$3.71 butterfat in 2023. $1.70 today. Same cows. Different math. Different future.

Executive Summary: Butterfat crashed 54%—from a record $3.71/lb in October 2023 to $1.70 today. Beef-on-dairy calves now bring $1,400; dairy bulls, maybe $800. This isn’t a down cycle. It’s the year global oversupply, China’s growing self-sufficiency, and processor consolidation collided—and the old playbook stopped working. For 300-800 cow operations, the math is forcing real choices: scale hard, capture niche premiums, or use beef-on-dairy as a planned exit over 3-5 years. This analysis delivers the diagnostic tools—breakeven thresholds, debt ratios, the five questions to ask your lender—alongside an honest look at the mental health stakes when “just hang on” becomes dangerous advice. Waiting isn’t a strategy. It’s a decision by default.

You know, looking at 2025, a lot of producers are saying the same thing over a cup of coffee: “On paper this shouldn’t be a disaster year… so why does it feel like one?” Class III futures are hovering around $17/cwt according to the latest CME data. Butterfat premiums have been cut nearly in half from their 2022–2023 peaks—USDA component pricing shows we’ve gone from above $3.00/lb down to $1.70. And here’s the kicker: beef-cross calves are commanding $1,400 a head in organized sales while the milk check shrinks.

Milk is still moving. Dairy demand hasn’t fallen off a cliff. Some export numbers even look decent based on what Rabobank’s been reporting. Yet plenty of 300–800 cow herds are staring at negative cash flow, higher debt from 2024 expansions, and kids who aren’t sure they want in.

The sentiment among multi-generation producers is a familiar one these days. They followed the signals. They invested when they were supposed to. And now many are questioning whether the playbook has fundamentally changed.

What farmers are finding is that 2025 isn’t just another low-price year. It’s the year a lot of long-standing assumptions got stress-tested all at once—about global demand, butterfat premiums, beef-on-dairy, and how much processing steel the system can really keep full. So let’s walk through what the data and real-world stories are showing us, and what that means for the mid-sized commodity herds feeling the squeeze the most.

“2025 isn’t just another low-price year. It’s the year a lot of long-standing assumptions got stress-tested all at once.”

