€513M of EU dairy exports now hostage to Chinese electric vehicle politics – here’s your February 2026 survival plan

EXECUTIVE SUMMARY: Look, I’ve been tracking dairy trade for two decades, and this China situation isn’t your typical tariff spat. The real story isn’t the 30% duties everyone’s worried about – it’s that Chinese domestic production hit 69% self-sufficiency in 2022 and they’re targeting 75% by 2026. That €1.7 billion in EU exports? Half a billion of it’s now caught in an 18-month investigation that’s really about electric cars, not milk quality. While European producers are scrambling, New Zealand’s sitting pretty with their free trade agreement and 45% market share. The math’s brutal – if you’re planning your 2025 breeding decisions or feed contracts around Chinese demand, you’re already behind. Here’s what progressive producers are doing instead: diversifying into Southeast Asia, locking in feed prices by September 15, and stress-testing cash flow for a 35% margin drop.

KEY TAKEAWAYS

- Lock feed contracts by September 15 – With corn at $10.50/bushel and trade volatility spiking, securing 2026 input costs now could save 15-20% on your feed bill while competitors scramble later

- Pivot export focus to Vietnam/Indonesia markets – These regions are absorbing displaced volume at 80-85% of Chinese pricing, but early movers get better buyer relationships and contract terms than late arrivals

- Stress-test your sustainability investments – Those methane digesters and solar panels financed on stable export revenues? Model them under 20-35% cash flow reduction scenarios before you can’t service the debt

- Adjust breeding for domestic market specs – If Chinese premium markets disappear, domestic buyers want lower protein/higher volume production – factor this into your genetic selections before October breeding season

- Review force majeure clauses in export contracts – Legal protection exists if you know where to look, but most producers haven’t checked their Chinese contract terms since signing

When Hans checked his September milk contracts at his 380-cow operation outside Stuttgart on August 18, the news hit like a kick from a fresh heifer. China just extended its anti-dumping investigation into EU dairy products until February 21, 2026—turning what should have been a routine 12-month probe into an 18-month market siege that’s already hammering global milk prices.

“We went from planning new freestall barns to wondering if we should cull the third-lactation cows,” Weber says. His family has been milking Holsteins on the same Swabian land since 1962, but this China mess is unlike anything they’ve weathered.

Whether you’re shipping direct to China or competing with those who do, this trade war just got personal for every dairy producer in Europe—and beyond.

Electric Cars Just Torched Your Cheese Exports

Let’s be straight about what happened here. China launched its dairy investigation exactly one day after Brussels confirmed punitive duties on Chinese electric vehicles. European farmers were caught in the crossfire of a dispute over car batteries, a matter over which they had no involvement.

What that means for your milk check is brutal. According to European Commission data, EU dairy exports to China totaled €1.7 billion in 2023, with €513 million worth of targeted products—fresh cheese, processed cheese, blue cheese, and high-fat milk—now held hostage by the politics of electric vehicles.

Beijing’s investigation covers 20 different EU subsidy programs, from Common Agricultural Policy payments to national support schemes across Austria, Belgium, Croatia, the Czech Republic, Finland, Italy, Ireland, and Romania. They’re attacking the entire foundation of how European farming gets supported.

What These Trade Terms Actually Mean:

- Anti-subsidy investigation: Beijing is checking if EU governments unfairly help their dairy farmers

- Anti-dumping probe: Looking at whether European dairy companies sell below cost in China

- CAP: The EU’s €387 billion Common Agricultural Policy that supports farmers across Europe

