Three years ago, the FDA cleared gene-edited cattle. Today, early adopters have data. Late adopters have… assumptions. Which are you betting your genetics program on?

EXECUTIVE SUMMARY: Dairy farmers estimate 60% of consumers reject gene-edited products. Research shows only 18% are firmly opposed. That perception gap may be the most expensive blind spot in your genetics program. Three years after the FDA cleared SLICK heat-tolerant cattle, early adopters have data—late adopters have assumptions. For heat-stressed herds, the cost of waiting runs $200-250/cow annually, with genetic improvements compounding each generation you delay. But the math isn’t universal: California operations losing $275/cow face a different decision than Wisconsin herds at $75-80. Meanwhile, Indonesia and Pakistan are now importing heat-tolerant genetics—positioning matters. This analysis delivers the research, the regional economics, and a threshold framework to help you decide: adopt, wait, or pass. Your answer depends on your numbers, not industry noise.

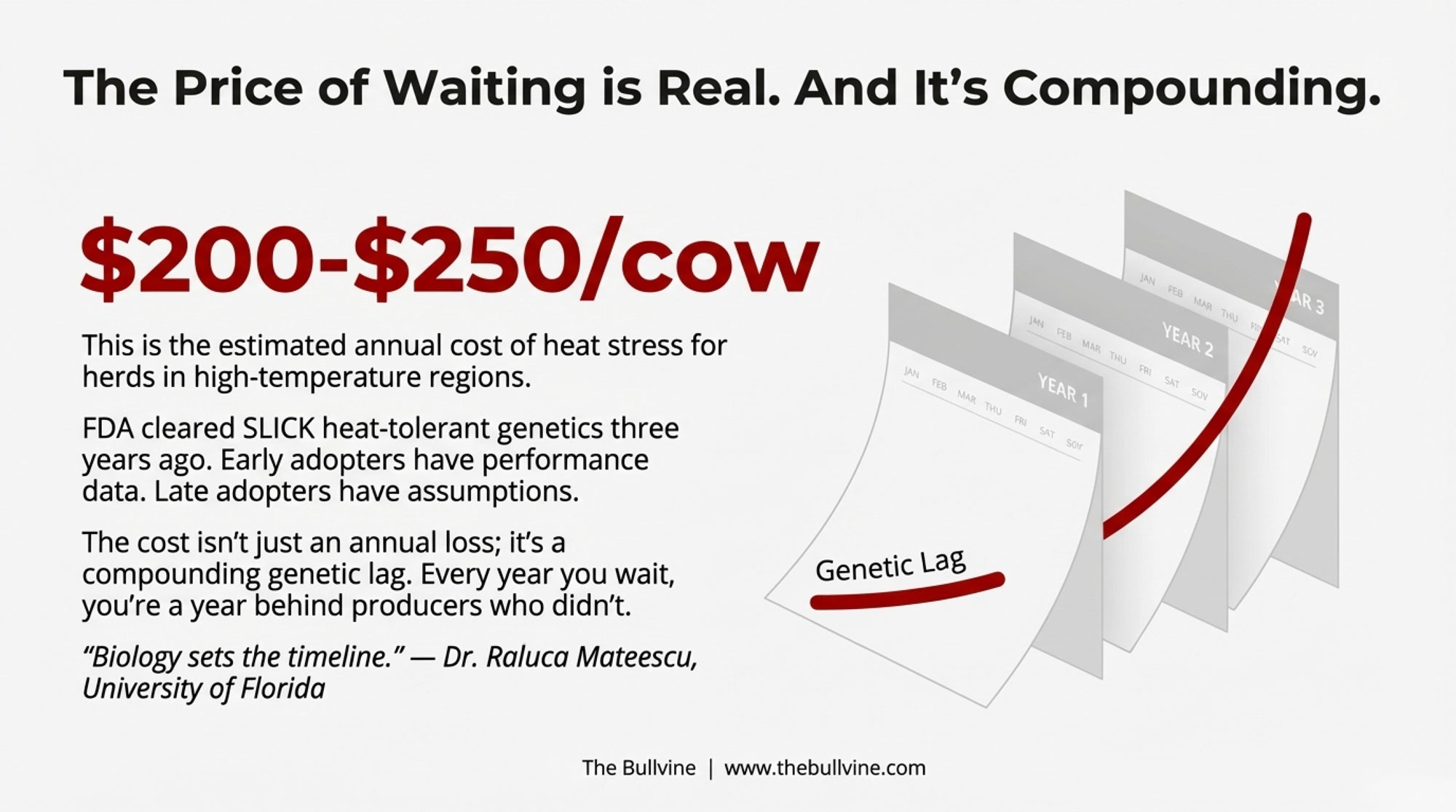

Three years and potentially $200-250/cow in heat-stress savings later, North American dairy producers are weighing a decision that’s less about the science itself and more about competitive timing. Here’s what the emerging data suggests—and why the assumptions driving most producers’ hesitation may be years out of date.

Mark Thompson (name changed at his request) runs 650 Holsteins outside Fresno, California, where summer temperatures routinely top 105°F. Last July, he watched his herd’s conception rates drop to 18%—down from 42% in the cooler months. His cooling infrastructure costs nearly $85,000 in electricity alone annually.

“I’ve been following the SLICK genetics conversation for two years now,” Thompson told me when we spoke in early December. “My AI rep keeps bringing it up. But every time I think about pulling the trigger, something holds me back. It still feels like we’re early on this.”

You know, Thompson’s hesitation reflects what I’m hearing from producers across the country—a reasonable caution about adopting new technology balanced against growing questions about what waiting might cost. That push-and-pull is worth unpacking.

Quick Math: Thompson’s Operation

- Estimated heat stress losses: ~$275/cow × 650 cows = ~$179,000/year

- Semen premium at current pricing: ~$60/breeding × 200 breedings = ~$12,000/year

- Net potential benefit: ~$167,000/year (before accounting for multi-year genetic lag)

Your numbers will be different. That’s exactly the point.

| Region | Annual Heat Stress Cost per Cow | Typical THI Days >72 | SLICK Break-Even at $60 Semen Premium | Adoption Priority |

| California (Central Valley) | $250-275 | 90-120 | Year 1 | High |

| Texas (South) | $220-240 | 85-110 | Year 1 | High |

| Arizona | $260-280 | 95-125 | Year 1 | High |

| Wisconsin | $75-80 | 25-35 | Marginal | Evaluate |

| Minnesota | $60-70 | 20-30 | No | Low |

| Pacific Northwest | $50-65 | 15-25 | No | Low |

What European Regulatory Shifts Signal for You

European regulatory shifts on gene-edited crops signal where livestock rules may eventually head—but if you’re tracking this space, don’t expect quick clarity. The EU has been moving toward a more permissive framework for new plant genomic techniques, though several member states, including Germany and Austria, remain cautious. Livestock-specific regulations are still being worked out, and Germany’s retail sector may create de facto barriers regardless of what Brussels decides.

