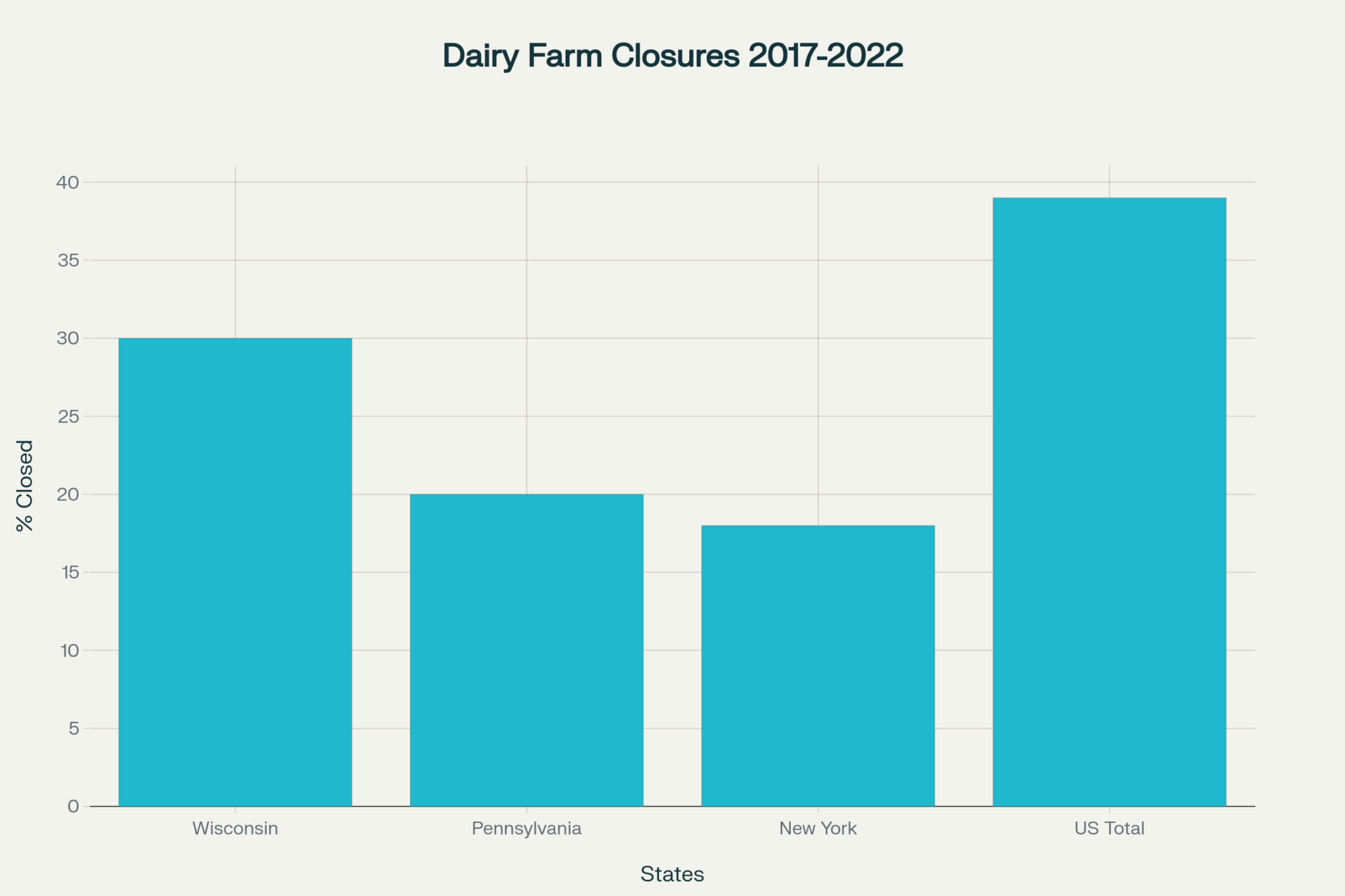

Nearly 40% of US dairy farms closed in 5 years — Can you afford to miss this shift?

