World’s largest dairy dodged €1B in taxes while 500,000 French cows vanished—coincidence?

EXECUTIVE SUMMARY: Here’s what we discovered: while independent farmers struggled with rising costs and regulatory compliance, Lactalis—the world’s largest dairy corporation—systematically avoided €475 million in taxes through Luxembourg shell companies from 2009 to 2020, using the savings to undercut honest competitors. French workers are now demanding €570 million for allegedly manipulated pension and benefit calculations, bringing total contested payments to over €1 billion from a company reporting just €359 million in 2024 profits. During this same period, France lost roughly 500,000 dairy cows and thousands of family operations that couldn’t compete against artificially subsidized pricing. The pattern extends globally—Australia fined Lactalis AU$950,000 in 2023 for contract violations designed to silence farmer criticism, while Dutch producers file complaints over unilateral pricing changes. This isn’t market consolidation through efficiency—it’s systematic regulatory arbitrage that gives multinational processors unfair advantages over operations playing by the rules. Every producer needs to understand: you’re not just competing against scale and technology, you’re competing against corporations that treat compliance as optional and reinvest the savings into market conquest.

So I’m sitting in the hotel bar at a conference last week, right? And this European consultant I’ve known for fifteen years—can’t name him but you’d recognize the company—slides over these legal documents about Lactalis. What I saw… honestly, it’s got me wondering if we’ve all been played for suckers while arguing over protein percentages and somatic cell counts.

You know that sick feeling when your butterfat drops, but somehow the big processors are still posting record profits? Like when corn hit $8 a few years back, but your feed costs never came back down to earth? Well, get this…

French dairy workers just launched what might be the most consequential labor revolt in European history. They’re demanding €570 million from Lactalis for allegedly unpaid benefits—and this is coming right after the company had to cough up €475 million to French tax authorities to settle fraud charges that investigators have been building since 2018.

I mean… Christ, that’s over a billion euros in contested payments from a company that only reported €359 million in profit last year.

The math doesn’t work. Unless the whole game is rigged.

When Shell Companies Become Weapons Against Family Farms

So here’s what really pisses me off about this whole mess—and I mean gets right under my skin in ways that make me question twenty-plus years of covering dairy consolidation.

From 2009 to 2020, eleven goddamn years, Lactalis was funneling profits through Luxembourg and Belgian shell companies using what French prosecutors now call “fictitious debts and paper transactions.” And I’m not talking about legitimate tax planning that your farm accountant might suggest when corn futures go sideways.

This was organized fraud designed to generate French profits… poof. Gone.

The scale? In 2017 alone—right when European milk prices were tanking and fresh cow costs were all over the map—French investigators tracked €1.99 billion flowing to empty shell companies with no employees, no operations, nothing except helping Lactalis dodge taxes they legally owed while competing against honest operations.