Here’s what matters for your planning: A 2024 survey commissioned by the German Association for Food without Genetic Engineering (VLOG) and conducted by the Civey polling institute with over 5,000 respondents found that 84% of German voters want mandatory labeling for new genetic engineering in food. That’s a significant number, and it creates real tension between regulatory permission and actual market acceptance.

German retailers have shown they’re willing to go beyond what regulations require. Back in 2022, ALDI’s German chains committed to shifting their private-label fresh milk to higher Haltungsform animal welfare tiers, and since then, they’ve steadily moved away from lower-tier sourcing—using welfare labeling as a competitive signal to consumers. Industry observers expect similar dynamics could develop around gene-edited dairy, where regulation might eventually permit it, but major retailers will continue to differentiate based on production methods.

In practice, this probably means Europe’s gene-edited dairy market—whenever it materializes—will develop as a two-speed structure. Denmark, the Netherlands, and parts of France appear more receptive to the technology. Germany and Austria may maintain de facto barriers through retail positioning, regardless of what Brussels ultimately permits. For North American producers thinking about export opportunities down the road, this regional variation matters.

Canadian producers face additional considerations given Health Canada’s separate regulatory process for novel foods and animal products—another variable for cross-border operations to track.

The Performance Data That’s Accumulating

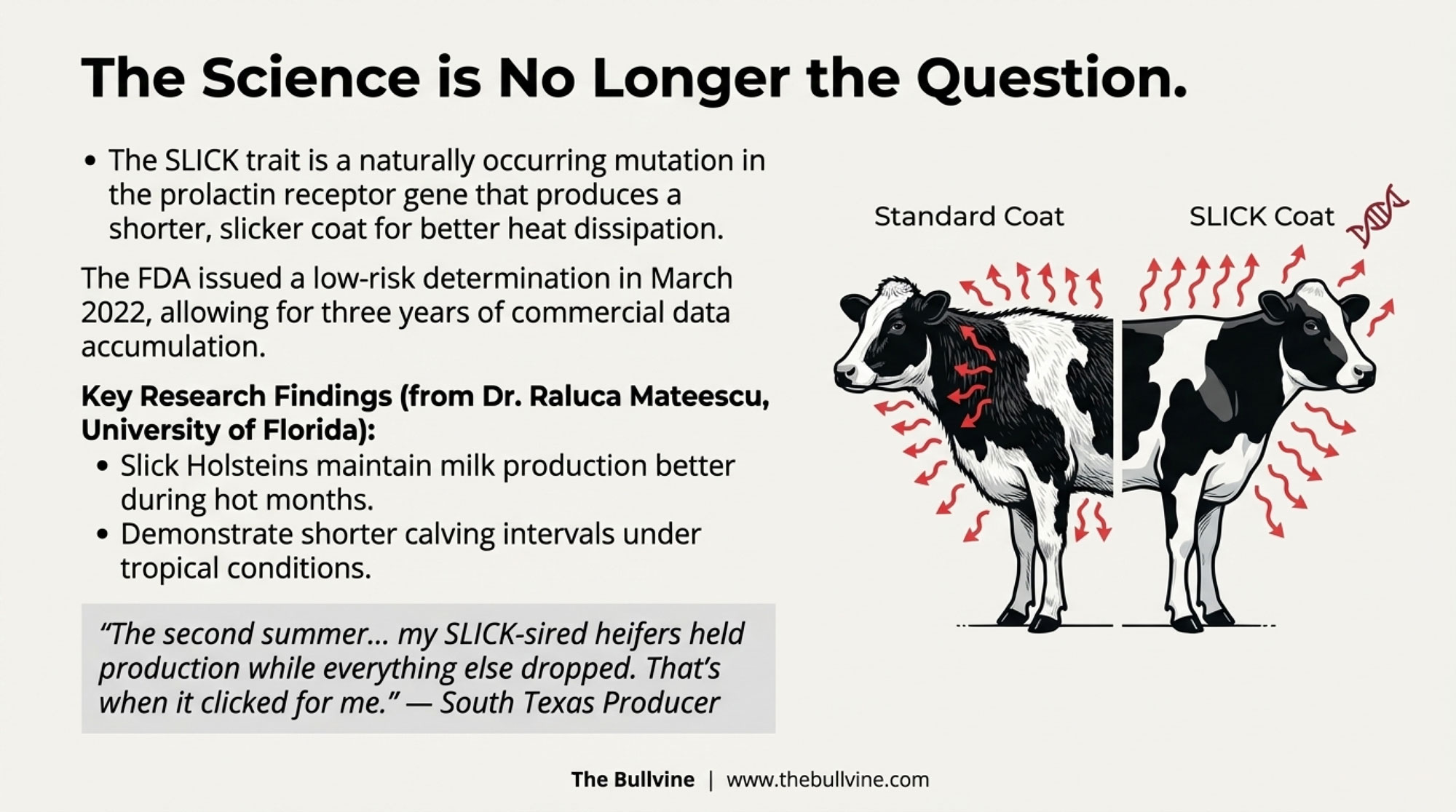

While European regulators deliberate, North American genetics companies have been building a meaningful head start. SLICK genetics—the naturally occurring mutation in the prolactin receptor gene that produces a shorter, slicker coat for better heat dissipation—have been commercially available in beef cattle since the FDA issued its low-risk determination and chose enforcement discretion in March 2022. That’s three years of real-world performance data.

Dr. Raluca Mateescu, professor of quantitative genetics at the University of Florida and one of the lead researchers on SLICK cattle, has documented the performance differences in studies published in the Journal of Dairy Science and Journal of Heredity. Research from her team and collaborators in Puerto Rico has shown that slick Holsteins hold milk production better during hot months and demonstrate shorter calving intervals under tropical conditions compared with their herd-mates—indicating measurable advantages for both production and fertility in heat-stress environments.

I spoke with a producer in south Texas who adopted SLICK genetics two years ago. “The first summer, I wasn’t sure I was seeing much difference,” he told me. “The second summer, when we had that brutal August, my SLICK-sired heifers held production while everything else dropped. That’s when it clicked for me.” His experience isn’t universal—results vary by operation and climate—but it reflects the pattern researchers are documenting.

