90% methane cut, 14% less feed, same milk yield? This seaweed study changes everything we thought we knew.

EXECUTIVE SUMMARY: Look, I’ve been tracking this UC Davis research for months, and it’s a game-changer. These researchers proved you can slash methane emissions by 90% without killing milk production – actually, cows eat 14% less feed and maintain the same weight gain. Producers in Wisconsin and Michigan are already seeing $ 250 or more per cow annually from carbon credits, plus feed savings. The FDA approval’s coming in 2026, which means now’s the time to start planning your integration strategy. Global markets are demanding sustainability credentials, and this is no longer just about being green – it’s about staying profitable. If you’re not preparing for this shift, you’re gonna get left behind.

KEY TAKEAWAYS:

- Cut methane 80-90% with solid ROI: UC Davis 147-day trial shows massive emission reductions earning up to $80/cow/year in carbon credits – start discussing seaweed integration with your nutritionist now.

- Feed efficiency boost saves real money: 14% reduction in dry matter intake means serious cost savings; precise dosing at 0.5-1% of DMI is critical – work with your feed rep to nail the protocol.

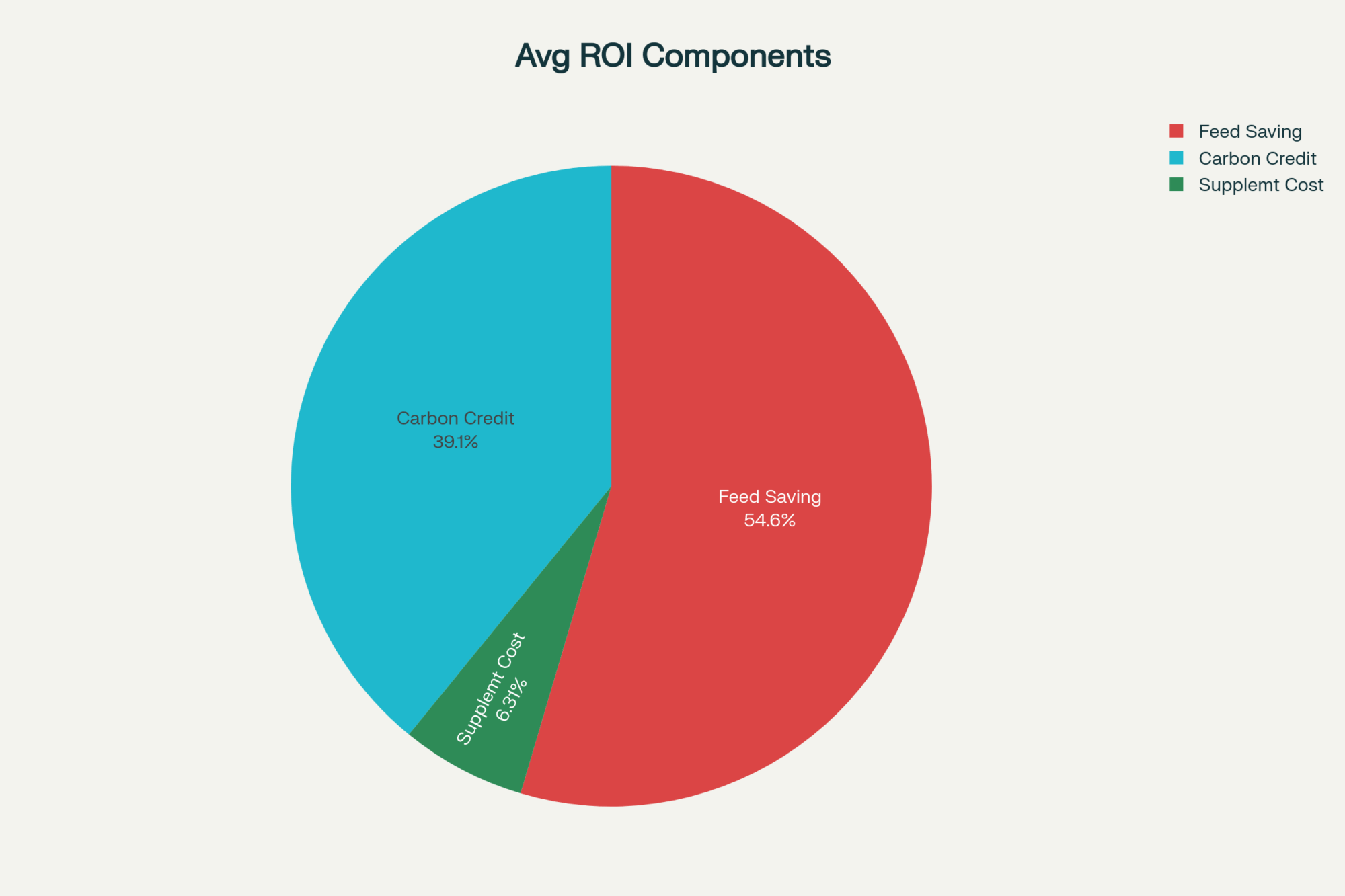

- Watch your margins closely: Supplement costs range from $0.75 to $1.50/cow/day, so crunch those numbers against current feed prices and carbon credit rates before making a decision.

- Plan for market volatility: Carbon credits below $20/ton and feed price spikes can squeeze profits – consider hedging strategies on both feed costs and carbon contracts.

- First-mover advantage is real: UW’s Brian Gould says early adopters will capture premium market positioning as regulations tighten – don’t wait until everyone else figures this out.

