What happens when your dairy depends on suppliers you can’t legally use anymore?

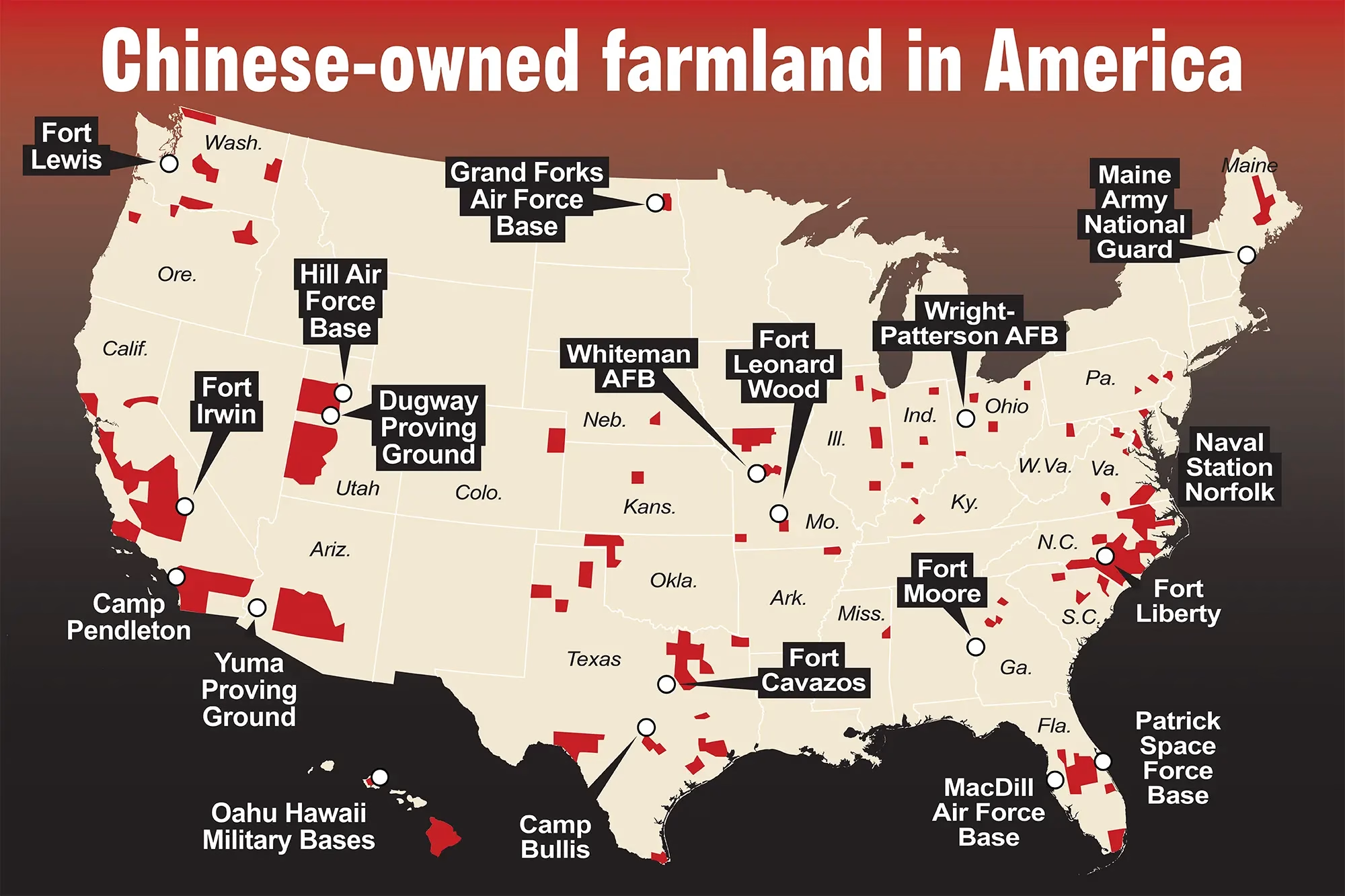

Everyone is talking about Trump’s new farm security plan, but most people are missing the bigger picture here. Sure, the headlines are all about Chinese-owned cropland near military bases, but a story is unfolding that will impact dairy operations in ways we haven’t fully grasped yet.

