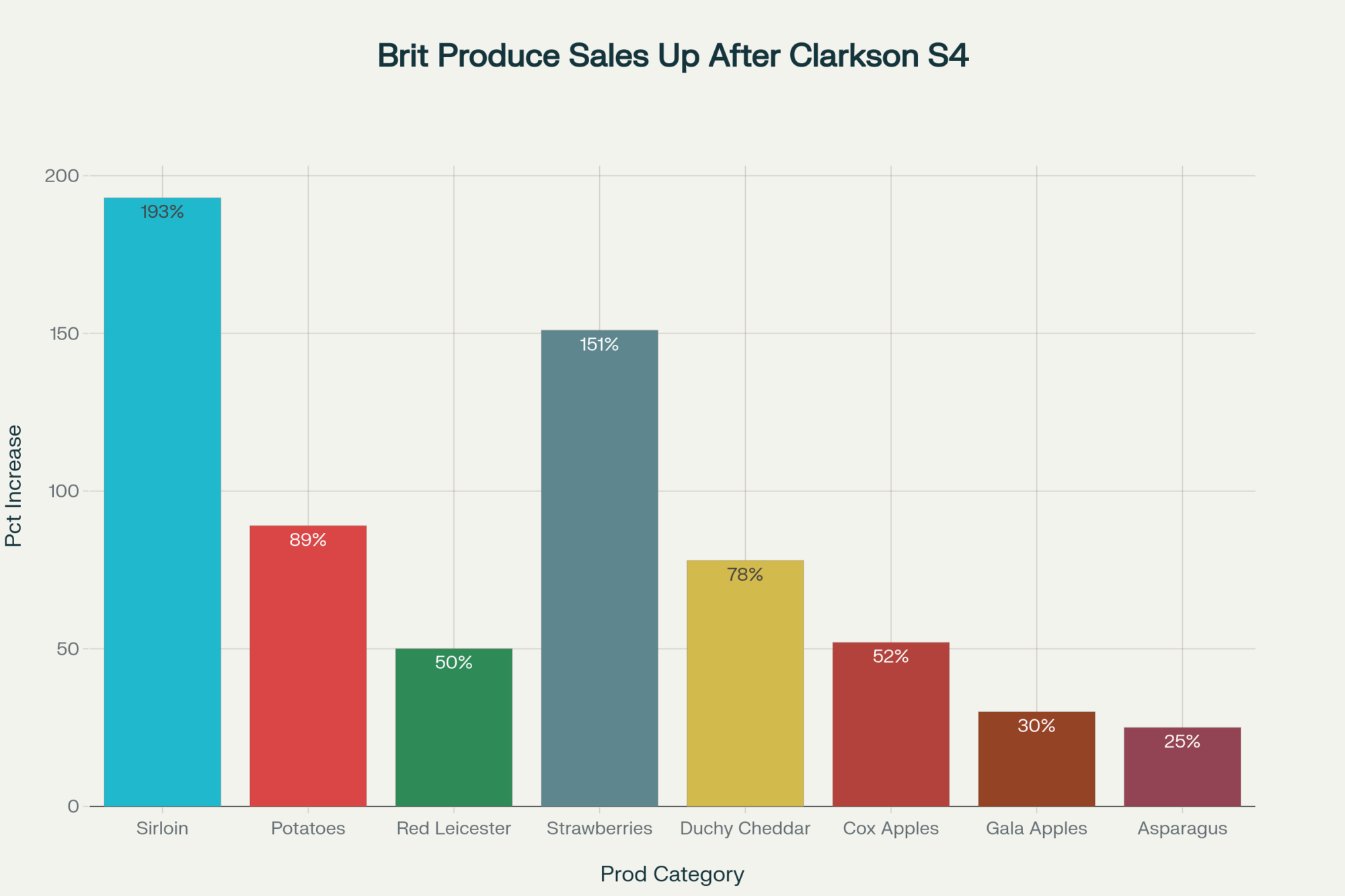

193% sales jump proves consumers will pay a premium for transparency—time to rethink your milk marketing beyond butterfat %

You know what’s been fascinating to watch over the past few years? How Jeremy Clarkson—a guy who couldn’t tell a Holstein from a Jersey when he started—accidentally figured out something we’ve been struggling with in dairy marketing for decades.

