Only 21% of our Canadian quota gets used—that’s $900M sitting on the table!

EXECUTIVE SUMMARY: Here’s what caught my attention—despite all the trade drama and those brutal 241% tariffs, American dairy still managed to ship $1.1 billion worth of product to Canada in 2024. But here’s the kicker… we’re only using about 21% of our allocated quota space, which means there’s nearly $900 million in untapped opportunity just sitting there. The research shows that with Bill C-202 now locked in and the 2026 USMCA review coming up, this trade fight is going to define the next decade of North American dairy economics. Canadian retail milk prices are hovering around CAD $1.07 per liter while we’re dealing with tighter margins down here. Smart producers who start building export relationships now—especially in the Midwest with those logistics advantages—are going to be first through the gate when those barriers start cracking. This isn’t just politics anymore, it’s real money with real potential.

KEY TAKEAWAYS:

- Track quota utilization like milk prices – Only 21% filled means massive room for growth if allocation systems get fixed, potentially opening $900M+ in new market access for prepared exporters.

- Build export co-op relationships now – Partner with processing facilities near the border and establish connections with Canadian buyers before barriers drop, especially if you’re running operations in Wisconsin, Minnesota, or New York.

- Monitor protein markets for profit signals – Canadian dumping is hammering global protein prices by 8-12%, so watch for market corrections that could boost your ingredient revenue streams.

- Position for 2026 USMCA review opportunities – Start documenting your export readiness and production capacity now, because when trade negotiations heat up, the prepared operations will capture the biggest opportunities.

- Focus on specialty and premium products – Canadian retail prices show there’s appetite for premium dairy, so consider organic certification or specialty cheese production that commands higher margins in protected markets.

Look, I’ve been watching this dance between us and Canada for years, and this feels different. The political pressure is real, the economics make sense, and the timing with that USMCA review coming up… it’s all lining up.

The producers who move first on this are going to be the ones laughing all the way to the bank when those trade barriers finally start coming down. What do you think? Are you ready to step up when those market doors crack open?

You know what’s got the whole industry talking? It’s not just another trade spat—we’re looking at a genuine crack in the $1.1 billion Canadian dairy market that’s been locked up tighter than a first-calf heifer. The political winds are shifting, and for the first time in decades, that northern fortress might actually have some weak spots showing.

What’s Really Happening Up There?

The thing about Donald Trump’s renewed focus on Canadian dairy—and I’ve been watching this dance for years—is that it’s hitting different this time. His team’s threatening to match Canada’s brutal 241% tariff on over-quota imports, which sounds like political posturing until you realize we still managed to ship $1.1 billion worth of dairy north in 2024. That’s real money flowing despite the barriers.

But here’s where it gets interesting… Canada just passed Bill C-202 back in June, and this thing is welded shut. They’ve literally made it illegal for future trade negotiators to lower dairy tariffs or increase quotas. Think about that for a minute—they took negotiation off the table entirely.

What strikes me about this whole situation is how it mirrors what we saw with Japan’s beef quotas years back. Same playbook: use legislation to remove any wiggle room for future deals.

The Numbers That’ll Make You Think Twice

Now here’s the part that should grab every producer’s attention—we’re only filling about 21% of our allocated Canadian quota. Not the 42% you hear tossed around, but less than a quarter. That means nearly 80% of our negotiated access is just sitting there unused.