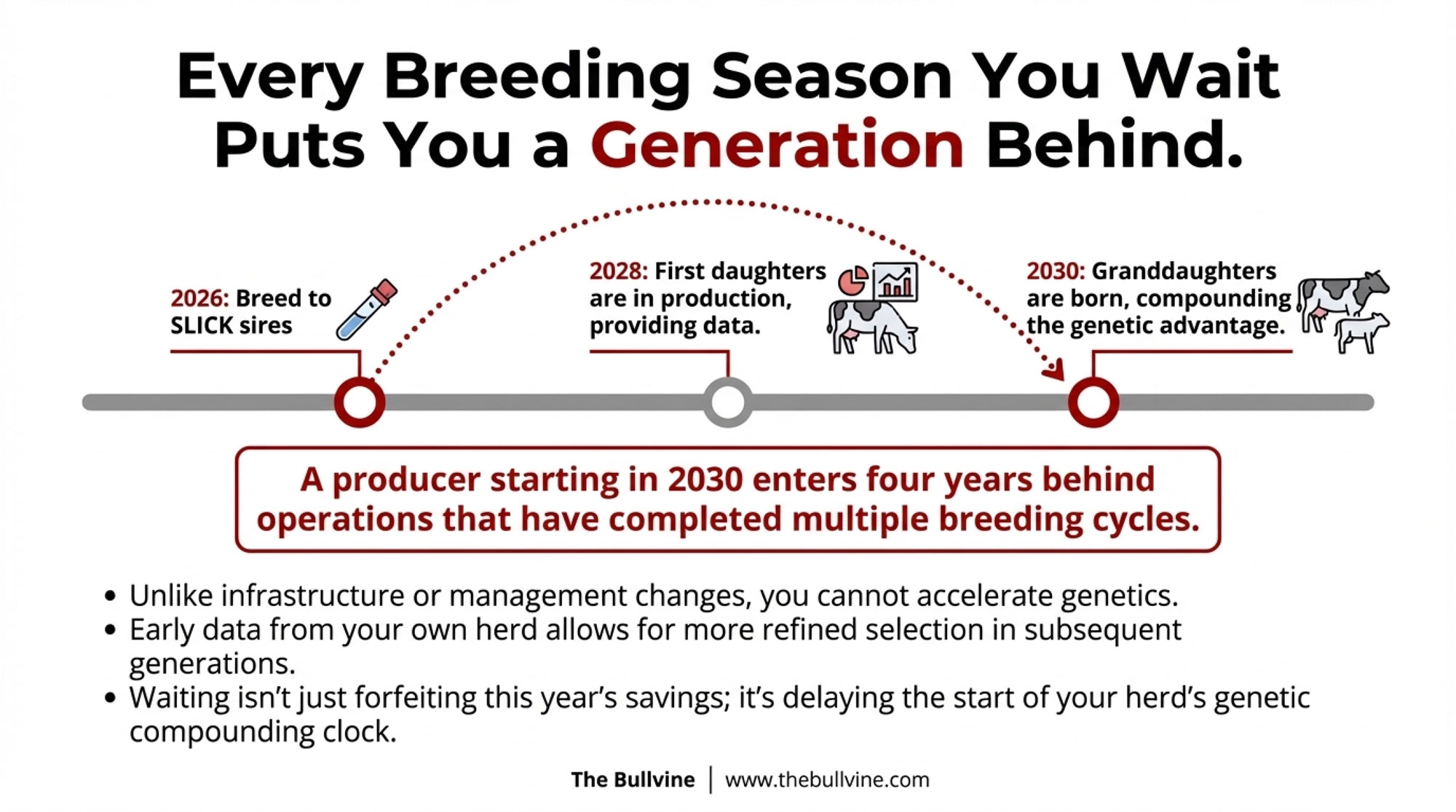

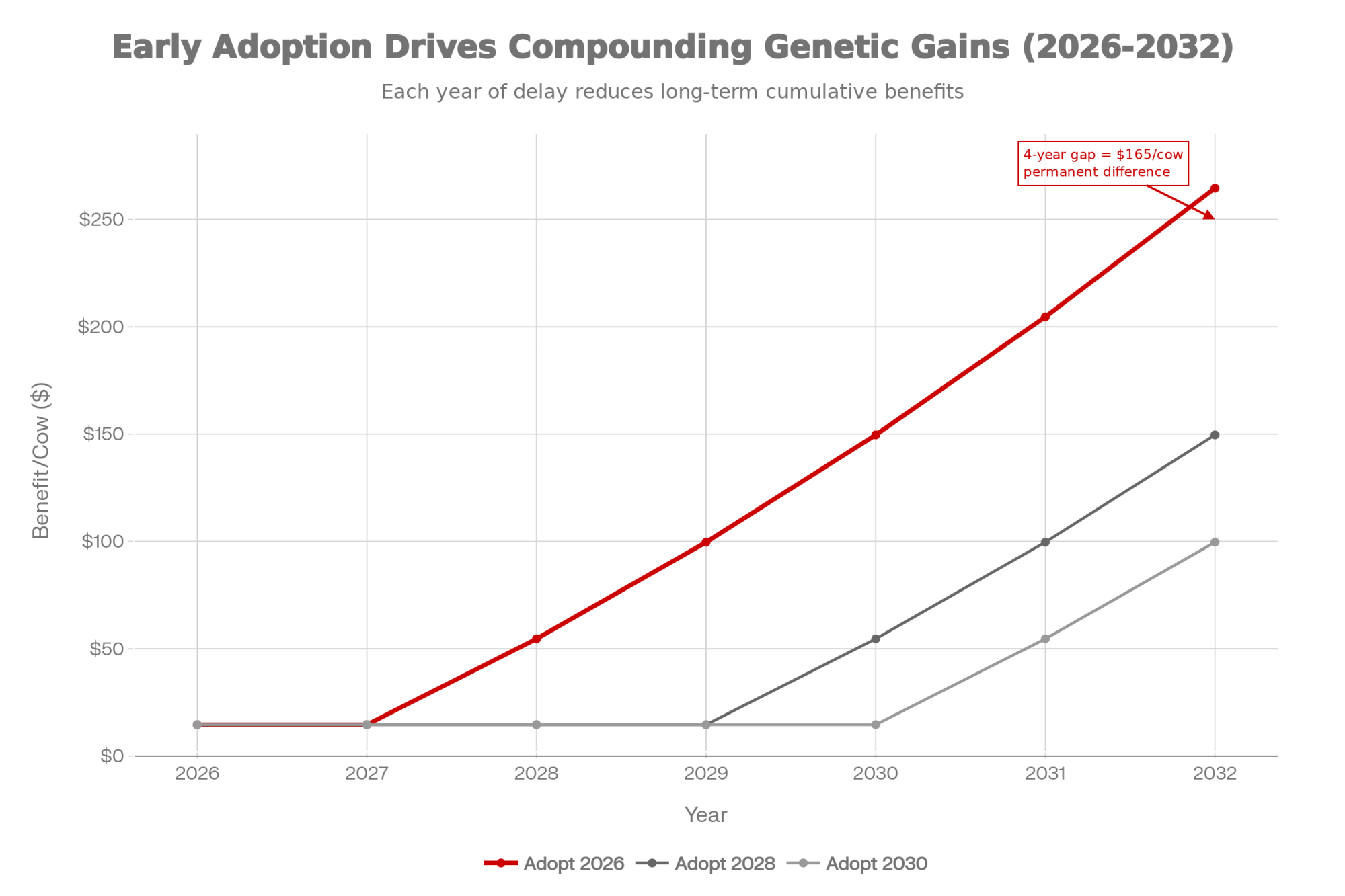

What’s particularly worth considering is how genetic advantages compound over generations. Producers implementing SLICK genetics in 2026 will have daughters producing by 2028. Those daughters provide lactation data that refines selection for subsequent generations. A producer starting in 2030 enters four years behind operations that have already completed multiple breeding cycles.

Dr. Mateescu framed it this way: “The genetics that go into your herd this year produce daughters that lactate in 2027-2028. Every year you wait, you’re a year behind the producers who didn’t wait. And unlike other management decisions, you can’t accelerate genetics. Biology sets the timeline.”

That’s a consideration worth weighing—though it needs to be balanced against the legitimate questions some producers have about technology maturity and market acceptance.

The Case for Deliberate Waiting

Not everyone is convinced the timing pressure is as urgent as some suggest, and those perspectives deserve serious consideration.

I spoke with a third-generation dairy operator in central Wisconsin who has deliberately decided to hold off. “My heat stress losses run maybe $75-80 per cow in a bad year,” he told me. “Most years it’s less. At current semen premiums, the math just doesn’t work for my operation. I’m not opposed to the technology—I’m just not going to pay a premium for a problem I don’t really have.”

