Ever wonder why European cheese floods our stores but we can’t crack theirs?

EXECUTIVE SUMMARY: Here’s the deal — the EU-US dairy trade gap is absolutely massive, and it just cracked wide open. European dairy exports to America topped €4.3 billion in 2024, while we barely scraped together $167 million going the other way. That’s a 25-to-1 beating we’ve been taking for years. But this new framework changes everything. We’re getting a 20,000-tonne tariff-free quota — that’s like giving 400 family farms direct access to premium European pricing. Sure, certification’s still gonna cost you anywhere from $650K to $2.5 million depending on your setup, but here’s the kicker… Europe’s Green Deal is jacking up their production costs by 15-20% while our herds keep growing. With Texas and Idaho leading the charge on expansion, this isn’t just about exports anymore — it’s about positioning yourself before everyone else catches on. Don’t sit this one out.

KEY TAKEAWAYS:

- Get in on that 20,000-tonne quota — equals roughly 400 mid-sized operations’ worth of access. Join or start a certification cooperative to split those million-dollar compliance costs.

- USDA’s promising 60% faster certification times — call (202) 720-3423 now because even “faster” still means months of prep work ahead of you.

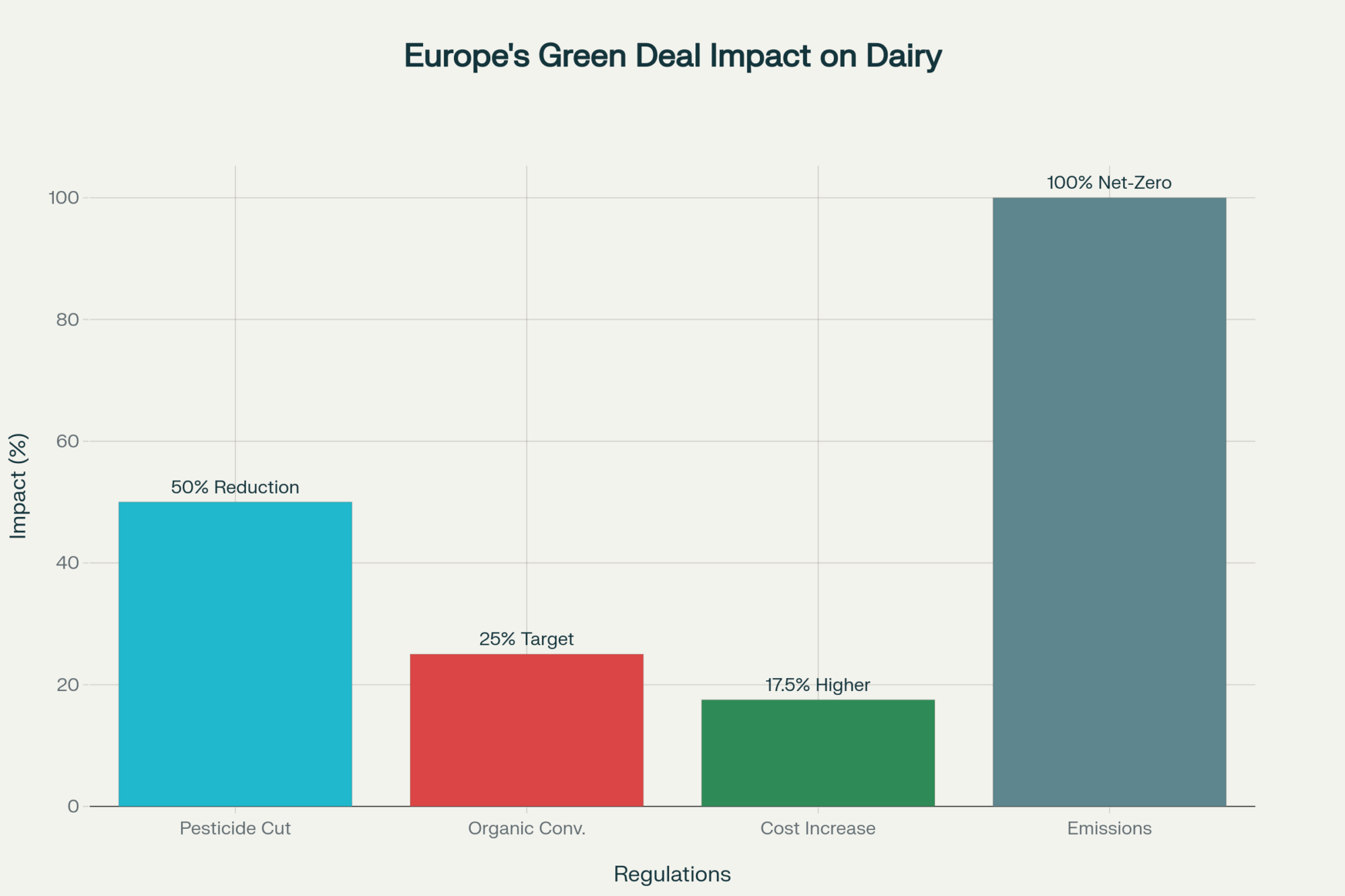

- Europe’s sustainability mandates are pricing them out — their Green Deal adds 15-20% to production costs, giving you a competitive edge if you stay efficient.

- The US herd just hit 9.45 million head with 20,000 added this year — growth means opportunity, but also stiffer competition at home.

- Smart compliance investments pay off double — meet export standards while boosting domestic margins as regulations tighten everywhere.

You know that feeling when you’ve been banging your head against a wall for decades, and suddenly—crack—it gives way? That’s exactly what hit me reading about the August 2025 EU-US Framework Agreement. After watching European cheese and butter flood our supermarkets while American producers got tangled in regulatory nightmares, Brussels finally had to face reality.