Who’s Winning and Losing in This Milk Market Shakeup

| Exporter | Market Share (H1 2024) | Competitive Position |

| New Zealand | 45% | Dominant due to the Free Trade Agreement |

| European Union | 28% | At risk; currently under investigation |

| Australia | 12% | Strong position with a Preferential Agreement |

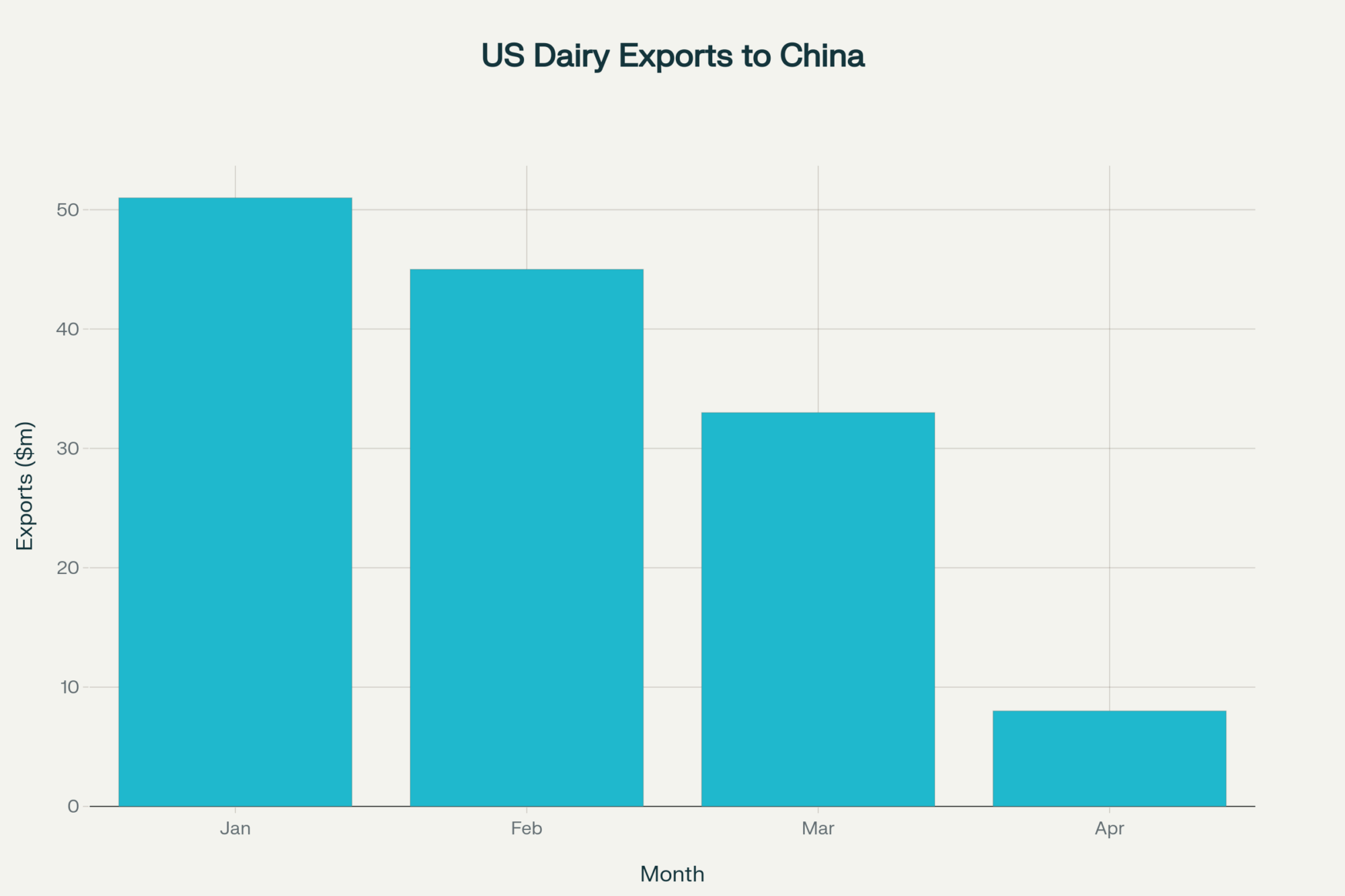

| United States | 5% | Heavily disadvantaged by retaliatory tariffs |

| Others | 10% | Various arrangements |

Chinese dairy imports dropped 14.1% in the first half of 2024 to 1.19 million tonnes as domestic production surged. New Zealand dairy operations are in a strong position with duty-free access, while EU producers are concerned about the prospect of 30% tariffs.

Europe’s Dairy Giants Got Bull’s-Eyes Painted on Them

FrieslandCampina executives, who run a €13.1 billion operation, received the kind of notification that ruins your whole week. Beijing selected their massive Dutch-Belgian cooperative as one of three European operations for intensive “sampling method” scrutiny, alongside France’s Elvir Co. and Italy’s Sterilgarda Alimenti.

