New research reveals surprising gaps between laboratory findings and real-world data, offering practical insights for navigating regulatory requirements while managing actual contamination risks

Executive Summary: The disconnect between H5N1 lab research and marketplace reality is costing cheese producers millions in unnecessary recalls. While Cornell’s October study found the virus can survive 120 days in experimental cheese, the same researchers discovered ferrets eating that cheese didn’t get infected—and FDA surveillance detected zero viable virus in 110+ retail cheese samples nationwide. The culprit? PCR testing that can’t distinguish between infectious virus and harmless RNA fragments, yet triggers $10+ million recall costs when it finds genetic debris. Wisconsin’s 19,000 milk samples with zero detections prove systematic surveillance works, but California’s 233 affected herds show real risk exists regionally. Smart risk management means sourcing from tested negative herds, considering pH optimization for natural protection, and avoiding voluntary testing that creates massive liability for what marketplace data suggests is minimal actual risk.

You know how sometimes the headlines tell one story, but when you dig into the actual numbers, you find something entirely different? That’s exactly what’s been happening with H5N1 in cheese.

I was talking with a group of producers the other day, and one of them said something that really stuck with me: “The lab research had us all worried, but our test results keep coming back clean. What’s going on here?” It’s a fair question—and as it turns out, there’s a fascinating answer emerging from the data.

Here’s what’s interesting: We’re now at 442 affected dairy herds nationwide, according to USDA’s latest October count, with California bearing the brunt at 233 farms. Those are real numbers. But for those of us in the cheese business—especially raw milk cheese—the story gets more complex when you compare what laboratory experiments suggest could happen versus what’s actually showing up in marketplace testing.

What Cornell’s Research Really Found

So the Cornell team got this $1.15 million FDA grant last July to figure out if H5N1 could survive cheese aging. Makes sense, right? Their work, which appeared in Nature Medicine this October, involved making these tiny experimental cheeses—about 5 grams each—using milk deliberately spiked with a lab-grown virus.

