The math is brutal: At $11.55/cwt margins, your 350-cow dairy bleeds $20K monthly. Here’s why processors still invest billions.

EXECUTIVE SUMMARY: American dairy is witnessing an unprecedented paradox: processors are investing $11 billion in expansion while margins have collapsed to $11.55/cwt, forcing 2,100-2,800 farms toward exit by 2026. The explanation is stark—processors have pre-secured 70-80% of future milk supply through exclusive contracts with mega-dairies, banking on industry consolidation from 26,000 to 15,000 farms. Current economics make this inevitable: mid-sized operations lose $20,000 monthly while 3,000-cow dairies maintain profitability through $4-5/cwt scale advantages that management excellence cannot overcome. A severe heifer shortage (357,000 fewer in 2025) ensures these dynamics persist regardless of price recovery, creating a biological ceiling on expansion. Farmers face three critical deadlines—May 2026 for viability assessment, August 2026 for processor clarity, and December 2026 as the final repositioning window. This transformation differs fundamentally from previous cycles: no government intervention is coming, traditional recovery mechanisms don’t exist, and the structural changes are permanent.

I was reviewing the October USDA milk production report with a group of producers, and we all noticed the same paradox. We’re producing 18.7 billion pounds of milk—up 3.9% from last year—yet margins have compressed from $15.57 to $11.55 per hundredweight since spring. Meanwhile, processors are committing approximately $11 billion to major new facilities through 2028.

One producer from central Pennsylvania put it perfectly: “How does massive processor expansion make any sense when we can barely cover feed costs?”

After months of analyzing this disconnect—visiting operations from the Central Valley to Vermont, reviewing research from land-grant universities, tracking processor announcements—what’s emerging is a fundamental restructuring of American dairy. This goes beyond typical market cycles into something more permanent, and understanding these shifts has become essential for strategic planning.

Key Numbers Shaping Our Industry

Before we dive deeper, here are the metrics that matter most for operational planning:

Production & Margins:

- Milk production: 18.7 billion pounds (October 2025, +3.9% year-over-year)

- Current margins: $11.55/cwt (down from $15.57 in September 2024)

- National herd: 9.35 million cows (highest since 1993)

- Production per cow: 1,999 lbs/month (24 major states)