His point is worth sitting with. A Wisconsin producer at $80/cow heat losses and a Fresno producer at $280/cow are facing fundamentally different math. For Upper Midwest, Northeast, and Pacific Northwest operations, where heat-stress events are less frequent and less severe, the economic case looks fundamentally different.

There’s also a reasonable argument for letting early adopters work through the learning curve. “Someone has to be first,” another producer in Minnesota mentioned. “But that doesn’t have to be me. I’d rather see three or four more years of commercial data before I commit my breeding program.”

That’s not resistance to technology—it’s rational risk management.

Beyond Heat Stress: The Broader Genetic Shift Coming

Heat tolerance represents the first commercially available application of gene editing in cattle, but it’s not the only trait in development. The same precision editing techniques are being applied experimentally to other welfare-relevant traits—and this broader shift may reshape how consumers and producers think about genetic technology altogether.

Gene editing has already been used experimentally to produce polled dairy calves—born without horn buds—which, if commercialized at scale, could eliminate the need for traditional dehorning. According to USDA’s 2014 NAHMS Dairy study and related welfare research, roughly 94% of U.S. dairy operations disbud or dehorn heifer calves. No commercial timeline for polled gene-edited dairy cattle has been announced, but the research is progressing.

As these alternatives approach availability, an interesting question arises: How will consumers view operations that continue traditional procedures when genetic alternatives exist? I don’t think anyone knows the answer yet, but it’s worth considering.

