Retailers get sustainability claims. Processors land premium contracts. Farmers get… a benchmarking report.

EXECUTIVE SUMMARY: Retailers want sustainability data. Processors are landing premium contracts. Farmers are doing the assessments—and asking a fair question: what’s coming back to the farm? The economics reveal a structural gap worth understanding. Programs like FARM Environmental Stewardship deliver genuine environmental progress, but while producers absorb the time investment and compliance costs, the marketing value and buyer relationships flow primarily upstream to cooperatives and processors. Technology economics follow a similar pattern: digesters can pay back in under five years for large operations in favorable policy states, but mid-size farms elsewhere often find lower-capital alternatives offer more practical returns. This analysis breaks down the real costs, maps where value flows, and provides a framework of questions to work through—helping farmers evaluate which sustainability opportunities actually make sense for their operation.

You know that feeling when your co-op asks you to complete another assessment, and you’re already behind on breeding decisions, that heifer pen needs attention, and you haven’t caught up on feed inventory in two weeks? You’re certainly not alone in feeling that tension.

I’ve been talking with producers across the Midwest and Northeast who are running mid-size operations—the 200- to 500-cow range—and hearing remarkably similar stories. One Wisconsin producer I spoke with recently shared his experience: he spent the better part of three days pulling together feed records, energy bills, manure management documentation, and herd data for his cooperative’s sustainability assessment. His co-op got metrics to share with their retail partners. He got a benchmarking report and a request to do it again next year.

“I’m not against tracking our environmental footprint,” he told me. “But when I added up my time and what the assessment cost, I’d invested close to two thousand dollars. The report told me things I mostly already knew. Meanwhile, my co-op is using that data to land contracts with grocery chains.”

That’s the heart of the issue. These programs aren’t inherently problematic—many drive genuine environmental improvements that benefit the entire industry’s reputation. But the economics work differently than farmers sometimes expect. Retailers get sustainability claims for their marketing. Processors get preferred supplier status. And farmers get… a benchmarking report.

Understanding that dynamic matters when you’re making decisions about your operation.

The Real Cost of Participation

Let me walk you through what these programs actually cost when you add everything up—not just the line items that show up on invoices.

The FARM Environmental Stewardship program has completed more than 4,000 on-farm assessments across 42 states since it launched, with the broader FARM Animal Care program covering approximately 99% of U.S. milk production. That’s according to the National Dairy FARM Program’s 2023 Year in Review, which notes that assessments cover operations ranging from 10 to over 35,000 lactating cows. Direct assessment costs vary by region and evaluator, but producers I’ve spoken with report fees ranging from a few hundred dollars for basic assessments to well over a thousand for comprehensive lifecycle evaluations.

But here’s what often gets overlooked: the time investment.

Dr. Greg Thoma, who directs the Agricultural Modeling and Lifecycle Assessment program at Colorado State University’s AgNext initiative, has noted that comprehensive farm-level data collection requires significant farmer involvement. We’re not talking about clicking a few buttons. Initial assessments typically run from half a day to two full days of farmer time for data gathering, verification, and review—depending on how your record-keeping systems are organized.

What’s that time actually worth? If you value your management hours at fifty to seventy-five dollars—and honestly, that’s conservative for someone juggling fresh cow protocols, transition period monitoring, feed inventory, and labor scheduling—you’re looking at several hundred to over a thousand dollars in opportunity cost before counting direct fees.

A farm business consultant who works with dairy operations across the Upper Midwest put it plainly: “The assessment process is useful for industry positioning, but provides limited direct benefit for the farmer completing it.”

Who Captures the Value You Create?

This brings me to something worth understanding, regardless of how you feel about sustainability initiatives generally.

When a cooperative aggregates sustainability data from member farms, they create several distinct value streams. According to the FARM ES Program documentation, aggregated data helps “demonstrate dairy’s environmental benefits to customers and consumers” and supports “cooperative, processor and national level” sustainability claims.

