259 US dairies filed bankruptcy in Q1 2025 while Canadian failures are too rare to track. Same cows, different systems.

Did you know 259 American dairy operations filed Chapter 12 bankruptcy in just the first quarter of 2025. That’s a 55% jump from last year… and frankly, it’s accelerating.

I’ve been covering this industry for over two decades now, and what I’m seeing in the numbers—well, it’s making me question everything we think we know about “efficient” dairy markets. But here’s the thing that really gets to me: while we’re watching good farmers get hammered by market volatility (people who’ve done everything right, mind you), there’s this whole system just 300 miles north that’s achieving something we can barely imagine.

Canadian dairy farm bankruptcies? They’re so rare that Statistics Canada doesn’t even bother tracking them as an economic indicator.

Let that sink in for a minute.

The Coffee Shop Conversation That Changed Everything

A sentiment I hear often was perfectly captured in a conversation with a producer from Wisconsin, who said something that’s been rattling around in my head ever since:

“I’m doing everything the extension guys tell me to do, but I can’t plan past the next milk check because who knows what prices will do.” — Mike, Watertown, Wisconsin

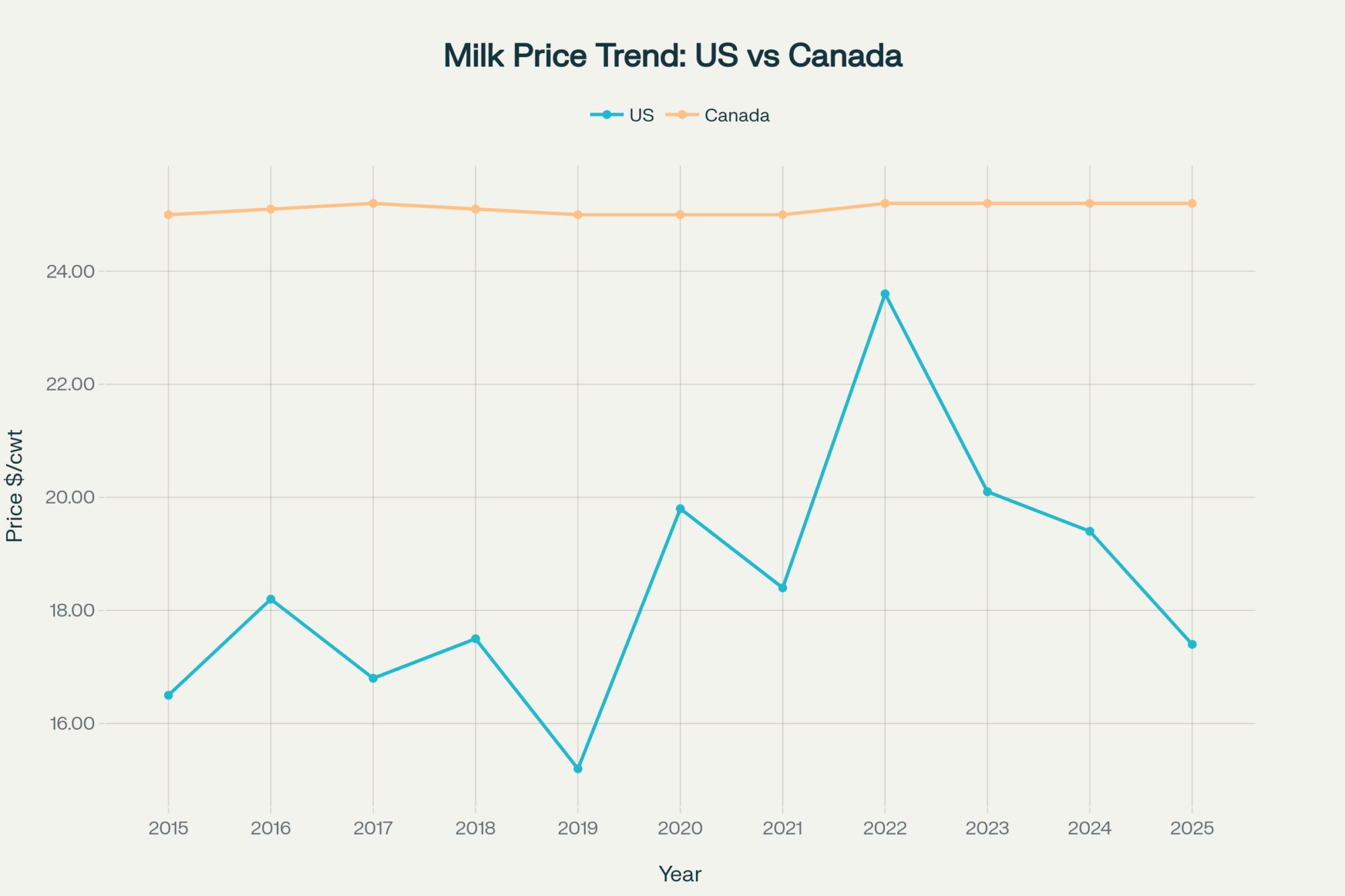

That got me digging into some data that… well, let’s just say it challenges pretty much everything we’ve been told about free markets and farm efficiency. Same Holstein genetics. Same robots. Same nutritional consultants. Same level of management skill and dedication. But one group of farmers is building generational wealth while the other group is filing for bankruptcy at rates that would trigger congressional hearings in any other industry.

The difference isn’t management—it’s the system.

And what’s really eating at me… we keep hearing about how Canada’s supply management is “inefficient” and “protectionist,” but their farmers aren’t the ones dumping milk or losing sleep over price forecasts. Meanwhile, our “efficient” system just required $42.4 billion in direct government payments in 2025—a 354% increase from 2024.

Something doesn’t add up, does it?

When USDA Forecasts Become Financial Weapons

Picture this scenario (and I guarantee you’ve lived some version of it): January 2025, you’re at your kitchen table with the calculator out, trying to make sense of that equipment loan for the new double-eight parlor. USDA’s milk price forecast looks decent—nothing spectacular, but workable if things stay reasonably steady.

Four months later… that same forecast drops $1.95 per hundredweight. Your equipment payment didn’t magically decrease. Neither did your feed costs or labor expenses. But the revenue projection that justified every major decision you made this year? Gone.