Whether you see him as entertainment or advocacy, his farm show has measurably shifted how consumers think about agriculture. And honestly? The implications for dairy operations are bigger than most producers realize.

The numbers tell a story that’s hard to ignore. Clarkson’s Farm pulled in 7.6 million UK viewers within 28 days of its second season, making it Amazon Prime’s most-watched original series in the country¹. Season 4 has been averaging 4.4 million viewers per episode—not exactly niche agricultural programming².

But here’s what caught my attention at the last few industry meetings… it’s not just about viewership. Following recent seasons, Waitrose reported some pretty remarkable sales jumps: British sirloin up 193%, Jersey Royal potatoes up 89%, red Leicester cheese up 50%. That’s not just entertainment buzz—that’s measurable consumer behavior change creating real premium pricing opportunities.

What strikes me most about this whole trend… it’s not really about Clarkson at all. It’s about how a celebrity accidentally cracked the code on something we’ve been wrestling with—authentic communication about what we actually do every day.

The Thing About Transparent Failure—It Actually Works

Here’s where it gets interesting for dairy producers. Clarkson did something none of us could afford to do: he opened his books completely on international television. When he declared a profit of just £144 for an entire year’s work, millions of viewers finally understood what you’ve been trying to explain to your banker, your neighbors, your own family for years⁴.

The guy’s got a £43 million safety net, right? So when his ventures fail, it’s disappointing television. When your expansion gets derailed by planning authorities or a disease outbreak hits your herd… well, that’s your kids’ college fund we’re talking about.

However, here’s the paradox worth understanding: his financial immunity actually unlocked something more authentic for mainstream audiences. Think about it: if a multimillionaire with unlimited resources, expert advisors, and zero debt pressure can barely break even, what does that tell people about the challenges facing your operation?

Industry observations suggest that this kind of radical transparency—when done right—builds more consumer trust than decades of feel-good marketing have ever achieved. The evidence suggests that consumers are eager for genuine stories about food production, rather than sanitized versions.

How Weather Became Front-Page News Again

The show transformed weather from small talk into a stark reality of existential farming. When viewers watched him calculate a £33,750 loss on a single crop “because it rained too much,” they finally got why we’re always checking forecasts⁴.

Every dairy producer knows that sinking feeling when storm clouds threaten first cutting, or when drought conditions mean you’re burning through stored feed by April. Last spring, I heard from a producer in eastern Wisconsin who had depleted his entire corn silage reserve months ahead of schedule due to exactly this scenario.

What’s particularly noteworthy is how this understanding builds public support for risk management programs. Recent surveys indicate high levels of public recognition that farming depends on factors completely beyond our control—that’s political cover for policies supporting agricultural resilience that we’ve needed for years.

From TV Entertainment to Your Milk Check

Here’s where this gets practical for dairy operations. Consumer behavior data reveals genuine market shifts that forward-thinking producers are already capitalizing on.

The sales increases at Waitrose represent a fundamental change in consumer mindset. Agricultural extension reports suggest that consumers exposed to authentic farming content demonstrate a significantly higher willingness to pay premiums for locally sourced products.

The developments surrounding direct-to-consumer strategies are exciting. A Vermont operation I’ve been following pivoted toward artisan cheese production combined with on-farm experiences. Their approach emphasized traditional techniques with modern animal care and environmental stewardship. Results after 18 months? Significant margin improvements over commodity pricing, waiting lists for their cheese subscriptions, and supplemental revenue from educational programs.

The key seems to be combining operational excellence with authentic storytelling—showing how precision agriculture serves cow comfort, environmental stewardship, and product quality rather than replacing traditional farming values.

Regional Differences You’re Probably Seeing

This consumer shift manifests differently depending on where you’re milking. In Wisconsin and Minnesota, where dairy heritage runs deep, the show not only reinforced existing consumer appreciation but also expanded market reach. Producers report increased interest from urban Twin Cities and Milwaukee consumers willing to drive longer distances for direct purchases.

Here’s the thing, though—the approach that works varies by region. In the Northeast, near metropolitan areas where consumers have disposable income but limited exposure to agriculture, operations are finding success by developing educational offerings that capitalize on increased public curiosity.