Let’s be direct about what that means: your operational data—the information you spent days compiling between morning milking and dealing with that problem fresh cow—becomes raw material for marketing claims that help your processor land contracts with Walmart, Kroger, and institutional buyers. It feeds into ESG reports that satisfy institutional investors. It supports premium positioning that benefits everyone in the supply chain above you.

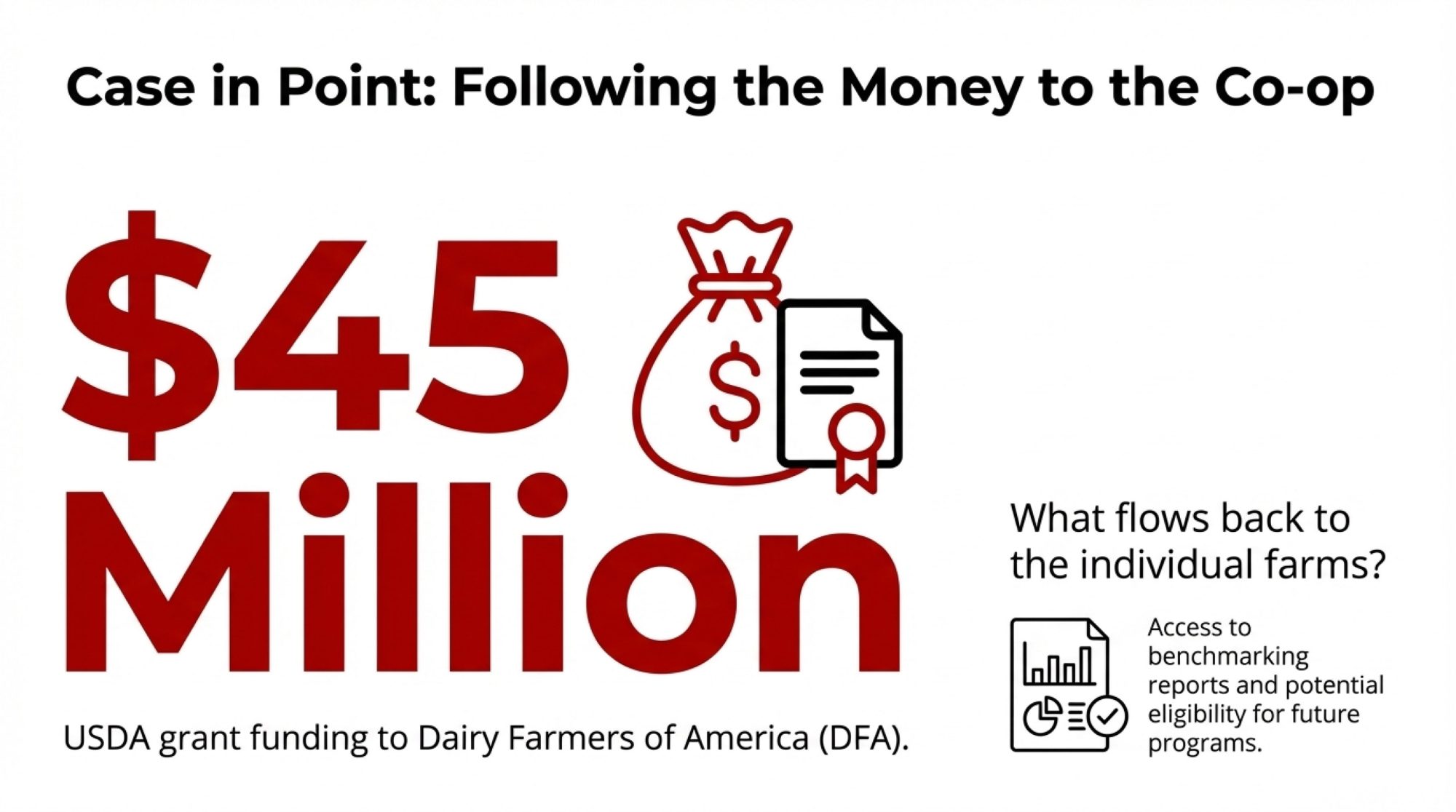

Here’s a concrete example. In August 2020, Dairy Farmers of America became the first U.S. dairy cooperative to have emissions targets validated by the Science Based Targets initiative. DFA is committed to reducing greenhouse gas emissions across its supply chain by 30% by 2030, relative to a 2018 baseline. That’s built on data from member farms. Then, in September 2022, DFA received up to $45 million in USDA grant funding through the Partnerships for Climate-Smart Commodities program.

That represents real industry progress. But $45 million flowed to the cooperative level. What flowed back to the farms that provided the data and implemented the practices? Access to benchmarking reports and potential eligibility for future incentive programs.

I should be fair here: cooperatives are responding to legitimate market pressures. Retailers have made sustainability documentation a condition of doing business, and someone has to aggregate and verify that data. The question isn’t whether this work should happen—it’s whether the current value distribution makes sense for farmers.