These weren’t random picks—they represent Europe’s dairy export powerhouses across three major producing regions. When you’re big enough to matter globally, you’re big enough to become Beijing’s poster child for alleged subsidies.

Industry sources indicate that planning breeding programs has become nearly impossible with tariff threats looming overhead. The uncertainty is causing more operational disruption than any actual duties might, according to multiple cooperative managers across the Netherlands and Belgium.

September Inspections: When Beijing Gets Down to Business

Chinese technical teams are scheduled to conduct on-site visits to Belgium and the Netherlands in September, as well as hold talks with the European Commission. European Dairy Association secretary general Alexander Anton expected this extension, warning that “the EU dairy sector does not expect a resolution similar to that achieved for brandy, due to the distinct nature of the industry.”

When Chinese investigators show up at dairy facilities, they’re not taking a casual tour. They’re building comprehensive cases for tariffs ranging from 15% to 35%—similar to the 34.9% duties they slapped on EU brandy producers last month.

China’s Self-Sufficiency Push Changes Everything for Your Markets

Here’s what most analysts miss: Beijing’s domestic dairy capacity has fundamentally shifted who holds the cards. Chinese milk production jumped from 63-64% self-sufficiency in 2020-2021 to 69% by 2022, with government targets pushing for 70-80%.

Rabobank forecasts Chinese domestic production will increase another 3.2% in 2024 to 43.3 million tonnes. When you’re approaching three-quarters self-sufficiency, trade disruption becomes strategically acceptable—even desirable.

Chinese domestic costs remain brutal, though. Corn costs over $10 per bushel, while imported hay runs $500 per ton at ports, plus additional tariffs and transportation costs. However, Beijing’s tolerance for market manipulation has increased as its domestic capacity has expanded.

How This Hits Different Regions and Products

This trade war doesn’t affect everyone equally. Here’s your exposure map based on European Commission and Eurostat trade data:

Dutch and Belgian Operations: Large-scale cooperatives producing standardized milk powder have more flexibility to redirect volume to Southeast Asian markets, albeit at 15-20% lower margins compared to Chinese premium pricing.

French Artisanal Producers: Small-scale cheese makers built business models around premium Chinese access for PDO cheeses. Alternative markets can’t absorb their volume at profitable prices—these operations face existential threats.

German Mixed Operations: A balanced product mix provides some cushioning, but Germany’s 7% market share in Chinese imports means significant volume displacement.

Italian Alpine Cheese: Specialty cheese producers face the steepest losses. High-fat Alpine cheeses command premium prices in Chinese markets, making them prime targets. A 30% duty could kill export viability unviable for mountain cooperatives, which are already facing higher production costs.

Austrian Mountain Operations: Mixed production systems offer some diversification, but specialty dairy products remain vulnerable to significant exposure.

European Farmers’ Fury Meets Cold Political Reality

Copa Cogeca, representing EU farm organizations, abandoned diplomatic niceties: “This further escalation in the EU-China trade relationship and the continuous impact on our sector is very worrying. Our dairy farmers and agri-coops produce and export in full respect of EU and WTO rules, but once again, our well-performing exports are the target due to other disputes.”

Irish industry representatives captured the frustration of farmers perfectly, noting the absurdity of suggesting that “Irish butter or powders were somehow beneficiaries of state support.” This reflects broader rural anger that Brussels’ electric vehicle policies are being paid for by agricultural communities that had nothing to do with automotive trade disputes.

Brussels Goes Nuclear: WTO Challenge Escalates

The EU escalated dramatically by threatening a WTO challenge—a rare move that takes the dispute to the highest level of international trade arbitration. Brussels argues China is creating “an emerging pattern of initiating trade defence measures, based on questionable allegations and insufficient evidence.”

But WTO dispute resolution takes 3-4 years. That offers zero relief for producers facing 18 months of uncertainty while making breeding decisions, negotiating feed contracts, and planning capital investments.

When Climate Investments Become Financial Liabilities

Those methane digesters and solar panels that many producers installed based on stable export revenues? They’re now potential liabilities if tariffs slash cash flows by 20-35%.

