Congress just reversed the whole milk ban—$4.3 billion and 13 years after dairy farmers first called it out. But here’s the uncomfortable truth: the farms best positioned to profit aren’t the ones that fought for it. Your 90-day playbook to change that.

Executive Summary: Whole milk won—13 years and $4.3 billion too late. Congress reversed school milk restrictions in December 2025, finally acknowledging what a 28-study meta-analysis proved in 2020: children who drink whole milk have a 40% lower risk of obesity than those who drink skim. The catch for most producers: school contracts require 500+ gallons daily, effectively locking out two-thirds of U.S. dairy farms. But the opportunity is real if you know where to look—mid-sized operations should be pushing cooperatives toward whole milk school packaging lines, smaller farms can tap a $2.15 billion premium market where marketing fat as a feature beats hiding it, and component-focused genetics now align with both institutional and consumer demand signals. This playbook segments 90-day action steps by herd size because the market opportunity from this shift is unevenly distributed. The lesson that outlasts whole milk: surviving in dairy means building operations resilient enough to weather the years between when science proves you right and when policy finally catches up.

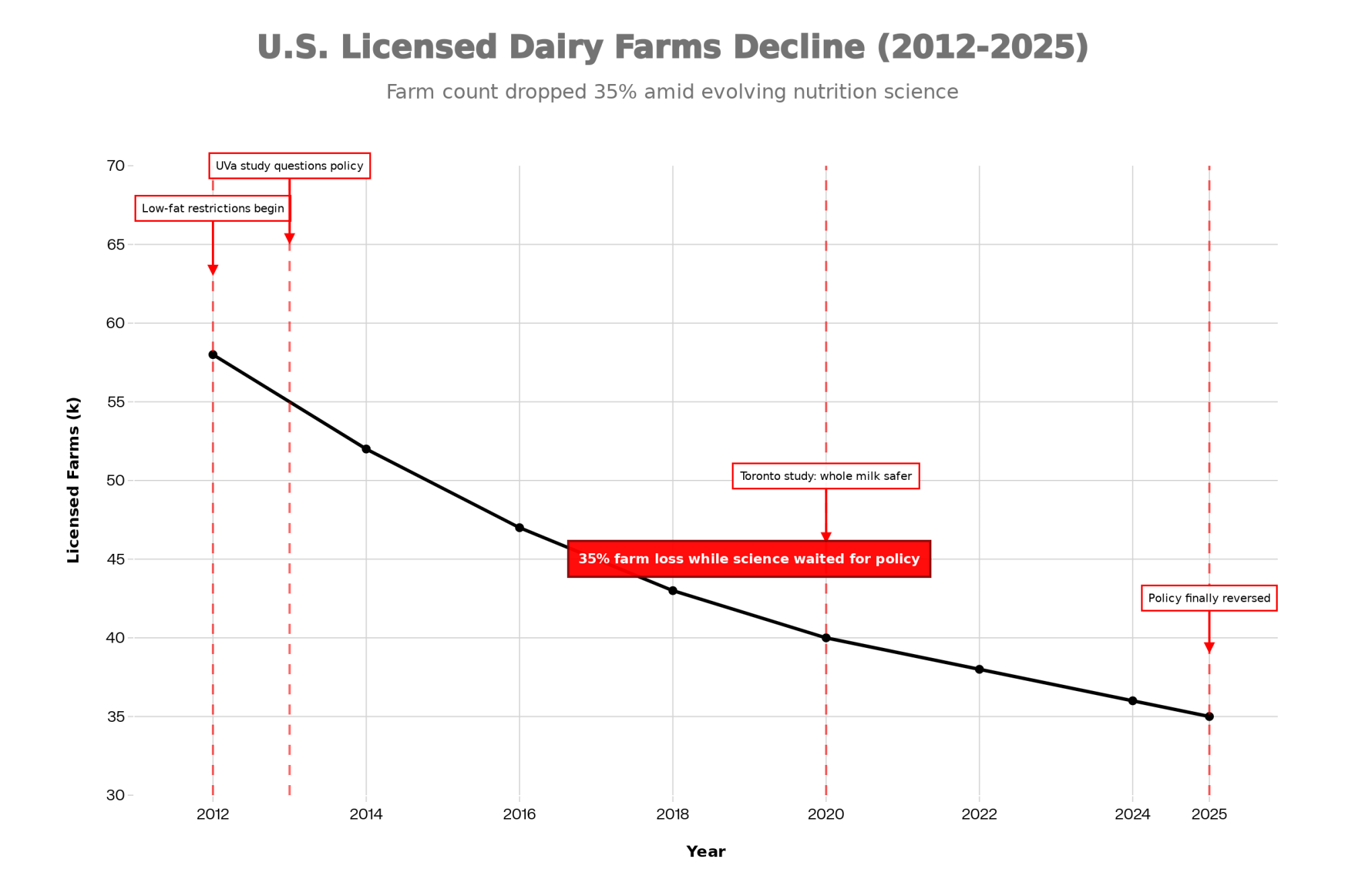

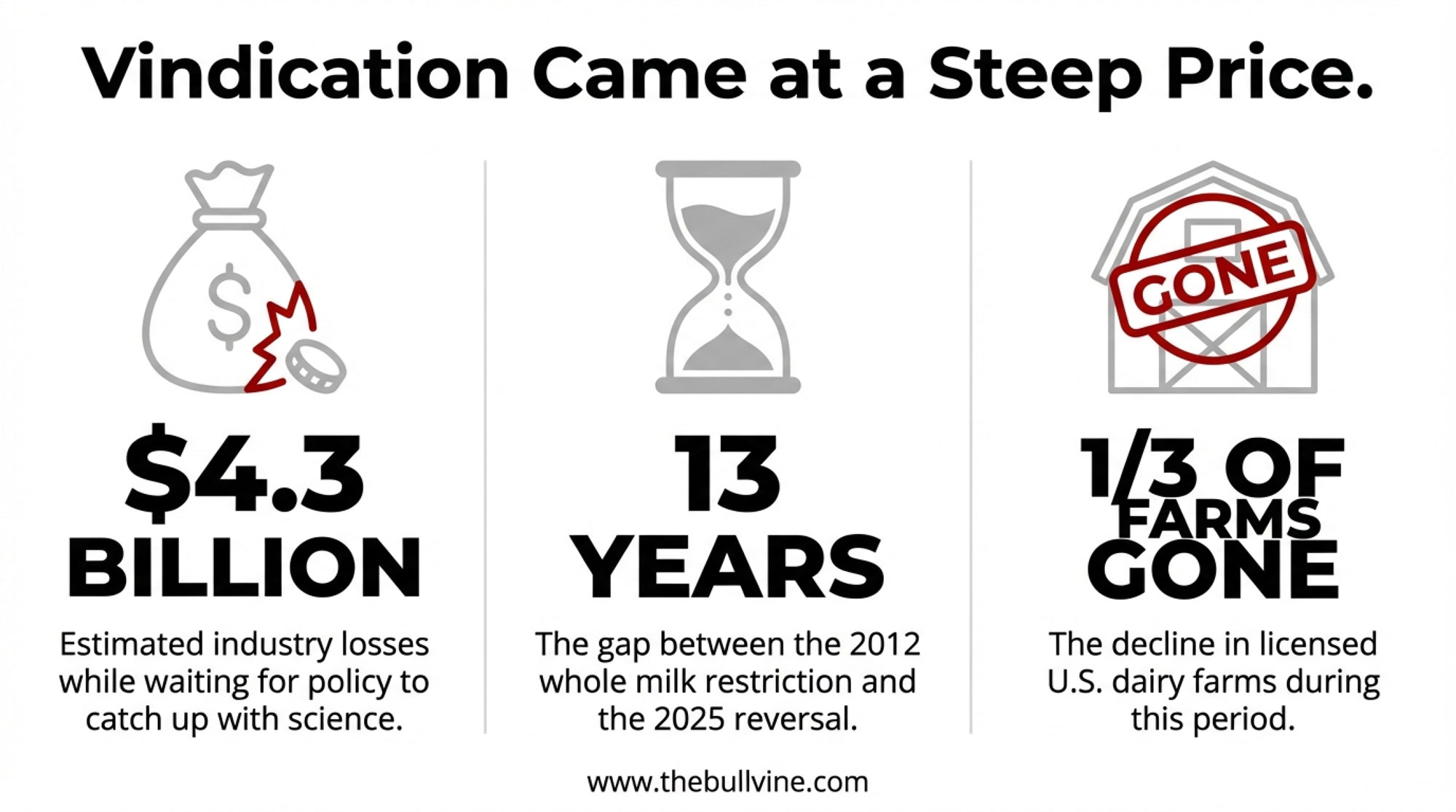

Thirteen years of watching kids push away skim milk cartons. $4.3 billion in estimated industry losses. Roughly one-third of U.S. dairy farms are gone.

And now, finally, whole milk is coming back to schools.

The U.S. Senate passed the Whole Milk for Healthy Kids Act by unanimous consent on November 20, 2025. The House followed on December 15. But before you celebrate, here’s the uncomfortable truth: the farms best positioned to capture this win aren’t necessarily yours—unless you’re running several thousand cows or you’ve already built direct consumer relationships.

So what can the rest of us actually do with this?

The Policy Shift at a Glance

| 2012 Restrictions | 2025 Reversal | |

| Flavored milk | Fat-free only | Whole and 2% permitted |

| Unflavored milk | Fat-free or 1% only | All fat levels permitted |

| Saturated fat rules | Milk counted toward weekly limits | Milk exempted from sat-fat caps |

| Scientific basis | 1980s-era low-fat consensus | A 2020 meta-analysis showing 40% lower obesity risk with whole milk |