Tom runs 280 cows in Wisconsin, and he put it perfectly:

“It’s like trying to hit a moving target while blindfolded. How do you make a 10-year investment decision when you can’t predict next quarter’s milk check?” — Tom, Wisconsin

Meanwhile—and this is where it gets interesting—Canadian producers experienced exactly what their system promised them: a farmgate price adjustment of 0.0237%. That’s less than a penny per liter. The kind of predictable variation that lets you actually plan multi-year capital investments with confidence.

What strikes me about this is the mathematical reality most of us don’t want to face. When you can predict cash flow, you can optimize investments. When you can’t… every strategic decision becomes a coin flip with your farm’s survival.

The Robot Paradox: Same Technology, Different Worlds

Here’s a story that really drives the point home. Last spring, I visited two farms on the same day. First stop: a 120-cow operation in Ontario that had just installed their second robot. The farmer showed me spreadsheets—payback calculated at eight years, cash flow projections extending to 2032, financing structured around predictable milk price increases.

“We know what milk will be worth. That makes everything else possible.” — Ontario dairy farmer

Second stop: a 240-cow operation in Wisconsin that had been considering robots for three years but couldn’t pull the trigger:

“Every time I run the numbers, I get a different result depending on what milk price assumptions I use. How do you make a quarter-million-dollar investment when you can’t predict revenue?” — Wisconsin dairy farmer

Same technology. Same potential benefits. Same management capability. But completely different investment climates.

Take a $250,000 robotic milker—pretty standard investment these days. In the Canadian system, that pencils out to a 7-10 year payback with high confidence. Here in volatility-land? Try 15+ years, assuming you don’t get wiped out by a price crash before you break even.

The Numbers That Should Terrify All of Us

During the 2019 downturn—you remember that mess—599 American dairy operations filed Chapter 12 bankruptcy. That’s more than one farm entering bankruptcy protection every single day for an entire year.

Canada during the same period? Zero. Not just low. Statistically negligible.

We’re not talking about slight differences in failure rates here. We’re not talking about the difference between systematic farm destruction and systematic farm preservation.

And what really gets to me—this isn’t about Canadian producers being better managers or having access to superior genetics. I’ve walked through barns in both countries. These are the same DeLaval parlors, the same breeding programs, often the same feed consultants. The farmers are equally skilled and dedicated.