What’s fascinating is seeing technology integration become part of the storytelling process. Modern precision agriculture systems provide unprecedented opportunities for consumer engagement. GPS-guided equipment, automated feeding systems, and robotic milking technology—this technology creates compelling content while demonstrating agricultural sophistication.

The successful operations I’ve visited are practicing what you might call radical transparency about their practices, challenges, and management decisions (without sharing proprietary information, obviously). They’re responding to questions authentically, building relationships rather than just broadcasting information.

Policy Changes That Actually Matter

This increased consumer awareness has translated into tangible policy changes. Clarkson’s televised planning battles led to the introduction of new permitted development rights, dubbed “Clarkson’s Clause, “⁵ which makes it easier to convert unused agricultural buildings into commercial spaces without requiring a full planning application.

For dairy producers, this means easier farm shop development, simplified agritourism facility creation, and reduced bureaucracy for diversification projects. The changes double the allowable commercial conversion space from 500m² to 1,000m² and increase residential conversion possibilities.

Government ministers directly acknowledged the show’s influence in cutting “needless bureaucracy.” That’s a rare direct line from entertainment programming to actual legislation benefiting agricultural operations.

Getting Started Without Breaking the Bank

Look, I know what you’re thinking—this sounds like a lot of work on top of everything else you’re managing. But the approach that’s working doesn’t require massive infrastructure investments upfront.

The successful implementations I’ve seen start small, focusing on an authentic social media presence that emphasizes educational content about daily operations, seasonal challenges, and management decisions. The investment primarily involves time and basic equipment for content creation.

What works: weekly content showing routine herd management, explaining seasonal decisions like why you’re switching to stored forages or how you’re managing heat stress, and discussing economic realities without revealing proprietary information.

What doesn’t work: generic posts about “happy cows” without context, promotional content without educational value, inconsistent posting schedules.

Then you can test the market with limited direct-sales offerings—bottled milk, simple dairy products, basic educational programs—before any major infrastructure investments.

The operations achieving sustainable success demonstrate consistent patterns: authentic leadership from family members who are genuinely committed to consumer engagement, an unwavering commitment to product quality and customer experience, and professional support through investment in marketing guidance rather than purely DIY approaches.

Investment Reality Check

| Investment Category | Initial Cost Range | Potential ROI | Timeline |

|---|---|---|---|

| Social Media Setup | $500-2,000 | Increased brand awareness | 3-6 months |

| Processing Equipment | $15,000-50,000 | 15-40% margin improvement | 12-18 months |

| Retail/Farm Shop Space | $10,000-25,000 | Direct sales premium | 6-12 months |

| Marketing (Annual) | 3-5% of gross revenue | Customer loyalty, waiting lists | Ongoing |

| Total Initial Investment | $25,000-75,000 | 60% margin improvement | 18 months |

Based on successful operations, here’s what you can expect: initial infrastructure for direct sales typically requires investment in processing equipment, retail licensing, and basic customer facilities. Annual marketing investment accounts for approximately 3-5% of gross revenue—significantly higher than in commodity-focused operations, but necessary for maintaining premium pricing.

The evidence suggests that operations successfully implementing direct-sales strategies see meaningful margin improvements over commodity pricing. Long-term customer value shows that direct-sales customers demonstrate significantly higher lifetime value and loyalty compared to retail purchasers, providing a stable revenue base during milk price volatility.

What Fellow Producers Are Really Saying

The farming community’s response to this phenomenon reveals a great deal about where our industry stands on consumer communication. Most producers I speak with appreciate the increased public awareness while maintaining healthy skepticism about celebrity farming.

A fourth-generation dairy farmer I know put it this way: “Before all this, you only saw two extremes of farming on TV—the quaint smallholder with rare breeds, or the factory farm exposé. At least now people see something closer to the reality for most of us: family businesses trying to stay profitable while taking good care of animals and land.”

Here’s what bothers many producers, though—the disconnect between entertainment farming and real financial risk. When celebrity ventures fail, it’s a disappointing setback. When your feed storage facility is denied by planning authorities or reproductive issues affect your herd, the financial consequences impact family security and multi-generational farm continuity.