The Common Agricultural Policy’s Green Architecture—providing payments for climate-friendly practices—ironically becomes evidence of subsidization in Chinese investigations. Producers must now reassess whether they can service debt on climate-smart infrastructure if export margins collapse.

Three Scenarios: What Happens to Your Operation

Scenario 1: Moderate Tariffs (15-25%)

European exporters absorb some costs and pass the remainder on to Chinese buyers. Alternative Southeast Asian markets see modest volume increases. Global milk powder prices rise 8-12%. Most operations survive with tighter margins.

Scenario 2: Heavy Tariffs (30-50%) – Most Likely

EU dairy is largely priced out of the Chinese market. New Zealand and Australia capture additional market share. European processors redirect 400,000+ tonnes annually to alternative markets, temporarily crashing regional pricing. Some smaller operations face serious cash flow problems.

Scenario 3: Complete Market Closure

Nuclear option forces total restructuring. European production contracts 3-5% over 18 months. Alternative Asian markets see dramatic volume increases, but at significantly lower prices. Marginal operations face closure.

Your Survival Playbook: Action Steps by Farm Calendar

By September 15:

- Lock feed contracts through spring 2026. Volatile corn and soy prices will get worse before they get better

- Begin outreach to Southeast Asian importers (Vietnam, Indonesia, Philippines) to explore alternative market development

- Review force majeure clauses in existing Chinese export contracts with your lawyer

October Planning:

- Model cash flow scenarios assuming 20-35% margin reductions from export disruption

- Meet with your lender about potential debt restructuring if export revenues fall significantly

- Consider temporary herd size adjustments based on alternative market capacity

Before Breeding Season:

- Adjust breeding plans for domestic market requirements (typically lower protein, higher volume production)

- Work with your nutritionist to reformulate rations if you’re shifting from export to domestic production focus

- Factor trade uncertainty into genetic selection decisions—don’t count on premium export markets

Financial Reality Check:

- Use your agricultural extension service’s dairy financial planning tools to stress-test your operation

- Evaluate whether sustainability investments can be serviced under reduced cash flow scenarios

- Plan for the potential need to restructure debt or delay expansion projects

The Bottom Line for Your Operation

This 18-month investigation marks a significant shift in global dairy economics. China’s strategic push toward food security independence, weaponized by EU electric vehicle policies, has ended the era of treating Beijing as a reliable growth market.

European producers face potential duties similar to the 34.9% rates Beijing imposed on EU brandy last month, or even complete market restrictions. Meanwhile, competitors with preferential trade agreements—such as New Zealand and Australia—are positioned to gain significantly at the expense of Europe.

The clock is ticking toward February 2026. Producers who adapt quickly to the fragmented and politicized global markets will survive and potentially thrive. Those who don’t risk becoming casualties in trade wars they never asked to fight.

Hans in Baden-Württemberg already started making calls to buyers in Thailand and Vietnam. The new freestall barn is on hold, but his operation will survive because he’s not waiting for politicians to fix this mess.

Your feed bills won’t wait for diplomats to sort this out. Your breeding decisions can’t wait for politicians to make nice. The market rewards adaptation and punishes hesitation.

Bottom line? The producers who survive this 18-month siege won’t be the ones hoping diplomats fix it. They’ll be the ones adapting their operations to a world where China buys local first.

Start making those calls. Today.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 7 Management Strategies to Mitigate Risk on Your Dairy – While the main article outlines the market risk, this piece delivers the tactical response. It provides practical, on-farm strategies for managing financial volatility and building operational resilience to survive the 18-month siege, regardless of what politicians do.

- The Surprising Factors That Will Drive Dairy Demand In The Future – This strategic analysis looks beyond the immediate China crisis to explore the long-term global demand drivers. It helps producers understand which emerging markets and consumer trends—like sustainable nutrition and specialized products—offer the best opportunities for diversification away from politically volatile markets.

- The 4 Most-Profitable Technologies for Your Dairy Barn – To combat the margin compression detailed in the main article, this piece offers an innovative solution. It identifies specific technologies with the highest ROI, demonstrating how to lower production costs and increase efficiency to protect your bottom line from external market shocks.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.