The difference is systematic. One system is architected for survival. The other accepts high failure rates as the price of “market freedom.”

Farm Consolidation: When “Efficiency” Becomes Desperation

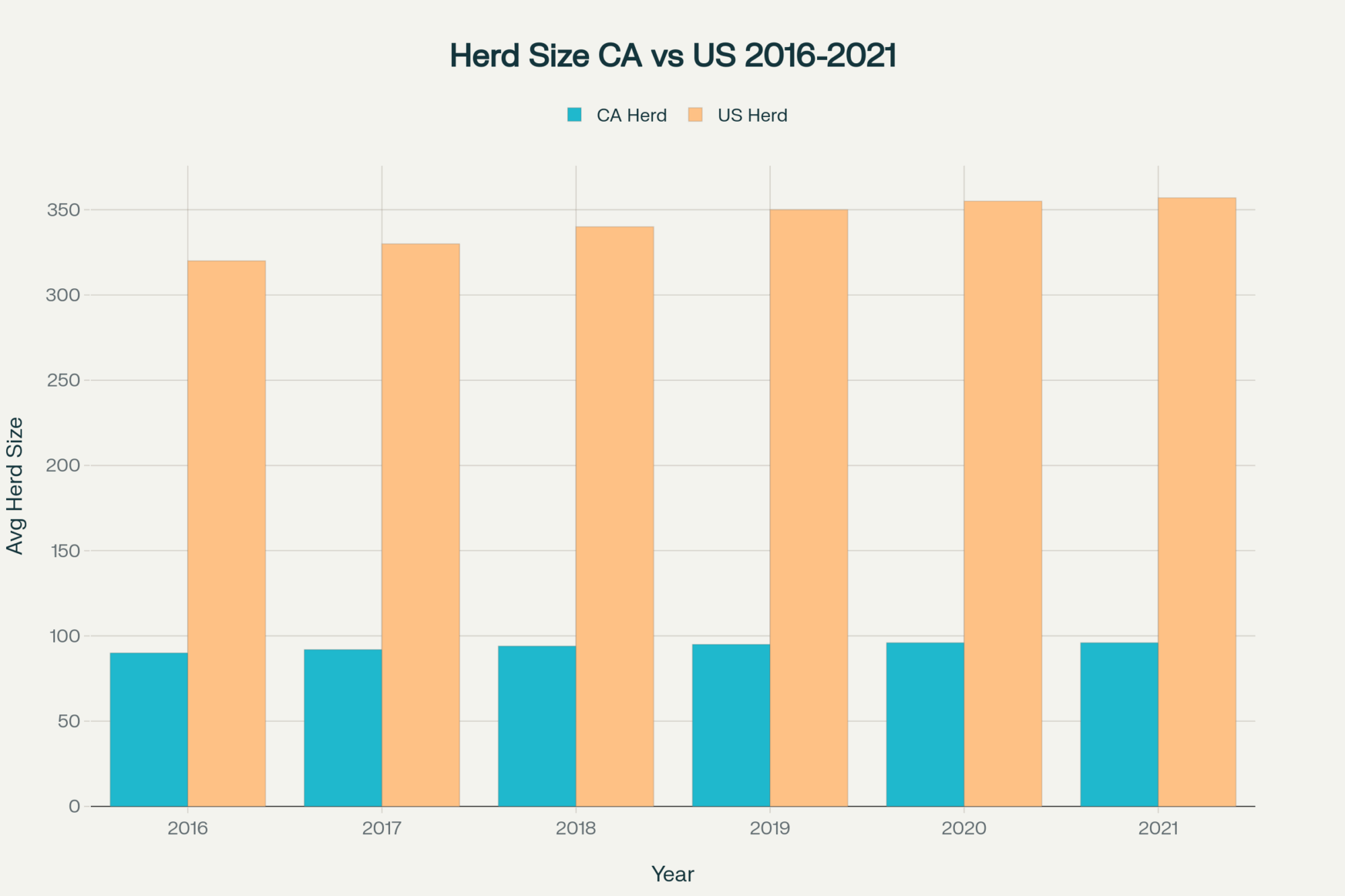

You want to talk about consolidation? American dairy farm numbers dropped 34% between 2016 and 2021. Canada? Just 11% in the same period.

