Plot twist: Dairy farms now produce more beef profit than beef ranches. $1,400/calf vs. their $800. The math is devastating.

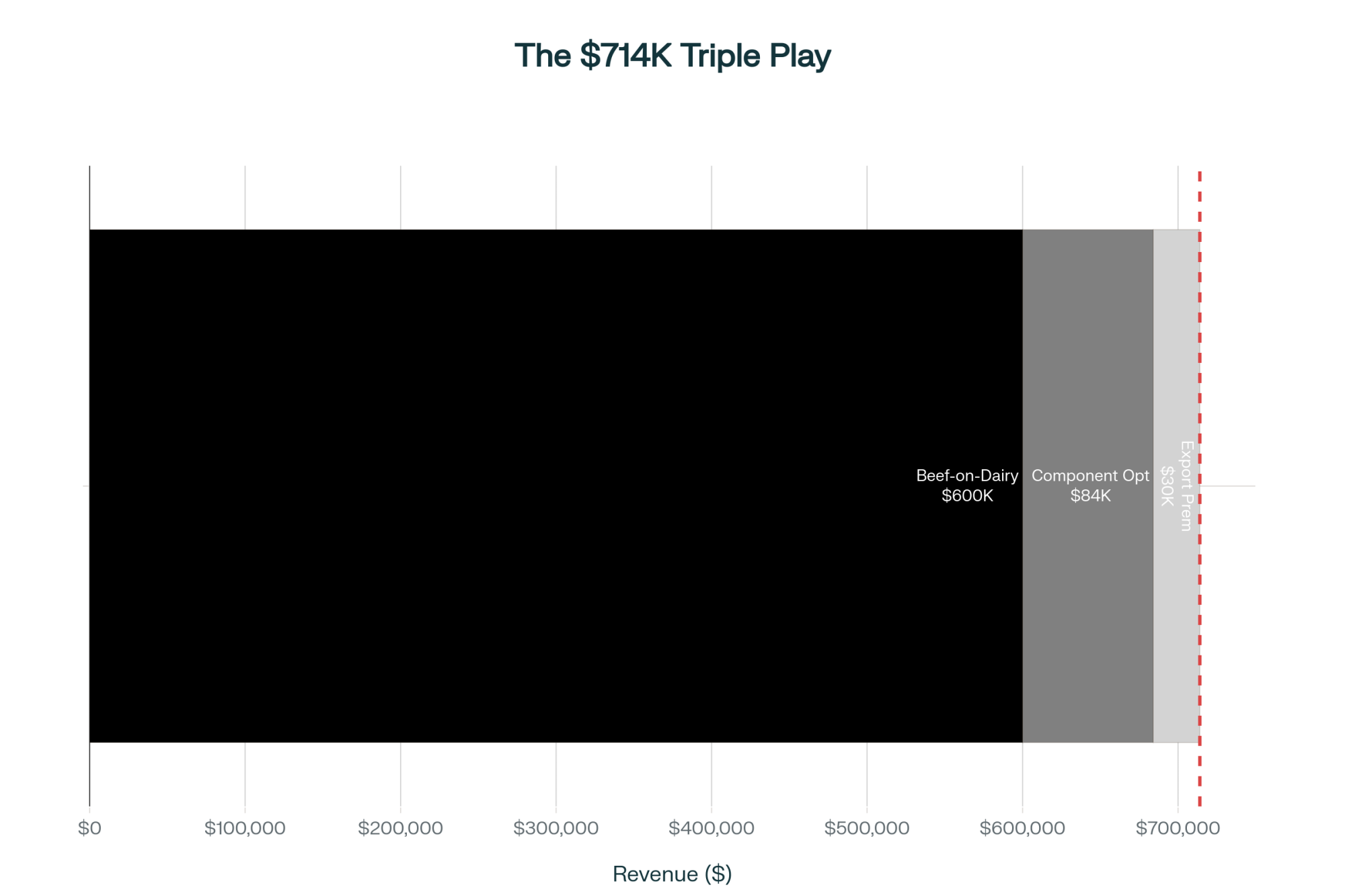

EXECUTIVE SUMMARY: Dairy has stumbled into the opportunity of a generation: we’re producing 230 billion pounds of milk while simultaneously filling the void left by beef’s collapse to 1961 lows—effectively owning both markets. Three strategies are generating $600-770K in additional annual revenue for progressive operations: beef-on-dairy genetics transforming worthless bull calves into $1,400 assets; component optimization capturing $84,000 from butterfat premiums; and export positioning, as China and India desperately need our proteins. The proof is compelling—producers investing $70,000 are returning $200,000 in year one, with 60% efficiency. Here’s the urgency: only 28% have moved while premiums are maximum; by 2027, when adoption hits 70%, the window closes. Make no mistake—this isn’t about incremental improvement, it’s about who survives the next decade.