The Thing About Policy Changes… They Always Have Unintended Consequences

So Agriculture Secretary Brooke Rollins rolled out this National Farm Security Action Plan on July 8th, and honestly? It’s more comprehensive than anything we’ve seen in agricultural security. What strikes me isn’t just the foreign farmland angle—though that’s getting all the press—it’s how this ripples through the technology partnerships, genetic sourcing, and even the feed supplier relationships that modern dairy operations absolutely depend on.

“We feed the world. We lead the world. And we’ll never let foreign adversaries control our land, our labs, or our livelihoods,” Rollins declared. Strong words, but here’s what’s really interesting… this isn’t just about land anymore. Industry geneticists are already raising questions about how these policies might affect genetic evaluation services and international breeding partnerships.

The plan targets seven areas, but three should have every progressive dairy producer paying attention: protecting agricultural research and innovation, enhancing supply chain resilience, and—this one’s huge—putting “America First” in every USDA program. That last point? It’s way broader than most people realize.

Why Your Butterfat Numbers Might Actually Be at Risk

Let me put this in perspective with some numbers that actually matter. Currently, foreign entities control approximately 45 million acres of U.S. agricultural land—that’s roughly 3.5% of all privately held farmland. China’s slice? Just 277,336 acres, which sounds small until you realize where some of that land is located and what companies it controls.

But here’s where it gets interesting for dairy folks… the real concern isn’t just about acreage. It’s about market concentration. Take Smithfield Foods, which has been owned by China’s WH Group since 2013, controlling approximately 25% of U.S. pork production. That $4.7 billion acquisition fundamentally changed the livestock landscape, and dairy economists have been tracking similar patterns in our sector.

Dr. Mary Hendrickson from the University of Missouri has conducted extensive research on agricultural market concentration, and her work suggests that enhanced regulatory scrutiny will likely impact international partnerships across the agricultural sector, from genetics companies to feed suppliers.

Consider your current operation for a moment. How many of your key suppliers have international ownership? Your milking system manufacturer? The company providing your genomic testing? Even some of those specialized feed additives that help optimize your butterfat and protein numbers? More than you might think, probably.

The Numbers That Should Keep You Up at Night

Here’s what really caught my eye in the data… with Class III averaging $18.82 per hundredweight in June, margins are tight enough that any supply chain disruption hits hard. Feed costs account for 50-60% of production expenses for most operations, and when dealing with international suppliers for critical inputs, policy changes like this create real operational risk.

What’s particularly noteworthy is how quickly enforcement ramped up. The USDA has increased penalties for foreign investment disclosure violations to 25% of the fair market value—that’s a 2,400% increase from the previous 1% assessment. This isn’t just a symbolic policy… they’re serious about compliance.

Dairy nutrition experts have long emphasized that when you’re pushing fresh cows for peak milk production, the consistency and quality of specialized feed additives becomes critical. Any disruption in supply chains doesn’t just affect costs… it affects production curves and overall herd performance.

And the biosecurity angle? That’s getting real attention, too. Just last month, the DOJ charged Chinese nationals with smuggling Fusarium graminearum—a fungus that can devastate grain crops. While that primarily affects corn and other feed grains, it highlights the vulnerability of our feed security. When you’re milking cows for 80+ pounds of milk daily, feed quality and consistency aren’t just important —they’re everything.

What’s Actually Changing on the Ground

The enforcement issue is that it’s becoming a personal matter. Rollins now sits on the Committee on Foreign Investment in the United States (CFIUS), which means that agricultural concerns receive equal weight alongside financial security reviews. The USDA also launched an online portal for reporting suspected violations, encouraging anonymous submissions.

Here’s what this means practically: if you’re working with international genetics companies, precision ag technology providers, or even specialized nutrition consultants, expect more paperwork. Due diligence requirements are expanding, and compliance costs are going up.

Industry professionals are already reporting delays in equipment installations and additional documentation requirements for international partnerships. Some operations are experiencing extended timelines for technology upgrades involving companies with international ownership, while others are seeing new requirements for genetic evaluation services that involve international data sharing.