| Market access | Favors large processors | Still favors large processors |

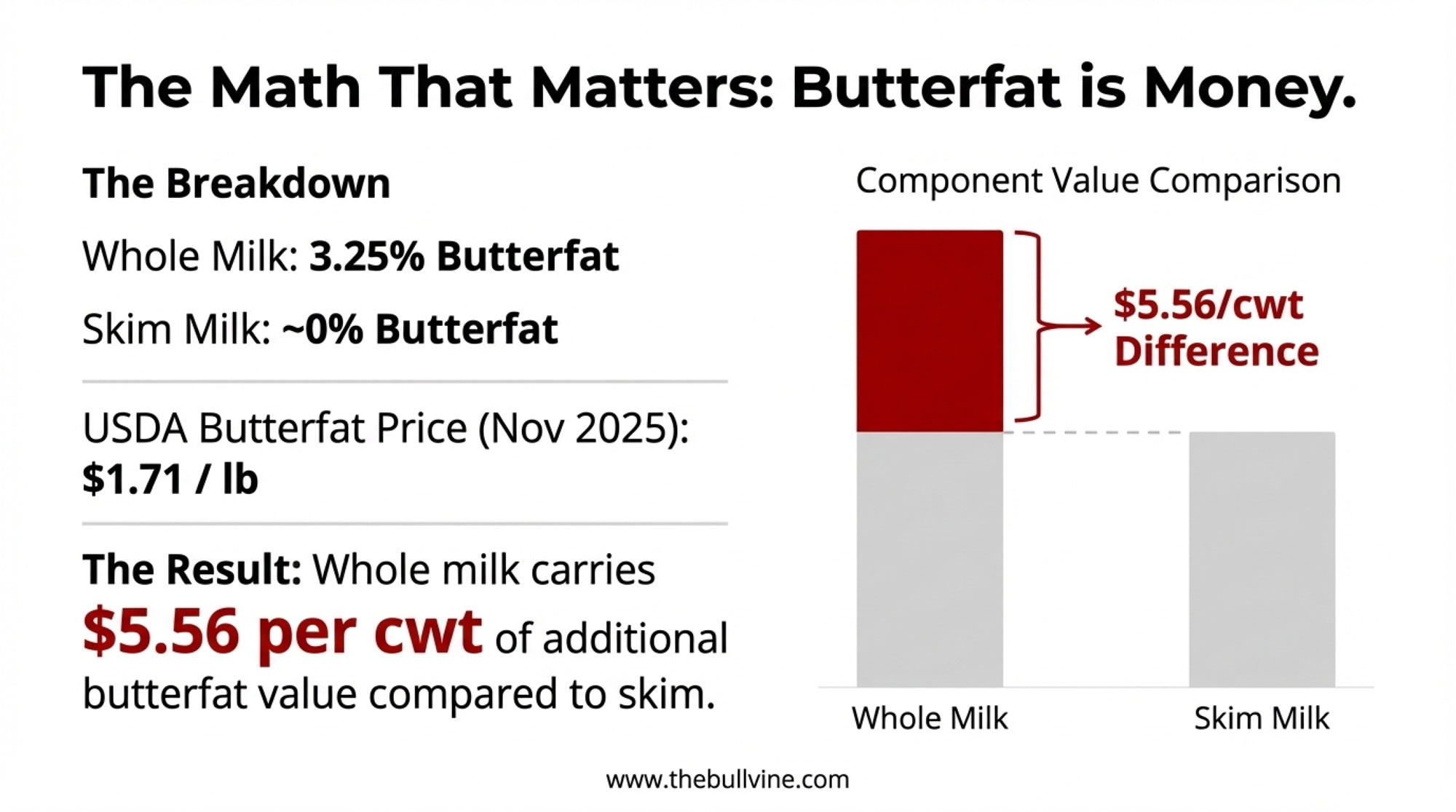

The Component Math: Why This Actually Matters to Your Milk Check

Let’s talk numbers—because this is where the policy shift translates into real economics.

Whole milk contains 3.25% butterfat. Skim milk? Essentially zero. That’s a 3.25-pound butterfat difference per hundredweight.

According to the USDA’s November 2025 component price announcement, butterfat is currently priced at $1.71 per pound. That means whole milk in school channels carries approximately $5.56 per cwt additional butterfat valuecompared to skim.

| Milk Type | Butterfat % | Nov 2025 Value/cwt | Jan 2025 Peak Value/cwt |

|---|---|---|---|

| Skim milk | 0.0% | Baseline ($0) | Baseline ($0) |

| 1% milk | 1.0% | +$1.71 | +$2.95 |

| 2% milk | 2.0% | +$3.42 | +$5.90 |

| Whole milk | 3.25% | +$5.56 | +$9.59 |

Here’s where it gets interesting: butterfat prices have been volatile this year. Earlier in 2025, butterfat ran as high as $2.95 per pound back in January, which would put that same differential at roughly $9.59 per cwt. Even at today’s lower prices, the component value difference is meaningful.

Quick ROI comparison—Premium Channel Economics:

| Channel | Price per cwt | Annual Revenue (100 cows, 23,000 lbs/cow) |

| Commodity (Class III, Nov 2025) | ~$17.18 | ~$395,140 |

| Premium direct/organic (based on Intel Market Research organic grass-fed pricing, typically 2-3× conventional) | ~$40-50 | ~$920,000-$1,150,000 |

| Difference | $525,000-$755,000 |

The math explains why producers willing to build direct relationships are capturing fundamentally different economics—even if the transition requires significant upfront investment.