Average US herd size is now 377 cows. Average Canadian herd size? 96 cows.

Now conventional wisdom says the US operations must be more efficient, right? Wrong. They’re not expanding because they’ve identified optimal scale economies. They’re expanding because they need volume to weather price volatility.

It’s survival strategy masquerading as efficiency optimization.

Canadian operations with 100 cows are profitable, stable, and planning capital improvements with confidence. Not because they’re protected from competition, but because they’re protected from financial chaos.

The Mental Health Crisis We Don’t Talk About

Behind every bankruptcy filing is a farm family facing financial ruin, but the human cost goes way beyond the operations that actually fail. Recent research confirms what those of us in rural communities already know—US farmers are 3.5 times more likely to die by suicide than the general population. The primary driver? Financial volatility.

I’ve been to too many farm auctions that shouldn’t have happened. Good farmers, solid managers, excellent stewards of the land—wiped out not by poor decisions but by market forces completely beyond their control.

Sarah ran a 180-cow operation outside of Fond du Lac. Excellent manager, invested in genomics, maintained detailed records, followed every extension recommendation. But three consecutive years of price volatility, compounded by some equipment failures and a spike in feed costs, and she couldn’t service the debt anymore.

“I wasn’t lazy. I wasn’t incompetent. I was just unlucky with timing.” — Sarah, former dairy farmer, Wisconsin

That’s the brutal reality of our system—it punishes bad timing just as harshly as bad management. Maybe more harshly, because at least bad management gives you something you can fix.

Canadian producers face their own stressors, sure—particularly around quota debt levels and succession planning—but they’re shielded from the existential uncertainty that characterizes American dairy production. Studies show that 58% of Canadian producers meet criteria for anxiety and 35% for depression, but these rates, while concerning, reflect manageable business pressures rather than survival uncertainty.

The $35 Billion Asset Most Americans Can’t Fathom

Canadian dairy farmers collectively own over $35 billion in production quota. That’s government-issued licenses to produce milk, and in provinces like Alberta, they’re trading for $58,000 per kilogram of butterfat.

A new entrant starting a 100-cow operation in Ontario faces roughly $840,000 in quota costs before buying their first cow or pouring their first concrete pad.

Sounds insane, right? Until you realize that quota also represents $840,000 in asset value that appreciates over time, provides stable returns, and never goes bankrupt.

I was talking with Dave, who runs a 90-cow operation near Woodstock, Ontario:

“People don’t understand. This quota isn’t just a cost—it’s our retirement fund. My neighbor sold his quota last year and bought a condo in Florida. Try doing that with your milk contracts.” — Dave, Ontario dairy farmer

The Hidden Cost of “Free” Markets (Spoiler: They’re Not Free)

Let’s talk about the elephant in the room—subsidies. Americans love criticizing Canadian supply management as “subsidized agriculture” while praising our “free market” system. But the math tells a different story.

US direct government payments to agriculture hit $42.4 billion in 2025—a 354% increase over 2024. That’s before counting crop insurance premium subsidies (where taxpayers cover about 62% of premiums) and various disaster assistance programs.

Canadian dairy farmers receive exactly zero dollars in direct government subsidies for milk production. Their support comes from higher consumer prices, which are transparent, predictable, and paid by the people who consume the products.

What’s fascinating about the political dynamics: The cost of the US system is hidden in complex farm bills and emergency appropriations that most taxpayers never see directly. The cost of the Canadian system hits every consumer at the grocery checkout.

Which system do you think faces more political pressure?

Current Market Reality: What July 2025 Looks Like from the Trenches

The financial pressures are intensifying across the Midwest, and I’m seeing it in conversations everywhere I go. All-milk prices are sitting at $22.00 per hundredweight—not terrible, but not great when you factor in everything else happening.

The US dairy herd is at 9.365 million head, but what’s really concerning: replacement heifer numbers are at their lowest ratio in decades. We’ve got 3.914 million heifers over 500 pounds—that’s only 41.9 head per 100 milk cows. Historically, we’ve run closer to 45-50.

What does that tell us? Producers are culling hard, selling replacements into the beef market, and avoiding long-term investments needed to maintain herd size.