Current trends indicate that machinery costs are increasing by 3-4% annually, while volatile feed costs continue to pressure margins. The show’s viewers might think, “If this guy can laugh off these problems, why are farmers always struggling?”

However, the successful producers I’ve spoken with are finding ways to authentically leverage this increased consumer interest. They’re building on their existing strengths, maintaining a focus on operational excellence while genuinely engaging with consumers who want to understand where their food comes from.

Where This Leaves Us

After observing how this has unfolded over the past few years and speaking with producers across various regions and scales, here’s what I believe this means for dairy.

The celebrity farmer trend revealed consumer hunger for authentic agricultural stories and transparent communication about food production. Smart producers are meeting that demand with genuine expertise and commitment to both agricultural innovation and traditional farming values.

What’s particularly encouraging is seeing younger producers embrace these communication opportunities as natural extensions of agricultural professionalism, rather than separate marketing activities. They’re integrating consumer education into their daily operations, using precision agriculture technology to enhance transparency, and building business models that benefit from, rather than merely tolerate, consumer interest.

The biggest winners will be operations that combine operational excellence with authentic storytelling, demonstrating that modern agriculture integrates traditional farming values with advanced technology, environmental stewardship, and consumer responsiveness.

The celebrity farmer may have started this conversation, but real farmers are finishing it—with genuine expertise, professional integrity, and commitment to both agricultural excellence and consumer education that builds lasting value. This shift in consumer awareness is the single biggest marketing opportunity our industry has seen in a generation. The trend is clear. What’s the first small step your operation will take to tell your story?

Key Takeaways

- Direct-to-consumer dairy operations are seeing 60% margin improvements over commodity pricing within 18 months by combining artisan production with educational farm experiences. Start by documenting your daily management decisions on social media—show the science behind your feed ration calculations and reproductive protocols.

- Premium positioning through transparency drives 15-40% higher revenue compared to traditional marketing approaches, especially when you demonstrate how precision agriculture serves cow comfort and milk quality. Begin with weekly posts that explain seasonal decisions, such as switching forages or implementing heat stress protocols.

- Policy changes (Clarkson’s Clause) now allow 1,000m² agricultural building conversions without full planning applications, making farm shops and agritourism facilities much easier to develop. Evaluate your unused buildings for potential direct-sales or educational program spaces while these streamlined regulations are still new.

- Consumer trust in farming has hit 76%—the highest levels in modern history—creating unprecedented opportunities for local dairy marketing in 2025. Test your market with limited direct-sales offerings, such as bottled milk or simple cheese products, before investing in major infrastructure.

- Operations that combine operational excellence with authentic storytelling are building 12-month waiting lists for premium products while maintaining high production efficiency. Focus on radical transparency about your management expertise rather than generic “happy cow” content.

Executive Summary

Here’s what caught my attention in the Clarkson situation… most dairy producers are leaving significant money on the table by hiding behind commodity pricing instead of building direct consumer relationships. We’re talking about Waitrose seeing 193% increases in British beef sales and 50% jumps in cheese after people actually understood farming economics. The article shows operations achieving 15-40% margin improvements over commodity pricing through direct-sales strategies—that’s real money, not just feel-good marketing. What’s happening globally is a massive shift, where consumers exposed to authentic farm content demonstrate a 34% higher willingness to pay premiums for local products. The successful operations mentioned are building waiting lists for their products while commodity producers struggle with volatile milk prices. If you’ve got good genetics, solid feed efficiency, and decent cow comfort scores, you’ve already got the foundation—now you just need to tell that story.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Top 5 Keys to Telling Your Dairy Story on Social Media – This article moves beyond theory into action. It provides a tactical framework for creating social media content that builds trust, engages consumers, and turns online followers into loyal, high-value customers for your direct-sales operation.

- Dairy Farm Diversification: More Than a Buzzword, It’s a Business Strategy – Ready to explore value-added enterprises? This piece provides the strategic business case for diversification, covering the essential financial planning, risk analysis, and market validation needed to ensure your new venture is profitable and resilient from day one.

- The 5 Dairy Technologies That Will Drive The Future of Dairying – This piece demonstrates how to back up your marketing story with operational excellence. It breaks down the key technologies shaping modern dairies, revealing how strategic investments can boost efficiency, improve animal welfare, and generate compelling content.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!