I was reviewing the November USDA reports, and something remarkable jumped out that deserves our attention. The latest WASDE data shows dairy production surging to 230 billion pounds, while beef production drops by 70 million pounds and pork production falls by 80 million pounds. What’s particularly noteworthy is how few producers have fully grasped the implications of this shift.

This development builds on what we’ve been seeing across the industry—not just another typical market cycle, but what appears to be a fundamental restructuring of North American protein production. Several economists I’ve spoken with are describing this as an 18-month window of genuine opportunity, and the more I analyze the data and talk with producers, the clearer the pattern becomes.

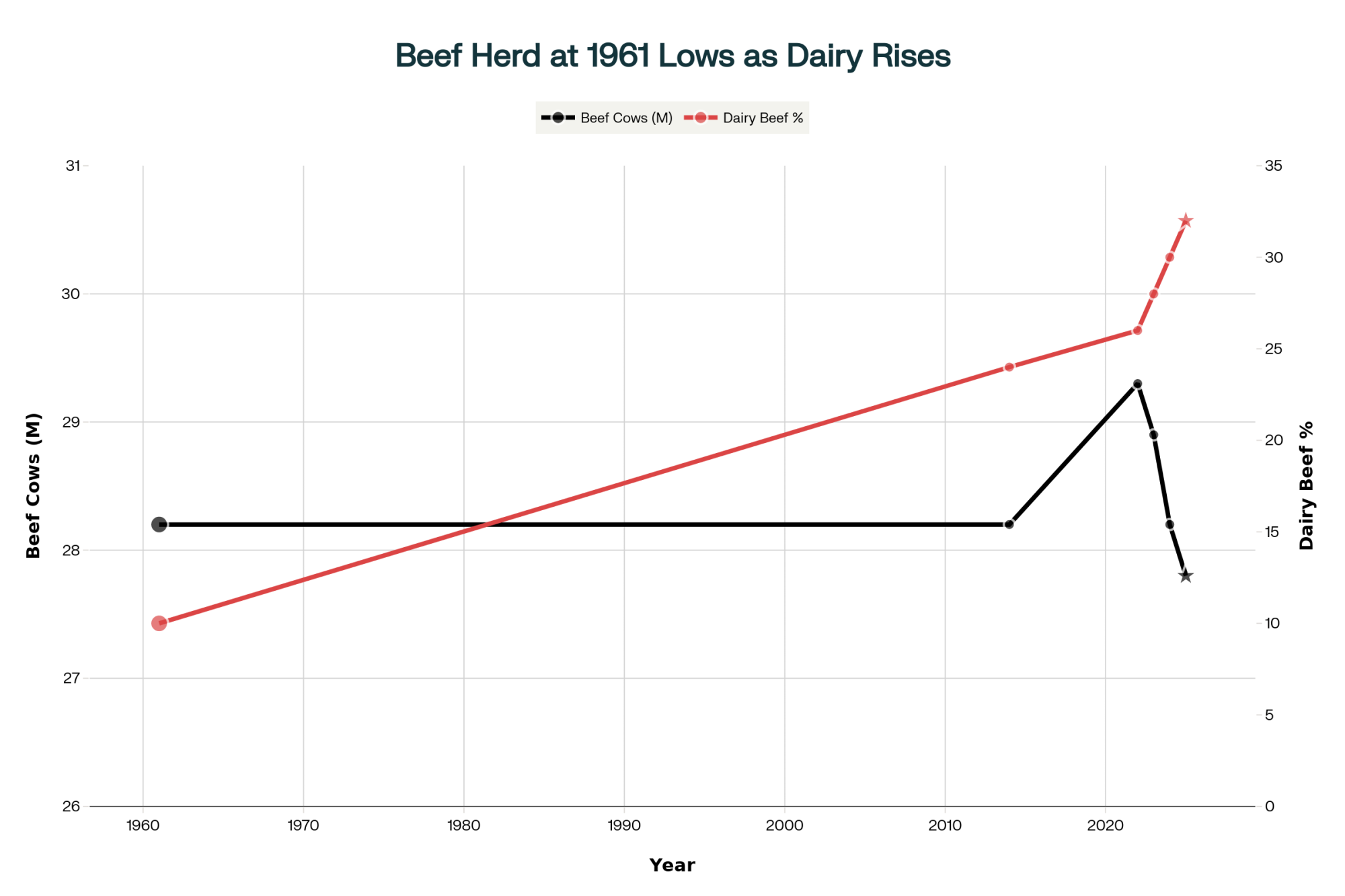

The consumption trends align with this narrative. USDA’s Economic Research Service shows Americans consuming record levels of dairy products, reaching historic highs that would have seemed impossible just five years ago. Globally, the milk protein market continues its substantial growth trajectory, with multiple analyses projecting sustained expansion through 2032. This coincides with the beef cow herd dropping to approximately 28 million head—USDA data confirms this represents the lowest level since the early 1960s.