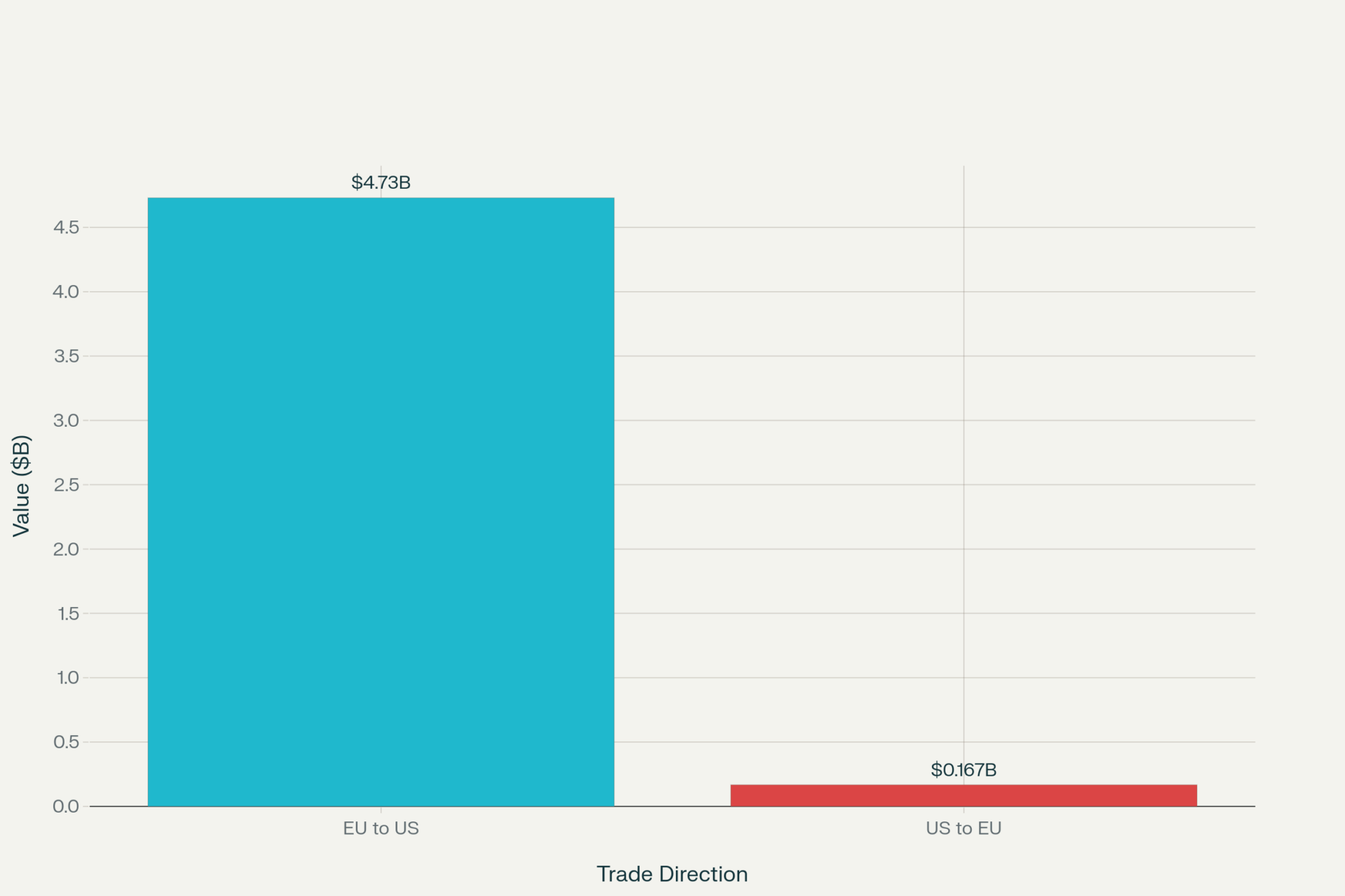

Here’s the numbers that forced their hand: European Commission data shows agricultural exports to the US hit €4.3 billion in 2024, with dairy products playing a major role. Meanwhile, US dairy exports to Europe barely scraped $167 million last year, according to USDA figures. That’s a 25-to-1 imbalance that became politically and economically impossible to ignore.

A Trade Gap So Big It Finally Forced Action

Walk through any processing plant from Wisconsin’s 150-cow family operations to California’s 4,000-head mega-dairies, and you’ll hear the same frustration. European products flow freely while our exports crawl through years of certification hell.

But here’s the breakthrough that’s got everyone talking: the framework opens a 20,000-tonne tariff-free quota for US dairy into Europe. Now, before you roll your eyes at what sounds modest, think about this—that’s roughly the combined output of 400 family farms running 500 cows each. Suddenly, we’re not just cracking the door; we’re pushing it wide open.

New Zealand’s been working this playbook for years. Their 15,000-tonne butter quota into Europe acts like a pricing anchor for their entire domestic market. When Kiwi producers can command EU premium prices for even a portion of their production, it lifts profitability across the board. That’s the kind of leverage American dairy hasn’t had in European markets… well, ever.

Industry feedback from recent dairy association meetings reflects deep skepticism: “These European market promises have been floating around forever. I need to see actual trucks rolling through German warehouses without regulatory delays before I change my expansion plans.” That wariness comes from years of watching certification processes drag on for three years or more.

