Asia’s hitting 5.3M QSR outlets by 2027—but most processors are missing the $55M opportunity. Here’s why.

EXECUTIVE SUMMARY: Here’s what’s got me fired up about this Fonterra move: they’re not chasing volume—they’re chasing margin, and it’s paying off big time. Their $55M bet on Asian foodservice cheese is pulling in 15-25% premium pricing over commodity markets, translating to serious money per cow. We’re talking about IQF technology that extends shelf life to 24 months and one-day processing that cuts $12 million in working capital annually. With Asia’s QSR market exploding toward 5.3 million outlets by 2027, this isn’t just smart—it’s essential. The co-ops and processors watching this unfold better start asking themselves: are we positioning our farmers’ milk for these premium channels, or are we stuck fighting commodity battles? Because this blueprint shows exactly how to turn raw milk into lasting global value.

KEY TAKEAWAYS:

- Target growth markets over mature ones — Asia’s QSR cheese demand is growing 12-15% annually while U.S. markets crawl at 2-3%

- Invest in problem-solving tech, not just capacity — Fonterra’s one-day aging process saves $12M annually in working capital vs. traditional methods

- Build supply chain advantages competitors can’t replicate — Their 10,500 farmer-owner network guarantees high-component milk essential for premium mozzarella

- Lock in long-term contracts for revenue stability — 70% of their revenues are secured through multi-year QSR partnerships worth $50-80M annually

- Question your processor’s strategy immediately — Ask if they’re targeting high-growth export markets or just chasing volume in saturated domestic channels

One aspect of Asia’s rapid growth in quick-service restaurants is that it’s truly changing the game for all of us in the dairy industry. Urbanization and shifting consumer tastes—especially in those tier-two Chinese cities where Western food is suddenly everywhere—are fueling this expansion toward 5.3 million outlets by 2027. While exact consumption data remains confidential, my analysis, backed by industry intelligence, suggests robust growth in per-outlet cheese sales. What really strikes me is the premium buyers are willing to pay here—signaling that reliable supply chains have become the currency of success.

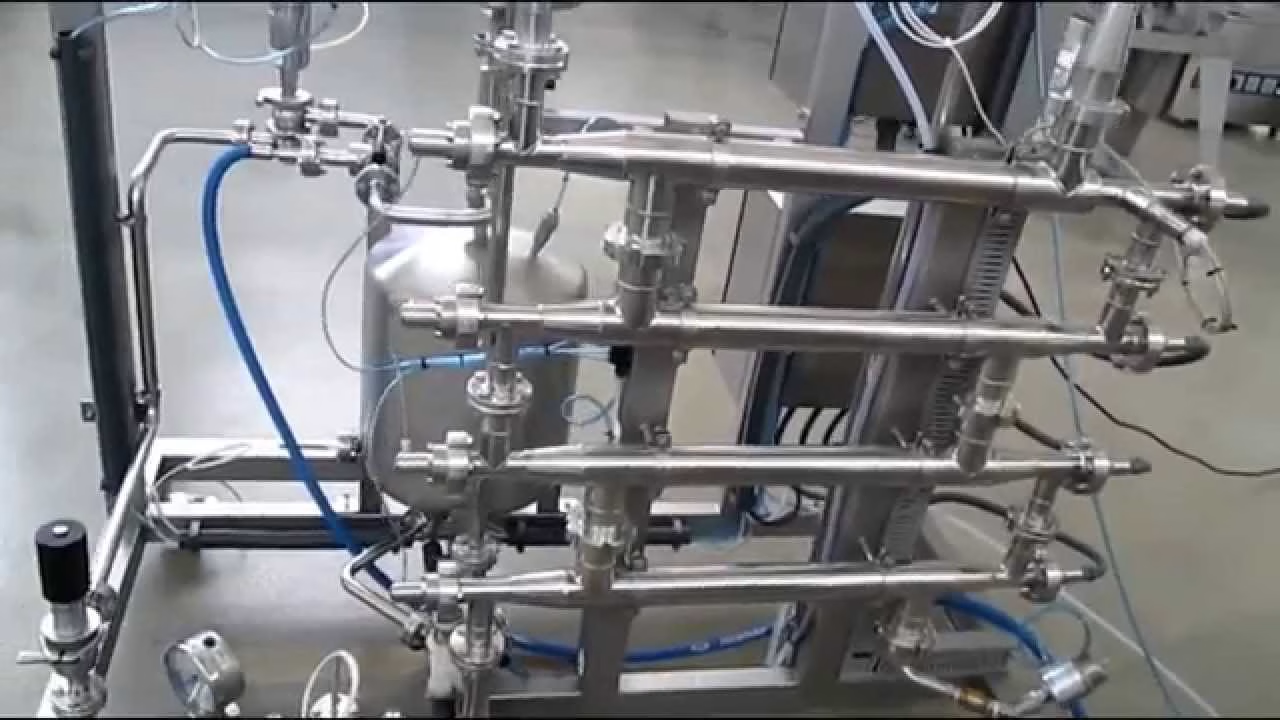

Investment at Eltham: What’s Actually Happening

Fonterra’s recent upgrade at its Eltham plant added approximately 6,000 tonnes of Individual Quick Frozen (IQF) mozzarella capacity annually, as well as expanded processed cheese lines to supply roughly 200 million more burgers per year. For Fonterra’s farmer-owners, this isn’t just another factory upgrade—it’s a strategic move to direct their milk into high-value, stable channels that can weather market volatility.