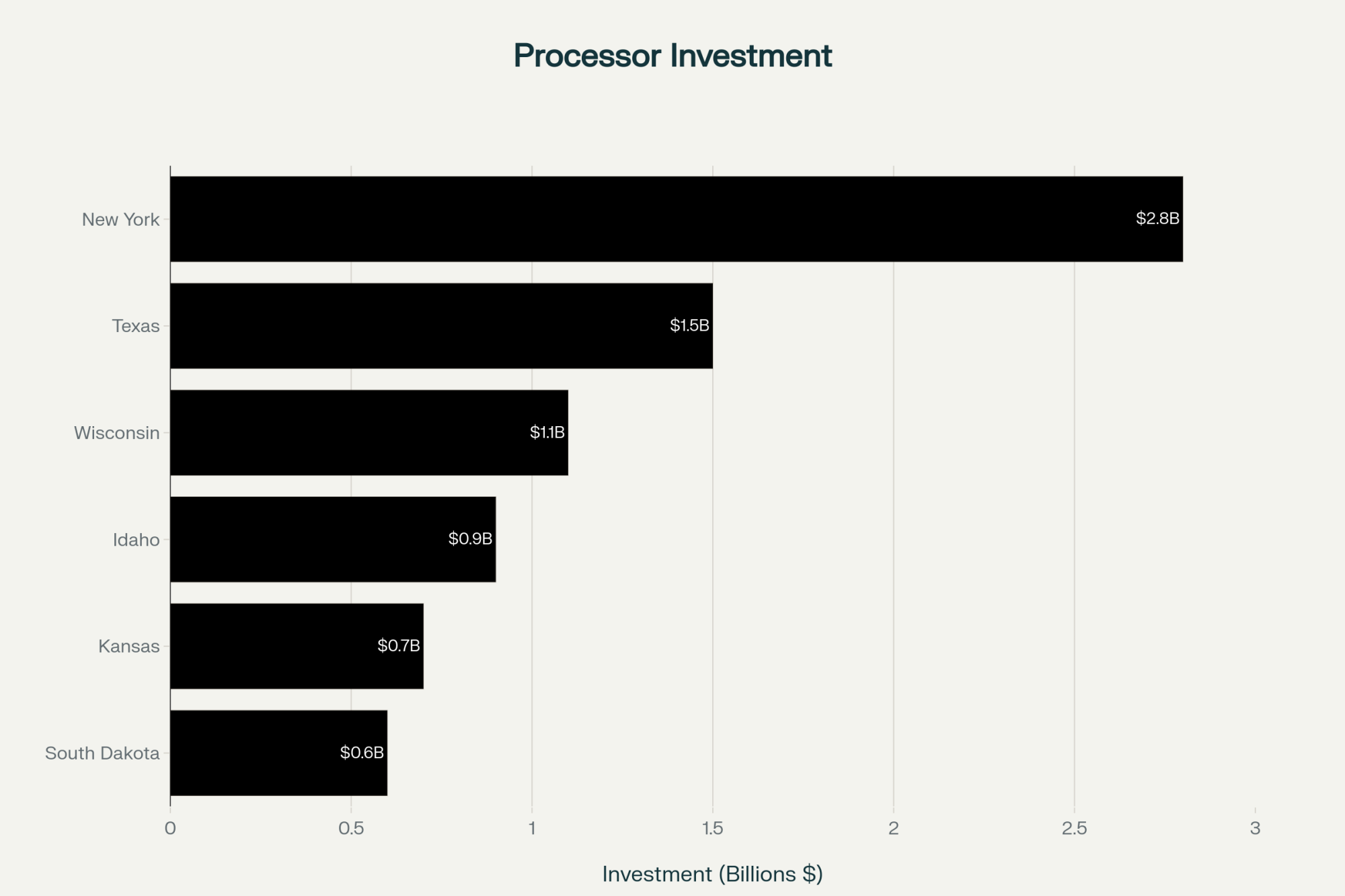

Processor Investment:

- Total commitment: approximately $11 billion

- Major new facilities through 2028

- Supply commitments: 70-80% already locked through contracts

Heifer Shortage:

- Current inventory: down 18% from 2018

- Replacement cost: $3,000-4,000+ (previously $1,700-2,100)

- 2025 shortage: 357,000 fewer heifers

- 2026 shortage: 438,000 fewer heifers

Industry Projections:

- Expected exits: 2,100-2,800 farms by end-2026

- Exit rate: 7-9% of current operations

- Most affected: 200-700 cow operations

The Production Paradox: Regional Perspectives

The latest USDA data shows we’re milking 9.35 million cows nationally—the highest count since 1993. But the story varies dramatically by region, and that variation matters for understanding what’s ahead.

Michigan operations are achieving a remarkable production of 2,260 pounds per cow per month. A producer near Lansing recently told me their herd’s averaging 95 pounds daily with consistent butterfat levels above 3.8%. That’s exceptional management paired with strong genetics.

Texas presents another fascinating case. They’re running 699,000 head now—the most since 1958—with production up 11.8% year-over-year. The panhandle operations I visited in September have adapted dry lot systems that work remarkably well in their climate, though water access remains a growing concern.

But regional differences create vastly different economic realities. A Wisconsin producer I work with regularly—running 300 cows with excellent grazing management—calculated that they’re facing approximately $240,000 less income than in September 2024. That’s based on their 6 million pounds annual production at current margins. For context, that’s their entire equipment replacement budget for the next three years.

Meanwhile, when I visited Tulare County last month, the 3,000-cow operations there are weathering margin compression better. Their operating costs run $4-5 per cwt lower than Midwest mid-size farms—not through better management, but through scale efficiencies in feed procurement, labor utilization, and infrastructure amortization.

The international dimension adds another layer. European production bounced back strongly in September—up 4.3% according to Eurostat data. France increased by 5.8%, Germany by 5%, and the Netherlands jumped by 6.9% despite their nitrate restrictions. A dairy economist colleague in Amsterdam tells me Dutch producers are maximizing production before additional environmental regulations take effect in 2026. This surge is pressuring our export markets precisely when domestic demand remains sluggish.

Understanding Processor Strategy: The View from Industry

The $11 billion processor investment initially seems counterintuitive. Why expand when farm margins are collapsing? The answer becomes clearer when examining specific projects and their strategic positioning.

Chobani’s $1.2 billion Rome, New York, facility—their largest investment to date—will process 12 million pounds daily upon full operation. That volume could come from about 40 mid-size farms, or more realistically, from 3-4 mega-dairies with guaranteed supply contracts.

During a recent industry meeting in Chicago, a procurement manager from a major processor (who requested anonymity) shared their perspective: “We’re not building for today’s milk market. We’re positioning for 2030 when global demand exceeds supply and premium products command higher margins.”

Walmart’s strategy offers another angle. Their third milk plant in Robinson, Texas, opens in 2026, continuing their vertical integration push. Based on standard industry practices and Walmart’s previous facility operations, these supply commitments typically extend for a minimum of 5-7 years.