Feed costs are providing some relief—corn’s forecast at $4.20 per bushel. But labor costs are hitting record levels at $53 billion industry-wide, and equipment costs are up 10-15% due to steel tariffs.

It’s the classic squeeze play. Input costs that don’t adjust downward as fast as milk prices drop, but adjust upward faster when milk prices rise.

The Milk Dumping Nightmare

You want to talk about systemic inefficiency? Let’s discuss milk dumping—a phenomenon that’s virtually non-existent in Canada but periodically devastates US producers.

During the COVID-19 pandemic, farmers across the country were forced to dump millions of gallons of milk into manure pits and fields. An estimated 7% of all milk produced in one week was discarded. Class III milk futures fell by over 30%.

The economic consequences are severe, but the kicker—the government often steps in with taxpayer-funded compensation programs afterward. This cycle of overproduction, price collapse, waste, and government bailout represents massive systemic inefficiency.

Meanwhile, Canada’s supply management system is specifically designed to prevent such structural surpluses by aligning national production with anticipated domestic demand.

What You Can Actually Do About This (Implementation Strategies for 2025)

Look, individual producers can’t change the fundamental policy architecture, but we can adapt our strategies to survive and thrive within the system we have.

Strategy One: Optimize for Liquidity, Not Leverage

Canadian producers can afford to optimize for leverage because their cash flows are predictable. American producers need to optimize for liquidity because our cash flows are chaotic.

What does this look like practically?

- Maintain higher cash reserves than traditional ratios suggest

- Structure debt with flexible payment schedules and seasonal adjustments

- Prioritize equipment leasing over purchasing for major capital items

- Develop multiple lines of credit before you need them

Tom survived the 2019 downturn specifically because he prioritized liquidity over maximizing leverage ratios:

“My banker thought I was being too conservative. But when prices crashed, I could make payments while my neighbors couldn’t.” — Tom, Wisconsin dairy farmer

Strategy Two: Component-Focused Production

With butterfat premiums hitting record levels—we’re seeing spreads of $1.50+ over protein in some markets—component management becomes crucial for margin optimization.

This means:

- Genetic selection focused on butterfat production (we’re seeing average tests hit 4.36% nationally)

- Nutritional programs optimized for fat test rather than volume

- Seasonal calving patterns that maximize high-component months

- Marketing arrangements that capture component premiums

Strategy Three: Revenue Diversification Beyond Milk

This isn’t about becoming a “diversified farming operation”—it’s about creating revenue streams that aren’t correlated with milk prices.

Examples I’m seeing work:

- Custom farming during non-peak labor periods

- Value-added products sold direct to consumers

- Renewable energy generation (solar installations are becoming common)

- Fee-for-service breeding and reproduction programs

Alicia runs 160 cows near Lancaster and generates about 15% of her gross revenue from custom heifer raising:

“When milk prices tank, heifer raising prices usually hold steady or even increase as people cut back on replacements.” — Alicia, Pennsylvania dairy farmer

Environmental and Sustainability Considerations: The Hidden Advantage

Canadian supply management creates incentives for maintaining smaller, distributed operations across the landscape. Average Canadian dairy farms produce 0.94 kg CO2 per liter of milk, compared to higher emissions in the consolidated US system.

The regional concentration we’re seeing in American dairy—with massive operations in California, Idaho, and Wisconsin—creates environmental pressure points. When you’ve got 5,000-cow operations clustered together, you’re dealing with manure management challenges that 100-cow operations spread across the landscape simply don’t create.

What’s particularly noteworthy is how Canadian farms integrate into their local ecosystems. I visited operations in Quebec where dairy farms anchor sustainable crop rotations that support soil health across entire watersheds. Try replicating that with industrial-scale operations.

The Technology Investment Climate: Building for Tomorrow or Surviving Today?

The difference in investment climates really becomes apparent when you look at technology adoption patterns. Canadian producers are consistently early adopters of efficiency technologies because they can predict the payback periods.

According to recent data, precision agriculture adoption rates in Canadian dairy operations are running about 18 months ahead of comparable US operations. Not because the technology is better—it’s often the same equipment—but because the business case is clearer.

I was at a robotics conference last year where the contrast was stark. Canadian producers were asking detailed questions about integration with existing systems and long-term service contracts. American producers were focused on lease structures and exit strategies.

