The 60-day pregnancy check is becoming the most terrifying day on the dairy calendar.

EXECUTIVE SUMMARY: You’ve been breeding 35% to beef, banking $1,200 per calf while dairy bulls bring just $200—the math seemed obvious until June’s pregnancy check reveals you’re 150 heifers short. With dairy heifer inventory at its lowest since 1978 and replacements costing ,000 each, this “profitable” strategy has just created a 0,000 problem that will take two years to fix. The culprit: not tracking what percentage of pregnancies are dairy versus beef, the single metric that predicts replacement availability 18 months out. Successful operations monitor this number weekly—when it drops below 45%, they immediately increase sexed dairy semen usage, trading $520 in monthly semen costs to avoid a six-figure crisis. The entire monitoring system takes 30 minutes weekly, yet most producers don’t discover the problem until it’s biologically impossible to fix. The difference between thriving and crisis isn’t luck—it’s whether you’re tracking one number that takes five minutes to calculate.

You look at the ultrasound monitor as the technician calls out the results. Bull. Bull. Bull. Heifer. Bull. Your stomach drops. You’ve been breeding 35% to beef, following the plan you set in January. The math was perfect on paper—$1,200 beef calves versus $200 dairy bulls. But now you’re staring at a 120-heifer shortage for next year, and replacement heifers are selling for $3,500 to $4,000 each.

How did this happen? You followed your breeding plan to the letter.

Here’s what’s interesting—the answer lies in a calculation that deserves more attention: the forward-looking replacement inventory formula. The beef-on-dairy movement has certainly delivered valuable calf revenue when we’ve needed it most. Lord knows, those $1,200 beef calves have kept many of us afloat. At the same time, it’s creating what CoBank economists describe as a significant structural adjustment period for operations whose monitoring systems haven’t evolved alongside their breeding strategies.