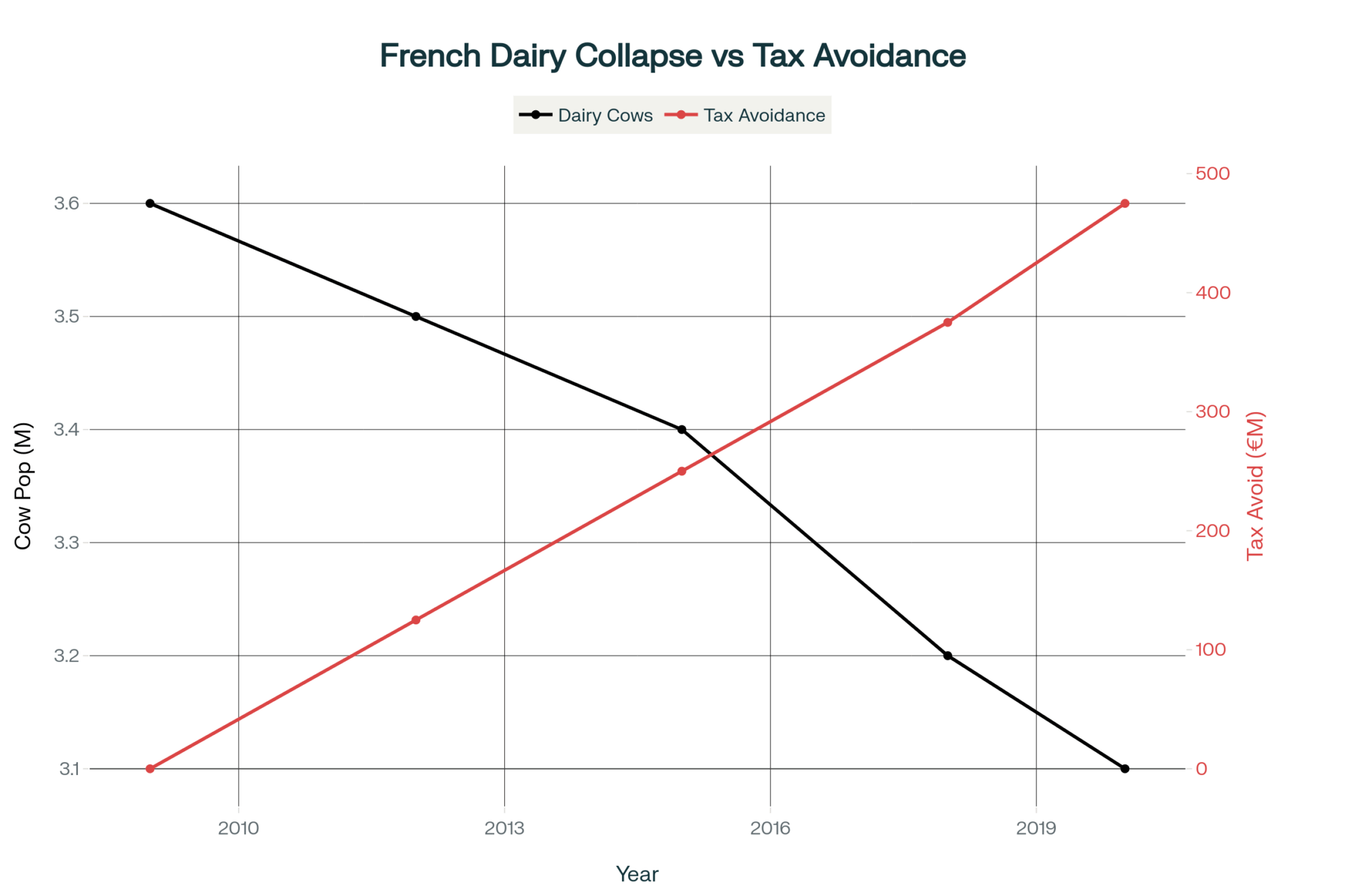

Now, I wish I could give you exact French farm closure numbers, but honestly? Their ag ministry data’s messier than a flooded lagoon, depending on who’s counting what and how they’re defining “active operations.” But here’s what I can tell you—and CLAL’s dairy sector tracking is usually solid on this stuff—France went from roughly 3.6 million dairy cows down to around 3.1 million during this same eleven-year period when Lactalis was playing shell games.

That’s half a million fewer cows producing milk. Half a million.

And before you say “well, that’s just productivity improvements,”—which, let’s be honest, we’ve all heard that line when farm numbers tank—let me tell you something about French dairy that most American producers don’t get. These weren’t 5,000-head confinement operations getting swallowed by efficiency. Most French dairy farms still run moderate-sized herds in places like Normandy and Brittany. Family operations milking maybe 80, 100 cows that should’ve been viable.

Should’ve been. But try competing against someone who’s literally playing with stolen money.

The Seven-Year Investigation That Wasn’t Really Investigating Anything

Want to know what really grinds my gears about regulatory enforcement these days?

I’ve got a buddy in Wisconsin who got audited by the IRS over a $3,000 feed deduction. Took them eight months to resolve, and it cost him more in accounting fees than the deduction was worth. Meanwhile, French authorities launched their criminal investigation into Lactalis in 2018. Tax raids happened in 2019. Settlement didn’t come until this year—2025.

Seven. Bloody. Years.

Seven years of “investigations” while Lactalis kept operating, kept expanding, kept using that deferred tax money to do whatever the hell they wanted with it. And what did they want? Market conquest, apparently.

Here’s the kicker about that €475 million settlement… I did some back-of-the-napkin math based on their latest financial reports, and that represents maybe eighteen months of current earnings. When penalties take the better part of a decade to materialize and can be spread across multiple fiscal years as operational expenses—like depreciation on a new parlor—they’re not really penalties anymore.

They’re interest-free loans for market manipulation.

Let me back up because I want you to really understand how this enforcement shell game works in practice. When you’ve got the treasury and legal firepower to drag out investigations for seven, eight years—and obviously most independent operations don’t have teams of lawyers on retainer—those eventual “fines” become something entirely different from what they’re supposed to be.