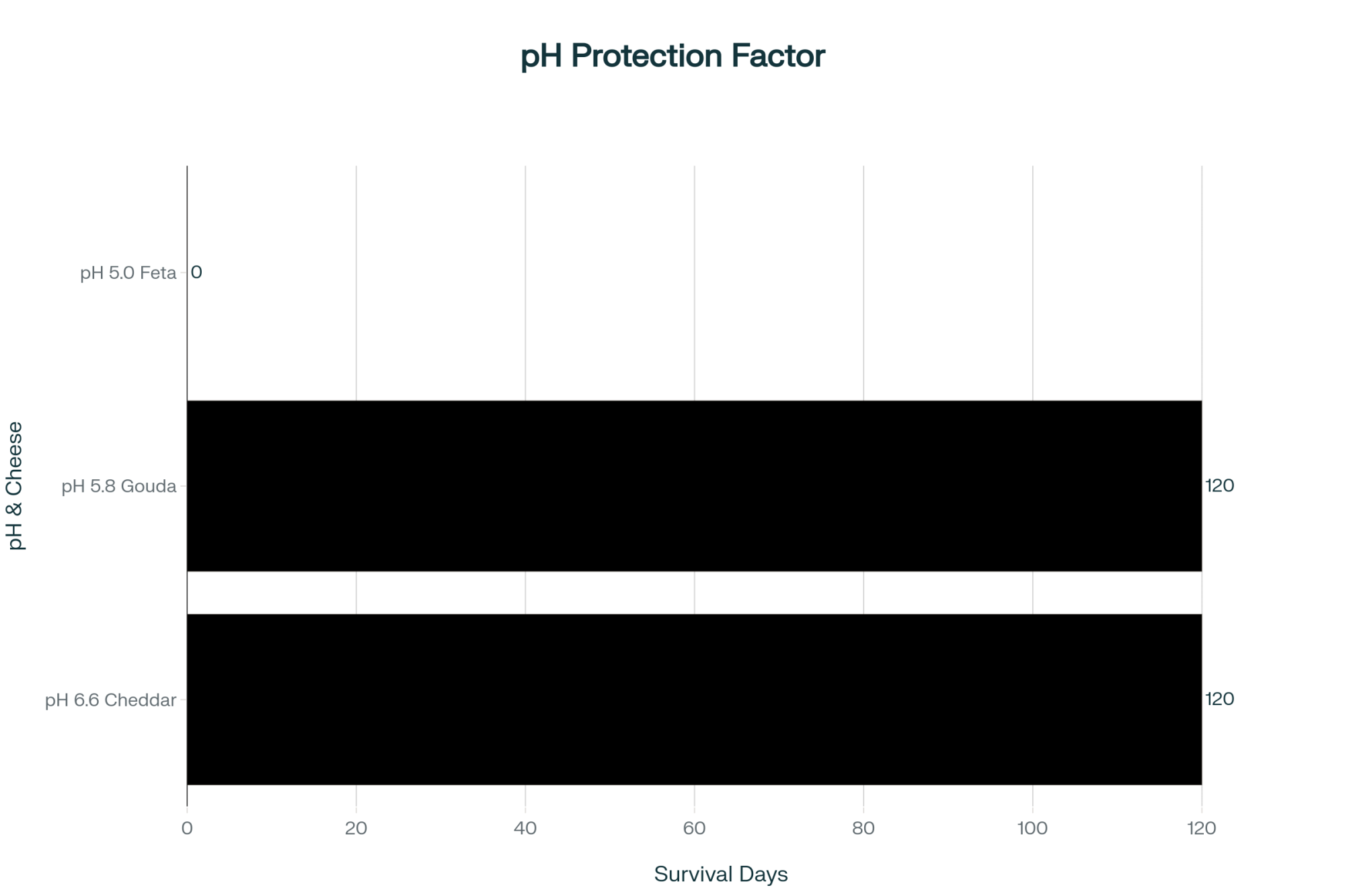

Here’s where it gets interesting, though. They tested three different pH levels, and the results were pretty clear-cut. At pH 6.6 and 5.8—that’s your typical aged cheddar or gouda range—the virus did persist through 120 days of aging. But at pH 5.0? Nothing. No viable virus at all. And you know what runs at pH 5.0? Your feta, your chèvre, most of your fresh cheeses.

But wait, it gets better. When the full paper came out (not just the preprint), it revealed something crucial: they fed this contaminated cheese to ferrets. Now, if you don’t know, ferrets are basically the canary in the coal mine for flu research—they’re incredibly susceptible. And guess what? Not a single ferret got infected from eating the cheese. Not one.

Meanwhile, some ferrets drinking contaminated raw milk did get sick. The researchers think—and this makes sense when you think about it—that the solid structure of cheese might trap the virus differently than liquid milk, where it’s just floating around freely. In cheese, you’ve got this protein matrix, salt everywhere, enzymes breaking things down… it’s actually a pretty hostile environment, even if the virus technically survives.

Understanding the Testing Game: PCR vs. Viability

What I’ve found is that most producers don’t really understand the difference between PCR testing and viability testing—and honestly, why would you? But it matters enormously.

Quick Reference: Testing Types and What They Mean

PCR Testing:

- Detects as few as 5-10 viral RNA copies per microliter

- Results in 3-7 days

- Can’t distinguish between live and dead virus

- Like finding footprints—proves something was there, not that it’s still dangerous

Viability Testing:

- Uses egg inoculation to grow the virus

- Takes up to 30 days for results

- Confirms if the virus can actually cause infection

- The only way to know if there’s a real risk

PCR is incredibly sensitive. According to research published in the Journal of Virological Methods this September, we’re talking about detecting as few as 5 to 10 copies of viral RNA per microliter. That’s… well, that’s basically nothing. It’s like being able to find a single grain of salt in a swimming pool.

But here’s the thing—and this is crucial—PCR can’t tell you if what it’s finding is alive or dead. It’s just finding genetic material. Think of it like finding footprints in your barn. Those footprints tell you something was there, but they don’t tell you when, or if it’s still around, or if it was even a threat to begin with.