Technology Economics: Finding What Actually Pencils Out

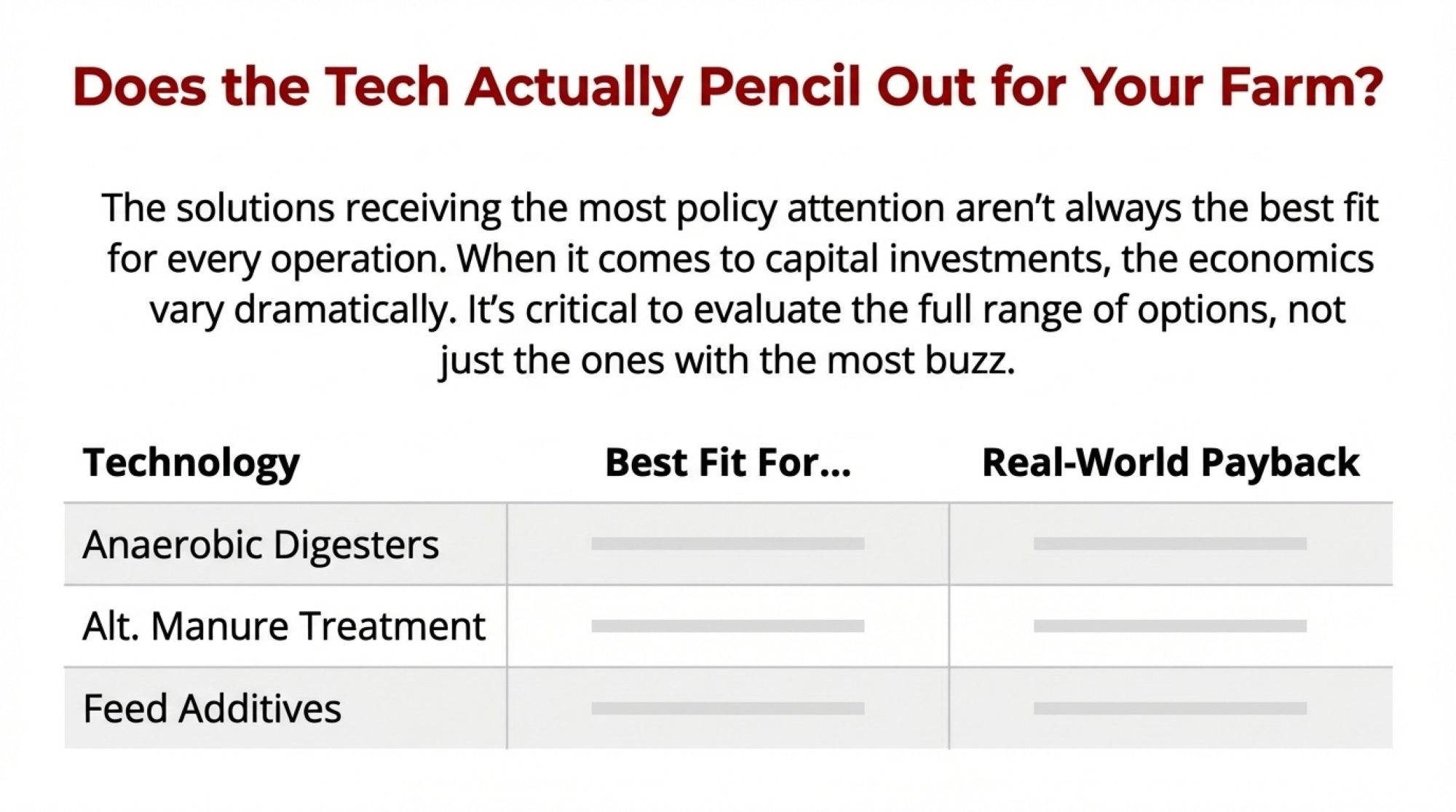

When it comes to capital investments for emissions reduction, the economics vary dramatically. And here’s what I’ve noticed: the solutions receiving the most policy attention aren’t always the best fit for every operation.

Technology Comparison at a Glance

Anaerobic Digesters

- Capital: $2-5 million full-scale; $125K-500K mini systems

- Operating: $20,000-51,000 annually

- Methane reduction: 25-35% from storage

- Payback without grants: Can exceed 22 years

- Payback with full grants: Under 5 years possible

- Best fit: 500+ cow operations in LCFS states

Alternative Manure Treatment Systems

- Capital: Varies significantly; generally lower than digesters

- Operating: Lower ongoing costs

- Methane reduction: Up to 97-99% from treated streams

- Payback without grants: Generally 4-7 years

- Payback with grants: 3-5 years

- Best fit: Various sizes, most regions

Feed Additives (3-NOP)

- Capital: Minimal infrastructure

- Operating: $40-60 per cow annually

- Methane reduction: 25-30% enteric

- Payback: Ongoing operational cost

- Best fit: Any size, immediate impact

Sources: Penn State Extension, March 2025; Bioresource Technology Reports, June 2022

The Digester Reality Check

Digesters have dominated the sustainability technology conversation, and for good reason—they can generate meaningful revenue streams on the right operation. But the financial threshold is steeper than many producers initially realize.