In recent conversations with producers from various regions—Wisconsin cooperatives, California independents, Texas operations—those experiencing the most success share a common trait: they’re adapting now, even if imperfectly, recognizing that this convergence of factors presents opportunities we haven’t encountered in decades.

The Beef-on-Dairy Revolution: From Liability to Asset

How Forward-Thinking Farms Discovered the Formula

Here’s what’s happening on farms across the country. Producers are telling me they used to essentially give away Holstein bull calves—some mentioned getting as little as five dollars for two calves just a few years back. Today, according to USDA Agricultural Marketing Service data this fall, those same genetics bred to carefully selected beef sires are commanding $1,200 to $1,400 each.

For perspective, a large dairy operation implementing this strategy could potentially generate $600,000 to $770,000 in additional annual revenue, depending on their size and execution. Same facilities, same management team, fundamentally different economics.

What’s particularly interesting—and this has been confirmed through discussions with extension specialists at both Cornell and Wisconsin—is how beef genetics on dairy has evolved beyond simple calf value. It’s reshaping our entire approach to genetic progress and herd optimization.

The Strategic Framework That Makes It Work

The most successful implementations I’ve observed, from California’s Central Valley to New York’s traditional dairy regions, share common elements that go well beyond basic crossbreeding.

Progressive producers are walking me through their approach: genomic testing of the entire herd at approximately forty dollars per animal, creating a precise roadmap of genetic potential. This allows targeted breeding decisions—sexed semen (at a fifteen to twenty-five dollar premium per breeding) on the top 40 to 50 percent of cows, while the remainder are bred to proven beef sires.

The sire companies report Angus and SimAngus dominating these selections, and for good reason—the calving ease and growth characteristics align well with dairy operations. University of Wisconsin research continues to validate this approach, showing consistent economic advantages.

Current industry data indicates dairy contributes approximately 28 percent of the total U.S. calf crop, compared to roughly 24 percent in the mid-1990s. Given beef cow rebuilding timelines—typically five to six years minimum based on historical cattle cycles—this percentage could realistically reach 32 to 35 percent by 2027.

Component Optimization: The Hidden Value in Every Tank

Why Volume-Based Production Is Becoming Obsolete

Producers in California have been showing me compelling comparisons of their milk checks from 2023 versus the current year. The transformation in how milk is valued has been striking.

When Federal Order changes took effect this summer, the entire pricing dynamic shifted. California pricing announcements show butterfat reaching $2.62 per pound, making component optimization increasingly critical. The economics are straightforward yet powerful—every 0.1 percent increase in butterfat adds approximately thirty-five cents per hundredweight in additional revenue.

For a typical herd producing 24,000 pounds daily, improving from 4.1 to 4.3 percent butterfat could translate to roughly $84,000 in additional annual revenue under optimal conditions.

These aren’t just theoretical projections—producers are seeing real improvements in their milk checks.

The Genetic Revolution Driving Component Gains

The April genetic base change data from the Council on Dairy Cattle Breeding revealed something significant—a 45-pound rollback in butterfat Estimated Breeding Values, representing substantial industry-wide genetic progress.

During a recent genetics conference, specialists characterized this as unprecedented selection intensity for components. The practical impact? Producers selecting bulls with plus-50 pounds butterfat and plus-40 pounds protein are creating meaningful competitive advantages over operations using industry-average sires.

Nutritionists working with herds across Wisconsin are sharing their evolving approach: precise rumen pH management, maintaining a pH of 6.0 to 6.2 for optimal fat synthesis, and transitioning from generic bypass fats to targeted palmitic acid supplements at 200 to 250 grams per cow daily. University research from this past spring demonstrates that this can increase butterfat by 0.2 percent within 30 days—seemingly modest yet economically significant across an entire herd.

The Export Opportunity: Beyond Domestic Markets

China’s Strategic Shift Creates Targeted Opportunities

While the U.S. Trade Representative confirms 135 percent tariffs on many dairy products to China, the underlying trade dynamics tell a more nuanced story. USDA Foreign Agricultural Service data from this fall reveals interesting patterns in China’s import behavior.