The Year Everyone Hit the Gas at the Same Time

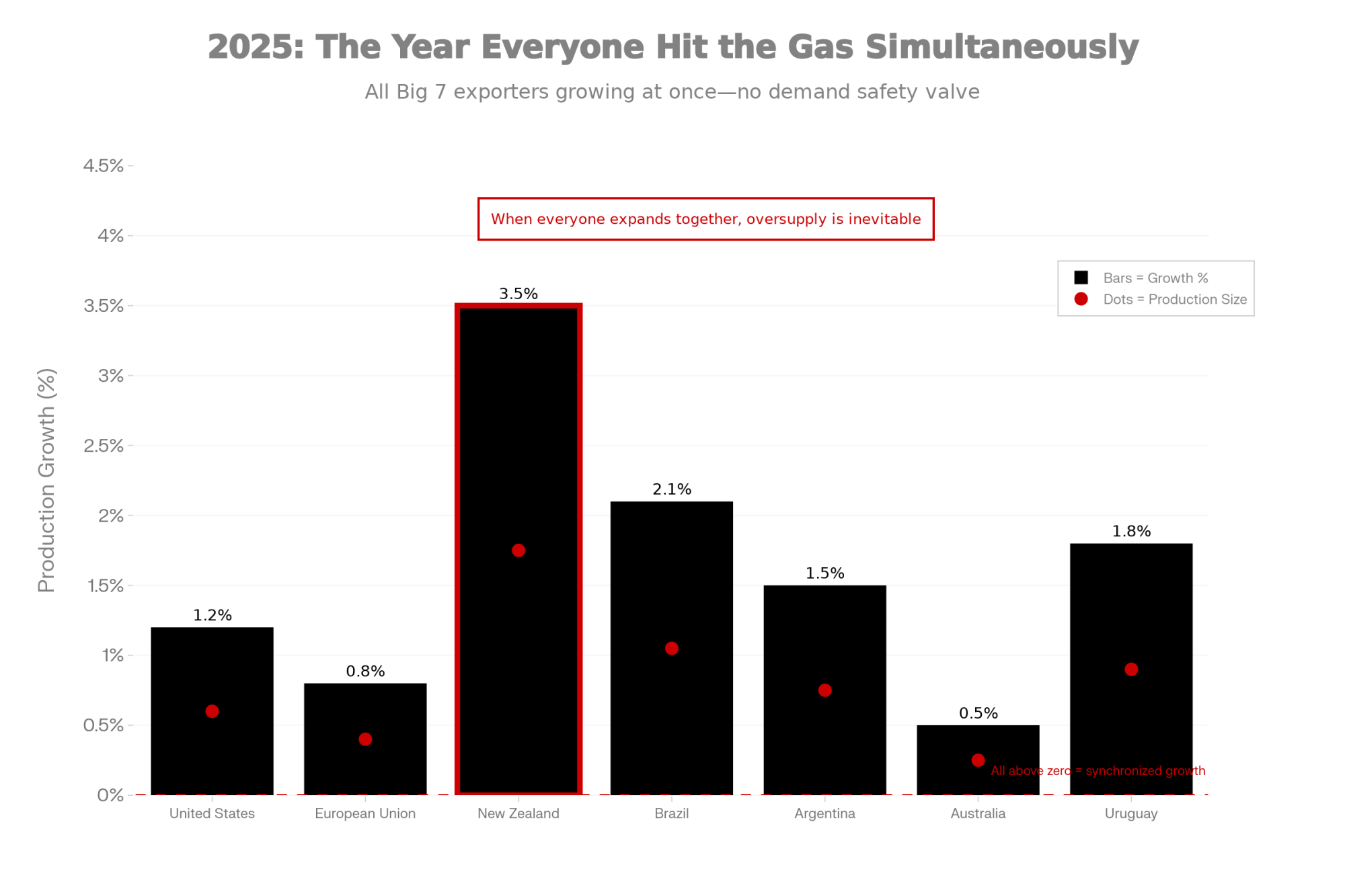

If you step back and look at global numbers, the first big lesson is simple: we managed to grow milk almost everywhere at once.

Rabobank’s late-2024 and 2025 global outlooks flagged something that probably should have gotten more attention. After several years of very modest growth, combined milk output from the major exporting regions—the “Big 7” of the US, EU, New Zealand, Australia, Brazil, Argentina, and Uruguay—was back in positive territory. On an annualized basis, Rabobank forecasts 2025 milk production from the Big 7 at 326.7 million metric tons—approximately 1–1.6% higher year-on-year, depending on the quarter measured—the highest annual volume gain since 2020.

United States: Volume on Top of Volume

USDA data shows the US dairy herd creeping back up toward 9.4–9.5 million cows by mid-2025, after earlier contraction. States like Texas, Kansas, and South Dakota led the way—in some periods, Texas was up by over 10% and Kansas by nearly 19%, according to USDA livestock reports. Monthly production in the first half of 2025 was regularly running several tenths of a percent to a few percent above the year before.

Here’s what’s interesting about where that growth landed. A lot of it didn’t go back into small parlor barns in traditional dairy counties. It went into dry-lot systems and large freestall complexes, specifically designed to handle high volumes of standardized milk for specific plants.

This creates a split reality we don’t talk about enough. In Texas and Kansas, expansion is still penciling out for operations built around $16 milk and economies of scale. Meanwhile, traditional dairy states like Wisconsin, New York, and Pennsylvania face a different equation entirely—higher land costs, older facilities, tighter environmental rules, and processors who may be more interested in sourcing from the new mega-plants out west.

California sits in its own category. Still a production giant, but increasingly constrained by water policy under SGMA and labor costs that have pushed some herds to relocate or downsize. Same industry, very different local math.