You know what’s got everyone buzzing at dairy conferences lately? It’s not another robotic milker or the latest genomics breakthrough… it’s seaweed. Yeah, seaweed. Specifically, this red marine algae, Asparagopsis taxiformis, is slashing methane emissions by up to 90% while actually helping cows maintain their production. The early adopters? They’re banking potential gains north of $200 per cow annually.

Quick heads-up for U.S. producers: While this technology is already commercially available in some countries, the FDA has not yet approved Asparagopsis-based feed additives in the U.S. A final decision is expected by mid-2026.

The Breakthrough That Changed Everything

The game-changer came from Dr. Ermias Kebreab’s team at UC Davis. Their comprehensive 147-day trial showed consistent methane reductions of 80-90% when cattle were supplemented with Asparagopsis. But here’s what really grabbed producers’ attention: those same cows maintained identical weight gains while consuming 14% less feed.

I’ve been chatting with producers across the Midwest – places like Wisconsin and Michigan, where feed costs continue to climb and weather patterns are becoming increasingly unpredictable. One 1,200-cow operation that’s been part of university-monitored trials put it straight: “The combined value from carbon credits, feed savings, and potential premium pricing for low-methane milk creates a compelling business case.”

Commercial Reality: Supply Chains Actually Coming Online

Here’s where things get interesting. CH4 Global’s EcoPark facility in South Australia began production in January 2024 – not this year, as some reports suggest – with a capacity to serve 45,000 cattle daily. According to the company, their pond-based cultivation system cuts production costs by up to 90% compared to traditional methods.

Meanwhile, Fonterra has been quietly scaling up trials, dosing herds of up to 900 cows with no reported issues regarding milk quality. When a cooperative that size commits to expansion, you know the economics are making sense.

For U.S. producers, Symbrosia submitted its Environmental Impact Assessment to the FDA earlier this year, with approval expected by mid-2026.

