China just killed $584M of our dairy exports in 4 months—but smart producers are already pivoting to Southeast Asia’s stable markets.

EXECUTIVE SUMMARY: Look, we’re all hearing about this record $8.4 billion in dairy exports, and yeah… the checks have been good. But here’s what’s keeping me up at night: nearly half of that money flows through just three politically unstable countries—Mexico, Canada, and China. When China slapped us with 125% tariffs earlier this year, we lost $584 million practically overnight. That’s the equivalent of our entire Indonesian market… gone. Wisconsin Extension ran the numbers, and if all three markets tank together? We’re looking at a $4 billion hit annually. The producers who are getting ahead of this mess aren’t waiting around—they’re diversifying into Southeast Asia’s 9.9 billion liter market and investing in robotic milking systems that deliver 12-15% consistency improvements. Indonesia just eliminated 99% of tariffs on our products, and their middle class is paying premium prices for quality. Bottom line: stop betting on politicians and start building export resilience that survives trade wars.

KEY TAKEAWAYS

- Diversify or die: Southeast Asia imports 9.9 billion liters annually with minimal political drama—contact your co-op’s international division this week to explore Indonesian and Vietnamese opportunities that pay premiums for consistent quality.

- Technology pays off fast: Robotic milking systems show 12-15% consistency improvements and 5-7 year payback periods for 500+ cow operations—exactly what export buyers demand for zero-residue guarantees and premium contracts.

- Co-products are serious money: China used to buy 42% of our whey exports before the tariff war—start tracking your co-product income because it’s often 15-20% of your total milk value.

- Sustainability opens doors: German buyers are already requiring carbon footprint documentation—get your environmental certifications now because companies like Nestlé won’t buy from uncertified suppliers.

- The math is brutal: If 40% of your revenue depends on Mexico, Canada, and China, you’re overexposed—with feed costs up 19% and milk prices at $22/cwt, you can’t afford to lose export premiums overnight.

The $8.4 billion export celebration is masking a concentration crisis that could bankrupt leveraged operations overnight. With 48% of exports flowing through three politically volatile countries, savvy producers are already diversifying into Southeast Asia’s stable markets while building technological advantages that withstand trade wars.

You know what struck me about last week’s Wisconsin Milk Marketing Board meeting? Three guys bragging about their August milk checks… and not one of them knew their co-op had quietly canceled whey contracts with China.

Look, I get it. U.S. dairy exports hit $8.4 billion in 2025—that’s a $400 million bump from 2024, and everybody’s feeling good about those numbers. However, what’s keeping me up at night is that half of that money flows through just three countries. Mexico, Canada, and China. And China just hammered us with 125% tariffs that wiped out our entire Indonesian market worth—$584 million—practically overnight.

From the feed stores in California’s Central Valley to Wisconsin’s Fox River Valley, I’m hearing the same story everywhere. Producers expanded based on export projections while trade wars quietly demolished their foundation. This isn’t sustainable, folks.

The Three-Country Trap That’s Got Us All Cornered

Here’s the thing about export dependency that most producers don’t fully grasp—and I’ve been tracking this for months now. Take a typical Central Valley operation milking 850 Holsteins through DFA’s Western Division. Every hiccup in Mexico, Canada, or China hits their milk check directly. “When Mexico sneezes, my milk check feels it. Same with Canada and China,” is what I keep hearing at cooperative meetings.

