Fonterra controls 80% of New Zealand’s milk, but farmers are liquidating assets to survive—your co-op could be next

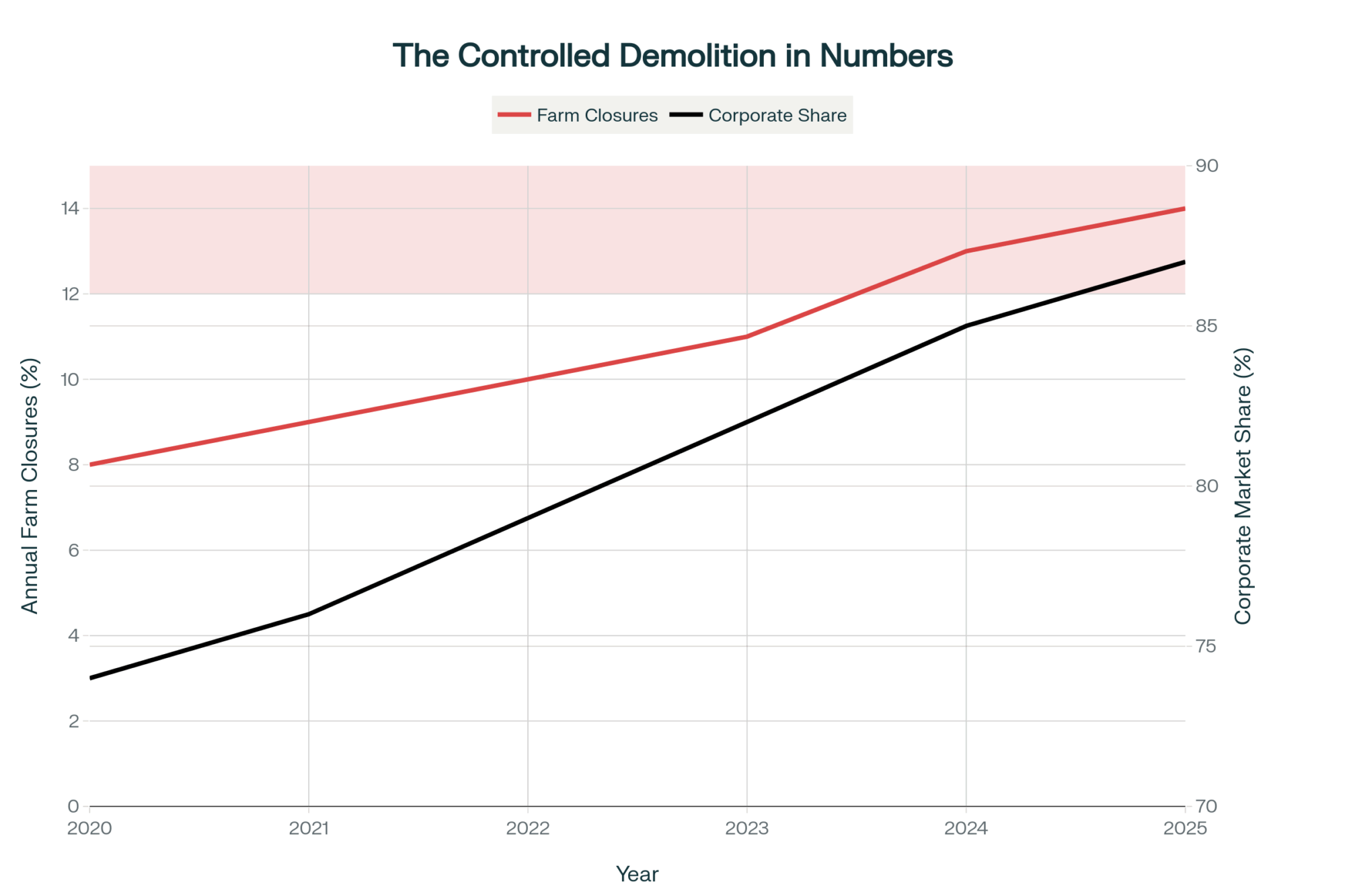

EXECUTIVE SUMMARY: Here’s what we discovered: The dairy industry’s “market volatility” story is covering up the most sophisticated wealth transfer in agricultural history. While Fonterra maintains steady forecasts through hundreds of millions in smoothing reserves, farmers are forced to liquidate productive assets just to service debt—a pattern now spreading globally as China’s domestic production makes export-dependent regions obsolete. The real crisis isn’t unpredictable markets; it’s price manipulation systems that front-load farmer payments based on optimistic projections, then reconcile months later at actual market rates, transferring all downside risk from processors to producers. Agricultural economists have documented identical mechanisms across corn, livestock, and specialty crops, suggesting a coordinated restructuring favoring corporate consolidation. Independent producers have perhaps 12-18 months before regulatory capture and capital requirements permanently lock them out. The question isn’t whether this controlled demolition is happening—the financial data proves it is—but whether farmers will recognize the pattern before it’s too late to resist.

KEY TAKEAWAYS:

- Immediate diversification pays: Farmers using transparent fixed-price contracts instead of co-op smoothing systems can eliminate reconciliation shortfalls that average 8-15% below projected advances

- Document the disconnect: Tracking retail dairy prices vs. farmgate payments reveals margin capture of $0.40-$0.80 per gallon that processors keep while socializing risk to producers

