Solid month for NFDM/SMP and WPC80+ not enough to offset another big decline in whey and butterfat.

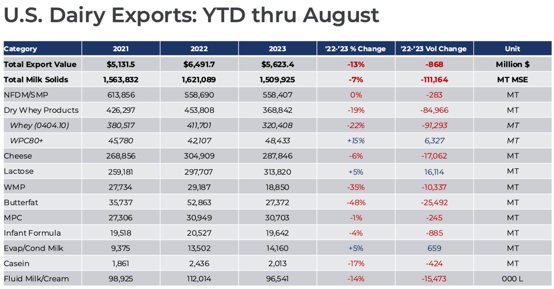

U.S. dairy exports continued to lag in August, with volume down 10.8% (milk solids equivalent or MSE) versus the previous year. The month looked very similar to July, with U.S. nonfat dry milk/skim milk powder (NFDM/SMP) posting a respectable gain but most other product categories failed to match last year’s record performance.

U.S. NFDM/SMP exports rose 4% year over year (+2,774 MT), the largest increase since January. U.S. sales to Mexico continue to hum along (+6%, +1,671 MT) but were supported this month by a surprising 17% jump in volume (+3,358 MT) to Southeast Asia. The Southeast Asia increase was the first year-over-year gain to the region in just over a year—since July 2022.

However, ongoing weakness in low-protein whey (0404.10) continued to hamper overall U.S. dairy exports, as it has over the past few months. As noted in last month’s trade data recap, significantly reduced feed demand from China’s struggling pig sector is the biggest reason for the decline (though gratefully there are signs demand may turn around later in the year, as we noted in our latest International Demand Analysis). U.S. low-protein whey shipments to China fell 41% (-13,184 MT) in August and were down 24% (-45,795 MT) year to date.

The bright side of U.S. whey exports remains WPC80+. After a flat July, year-over-year U.S. WPC80+ shipments surged 34% in August (+1,676 MT), with strong demand from Japan and Brazil. Year-to-date, U.S. WPC80+ exports are up 15% (+6,327 MT).

U.S. cheese exports fell 3% (-1,114 MT) but the decline was almost solely due to a plunge in volume to South Korea, where the EU has been selling large volumes of mozzarella at a substantial discount to U.S. exports.

Year-to-date through August, U.S. export volume remains off by 6.9% MSE with value running -13% compared to January-August 2022.

For more detailed information, as well as interactive charts and data, visit USDEC’s Data Hub

High-value whey exports continue to grow

Even amidst the downturn in whey permeate and sweet whey, high-value whey protein concentrates have excelled in 2023. Year-to-date, U.S. exports of WPC80+ increased by 15% (+6,327 MT) with shipments accelerating in August, improving by 34% year-over-year (+1,622 MT).

Improved availability and lower prices are clearly part of the explanation for the surge. Through August, U.S. production of WPC80 was at an all-time high, increasing 13% over the previous year, despite U.S. milk production up only 0.9% on a component basis – partially due to growth in cheese production and partially due to manufacturers eschewing whey protein isolate for WPC80. In both 80 and isolate, U.S. inventories hit a five-year high earlier this year as production volumes grew (for 80 at least) and domestic sales lagged.

The growth in whey protein supply increased export availability and cooled prices, which hit all-time highs last year. For comparison, in August 2022, the average unit value of U.S. WPC80+ exports was $12,947/MT ($5.87/lb.), and in August 2023, the average price was $7,068/MT ($3.21/lb.).

Naturally, lower prices alongside more production helped pave the way for improvement in 2023, as markets that pulled back or saw slower demand growth have become increasingly active. For instance, U.S. WPC80+ exports to China were up 33% YTD (after a 34% drop in 2022), and U.S. exports to Japan jumped 50% in August despite Japan proving relatively robust in 2022.

Still, opportunistic buying isn’t the sole reason for the surge. We are seeing real demand growth from key markets, most notably Brazil driven by increased utilization for sports nutrition. U.S. WPC80+ exports to the country have more than doubled through August (+124%, +3,060 MT), making Brazil the fourth largest market for U.S. whey proteins.

Positively, additional export sales in 2023 have helped tighten protein markets as inventories for both WPC80 and WPI have declined from their highs in Q1. At the same time, this improvement in exports has come despite two major U.S. markets—South Korea and Southeast Asia—remaining relatively quiet, with trade to both destinations down in August and year-to-date despite prices being far more attractive than at this point last year.

Looking ahead, we expect WPC80+ exports to remain strong through the end of the year. There will even be potential to see an acceleration in exports in 2024 with new manufacturing capacity expected to come online and the global economic environment anticipated to improve.

Other relevant data points from August’s trade data:

- U.S. cheese export numbers in August are a bit deceptive. While August marked the fifth straight month of year-over-year declines, a closer market-by-market look shows the drop-off was almost solely due to two markets: South Korea and the Middle East/North Africa (MENA), where U.S. suppliers are facing intense competition from the EU. U.S. cheese exports to South Korea plummeted 50% in August (-3,714 MT), while shipments to MENA fell 64% (-1,606 MT). Factor out those two markets and U.S. year-over-year August cheese exports actually jumped 15% (+4,206 MT), backed by strong shipments to Mexico (+14%), Japan (+37%), Central America (+41%) and Australia (+87%).

- With the August gain, U.S. NFDM/SMP exports year-to-date were statistically tied with the first eight months of 2022. U.S. year-to-date volume was 558,407 MT in 2023 – off by only 283 MT compared to the same period the previous year. Over the last three months of data, U.S. NFDM/SMP exports have grown by 3% (+5,949 MT). Gratefully, exports to Mexico remain on record pace, while exports to Southeast Asia are finally showing signs of life.

- U.S. lactose exports were up 5% through the first eight months of the year, but that gain continues to erode. U.S. lactose started out the year strong: First-quarter 2023 shipments were up 27% (+24,585 MT) over 1Q 2022. But the monthly results have been in the red ever since. From April-August, U.S. lactose exports fell 4% (-8,472 MT) compared to the same period the previous year. The softness has come despite a 19% year-to-date increase (+15,006 MT) in shipments to China, the United States’ top lactose customer. Instead, Southeast Asia has been the biggest reason for the erosion. U.S. shipments to Southeast Asia fell 47% (-4,226 MT) in August and lagged last year’s volumes by 10% year-to-date (-6,545 MT).

%20(593%20x%20281%20px).png?width=554&height=263&name=Chart%2010%20(605%20x%20340%20px)%20(593%20x%20281%20px).png)