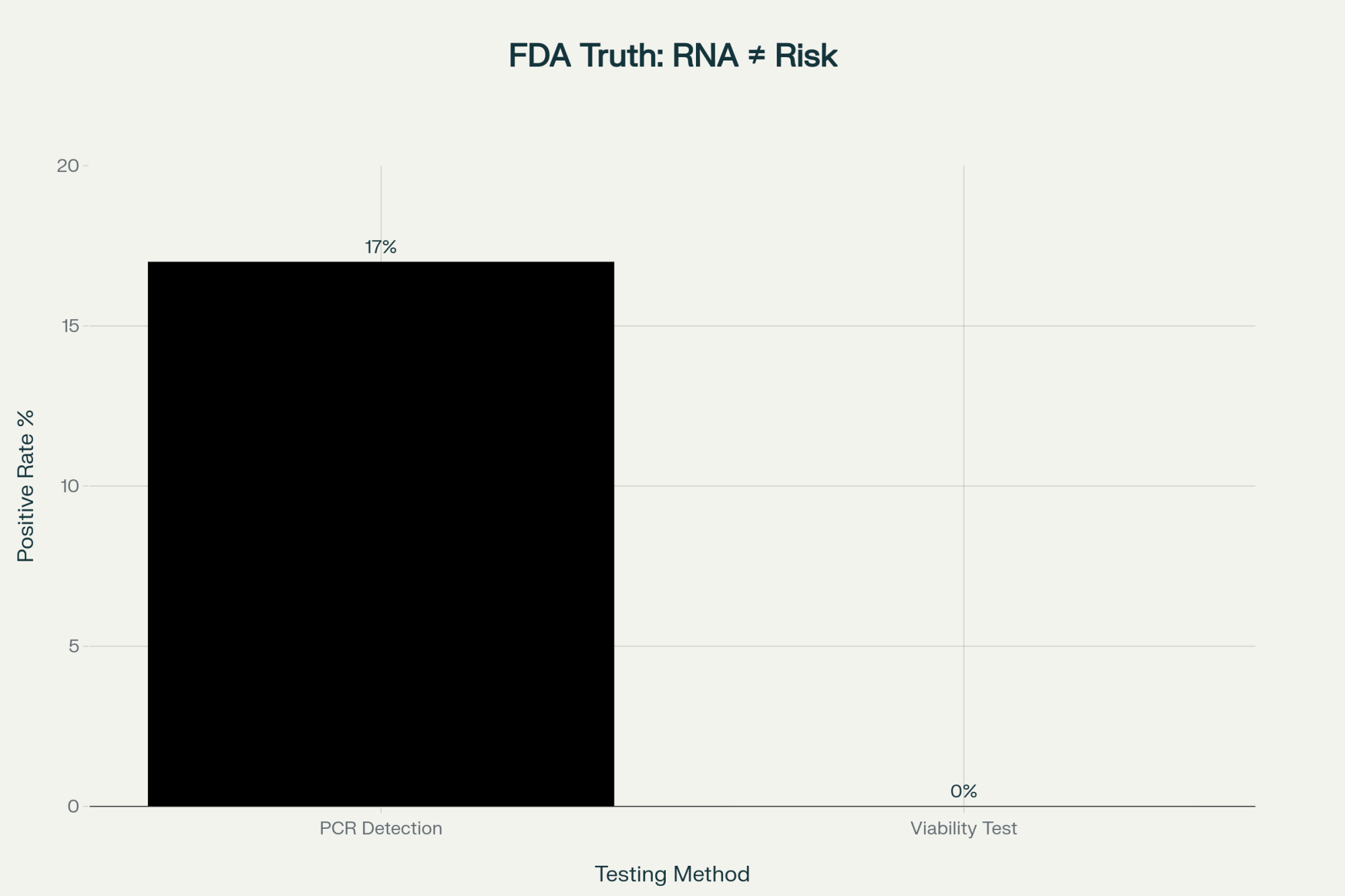

Now, the FDA has been running this massive surveillance program, and its March update revealed something really eye-opening. They found viral RNA fragments in about 17% of some dairy products they tested. Sounds scary, right? But then they took those same positive samples and did viability testing—that’s where you actually try to grow the virus in chicken eggs to see if it’s infectious—and every single sample came back negative. Every one. No viable virus.

Why does this matter? Well, Food Safety Magazine’s analysis puts the average food recall at over $10 million in direct costs alone. So if you’re destroying product based on PCR positives that turn out to be just RNA fragments… you can see the problem.

State Strategies: From Wisconsin’s Testing Blitz to California’s Realities

What’s fascinating to me is how differently states are handling this. Wisconsin—and you’ve got to hand it to them—they’ve gone all-in on testing. They’re processing over 5,000 milk samples every month through their state lab. The result? As of October, they’ve tested more than 19,000 samples with zero H5N1 detections. Zero. That’s not luck, that’s systematic surveillance working.

Pennsylvania took a more measured approach. Their State Veterinarian, Dr. Hamberg, caught some flak back in March when he basically said, “Let’s wait for the full peer-reviewed study before we panic.” Looking back now? Smart move. Pennsylvania has maintained what USDA calls Stage 4 status—that is, no H5N1 present—with over 100 dairy herds. They’re actually the only state with that many herds to achieve that status.