The Tech Reality: Innovation Meets Complexity

Here’s what really impresses me about their approach: that proprietary one-day mozzarella process. Think about it—shrinking traditional aging from 60 days down to just one day. According to research documented in Hoard’s Dairyman, this cuts working capital tied up in inventory by roughly $12 million annually. In today’s margin environment, that’s real money hitting the bottom line.

The IQF technology extends mozzarella shelf life to 18-24 months, which is absolutely critical when you’re shipping to QSRs across multiple continents. But here’s the catch—and there’s always a catch—this stuff isn’t cheap to run. Industry estimates place the upgrade costs between $45 million and $ 55 million, with payback periods ranging from 7 to 9 years, depending on utilization rates and market conditions.

Additionally, you can expect 25-30% higher energy consumption and approximately 40% more skilled technicians compared to conventional processing. Add currency volatility in Asian markets, potentially squeezing margins by 8-12%, and you start seeing why only operations with serious financial backing can play this game.

Asian Appetite: High Standards, High Stakes

Let me tell you something about these QSR contracts—McDonald’s and Pizza Hut don’t mess around. We’re talking about quality standards that would make your head spin, and one slip-up can cost you contracts worth tens of millions of dollars. Industry sources estimate that these deals range between $50 million and $ 80 million annually, though exact figures are, unsurprisingly, closely guarded.

What’s fascinating is how these relationships take 2-3 years of rigorous qualification. You can’t just show up with decent cheese and expect to land a global contract.

Financial Foundation: The Cooperative Advantage

Fonterra’s cooperative structure supports a disciplined debt-to-equity ratio of around 35-40%, providing financial flexibility that publicly traded competitors often can’t match. Here’s what’s impressive: their foodservice segment generates approximately $3.9 billion using just 13% of their milk supply. That’s the kind of milk-to-margin conversion every processor dreams about.

| Market Segment | Milk Volume Used | Annual Revenue | Margin Impact |

|---|---|---|---|

| Foodservice | 13% | $3.9 Billion | High margins via premium pricing & contracts |

| Other Markets | 87% | Balance of total | Lower margins, volume-driven |

The Bullvine’s analysis suggests that the Eltham expansion could contribute $12-15 million in EBITDA annually, with a payback period of around 18 months under stable market conditions. The kicker? About 70% of their revenue is locked in through long-term contracts, providing a buffer against the price swings that keep the rest of us up at night.

Strategic Lessons: What This Means for Your Operation

If you’re watching from the Midwest or anywhere else experiencing single-digit growth, take note. The real action isn’t in mature domestic markets anymore—it’s in Asia, where margins and volumes are both expanding rapidly.

But here’s the secret sauce that everyone misses: supply chain integration. Fonterra’s 10,500 farmer-owners aren’t just milk suppliers—they’re true partners providing the high-component milk essential for premium mozzarella quality. That’s a competitive moat most independent processors would find nearly impossible to replicate.

The industry is bifurcating, plain and simple. Commodity bulk producers on one side, precision tech-savvy specialists on the other. Fonterra has planted its flag firmly in specialist territory.

Questions Every Producer Should Be Asking

Here’s what keeps me thinking… are you asking your cooperative or processor the right questions? Do they have a clear strategy for targeting these booming international markets? More importantly, are they investing in technology that actually adds value, or are they just chasing volume for its own sake?

I’ve been speaking with producers across various regions, and those asking these questions—and receiving good answers—appear better positioned for what’s to come in the next decade.

The Bottom Line

Innovation, integration, and insight are becoming the pillars of sustainable dairy profitability. Fonterra’s Eltham upgrade demonstrates how strategic market positioning, advanced processing technology, and cooperative advantages create lasting competitive value.

For producers evaluating their own operations, the blueprint is becoming clear: target growth markets over mature ones, invest in problem-solving technology rather than just capacity, and build supply chain advantages that competitors can’t easily replicate. The processors that can deliver on these fronts are the ones best positioned to provide stable, premium-based milk prices in the years ahead.

This isn’t just about making more cheese—it’s about turning raw milk into lasting global value. Every progressive producer should be watching moves like this closely, because they’re writing the playbook for the dairy industry’s future.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Ultimate Guide to Increasing Milk Fat and Protein – This guide offers practical feeding and genetic strategies for increasing milk solids. It demonstrates how to produce the high-component milk essential for value-added products like mozzarella, directly connecting on-farm decisions to processor profitability and premium milk payments.

- Navigating the Choppy Waters of the Global Dairy Market – Dive deeper into the market volatility the Fonterra strategy is designed to mitigate. This analysis reveals methods for managing risk and understanding the global economic forces that impact milk prices, providing essential context for your own long-term strategic planning.

- The Real ROI of Precision Dairy Farming: Is It Worth the Investment? – Fonterra’s bet is on processing tech; this piece scrutinizes the ROI of on-farm technology. It provides a framework for evaluating if precision dairy tools deliver real financial returns, helping you make smarter capital investment decisions for your operation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!