The New Economics Reshaping Dairy Breeding

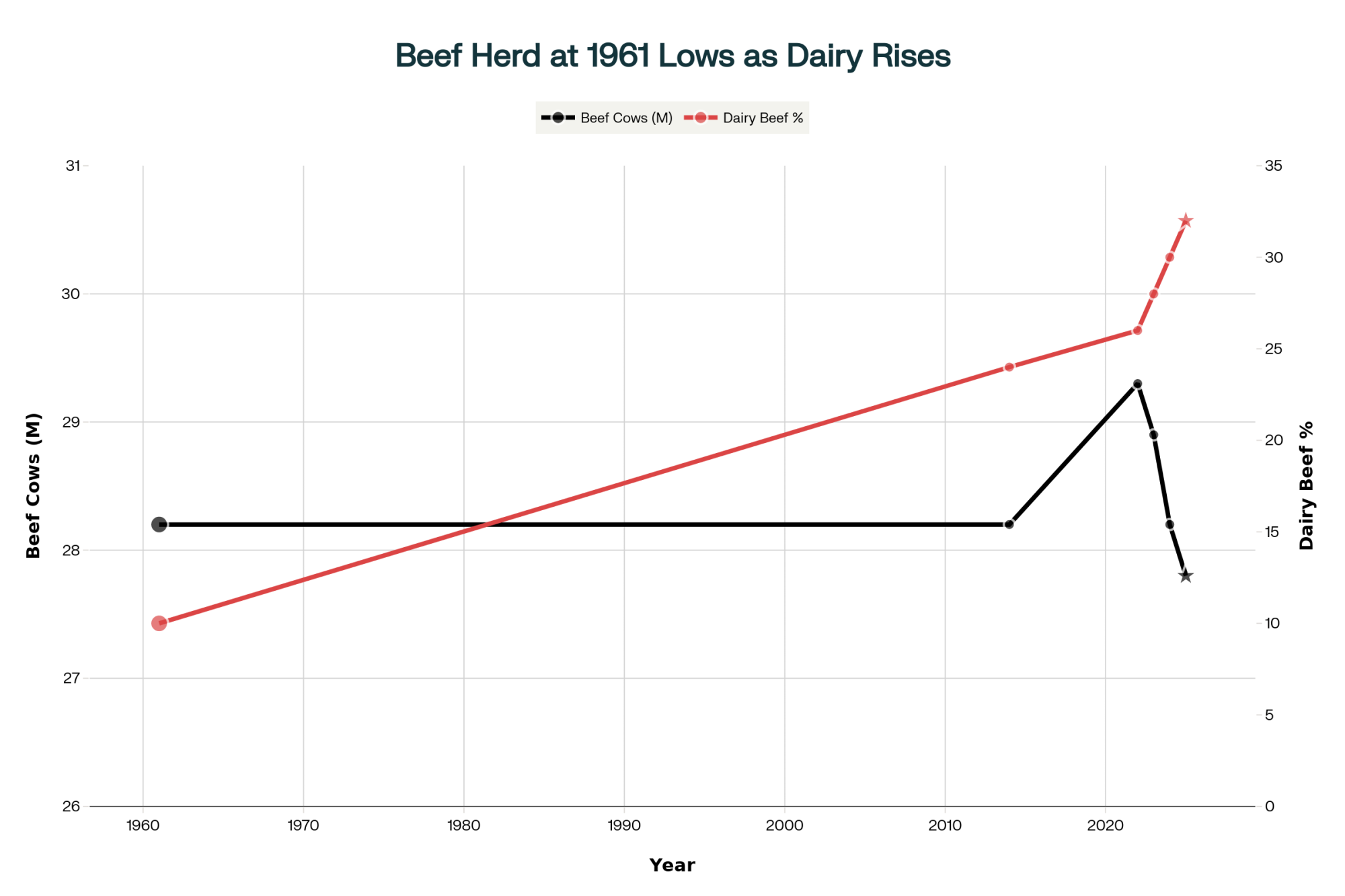

You know, the numbers tell a compelling story about where we are as an industry. The National Association of Animal Breeders reports that beef semen sales to dairy operations climbed from 2.5 million units in 2017 to 7.9 million units in 2024—a 216% increase that reflects fundamental changes in how we think about calf value.