Europe and Oceania: Back in Expansion Mode

On the other side of the Atlantic, 2024 forecasts projected stable-to-slightly higher EU milk deliveries as margins improved from earlier lows. Ireland, Poland, and some German regions have all contributed to that uptick, offsetting declines in more constrained zones.

In New Zealand, Fonterra’s updates through late 2024 and 2025 pointed to milk collections running 2–4% ahead of the prior season in some periods. Reasonable pasture growth and a farmgate price forecast that—while trimmed at times—still kept most herds milking hard. Add in recovering output in Brazil and Argentina, and global trade reports going into 2025 were pretty consistent: exportable milk supply was growing again across the big players at the same time.

That’s our backdrop. Now layer on demand.

When the “China Safety Valve” Stopped Working the Way It Used To

For close to a decade, a lot of quiet boardroom confidence in export expansion could be summed up in one thought: “If we’re a little long on powder or whey, China will take it.” That was never entirely true, but it was true enough to guide a lot of investments.

Recent Chinese dairy outlooks from the USDA’s Foreign Agricultural Service tell a different story. Over the last several years, Chinese raw milk production has risen steadily, backed by large-scale commercial dairies and improved fresh cow management. At the same time, Chinese imports of some dairy commodities have flattened or declined—particularly whole milk powder—as domestic supply fills more of the pipeline.

Rabobank Research highlighted that net dairy product import volumes in 2024 fell by 12% from a year earlier, with skim milk powder imports dropping by nearly 37% according to their December 2024 analysis. Chinese buying is still important, but it’s no longer the automatic “pressure release” it once seemed to be.

So in 2025, we have more exportable milk from the US, EU, New Zealand, and South America… and a key customer that’s now partly replacing imports with its own production. The world is less forgiving of synchronized overproduction than it was ten years ago.

How the Component Story Flipped on High-Butterfat Herds

Now let’s zoom back into the bulk tank.

For most of the last decade, breeding and feeding for top-end butterfat performance was one of the clearest, most rational strategies available. Butter prices were strong. Fat-based milk pricing rewarded high tests. Nutrition and genetics teams encouraged ration tweaks and sire selection that reliably bumped herd butterfat 0.2–0.4 points over time.

And you know what? It worked beautifully. According to Federal Milk Marketing Order data reported by USDA, butterfat saw five consecutive months of record-breaking prices in 2022, from June to October, with prices ranging from $3.33 to $3.66 per pound. Then in October 2023, butterfat hit a new summit of $3.7144 per pound—an all-time record.

Not surprisingly, farmers responded. By late 2023, commentaries from US economists and industry consultants noted that national butterfat production had grown faster than protein output as herds and rations adjusted to these incentives. We did exactly what the market told us to do.

2025: Butterfat Comes Back to Earth

By late 2025, that story had changed dramatically. USDA’s November 2025 component price announcement shows butterfat at $1.7061 per pound—down more than 54% from that October 2023 peak. November butterfat fell almost 12 cents from October and was $1.20 less than the $2.91 per pound value from one year ago. Protein, meanwhile, has held steadier at $3.01 per pound according to USDA Dairy Market News.

One ag economist told Brownfield in October 2025 that US producers should pay more attention to protein going forward, because relative protein value was expected to play a larger role in milk checks than in recent years.

For herds that had pushed bulk tank fat to 4.3–4.5% and beyond, this doesn’t mean they were “wrong.” But it does mean the payback period on those genetic and ration decisions suddenly got longer.

What’s important to understand—and I think this gets missed sometimes—is that you can’t “un-breed” a cow in a year. It takes two or three calf crops, plus solid fresh cow and transition management, to materially shift the herd’s component profile. That lag is exactly why many producers started looking for a faster-acting lever to help the milk check in 2025: the beef-on-dairy calf.

