Cheese prices hit 2-day surge as block-barrel spread inverts! Class III futures defy USDA forecasts. Global dairy shifts ahead—key insights inside.

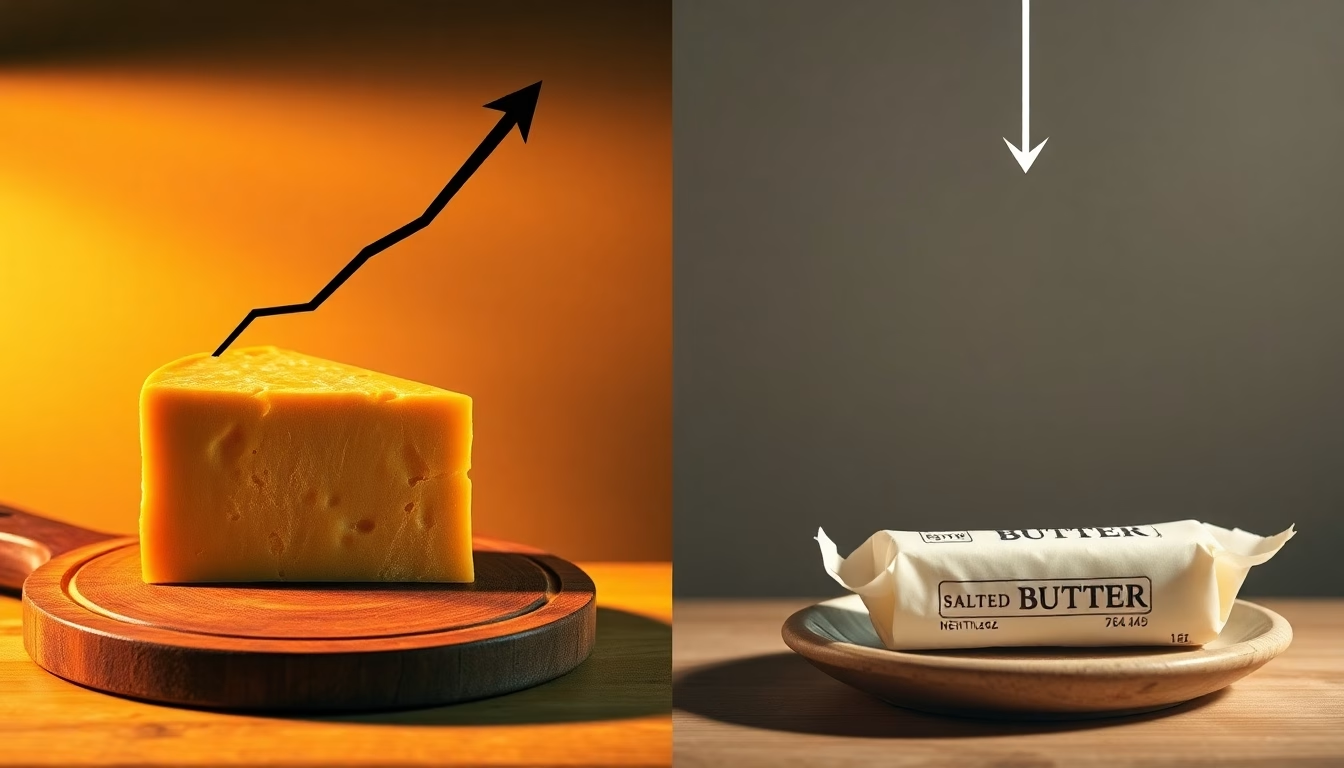

EXECUTIVE SUMMARY: The April 1 CME dairy market saw cheese prices surge (+2.25¢ blocks, +3.50¢ barrels) amid tightening Midwest milk supplies and robust trading activity, while butter held steady. Class III milk futures (.66/cwt) continue to trade above USDA’s Q2 forecast (.50), signaling market optimism despite rising feed costs. Key drivers include New Zealand’s drought-driven production constraints, recovering Chinese import demand, and a rare block-barrel price inversion suggesting barrel supply tightness. Analysts recommend producers lock in Q2 contracts and monitor export trends, as global dynamics and feed prices pose risks to margins.

KEY TAKEAWAYS:

- Cheese Rally: Blocks/barrels gained for 2nd day, with barrels briefly overtaking blocks—a rare inversion signaling tight supplies.

- Futures Divergence: Class III futures ($18.66) outpace USDA’s Q2 forecast ($18.50), reflecting bullish sentiment.

- Global Pressures: New Zealand droughts and Chinese demand shifts may impact U.S. export opportunities.

- Feed Cost Risk: Corn (+5.25¢) and soybeans (+19¢) gains threaten dairy margins unless milk prices rise further.

- Actionable Insight: Secure cheese inventories and forward contracts now to hedge against Q2 volatility.

Today’s dairy market at the Chicago Mercantile Exchange (CME) saw notable strength in cheese prices, with both blocks and barrels posting significant gains amid robust trading activity. Class III milk futures continued to trade above the USDA’s Q2 forecast of .50/cwt, reflecting market optimism about near-term demand and tighter milk supplies. This updated report incorporates enhanced visual analysis and refined recommendations to provide a clearer understanding of market dynamics.