The National Milk Producers Federation has already expressed concerns about unintended consequences, particularly around dairy cooperatives’ international partnerships. And they should be worried… some of our most innovative genetic evaluation tools and breeding technologies come from companies with complex international ownership structures.

The Genetics Game is About to Get More Complex

Here’s where things get really interesting for progressive dairy breeders. Many of our most advanced genomic evaluation tools rely on international databases and computational resources. If those partnerships face regulatory constraints, it could potentially slow genetic progress in U.S. dairy herds.

Consider this: Alta Genetics, CRI, and several other major players in the dairy genetics sector have international partnerships or ownership structures that could be subject to enhanced scrutiny. If your breeding program relies on genomic evaluations that incorporate international data, you may want to consider contingency plans.

Agricultural economists specializing in dairy genetics note that the industry has become increasingly globalized, with breeding data and genetic material flowing across international borders to optimize herd improvement programs. Any restrictions on these partnerships could affect the pace of genetic advancement in U.S. dairy herds.

Regional Realities Are Already Shifting

I’ve been speaking with producers across various regions, and the implementation patterns are fascinating. In the Upper Midwest, where we’ve tight integration with Canadian feed suppliers and some European genetics companies, producers are adapting differently than those in the Southwest, who have been dealing with more diverse international partnerships.

Industry reports suggest that producers are already beginning to diversify their supplier networks as a precautionary measure. Some operations are exploring domestic alternatives for feed additives and other inputs, while others are reassessing their international partnerships to ensure compliance with evolving regulations.

In California’s Central Valley, where water restrictions have driven interest in precision feeding technologies, several operations are reportedly holding off on new system installations until they receive clarity on the regulatory landscape. This could potentially delay efficiency improvements that typically provide significant returns per cow annually.

Here’s what’s interesting, though… this might not be entirely bad news. Enhanced scrutiny could benefit smaller, domestic suppliers who’ve been competing against international companies with deeper pockets. The administration’s emphasis on domestic production suggests potential opportunities for American suppliers to expand market share.

The Compliance Reality Check

Let’s talk about what this actually means for your operation. Foreign investors must now report agricultural land transactions within 90 days, with new penalties of 25% hanging over any violations. However, the reporting requirements extend beyond land purchases to include research partnerships, technology licensing, and certain consulting arrangements.

Agricultural economists tracking compliance costs in dairy operations estimate that farms with international partners may incur increased administrative expenses, depending on the complexity of their relationships. The exact costs will vary significantly based on the scope and nature of international partnerships.

But there’s also the contingency planning aspect… the plan establishes protocols for supply chain disruptions that could actually strengthen domestic supplier networks over time. In regions like the Upper Midwest, where winter feed costs can spike dramatically, having more domestic supplier options might improve price stability.

What Smart Producers Are Already Doing

From what I’m seeing across the industry, the most successful operations are taking a proactive approach. They’re auditing current supplier relationships, documenting international partnerships, and developing contingency plans for potential disruptions.

Industry consultants recommend that operations map out all their international supplier relationships, from equipment manufacturers to feed additive suppliers. Many producers are discovering that a significant percentage of their critical inputs have an international component they hadn’t previously considered.

The most forward-thinking operations are also strengthening relationships with domestic genetics companies and feed suppliers. This isn’t about abandoning international partnerships that work well… it’s about building resilience into your supply chain.

Regional Considerations You Need to Know

What’s particularly fascinating is how this plays out differently across regions. In the Northeast, where many operations depend on Canadian feed ingredients, the policy emphasis on “non-adversarial partners” suggests those relationships should remain stable. Canada controls 32% of foreign-held agricultural land, but they’re clearly not the target here.

In the Southwest, where some operations have partnerships with Mexican feed suppliers or processing facilities, the situation might be more complex. The policy framework doesn’t specifically address Mexico, but enhanced scrutiny could affect cross-border agricultural relationships.

The Great Lakes region presents unique challenges because of the concentration of international agricultural technology companies. Many precision agriculture tools, genetic evaluation systems, and even some specialized veterinary products originate from companies with European or international ownership.