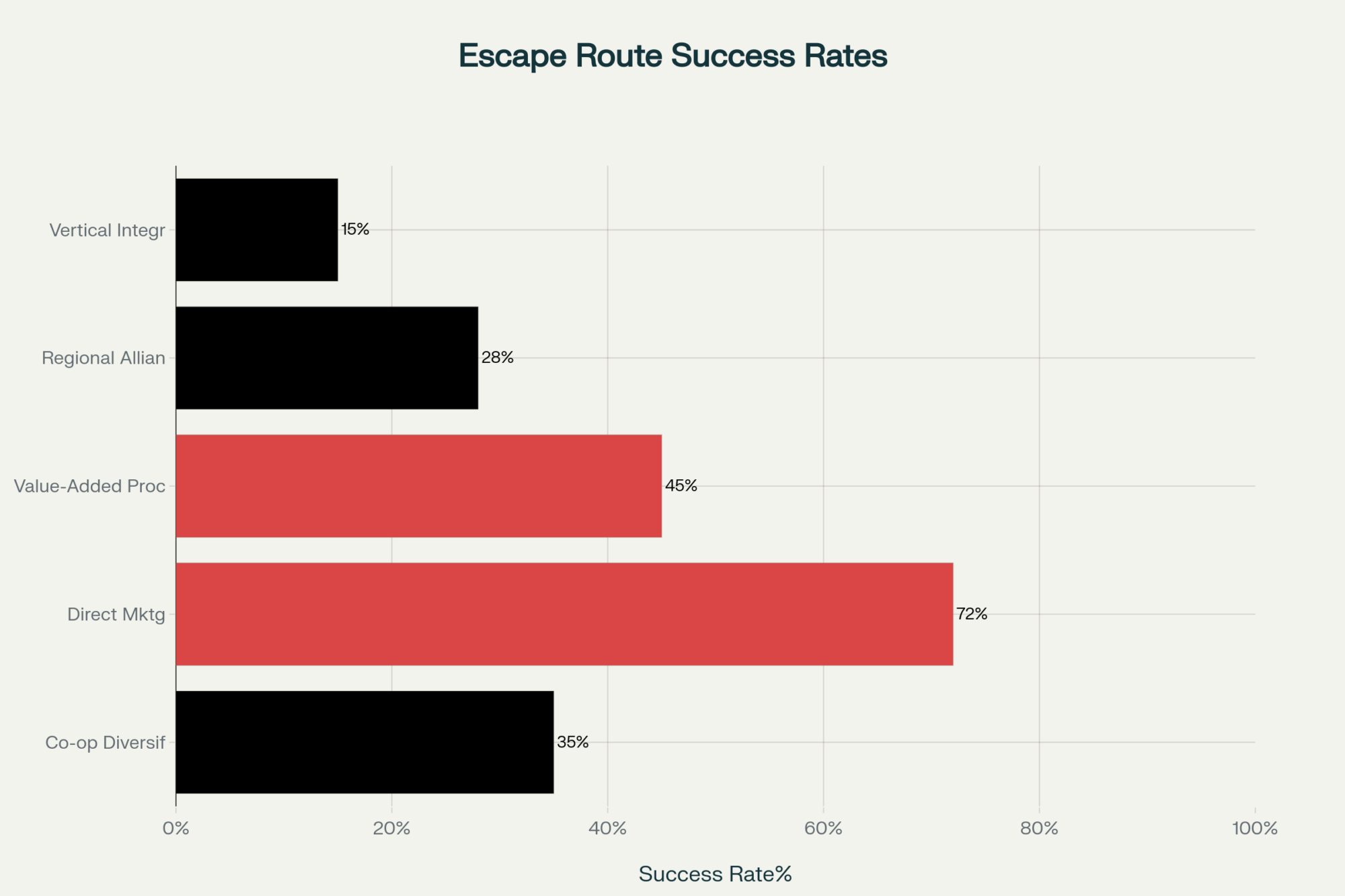

- Build escape routes now: Direct-marketing capability—even small-scale farm stores or local restaurant contracts—can capture 30-50% premiums over commodity pricing before regulatory barriers get higher

- Time is running out: Capital requirements for processing alternatives are rising 12-18% annually, while export quota systems increasingly favor established players over independent operators

- The pattern is spreading: Similar price manipulation mechanisms documented in corn (basis premium capture), livestock (forward contract weighting), and specialty crops signal coordinated agricultural restructuring favoring consolidation

Alright, settle in for this one… because what I’m about to tell you is going to make your blood boil.

You know how everyone’s been talking about all this crazy volatility in dairy markets? Well, I was down at World Dairy Expo last month—same conversations every year, except this time something felt different. Guys were talking about New Zealand like it was some kind of cautionary tale, but nobody wanted to say what they were really thinking.

So I started digging into the numbers. And what I found… Christ, it’s like watching a slow-motion train wreck.

Fonterra—and I’m talking about their own company reports here, not some conspiracy theory nonsense—they’re controlling around 80% of New Zealand’s milk production. Eighty percent! That’s not a cooperative, that’s a monopoly with better PR.

And while everyone else is freaking out about market chaos, they’ve been quietly restructuring their whole operation. Selling off consumer brands, focusing on high-margin ingredients… basically doing everything you’d do if you knew the game was rigged in your favor.

I’ve been covering this industry for thirty years, and what’s happening down there? It’s coming here. Bank on it.

China Doesn’t Need Our Milk Anymore (And It’s About Damn Time We Admitted It)

So here’s the thing nobody wants to talk about at these industry conferences…

The USDA’s been putting out these Foreign Agricultural Service reports that basically spell out the whole story, but somehow it never makes it into the mainstream trade press. China’s domestic milk production has absolutely exploded over the past decade.

Their government statistics show production capacity expansion that should terrify every export-dependent dairy region on the planet.

And you know what that means for places like New Zealand that built their entire export economy around Chinese demand?

Party’s over, folks.

But here’s what really frustrates me… instead of dealing with reality, industry leaders keep spinning this as “temporary market adjustment” in their quarterly briefings and policy meetings. Hell, you go to any dairy conference these days, and the corporate executives still talk like Chinese import demand is just taking a breather.

A breather? Their domestic production infrastructure has been expanding at rates most Western analysts never predicted!

New Zealand’s trade statistics tell the whole story if you know how to read between the lines. Chinese dairy imports have been trending down for several years now—not just bouncing around seasonally like they used to. This isn’t some temporary blip.

