Your biggest ROI isn’t in feed—it’s in airflow, space, and shade. Comfort is still the cheapest form of nutrition.

You know, it’s easy to see why so many of us start with feed when we think about performance. Feed costs take up the biggest line in most of our budgets — and it’s the part of management we can see, mix, and adjust every day. But what I’ve found, after years of walking barns across Wisconsin and talking with producers from Ontario to Idaho, is that sometimes the problem isn’t in the ration. It’s in the roof, the floor, and the airflow.

You can’t fix nutrition in a broken barn. And once you understand the biology behind that statement, it changes everything about how you think about profitability.

The $50 Fix That Unlocks 3.5 Pounds of Milk

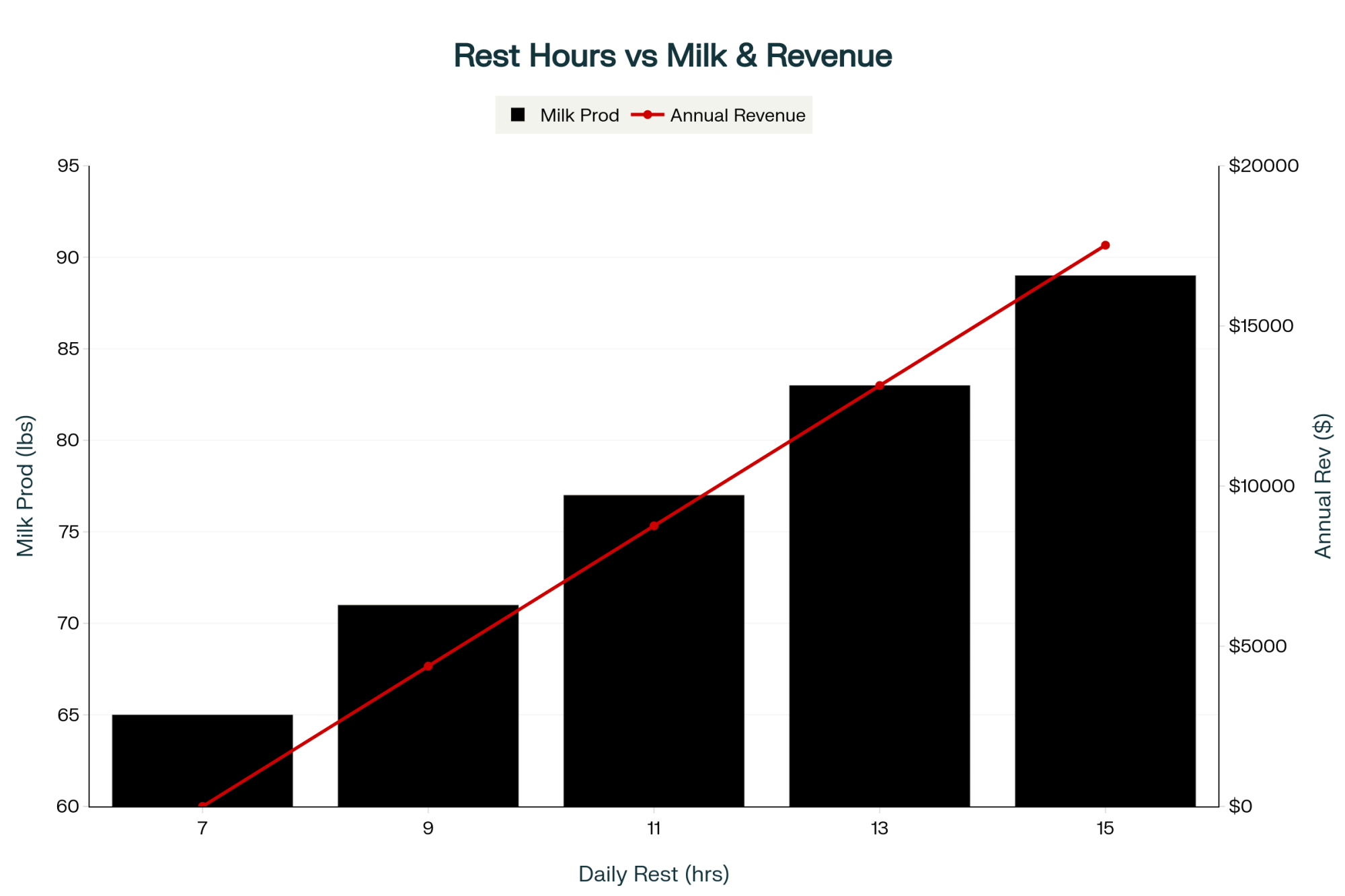

Research is clear on this one — comfort is milk in the tank. The University of Wisconsin’s Dairyland Initiative and William H. Miner Agricultural Research Institute have both documented that every additional hour a cow spends lying down yields 1.7 to 3.5 pounds more milk each day (UW Dairyland Initiative and Miner Institute Cow Comfort Resources).