EXECUTIVE SUMMARY: We’ve been tracking some sobering trends, and here’s what the data’s telling us: the US dairy industry just lost nearly 40% of its farms in five years, with mega-dairies now controlling over 66% of milk production according to recent USDA census figures. This isn’t just consolidation — it’s a fundamental reshaping that’s creating a $9.77 per hundredweight cost advantage for large operations, which translates to over $50,000 annually for typical mid-size dairies trying to compete. The 2025 Emergency Livestock Relief Program covers 60% of disaster-related feed costs, but here’s the kicker — it favors producers in disaster-declared regions with streamlined processing that creates systematic competitive advantages. While tools like Dairy Margin Coverage continue buffering volatility with regular payouts, we’re seeing concerning patterns where federal aid dependency might actually accelerate the very consolidation it’s meant to help farmers survive. The smartest producers aren’t just applying for relief — they’re using strategic fund allocation to turn survival money into a competitive advantage. This shift demands immediate attention and thoughtful action from every progressive dairy operation.

KEY TAKEAWAYS

- Immediate Relief Opportunity: USDA’s Emergency Livestock Relief Program offsets up to 60% of disaster-related feed costs through a 46-day application window — submit documentation now to access up to $250,000 in recovery funds

- Scale Economics Reality: Mega-dairies maintain a $9.77/cwt production cost advantage over smaller operations, emphasizing the urgent need for mid-size farms to optimize efficiency and leverage available support programs

- Risk Management Buffer: Dairy Margin Coverage delivers consistent value with $1.49/cwt average payouts in two-thirds of months since 2018 — maximize enrollment to reduce margin volatility and strengthen financial resilience

- Technology ROI Acceleration: Precision feeding systems and robotic milking reduce operational costs by 15-25% and 50% respectively, with 5-7 year payback periods that federal relief can help accelerate for competitive positioning

- Strategic Fund Deployment: Apply the 50/25/25 allocation framework — half for disaster recovery, quarter for productivity upgrades, quarter for risk management tools — to survive current pressures while building long-term competitive strength

The thing about these federal relief programs? They tend to show up just when you’re not expecting them. But this one? It’s landing right in the middle of some of the biggest shifts we’ve seen in the US dairy scene in years. The USDA’s Emergency Livestock Relief Program, rolling out in September 2025 to cover flood and wildfire losses from the past couple of years, isn’t just another check—it’s shifting the landscape for who stays in the game and who’s edging toward the exit.

The Numbers Tell a Brutal Story

Digging into USDA census data, it’s hard not to notice the brutal facts. Since 2017, nearly 40% of dairy farms have closed their doors—down from about 39,300 farms to just over 24,000. That’s almost four farms out of every ten gone in five years. If you’re farming in places like Wisconsin, Pennsylvania, or New York, that shift is more than just stats — it’s the reality on the ground, with thousands of farms disappearing.

Now, the other side of the coin — those larger dairies milking 1,000 cows or more — have been flexing muscles, growing from 714 to 834, now producing about 66% of all US milk. This degree of concentration is intense.

What jumps off the page for me is the cost gap. On average, these big operations enjoy a $9.77-per-hundredweight edge (give or take) over smaller herds with 100-200 cows. Feed, labor, tech — economies of scale just make a huge difference. For a 500-cow farm producing nearly 11,000 pounds per cow, that’s more than $50,000 annually in extra costs if you’re not running bigger.

Here’s How the Relief Program Actually Works

Now, here’s where the relief program plugs in. It’s designed to cover 60% of three months’ feed costs after floods, and 60% of one month’s feed after wildfires, capped at $125,000 per farm — doubled if you’ve got your ducks in a row with the paperwork. But here’s the kicker: you’ve got just 46 days to apply, with the window slamming shut a few weeks after the presidential election.