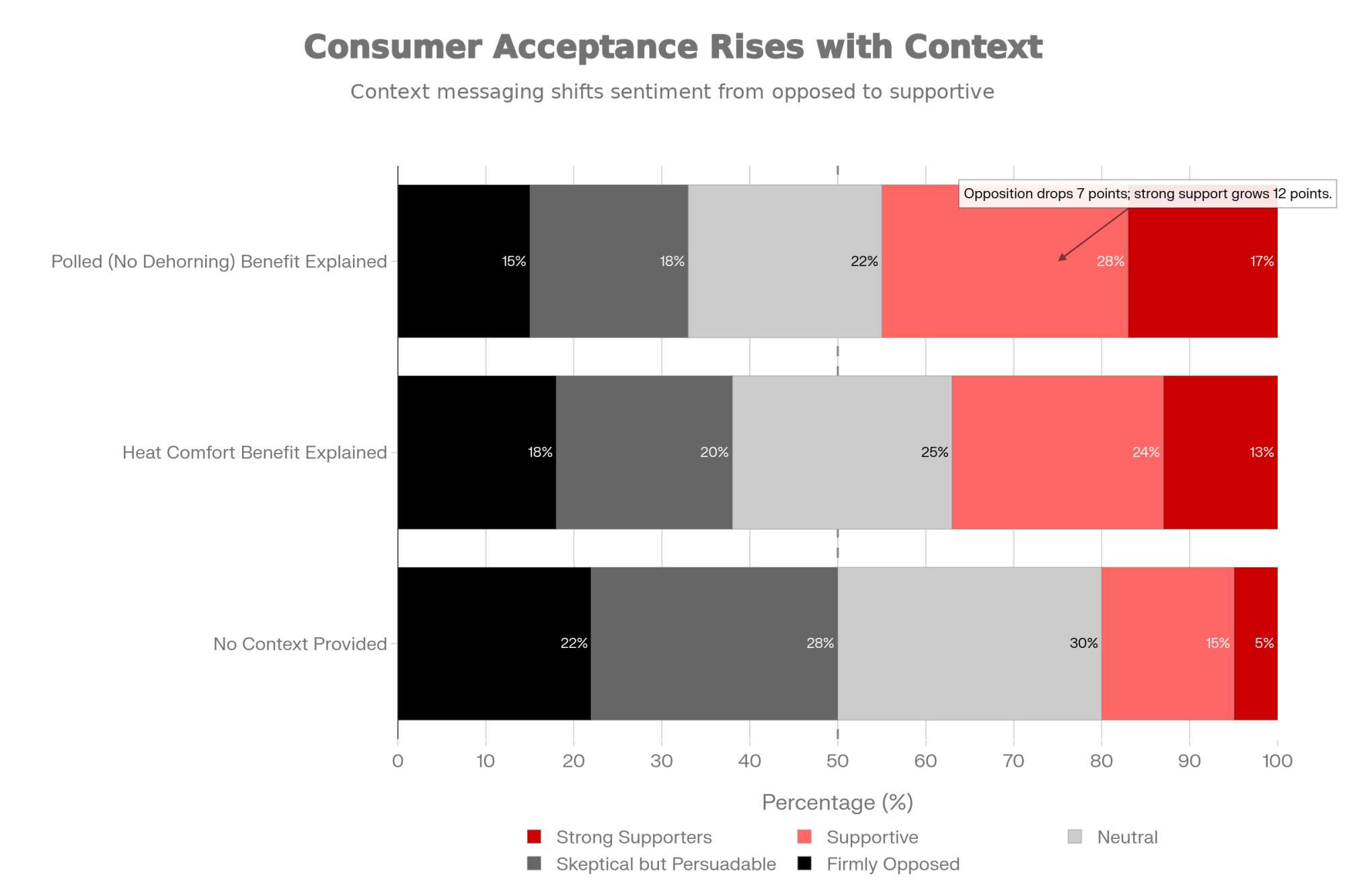

Work from Dr. Candace Croney’s team at Purdue University’s Center for Animal Welfare Science suggests that when gene editing is explicitly tied to animal welfare benefits—such as reduced pain or better heat comfort—consumer acceptance rises noticeably, and a substantial share of consumers report they’d be willing to pay more for those products.

| Consumer Segment | No Context (%) | Heat Comfort Benefit (%) | Polled Benefit (%) |

|---|---|---|---|

| Firmly Opposed | 22% | 18% | 15% |

| Skeptical but Persuadable | 28% | 20% | 18% |

| Neutral | 30% | 25% | 22% |

| Supportive | 15% | 24% | 28% |

| Strong Supporters | 5% | 13% | 17% |

The Perception Gap You Should Know About

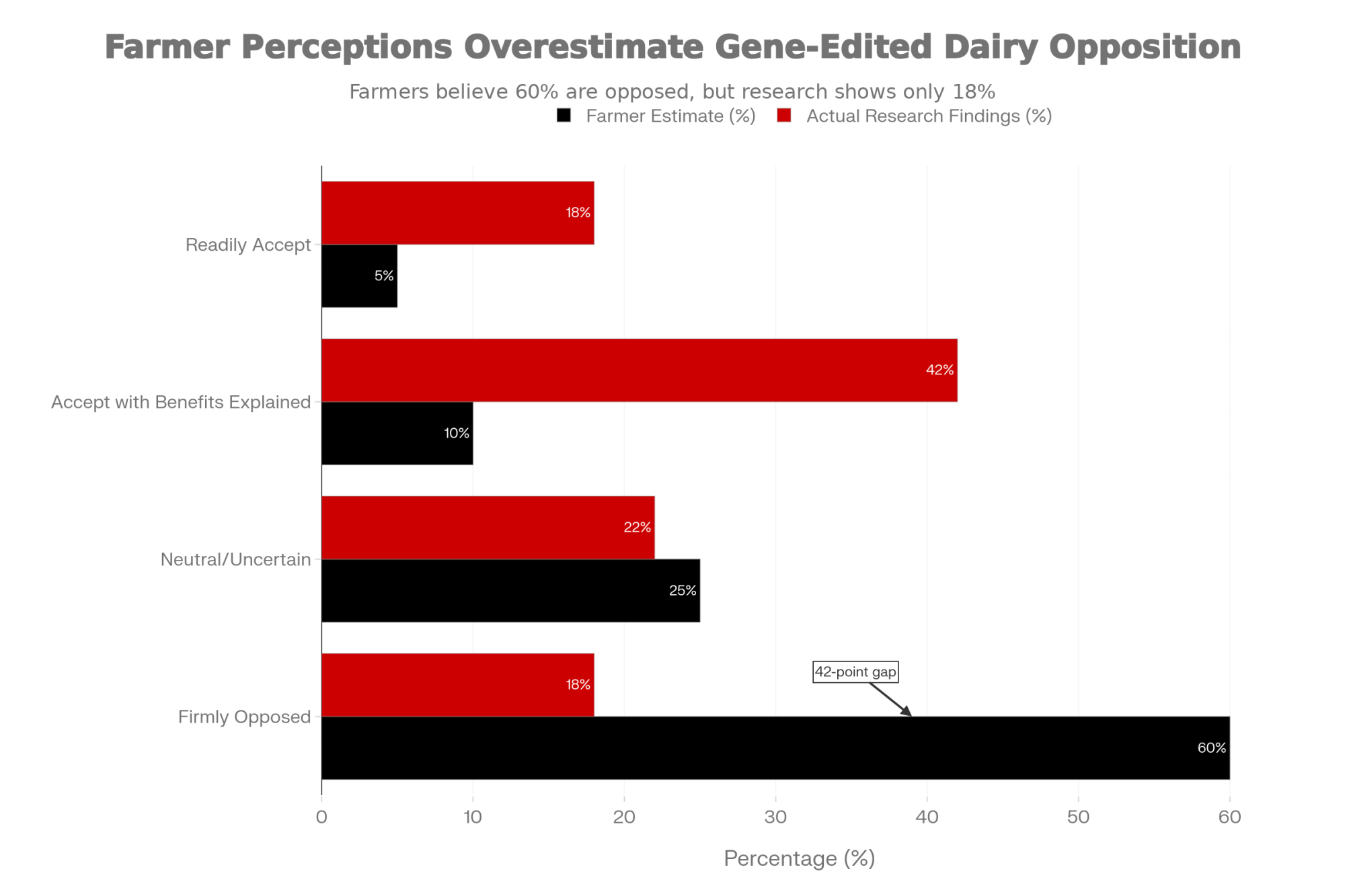

This brings me to something genuinely surprising from the research—and it’s worth paying attention to.

European consumer research, including work from the University of Copenhagen published in peer-reviewed journals, has found that when benefits are clearly explained, only about one in five consumers express firm opposition to gene-edited dairy products—substantially lower than most farmers estimate.

When farmers in those same studies estimated consumer response to gene-edited dairy, most thought only 30-40% would accept it. The research suggests acceptance runs considerably higher than that.

Think about that: most of us have been making breeding decisions based on consumer resistance assumptions that the research says are roughly twice the actual level. That’s a meaningful blind spot.

Why might this be? Anti-GMO messaging is organized, visible, and gets significant media coverage. But across multiple consumer studies on GM and gene-edited foods, researchers commonly find a relatively small but vocal minority who are strongly opposed, while a much larger middle group is either neutral or open to these technologies once they understand the benefits—particularly when those benefits relate to animal welfare.

There’s also loss aversion to consider. Behavioral economics research consistently finds people weight perceived losses roughly twice as heavily as perceived gains when evaluating new decisions—a pattern that applies to technology adoption in agriculture. The immediate $50-75 premium for gene-edited semen feels more significant than a delayed annual benefit per cow—even when the math clearly favors adoption over time.

