Feed costs eating your profits? Some herds just cut expenses 26% while boosting milk yield. Here’s their secret.

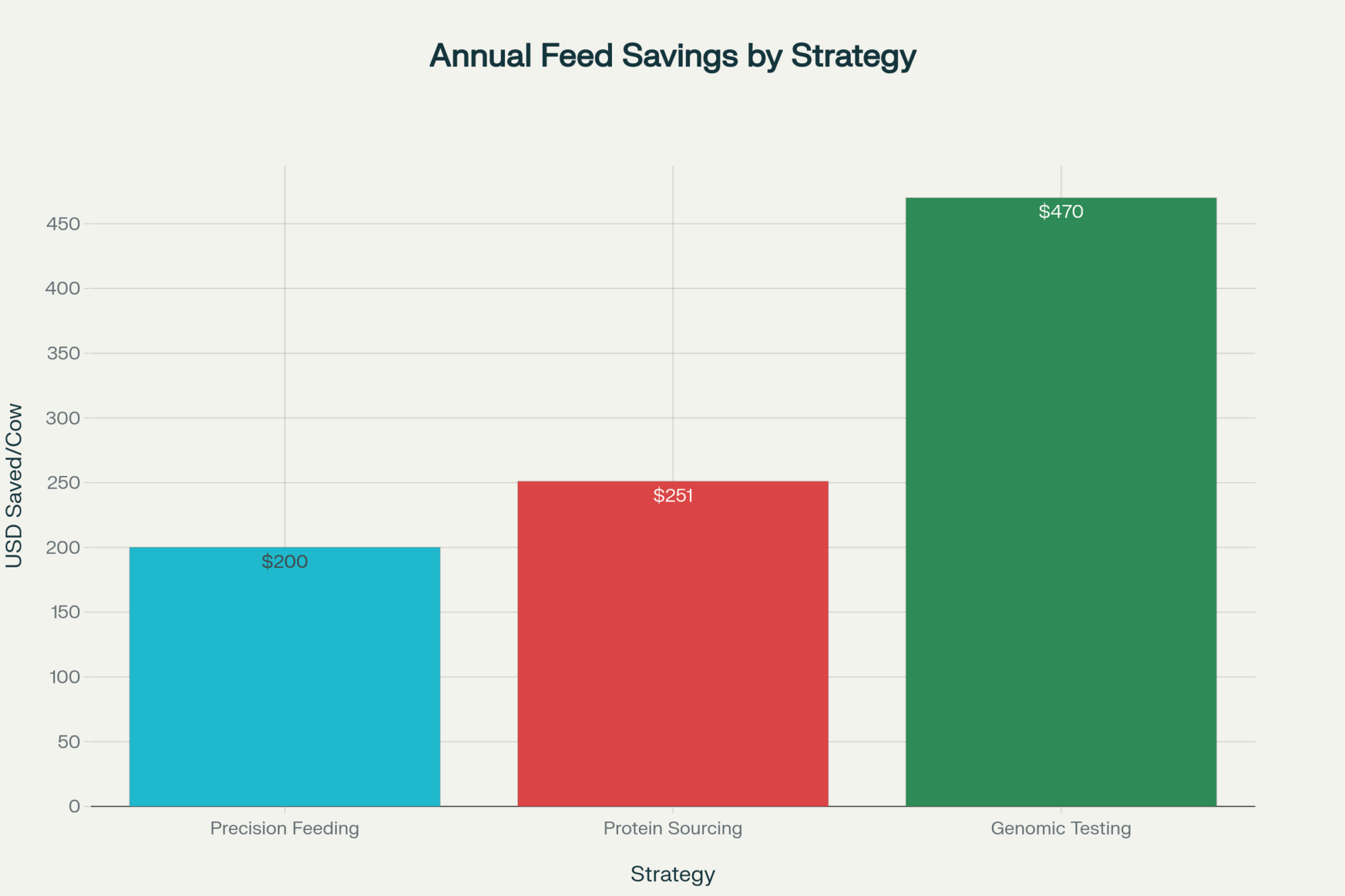

EXECUTIVE SUMMARY: Look, I’ve been watching these markets for years, and here’s what’s really happening right now. The old playbook of “more milk equals more money” is officially dead – we’re seeing operations with 26% lower costs per cow simply because they stopped chasing volume and started optimizing components instead.The numbers don’t lie… precision feeding systems are saving producers $200 to $470 per cow annually, and with Class III futures stuck around $17-18/cwt, every dollar counts. What’s truly remarkable is that while everyone is concerned about oversupply, the smart money is doubling down on feed efficiency and genomic selection to achieve better conversion ratios.Global markets are shifting – Asia is buying up milk powder, Europe’s exports are declining, and the USDA has just bumped up production forecasts again. Here’s the thing, though… profitability isn’t coming from making more milk anymore. It’s coming from making better milk, more efficiently.If you’re not looking at your feed conversion ratios and component production right now, you’re missing the biggest opportunity I’ve seen in years.