Beef-on-Dairy: From Extra Cash to Core Margin Tool

If you want to see how quickly economics can reshape breeding philosophy, just look at the 2025 calf markets. According to Laurence Williams, dairy-beef cross development lead at Purina Animal Nutrition, beef-on-dairy calf prices averaged about $650 three years ago, compared to today’s average of $1,400 for day-old beef-on-dairy calves. A 2025 report puts current prices at $1,000 to $1,500 per head, driven by strong demand for high-quality beef and tight supplies.

| Year | Beef on Dairy Calf Price | Holstein Bull Calf Price | Replacement Heifer Price |

|---|---|---|---|

| 2022 | 650 | 50 | 1800 |

| 2023 | 900 | 150 | 1990 |

| 2024 | 1200 | 600 | 2400 |

| 2025 | 1400 | 800 | 2850 |

Meanwhile, even Holstein dairy bull calves—once nearly worthless—can today fetch as much as $10 per pound at auction because of historically high beef prices, according to Christoph Wand, livestock sustainability specialist with Ontario’s Ministry of Agriculture, Food and Rural Affairs. But a dairy-beef crossbred animal commands about 50% more.

Academic and extension work backs up the economic case. A 2021 analysis in JDS Communications found that when beef calves sell at a strong premium, using beef semen on lower genetic merit cows can significantly improve whole-farm profitability—especially when sexed dairy semen is used strategically on replacements. A 2023 paper in Animals, which modeled beef-on-dairy strategies at herd and sector levels, reached similar conclusions.

As many producers have been sharing at industry meetings lately, the beef calf check in some months now rivals or exceeds net milk margin. That’s not a side hustle anymore. That’s starting to look like a business model.

What we’re all figuring out is there’s a tipping point where this shifts from “nice emergency cash” to “core business model.”

- At 20–30% of breedings to beef, beef calves feel like a smart way to trim replacement heifer numbers and pick up needed cash. Milk remains the clear focus.

- Somewhere around 40–60%, the beef calf check can rival or even exceed net milk income in tough years, especially for mid-sized herds.

- Above 70% beef usage, the operation starts to resemble a confinement cow-calf system that happens to have a milk parlor attached.

That’s not a moral judgment—the cow is perfectly capable of playing both roles. The key is that this shift has downstream consequences, especially for processors and milk sheds built on the assumption of a steady dairy-only supply.

