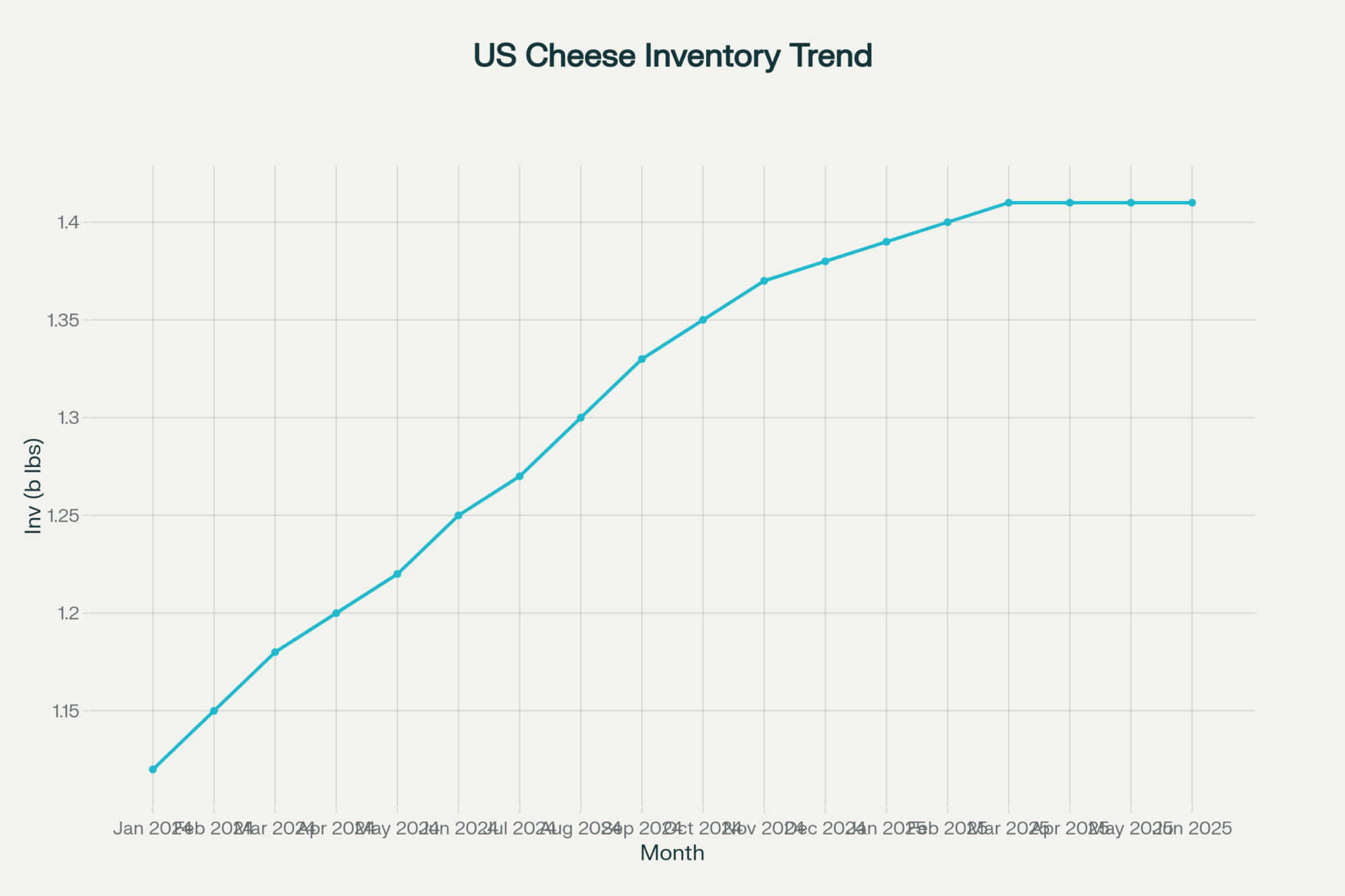

1.41 billion pounds of cheese sitting idle—here’s what that means for your milk check.

EXECUTIVE SUMMARY: Here’s the reality: We’re sitting on 1.41 billion pounds of cheese—the biggest stockpile in a century—and that’s putting serious pressure on your milk prices. CME cheddar blocks have been bouncing around $1.80 per pound, but with this kind of inventory overhang, margins are tightening fast. Income-over-feed-cost margins could squeeze from about $14.50 now to near $12.20 by early next year if current trends hold. The smart money is saying there’s a 75% chance we’ll see a market correction within six months. But here’s the thing—producers who get ahead of this with strategic hedging, feed efficiency improvements, and component optimization are going to weather this storm much better than those who just hope for the best.

KEY TAKEAWAYS:

- Lock in feed security now — Stock 120+ days of feed and review forward contracts for corn and soy to protect against input cost spikes when margins are already tight.

- Optimize milk components for premium capture — Target 3.8%+ protein levels to potentially capture $1.25-1.50/cwt premiums, which becomes critical income protection in a down market.

- Use strategic risk management tools — DMC coverage kicks in around $9.50 margins, and futures contracts through December can stabilize revenue streams during this volatile period.