The geographic clustering is noteworthy. Hilmar’s Dodge City facility and Leprino’s Lubbock plant—both processing 8 million pounds daily—are positioned in regions with concentrated mega-dairy operations and favorable logistics for export markets.

CoBank’s August analysis reveals that processors have already secured 70-80% of the required milk supply through long-term contracts, predominantly with operations milking 2,000+ cows. This pre-commitment strategy represents a departure from historical reliance on the spot market.

Ben Laine from Rabobank articulated this shift well during a recent webinar: “Companies aren’t investing hundreds of millions without secured supply. The relevant question for producers is whether they’re included in these long-term arrangements.”

The global context drives processor confidence. The International Dairy Federation’s April report projects a potential 30-million-ton global milk shortage by 2030, while even conservative IFCN estimates suggest a 6-10 million ton deficit. Chinese import data reinforces this outlook—cheese imports up 13.5%, whole milk powder up 41% through September, according to USDA Foreign Agricultural Service tracking.

There’s also an unexpected shift in demand for GLP-1 medications. With 30 million Americans now using these drugs, according to IQVIA’s pharmaceutical data, consumption patterns are changing dramatically. Whey protein demand increased 38% among users, while cheese and butter consumption declined 7.2% and 5.8% respectively. For processors with flexible infrastructure, this creates opportunities in high-margin protein products.

The Heifer Shortage: A Constraint Years in the Making

The replacement heifer situation deserves careful attention because it represents a multi-year constraint on expansion regardless of price improvements.

Current inventory sits 18% below 2018 levels according to CoBank’s analysis. At a recent sale in Fond du Lac, Wisconsin, quality springer heifers brought $4,500—compared to $2,200 for similar genetics five years ago. A producer from Idaho mentioned paying $4,800 for exceptional genetics last month.

The shortage—357,000 fewer heifers in 2025, rising to 438,000 fewer in 2026—stems from rational individual decisions that create collective constraints. When beef-on-dairy calves bring $1,400-1,600 while raising a replacement costs $2,800-3,200, the economics are clear.

A California dairyman running 1,500 cows told me they went 80% beef-on-dairy in 2023-2024. “At those prices, it was irresponsible not to,” he explained. Even traditionally conservative Midwest operations shifted 40-50% of breedings to beef genetics.

Dr. Kent Weigel from UW-Madison’s dairy science department frames it well: “Producers made financially sound individual choices that collectively created a demographic cliff for the industry.”

The regional impacts vary significantly. Idaho’s expanding operations are aggressively bidding for available heifers, driving prices higher across the West. Pennsylvania’s smaller farms face a different challenge—they simply can’t compete financially for limited replacement inventory.

This creates a biological ceiling on expansion that price signals alone can’t overcome. Even if milk prices reached $20 per cwt tomorrow, most operations couldn’t expand without available replacements.

Historical Context: Why This Cycle Differs

Having worked through previous downturns, the current situation presents unique characteristics worth examining.

The 2009 crisis saw milk prices crash from $24 to $8.80 per cwt—a devastating 63% decline. But Congress responded with $3.5 billion in direct support, and USDA purchased 379 million pounds of milk powder to stabilize markets. Those interventions, combined with natural supply adjustments, enabled recovery within 18-24 months.

The 2015-2016 downturn followed a different pattern. Without direct payments, the industry relied on market forces. Global weather challenges and China’s growing imports eventually tightened supply, supporting price recovery by 2017-2018.

Today’s environment lacks these recovery mechanisms. Current USDA policy emphasizes market solutions over intervention. The Dairy Margin Coverage program triggers only at $9.50 per cwt—well below current margins of $11.55. Even when triggered, coverage caps at 5 million pounds annually, providing limited support for larger operations.

More significantly, processor supply commitments through 2030-2034 have pre-allocated market access in ways that didn’t exist during previous cycles. A Northeast cooperative board member recently described this as “musical chairs where the music has already stopped for many producers.”

Dr. Andrew Novakovic from Cornell’s dairy program observes that, unlike previous downturns with natural recovery mechanisms, “this transformation represents structural reorganization that doesn’t self-correct through normal market cycles.”

Scale Economics: The Widening Gap

The economic disparities between operation sizes have widened beyond what management excellence can overcome. Data from the University of Minnesota’s FINBIN system and USDA surveys reveals striking differences.

A typical Wisconsin 350-cow operation incurs costs of around $20.85 per cwt, with fixed costs accounting for 38% of that total. Compare that to a 3,000-cow Texas panhandle operation at $16.16 per cwt with only 25% fixed costs. That $4.69 difference translates to roughly $394,000 annually—often the difference between profit and loss.