According to trade data, imports of sweet whey powder have been growing significantly year over year, even as imports of commodity milk powder have declined. The driver appears to be specialized demand for swine feed ingredients and infant formula components rather than bulk commodities.

Producers shipping to export-oriented processors are reporting premiums of approximately forty cents per hundredweight for high-protein milk that yields better in whey extraction. For a mid-sized operation, that could translate to meaningful additional annual revenue—we’re talking potentially $25,000 to $30,000 for a 600-cow herd.

India’s Protein Crisis Opens New Channels

The opportunity in India may be even more significant, based on USDA attaché reports from New Delhi. Given that 70 to 80 percent of Indians do not meet daily protein requirements, according to the Medical Research Council, the government has launched a revised National Program for Dairy Development with substantial funding for fortification initiatives.

The tariff structure clearly reveals the opportunity. India applies approximately 30 to 60 percent tariffs on fluid milk and cheese imports, yet only around 8 percent on whey protein and 5 percent on lactose—reflecting limited domestic production capacity for these specialized ingredients.

European Market Dynamics

What’s also developing—and this hasn’t received much attention—is the European Union’s shifting protein strategy. With increasing pressure on their livestock sector from environmental regulations, industry reports suggest EU imports of specialized dairy proteins have been growing substantially since 2023. U.S. producers meeting specific sustainability metrics are finding opportunities for premium access to these markets.

The Operations at Risk: Recognizing Warning Signs

Who Faces the Greatest Challenges

We need to acknowledge candidly that not all operations are positioned to capture these opportunities. USDA’s Agricultural Resource Management Survey data from recent years indicates that operations with fewer than 200 cows face average production costs of around $20.93 per hundredweight, compared to $16.50 for operations with more than 1,000 cows.

Producers who’ve recently exited the industry have shared their experiences. When cooperatives announce infrastructure deductions—like the documented four-dollar-per-hundredweight case with Darigold in May—smaller operations can face thousands of dollars in additional monthly costs. For a 150-cow operation, that could mean over $7,000 in additional monthly expenses, creating immediate cash-flow challenges.

Studies suggest the majority of recent dairy exits have involved smaller operations with single-processor relationships and limited value-added strategies. While difficult to discuss, understanding these dynamics is essential for informed decision-making.

Regional Variations Matter

The strategies that succeed in Wisconsin may face challenges in Georgia—regional context matters tremendously. University of Florida dairy specialists have documented that Southeast operations often face production costs per hundredweight that are 2 to 3 dollars higher due to heat-stress management and feed procurement requirements.

Conversely, Texas Panhandle operations benefit from proximity advantages. Producers there report capturing an additional hundred to hundred-fifty dollars per calf on dairy-beef crosses compared to operations shipping longer distances, simply because of their location near multiple beef feedlots.

Technology Adoption Patterns

What’s interesting is how technology adoption varies by operation size. Research suggests operations between 500-1,000 cows often show strong adoption rates for genomic testing and precision feeding—they seem to hit a sweet spot of having adequate resources while maintaining operational flexibility.

Practical Implementation: Learning from Those Who’ve Done It

The Measured Approach That Works

Producers who’ve successfully transitioned share common timelines and approaches. They typically start with genomic testing—investing approximately $40-50 per animal for a comprehensive herd evaluation. This provides the genetic roadmap.

Within a few months, they’re implementing sexed semen on superior genetics. Then comes beef sire selection tailored to their facilities—calving ease often proves critical, especially in older barn configurations. By the following fall, they’re seeing the first beef-cross calves arriving.

“Year one, we captured perhaps 60 to 70 percent of the potential while learning the system. Even at that efficiency level, we generated substantial additional revenue on essentially unchanged feed costs.” — Minnesota dairy producer

Investment Reality Check

Based on producer experiences and consulting firm analyses, here’s the realistic investment framework:

- Genomic testing: $40-50 per animal (one-time investment)

- Sexed semen: $15-25 premium per breeding above conventional

- Nutritionist consultation: $2,000-5,000 monthly, depending on service level

- Component feed adjustments: Approximately $0.50 per cow daily

- Data management software: $200-500 monthly for quality tracking systems

For a representative mid-sized operation, year-one implementation might total $60,000 to $80,000. However, combining beef-calf premiums with component improvements could potentially generate substantial additional revenue. While results vary, the fundamentals of economics generally favor well-managed operations.

Sustainability Considerations

What’s encouraging for long-term viability is how these strategies align with sustainability goals. The genetic improvements that reduce days to market for beef-cross calves can translate into lower lifetime emissions per pound of protein produced. Several processors are beginning to consider these metrics—something worth monitoring as carbon markets develop.