- Invest in operational efficiency now — Feed efficiency technologies and precision management can potentially save $300-500 per cow annually, providing crucial margin protection when cheese markets are under pressure.

The thing about cheese prices right now? They’re getting a little unsettling. You might’ve seen CME cheddar blocks bouncing around the $1.80 mark recently—down about 9.5 cents in some volatile sessions (see CME Group data). But what really caught my attention is the sheer volume of cheese sitting idle: 1.41 billion pounds in cold storage as of June 2025, according to the USDA’s latest report (see USDA Cold Storage Report). That’s almost five months’ worth of cheese demand sitting quietly, based on average monthly disappearance data.

What’s happening? Milk production keeps humming along. The USDA reports we’re hitting about 18.9 billion pounds monthly as of July 2025, up a bit over 2% from last year (see USDA ERS report). But buyers aren’t keeping pace. Demand isn’t matching supply, and that extra cheese keeps piling up.

At the recent Global Dairy Trade auction on August 5, 2025, the overall index nudged up 0.7%. However, whole milk powder prices rose 2.1%, while lactose wasn’t offered in this round (see GDT auction results). That split is important—it shows different products face distinct supply and demand pressures.

The butter market in Europe is also telling a different story, trading about 46% higher than our CME prices—a premium highlighted in Rabobank’s Q1 2025 Dairy Quarterly (see Rabobank Quarterly). This spread often signals potential export arbitrage that could weigh on U.S. butter prices over time.

The futures market is showing backwardation, meaning prices are higher now than for future months. This means the market expects oversupply to build in the future, which could translate to lower prices for your milk checks down the line.

China’s dairy production has dipped about 2.6%, which usually would open import doors. But tariffs have hovered around 10%, following a temporary reprieve, with uncertainty over potential increases. Meanwhile, Europe’s producing roughly 10.8 million metric tons of cheese annually—mostly specialty varieties—but processing capacity limits their ability to absorb U.S. surplus.

What does this mean for your milk check? Industry prices for Class III milk recently hovered around $17.32 per hundredweight in July 2025. Projections beyond that vary, so consider this a reference point rather than a forecast. Income-over-feed-cost margins may tighten from around $14.50 now to about $12.20 early next year.

Dairy Margin Coverage programs typically trigger protections near a $9.50 margin, providing some cushion if the market dips further (see Penn State Extension).

5 Smart Moves to Protect Your Margins

- Stockpile feed and lock in pricing where possible. Aim for at least 120 days’ worth. Review your forward contracts and look for opportunities to secure favorable prices on key feeds like corn and soy.

- Forward-price your milk prudently. Futures contracts extending through December can stabilize your revenue but weigh the trade-offs carefully—locking prices also caps your potential upside if markets improve.

- Maintain proactive communication with your co-op or milk buyer. Discuss your anticipated volume and component levels regularly—they might offer you premiums or pricing adjustments based on that dialogue.

- Optimize your milk components. Target protein levels of 3.8% or higher, which have been reported to yield premiums in the range of $1.25 to $1.50 per hundredweight, depending on your market and buyer.

- Invest in feed efficiency technologies. Automated feeding systems, like DeLaval’s latest offerings, can significantly boost feed efficiency, leading to substantial savings on feed costs (see DeLaval). The exact financial benefit varies by operation size and management.

Bonus tip: Reevaluate culling strategies and consult your financial advisor to ensure your capital plan can withstand market volatility.

Looking Ahead

The consensus among market analysts is a roughly 75% chance of a correction hitting within the next six months. If demand remains steady, working through the surplus inventory could take close to two years according to INTL FCStone (see INTL FCStone analysis).

The key takeaway is clear: producers who act early to hedge prices, protect margins, and focus on efficient operations will be much better positioned than those who wait to react.

Markets cycle—this pattern isn’t new. But how you prepare today will shape your resilience in the months and years ahead.

Remember: this article is informational, not financial advice. Be sure to consult your personal advisors before making major decisions.

If you’re closely watching cheese prices and tightening margins, don’t delay. Stay informed, adjust your strategies, and keep evolving with the market. The dairy industry doesn’t wait—and neither should you. What steps are you taking to protect your operation?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – This tactical guide reveals three high-impact, low-cost strategies for the current year. It provides practical methods for optimizing silage, using targeted nutrition like methionine, and managing transition cows to improve health and boost milk components, offering a direct path to thousands in annual savings per cow.

- Global Dairy Market Trends 2025: European Decline, US Expansion Reshaping Industry Landscape – This article provides the strategic, big-picture context for the market pressures outlined in the main piece. It analyzes why Europe’s production decline and America’s expansion are creating a global supply imbalance, offering a crucial long-term perspective on the forces influencing your milk price.

- Revolutionize Your Dairy Operation: How Strategic Tech Integration Can Boost Annual Profits by $4.28 Billion Industry-Wide – Go beyond operational efficiencies and see how technology is a key driver of future profitability. This piece demonstrates how integrating genomic selection, health monitoring sensors, and automated systems can reduce costs, increase genetic gain, and unlock new revenue streams like carbon credits.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.