Here’s what’s interesting: the fix for poor comfort isn’t always expensive. I visited a mid-sized herd near Ripon, Wisconsin, that simply raised neck rails by four inches and deepened bedding. The cows immediately started using the stalls properly, adding almost 2.5 hours of rest per day. “Same cows, same feed,” the producer told me. “We gained six pounds of milk just by fixing the structure.”

It makes sense when you look at history. Freestall dimensions built before 2010 were designed for smaller Holsteins, around 1,100–1,300 pounds. Modern cows average closer to 1,500–1,600 pounds, which means their natural movement is restricted in older stalls. Adjusting neck rails to 48–52 inches high and 68–70 inches from the curb better fits today’s herds.

| Investment Type | Cost Per Stall | Payback Period | Milk Gain (lbs/day) | Annual ROI |

| Neck Rail Adjustment | $50 | 3 months | 2.0-3.5 | 360% |

| Bedding Deepening | $75 | 4 months | 1.7-3.0 | 280% |

| Fan Repositioning | $0-25 | 1-2 months | 2.5-4.0 | 450% |

| Stall Width Increase | $150 | 6 months | 3.0-4.5 | 320% |

Cornell Pro‑Dairy economic modeling shows that small structural corrections like these deliver consistent three‑month paybacks with average returns of 360%. The investment? About $50 per stall, mostly in tools and labor (Cornell Stall Design & Economics Tools).

Heat Stress Isn’t Just a Southern Problem

A lot of northern producers still assume heat stress doesn’t affect them — but science and data say otherwise. Dr. Geoff Dahl, professor of animal sciences at the University of Florida, has shown that cows begin to decline in performance when the Temperature‑Humidity Index (THI) exceeds 68, roughly 70°F with 60% humidity (University of Florida – Heat Stress Research).

What’s really eye‑opening is that heat stress during the dry period doesn’t just affect current milk yield. It alters calf development in utero, setting those heifers up for life‑long performance losses. Dahl’s studies have shown that heifers born from heat‑stressed dry cows produce 5‑11 pounds less milk during their first lactation — a penalty that carries on through adulthood.

Even in the Upper Midwest and Ontario, weather-tracking from UW‑Extension shows that cows experience that threshold for 50–90 days per year, depending on ventilation and humidity. The solution doesn’t always mean a major retrofit — just adjusting fan direction or installation height to maintain 300‑400 feet per minute of airflow at cow levelcan significantly change outcomes.

At one Ontario farm, redirecting fans over feed alleys rather than back walls completely flattened milk yield swings. The owner laughed when he said, “We didn’t add fans — just turned them the right way.” That small shift eliminated bunching, improved feed intake, and kept butterfat performance steady all summer.

When Infrastructure Outperforms Feed

| Investment Category | Typical Cost | Payback Time | Milk Response | Works 24/7 | Risk Level |

| Stall Modification | $50-150/stall | 3-6 months | 2-4 lbs/day | Yes | Low |

| Cooling System | $200-500/cow | 6-12 months | 3-5 lbs/day | Yes | Low |

| Nutrition Additive | $0.20-0.50/day | Continuous | 0.5-2 lbs/day | No | Medium |

| Premium Feed | $50-100/ton | Continuous | 1-3 lbs/day | No | Medium |

Let’s talk numbers, because that’s where the case for infrastructure gets serious. Studies from Cornell Pro‑Dairy, University of Wisconsin, and Kansas State University show the ROI on barn improvements consistently competes with — and often beats — nutrition investments.

One 450‑cow herd in western New York implemented these upgrades and dropped its cull rate by 10% while cutting hoof‑trimming costs by a quarter. Herd average climbed five pounds — all from removing the bottlenecks stalls created. The farm’s owner summed it up well: “I used to buy almost every nutrition additive out there. Now my barn does most of the work.”

Why Improvements Still Lag

If the data is so compelling, what holds farms back? Psychologists — and farm economists like Dr. Cameron King of the University of Guelph — believe it’s about visibility. As King puts it: “Producers invest where they can see results fast. Feed changes give immediate feedback. Infrastructure improvements return slower, even though the payoff is bigger.”

That rings true. With a slight tweak to the ration, you can check the milk weights the next morning. But it’s harder to measure peace, comfort, and stability — the quiet gains of removing friction from cow behavior. What’s encouraging is that the operations making these investments are often the same ones noticing calmer cows, fewer metabolic issues, and a stronger transition period before any milk data even comes in.