The Real Investment (And It’s Serious Money)

Here’s where rubber meets road. USDA analysts project certification times could drop by up to 60%—which represents massive progress. But the upfront costs? Industry estimates suggest you’re looking at:

- Small cheese plants (under 50,000 lbs/day): $650,000-$850,000

- Mid-size operations (50-200,000 lbs/day): $1.2M-$1.8M

- Large processors (200,000+ lbs/day): $1.8M-$2.5M

Then add ongoing expenses—lab testing, staff training, compliance monitoring—running tens of thousands annually.

One Pennsylvania processor I know described the reality: “We essentially built a whole new operation inside our existing plant just to meet EU standards. Every piece of equipment, every surface had to be recertified. It’s like building a plant within a plant.”

Production Dynamics Flip: EU Shrinks While US Grows

What’s fascinating about this framework’s timing—it hits just as fundamental production dynamics between the US and EU are completely flipping.

In the Netherlands, environmental regulations are leading to a reduction of around 15% in herd sizes. Industry reports from Dutch producers paint a grim picture: “These nitrogen limits keep squeezing us tighter—every new regulation costs money we don’t have.”

Back home, it’s in growth mode. The US dairy herd reached 9.45 million head with approximately 20,000 added year-over-year through May 2025. Texas keeps booming with double-digit production increases, Idaho’s building processing capacity for mega-dairies, and even Wisconsin family farms are exploring cooperative export strategies.