This is permanent market restructuring.

But good luck getting anyone in industry leadership to admit that reality…

The Smoothing Reserve Shell Game (Or: How to Rob Farmers in Broad Daylight)

Okay, this is where it gets really ugly. And I mean really ugly.

Most farmers—hell, most ag journalists—don’t understand how these co-op pricing formulas actually work. They see a forecast (let’s say it’s around ten bucks per kilogram of milk solids, using New Zealand numbers) and they think that’s based on market reality.

The reality is way more complex.

Here’s how the mechanism works, and this comes from looking at how agricultural economists describe these pricing systems:

That forecast isn’t based on current market prices. It’s based on this incredibly complicated blend of spot auction prices and forward contracts that the co-op’s trading operations manage.

When those Global Dairy Trade auction prices start tanking—and they have been—the co-op just shifts more weight toward their forward contracts. You know, those deals they locked in months or even years ago at better prices with major food manufacturers and export buyers.

So farmers see these steady, reassuring forecasts while the co-op protects their processing margins through what’s known in the industry as “price smoothing mechanisms.”

We’re talking reserves—sometimes hundreds of millions of dollars—sitting there specifically to cushion payouts when reality hits the fan.

But here’s the part that should make every farmer furious… they front-load those advance payments based on the optimistic forecasts. Farmers spend that money immediately on operating expenses. Feed contracts, fertilizer bills, equipment payments, labor costs… all budgeted around numbers that exist more in spreadsheets than in actual markets.

Then comes the reconciliation. Usually eight, maybe twelve months later.

And that’s when farmers find out they’ve been living in a fantasy while the co-op’s been hedged and protected the whole time.

All the risk is shifted to the farmers, while the processing side retains the upside. It’s brilliant if you’re a corporate processor. Criminal if you’re a farmer.

The Export License Game That Locks Out Competition

You want to see how the system gets rigged in favor of big players? Look at how New Zealand handles dairy export licensing.

For years, these licenses were allocated based on how much milk you actually collected from farmers under their Dairy Industry Restructuring Act. Made sense—more milk, bigger quota, simple math.

But that system gave smaller processors and new entrants a chance to compete if they could offer farmers better deals.

Well, can’t have that, right?

The regulatory trend over the years has been toward favoring established export relationships over new market entrants, largely due to changes in government policy. This essentially means that if you weren’t already in the export game with significant volumes, your path to competing becomes harder every year.

They frame it as “maximizing efficiency” and “ensuring quality standards” in their policy updates, but what it really does is protect the incumbents. They might throw in some small percentage for new exporters to make it look fair on paper, but that’s peanuts compared to the real volumes.

I’ve seen this pattern across agricultural sectors. Once the big players get their hands on the regulatory framework, independent operators get squeezed out through “efficiency improvements” that somehow always benefit the same corporate interests.

Why China’s Exit Changes the Entire Global Game

Here’s what should keep every dairy producer awake at night…

For twenty years, the entire global dairy expansion was built on one assumption: China’s growing middle class would keep buying more and more imported dairy products. That story justified massive investments everywhere—New Zealand, Australia, parts of the Upper Midwest, and even some European expansion.

But what if the story was wrong?

Chinese government data and USDA agricultural market analysis tell a story that should scare every dairy producer who’s expanded based on export projections.

China didn’t just get better at making milk. They got competitive.

Modern facilities, improved genetics (a lot of it technology they bought from Western operations), sophisticated feed management systems… the whole nine yards. Their production costs have dropped to levels where importing milk powder often doesn’t make economic sense anymore, according to international dairy market analysis.

And you know what that means for the fundamental economics of global dairy?

Everything changes.

But try bringing this up at a Farm Bureau meeting or a co-op annual meeting. Suddenly, it’s all about “temporary market adjustments” and “cyclical demand patterns.” Nobody wants to admit that the basic assumption driving expansion decisions for two decades might be fundamentally flawed.