Penn State Extension’s March 2025 analysis—titled “Enhancing Digester Profitability: Strategies for Farmers”—lays out the numbers clearly. Without grant funding, payback periods can stretch to 22 years or more. In challenging scenarios, payback could exceed 50 years. That’s longer than most of us plan to be milking cows.

With substantial grant funding, the picture changes dramatically. Payback can drop to under five years, and under optimal conditions with full grant coverage, Penn State documented payback periods as short as 1.3 years.

So the practical question becomes: can your operation access that level of grant funding? Farms in California benefit from Low Carbon Fuel Standard credits that create additional revenue streams. Operations in Wisconsin, New York, or Pennsylvania are working with a different policy landscape entirely.

The result is that digester economics work particularly well for larger operations—generally 500 cows or more—in favorable policy environments. For everyone else, the math often doesn’t work.

Looking at Economic Alternatives

This is where mid-size operations need to think creatively. Research published in Bioresource Technology Reports in June 2022 found that alternative manure treatment approaches—including biological systems—can achieve 97-99% methane reduction from treated streams at substantially lower capital requirements. The California Dairy Research Foundation has funded multiple demonstration projects through CDFA’s Alternative Manure Management Program with promising results.

Payback periods for these systems generally range from 4 to 7 years, often achievable without major subsidies.