From Managing to Designing Systems

There’s a shift happening that’s worth watching. Instead of “managing stress,” many top herds are designing barns so that stress never builds in the first place. In a series of case studies, Cornell Pro‑Dairy and Kansas State Universityfound that herds that improved stall space, bedding, and airflow gained 2 hours of rest per cow daily, resulting in 8–9 pounds more milk per cow without changing feed.

Cows weren’t “pushed” to perform; their biology was finally allowed to express what the ration and genetics were already capable of. Transition cows handled fresh periods more smoothly, fertility improved, and energy balance stabilized.

One Minnesota dairy manager put it perfectly during a University of Minnesota Extension discussion: “We quit trying to ‘manage’ around cow comfort. Now, the management kind of takes care of itself.”

Five Quick Ways to Gauge Comfort

If you want to know where your barn performance really stands, start with these simple checks:

- Monitor THI at the cow level. Anything above 68 calls for immediate cooling actions.

- Try the 25‑second knee test. Kneel in a stall for half a minute. If it’s painful or wet, it’s failing your cows.

- Look mid‑day. At least 80–85% of your cows should be lying down comfortably after feeding.

- Start small. Neck rails, fans, and bedding deliver immediate ROI—and can fund larger phases later.

- Recalibrate your ration. Once comfort improves, cows eat differently — work with your nutritionist to reflect that change.

The Foundation That Never Takes a Day Off

I remember something Dr. Mike Hutjens once told a group of producers: “Infrastructure never takes a day off.” And it stuck with me. A properly fitted stall or well‑placed fan doesn’t clock out when you do; it’s the one system on the farm that works 24/7 without supervision or overtime.

What’s important—and, frankly, encouraging —is that comfort strategies aren’t limited to freestall setups. Tie‑stall and dry lot systems achieve similar returns when cow biology drives design rather than human habit. Sand or dry bedding, airflow direction, and clean water space work for dairies of every scale and layout.

If there’s a single takeaway here, it’s this: foundation before feed. The barn sets the biological ceiling, and the feed fills the space below it. Get that order right, and suddenly everything else — the ration, the reproduction, the milk components — starts falling into place naturally.

Further Reading and Resources

- UW‑Madison Dairyland Initiative – Freestall Design & Guidelines

- Cornell Pro‑Dairy – Stall Design & Economic Tools

- University of Florida – Dr. Geoff Dahl’s Heat Stress Research

- Kansas State University – Dairy Ventilation & Cooling Resources

- University of Guelph – Farm Management and Decision Economics

Key Takeaways:

- Every extra hour cows rest can earn roughly 3.5 lbs of milk—comfort converts directly into production.

- Feed can’t fix a poorly built barn. Airflow, shade, and stall comfort determine how well the feed performs.

- Simple $50 stall fixes often deliver a 300% ROI—before your next feed bill even prints.

- Heat stress begins at a THI of 68 °F, not 80. Early cooling preserves milk yield and fertility.

- Infrastructure pays you every day—it never takes a day off.

Executive Summary

Most producers focus on feed when milk performance stalls — but new research shows the real ceiling may be in the barn, not the bunk. Studies from Wisconsin, Florida, and Cornell link each extra hour of cow rest to 1.7–3.5 lbs of milk per day, with simple $50 comfort fixes delivering triple‑digit ROI. Heat stress starts earlier than we think — at just 68 °F THI — quietly costing milk, fertility, and even the next generation’s output. What’s encouraging is how quickly these investments pay back, often inside one season. Across freestalls, tie‑stalls, and dry lots, the takeaway is the same: infrastructure is the quiet partner that lets nutrition, genetics, and management finally show their full potential.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Cow Comfort: The Hidden Driver of Milk Production in 2025 – This tactical guide reveals how to translate lying time into profit. It details practical strategies for bedding management and stocking density to help you capture the 2-3.5 extra pounds of milk per cow discussed in this article.

- Slick Genetics Revolution: How One Gene Could Save Dairy Farmers $5,000 Per Cow Lifetime – This analysis offers an innovative alternative, comparing the ROI of genetic selection for heat tolerance (Slick genes) against the infrastructure investments (fans and soakers) detailed above. It provides a crucial, long-term strategic perspective on managing heat stress.

- Quality Over Quantity: Revolutionary Approaches to Dairy Replacement Management – This article expands the “infrastructure” concept to your future herd. It demonstrates how strategic investments in maternity and calf housing directly impact the long-term profitability and genetic potential of your replacements, securing future efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!