If you can avoid paying €50 million in taxes this year, invest that money in undercutting competitors and grabbing market share, then pay it back seven years later with some paperwork and PR damage control… what have you really lost?

Nothing. You’ve gained seven years of competitive advantage funded by money that was never legally yours to begin with.

Meanwhile, every honest dairy operation in France—guys running 60-head herds in Normandy, family farms that’ve been there for generations—was funding their growth, equipment purchases, seasonal cash flow needs… all of it out of their own pockets, in real time, competing against artificially subsidized pricing that they had no way of understanding or matching.

Can you believe that? While you’re worrying about whether to upgrade your parlor or fix the feed mixer, these guys are literally using unpaid taxes to fund below-market milk contracts.

The Employee Revolt That Changes The Whole Game

Okay, so this is where it gets weird. I mean, weird in maybe a good way? Never thought I’d be rooting for French lawyers, but here we are…

France completely overhauled their class action laws back in April—made it dramatically easier for employee groups to challenge corporate giants. Workers only need to prove contractual violations affecting multiple employees. No need to demonstrate corporate intent or calculate individual damages or any of that legal complexity that usually protects big companies from accountability.

The €570 million employee claim that just got filed alleges systematic manipulation of pension contributions, profit-sharing calculations, and benefit payments across thousands of workers over multiple years. Same playbook as the tax dodge, just applied to different victims who couldn’t fight back individually.

Makes you wonder what else they’ve been manipulating while we weren’t looking, doesn’t it?

But what gives me hope—and I’m not usually the optimistic type when it comes to corporate accountability—is that it’s not just happening in France anymore. The pattern’s emerging globally.

Down in Australia, and this is well documented through their competition authority, Lactalis got slapped with an AU$950,000 fine in 2023 for systematically breaking dairy farmer protection codes. They were using contract clauses specifically designed to silence producers who criticized payment practices publicly. You complain about your milk check in the local paper? Contract violation. Legal action.

Over in the Netherlands, farmers are filing competition complaints about unilateral price changes and hidden fees that they can’t even audit or verify. Same tactics, different countries, same pattern of… well, let’s call it creative contract interpretation that always benefits the processor.

Starting to see a pattern here? I am.

The Global Pattern Corporate Communications Won’t Discuss

You know what really keeps me up at night thinking about all this? And I was just talking about this with some Holstein guys from New York at the genetics meeting…

Lactalis operates in roughly 100 countries worldwide, and they adjust their compliance strategy—I’m being diplomatic, calling it that—based on how tough enforcement is in each jurisdiction. Strong regulators get one approach. Weak enforcement gets… something else entirely.

Think about what that means for fair competition. While independent producers everywhere are paying full tax rates, meeting all labor obligations, funding growth from actual profits earned through legitimate dairy operations… you’ve got this global corporation deferring tax payments for over a decade, manipulating employee calculations, reinvesting those savings into market conquest and pricing strategies that honest operations simply can’t match.

It’s like playing poker against someone who’s seeing your cards. And stealing your chips. At the same time.

And even after paying that massive settlement? They still reported €30.3 billion in revenue for 2024, up 2.8% from the previous year. The penalty barely shows up as a blip in their growth trajectory.

When your avoided costs are so massive that a €475 million fine doesn’t even impact your expansion plans… well, you’re not really running a dairy processing business anymore, are you?

You’re running something else entirely.

What This Actually Means When You’re Milking At 4 AM

So here’s the deal—and I mean really think about this next time you’re out there in the parlor at four in the morning, watching your bulk tank fill up while corn’s at six bucks and diesel’s hitting your budget like a sledgehammer.

You’re not competing against operational efficiency or economies of scale or better genetics or any of the traditional advantages we’ve always talked about in this industry. You’re competing against corporations that treat regulatory compliance as optional and use the cost savings to subsidize operations that honest farmers simply cannot match through legitimate means.

A producer I know in Lancaster County—a third-generation guy, runs about 150 head, declined to be named, but you might know him from the Holstein shows—said something that stuck with me. He said, “We’ve been told for years we need to get more efficient to compete. But how do you get more efficient than free money?”

How do you compete with free money? That’s the question that should be keeping all of us up at night.

Because when I see tax avoidance schemes lasting eleven years, employee benefit manipulation across thousands of workers, contract violations designed to silence farmers, pricing strategies that seem to ignore actual input costs… it all connects back to the same fundamental problem: some players are operating under completely different rules while we’re all pretending it’s still a fair game.