Then there’s California. Different story entirely. With 233 of the 442 affected herds nationally—we’re talking over half the outbreak—they’re dealing with real contamination. I was talking with a Central Valley producer recently who put it this way: “We’re not worried about theoretical risk here. We’ve got affected herds all around us. Our testing is about survival, not compliance.”

And what about operations in the Southeast or Mountain West? They’re watching all this unfold, implementing practical measures based on their regional risk. A Georgia operation I heard about is focusing testing at their processing facility rather than individual farms—makes sense given their smaller dairy sector and limited resources.

The Raw Farm Story: A Cautionary Tale

The Raw Farm situation from last November and December really shows how this all plays out in real time. Santa Clara County found influenza A virus through routine PCR testing on November 24th, right before Thanksgiving—couldn’t be worse timing. This triggered recalls of everything produced after November 9th.

Now here’s what’s important: Despite multiple PCR-positive results across different products, California’s health department confirmed on December 3rd that not a single person got sick. Not one. But the damage was done—holiday sales season shot, product destroyed, consumer confidence shaken.

While Raw Farm hasn’t released exact figures, industry standards indicate that recalls of this scope typically exceed $10 million in direct costs alone. That’s before you factor in lost sales, brand damage, all of that. And remember, this happened during the peak holiday season when specialty cheese sales traditionally surge.

The Economics Nobody Talks About

Let’s get real about the numbers here. Research from the Journal of Dairy Science shows that aging facility costs range from $0.25 to $0.27 per pound for the entire aging period. So if you’ve got 10,000 pounds aging for 120 days—pretty standard for a mid-sized operation—you’re looking at $90,000 to $130,000 in product value, plus another $10,000 or so in aging costs you’ve already paid.

Key Financial Considerations for Producers

- Aging costs: $0.25-0.27 per pound for the entire aging period

- Product Contamination Insurance: $1,000-$20,000 annually (varies by size)

- Voluntary testing: $50-$150 per sample

- Average recall cost: $10+ million in direct expenses

- Viability testing wait: Up to 30 days (during which the product is quarantined)

And insurance? Don’t get me started. Agricultural insurance data shows that Product Contamination Insurance ranges from $1,000 to $20,000 a year, depending on your size. But—and this is the kicker—standard policies usually exclude most recall costs. You need special coverage, and good luck affording it after any claims.

What’s really tough is how this hits different sized operations. If you’re running 500 cows and making commodity cheese, you can spread these costs across volume. But if you’re a 50-cow farmstead operation? These compliance costs can wipe out your entire margin.

I’ve been hearing from a lot of smaller producers who are rethinking voluntary testing. University labs charge $50 to $150 per sample—seems reasonable, right? But if you test voluntarily and get a PCR-positive result —even if it’s just dead virus fragments —you’re often required to report it. That can trigger recalls before anyone even checks whether there’s an actual infectious virus. And that viability testing? Takes up to 30 days. By then, you’re already destroyed.

Some cooperatives are starting to pool resources for testing—spreading costs across multiple small operations. It’s one way smaller producers are adapting, though it’s not yet available everywhere. The Wisconsin Cheese Makers Association has been particularly active in helping members navigate these challenges—they’re a good resource if you’re looking for guidance.

What’s Actually Working Out There

So what approaches are proving effective? From what I’m seeing across the industry, a few things stand out.

First, source control is absolutely critical now. With the USDA’s National Milk Testing Strategy mandatory since December 6th, systematic bulk tank surveillance is underway. If you’re working exclusively with tested, negative herds, you’ve got documentation and significantly lower risk.

pH management is proving to be another practical tool. The Cornell findings that pH 5.0 is protective align with what many of us have long known about acidification. I know several Vermont operations that have shifted toward more acidic varieties—their chèvre naturally hits pH 4.6, which, according to this research, provides inherent protection through normal production.

But here’s something that might surprise you: voluntary finished product testing might actually increase your risk rather than reduce it. Legal guidance emerging in trade publications suggests really thinking twice before implementing voluntary testing unless customers demand it. The liability exposure from triggering costly recalls due to RNA fragments… it’s just not worth it for many operations.