Looking Ahead: The Questions That Matter

Is This Sustainable or Another Bubble?

In discussions with agricultural economists and market analysts, the consensus suggests solid fundamentals underpin current conditions. Beef cow herd rebuilding faces structural constraints, with projections indicating a return to pre-drought inventory levels at the earliest in 2030. Global protein demand maintains 2 to 3 percent annual growth,according to FAO data—this reflects structural rather than cyclical factors.

However, appropriate caution is warranted. As beef-on-dairy adoption increases—already substantial in certain regions—some premium compression is likely. Markets are already seeing variation, with premiums ranging from $1,000 to $1,400 depending on genetics, location, and buyer relationships.

The indicator I’m monitoring most closely? USDA’s quarterly Cattle on Feed reports tracking dairy replacement heifer inventories, currently at approximately 1.88 million head—the lowest since the late 1970s, according to NASS data. Continued decline through 2026 would suggest structural transformation; recovery above 2.1 million might indicate temporary market dynamics.

What About Farmers Who Can’t or Won’t Change?

I’ve spoken with veteran producers approaching retirement who’ve made the conscious choice to maintain current practices rather than implementing new strategies. With paid-off operations and no succession plans, this approach has validity.

Industry observers suggest a significant portion of current operations may exit within the next decade, regardless of market conditions—due to demographic realities rather than economic failure. For these producers, operational stability may appropriately outweigh optimization opportunities.

Key Takeaways for Your Operation

After extensive data analysis, producer conversations, and expert consultation, several key insights emerge.

The opportunity window exists, but it continues to narrow. Early adopters captured the highest premiums with limited competition. Current implementers are seeing good returns, though not quite at early-adopter levels. By 2027, returns may normalize further, though they will remain profitable for efficient operations.

Geography influences profitability more than scale—surprising but documented. A strategically located, smaller dairy near beef infrastructure can perform well compared to larger operations that face logistical challenges. Understanding your regional advantages and constraints proves essential.

Processor relationships have evolved from customer-vendor to strategic partnerships. If your processor cannot articulate clear export strategies or component valuation methods, opportunities may remain unexploited. Business alignment now matters as much as traditional loyalty considerations.

Experience teaches that perfection often impedes progress. Producers achieving partial efficiency in year one while generating meaningful profits demonstrate that imperfect action often surpasses perfect planning.

Your Next Steps

Looking at actionable items for interested producers:

- Request genomic testing information from your breed association or genetics provider—understanding costs and logistics is the first step

- Schedule a conversation with your nutritionist about component optimization potential in your current ration

- Contact your processor to understand their component pricing structure and export market positioning

- Reach out to beef breed associations for information on dairy-appropriate sires and local calf buyer networks

- Connect with producers who’ve already made transitions—their practical experience proves invaluable

As we consider the industry landscape this November, dairy isn’t declining—it’s transforming. Producers who recognize the shift from commodity milk production to strategic protein business models position themselves for success. Those awaiting return to historical norms may discover that “normal” has fundamentally changed.

The data supports action. Strategies have proven effective. Progressive neighbors are already implementing changes. The question has evolved from whether to adapt to how rapidly you can position your operation for emerging opportunities.

KEY TAKEAWAYS

- The $1,400 Reality Check: Your Holstein bull calves are worth $1,400 to smart producers, $50 to you—the difference is three breeding decisions and genetics testing

- Triple Revenue Stream, Same Cows: Beef-on-dairy ($600K) + butterfat optimization ($84K) + export premiums ($30K) = $700K+ additional annual revenue without adding a single cow

- The 18-Month Countdown: Today, only 28% have adapted; when it hits 70% by 2027, premiums crash from $1,400 to $800—early movers win, others consolidate

- Proven ROI Formula: Invest $70K (genetics + nutrition + consulting) → Return $200K year one, even at 60% efficiency—this isn’t theory, it’s what producers are doing now

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beyond the Milk Check: How Dairy Operations Are Building $300,000 in New Revenue Today – Reveals immediate revenue tactics beyond genetics, detailing how silage management, refusal reduction, and DMC enrollment can generate an additional $45,000 to $60,000 annually for mid-sized herds while protecting margins.

- The $1,350 Replacement Advantage – Analyzes the critical heifer shortage driving replacement costs to over $3,000, providing specific breeding strategies to balance beef premiums against the rising cost of maintaining herd size in a shrinking inventory market.

- CDCB’s December ‘Housekeeping’ Is Actually Preparing Dairy Breeding for an AI Revolution – Explains the massive shift to AI-driven genetic evaluations arriving in late 2025, detailing how new neural networks will change breeding values and why producers must prepare their data systems now to remain competitive.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!