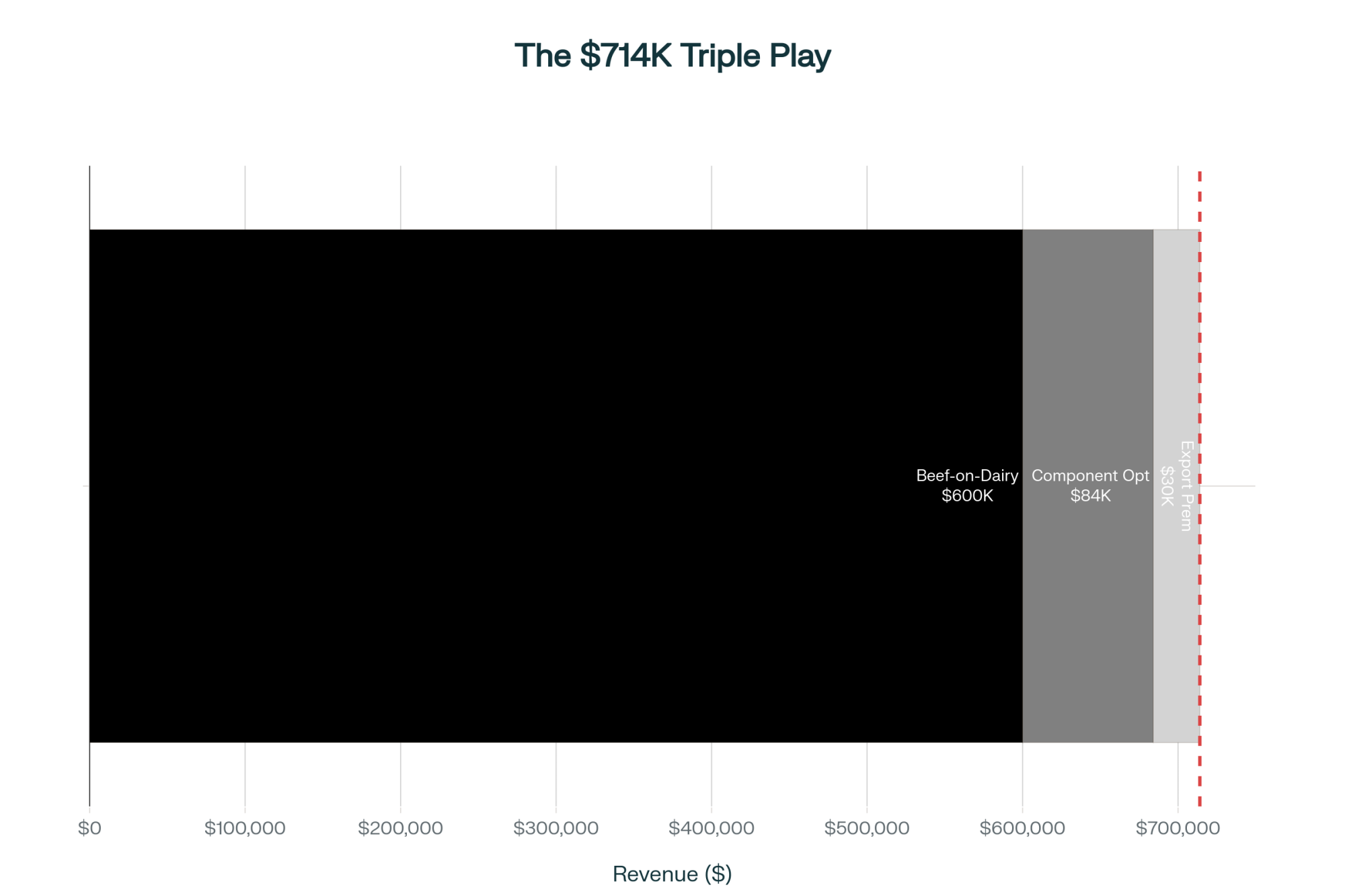

Day-old beef-cross calves now command $1,000 to $1,400. Dairy bull calves? You’re lucky to get $100 to $200, and that’s if you can find a buyer. For a 1,000-cow operation breeding 35% to beef, that’s approximately $210,000 to $245,000 in additional annual calf revenue. That’s real money when you’re dealing with volatile milk prices and input costs that just won’t quit.

But here’s what’s particularly concerning—and what many of us are just starting to realize. The Holstein Association has documented that each percentage-point shift toward beef breeding removes approximately 95,000 dairy heifers from the national pipeline each year. The USDA’s January cattle inventory report reveals our dairy heifer inventory has declined to 3.914 million head. That’s a level we haven’t seen since 1978, when we were milking very different cows in very different systems.

CoBank’s dairy quarterly analysis from August makes this clear: we’re facing an 800,000-head decline in dairy heifer inventory before any meaningful recovery begins in 2027. This replacement shortage is becoming increasingly apparent to anyone who’s tried to buy heifers lately. They’re simply not available—at any price in some regions.

What’s worth noting is how this plays out differently across borders. Canadian producers navigating supply management face unique constraints when beef revenue opportunities conflict with quota requirements. European operations are balancing beef-on-dairy opportunities with stricter environmental regulations and different subsidy structures. Australian and New Zealand producers, with their seasonal calving systems, face entirely different timing pressures. But the fundamental challenge—balancing today’s revenue with tomorrow’s replacements—that’s universal.

The Critical Calculation Most Operations Miss

Let me share something that I’ve found most operations overlook:

The Forward Replacement Inventory Formula:

Herd Size × (Age at First Calving ÷ 24) × Cull Rate × (1 + Heifer Non-Completion Rate) = Annual Replacements Needed

| Scenario | Dairy Pregnancies % | Annual Heifer Shortage | Replacement Cost | Crisis Total |

| Unmonitored Herd (No Weekly Tracking) | 35% | -150 | $3,500-$4,000 | $525,000-$600,000 |

| Target Range (Disciplined Monitoring) | 45-55% | On target | N/A | $0 (Averted) |

| Early Warning (April Detection) | 42-45% | -50 | $3,500-$4,000 | $175,000-$200,000 |

| Sexed Semen Response | 50%+ recovery | -25 | $520/month semen | $6,240 annual |

| Late Detection (June Preg Check) | 35% | -120+ | $3,800-$4,200 | $456,000-$504,000 |

Based on conversations with producers across the country—and I talk to a lot of them—most operations make at least one of three common miscalculations that can really bite you later:

First, we tend to be optimistic about heifer completion rates. Many of us plan with the assumption that 90-95% of heifer calves will eventually enter the milking herd. But research from folks at Elanco, based on extensive herd monitoring, shows actual rates are 75-80% on well-managed operations. That 15-20 point gap? It compounds annually, and suddenly you’re wondering where your heifers went.

Second: Age at first calving matters more than we think. Penn State Extension research shows that each month beyond 24 months increases replacement needs by approximately 4%. Push from 24 to 26 months—maybe because your heifer grower had a tough winter or you had some respiratory issues—and a 1,000-cow operation needs 33 additional heifers annually just to maintain herd size.