“The Canadians plan like they’ll be farming forever. The Americans plan like they might not be here next year.” — Equipment dealer at industry conference

Regional Variations: It’s Not Just Country vs. Country

Upper Midwest dairy operations—traditional family farm country—are experiencing the most stress from this volatility.

Minnesota and Wisconsin producers are caught in a particularly tough spot. They don’t have the scale advantages of Western operations or the proximity to processing that Northeast producers enjoy. They’re competing on efficiency alone in a market that rewards volume.

Meanwhile, Canadian producers in similar climatic and geographic conditions—Ontario and Quebec—maintain profitable operations at much smaller scale because their system isn’t optimized for volume competition.

I spent time in both Sauk County, Wisconsin, and Wellington County, Ontario, over the past few years. Similar soils, similar climate, similar farming traditions. But walking through those operations felt like visiting different industries entirely.

The Succession Crisis: When Stability Creates Its Own Problems

Canadian supply management shows its limitations when it comes to succession planning—it becomes incredibly complex when farms are worth millions primarily because of government-created assets.

I met with a family near Sherbrooke, Quebec. Third-generation dairy farmers with 85 cows and quota worth nearly $3 million. The retiring generation needs to cash out that quota value for retirement, but the next generation can’t secure financing to buy non-productive assets from their parents.

This creates what researchers are calling a “liquidity trap”—farms that are consistently profitable operationally but impossible to transfer generationally.

Compare that to US operations, where succession crises are driven by unpredictability rather than asset values. American farms fail to transfer not because they’re too valuable, but because they’re too risky.

The Policy Innovation Question: Learning Without Copying

So what can American dairy learn from Canadian success without adopting Canadian constraints?

Some ideas I’m hearing discussed:

Regional Production Cooperatives: Voluntary associations that could coordinate production planning within defined geographic areas. Not quotas, but collaborative forecasting that helps prevent the overproduction cycles that create crises.

Counter-cyclical Price Floors: Automatic triggers that activate support when milk prices fall below calculated break-even levels for extended periods. Less reactive than current disaster programs, more targeted than blanket subsidies.

Risk Management Innovation: Expanding programs like DMC to cover more production and lengthening coverage periods. Current coverage caps at 5 million pounds—roughly the output of a 200-250 cow herd—which leaves larger operations exposed.

The key insight from Canada isn’t that government control is inherently better—it’s that systematic stability enables long-term thinking, which enables sustainable operations.

Financial Resilience Audit: Where Does Your Operation Stand?

Given everything we’ve discussed, it’s worth conducting an honest assessment of your operation’s resilience. Here are the questions that really matter:

Cash Flow Predictability: Can you forecast net income within 15% accuracy six months out? If not, you’re operating with excessive uncertainty for strategic decision-making.

Debt Structure: Is your debt service manageable if milk prices drop $3/cwt for 12 months? That’s not worst-case—that’s recent history.

Investment Recovery: For capital investments over $100,000, do you calculate payback periods under multiple price scenarios? If you only model “normal” conditions, you’re not modeling reality.

Market Risk Exposure: What percentage of your milk is sold at fixed prices versus spot market? Operations with less than 40% price protection are essentially speculating on volatility.

Looking Forward: The Next Five Years

Current trends suggest we’re heading into a period of increased volatility, not decreased. Climate patterns are becoming less predictable, trade relationships are increasingly unstable, and consumer preferences are shifting faster than ever.

The US dairy operations that thrive over the next five years will be those that acknowledge volatility as a permanent feature, not a temporary aberration, and structure their businesses accordingly.

Canadian operations will face their own challenges—particularly around trade pressure and succession planning—but they’ll approach those challenges from a foundation of systematic stability.

The Uncomfortable Truth About American Dairy

After 25 years covering this industry, the difference between operations that survive versus those that fail isn’t primarily about management skill, genetic programs, or production efficiency.

It’s about understanding and adapting to the financial reality of the system we operate in.

Canadian supply management has achieved something remarkable—systematic farm survival in an industry where systematic farm failure has become normalized in the US. That doesn’t mean we should adopt their system wholesale, but it does mean we should learn from their success.

The uncomfortable truth is that our current system works well for large-scale, well-capitalized operations that can weather volatility and achieve economies of scale. It works poorly for mid-size operations caught in the middle, and it’s brutal for beginning farmers trying to enter the industry.