The Market Reality

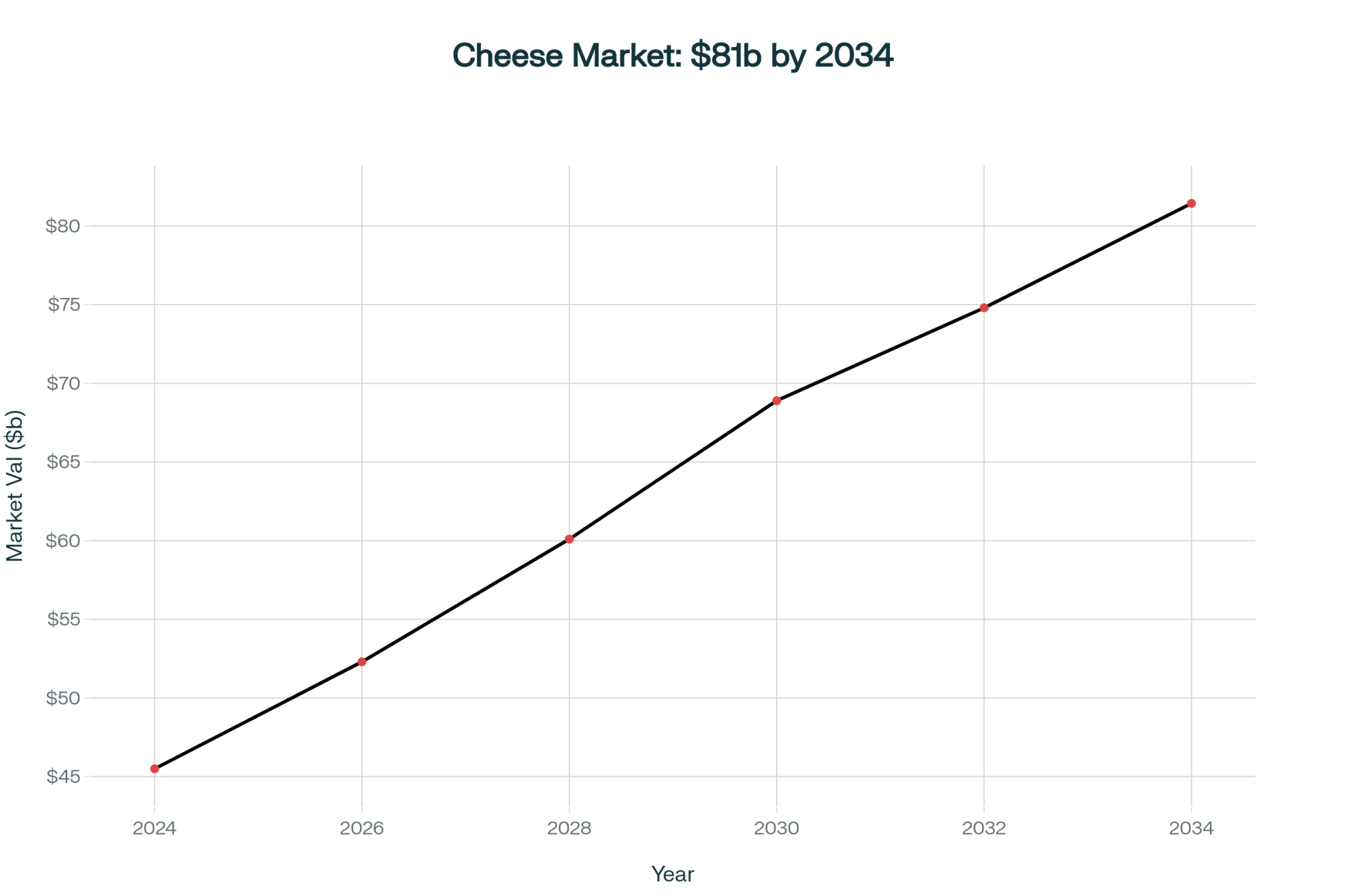

Here’s what’s encouraging: Grand View Research projects that the specialty cheese market will reach $81.44 billion by 2034. Consumer demand isn’t going away. University of Vermont research from this August shows buyers will still pay good premiums for local, artisanal, traditional methods.

But—and this is important—H5N1 testing as a marketing point doesn’t work. Trade publications have been reporting that producers who try advertising their H5N1 testing actually see sales drop. It introduces a concern customers hadn’t even considered. It’s like putting “arsenic-free” on bottled water—suddenly everyone’s worried about arsenic.

What Europe’s Doing Differently

The European approach is worth noting. Their Food Safety Authority concluded in June that H5N1 trade risks are, quote, “a lesser concern” compared to migratory birds. They require demonstrating that actual risk exceeds thresholds before restricting traditional products.

The UK’s surveillance data backs this up. Food Standards Agency testing of 629 raw milk cheese samples found that 82% met satisfactory standards, and zero human infections were reported in their 2024 summary. They’re monitoring, not prohibiting. Different philosophy entirely.