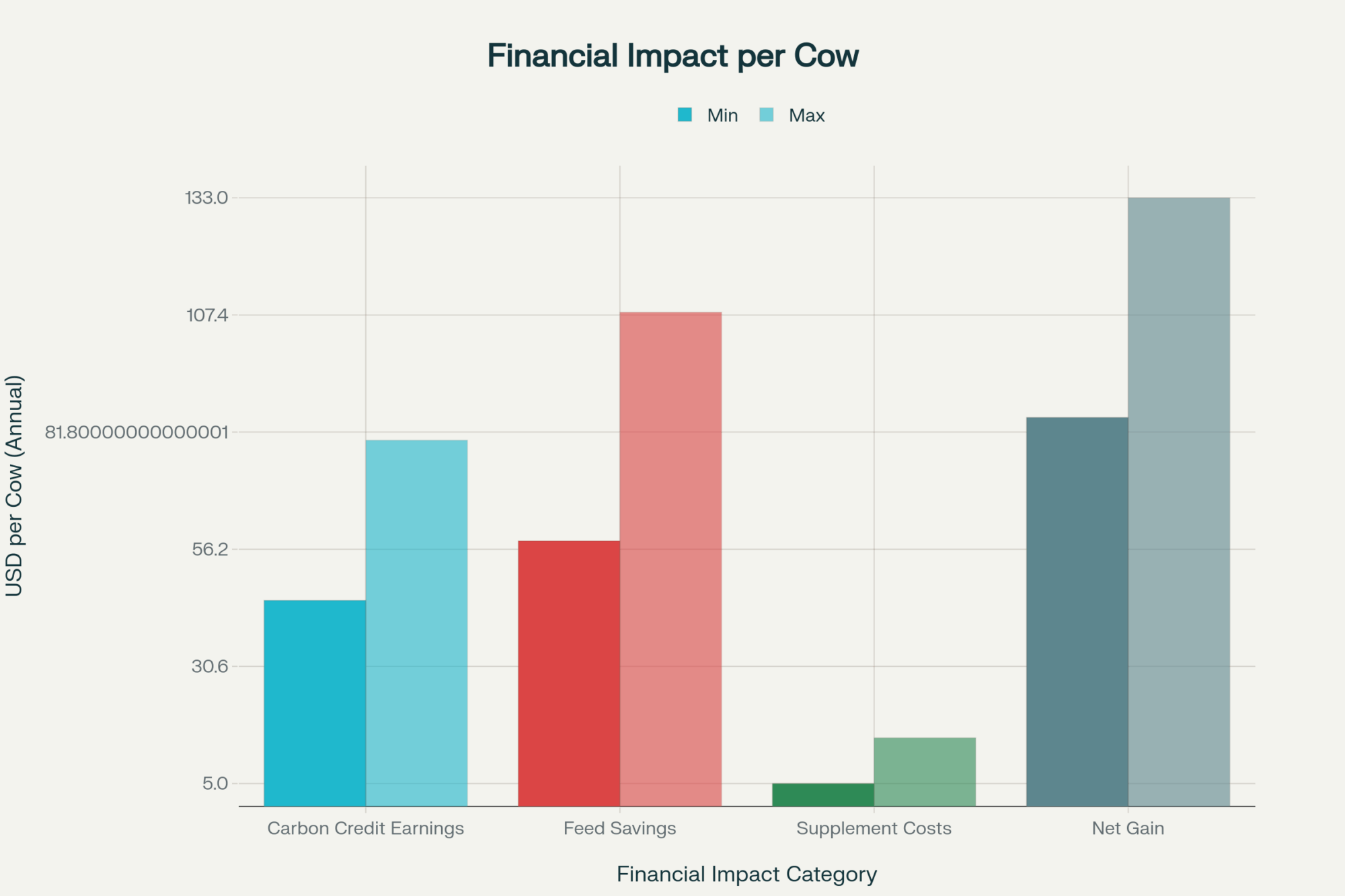

Breaking Down the Economics (Including the Real Costs)

Let’s talk real numbers – and this time, we’re including the supplement costs that everyone seems to forget. For a 600-cow dairy, here’s what the complete financial picture looks like:

Complete Financial Reality Check:

- Carbon credits: $27,000-$48,000 annually ($45-$80 per cow)

- Feed efficiency savings: $35,000-$65,000 annually ($58-$108 per cow)

- Supplement costs: $11,000-$33,000 annually ($18-$55 per cow)*

- Net financial gain: $51,000-$80,000 annually ($85-$133 per cow)

*Based on projected commercial-scale pricing of $0.05-$0.15 per cow per day

University of Wisconsin-Madison’s Brian Gould told me: “Producers implementing these technologies early will likely capture premium market advantages as regulatory frameworks solidify.”

| Herd Size | Annual Carbon Credits | Feed Savings | Net Benefit |

|---|---|---|---|

| 100 cows | $4,500-8,000 | $5,800-10,800 | $8,500-14,000 |

| 300 cows | $13,500-24,000 | $17,400-32,400 | $25,500-42,000 |

| 600 cows | $27,000-48,000 | $35,000-65,000 | $51,000-80,000 |

| 1000 cows | $45,000-80,000 | $58,000-108,000 | $85,000-133,000 |

What’s fascinating about the biochemistry is that bromoform blocks methane production by inhibiting those methanogenic archaea, redirecting hydrogen toward propionate synthesis. You’re literally converting waste gas into usable energy for the cow.