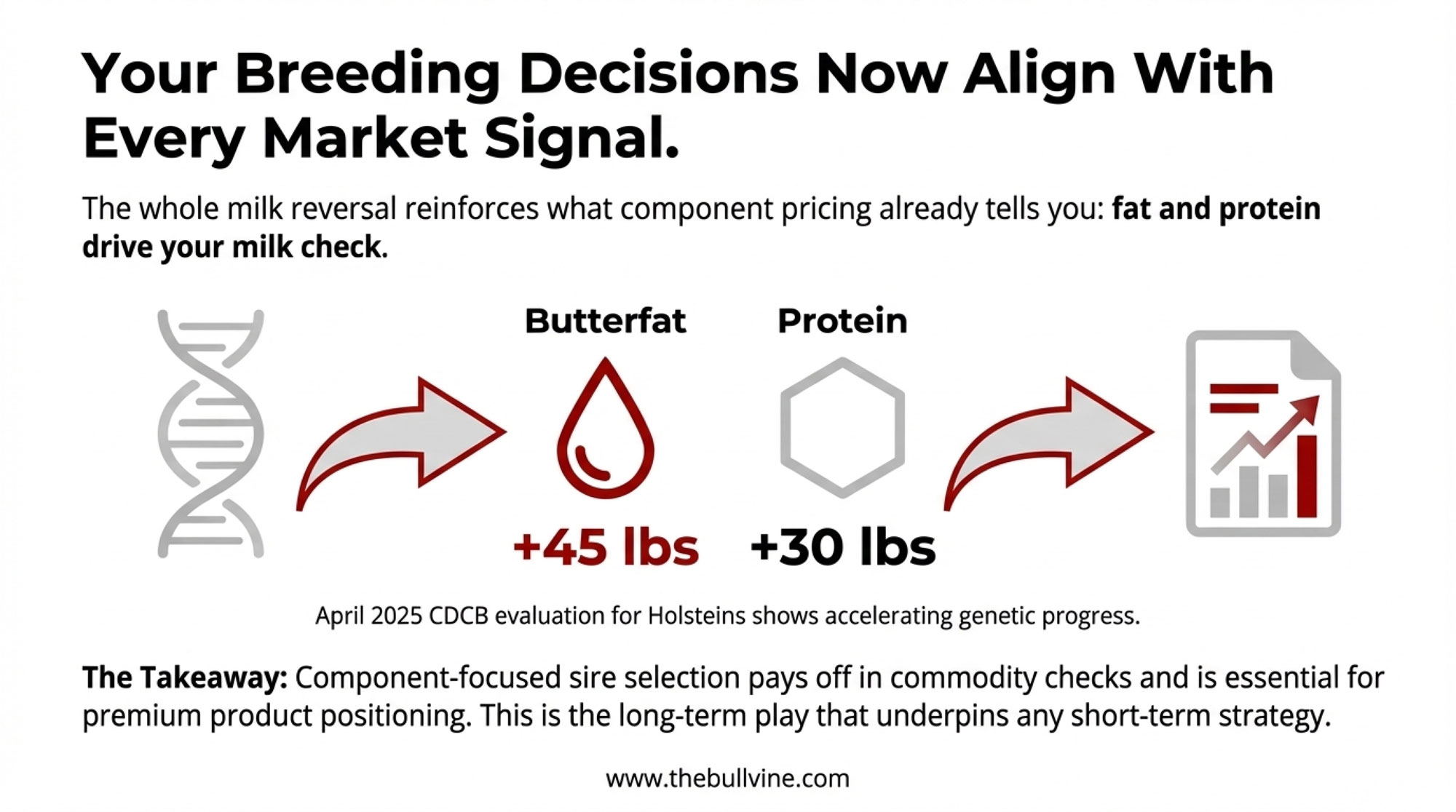

The Genetics Connection: Breeding for a Whole Milk Future

Here’s something worth considering for those of you making breeding decisions right now: the whole milk policy shift adds another data point to an already strong case for component selection.

According to CDCB, the April 2025 genetic base evaluation showed unprecedented gains—Holsteins improved by 45 pounds for butterfat and 30 pounds for protein. The butterfat number’s almost double any number that’s taken place in the past.

The drivers are clear: genomic testing has improved selection accuracy, and multiple-component pricing allocates the majority of milk check value to butterfat and protein—the two components that drive your check under current FMMO formulas. With 61% of all dairy semen sold in the U.S. now coming from sexed categories, producers can accelerate genetic progress by creating heifer calves from top-component females while using beef semen on the rest.

Industry analysts projects that genetic selection could push average butterfat content above 5% within the next decade if herd nutrition can keep pace with genetics.

The practical takeaway for breeding programs: The whole milk policy shift reinforces demand signals that already favor component-focused genetics. If you’re not already emphasizing butterfat and protein in your sire selection, the economics increasingly favor that direction. Top Holsteins are now adding 45 lbs butterfat per genetic base reset—that’s real money showing up in component checks.

How We Got Here

The original policy wasn’t arbitrary. When the Healthy, Hunger-Free Kids Act passed in 2010, policymakers were responding to real concerns—childhood obesity had tripled since the early 1970s, climbing from around 5% to 15% by 2000, according to CDC data.

And you know what? The people who designed these policies weren’t acting in bad faith. They were working within the scientific framework available at the time. The problem? That framework had blind spots that dairy farmers spotted immediately.

Kids stopped drinking the milk. Schools added sugar to improve palatability. The anticipated health benefits never materialized.

When we chatted with a producer who runs a 650-cow operation near Fond du Lac, Wisconsin—who is a third generation on his family’s farm—he put it to me pretty directly: “We knew something was off within the first year. You’d watch the trash cans fill up with barely-touched cartons. The nutritionists were telling us fat was the problem, but we could see with our own eyes that kids just wouldn’t drink the stuff. My dad used to say the same thing about the low-fat push in the ’80s—consumers know what tastes right.”

It’s a sentiment I’ve heard echoed across dairy country, from Vermont to California.

What the Research Actually Found

The turning point came in February 2020. Dr. Jonathon Maguire, a pediatrician at the University of Toronto’s St. Michael’s Hospital, led a meta-analysis published in the American Journal of Clinical Nutrition that encompassed 28 studies across seven countries.

The findings were striking:

- Children drinking whole milk had 40% lower odds of being overweight or obese

- Not a single study showed that reduced-fat milk is associated with a lower obesity risk

- The biological mechanism makes intuitive sense: dietary fats support satiety; remove them, and kids end up consuming more calories elsewhere

What I found particularly frustrating in this research was the timing. A 2013 University of Virginia study had already pointed in this direction—preschoolers who drank 1% or skim milk had higher odds of being overweight than peers who drank whole milk.

That study came out just one year after the restrictions took effect. It took seven more years for the Toronto meta-analysis and five more for the policy reversal.

Which raises an uncomfortable question many of us have asked ourselves: how many farms might still be operating if the policy had responded to evidence more quickly?