Where This Leaves Us

After looking at all this—the research, the surveillance data, what producers are experiencing—a few things become clear.

The science suggests aged cheese poses minimal real-world risk. Cornell’s ferrets stayed healthy eating contaminated cheese. The FDA found zero viable virus in over 110 retail cheese samples. Wisconsin’s 19,000 tests came back clean. At some point, you have to acknowledge what that’s telling us.

But regulatory frameworks don’t pivot quickly. FDA’s March guidance still says aging “may not be effective,” despite their own surveillance data. That’s just how these systems work—once precautionary measures are in place, they rarely get walked back.

For those of us actually making cheese, this means developing strategies based on real risk assessment, not just regulatory compliance. Source from tested herds—that’s foundational now. Consider pH optimization where it makes sense for your products. Carry adequate insurance, but understand what it actually covers. And think very carefully about voluntary testing that could trigger massive recalls for what might be harmless RNA fragments.

Your geographic location matters enormously here. Operating in Wisconsin or Pennsylvania with comprehensive surveillance and zero detections is fundamentally different from operating in California, where outbreaks are ongoing. Know your state’s status and plan accordingly.

And if you’re a smaller operation—under 50 cows—the economics are completely different. You might need to explore cooperative testing approaches to reduce testing costs, focus on direct sales where relationships matter more than paperwork, and maintain product diversity to spread risk.

The Bottom Line

You know, the specialty cheese market’s going to keep growing. Consumer demand for quality, artisanal products isn’t disappearing. What we’re learning is that producers who understand both the science and the regulatory landscape—who can implement practical risk management based on actual rather than theoretical threats—they’re finding ways forward.

Understanding the difference between finding viral RNA and finding infectious virus, knowing what your state’s surveillance shows, making informed decisions for your specific operation—that’s what gets you through this.

The gap between laboratory worst-case scenarios and what we’re actually seeing in the field tells us something important. While it’s appropriate to be cautious with new threats, there’s a point where precaution becomes… well, maybe overcautious.

This situation’s going to keep evolving. What we know today builds on yesterday, and tomorrow will probably bring new insights. But armed with good science, awareness of regional differences, and practical approaches, we can navigate this while protecting both public health and our operations.

Every producer meeting I attend, every conversation at the co-op, we’re all trying to figure this out together. And that’s actually encouraging—we’re not just reacting anymore, we’re understanding. That’s real progress.

Key Takeaways

- PCR’s $10 million problem: Testing detects harmless RNA fragments but can’t identify actual infection risk—triggering massive recalls for dead virus that FDA surveillance shows doesn’t exist in retail cheese

- The data is reassuring: Cornell’s infected ferrets stayed healthy eating contaminated cheese, Wisconsin tested 19,000 samples with zero detections, and the FDA found zero viable virus in 110+ retail samples nationwide

- Geography drives strategy: California’s 233 affected herds require aggressive risk management, while Wisconsin and Pennsylvania’s comprehensive surveillance with zero detections means regulatory compliance matters more than contamination risk

- Your three-point action plan: Source exclusively from tested negative herds (non-negotiable), optimize toward pH 5.0 or below for natural viral inactivation, and avoid voluntary finished product testing unless customer-mandated—it creates $10M liability exposure for detecting fragments that pose no risk

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Information current as of October 28, 2025. Regulations and surveillance data continue evolving. Always consult current USDA and FDA guidance, along with your state regulations, for the most up-to-date requirements. For more information on navigating these challenges, the Wisconsin Cheese Makers Association (www.wischeesemakers.org) and your state dairy associations can provide valuable resources and support.

Learn More:

- Protecting Your Herd: An H5N1 Biosecurity Checklist for Dairy Farms – Provides a practical, on-farm checklist for enhancing biosecurity. This guide offers actionable steps to prevent the initial herd infection that leads to the raw milk complications discussed in the main article.

- H5N1 in Dairy Cattle: The Economic Ripple Effect on Milk Prices and Markets – Explores the broader market-level impact of H5N1, from milk futures to export restrictions. This strategic analysis provides crucial context for the single-operation recall costs detailed in the main article.

- H5N1 Update: USDA Invests $824 Million in Biosecurity, Testing, and Vaccine Development – Details the next wave of innovation in response to H5N1, including federal investments in rapid testing and vaccine R&D. It answers the “what’s next” question raised by the main article’s testing limitations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!