Actually, let me tell you about a conversation I had with a dairy economist—can’t name the university, but it’s Big Ten—at a farm management conference last spring. He said something that’s been eating at me ever since: “The biggest competitive advantage in modern agriculture isn’t technology or genetics. It’s regulatory arbitrage.”

Regulatory arbitrage. That’s the fancy academic term for what Lactalis has been doing: exploiting differences in enforcement between countries, between agencies, between legal systems to generate competitive advantages that have nothing to do with actually being better at producing or processing milk.

What You Can Actually Do About It Right Now

So what can you do? Because I know that’s what you’re thinking—this is all great to know, but what does it mean for my operation when the truck shows up tomorrow morning?

Well, first off—and I learned this the hard way, dealing with a processor dispute about five years ago that cost me more in legal fees than I care to remember—document everything. Every payment, every contract modification, every pricing conversation, every settlement negotiation. When these schemes finally get exposed (and they do get exposed, eventually, though it takes way too long), documentation becomes crucial evidence.

I keep telling producers: take photos of delivery tickets, save email chains, document phone calls with timestamps. Your smartphone’s probably recording everything anyway—might as well make it work for you.

Second, understand your legal options. These new class action frameworks spreading across Europe could apply to supplier relationships, not just employment disputes. Know what contractual violations might trigger collective challenges in your jurisdiction. Get to know other producers’ experiences. Talk to your co-op board members. Ask uncomfortable questions.

And third… build coalitions. I know, I know—dairy farmers organizing is like herding cats in a thunderstorm. But connect with other independent operations. Share information about pricing patterns, contract terms, payment delays, and suspicious competitive behavior. These manipulation schemes become visible when individual experiences get put together.

There’s actually a WhatsApp group I’m in with about forty producers from across the upper Midwest, and we share pricing information weekly. Started noticing patterns none of us would’ve seen individually. Patterns that made us ask better questions about our own contracts.

Because honestly? What happened in France with those shell companies and deferred tax obligations… that’s not just a European problem. That’s a business model. And if we don’t start recognizing these patterns and pushing back collectively—and I mean really pushing back, not just complaining at coffee shop meetings about how tough things are getting—the next wave of “inevitable market consolidation” might include your operation.

The question isn’t whether you can out-farm corporate efficiency through better management or lower feed costs, or genetic improvements. The question is whether you’re willing to demand that everyone play by the same regulatory rules—and what you’ll do when they systematically don’t.

But that’s probably enough for one morning. Right now, I’ve got to get back to figuring out why my protein’s been running low all month… though after seeing these Lactalis documents, I’m starting to wonder if the problem isn’t in my feed room at all.

KEY TAKEAWAYS:

- Document everything systematically: Every processor payment, contract modification, and pricing conversation becomes crucial evidence when these schemes get exposed—delayed enforcement means violations compound for years before penalties hit

- Recognize regulatory arbitrage red flags: Competitors offering consistently below-market pricing, complex corporate structures spanning multiple jurisdictions, and contract terms preventing suppliers from discussing pricing with others signal systematic manipulation

- Build producer coalitions for pattern recognition: Individual experiences reveal manipulation schemes when aggregated—French workers’ €570 million class action succeeded because new laws require only proof of contractual violations affecting multiple parties

- Leverage strengthening legal frameworks: Europe’s enhanced class action laws and coordinated enforcement across borders mean systematic corporate violations face real-time scrutiny rather than decade-long delays that previously enabled market manipulation

- Understand the true competitive landscape: The €1+ billion in contested Lactalis payments proves consolidation advantages often come from regulatory violations, not operational efficiency—demanding equal enforcement levels the playing field for honest operations

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Verified Strategies for Navigating 2025’s Dairy Price Squeeze – This article provides a tactical, how-to guide for managing operational costs and market volatility. It offers specific, actionable advice on locking in feed costs, maximizing component premiums, and using risk management tools like the DMC program to protect your cash flow from the market manipulation discussed in the main piece.

- The $50 Billion Truth: Why Canada’s Supply Management System is Quietly Outperforming Every ‘Free Market’ Dairy System – This strategic analysis offers a powerful counter-narrative to the “free market” ideology. It uses data on farm bankruptcies, debt levels, and government support to demonstrate how a supply-managed system creates stability and allows for strategic investment, directly contrasting the “regulatory arbitrage” problem exposed in the main article.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – This piece highlights how technology is an essential tool for navigating a distorted market. It details the tangible benefits of robotic milking, from labor savings to improved data collection, and demonstrates how these innovations offer a path to efficiency gains that are crucial for survival when your competition isn’t playing by the rules.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!