$320K today or $3.7M over 10 years? When your bank’s calling and debt’s at 7%, that’s not really a choice. 88% of farmers agreed.

Executive Summary: Yesterday’s 88.47% vote to sell Fonterra’s brands for $4.22 billion was mathematical destiny: farmers trading $3.7M in future value for $320K in immediate debt relief. With 75% of recipients sending payouts straight to banks, this wasn’t a strategy—it was survival. The predictable outcome followed 13 years of structural changes: tradeable shares (2012), flexible shareholding (2021), and production-weighted voting that gave debt-heavy large farms control. The same pattern—debt pressure, governance changes, asset sales—is unfolding from Arla-DMK to DFA. As Keith Woodford warns: ‘The best time to protect your cooperative is when you don’t desperately need to.’ For farmers whose cooperatives show warning signs (debt-funded growth, executive pay spikes, voting reforms), Fonterra’s story isn’t distant news—it’s your preview unless you organize now.”

Picture this familiar scene: you’re in the milking parlor at 5:30 AM, checking your phone between rotations while the cows move through their routine. That’s exactly where many Fonterra farmers found themselves yesterday morning, October 31st, absorbing the news.

The vote had closed—88.47% of shareholders approved selling Anchor, Mainland, and Kāpiti to French dairy company Lactalis for NZ$4.22 billion.

What makes this particularly noteworthy isn’t just the sale itself. It’s what this decision reveals about how dairy cooperatives are evolving to meet modern challenges—something we’re seeing from California’s Central Valley to the Netherlands’ dairy regions.

Transaction Overview:

- Sale price: NZ$4.22 billion (approximately US$2.42 billion)

- Shareholder approval: 88.47% on October 30, 2025

- Capital distribution: NZ$3.2 billion returning to shareholders

- Per-farm benefit: NZ$320,000 average (ASB Bank analysis suggests closer to $392,000)

- Brands transferred: Anchor, Mainland, Kāpiti, plus various licensing agreements

- Recent performance: Consumer division achieving 103% quarter-on-quarter profit growth

Key Financial Metrics:

- NZ dairy sector debt: NZ$64 billion (RBNZ, 2024)

- Average interest on NZ$500,000 at 7%: NZ$35,000 annually

- Consumer division quarterly profit: NZ$319 million (103% increase YoY)

- Voting progression: 66.45% (2012) → 85.16% (2021) → 88.47% (2025)

Financial Realities Driving Change

Looking at BakerAg’s October survey of 164 Fonterra suppliers, the findings align with what we’re hearing across dairy regions globally. Three-quarters plan to use their capital distribution primarily for debt reduction.

The average farm expects to send about 72%—roughly NZ$230,400—straight to debt servicing.

Keith Woodford, who spent three decades as a Lincoln University professor tracking New Zealand dairy economics, puts it simply:

“The debt servicing relief is what drove this vote. When you’re paying 7% interest on half a million in debt, that’s $35,000 annually just in interest. The ability to cut that in half changes your whole operation’s viability.”

This resonates with Wisconsin operations facing similar pressures. Immediate financial relief often takes precedence over longer-term considerations—not because producers lack vision, but because survival math is unforgiving.

What’s interesting here is the performance of these consumer brands. Fonterra’s May financial report shows NZ$319 million in quarterly operating profit—up 103% year-over-year.

These weren’t struggling assets. They were growing rapidly.

But when you need capital today, tomorrow’s potential becomes someone else’s opportunity.

Miles Hurrell, Fonterra’s CEO since 2018, emphasized during the August announcement that this lets them focus on ingredients and foodservice—their core strengths. The consumer business generated NZ$5.4 billion in revenue, but accounted for less than 7% of total milk solids. We’re hearing the same efficiency argument in European cooperatives, too.

How Voting Power Actually Works

Here’s something that surprises many outside observers. Fonterra doesn’t use one-member-one-vote like smaller Midwest cooperatives.

They have production-weighted voting—one vote per 1,000 kilograms of milk solids, backed by paid shares.

DairyNZ’s 2023-24 statistics show the average New Zealand herd runs about 441 cows producing 393 kg of milk solids each. Do the math: that’s roughly 173,000 kg MS annually, giving that farm 173 votes.

But a 1,000-cow Canterbury operation? They’re producing 393,000 kg MS—that’s 393 votes, more than double.