Smaller producers are getting smart about this—forming cooperative export groups to pool resources, share certification costs, and navigate the regulatory maze together. Wisconsin, Pennsylvania, and New York already have groups in development stages.

Europe’s Cost Burden Becomes Our Competitive Edge

Here’s the underlying story: Europe’s Green Deal mandates are creating permanent cost disadvantages. The requirements—50% pesticide reduction, 25% organic conversion, net-zero emissions by 2050—add an estimated 15-20% to European production costs compared to US operations.

That’s not a temporary market cycle. That’s structural competitive advantage shifting permanently toward American producers just as market access barriers start coming down.

“America’s dairy farmers are done playing second fiddle in Europe’s rigged system,” declared Krysta Harden, USDEC president and CEO. “For too long, the EU has wielded tariffs and red tape as weapons to shut US products out while European exporters enjoyed extensive access to our shelves. That imbalance has saddled us with a staggering $3 billion dairy trade deficit in 2024 alone.”

Your Next Moves (Real Steps, Real Contacts)

If you’re serious about European markets, here’s where to start:

- Contact USDA Export Assistance at (202) 720-3423 for pre-certification assessment. The process can take months, so early engagement matters.

- Connect with your state dairy association about cooperative export groups. Multiple states already have formation meetings scheduled.

- Check out NMPF’s market access resources for industry-specific guidance on EU requirements.

- Explore Farm Credit export financing for facility investments—they understand dairy operations and have specialized programs.

Not ready for exports? Prepare for increased competition at home. European specialty products will keep flowing in, so focus on efficiency, differentiation, and operational excellence.

The Global Ripple Effect

This bilateral agreement is creating waves throughout global dairy markets. New Zealand’s accelerating US market expansion is aimed at maintaining its competitive positioning. Australia’s preparing similar market access demands for EU negotiations. Canada’s monitoring third-party impacts carefully.

“U.S. farmers win when competition is fair, but there’s nothing fair about Europe’s system,” said Gregg Doud, NMPF president and CEO. “An agreement with the EU has the potential to unlock billions in new opportunities for American dairy.”

Bottom Line: The Industry Just Shifted into High Gear

What strikes me most about this framework is how it proves even Europe’s most entrenched dairy protections eventually crack under sustained economic pressure. That €4.3 billion trade imbalance became politically unsustainable, and Brussels had to respond.

The walls protecting European dairy are cracking. European producers who think regulatory barriers alone will protect their turf are living in the past. American producers who assume this automatically opens up European gold mines without serious investment are dreaming.

The winning strategy? Know exactly where your operation stands competitively. If you’re serious about European markets, start building capabilities now—certification takes years even with streamlined procedures. If you’re focusing domestically, prepare for intensified competition by doubling down on efficiency and quality.

The dairy industry just shifted into high gear. Will you be accelerating with it, or watching from the sidelines?

Essential Contacts:

- USDA Export Assistance: (202) 720-3423, fas.usda.gov/topics/exporting

- National Milk Producers Federation: nmpf.org/issues/trade-policy

- Farm Credit Export Financing: farmcreditnetwork.com

Ready to stop watching from the sidelines? This door won’t stay cracked forever.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Canada’s Dairy Fortress Under Pressure: What Smart Producers Are Doing About 2026 – While the main article focuses on Europe, this piece provides tactical steps for cracking another protected market: Canada. It reveals practical strategies for HACCP certification and risk management that directly apply to any export-focused operation looking to capitalize on new trade deals.

- When the Dairy Market Takes a Dive: What Every Producer Needs to Know – This article delivers a crucial strategic counterpoint, showing how to thrive when global markets get volatile. It demonstrates how top producers use risk management, feed strategies, and tactical culling to build operations that are profitable even at low milk prices.

- Embracing the Future: The Latest Innovations in Dairy Technology and their Impact on the Industry – Looking beyond trade, this piece explores the future of dairy efficiency. It highlights how innovations in manure management and other on-farm tech can create new revenue streams and reduce your environmental footprint, future-proofing your operation for tomorrow’s challenges.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!