Interestingly, California’s mid-size operations (500-750 cows) achieve competitive costs around $17-18 per cwt through different strategies. They utilize more contracted labor, which provides flexibility during margin compression despite higher hourly costs.

Beyond direct operating expenses, scale creates compounding advantages. Large Idaho operations negotiate feed contracts at $0.50-1.00 per cwt below spot prices. Labor efficiency reaches $183 per cow annually, compared with $343-514 for Northeast mid-size farms. A robotic milking system costs $83 per cow to amortize at a 3,000-head scale but $714 at a 350-head scale.

Dr. Christopher Wolf from Cornell captures this reality: “We’ve moved beyond management quality as the primary determinant of success. Structural economics now dominate, where excellent managers at smaller scales face insurmountable cost disadvantages.”

Processor Relationships: The New Reality

The evolution of processor-producer relationships represents a fundamental shift that many producers haven’t fully grasped.

Modern facilities require 5-12 million pounds per day from consolidated sources, typically through 5-10-year exclusive agreements. A central Pennsylvania producer recently shared their experience: offered a premium for exclusive supply but required a commitment to all production through the decade’s end—no spot sales, no price shopping during market spikes.

These contracts include strict confidentiality provisions, creating information asymmetry. While processors map regional supply commitments years in advance, individual producers lack visibility into capacity allocation. Your neighbor might have secured long-term access while you’re still assuming spot markets will continue.

The timing matters critically. Major processors locked supply agreements in 2023-2024 when planning current expansions. Producers now recognizing tightening access are discovering capacity is already committed through 2030.

Several New York producers mentioned their long-standing processor relationships—some spanning 30+ years—are being “reassessed” for 2026. That’s industry language for supply consolidation toward larger operations.

Community Impacts: Beyond the Farm Gate

The projected 2,100-2,800 farm exits by end-2026 create ripple effects throughout rural communities. The Center for Dairy Profitability at UW-Madison developed these projections based on current exit rates and economic pressures.

Consider Marathon County, Wisconsin, with approximately 180 dairy farms. An 8% exit rate means 14-15 operations closing. Each supports an ecosystem—equipment dealers, nutritionists, veterinarians, feed suppliers—all of which are losing revenue simultaneously.

Projection show that 40% of Northeast dairy equipment dealers will consolidate or close by 2027, as demand drops by 30%. The implications extend beyond sales to parts availability, service expertise, and technology support for remaining operations.

Veterinary services face particular challenges. The American Association of Bovine Practitioners projects service reductions of 15-25% in dairy regions. Northern Minnesota already has one large-animal practice serving five counties. When economic forces drive further consolidation, emergency coverage becomes problematic.

School districts in dairy-dependent counties could lose 5% of their property tax base. That translates to program cuts, route consolidations, and reduced educational opportunities for rural youth.

Bob Cropp, from the University of Wisconsin, quantifies what we’re losing: “These exits represent approximately 74 million farmer-years of accumulated expertise. That knowledge—built through generations of problem-solving and adaptation—cannot be quickly replaced.”

Decision Framework: Practical Steps Forward

Based on extensive discussions with financial advisors, producers, and industry analysts, here’s a framework for evaluating your operation’s position.

Immediate Assessment Priorities:

Calculate true operating costs, including family labor at market value. Many operations undervalue owner labor, distorting profitability assessments. If 80-hour weeks at zero value keep you “profitable,” that’s not sustainable.

Working capital should be at least 25% of annual revenue. Wisconsin’s Farm Credit offices recommend a 30% allocation given current volatility. Debt-to-asset ratios above 60% limit refinancing flexibility according to multiple ag lenders.

Most critically, seek clarity from milk buyers about 2026-2027 commitments. Vague responses or deferrals suggest capacity is already allocated elsewhere. February 2026 represents a critical deadline for securing clarity.

Warning Signals to Monitor:

Subtle changes often precede major shifts. Processors asking about “future plans” after years of routine relationships are assessing supplier consolidation options. Lenders requesting earlier reviews or suggesting consultants have identified concerning trends in your financials.

Regional consolidation patterns matter. Multiple exits within six months indicate accelerated structural change rather than normal attrition.

Critical Timeline:

May 2026: Assess whether operations can sustain through late 2026 without margin improvement. August 2026: Processor commitments and regional consolidation patterns become clear. December 2026: Final window for strategic repositioning before options significantly narrow

Strategic Paths for Different Situations

Based on current operations, successfully navigating these challenges:

Strong fundamentals (positive cash flow, manageable debt, processor commitment): Focus on operational efficiency over expansion. Build reserves during any margin improvements. Avoid major capital investments without secured long-term processor agreements. An Idaho producer recently canceled planned parlor expansion despite available capital due to uncertain processor signals.