Peter McBride, Fonterra’s Chairman, calls this outcome a clear mandate showing farmer control. Technically true, though it highlights how voting structure shapes outcomes.

ASB Bank’s analysis shows the payout distribution mirrors this structure:

- Smaller operations (100,000-150,000 kg MS): $150,000-$230,000

- Large Canterbury farms (350,000+ kg MS): $700,000 or more

The Path That Led Here

Understanding yesterday requires examining the past decade’s progression.

2012: Trading Among Farmers

TAF addressed redemption risk—the potential crisis if many farmers exited simultaneously. It passed with 66.45% approval on June 25, 2012, though about a third opposed or abstained.

Dutch cooperative expert Onno van Bekkum warned TAF would separate ownership from control in fundamental ways. Opposition leader Lachlan McKenzie called it “morally wrong” in media interviews.

But the board proceeded, creating tradeable shares and opening the Fonterra Shareholders’ Fund to outside investors.

2021: Flexible Shareholding

In December 2021, 85.16% approval was granted for shareholding, increasing from 33% to 400% of production requirements.

Fonterra’s August 2024 report shows the results:

- 1,422 farms now exceed 120% of the standard shareholding

- 552 hold minimal 33% positions

John Shewan, chairing the Shareholders’ Fund, called it a mixed blessing, noting a 20% decline in unit value during consultation.

2025: The Pattern Emerges

Notice the progression: 66.45%, then 85.16%, now 88.47%.

That’s not growing enthusiasm—it’s something else. Maybe changing demographics. Maybe mounting pressure.

Keith Woodford observes that each restructure makes the next more likely:

“Once you start down this path, reversal becomes increasingly difficult.”

Global Patterns Worth Watching

Fonterra’s not alone here. The June announcement of Arla and DMK merging into a €19 billion entity sparked similar discussions.

Kjartan Poulsen, an Arla member who also heads the European Milk Board, stated bluntly in October:

“Co-operatives have ceased to be the representatives of producers’ interests they claim to be on paper.”

In North America, DFA acquired 44 Dean Foods facilities after the 2020 bankruptcy, becoming both the largest milk producer and processor.

The subsequent class action by Food Lion and Maryland and Virginia Milk Producers alleges this creates dynamics that “compel cooperatives and independent dairy farmers to either join DFA or cease to exist.”

Common threads emerge:

- Rising debt

- Efficiency pressures

- Governance structures increasingly resembling corporate models

The Compensation Question

The New Zealand Herald reported in October 2024 that Fonterra’s CEO compensation hit NZ$8.32 million. Base salary runs about NZ$1.95 million, with incentives tied to Return on Capital Employed and share price performance.

Here’s where it gets interesting. Improving ROCE by selling capital-intensive assets—even profitable ones—can trigger bonuses, regardless of the long-term impact on members.

It’s what academics call a principal-agent problem: decision-makers’ incentives potentially diverging from those they represent.

This pattern extends beyond Fonterra. Cooperative executive packages increasingly mirror corporate structures, raising questions about alignment.