Key Price Changes & Market Trends

Today’s CME cash dairy product prices showed mixed performance across key commodities:

| Product | Closing Price | Change from Yesterday | Trades | Bids | Offers |

| Cheddar Blocks | $1.6575/lb | +2.25¢ | 24 | 7 | 0 |

| Cheddar Barrels | $1.6600/lb | +3.50¢ | 7 | 3 | 0 |

| Butter | $2.3400/lb | Unchanged | 0 | 0 | 0 |

| NDM Grade A | $1.1725/lb | +1.00¢ | 1 | 3 | 1 |

| Dry Whey | $0.4950/lb | -0.50¢ | 2 | 3 | 1 |

Cheddar blocks rose by 2.25 cents, while barrels surged by an impressive 3.50 cents, narrowing the block-barrel spread to just -0.25 cents—a rare inversion that signals tight supply conditions for barrel cheese or strong demand from processed cheese manufacturers. This marks the second consecutive day of gains for both products, driven by tightening milk supplies in the Midwest and steady domestic demand from retail and foodservice sectors.

Butter prices remained unchanged at $2.3400/lb amid quiet trading activity, suggesting that current price levels are sufficient to balance supply and demand. Nonfat dry milk (NDM) gained one cent to close at $1.1725/lb, continuing its gradual recovery as export interest strengthens in Southeast Asia. Dry whey weakened slightly, losing half a cent to close at $0.4950/lb, reflecting softer export demand in key markets such as China.

Volume and Trading Activity

Trading activity was particularly robust in the cheese markets today:

- Cheddar Blocks: With 24 trades completed and seven unfilled bids, blocks saw significant interest from buyers seeking to secure product ahead of the spring demand season.

- Cheddar Barrels: Seven trades were executed with three additional bids left unfilled, indicating strong buyer interest despite the narrowing block-barrel spread.

- Butter: No trades were recorded today, reflecting a balanced market with ample inventories.

- NDM & Dry Whey: These products saw limited activity with one and two trades respectively, consistent with their typical trading patterns.

The narrowing spread between blocks and barrels is noteworthy as it reflects atypical market conditions that may signal further price adjustments in the coming days.

Global Context

International dairy markets continue to exert influence on U.S. pricing trends:

- New Zealand Production: Persistent drought conditions in New Zealand have constrained milk output, limiting their export availability and providing indirect support for U.S. NDM prices.

- European Union Trends: Seasonal increases in EU milk production are beginning to place downward pressure on global butter prices, potentially impacting U.S. export competitiveness.

- Chinese Import Demand: After several months of subdued activity, Chinese import demand has shown signs of recovery, particularly for skim milk powder (SMP) and whole milk powder (WMP). This could indirectly support U.S. NDM prices if the trend continues.

U.S. cheese remains competitively priced against European offerings despite a stronger dollar, bolstering export opportunities to Latin America and Southeast Asia.

Forecasts and Analysis

CME Class III Futures vs USDA Q2 Forecast

The USDA projects Class III milk prices to average $18.50/cwt for Q2 2025—a figure that remains below current CME futures levels. As shown in Figure 1 below, March Class III futures have consistently traded above this forecast throughout the past month:

The chart demonstrates that futures prices have hovered between $18.60 and $18.75/cwt for most of March, reflecting stronger market sentiment than USDA’s conservative projection. This divergence may be attributed to expectations of tighter milk supplies or stronger-than-anticipated domestic cheese demand.

Feed Costs

Feed markets showed upward momentum today:

- Corn futures rose by 5.25 cents to close at $4.61/bushel.

- Soybean futures gained nearly 19 cents to close at $10.33/bushel.

- Soybean meal held steady at $291/ton.

These higher feed costs could pressure dairy margins in Q2 unless milk prices rise sufficiently to offset input cost increases.

Market Sentiment

Market sentiment remains cautiously optimistic as we enter Q2:

- A dairy broker observed: “The active trading we’re seeing in blocks and barrels suggests buyers are concerned about securing product ahead of the spring demand season.”

- Another analyst noted: “The inversion of the block-barrel spread is unusual but reflects tight supply conditions for barrels.”

Overall, participants appear confident in near-term cheese price strength but remain wary of rising feed costs impacting producer margins.

Closing Summary & Recommendations

Today’s dairy markets exhibited strength in cheese prices amid active trading, while other products showed mixed performance:

- Producers should consider forward contracting milk sales for Q2 at current price levels to mitigate margin risks from rising feed costs.

- Exporters should monitor Chinese import trends closely through mid-April as renewed buying interest could support NDM prices further.

- Processors may want to secure cheese inventories now before potential further price increases driven by seasonal demand.

In summary, while cheese markets remain well-supported heading into spring, stakeholders should remain vigilant about evolving global dynamics and input cost pressures that could influence market conditions in the coming weeks.

READ MORE:

- March 26, 2025 – Mixed Dairy Markets as Nonfat Dry Milk Surges, Cheese Retreats

Explore how nonfat dry milk surged amid strong export speculation, while cheese prices dipped, and Class III futures continued to outpace USDA forecasts. - March 18, 2025 – Cheese Prices Plummet as Butter Softens, Dry Whey Provides Lone Bright Spot

Analyze the sharp declines in cheese prices and butter’s continued weakness, with dry whey emerging as the only product showing positive movement. - March 25, 2025 – Cheddar Prices Rise While Butter Retreats

Review cheddar’s price recovery amid strengthening demand and butter’s retreat due to adequate cream supplies, highlighting trends ahead of the spring flush.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Daily for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!