Processors, Plants, and the Risk of Empty Steel

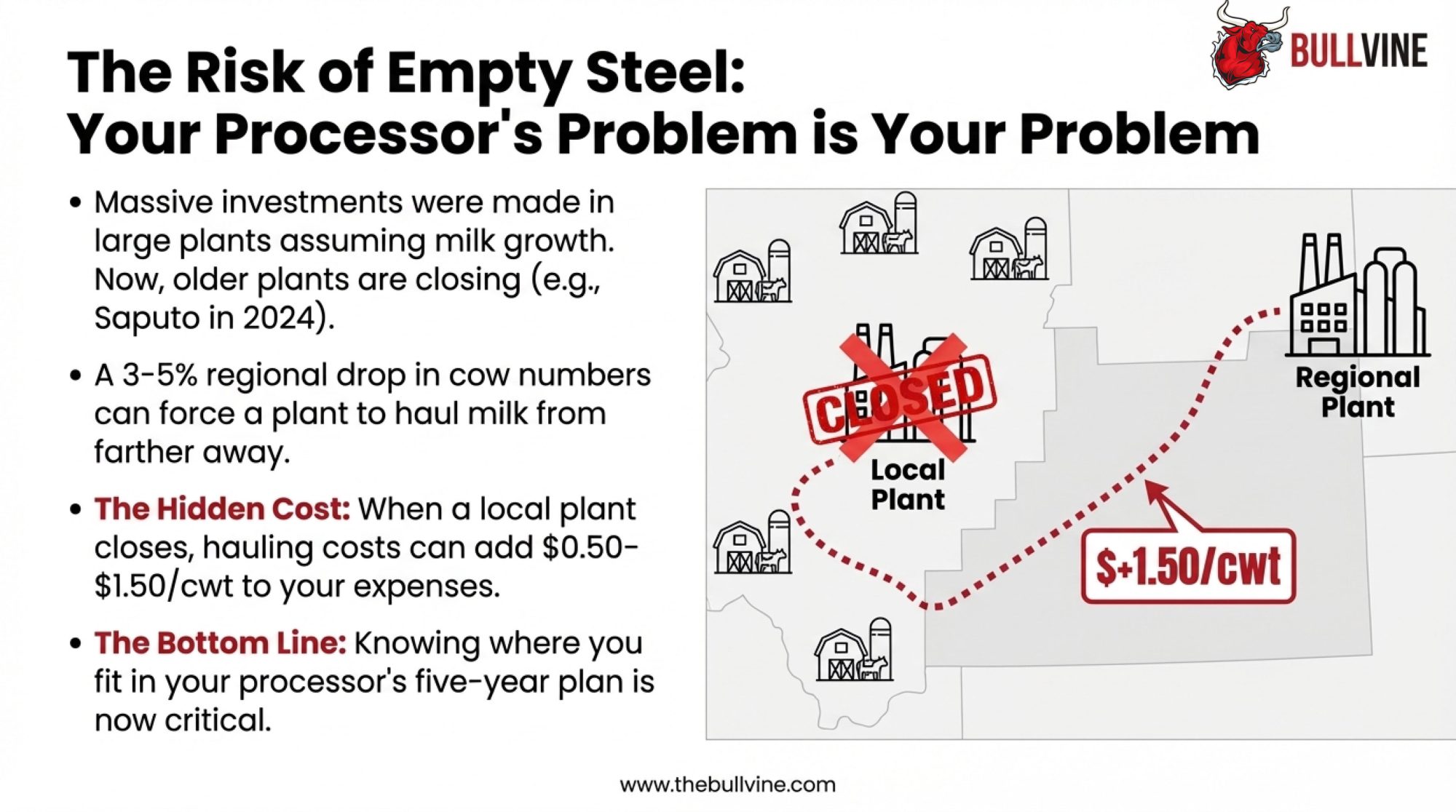

While all of this is happening on the farm, processors are juggling their own challenges. Over the past decade, North America saw massive investment in large, efficient processing plants designed to handle millions of pounds daily. Those decisions assumed long-run milk growth and strong export markets.

At the same time, older, smaller plants keep closing. In 2024, Saputo announced closures of several US facilities as part of a network optimization plan. Regional media in 2025 highlighted more closures in the Northeast and parts of Canada.

Here’s why this matters to you: keeping plants viable depends on high utilization and dense, local milk supplies. Even a 3–5% regional reduction in cow numbers can force a plant to haul milk from farther away or cut shifts. And hauling costs have climbed—milk transport expenses now run $0.50–$1.50/cwt more when a nearby plant closes, and milk has to travel an extra 100–150 miles round-trip.

The remaining dedicated dairies—folks who want to stay 100% in milk—can end up paying part of the bill for regional consolidation, even if they themselves haven’t downsized. That’s one more reason to know where your buyer sees you fitting in their long-term supply plans.

The Quiet Load: Mental Health and Identity in a Restructuring Industry

Up to this point, we’ve mostly talked numbers. But the other part of the 2025 story—the part that doesn’t show up in USDA reports—is the mental and emotional toll of trying to navigate all this change while the bills are due every month.

Multiple studies and policy briefs over the past few years have documented that farmers, including dairy farmers, face significantly higher suicide risk than the general population. CDC data and rural health research put it at often around three-and-a-half times higher, depending on the dataset. A 2024 paper in FACETS reviewing Canadian data linked poor mental health directly to stressors such as financial pressure, weather extremes, and the feeling of being trapped between tradition and economics.

Qualitative work focused on agricultural communities has found similar themes. Farmers talk about isolation, stigma around seeking help, and the unique pain of feeling like “the generation that lost the farm.” A 2021 systematic review of farmer mental health interventions highlighted both the scale of the issue and the need for supports that actually fit farm culture and schedules.

Dairy-specific stories in 2024–2025 from farm mental health organizations describe producers who came very close to suicide during prolonged downturns, often when they felt powerless to change course or communicate with family and lenders. Many of these farmers eventually decided on a concrete plan—scaling back, changing enterprises, or exiting—that gave them what one producer called “permission to breathe again.”