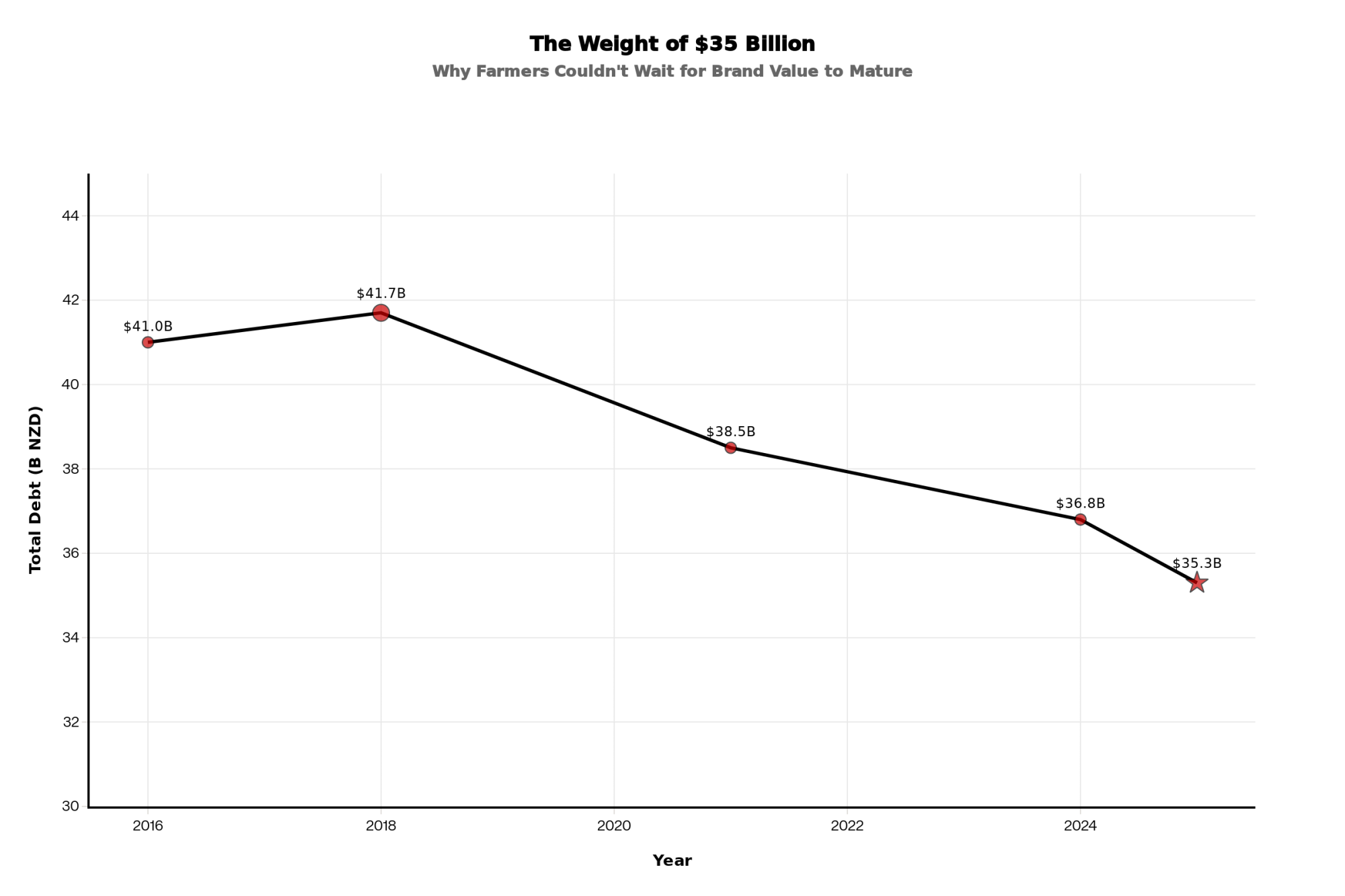

Current Debt Reality

Reserve Bank of New Zealand data shows dairy sector debt at NZ$64 billion. DairyNZ’s 2023-24 survey found that debt-to-asset ratios increased by 1.8 percentage points last season, reversing the progress in deleveraging.

Input costs compound this. Consider a typical Waikato farm with NZ$500,000 in debt at 7%—that’s $35,000 in annual interest.

When offered $320,000 to cut that burden by two-thirds, philosophical debates about cooperative principles take a back seat.

Producers consistently report they’re not selling eagerly. They’re protecting against scenarios where consecutive tough seasons force a complete exit. That capital buffer might determine whether the next generation continues farming.

Supply Agreement Details

The Lactalis deal includes two key contracts:

- 10-year Raw Milk Supply Agreement: Up to 350 million liters annually, plus 200 million more at premium pricing

- Global Supply Agreement: Three years initially for ingredients, auto-renewing unless terminated with 36 months’ notice

Miles Hurrell notes that Lactalis becomes a cornerstone customer.

Winston Peters, New Zealand’s Deputy Prime Minister with a farming background, sees it differently. His October 7 letter warns:

“After three years, Lactalis gains flexibility on milk sourcing for these brands—potentially diluting with alternatives.”

Fonterra clarifies that the 36-month notice effectively guarantees a minimum of 6 years. Still, Peters’ point about long-term leverage resonates with farmers remembering past processor consolidations.