Structural challenges (tight cash flow, high debt, uncertain processor access): Consider neighbor consolidation to achieve viable scale. Three New York operations recently merged to create an 1,800-cow enterprise—complicated but preferable to individual failure.

Premium market transitions require time and capital. Organic certification takes three years. Grass-fed requires an appropriate land base. A2 genetics need development time. These aren’t immediate solutions.

Exit timing matters if that’s your path. Current cattle values ($3,000-4,000 for quality animals) and strong farmland prices create windows that may narrow if exits accelerate.

Universal recommendations: Maximize Dairy Margin Coverage despite current margins above trigger levels—premiums typically run $0.10-0.20 per cwt for basic protection. Document monthly production costs rather than quarterly estimates. Develop relationships with multiple milk buyers, even with satisfactory current arrangements in place.

Emerging Market Forces: The GLP-1 Factor

| Dairy Product | Consumption Change | Primary User Group |

| Cheese | -7.2% | General Users |

| Butter | -5.8% | General Users |

| Ice Cream | -5.5% | General Users |

| Milk/Cream | -4.7% | General Users |

| Yogurt High-Protein | +38.0% | Fitness Focus |

| Whey Protein | +41.0% | Fitness Focus |

Looking Forward: Industry Implications

What we’re experiencing transcends normal market cycles into fundamental restructuring. The convergence of processor pre-positioning, heifer constraints, and widening scale economics creates permanent rather than temporary change.

Operational excellence remains necessary but insufficient. A well-managed 350-cow Pennsylvania operation faces structural disadvantages that exceptional management cannot overcome when competing against 3,000-cow Texas operations with locked processor contracts.

Time-limited decision windows define positioning for 2027-2030. Information asymmetry—where processors and mega-operations understand supply commitments while smaller producers operate in the dark—compounds the challenges. Traditional crisis recovery mechanisms no longer exist in the current market structure.

The central question isn’t management quality but structural positioning within emerging industry architecture. For many operations, honestly assessing this question—though difficult—enables deliberate choices rather than outcomes driven by circumstance.

The dairy industry will certainly continue producing milk. Whether individual operations participate in that future, and in what form, depends on decisions made within current windows. What’s encouraging is that informed decisions still influence outcomes despite powerful structural forces.

Regional collaboration strengthens individual positions. Sharing information, comparing strategies, and coordinating responses—even when processors prefer confidentiality—creates collective strength. This remains our industry, even as it transforms more rapidly than many anticipated.

The path forward requires accepting new realities while maintaining the innovative spirit that has always characterized American dairy. Those who adapt deliberately rather than reactively will find opportunities within structural change. The key is acting on information rather than hope, making strategic choices rather than letting circumstances decide.

Key Takeaways:

- The game has changed permanently: Processors invested $11 billion betting on 15,000 farms by 2030, pre-locking 70-80% of milk supply with mega-dairies—if you lack a long-term contract, you’re competing for scraps

- Scale economics are now destiny: A 350-cow farm bleeds $20,000 monthly at current margins while 3,000-cow operations profit—this isn’t poor management, it’s structural disadvantage

- Biological ceiling locks in consolidation: With 357,000 fewer heifers and beef-on-dairy economics, expansion is impossible for 2-3 years, regardless of price recovery

- Three deadlines determine your fate: May 2026 (viability assessment), August 2026 (processor commitment), December 2026 (final repositioning)—decide deliberately, or circumstances will decide for you

- Information asymmetry is real: While you see falling milk checks, processors and mega-farms already know the 2030 industry structure—sharing information with neighboring farms is your only counterweight

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Hidden Cost of Every $1,200 Beef Calf: A $4,000 Heifer Bill – Reveals the “Forward Replacement Inventory Formula” to prevent six-figure heifer shortages, demonstrating how weekly monitoring of pregnancy ratios can save operations from the current $4,000 replacement crisis.

- Why Dairy Markets Can’t Self-Correct Anymore: The Hidden Forces Reshaping the Dairy Industry’s Future – Analyzes six permanent structural changes—from European cooperative mandates to digester revenue—that have broken traditional market cycles, explaining why waiting for a standard recovery is no longer a viable strategy.

- The Tech Reality Check: Why Smart Dairy Operations Are Winning While Others Struggle – Provides a 5-dimension framework for AgTech investment, exposing why most robotic implementations fail to deliver ROI before year 4 and how to avoid the “lottery ticket” approach to modernization.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.