“I think a lot of us tie our self-worth to the operation,” one Upper Midwest producer told a farm stress counselor in a 2025. “When the numbers say you’re failing, it feels like you’re failing—not just the business.”

From a purely business perspective, it can be tempting to say “hang on for better prices.” From a human perspective, there’s a point where “tough it out” becomes dangerous advice—especially when a farm is burning equity simply to keep operating with no clear path back to profitability.

The point isn’t that everyone should sell out. It’s that mental health and business planning are now inseparable topics. Decisions about scaling, shifting to beef-on-dairy, taking on new debt, or stepping away all have real emotional weight. And that weight deserves as much open, factual discussion as the milk-to-feed ratio.

A Simple Diagnostic for 300–800 Cow Commodity Herds

Most Bullvine readers aren’t running 30,000-cow dry lots or tiny direct-market dairies. You’re probably in that 300–800 cow band—big enough to be a full-time enterprise, small enough to feel exposed when margins shrink.

Based on extension work, lender guidance, and whole-farm modeling from land-grant universities, three numbers can really sharpen the conversation about next steps.

1. Your True All-in Breakeven

This isn’t just feed and vet. It’s everything:

All-in breakeven = (Total farm expenses + principal & interest + family living) ÷ cwt sold. Using USDA’s Dairy Margin Coverage calculations, the average dairy producer spent $9.38/cwt on feed alone in August 2025—down from $9.86/cwt in July. August feed costs were the lowest for any month since October 2020. 2024 Northeast Dairy Farm Summary showed a net cost of production at $21.49/cwt, down $1.15 from 2023.

Studies suggest efficient herds can still produce milk in the high teens per cwt all-in, while others sit in the low 20s once all costs are honestly accounted for.

As a rough rule of thumb…

- If your honest all-in breakeven is under $18.50/cwt, you’re positioned to consider careful growth if demand justifies it.

- If you’re between $18.50 and $20.50, you’re in the “tight but workable” zone, where beef-on-dairy, better component focus, or cost control can make the difference.

- If your all-in breakeven is consistently above $20.50, and local mailbox prices are expected to average well below that, then every tanker load you ship deepens the hole unless you have strong non-milk income.

2. Debt-to-Asset and Working Capital

Look at your debt-to-asset ratio—using realistic values for land, cows, and facilities. Not peak boom prices. Farm financial work from universities and ag lenders generally marks 35–40% D/A as a comfortable zone, and anything over 50–60% as a caution area where new borrowing becomes riskier.

Similarly, working capital (current assets minus current liabilities) should be at least 15–20% of gross farm revenue to handle volatility safely. If you’ve slipped below 10%, even small shocks can force fire-drill decisions.

3. Matching Numbers to a Path

Once you’ve run those numbers, three broad paths look clearer.

Path 1: Scale Aggressively makes sense when costs are already competitive (breakeven in the high-teens), debt-to-asset is modest, working capital is healthy, and a processor explicitly wants additional volume. Some 2024–2025 appraisals have documented distressed facilities selling at 40–60 cents on the dollar.

Path 2: Capture Premium or Niche Value looks promising when you’re near urban markets or specialty processors for organic, A2, grass-based, or farmstead products. You need contracted premiums that justify the extra work.

Path 3: Strategic Exit or “Milk-Out” with Beef-on-Dairy deserves attention when all-in breakeven is consistently above realistic price expectations, debt-to-asset is high, and there’s no next generation eager to step in. Some herds are using beef-on-dairy as a 3–5 year glide path—selling high-value calves and older cows while avoiding the cost of raising many replacements.

Five Questions to Discuss with Your Lender in 2026

- “If milk prices stayed where they are for the next two years, what would our cash flow and equity position look like?”

- “What’s our true all-in breakeven right now—not our best year, but our honest trailing twelve months?”

- “Where does our processor see us in their five-year supply plan? Are we core, or are we on the margin?”

- “If we shifted 50% of breedings to beef and stopped raising most replacements, what does that do to our debt service capacity over 36 months?”