Practical Insights for Producers

Drawing from Fonterra’s experience, several patterns merit attention:

Warning Signals

- Debt-financed growth rather than retained earnings

- Executive compensation outpacing member returns

- Share trading or ownership flexibility proposals

- External strategic reviews

- Rising approval rates on successive changes

The intervention window closes quickly. Once voting concentrates and pressure intensifies, changing course becomes exponentially harder.

Breaking the Isolation

BakerAg’s survey revealed widespread isolation among farmers with reservations. Many assumed neighbors supported the proposal, creating silence that reinforces itself.

Research consistently shows that producers with strong peer networks resist short-term pressures more effectively when evaluating strategic choices.

Action Steps

Near-term:

- Talk with neighbors about governance—you’d be surprised how many share your concerns

- Understand your voting system

- Seek compensation transparency

- Track debt trajectories

Medium-term:

- Strengthen balance sheets for voting independence

- Consider board service or supporting aligned candidates

- Advocate for appropriate approval thresholds

- Build communication networks

Long-term:

- Diversify market relationships

- Educate the next generation on cooperative principles

- Document experiences for future members

Looking Forward

The Fonterra vote illuminates tensions between immediate needs and long-term positioning that define modern dairy economics. That 88.47% likely reflects not enthusiasm but recognition of limited alternatives.

The generational dimension adds complexity. Families who built these brands face wrenching decisions, trading legacy for relief. Yet when survival’s uncertain, strategic control becomes secondary.

For cooperatives not facing acute pressure, Fonterra offers valuable lessons. Decisions about capital structure, voting, and debt create compounding path dependencies.

Keith Woodford’s wisdom bears repeating:

“The best time to protect your cooperative is when you don’t desperately need to. Once you’re in crisis, options narrow dramatically.”

As farmers await capital distributions, the industry watches. Emmanuel Besnier, Chairman of Lactalis, highlighted in August his company’s strengthened positioning across Oceania, Southeast Asia, and Middle Eastern markets.

Lactalis now controls brands developed by New Zealand farmers over generations.

For global dairy producers, the implications are clear: cooperative structures remain viable but require active protection. Forces favoring consolidation—debt, scale requirements, global competition—aren’t abating.

What’s encouraging is the quality of current discussions. Producers worldwide are sharing experiences, analyzing outcomes, and considering alternatives. This collective learning might help some organizations navigate challenges more successfully.

The critical question: Will cooperative members recognize patterns early enough to maintain meaningful options?

Fonterra’s experience suggests that once certain changes occur, reversal becomes exceptionally difficult.

The conversation continues, shaped by each cooperative’s circumstances, member priorities, and market position. What remains constant is the need for engaged, informed membership making deliberate choices—before circumstances make those choices for them.

KEY TAKEAWAYS:

- Debt math is brutal: Farmers knowingly traded $3.7M in future value for $320K today because $35K annual interest payments can’t wait for tomorrow’s profits

- Large farms control your fate: Production-weighted voting gives a 1,000-cow operation (393 votes) more than double the power of an average farm (173 votes)—and they vote their debt, not your interests

- The timeline is always 13 years: Tradeable shares (Year 1) → Flexible ownership (Year 9) → Asset sales (Year 13)—once step one passes, the rest becomes mathematical inevitability

- Watch executive pay like a hawk: When your co-op CEO makes NZ$8.32M while average farmers net $150K, those aren’t cooperative incentives—they’re corporate ones

- You have exactly ONE intervention point: Between your first governance “modernization” proposal and passing it—after that, you’re not protecting your cooperative, you’re negotiating its sale terms

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Real Cost of Producing Milk and Why It Matters Now More Than Ever – This tactical guide provides a framework for mastering your farm’s true cost of production. It reveals methods for gaining financial clarity to combat the exact debt pressures highlighted in the Fonterra vote, empowering you to strengthen your operation’s financial resilience.

- The Future of Dairy Farming: Navigating the Next Decade of Change – This strategic analysis unpacks the market forces, consumer trends, and policy shifts shaping the industry’s next decade. It provides essential context for the Fonterra vote, demonstrating how to anticipate future challenges and strategically position your operation for long-term survival.

- AI in the Parlor: How Artificial Intelligence is Redefining Dairy Herd Management – This piece explores how adopting cutting-edge technology can create a competitive advantage. It demonstrates how AI-driven herd management directly boosts efficiency and profitability, providing a powerful internal solution for building the financial strength needed to resist external market pressures.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!