Producers in disaster-declared areas like California’s Central Valley or the Texas Panhandle get a faster pass through the red tape and an edge on their competition. It’s not exactly a level playing field.

California’s Bird Flu Payouts Show What’s Possible

Cast your mind back to last year’s bird flu outbreak in California: the federal government cut checks totaling over $231 million, with the average payout coming in around $645,000, and some of the larger dairies snagging multimillion-dollar sums. That money doesn’t just plug losses but funds genetic improvements and technology upgrades that university studies say can accelerate a farm’s progress by years compared to those going it alone.

Risk Management Is the Quiet Hero

Risk management isn’t just talk, either. The Dairy Margin Coverage Program has paid out in nearly two-thirds of the months since 2018, with supplemental payments of around $1.49 per hundredweight. That’s a real cushion against milk price and feed cost swings.

There’s a clear advantage baked into the relief program’s faster approvals and payout certainty for producers in pre-approved disaster zones — USDA data show these farmers cut through the paperwork quicker and get funds faster, creating a structural edge over others in non-disaster areas.

The Technology Race Is Accelerating

That said, some research underscores caution: farmers increasingly relying on federal aid may cut back on personal risk management efforts and take on riskier business moves. Food for thought.

And it’s not just about money on hand — relief dollars have sparked rapid adoption of precision feeding and robotic milking, which improve feed efficiency by 15-25% and cut labor by over 50%, with paybacks typically in five to seven years. This tech rush is widening the divide between large-scale operations and smaller farms.

Suppose around 30% of producers jump on this strategic relief game. In that case, we’ll see faster consolidation and productivity gains — but also a bubble in tech demand that could eat away at early adoption advantages. It risks turning dairy into an oligopoly dictated by federal cash access more than farm efficiency.

What Should Smart Producers Do?

So, what’s the smart move? You apply, that’s for sure. But don’t spend all your relief money on shiny new toys. Think balance:

- Half the funds should go towards recovering what the disaster damaged

- A quarter on sensible upgrades that deliver returns

- The rest invested in risk management tools or cooperative efforts, like beefing up Dairy Margin Coverage

It’s like managing your dry cows — you want them healthy but not overfed.

The biggest, most tech-heavy dairies? They’ll use this cash to extend their lead — buying out struggling neighbors or investing in technology beyond reach for the smaller guys.

Regional Realities Are Getting Starker

Out in the Pacific Northwest, wildfire-prone farms are accounting for disaster relief in their budgets, while places like Wisconsin’s driftless region face a tougher grind with less access to these programs[USDA regional disaster reports]. The geographic divide is real and growing.

The Bottom Line Question

Here’s the bottom line — this aid buys breathing room but accelerates big changes faster than most realize. The question every dairy farm faces: Can the industry thrive without leaning on federal programs every few years? The honest answer is probably not.

Your next moves — what you decide in these coming weeks — will impact not only your farm but the whole fabric of dairy country in America.

Learn More:

- Will Your Dairy Farm Survive the Next Decade? The Brutal Math of Consolidation – This strategic article complements the main piece by providing a deeper look at the economic forces driving consolidation. It outlines two stark survival paths—scaling up or hyper-specializing—to help you assess your farm’s long-term position.

- The Robotics Revolution: Embracing Technology to Save the Family Dairy Farm – This tactical guide offers a step-by-step approach to implementing robotic milking. It provides actionable insights and case studies demonstrating how technology can cut labor costs and boost milk production, complementing the main article’s strategic allocation advice.

- Harnessing Precision Technology in Dairy: “Fitbits” for Cows, Evolving Consumer Trends, and Essential Grants for Dairy Producers – This innovative article explores emerging sensor technologies and their ROI. It shows how “Fitbits for cows” can reduce veterinary costs and improve herd health, providing a forward-looking perspective on how to turn tech into a competitive edge.