Dr. Nicole Olynk Widmar at Purdue, who’s done extensive published work on agricultural technology perceptions, put it to me this way: “Producers are making rational decisions based on the information environment they’re in. But that information environment is heavily weighted toward vocal opposition. The silent majority of consumers who are neutral or positive just don’t show up in the same way.”

Consumer attitudes can shift, and survey responses don’t always predict purchasing behavior. But the size of this perception gap suggests many producers may be working with assumptions that are years out of date.

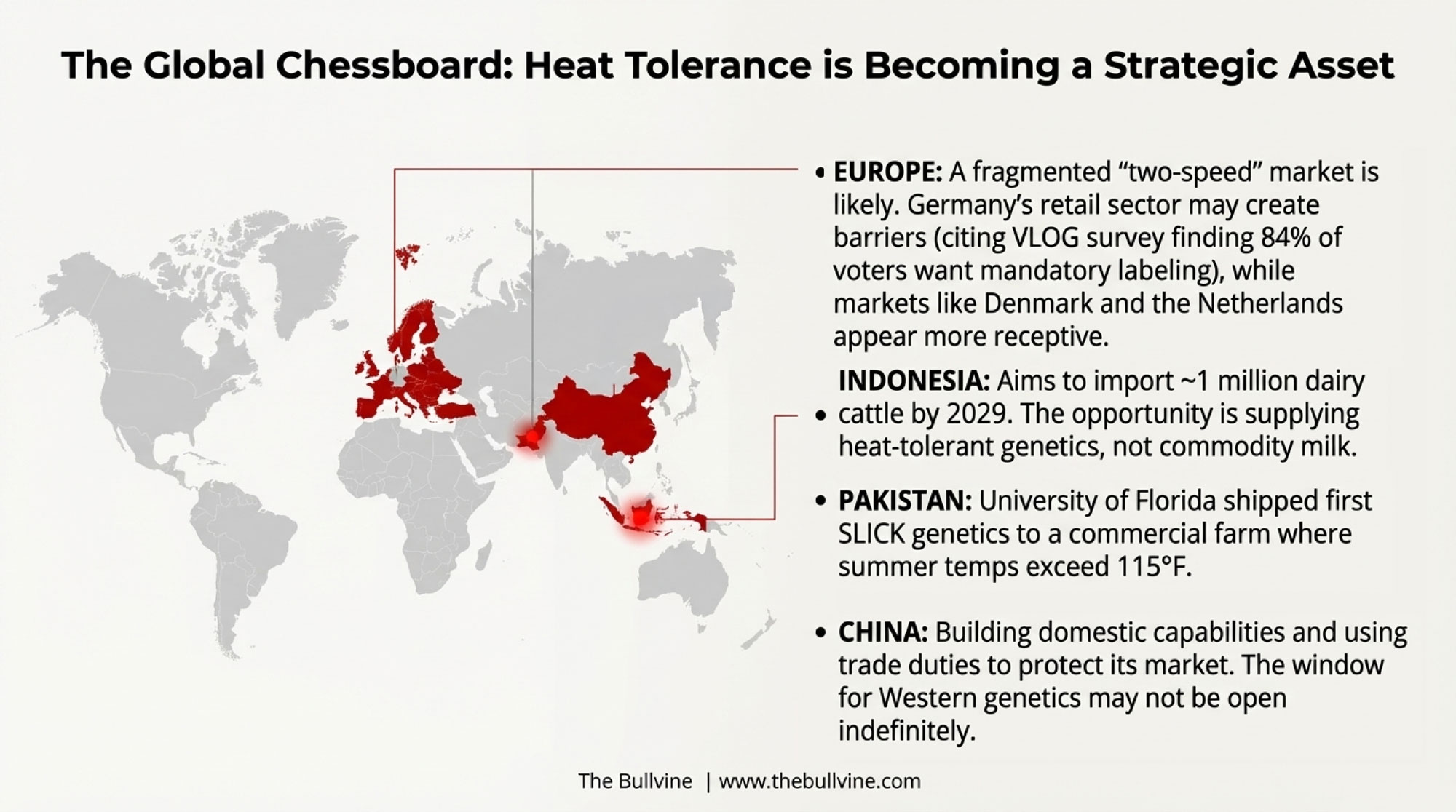

The Global Picture—And Why It Matters for Your Genetics

For those of you tracking export genetics opportunities, here’s the global context in brief.

Indonesia has set a target of importing around 1 million dairy cattle by 2029 under their Fresh Milk Supply Road Map, according to Agung Suganda, director general of livestock and animal health at Indonesia’s Ministry of Agriculture. The opportunity isn’t selling commodity milk—it’s supplying heat-tolerant genetics that make tropical dairy production viable.

In May 2025, University of Florida researchers shipped the first SLICK Holstein genetics to Pakistan, working with a commercial operation called DayZee Farms in Bahawalpur, Punjab province, where temperatures routinely exceed 115°F in summer. Traditional Holstein genetics struggle in those conditions—this is exactly the kind of market where heat-adapted genetics could become essential.

China is building domestic breeding capabilities rather than remaining dependent on Western genetics. And recent trade actions—China imposed provisional duties of up to 42.7% on EU dairy products effective December 23, 2025, according to multiple news sources, including Reuters and ABC News—suggest the country views dairy increasingly through a strategic lens.

Operations building heat-adapted genetics now are positioning for export markets that may become significant—but that window may not stay open indefinitely.

