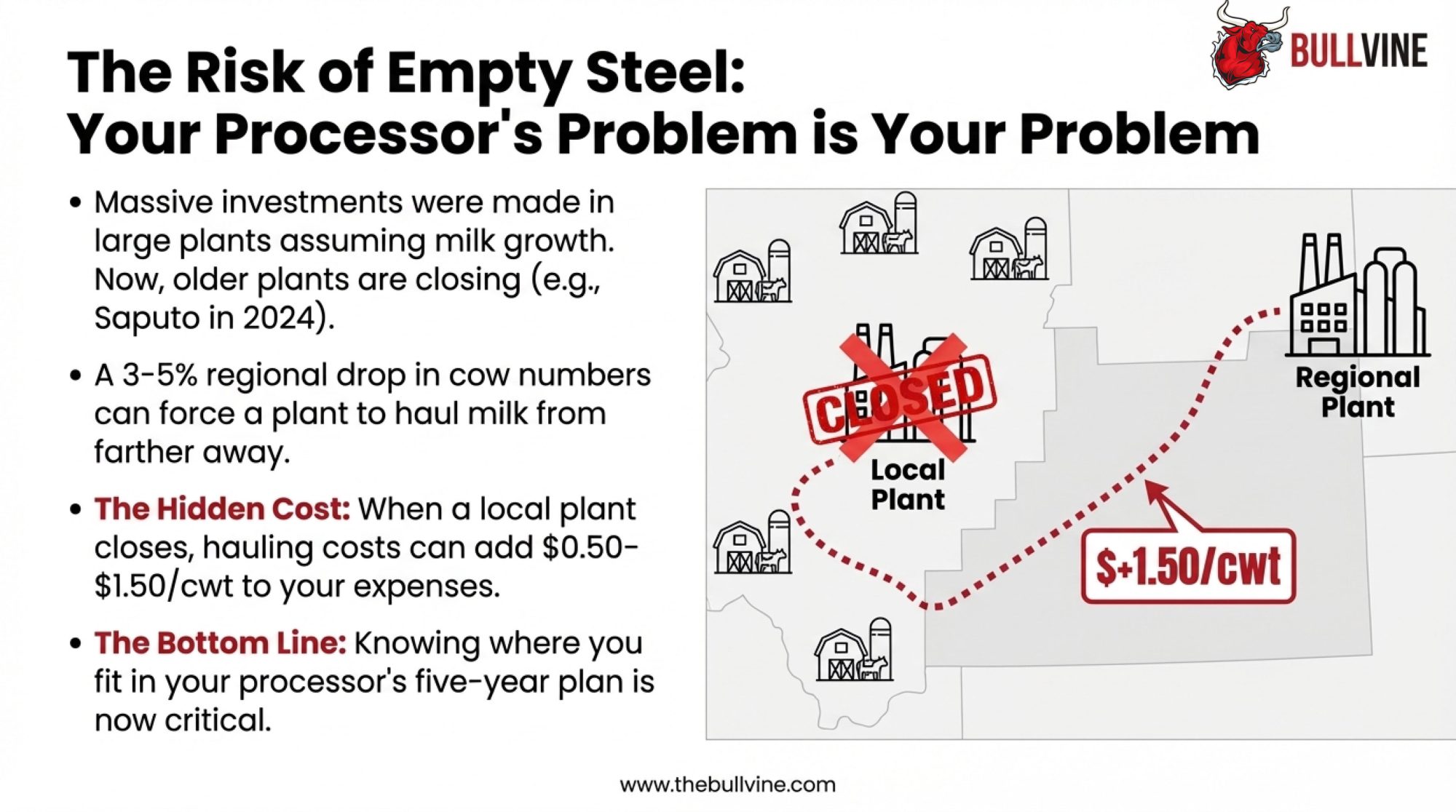

What’s interesting is that biology may ultimately accomplish what price signals haven’t—the 800,000-head heifer deficit documented by CoBank creates a hard ceiling on expansion that capital alone can’t override. By 2027, when $10 billion in new processing capacity needs filling, the cows to supply it may simply not exist.

Operations focused on efficiency, component quality, and cost discipline will be best positioned to weather this period—and to capitalize when conditions eventually turn.

| Margin Strategy | Estimated Impact per Cow/Year | Implementation Difficulty | Works Best For | What this means |

| Component premium focus | +$180-$320 | Medium | All herd sizes | “Non-negotiable. Volume into a surplus is suicide.” |

| Feed efficiency optimization | +$140-$220 | Low-Medium | Herds >100 cows | “Low-hanging fruit. Audit your ration immediately.” |

| Strategic beef-on-dairy | +$250-$400 | Low | Herds with replacement flexibility | “Beef prices won’t save you, but they’ll soften the blow.” |

| Heifer inventory as asset | +$150-$500 | High | Herds with genomic programs | “Your heifer pen is now a gold mine. Stop culling verified genetics.” |

| Cash reserve building | N/A (protects survival) | Medium | All farms | “Six months operating capital. Non-negotiable for 2026.” |

| Cull rate discipline | +$80-$180 | Low | Herds facing heifer shortage | “That ‘marginal’ cow is worth one more lactation.” |

Editor’s Note: Market data in this analysis comes from CME Group, Global Dairy Trade platform, USDA FAS reports, University of Wisconsin-Madison Extension, Penn State Extension, CoBank sector research, and industry analyst commentary from RaboResearch, Maxum Foods, and Ever.Ag (December 2025). National and regional averages may not reflect your specific operation’s circumstances. Feed and milk prices vary significantly by region, management practices, and market access.

Key Takeaways

- Rare synchronized surplus: U.S., Europe, New Zealand, and South America are all growing milk production simultaneously—a phenomenon that almost never occurs and is crushing prices globally

- December market snapshot: GDT index down 4.3%, butter plunged 12.4% in one auction, spot cheddar at $1.35/lb, Class III futures hovering near $15.88/cwt

- America’s export paradox: U.S. cheese exports are setting records precisely because we’ve become the world’s cheapest supplier—though that advantage narrows as global prices converge

- The 800,000-head constraint: Dairy heifer inventories have hit 20-year lows; this structural deficit from beef-on-dairy breeding may eventually limit supply when price signals alone haven’t

- 2026 outlook and action items: RaboResearch sees no meaningful recovery until European contraction mid-year; prioritize cost control, component premiums, and cash reserves to weather an extended trough

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Is Beef-on-Dairy causing America’s Heifer Shortage? – Reveals the structural root of today’s replacement crisis, detailing how the aggressive shift to beef-on-dairy created a biological lag that no amount of capital can quickly reverse.

- 11 Proven Strategies to Lower Feed Costs and Boost Efficiency on Your Dairy – Provides actionable tactics for reducing feed waste and optimizing rations, helping producers defend margins against the volatility highlighted in the market recap.

- From Milk Machines to Component Champions: How Genomics and Sexed Semen Are Remaking the Dairy Cow – Explains the genetic pivot from volume to solids, offering a roadmap for using sexed semen and genomic tools to capture the component premiums now driving milk checks.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!