- “At what point would you advise us to exit with equity intact rather than continue operating at a loss?”

These aren’t comfortable questions. But they’re the ones that can turn a vague sense of pressure into a concrete plan—one way or another.

How This Looks in Your Region

National averages hide a lot of variation. The 2025 squeeze doesn’t hit every geography the same way.

High Plains (Texas, Kansas, New Mexico): Expansion is still happening, driven by new processing capacity and relatively low costs. If you’re already here with scale, the game is volume and efficiency. Heat stress management becomes a year-round conversation.

Upper Midwest (Wisconsin, Minnesota, Michigan): Traditional dairy country is caught in the middle. Strong infrastructure, but older facilities, tighter environmental rules, and a wave of 50–200 cow retirements. Many Midwest producers report running the beef-on-dairy numbers very seriously for the first time.

Northeast (New York, Pennsylvania, Vermont): Proximity to population centers creates niche opportunities—fluid, organic, farmstead. But commodity margins are brutal, given land and labor costs. Northeast producers often note they’re not competing with Kansas—they’re competing with the farm down the road for the same premium slot.

California: Still a powerhouse, but increasingly constrained by water policy under SGMA, labor costs, and air quality rules. Some herds are relocating; others are doubling down on efficiency or specialty markets.

Canada: Supply management provides price stability but limits growth. The pressure shows up differently—less about survival, more about succession and quota value as the next generation weighs options.

No single playbook fits everywhere. The key is understanding which forces are strongest in your specific situation.

Key Takeaways: How to Use 2025 as a Turning Point

2025 is a structural stress test, not just a price dip. Synchronized production growth, China’s partial self-sufficiency, component pricing shifts, and processing consolidation all lined up this year. Those forces are likely to return.

Beef-on-dairy has become a core margin tool. With beef-cross calves worth several times a straight dairy bull, and good research backing the economics, it’s a strategy every herd should run the numbers on. The key is deciding how far up that scale you want to go.

Component focus needs a reset, not a reversal. Butterfat had a great decade. Protein and overall solids will deserve more attention going forward. Flexibility and balance matter more than chasing a single number.

Processing relationships matter more than ever. With plant closures reshaping where milk can go, knowing your buyer’s long-term plans is as important as any ration change.

Mental health isn’t separate from business planning. High suicide rates remind us that “just toughing it out” can be far costlier than a few bad years on a tax return. Sometimes the bravest decision is to change course in time.

Policy tools exist, but face real barriers. Supply management, environmental caps, and coordinated export agreements could, in theory, dampen boom-bust cycles. In practice, structural volatility is likely to persist. Betting on policy rescue probably isn’t a sound business plan for 2026.

If there’s one encouraging thread through all of this, it’s that information and tools are better than ever. We have more transparent market data, more refined economic models, and more breeding and management options than our predecessors did. The hard part is being willing to look those numbers in the eye and let them inform decisions, even when the answers aren’t what we hoped for.

What 2025 offers, if we let it, is a chance to re-align our operations with the new reality—whether that means becoming a lean, scalable commodity producer, a differentiated value creator, or a family that chooses to step away with its equity and relationships intact.

That’s not an easy conversation. But it’s one worth having now, while there are still options on the table.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The 90-Day Dairy Pivot: Converting Beef Windfalls into Next Year’s Survival – Provides an immediate financial triage plan for 300-800 cow herds, detailing how to stack cull cow timing, beef calf revenue, and component premiums to bridge the gap between current milk prices and breakeven.

- The Real Reason Dairy Farms Are Disappearing (Hint: It’s Not About Better Farming) – exposes the structural economics driving industry consolidation, analyzing why “efficiency” alone is no longer enough and how processor leverage is rewriting the survival rules for mid-sized operations.

- Genetic Revolution: How Record-Breaking Milk Components Are Reshaping Dairy’s Future – Explores the 2025 genetic reset and new index weightings, offering a forward-looking breeding roadmap to align herd genetics with the shift toward higher component value and feed efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!