The Debt Liquidation Death Spiral

This part makes me angry…

Industry publications love talking about how farmers are “improving their financial position” by paying down debt. Makes it sound like smart financial management, right?

That narrative is misleading.

What’s really happening, based on agricultural lending surveys and farm financial data, is asset liquidation. Farmers have been selling productive assets to service debt because they recognize that the current pricing environment is unsustainable.

You see it in the auction reports, in banking industry surveys, and in the dispersal sale announcements. Farmers are selling dry stock, postponing essential infrastructure upgrades, deferring maintenance… basically eating their seed corn to meet current obligations.

Why? Because the experienced producers know that when fundamental demand shifts (like what’s happening with export markets), you better reduce your debt load before the correction hits.

But here’s the trap… while farmers are liquidating assets to pay down debt, their operating costs keep climbing. Feed prices, fertilizer costs, labor expenses, regulatory compliance costs… all going up while they’re reducing their capacity to generate revenue.

That’s not financial strength. That’s managed decline.

And the really ugly part? Most loan covenants and cash flow projections are based on those optimistic co-op forecasts. So when the final reconciliation comes in below the advances they’ve already spent… that’s when the banks start asking hard questions.

The Same Pattern, Different Commodities

What really worries me is how widespread this pattern has become…

You see similar systems in corn and soybean marketing through major processors like ADM and Cargill. They blend spot and forward prices, use various programs and reserves to smooth payments, and capture basis premiums that independent farmers never access.

Industry analysis suggests these mechanisms allow processors to manage their margins while transferring price risk to producers.

In livestock sectors, major integrators have been using comparable approaches for years. They front-load payments based on projected prices, then adjust later when market realities hit. Same basic risk transfer mechanism, just different commodities.

The pattern is evident in cotton markets and other specialty crops. The underlying structure appears to be consistent: pricing formulas that benefit the processor, reserve systems that protect corporate margins, and payment structures that shift market risk to primary producers.

And it works. Really well. For the corporate side.

What gets me is how little this gets discussed in mainstream farm media. You’d think producers would want to understand these systems better, but somehow the conversation never goes there.

Why Independent Producers Can’t Compete (And Why Time’s Running Out)

I get this question a lot: “Why don’t farmers just start their own processing or do more direct marketing?”

Valid question. Here’s the reality…

The capital requirements are crushing, according to equipment suppliers and regulatory compliance experts. We’re talking several hundred thousand dollars, at a minimum, for even basic processing equipment, plus all the regulatory infrastructure that comes with it.

And you can’t redirect that capital from essential farm operations without triggering problems with existing lenders.

Then there’s the knowledge gap. Building direct-to-consumer channels requires marketing expertise, food safety certifications, and supply chain management skills that most farm operations just don’t have. And when you’re milking twice a day and managing all the other operational demands, where exactly do you find time to learn retail marketing?

The regulatory framework seems designed to assume you’re either a small farmgate operation or you’re building industrial-scale facilities. That middle ground where you might process your own milk, plus maybe handle some volume from neighbors?

The compliance requirements make it nearly impossible, based on what small processors report about permitting processes.

Cash flow pressure from existing operations is the killer, though. Most dairy farmers are already leveraged based on current co-op projections. Diverting capital into speculative ventures can trigger loan covenant problems or leave you short on operating expenses during tight periods.

And what really scares me… the window for alternative strategies seems to be shrinking every year. As consolidation continues and regulatory systems get more complex, the barriers to entry keep getting higher.

Who’s Really Winning This Game

Let me be crystal clear about who benefits from all this “market volatility”…

Large processing operations—whether they call themselves cooperatives or corporations—make money regardless of price direction. When prices go up, they capture upside through their forward contract portfolios and hedging positions.

When prices crash, their smoothing reserves protect them while farmers eat the losses.

Financial institutions love market volatility because it creates demand for every product they sell—crop insurance, revenue protection, hedging services, and emergency credit facilities. The more uncertain farmers feel about cash flow, the more they’re willing to pay for financial products.