Success in American dairy in 2025 and beyond will be defined by financial resilience that can survive multiple down cycles, operational efficiency that captures available margins, and strategic positioning that plays to regional advantages.

The Choice Ahead

The choice facing American dairy producers isn’t between free markets and supply management. It’s between adapting to the volatility that characterizes our system or becoming another statistic in the bankruptcy files.

Canadian producers chose stability over opportunity. American producers chose opportunity over stability. Both systems work for their intended purposes, but only if you understand what game you’re actually playing.

The question for your operation: Are you playing to survive the game as it exists, or are you still playing by rules that don’t match reality?

Because the market doesn’t care about fairness, tradition, or what “should” work. It only cares about what does work. And right now, systematic financial resilience works better than hoping for the best while preparing for nothing.

The Canadian model isn’t perfect, but it’s produced outcomes our “efficient” system has failed to deliver: systematic farm survival, predictable investment climates, and rural communities that aren’t hollowing out from farm failures.

Whether American dairy can learn those lessons without adopting Canadian constraints remains to be seen. But one thing’s certain—continuing to do what we’ve always done will continue producing the results we’ve always gotten.

And those results include bankruptcy rates that would be considered a national emergency in any other industry.

What keeps me up at night isn’t just the statistics—it’s the realization that we’ve normalized financial chaos as the price of “freedom.” Maybe it’s time to ask whether the freedom to fail is worth the cost of systematic instability.

Your Canadian neighbors sleep better at night because their system prioritizes survival over volatility. The question is: what are we willing to learn from that success?

Look, I’ve been walking through barns in both countries for decades. Same genetics, same equipment, same dedication. The difference isn’t the farmers—it’s the system we’re operating in. Maybe it’s time we learned something from our northern neighbors who figured out how to make dairy farming sustainable instead of just survivable.

KEY TAKEAWAYS

- Financial resilience beats scale every time — Canadian operations maintain 16% debt-to-asset ratios with negligible bankruptcy rates versus our 55% surge in failures, proving you can optimize for liquidity over leverage when cash flows are predictable (start building 6-month operating reserves now)

- Investment confidence drives technology adoption — Stable pricing allows 18-month earlier adoption of precision dairy tech because payback calculations actually work, while our volatility makes every major purchase a gamble (consider leasing over purchasing for equipment over $100K)

- Component premiums are your profit lifeline — With butterfat hitting $1.50+ spreads over protein and average tests reaching 4.36% nationally, genetic selection focused on components rather than volume could be your 2025 margin saver (audit your breeding program this quarter)

- Mental health costs are measurable — US farmers face 3.5x higher suicide rates directly linked to financial volatility, while Canadian producers deal with manageable business stress rather than survival uncertainty (seriously, if you’re struggling with uncertainty, you’re not alone)

EXECUTIVE SUMMARY

So here’s what’s got me fired up—Canadian dairy farmers have essentially eliminated bankruptcy risk through supply management while we’re watching a 55% surge in Chapter 12 filings. Think about that for a second. Their average operation runs 96 cows and pencils out robotic milkers with 7-10 year paybacks, while our 377-cow “efficient” operations are looking at 15+ years if they don’t get wiped out first. The kicker? We just hit $42.4 billion in taxpayer bailouts (up 354% from 2024) while calling their consumer-funded system “subsidized.” Global dairy markets are shifting toward stability models, and frankly… maybe it’s time we paid attention. Look, I’m not saying we need to copy everything, but when your competition sleeps soundly while you’re stress-planning around $1.95/cwt forecast revisions, something’s worth learning.

Data verification: All statistics and market figures referenced in this analysis have been verified against current USDA-AMS, USDA-ERS, USDA-NASS, Statistics Canada, and industry reports published through July 2025.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – Reveals practical strategies for boosting profits by $500+ per cow through forage quality optimization, methionine supplementation, and transition cow management that you can implement immediately regardless of farm size.

- 2025 dairy crisis – Demonstrates how to build layered financial protections using DMC, forward contracts, and strategic risk management to survive the 18% milk price crash and margin squeeze hitting operations nationwide.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Exposes the five game-changing innovations—from smart calf sensors reducing mortality 40% to AI-driven feed optimization—that separate thriving operations from those struggling to survive market volatility.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.