The point isn’t that one technology is universally better than another—it’s that farmers should evaluate the full range of options rather than defaulting to whatever solution has the most policy momentum. For mid-size operations in states without LCFS programs, lower-capital alternatives may offer more practical economics. It’s worth exploring what actually fits your situation rather than what fits the policy conversation.

Government Support: Helpful, But Don’t Build Your Strategy Around It

Federal sustainability funding has expanded significantly. The Partnerships for Climate-Smart Commodities program allocated $2.8 billion across 70 projects, with USDA announcing support reaching more than 50,000 farms.

Those are meaningful numbers. But here’s the context that matters for individual operations.

Of that $2.8 billion, dairy-specific allocation represents roughly $500-600 million—the remainder flows to row crops, beef, specialty crops, and other commodities. Divide dairy funding across approximately 24,000 U.S. dairy farms (USDA NASS data), and you get a theoretical availability of around $22,000 per farm.

In practice, several factors reduce that figure. Program administration requires resources. Competition for applications means not every eligible farm accesses available support. And let’s be honest—grant-writing capacity matters. Larger operations with professional staff have real advantages in navigating application processes that 200-cow family operations simply don’t have.

Government support can help on the margins. But building your sustainability strategy around grant funding you may or may not receive is a risky proposition.

Corporate Partnerships: Read the Fine Print

Major food companies are investing substantial resources in the sustainability of the dairy supply chain. In February 2025, Mars announced a $27 million commitment over five years to support Fonterra’s farmer sustainability initiatives in New Zealand, with Nestlé backing additional incentive payments through the same partnership. The stated goal: reduce dairy-related emissions by 150,000 metric tons by 2030.

According to ESG News reporting, farmers who achieve significant emissions reductions—30% or more compared to the industry average—become eligible for per-kilogram incentive payments ranging from NZ$0.10 to NZ$0.25 per kgMS. That’s meaningful compensation for documented environmental improvements.

But there’s a structural element worth understanding. When these programs involve carbon “insetting”—where farmers sell their emissions reductions to their processor rather than on open markets—you permanently transfer that environmental attribute. You can’t sell the same carbon reduction to another buyer. You can’t use it to market your operation independently.

The processor gets to claim the carbon reduction in their corporate sustainability reports. You get a per-kilogram payment. Whether that’s a fair exchange depends on how the market develops—but it’s worth understanding before you sign.

What Happens When Corporate Priorities Shift

In August 2021, 89 organic dairy farmers across Maine, Vermont, New Hampshire, and parts of New York received termination letters from Horizon Organic, with their contracts set to end by August 2022. Around the same time, another 46 farms were dropped by Maple Hill Creamery—documented by Dairy Reporter and the Northeast Organic Dairy Producers Alliance.

These were established operations—multi-generational family farms that had invested substantially in organic certification, infrastructure changes, and the three-year transition period. They’d met all program requirements. They’d done everything asked of them.

When Danone decided to consolidate supply around fewer, larger operations closer to processing facilities, none of that mattered. The terminations reflected corporate supply chain optimization, not farmer performance.

What happened next offers an encouraging counterpoint. Organic Valley—the farmer-owned cooperative with more than 1,600 member farms producing over 30% of U.S. organic milk—stepped in. According to their reporting, 50 farms from the affected states joined as new members, with another 15 farms joining earlier that year.

Two lessons here. First, concentrated market relationships create real vulnerability. Second, farmer-controlled alternatives can provide meaningful options when corporate priorities shift.

Models Worth Understanding

Not every sustainability structure concentrates value away from farmers.

Organic Valley’s cooperative ownership structure shapes how they respond to challenges. When feed costs increased significantly during 2021-2023, they mobilized member support through task forces, deployed field staff for technical assistance, and invested in tools helping farmers maximize on-farm feed production. Their sustainability programs include farmer compensation for sequestration and avoided emissions, with farmer governance over program evolution.

In Europe, farmer-controlled data cooperatives offer another model. The JoinData approach in the Netherlands allows farmers to retain ownership of their operational data, authorize each use individually, and receive compensation when their data generates commercial value.