Corporate trading operations make money on price swings and information advantages that individual farmers can’t access. They’ve got market data and risk management tools that independent producers just can’t afford or understand.

Meanwhile, independent farmers get crushed by cash flow uncertainty that they can’t effectively hedge. Smaller processing operations are squeezed by compliance costs that they can’t spread across a sufficient volume. Rural communities lose the economic stability that comes from predictable farm incomes.

And consumer prices? They keep climbing regardless of what farmers get paid. Funny how that works.

What Every Producer Needs to Do (Before It’s Too Late)

Alright, here’s what I think you need to consider if you want to survive what’s coming…

IMMEDIATE ACTIONS (Next 30 days): Stop accepting this “new normal” of engineered volatility. Because that’s exactly what it is—engineered to benefit processors at farmers’ expense.

Diversify your marketing relationships if you possibly can. I don’t care if your family’s been with the same co-op since the 1940s. Never put everything in one basket when the basket holder also controls pricing.

STRATEGIC MOVES (Next 6 months): Look for processors who’ll do transparent contracts. Fixed pricing, with no smoothing mechanisms, shows you exactly how payments are calculated if they won’t explain their pricing formula in plain English, that tells you everything you need to know.

Start documenting the disconnects. Track what you get paid against retail dairy prices in your area. Keep records of forecasts versus actual payments. Those gaps tell the real story of where margins go.

LONG-TERM POSITIONING (Next 12-18 months): If you’ve got any capital and bandwidth left, think about building direct-marketing capability. Even something small—farm store, local restaurants, farmers’ markets. Anything that lets you capture more of what consumers actually pay.

And connect with other producers who are asking these same questions. Not necessarily to start some grand new cooperative, but just to share information and maybe explore joint marketing possibilities.

Time’s running shorter than most people realize.

The Bigger Picture (And Why Every Farmer Should Be Worried)

What’s happening in dairy isn’t unique to our sector. Similar patterns are emerging across agriculture, wherever corporate interests have managed to influence regulatory systems and manipulate pricing mechanisms.

Every year, these systems get more entrenched. More regulatory complexity that favors large-scale operations. Higher financial requirements for market access. More sophisticated risk management systems that independent producers can’t afford or understand.

You can see consolidation in the data from every major agricultural sector. The question isn’t whether it’s happening—it obviously is. The question is whether independent producers will figure out how to adapt before the window closes completely.

Because honestly? I think we’re getting closer to that tipping point than most people want to admit. Maybe not this year, maybe not next year, but sooner than we’d like to think.

Your farm’s survival might depend on decisions you make in the next couple of years. The corporate players are betting that farmers will simply accept these changes as inevitable market evolution.

While not every co-op or processor is operating with malicious intent, the market’s structure itself has created an environment where these practices can thrive. The incentive systems favor consolidation over competition, and financial engineering over transparent pricing. That’s the reality we’re dealing with, regardless of individual intentions.

Prove them wrong.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating The Waves Of Dairy Market Volatility: A Producer’s Guide To Risk Management – This tactical guide reveals how to implement specific financial risk management tools like futures, options, and insurance. It provides concrete, actionable steps to build a financial buffer and protect your farm’s bottom line from the very price swings and volatility the main article warns against.

- EXPOSED: The $29.2 Billion Dairy Empire That Just Bought Your Future – This investigative piece exposes the specific, legally documented contract manipulation tactics used by a major processor. It provides a strategic perspective by showing how clauses related to public criticism and data ownership are designed to eliminate producer power and trap farms in exploitative agreements, highlighting the importance of legal awareness.

- Danone vs. Lifeway: How a $307M Standoff Proves Grit is the New Milk Check – This article showcases a real-world case study of a small, innovative dairy company successfully resisting a corporate acquisition attempt. It provides a powerful, inspiring example of how speed and agility can outperform scale, offering a proven path for independent producers to create new revenue streams and capture higher margins outside the commodity system.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!