The Economic Damage

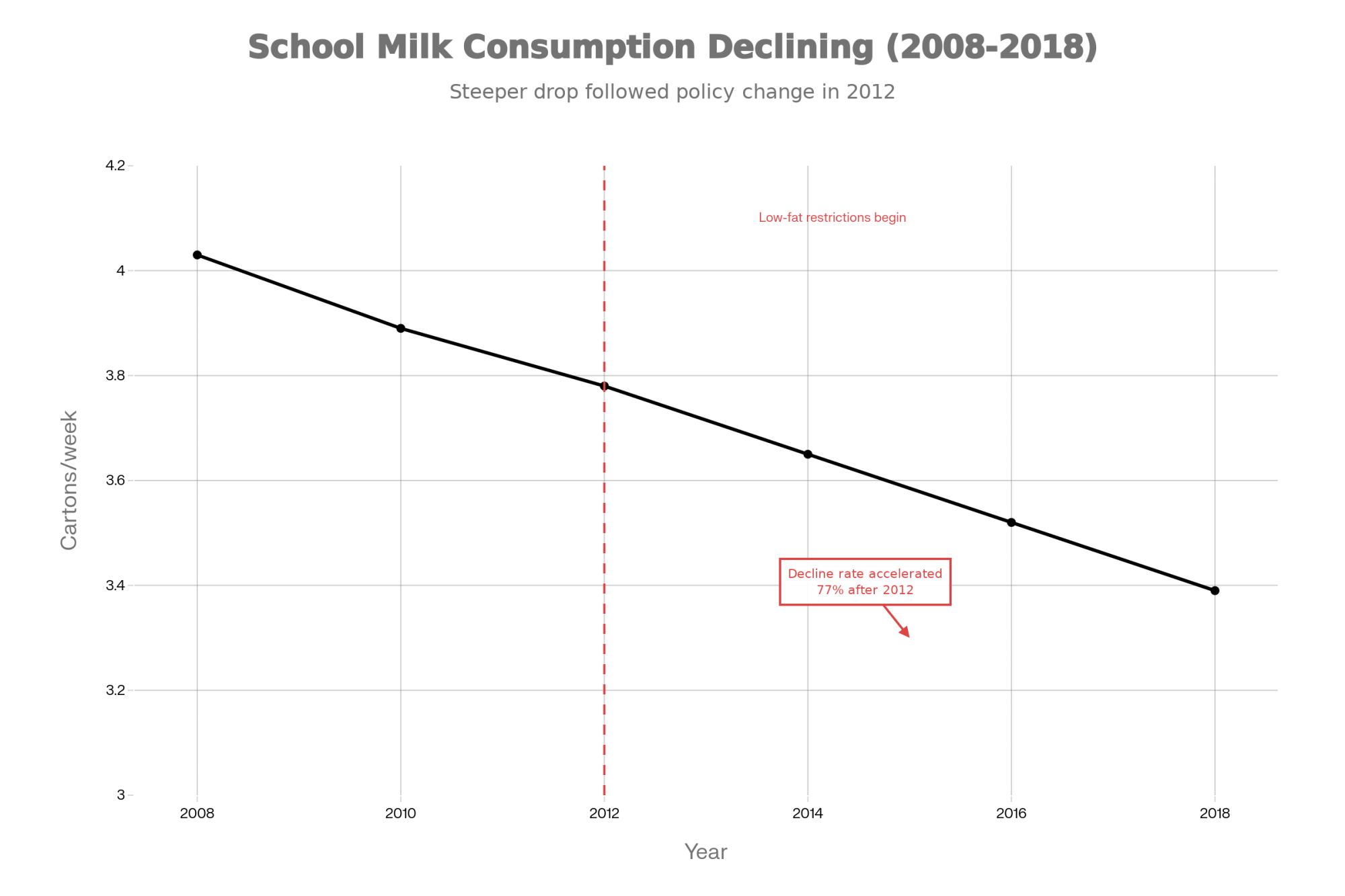

The American Farm Bureau’s analysis documents the consumption collapse pretty clearly:

- School milk use fell from 4.03 cartons per student per week (2008) to 3.39 (2018)—a 15% drop

- Rate of decline accelerated 77% after the 2012 rule change compared to the years before

- An industry analysis by The Bullvine estimated a total economic impact of around $4.3 billion (though, like any economic model, that involves assumptions about multiplier effects and competitive dynamics)

“A policy that takes 13 years to correct can put an operation out of business long before the evidence wins out.”

The farm-level damage has been severe. USDA analyses show licensed U.S. dairy farms have fallen by roughly one-third over the past decade. You probably know some of those families personally.

Regional breakdown tells its own story:

| State/Region | 2012 Licensed Farms | 2025 Licensed Farms | Change (Farms) | % Decline |

|---|---|---|---|---|

| Vermont | 973 | 439 | -534 | -49% |

| Wisconsin | ~11,800 | ~6,800 | ~-5,000 | ~-42% |

| California | ~1,600 | ~1,150 | ~-450 | ~-28% |

| Pennsylvania | ~6,800 | ~4,900 | ~-1,900 | ~-28% |

| National (U.S.) | ~58,000 | ~35,000 | ~-23,000 | -40% |

- Vermont: 973 farms (2012) → 439 farms (March 2025 UVM Dairy Update)—a 49% decline

- Wisconsin: Steady reduction throughout the decade, particularly among smaller herds

- California: Fewer but larger operations capturing an increasing production share

Canadian producers operate under different economic conditions—quota systems insulate them from some commodity volatility but create constraints on fluid milk innovation. The whole milk policy shift is a U.S.-specific development, but Canadian producers watching cross-border trends should note the demand signals. If American consumers are increasingly seeking full-fat dairy products, that sentiment doesn’t stop at the border. Some Ontario and Quebec processors are already watching U.S. premium channel growth with interest, and there may be lessons here for Canadian direct-market producers positioning their own operations.

A third-generation Vermont producer who transitioned to organic during this period described the frustration I’ve heard from many in the region: the school milk situation was just one piece of the economic pressure, but it was the piece that felt most frustrating because producers could see with their own eyes it wasn’t working.

What the Reversal Actually Means for Markets

Here’s where we need to be realistic with each other.

The Farm Bureau projects whole milk could shift 2-3% of U.S. butter production into higher-value bottled milk channels. That’s meaningful volume—but it’s not transformational on its own.

The adoption timeline is going to stretch out:

- Early 2026: Districts start releasing procurement RFPs

- Spring 2026: Contract bids due

- July 1, 2026: First-wave contracts begin

- Year 1: Maybe 40-50% district adoption, realistically

- Year 3: Perhaps 50-60% adoption

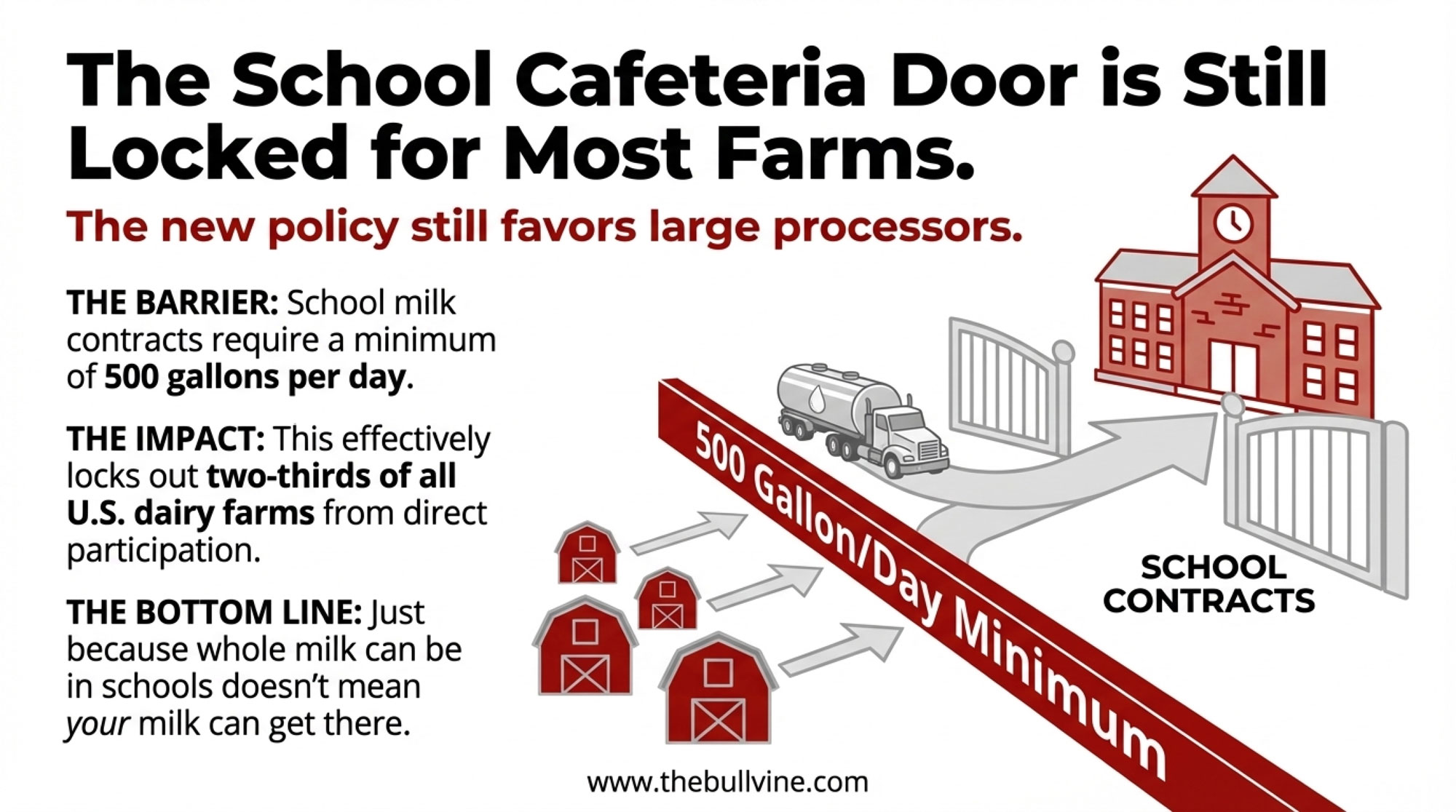

School milk procurement requires a minimum of 500 gallons per day and favors operations that can consistently meet volume and delivery demands. For herds under 300 cows—roughly two-thirds of remaining U.S. dairy farms—direct school contracts just aren’t realistic. The logistics don’t pencil out.

The “Missing Middle” Problem—And What to Do About It

If you’re running 300 to 1,000 cows, you’re in a tough spot. Too small for institutional school contracts. Too large (and too busy) for a farmers’ market stand on Saturday mornings.

But you’re not without options. And frankly, your cooperative’s board probably isn’t thinking about this as hard as you are. That’s your job to push them.

Pressure your cooperative to innovate. Farmers own their co-ops—you can sit on the board, attend meetings, and push for change. Major cooperatives, including DFA, Land O’Lakes, and California Dairies, all offer forward contracting and risk management programs for members. Land O’Lakes launched its Dairy 2025 Commitment, a sustainability and processing innovation initiative. Some specific asks worth raising at your next member meeting:

- School-specific packaging lines for whole milk that your co-op can bid on district contracts

- Higher-fat fluid product development—the demand signal from this policy shift is clear

- Regional processing partnerships that keep more value closer to member farms

Consider cooperative processing arrangements. One Minnesota cooperative involving four farms with a combined 1,800 cows reports routing 25% of collective production through a small processing facility they financed together, according to a recent Bullvine analysis of mid-sized farm strategies. That portion generates roughly twice the commodity price. The remaining 75% continues through traditional channels, so they’re not betting the whole operation on one approach.

“We didn’t have the scale individually to make processing investment work,” one participating farmer explained. “Together we did.”

This isn’t quick or easy—figure 24-36 months for facility build-out and $200,000-$500,000 in shared investment. But for operations with geographic proximity and complementary goals, it’s worth having a feasibility conversation over coffee with neighboring farms.

What if you do nothing? Let’s run those numbers honestly. If you’re in the 300-1,000 cow range, shipping commodity milk at ~$17/cwt while premium channels deliver $35-50/cwt, every year of inaction leaves roughly $200,000-$400,000 on the table (depending on herd size and component production). Over a five-year window, that’s potentially $1-2 million in foregone revenue—capital that could have funded the very infrastructure needed to access premium markets. The cost of waiting isn’t zero, even if it feels safer in the short term.

Advocate for policy that helps mid-sized operations. The school milk win came from organized industry pressure sustained over the years. The same approach applies to FMMO reform, processing infrastructure grants, and cooperative development programs. Individual voices get lost; collective voices get heard.

Your 90-Day Action Checklist

For operations under 300 cows (direct-to-consumer potential):

- [ ] Contact your state dairy promotion board about marketing support programs—Midwest Dairy, American Dairy Association Northeast, Southeast Dairy Association, and regional councils often have resources specifically for small-scale direct marketing

- [ ] Research farmers’ market requirements and seasonal milk subscription models in your region

- [ ] Calculate your break-even point for premium channel investment (licensing, packaging, refrigeration)

- [ ] Identify 2-3 neighboring farms for potential cooperative marketing conversations

- [ ] Develop your “whole milk story” messaging for consumer-facing channels

For operations 300-1,000 cows (cooperative innovation focus):

- [ ] Request your cooperative’s current school milk bid status and whole milk product plans

- [ ] Attend your next cooperative member meeting with specific asks (school packaging lines, higher-fat fluid products)

- [ ] Explore regional processing partnership feasibility with 2-3 neighboring farms

- [ ] Review your forward contracting options through DFA, Land O’Lakes, or your current cooperative

- [ ] Assess your genetics program’s component emphasis and adjust sire selection if needed

For operations 1,000+ cows (institutional positioning):

- [ ] Contact your cooperative about direct school district procurement opportunities