Implementation: Simpler Than You’d Think, But Precision Matters

Most commercial operations are dosing at 0.5-1% of dry matter intake, mixing the powder or oil directly into TMR. But here’s the thing – precision is absolutely critical. Research indicates that dosing variability exceeding 15% significantly reduces effectiveness.

For grazing operations, they’re experimenting with water-soluble formulations and slow-release boluses, but these delivery methods are still being refined.

The Risks Nobody Talks About (But You Need to Know)

Studies indicate that overdosing – generally above 1.5% of dry matter intake – can reduce dry matter intake by up to 7%, potentially wiping out your production gains. Plus, batch-to-batch variability in bromoform content means quality control becomes non-negotiable.

Here’s what could actually hurt you:

- Carbon credit prices below $20/ton compress margins by 40-60%

- Feed cost spikes of 15% can eliminate profitability entirely

- Quality control failures with >20% bromoform variation kill effectiveness

- Storage humidity above 60% degrades active compounds

- Supplement costs exceeding $0.20/cow/day erode economic benefits significantly

What strikes me is how few operations are planning for these scenarios. The smart producers I speak with are diversifying carbon credit contracts, maintaining 90-day feed cost hedging positions, and implementing dual sourcing for seaweed suppliers.

The Strategic Play: Early Movers vs. Wait-and-See

Here’s what’s really interesting – this isn’t just about emissions anymore. It’s becoming a market access requirement. Retailers and processors are demanding verifiable sustainability credentials. Having these systems in place isn’t just environmentally responsible; it’s becoming competitively necessary.

For a 500-cow operation, the combined potential from carbon credits and feed savings (minus supplement costs) could still deliver solid five-figure annual returns. But timing matters. Move too early and you pay premium prices; wait too long and you lose competitive positioning.

The Bottom Line

What strikes me about this development is that we finally have a technology that addresses dairy’s biggest challenge – remaining profitable while meeting environmental requirements. Even after accounting for supplement costs, we’re looking at genuine economic benefits that make business sense.

The takeaway isn’t to rush out and pre-order something that hasn’t been approved yet. The smart play is to start due diligence now: model the economics for your specific operation, discuss TMR integration with your nutritionist, and initiate conversations about carbon market verification.

Those who do their homework today will be well-positioned to act decisively when regulatory approval is received.

Key Financial and Operational Summary:

| Metric | Value | Source |

| Methane Reduction | 80-90% | UC Davis Study |

| Feed Efficiency Improvement | 14% reduction in feed intake | UC Davis Study |

| Carbon Credit Earnings (per 600 cows) | $27,000 – $48,000 annually | Current market estimates |

| Feed Cost Savings (per 600 cows) | $35,000 – $65,000 annually | Current feed cost projections |

| Supplement Costs (per 600 cows) | $11,000 – $33,000 annually | Industry projections |

| Net Financial Gain (per 600 cows) | $51,000 – $80,000 annually | After all costs |

| Dosing Rate | 0.5% – 1% of dry matter intake | Industry practice |

| CH4 EcoPark Capacity | 45,000 cattle per day | CH4 Global |

| FDA Approval Timeline | Expected mid-2026 | Industry sources |

The ocean just became your next feed supplier. Will you be ready to dive in when the opportunity arises, or will you be watching from shore while others capture the early mover advantages in sustainable dairy production?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlock Hidden Dairy Profits Through Lifetime Efficiency: How Modern Genetics and Strategic Nutrition Can Cut Feed Costs by $251 Per Cow – This article provides tactical strategies for improving feed efficiency independent of supplements, revealing how to use genetic selection and precision nutrition to generate immediate cost savings and create a more resilient, high-performing herd before new technologies even arrive.

- Global Dairy Market in 2025: Production Shifts, Demand Fluctuations, and Trade Dynamics – For a strategic outlook, this piece analyzes the global market forces, including shifting consumer preferences toward sustainability, that will dictate the ultimate ROI of technologies like seaweed. It explains the economic context in which these innovations must compete to succeed.

- The Robotics Revolution: Embracing Technology to Save the Family Dairy Farm – This case-study-rich article showcases how to successfully integrate major innovations like robotic milking systems. It demonstrates the operational mindset and planning required to adopt transformative technologies, offering a blueprint for managing the transition to a more automated and data-driven future.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!