These aren’t the only valid approaches—conventional cooperative relationships and corporate partnerships provide real value for many operations. But knowing alternatives exist helps you evaluate what structure works best for your situation.

Questions to Work Through Before Signing

Based on conversations with producers who’ve navigated these decisions:

On costs and time:

- What’s the total annual commitment—assessment fees, data platform costs, and your time at realistic hourly rates?

- Does the potential return justify that investment?

- How does timing align with your busiest seasons?

On value distribution:

- Who captures the marketing value from your participation?

- What specific benefits are guaranteed versus contingent on future development?

- Are you comfortable with the exchange you’re making?

On data:

- What do contract terms say about data ownership and use?

- Can your data be aggregated for purposes beyond your direct benefit?

- What compensation exists when your data supports others’ sustainability claims?

On technology:

- Does the promoted solution match your operation’s scale and capital access?

- What alternatives might offer better economics?

- Does the investment make sense without grant funding?

On market relationships:

- What notice period does your buyer have for relationship changes?

- How dependent are you on a single market channel?

- What options exist if current arrangements become unfavorable?

The Bottom Line

The dairy industry’s sustainability transformation is real and likely to continue. Consumer expectations, retailer requirements, and regulatory pressures create market dynamics that aren’t going away. Farms that can document and improve their environmental performance will generally have better positioning over time.

But how you participate matters enormously.

Right now, a lot of the sustainability conversation asks farmers to provide data, implement practices, and absorb costs—while the marketing value and premium positioning flow primarily to other parts of the supply chain. That’s not necessarily wrong, but it’s worth seeing clearly.

The producers who feel good about their sustainability investments share some common approaches. They understood the full economics before committing. They maintained diverse market relationships. They chose technologies that fit their scale and geography. And they asked direct questions about value distribution before signing anything.

That’s not cynicism—it’s the same analysis that characterizes good management decisions in any area of the operation. What does this cost? What do I receive? Who else benefits, and by how much?

The sustainability conversation doesn’t change those fundamentals. If anything, it makes asking them more important than ever.

Have experiences with sustainability programs that might help other producers? We’re interested in hearing what’s working—and what isn’t—across different operations and regions.

KEY TAKEAWAYS:

- Know the exchange you’re making: Your data and compliance work enable sustainability claims that benefit the entire supply chain—be clear on what returns to your farm before committing

- Technology economics are operation-specific: Digesters pay back quickly for 500+ cow farms in favorable policy states; mid-size operations elsewhere often find lower-capital alternatives pencil out better

- Build strategy around economics, not grants: Federal programs are competitive and favor operations with professional staff—assume you won’t get funding and be pleasantly surprised if you do

- Market concentration creates vulnerability: When Horizon and Maple Hill dropped 135 organic farms in 2021-2022, performance wasn’t the issue—farms with multiple buyer relationships recovered fastest

- Programs deliver real value; distribution is the question: Sustainability initiatives drive genuine environmental progress—the issue worth examining is whether farmers share fairly in the value they help create

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Profitability vs. Sustainability: Can You Have Both? – Challenges the assumption that environmental goals must come at the expense of your bottom line. This analysis breaks down strategies for aligning green initiatives with black ink, ensuring your operation remains financially viable while meeting modern market demands.

- Feed Efficiency: The Single Greatest Opportunity to Improve Profitability and Sustainability – Moves beyond the hype to practical genetics. This guide demonstrates how selecting for feed efficiency reduces input costs and methane output simultaneously, offering a proven, low-capital tactic to improve your sustainability metrics without massive infrastructure investments.

- Is Technology the Answer to the Labor Crisis? – Examines the ROI of automation beyond just milking cows. Learn how data-driven systems can reclaim the management hours lost to manual record-keeping—directly addressing the “opportunity cost” of time highlighted in our sustainability analysis.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!