- [ ] Request information on your cooperative’s 2026 school milk RFP timeline and bid process

- [ ] Evaluate your component production against school milk volume requirements

- [ ] Explore branded whole milk partnership opportunities with regional processors

- [ ] Consider school district direct outreach in your geographic area

| Herd Size | Primary Opportunity | 90-Day Priority Action | Investment/Timeline |

| <300 cows | Premium direct-to-consumer channels | Contact state dairy promotion board; research farmers’ market + subscription models | $15K-$50K (licensing, packaging, refrigeration); 6-12 months to first sales |

| 300-1,000 cows | Cooperative innovation + shared processing | Attend co-op member meeting with specific asks (school packaging lines, higher-fat fluid products); explore regional processing partnerships | $200K-$500K shared investment; 24-36 months facility build-out |

| 1,000+ cows | Direct school district contracts + institutional positioning | Contact cooperative about 2026 school RFPs; request school milk bid timeline; explore branded whole milk partnerships | Immediate (contracts start July 1, 2026); leverage existing volume |

The Premium Opportunity: Marketing the Fat

Here’s where smaller operations have a genuine advantage—if they understand what’s actually working out there.

Market research from Intel Market Research estimates the U.S. organic grass-fed milk market at $2.15 billion in 2025, projected to reach $3.28 billion by 2032 at roughly 7.3% annual growth. Subscription-based delivery models grew 92% over the past year alone.

But here’s what I’ve noticed watching the producers winning in this space: they’re not just producing premium milk. They’re marketing the fat. That’s a meaningful distinction.

Take Painterland Sisters, a fourth-generation Pennsylvania organic dairy. According to a recent Forbes profile, co-founder Stephanie Painter puts it directly: “We aimed to change the narrative surrounding milk fat.”

Their skyr yogurt contains 6% milkfat—double cream. According to Dairy Processing, each 5.3oz container holds the equivalent of four cups of milk. The sisters have emphasized that those healthy fats are central to their product’s nutritional profile—it’s a feature, not something to minimize or apologize for.

The result? Over 6,000 stores in all 50 states, including Whole Foods, Sprouts, and Publix. Forbes’ “30 Under 30” list. The fastest-growing yogurt brand in the natural foods space.

Their insight is instructive: the whole milk vindication isn’t just about returning to what was—it’s about actively marketing fat as a feature.

“Our story is what sets us apart on the shelves,” they told in a recent interview. “Every detail on the cup is designed to tell a story, bridging the gap between the farm and the fridge.”

For farms considering this pathway: launching farmers’ market sales, subscription programs, or an on-farm store requires real investment in licensing, packaging, and refrigeration. Your state dairy promotion board or cooperative extension office can connect you with producers who’ve made similar transitions in your region.

The honest question to ask yourself: Do you have the temperament for direct customer relationships, the capital for infrastructure, and the patience to build a brand? It’s not for everyone—and that’s okay. But for farms that fit the profile, the whole milk story provides a ready-made narrative that consumers genuinely want to hear right now.

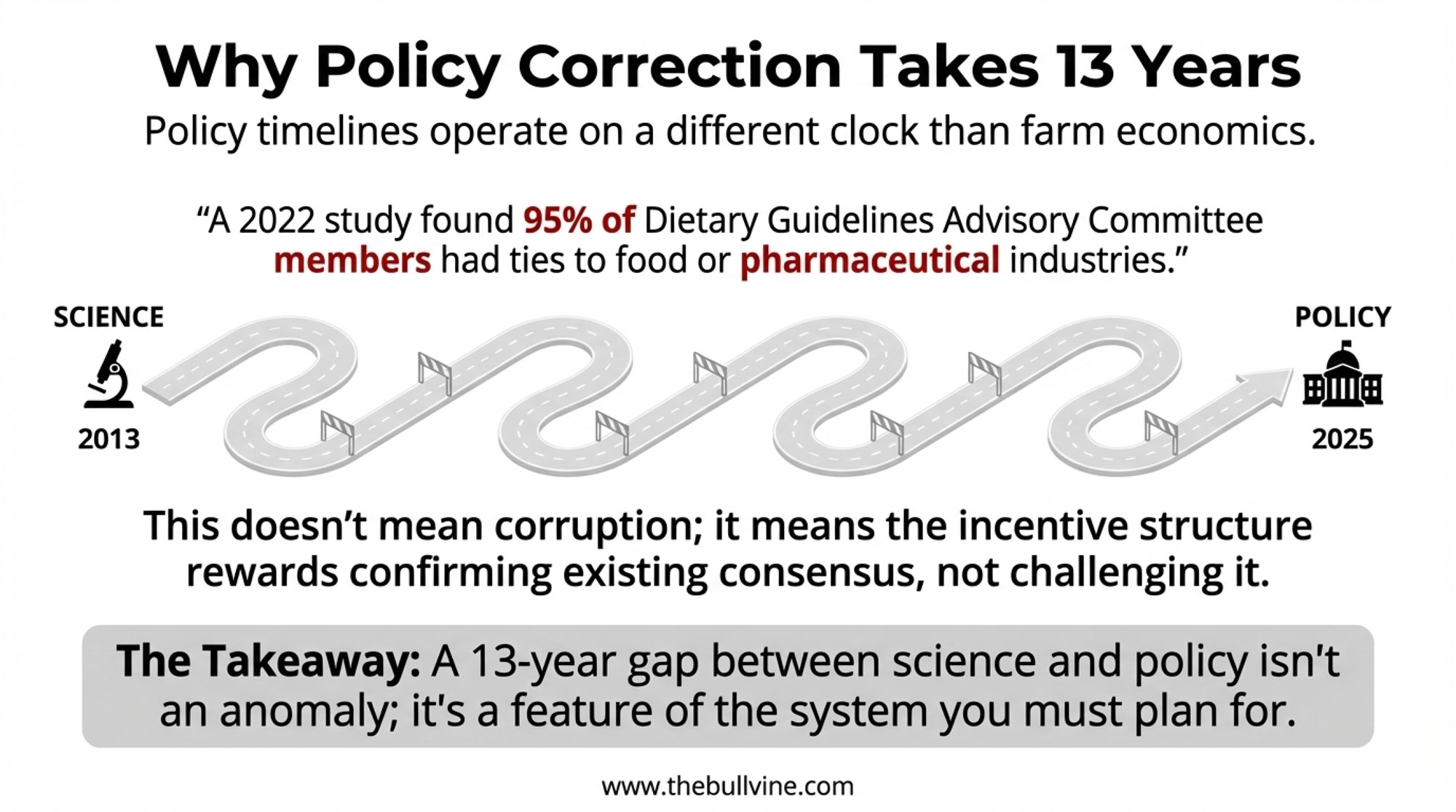

Why Policy Correction Takes So Long

Understanding this dynamic helps prepare for whatever comes next—methane regulation, climate requirements, antibiotic restrictions. There’s always something on the horizon.