Agricultural researchers tracking these regional patterns note differential impacts based on historical supplier relationships. Operations with diversified supplier networks appear to be adapting more easily than those with concentrated international partnerships.

The Economics of Adaptation

Here’s where the rubber meets the road: adaptation costs. Based on conversations with producers and industry consultants, compliance and adaptation expenses are varying significantly depending on the size and complexity of international relationships.

But here’s the interesting part—some of these changes might actually provide economic benefits. Industry reports suggest that some operations switching from international suppliers to domestic alternatives are finding comparable or even improved cost structures, with the regulatory pressure simply accelerating switches that made economic sense anyway.

The operations facing the biggest challenges are those with highly specialized international partnerships—think custom genetics programs or precision agriculture systems that require ongoing international support. These relationships are more challenging to replicate domestically and more expensive to maintain under heightened scrutiny.

The Bottom Line: Prepare Now, Adapt Later

Here’s what I think this really means for progressive dairy producers… we’re entering a period where supply chain diversification isn’t just good business practice—it’s becoming a compliance necessity. The operations that thrive will be those that proactively adapt to this new regulatory environment while maintaining access to the best genetics, technology, and inputs available.

This development is fascinating from a market structure perspective. We’re potentially looking at a fundamental shift in how agricultural inputs are sourced and how international partnerships are structured. For dairy operations, success means navigating increased scrutiny on international partnerships while capitalizing on enhanced support for domestic innovation.

The smart play? Start now with relationship diversification and compliance documentation. Don’t wait for enforcement actions to force your hand. The operations that get ahead of this regulatory curve will have more options and better negotiating positions as the landscape continues to evolve.

And honestly? Given how concentrated some agricultural input markets have become, a little more domestic competition might not be such a bad thing for producer margins in the long run. The question is whether the transition costs and potential disruptions are worth the long-term benefits. This is something each operation will need to evaluate based on its specific circumstances and risk tolerance.

What’s clear is that this isn’t just policy noise. This represents a fundamental shift in how agricultural assets are viewed from a national security perspective, and dairy operations must be prepared to adapt accordingly.

KEY TAKEAWAYS

- Compliance costs are spiking fast – Farms with international partnerships could see $5,000-15,000 in additional admin expenses annually. Start documenting all your foreign supplier relationships now, especially genetics companies and feed additive sources.

- Feed security vulnerabilities are real – With 50-60% of production costs tied to feed, any disruption hits hard. Map out domestic alternatives for critical inputs like specialized yeast cultures and precision nutrition additives while prices are still competitive.

- Genomic partnerships face scrutiny – International breeding databases and computational resources could get restricted. Strengthen relationships with domestic genetics companies now before regulatory pressure forces rushed decisions.

- Supply chain diversification pays – Some operations switching to domestic suppliers are finding 10-15% cost savings with comparable performance. Use this regulatory shift to negotiate better deals with American suppliers who want your business.

EXECUTIVE SUMMARY

Look, I’ve been tracking this farm security story, and here’s what most folks are missing… the real threat isn’t Chinese farmland—it’s the international partnerships your operation depends on every single day. With Class III at $18.82/cwt and feed costs eating up 50-60% of your budget, you can’t afford supply chain disruptions. The feds just cranked penalties up 2,400% for foreign investment violations, and that’s hitting everything from your milking robots to your genomic evaluations. Operations that diversify their supplier networks now are positioning themselves for better margins when domestic competition heats up. You need to audit your international partnerships before they audit you.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Are Chinese Investors Buying Up U.S. Farmland? Here’s the Truth for Dairy Farmers – Reveals the actual data behind foreign farmland ownership claims, helping producers separate political rhetoric from operational reality and make informed decisions about land acquisition and partnership strategies.

- Your Milk Check Just Dropped 12% Because of Events 6000 Miles Away – Demonstrates proven risk management strategies that reduce financial distress by 18% while increasing cash flow by 36%, showing how to protect your operation from geopolitical supply chain disruptions.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Explores how smart sensors, robotic systems, and AI analytics can reduce dependency on international suppliers while boosting yields by 20% and cutting operational costs in the new regulatory environment.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!