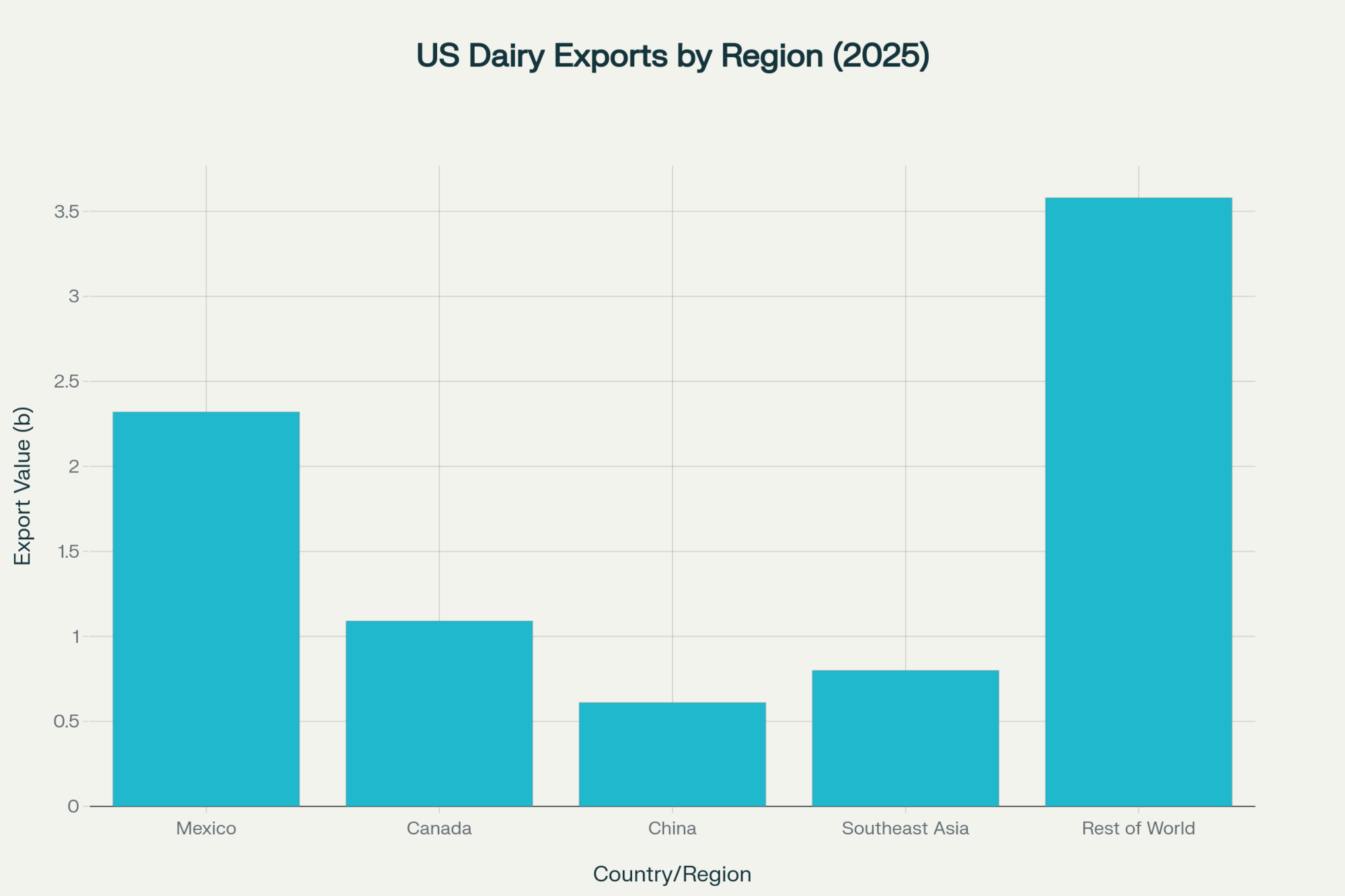

The numbers don’t lie, and they’re honestly more concentrated than I expected when I first started digging into this: Mexico buys $2.32 billion annually, Canada takes $1.09 billion, and China represents $610 million despite all the current hostilities. Those three countries control 48% of American dairy exports. Nearly half!

University of Wisconsin Extension economist Dr. Mark Stephenson doesn’t sugarcoat it: “The current conflict accelerates structural shifts that permanently reshape global dairy trade flows. Today’s tariff rates are exponentially higher than those in previous disputes.”

What strikes me about this concentration is how vulnerable it makes us:

| Market | Annual Value | Share | Political Risk |

| Mexico | $2.32 billion | 28% | Border tensions escalating |

| Canada | $1.09 billion | 13% | USMCA disputes ongoing |

| China | $610 million | 7% | Trade war active |

| Southeast Asia | $800 million | 10% | Generally stable |

| Rest of the world | $3.58 billion | 42% | Mixed conditions |

The Wisconsin Extension ran a nightmare scenario that honestly shocked me: simultaneous disruption in our top three markets would result in an annual loss of $4 billion. For operations that borrowed big on export projections? That’s not just a bad year—that’s bankruptcy math.