Third: And this is the one that really catches people—not tracking dairy versus beef pregnancy percentages. Research from UW-Madison identifies this as a critical predictive metric for future replacement availability. You probably know your overall pregnancy rate, but do you know what percentage of those pregnancies are dairy versus beef?

When Reality Hits: The 60-Day Moment of Truth

Here’s how it typically unfolds. You set your breeding plan in January, usually over coffee at the kitchen table or during that annual meeting with your nutritionist and vet. Execute it faithfully through spring. Everything looks fine on paper. Then June arrives with 60-day pregnancy checks and fetal sexing capability.

The ultrasound technician begins: “Heifer, bull, bull, bull, heifer, bull…”

Your expression changes as you realize the sex ratio isn’t what you expected. And here’s the kicker—five months of breeding decisions are now locked into 280-day gestations. A shortage of 120 to 150 replacement heifers is mathematically inevitable. You can’t unbred those cows.

What happens next? Well, I’ve watched this play out too many times:

- July: You’re calling every heifer dealer in 200 miles

- August: Prices climb from $3,000 to $3,600 per head

- September-October: Crisis pricing hits—$3,800 to $4,200

- November: You either write massive checks or keep those arthritic fifth-lactation cows another year

The Weekly Metric That Changes Everything

What successful operations are doing differently—and this really surprised me when I first learned about it—is monitoring dairy pregnancies as a percentage of total pregnancies weekly. Not monthly. Not quarterly. Weekly.

Your Decision Tree:

- Dairy % between 45-55%: ✓ Continue current strategy

- Dairy % at 42-45%: ⚠ CAUTION – Monitor closely next week

- Dairy % below 42% or declining 3 weeks straight: 🔴 ACTION – Adjust immediately

This 5-minute habit can save you six figures. Think about that for a second. Identifying trends in April or May allows correction before June’s breedings lock in. Waiting for a 60-day pregnancy confirmation means the opportunity has passed. The biology is already set.

The Sexed Semen Solution That Surprises Producers

When dairy pregnancy percentages decline, here’s what seems counterintuitive: increase sexed semen usage despite lower conception rates. But look at the math:

| Semen Type | Conception Rate | Female % | Result per 100 Breedings |

| Conventional | 40% | 50% | 20 female calves |

| Sexed | 33% | 90% | 30 female calves |

Despite an 18% conception penalty, sexed semen generates 50% more females. The cost difference? About $520 monthly in additional semen cost versus $3,500-4,000 per replacement heifer. That’s a no-brainer when you run the numbers.

The 30-Minute Weekly System That Works

Here’s what you need—and you probably already have most of it:

- Your existing herd management software

- A basic spreadsheet (or, honestly, even a notebook works)

- 30 minutes weekly

Track five simple data points:

- Week number

- Total pregnancies confirmed

- Dairy pregnancies

- Beef pregnancies

- Dairy percentage (calculated)

Veterinarians I work with report that producers have avoided $400,000 replacement crises with nothing more than disciplined weekly monitoring. That’s it. Thirty minutes that could save you from financial disaster.

What Successful Producers Do Differently

They adjust breeding strategies based on real-time data rather than annual projections. When dairy pregnancy percentages drift, they respond within weeks, not quarters. No committee meetings, no analysis paralysis—just adjustments based on data.

They monitor conception rates by semen type. One California producer who asked not to be named noticed a problem when dairy conception was running at 38% while beef was at 44%. Overall, it looked fine at 41%, but the divergence signaled specific dairy bull fertility issues that needed to be addressed immediately.

They plan realistic completion rates. A Pennsylvania producer shared this experience: “We assumed 90% of heifer calves would reach the milking parlor. Reality was 76%. That 14% gap over three years? 180-heifer shortage.” That’s a lesson learned the hard way.

And perhaps most importantly, they resist market timing. When beef prices surge—and they will again, markets are cyclical—disciplined operations maintain their breeding allocation rather than chase short-term revenue.

The Industry Dynamics Creating This Challenge

Several factors are converging that make this more complex than it was even five years ago.

Rabobank identifies $10 billion in new processing capacity requiring 2-3% annual production growth. That milk has to come from somewhere—either more cows or higher production per cow, both requiring careful replacement planning.

Research from UW-Madison shows that keeping older, lower-genetic cows costs several hundred dollars per lactation in unrealized genetic potential. It’s a hidden cost that adds up quickly when you’re holding onto cows past their prime.