Research published in 2022 in the journal Public Health Nutrition examined the Dietary Guidelines Advisory Committee. The finding: 19 of 20 members (95%) had at least one documented financial or professional relationship with actors in the food or pharmaceutical industries.

Now, this doesn’t mean committees are corrupt or that members are consciously biased. What it illustrates is something more structural: these committees naturally draw from pools of credentialed experts who’ve built careers within existing consensus frameworks. Challenging established positions carries professional risk. Confirming them is safer. The incentive structure doesn’t reward rapid revision, even when new evidence accumulates.

The result? A system that changes slowly, regardless of how compelling the contradicting evidence becomes.

For producers, the takeaway isn’t that experts can’t be trusted. It’s that policy timelines operate on a different clock than farm economics. Plan accordingly.

Practical Lessons for What Comes Next

Build flexibility into your revenue structure. The farms that survived the last 13 years weren’t entirely dependent on a single market channel. Diversification provides a cushion when policy shifts unexpectedly against you.

One California producer I spoke with recently—running about 2,200 cows in the Central Valley—described it as “not putting all your milk in one tank.” He’s got relationships with three different buyers, plus a small direct-sales operation his daughter runs. When one channel gets disrupted, the others absorb the shift. It’s not complicated, but it requires intentionality.

Consider your story as an asset. If you’ve been farming through these years, you have credibility with consumers who’ve grown skeptical of institutional guidance. A farm that can authentically say “we knew whole milk was nutritious when experts said otherwise” has differentiation that larger operations simply can’t replicate.

Engage policy discussions before consensus hardens. The dairy industry’s organized response to school milk restrictions gained real momentum only after substantial damage had already accumulated. For emerging issues—such as methane regulation and climate requirements—earlier engagement yields better outcomes.

Plan for policy timelines, not evidence timelines. You might be right about the science for years before policy catches up. Your operation needs to survive that gap. That means capital reserves, operational flexibility, and revenue diversification that doesn’t depend on regulatory environments being rational.

The Bottom Line

The immediate market impact from whole milk’s return will be modest—a few percentage points of butterfat utilization, phased in over several years as districts convert.

But the broader lessons apply to whatever comes next:

- Policy corrections take longer than farm economics can absorb. Build flexibility to survive the gaps.

- Being right doesn’t automatically translate to market benefit. Thousands of farms closed while dairy farmers were correct about whole milk.

- Market opportunity distributes unevenly. Large operations win on institutional contracts; small operations can win on premium positioning; mid-sized farms need cooperative innovation or collective processing strategies.

- Direct consumer relationships provide policy insulation. And marketing the fat—not just producing it—is what’s actually working in premium channels.

- Genetics reinforce the direction. Component-focused sire selection aligns with both premium market demand and institutional whole milk needs—top Holsteins are now adding 45 lbs butterfat per genetic base reset, and that’s real money showing up in component checks.

And honestly, that’s what this whole 13-year story comes down to. The farms that thrive going forward will likely be those that learned from this experience: not just that whole milk was right, but that surviving in this industry requires building operations resilient enough to weather the gaps between when evidence emerges and when policy finally responds.

That’s the real lesson here. Not just vindication—preparation.

We’ll be tracking school district adoption rates and Class I utilization by FMMO region throughout 2026—watch for quarterly updates on how whole milk demand is actually showing up in producer checks.

KEY TAKEAWAYS

- $4.3 billion too late: Whole milk won in December 2025—but one-third of U.S. dairy farms closed during the 13 years policy ignored the science that proved them right

- School milk isn’t your opportunity (yet): Contracts require 500+ gallons daily, locking out two-thirds of farms. Push your cooperative to bid on school packaging—that’s how mid-sized herds access this market

- Your 90-day move by herd size: Under 300 cows → premium direct channels (organic grass-fed is $2.15B, growing 7.3%). 300-1,000 cows → cooperative pressure + shared processing ($200K-$500K). 1,000+ cows → 2026 school RFPs start soon

- Butterfat math favors whole milk: At $1.71/lb, whole milk carries $5.56/cwt more value than skim. Top Holsteins now add 45 lbs butterfat per genetic base reset—component breeding pays regardless of channel

- Build resilience before the next policy fight: Thirteen years between science and policy correction is normal, not unusual. Methane rules, climate mandates, antibiotic restrictions—your operation needs to survive the next gap, not just celebrate this win

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Whole Milk is Back in Schools. Here’s Why Only 834 Dairy Farms Will Really Win. – Exposes the brutal administrative reality of school contracts and delivers a segmented ROI analysis. This breakdown arms you with specific volume thresholds to determine if institutional bidding actually pencils out for your specific herd size.

- US Dairy Market in 2025: Butterfat Boom & Price Volatility – How Farmers Can Protect Profits – Reveals how the “component economy” is decoupling fat production from milk volume. This strategy helps you navigate the 5.3% surge in butterfat supply, ensuring your 2026 price floors protect margins against inevitable supply-driven dips.

- $2 Milk or $20 Milk: The Simple Testing Strategy Creating 1000% Premiums – Breaks down the unconventional testing protocols that allow smaller herds to unlock thousand-percent price premiums. It delivers a proven blueprint for transforming regulatory transparency into a high-margin brand that completely bypasses the commodity price squeeze.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!