China’s Co-Product Massacre (And Why Most Producers Missed It)

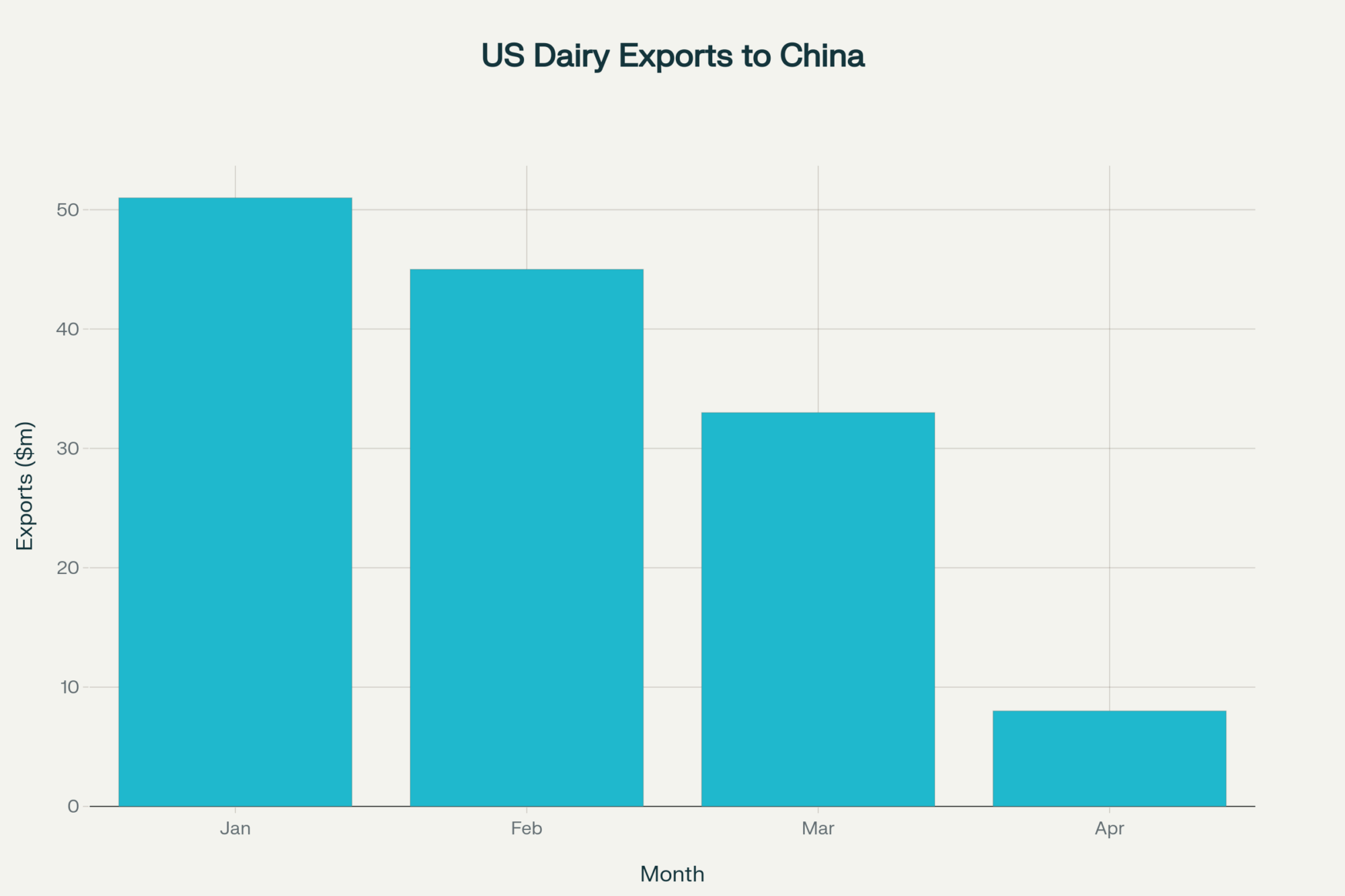

This is where it gets really concerning. I’ve been talking to Wisconsin operations that run 650 Jersey cows, and they’re watching their cooperative whey income just… evaporate. Chinese tariffs exploded from 10% in January to 125% by April 2025. Four months. That’s all it took.

Here’s what most producers don’t track—and this is a big mistake. When you’re making cheese, you create nine pounds of whey for every pound of cheese. Before this trade war, China bought 42% of our whey exports and 72% of our lactose sales. Those co-products… they’re not just byproducts anymore. They’re serious money.

Cornell calculated the damage, and it’s brutal: USDA slashed Class III milk forecasts by 35¢/cwt as these markets collapsed.