KEY TAKEAWAYS

- Reduce feed costs by $200-$ 470 per cow this year by starting with precision feeding technology and improved protein sourcing. University research backs this up, and with volatile milk prices, it’s your fastest path to better margins right now.

- Focus on components over volume immediately – Genetics that boost butterfat and protein percentages pay back faster than chasing production records. The new TPI formula rewards efficiency, not just output.

- Lock in your feed positions before Q4 – Corn’s forecast at $4.20/bushel through 2026, but protein markets are firming up. Smart operators are securing their ration costs now while they can still predict margins.

- Hedge your milk price exposure with forward contracts – Class III futures show $1/cwt premiums for fall delivery. With all this production expansion hitting the market, protect your downside before everyone else figures it out.

- Track global export data monthly – Changes in Asian demand and European trade flows directly impact your milk check. What happens in China and the EU is no longer staying there.

Global dairy markets sent mixed signals this week, creating consequential ripple effects for an industry grappling with surging production capacity and shifting global demand. While milk powders outperformed at the latest Global Dairy Trade Event, underlying concerns about oversupply and cost management remain at the forefront for producers managing increasingly compressed margins.

Key Developments and Market Context

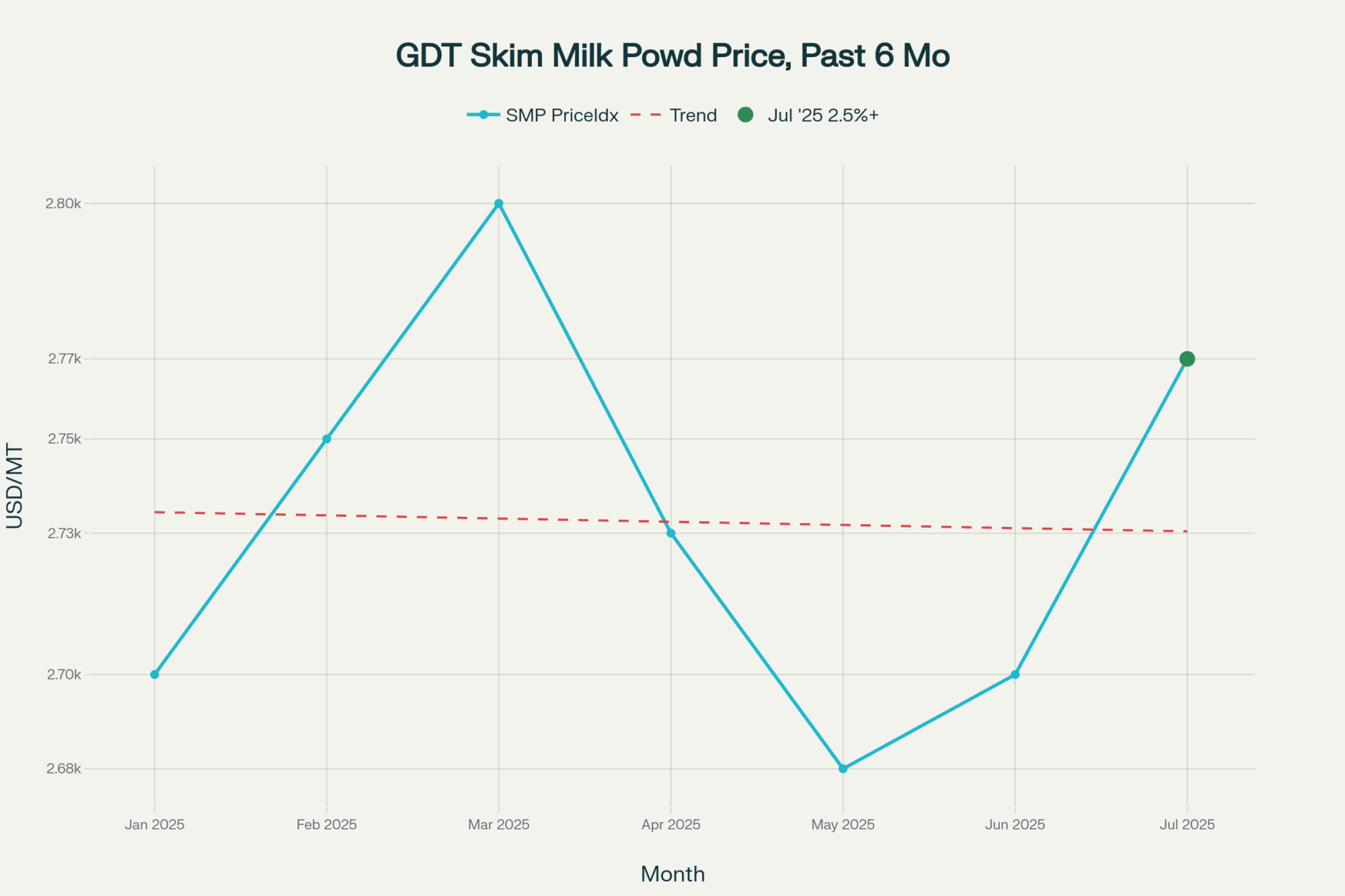

The Global Dairy Trade (GDT) auction brought a touch of optimism, with skim milk powder advancing 2.5% and whole milk powder up 1.7%. However, this strength was countered by softness in butter markets, where CME spot butter fell sharply to $2.5125/lb and EEX European contracts averaged €7,099/tonne (approx. $3.70/lb USD), down 1.1% on the week. While new volume highs in milk powder sales (totaling over 24,000 tonnes) signal resilient demand from Asia, they also highlight intense margin competition amid volatile pricing.

The U.S. Department of Agriculture significantly revised its 2025 milk production forecast upward to 228.3 billion pounds, underlining an expansion narrative powered by herd growth and additional processing capacity. Europe mirrored this pattern, with EU-27+UK May collections up 0.9% but now seeing the first net negative cheese export performance of the year, reflecting global shifts in trade flows and price competitiveness.

Impact on Profitability: Strategic Cost Management Takes Center Stage

With Class III milk futures at muted levels, the upside for July and August is severely limited. Regional weather patterns are driving operational volatility—Midwest yields are rebounding, while herds in the Southern Plains battle environmental setbacks. Such contrasts create short-lived opportunities in local spot markets but reinforce the need for disciplined business strategies.

Financial performance now hinges less on volume and more on manufacturing efficiency, feed management, and risk strategy. As University of Illinois research highlights, precision feeding systems and strategic protein sourcing can result in annual cost savings of $200 to $470 per cow. While feed grain prices remain favorable for now—corn forecasts through 2026 sit near $4.20/bushel—protein markets are expected to remain firmer, requiring operations to optimize total ration economics rather than chasing ingredient bargains.

Industry Perspective and Key Risk Considerations

Katie Burgess, Dairy Market Advising Director at Ever.Ag, emphasizes this point:

“Hedging is not gambling. Hedging is when we take the risk away.”

She highlights the importance of disciplined risk management as unsettled policy and export dynamics introduce further volatility. Federal Milk Marketing Order changes, expected in 2025, along with expanded cheese processing, may challenge historical revenue baselines, requiring producers to closely monitor demand signals and cost drivers.

Consolidation trends are shifting the competitive landscape. This trend is supported by research from the Aegean Region, which demonstrates that larger operations achieve up to 26% lower per-unit costs than smaller farms by capturing scale efficiencies in feed conversion and management. Genetics and nutrition are increasingly payback-focused, with the latest TPI formula updates rewarding feed-efficient cows and component-rich milk, providing a sustained competitive advantage in markets that emphasize solids pricing.

Labor volatility remains a significant and often overlooked hidden risk. Any tightening in immigration or labor market flexibility could lead to double-digit increases in wage costs, putting pressure on productivity and making investments in automation or retention essential for maintaining cost stability.

Actionable Takeaways for Dairy Businesses

- Prioritize component and feed efficiency: Manage for solids and optimize precision nutrition—current paybacks for technology and strategy upgrades remain strong.

- Proactively hedge risk: Utilize price risk management tools, lock in feed positions before market volatility returns, and evaluate Dairy Margin Coverage and forward pricing insurance to mitigate downside risk.

- Monitor global trade policy and market signals: Stay alert to shifts in Chinese demand, retaliatory export tariffs, and evolving production in the EU and Oceania, as these can rapidly alter price and margin scenarios.

- Focus on expansions and investments that drive long-term efficiency. Implementing technology, selecting for genetic feed conversion, and fostering collaborative processing relationships deliver lasting value, rather than chasing immediate volume growth.

Outlook and Closing Perspective

As global supply trends continue to rise and cost variables remain paramount, 2025 will reward producers who align operational discipline with strategic risk management and effective cost control. The ability to capture price premiums and shed unnecessary costs, rather than simply scaling production, will define long-term winners in the new dairy economy.

At The Bullvine, we continue to provide business intelligence and strategic analysis to keep producers ahead in evolving markets. How is your operation adjusting its feed strategy for Q3? Share your insights in the comments below.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 11 Proven Strategies to Lower Feed Costs and Boost Efficiency on Your Dairy – Reveals practical strategies for fine-tuning ration formulation and reducing feed waste that you can implement immediately to maximize profitability while feed markets remain stable.

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – Demonstrates how record butterfat levels and market volatility create strategic opportunities for component optimization and risk management to protect your bottom line through uncertain times.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Explores cutting-edge solutions like smart calf sensors and robotic milking systems that deliver measurable ROI within 7 months while addressing labor shortages and efficiency challenges.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!