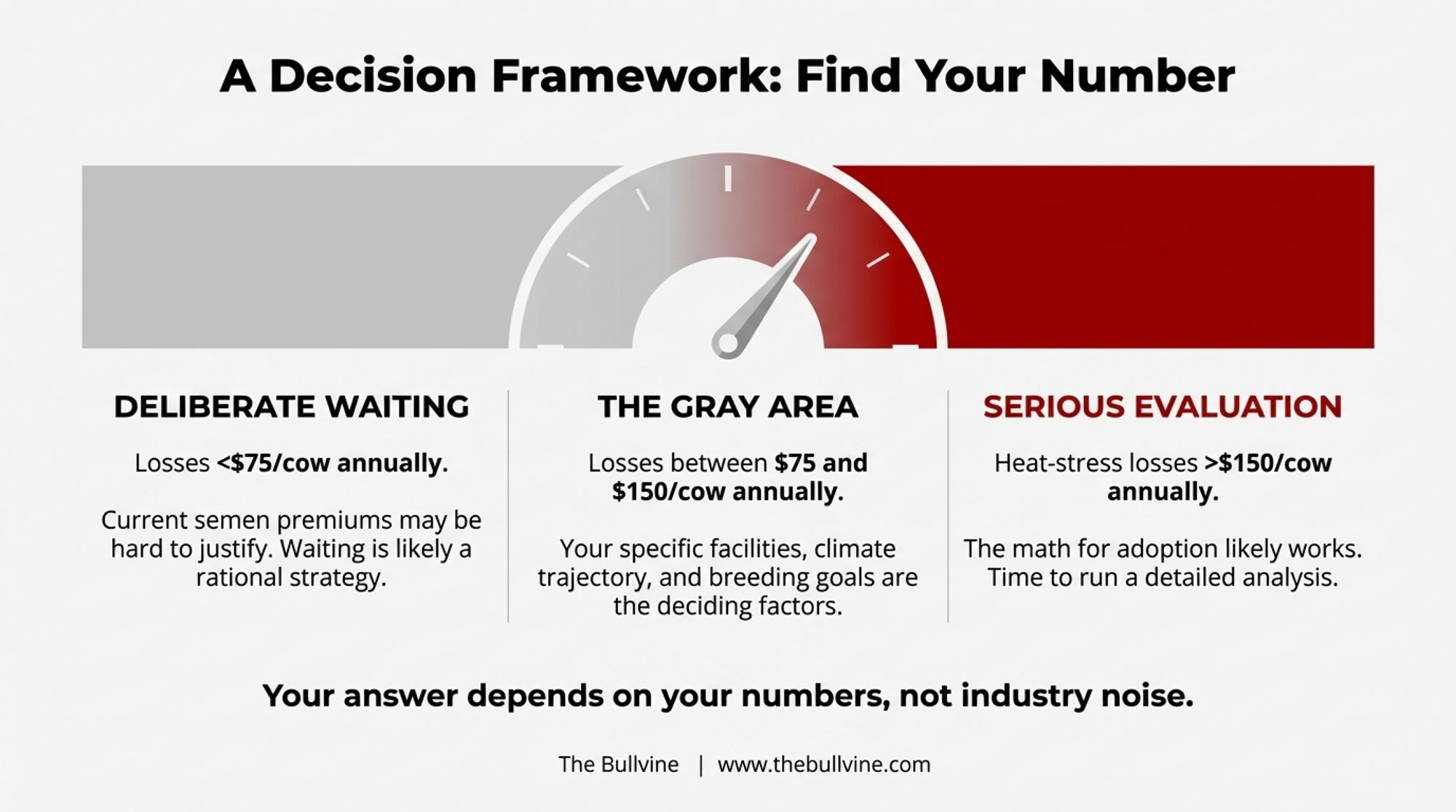

Running Your Numbers: A Decision Framework

So what does this mean for your operation? Here’s how to think through it:

- As a rough threshold: Operations seeing heat-stress losses above $150/cow annually in an average year are likely candidates for serious evaluation. Those below $75/cow may find the current semen premium harder to justify. Between those numbers? That’s where your specific circumstances—facilities, climate trajectory, breeding goals—really matter.

- Understand your actual heat stress economics. Pull DHI records from the last three summers. Identify days when your Temperature-Humidity Index exceeded 68-72. Calculate the production drop compared to your spring and fall baseline. When Thompson dug into his records, he estimated that heat stress was costing him about $250-300 per cow annually. The Wisconsin producer pegged his at $75-80. Those aren’t national benchmarks—they’re individual calculations that show how sharply the economics diverge by region.

- Have the availability conversation. SLICK genetics are commercially available through university programs and select AI providers, with availability expanding. Ask your rep about current sire offerings and pricing in your market, and whether they can connect you with producers in your region who’ve made the switch.

- Factor genetics into infrastructure decisions. If you’re planning significant upgrades to cooling infrastructure, consider model genetics as a partial alternative. SLICK genetics won’t eliminate cooling needs in serious heat-stress environments, but they may deliver a meaningful portion of the benefit at lower cost.

- Document your baseline. Whatever you decide, keep detailed records. If you adopt, you’ll want data showing improvement. If you wait, you’ll want to understand what that decision cost—or saved—you.

| Heat Stress Loss ($/cow/year) | Years to Break Even | Annual ROI | Economic Verdict | Typical Regions |

| $50-75 | 5-7 years | Low (10-15%) | Hold – Wait for cost decline | PNW, Upper Midwest |

| $75-125 | 3-4 years | Moderate (20-30%) | Marginal – Evaluate closely | Wisconsin, N. Minnesota |

| $125-175 | 2-3 years | Strong (35-50%) | Favorable – Consider adoption | Iowa, S. Wisconsin, N.Y. |

| $175-250 | 1-2 years | Very Strong (60-80%) | Strong – Adopt strategically | Missouri, S. Texas |

| $250+ | <1 year | Exceptional (90%+) | Compelling – Delay costs money | CA, AZ, S. TX |

Your Next 30 Days

- Pull DHI records for the last three summers—calculate your actual heat stress cost per cow

- Call your AI rep and ask specifically about SLICK sire availability and current pricing

- If cooling infrastructure investment is on your horizon, model genetics as a partial alternative

- Watch for processor/retailer sustainability messaging shifts in your market

- Document your 2025 baseline so you can measure whatever you decide

Finding the Right Path for Your Operation

The gene-editing question isn’t really about whether the science works—the accumulating data from the University of Florida and commercial operations suggest it does. And it’s increasingly less about whether consumers will accept it—the research shows most will when benefits are explained, though some uncertainty remains.

The question is about timing, risk tolerance, and competitive positioning. And reasonable people can reach different conclusions.

Thompson called me last week with an update. He’s planning to breed 30% of his heifers to SLICK sires starting this spring. “I’m not going all-in,” he said. “But I’m done waiting for perfect certainty. The cost of being wrong looks a lot smaller than the cost of being late.”

That’s one framework—partial adoption that builds experience while maintaining flexibility. The Wisconsin producer is taking a different approach, deliberately waiting until the economics make more sense for his climate. The Minnesota dairyman wants more commercial data before committing.

Each of these can be the right decision depending on circumstances.

What’s clear is this decision deserves fresh evaluation—not because adoption is right for everyone, but because the assumptions driving most producers’ hesitation may be three years out of date. The landscape has evolved. In a global market, you’re either the one setting the pace or the one wondering where the margin went. Your 2026 breeding list is the first signal of which one you intend to be. Choose based on your math, not your neighbor’s comfort zone.

Key Considerations for Your Decision

- Your heat stress threshold matters most. Above $150/cow in annual heat losses? Serious evaluation warranted. Below $75/cow? Current premiums may not pencil. Know your number before deciding.