CME data confirms we’re seeing unprecedented spreads between beef-cross and dairy bull values. That economic pressure to breed beef is real and it’s intense.

And here’s what makes it tough—once beef-on-dairy revenue reaches a significant portion of farm income, as industry analysis suggests is happening for many operations, returning to previous breeding strategies becomes financially challenging, even when replacement needs suggest you should.

These industry pressures aren’t just numbers on a spreadsheet—they’re reshaping how we make decisions every single day on our farms.

Practical Lessons from the Field

Looking at how these dynamics play out in real operations, the patterns become clear.

One California producer managing 1,500 cows, who preferred to remain anonymous, shared this sobering experience: “We bred 40% to beef without weekly monitoring. By July, we were 180 heifers short. Cost us $650,000 in purchased replacements plus another $80,000 in health and adaptation challenges. Now we monitor weekly—takes 20 minutes, prevents million-dollar mistakes.”

A Pennsylvania operation with 800 cows reported better results: “When our dairy percentage dropped to 43% in April, we immediately increased sexed semen usage. That early adjustment means we’re actually ahead on replacements now.”

And from the other side of the equation, a Minnesota custom heifer raiser tells me: “Three years ago, I had excess capacity. Today, I’m declining inquiries weekly. The offers I’m getting—$500 per head premiums just to accept calves, before any feeding costs—show how desperate the situation has become. But biological realities mean these animals require two years regardless of how urgent the need.”

Looking Ahead: What This Means for Your Operation

The beef-on-dairy opportunity has provided crucial revenue during challenging economic periods—I’m not arguing against it. As replacement availability tightens and prices reach historic levels, though, success will belong to operations that balance opportunity with disciplined management.

This isn’t really about choosing between beef revenue and dairy replacements. It’s about implementing systems that enable real-time response rather than hoping annual projections prove accurate. These principles apply whether you’re managing 3,000 cows in an Arizona dry lot or 200 cows on a Missouri pasture—the mathematics remain consistent, only the scale varies.

So here’s the question that matters: Are you monitoring the right metrics weekly, or are you waiting for problems to become crises?

Tracking dairy pregnancies as a percentage of total pregnancies requires just 30 minutes weekly. The cost of not monitoring? Producers nationwide are discovering it can easily exceed $400,000 when replacement shortages force them to make desperate purchasing decisions.

The beef-on-dairy opportunity remains valuable—genuinely so. But like all agricultural opportunities, it rewards those who measure, monitor, and adjust based on data—not those who set plans in January and hope for the best.

As we approach 2026, your dairy pregnancy percentage might be the most critical metric on your farm. The encouraging news? The tools and knowledge exist to navigate this successfully. It simply requires discipline and perhaps a shift in how we think about breeding management—from annual planning to continuous optimization.

Don’t know your current Dairy Pregnancy %? Go check your herd management software right now. If it’s below 42%, call your breeding advisor today.

KEY TAKEAWAYS

- Your dairy pregnancy percentage predicts your future: Below 45% means you’re heading for a 150-heifer shortage worth $600,000—monitor it weekly, not annually

- Timing is everything: Problems discovered in April can be fixed with breeding adjustments; problems discovered at June’s 60-day check are locked in for two years

- Sexed semen is cheaper than panic: $520/month extra for sexed semen generates 50% more heifers and beats paying $3,500-4,000 per replacement

- The 30-minute solution: Weekly monitoring of one metric (dairy pregnancies ÷ total pregnancies) has prevented $400,000 crises for disciplined producers

- Action required today: Check your dairy pregnancy percentage now—if it’s below 42%, increase sexed dairy semen usage immediately

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef-on-Dairy: Real Talk on Turning Calves into Serious Profit – Provides a tactical roadmap for using genomic testing to identify the exact 30-40% of your herd that requires sexed semen, ensuring you capture beef premiums without compromising your future replacement inventory.

- The 800,000-Heifer Shortage Reshaping Dairy: Why Some Farms Will Thrive While Others Exit – Analyzes the structural collapse of the U.S. heifer inventory and offers long-term strategic modeling to help you navigate the 30-month supply gap that is currently driving replacement costs to historic highs.

- The UK’s Sexed Semen Playbook: How UK Dairies Hit 84% While You’re Still Stuck at 50/50 – Reveals how progressive herds are using SexedULTRA 4M technology to overcome the conception rate penalties mentioned in this article, demonstrating how to achieve near-conventional fertility rates with gender-sorted semen.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!