The timeline tells the whole story: Source: USDA export data and China’s Ministry of Commerce tariff schedules

| Period | Tariff Rate | Monthly Exports | Wisconsin Impact |

| January 2025 | 10% | $51 million | Manageable strain |

| March 2025 | 34% | $33 million | Pain begins |

| April 2025+ | 125% | $8 million | Market death |

A 92% collapse in monthly export value in four months. One Wisconsin producer put it perfectly at a dairy meeting: “Never count on a government that changes trade rules faster than Jersey cows change moods.”

Indonesia: Finally, Some Good News

Now here’s where things get interesting—and frankly, more hopeful than I expected. California Dairies Inc.’s operations, which include 1,200 Holsteins, are securing direct contracts with Indonesian processors, thanks to the U.S.-Indonesia agreement that eliminated tariffs on 99% of American dairy exports.

What I’m hearing from Central Valley producer meetings is encouraging: “Indonesia’s middle class wants our quality and pays premiums for consistency.” Indonesia represents our seventh-largest export market, with annual sales of $246 million, and this is just the beginning.

Krysta Harden from the U.S. Dairy Export Council gets it: “This deal gives U.S. dairy companies a fair shot at competing without governments tilting the playing field.”

The fact is, while Indonesia provides a clear win, progress elsewhere remains… complicated.

Europe’s Endless Framework Dance

The August 2025 U.S.-EU trade framework represents some progress toward addressing our $3 billion dairy trade deficit; however, specific tariff reductions and European Commission final approval are still under negotiation. We’ve been down this road before.

National Milk Producers Federation’s August brief captures the frustration perfectly: American producers are “done playing second fiddle in Europe’s rigged system.” I couldn’t agree more.

Asia’s Production Revolution (This Should Terrify Us)

While we’re debating tariffs, Asia has undergone a complete revolution in dairy production. And honestly? We missed it. Asia now makes half the world’s milk—458 million tonnes annually. Half!

China’s 4.8% production growth reached 45.5 million tonnes in 2025, while our growth rate is 0.3% annually. Meanwhile, New Zealand’s production contracted to its lowest level in 30 years. The landscape is shifting faster than most people realize.

Land O’Lakes operations near New Prague, Minnesota, are monitoring a 25% drop in premium powder prices as Chinese domestic production improves. “Used to be, they needed our quality. Now they’re building plants that make ours look dated,” one producer told me recently. That’s the reality we’re facing.

Tech: Your Secret Weapon in This Mess

Here’s where I get excited about our future, though. California Central Valley operations, which manage 1,400 cows using four DeLaval robotic milking systems, are reaping real benefits through export contracts that demand consistent quality specifications. This is happening right now.

The global milking robot market is projected to grow from $3.2 billion to $5.3 billion by 2029, driven by a 10.8% annual growth rate, primarily due to increasing demand for high-quality exports. That’s not just growth; that’s transformation.

University of Minnesota Extension research shows that robotic systems typically deliver payback periods of 5-7 years for operations with over 500 cows. The numbers work.

What’s particularly noteworthy about the tech investment reality: Based on University of Minnesota Extension studies and industry performance data

| Investment | Cost Range | Quality Benefit | Export Premium |

| Robotic milking | $200-300K/unit | 12-15% consistency improvement | $0.15-$0.20/cwt |

| Automated feeding | $75-150K/system | 10% nutrition precision | $0.08-$0.10/cwt |

| Sensor monitoring | $25-75K/farm | 20% faster health detection | Zero residue guarantee |

Sustainability: The New Gatekeeper (Whether You Like It or Not)

Wisconsin operations milking 550 cows through Foremost Farms are losing lucrative German contracts for lacking carbon footprint documentation. “They wanted more paperwork than my banker,” is becoming a common frustration at sustainability meetings.

But here’s the thing—companies like Nestlé and McDonald’s fund sustainability research specifically for supply chain requirements. Premium export buyers want responsible production documentation, not just quality milk. This isn’t going away.

Southeast Asia: The Opportunity Hiding in Plain Sight

While everyone obsesses over Chinese losses, Southeast Asia quietly imports 9.9 billion litres annually with minimal political drama. Philippines, Malaysia, Thailand, Singapore, Vietnam—they offer middle-class growth without trade war risks.

What’s fascinating is that regional self-sufficiency rates stay low through 2030, creating sustained opportunities. This isn’t a flash in the pan.