- Consumer resistance is lower than you probably think. European research consistently shows that only about one in five consumers firmly oppose gene-edited dairy when benefits are explained. Most farmers estimate roughly half that acceptance level—a meaningful blind spot worth correcting.

- The welfare narrative is shifting. When gene editing is framed around animal welfare benefits, consumer acceptance increases substantially. Watch for shifts in processor messaging in your market.

- Genetic improvement compounds. Decisions made in 2026 produce results in 2028; subsequent generations build on that. Biology sets the timeline—you can’t accelerate later.

- European markets are fragmenting. German retail dynamics may create barriers even with EU regulations in place. Factor this into export genetics calculations.

- Deliberate waiting can be rational. For cooler climates with minimal heat stress, or operations wanting more commercial data, waiting may be appropriate. The right answer depends on your math, not industry hype.

The Bottom Line

Here’s my take: Gene editing in dairy isn’t a question of if anymore—it’s a question of when and whether it fits your operation. The producers I respect most aren’t rushing in or digging in their heels; they’re running their own numbers, watching the early data, and making decisions based on their specific circumstances rather than industry hype or outdated fears.

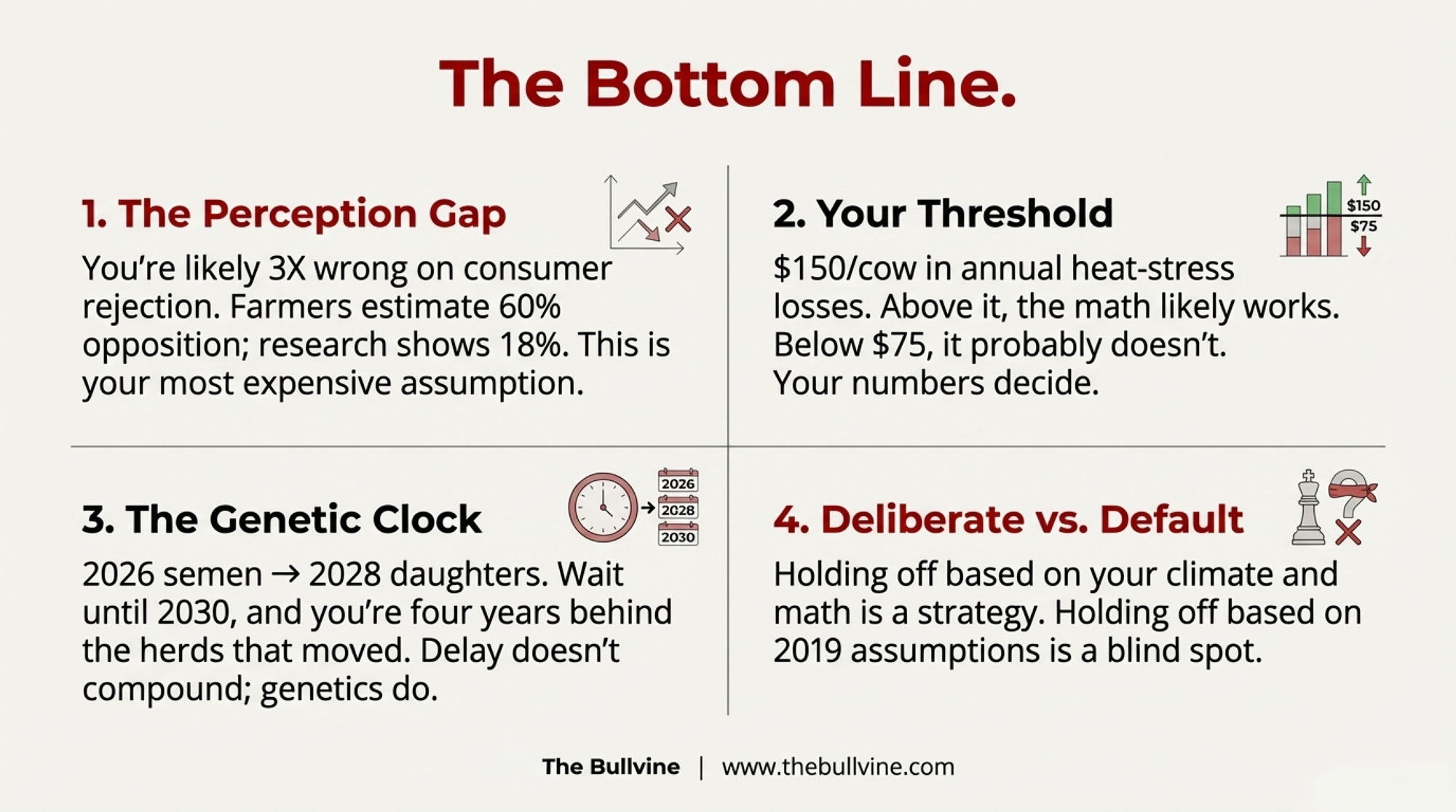

KEY TAKEAWAYS

- You’re likely 3X wrong on consumer rejection. Farmers estimate 60% oppose gene editing. European research shows 18%. That gap may be the most expensive assumption in your genetics program.

- Your threshold: $150/cow in heat-stress losses. Above that annually? Gene editing math likely works. Below $75? It probably doesn’t. In between? Your specific numbers decide.

- Genetics compound. Delay doesn’t. 2026 semen → 2028 daughters → 2030 granddaughters. Wait until 2030 to start, and you’re four years behind the herds that moved now.

- Same technology, 4X different economics. A Fresno operation losing $275/cow and a Wisconsin herd at $75/cow aren’t facing the same decision—even when the pitch sounds identical.

- Deliberate waiting is thoughtful. Defaulting to “not yet” isn’t. If you’re holding off based on your climate and math, that’s a strategy. If you’re holding off based on 2019 assumptions, that’s a blind spot.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Genetics vs Management: The Multi-Million Dollar Dairy Tug-of-War – Reveals exactly where management failures mask your genetic potential. This guide breaks down the “profit leak” audit, ensuring you stop wasting elite genetics on facilities that simply cannot support the extra production.

- The Global Dairy Outlook: Strategic Positioning for 2025 and Beyond – Exposes the structural shifts in global trade that will favor “cleaner” genetics. It arms you with the foresight to position your herd for premium export markets before the window of opportunity slams shut.

- Gene Editing: The Next Frontier in Dairy Cattle Breeding – Delivers a technical roadmap for the traits following heat tolerance. Understand the commercial timeline for disease-resistant edits, giving you the competitive edge to pivot your breeding program before the rest of the industry reacts.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!