Here’s how I’d rank export opportunities right now:

| Market | Size | Growth | Political Risk | Entry Difficulty | My Grade |

| Southeast Asia | Large | +5.2% | Low | Moderate | A- |

| Latin America | Medium | +3.8% | Moderate | Low | B+ |

| Mexico | Very Large | +2.1% | Moderate | Low | B |

| Canada | Large | +0.8% | High | Very High | C- |

| Europe | Massive | +1.2% | Moderate | Very High | C+ |

| China | Massive | Unknown | Critical | Impossible | F |

Focus on A- and B+ markets. Don’t waste 25% of your budget chasing resistant markets—it’s not worth the headache.

What Your Milk Check Actually Shows

USDA forecasts 2025 all-milk prices at $22.00/cwt, up from earlier projections but still subject to trade volatility. The fact is, feed costs increased by 19% from 2019 to 2024 across major regions. Q2 2025 corn averaged $4.85/bushel, up from $4.12 last year. With 16% of U.S. milk exported, trade disruptions have a direct impact on farm profitability.

The export picture by product tells an interesting story:

| Product | Export Change | Farm Impact | Cash Reality |

| Butter | +87% | Minimal direct benefit | Co-ops capture gains |

| Nonfat dry milk | -21% | Component price hit | Lower protein premiums |

| Whey | -19% | Co-product income loss | Reduced milk checks |

| Specialty cheese | +12% | High potential | Premium processing needed |

Your Action Plan (Don’t Wait on This)

This month, you need to:

- Calculate export dependency using your cooperative statements

- Contact your field rep about sustainability certification programs

- Evaluate robotic milking ROI for your specific herd size

- Research Southeast Asian opportunities through your co-op’s international division

Next six months:

- Document environmental practices for premium export buyers

- Diversify beyond those volatile top three markets

- Invest in consistent technology that creates export advantages

- Build relationships in stable, growing regions

The implementation timeline that makes sense:

| Action | Timeline | Investment | Key Considerations |

| Southeast Asian relationships | 12-18 months | $25-50K marketing | Needs cooperative support and cultural understanding |

| Value-added processing | 24-36 months | $500K-2M | Market demand validation and regulatory compliance are required |

| Sustainability certification | 6-12 months | $15-30K | Essential for premium market access, relatively low risk |

| Technology upgrades | 18-24 months | $200K-1M | ROI depends on herd size and management capability |

The Bottom Line (And Why This Matters Right Now)

Winners capture premium pricing through documented quality, environmental credentials, and strategic diversification—not waiting for politicians to fix broken relationships.

The $8.4 billion export boom masks a significant vulnerability to concentration that can collapse in the face of political crises. China’s $584 million market loss proves trade relationships disintegrate overnight—faster than most of us anticipated.

However, here’s what gives me hope: Indonesia’s breakthrough and the opportunities in Southeast Asia reward producers who build technological advantages and sustainable practices over those who rely on political dependencies.

Your expansion depends on customers you can serve consistently, not governments you can’t control.

What you need to do this week:

- Check your dependency—if 40%+ revenue flows through three countries, you’re overexposed

- Document practices—environmental and quality certifications open premium access

- Evaluate technology—consistency creates competitive advantages, politics can’t eliminate

- Contact your cooperative—international marketing divisions have Southeast Asian contacts ready now

The choice is yours: keep betting on political promises or build export resilience that survives trade wars.

This isn’t doom and gloom, folks—it’s a wake-up call. The producers who act on this now will be the ones still standing when the next trade war hits.

Contact your cooperative’s international marketing division this week. Your future milk checks depend on decisions you make today… and honestly, tomorrow might be too late.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Robotic Milking Systems: A Game-Changer for Modern Dairy Farming – This article provides a tactical deep-dive into robotic milking, detailing how the technology directly improves herd health, milk quality, and labor efficiency—key factors for securing the premium-paying export contracts mentioned in the main piece.

- The Genomic Secret: The Untapped Goldmine in Your Herd’s DNA – Shifting to a strategic perspective, this piece reveals how to leverage genomics to build a more profitable and resilient herd, creating the high-component, efficient cows that give you a competitive edge in demanding international markets.

- Sustainable Dairy Farming: The Future is Green and Profitable – Looking to the future, this article breaks down the practical economics of sustainability. It offers innovative methods for reducing your environmental impact through feed efficiency and management, turning the “gatekeeper” issue into a significant market advantage.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.