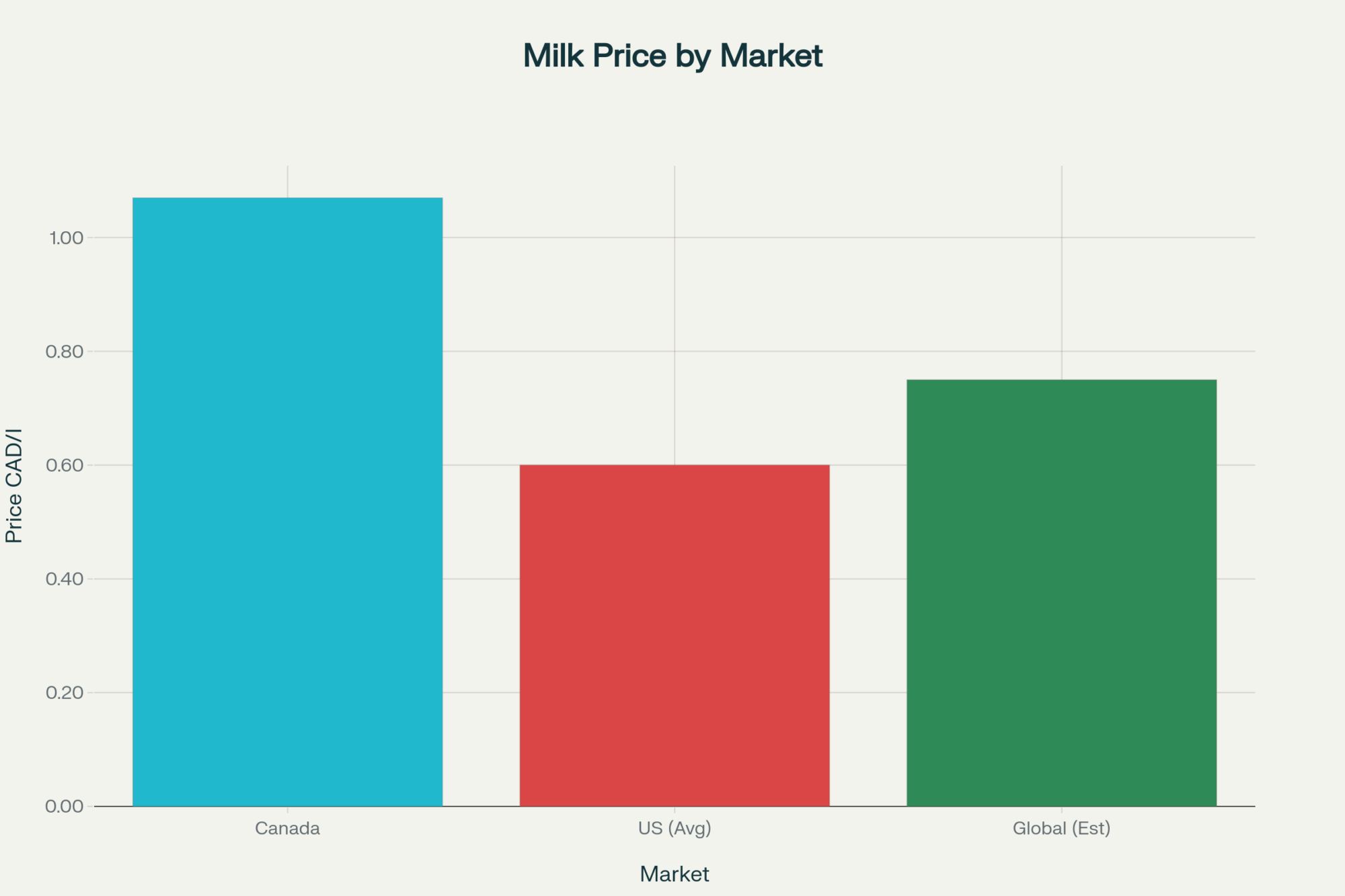

I was talking to a producer from Vermont the other day (you know how those Northeast operations are dealing with labor shortages and feed costs), and he put it this way: “We’re staring at Canadian retail milk prices around CAD $1.07 per liter while we’re trying to make sense of margins that barely pencil out.” That premium is serious money.

Those tariffs work like a cliff edge, too. Inside quota? You’re golden with zero or low tariffs. Cross that line and boom—241% or higher depending on the product. It’s designed to be a hard stop, and honestly, it works perfectly.

Voices from the Trenches

Shawna Morris from the National Milk Producers Federation doesn’t mince words about this mess. She’s been pointing out for months that Canada’s quota allocation system heavily favors domestic processors who have zero incentive to bring in competing American product.

This isn’t happening in a vacuum either. When the latest round of tariffs kicked in, Canada fired back with retaliatory measures on $30 billion worth of U.S. goods, dairy included. Classic trade war escalation.

The Global Ripple Effect You Might Miss

Here’s something that caught my attention recently, and it’s bigger than just U.S.-Canada trade dynamics. Canada’s been dumping surplus dairy proteins—think skim milk powder—onto global markets at prices that are hammering worldwide protein markets by an estimated 8-12%.

If you’re a producer selling into ingredient markets, that hits your bottom line whether you’re exporting to Canada or not. It’s one of those interconnected things that doesn’t make headlines but shows up in your milk check.

This pattern is becoming more common… protected domestic markets subsidizing export dumping. We’ve seen it with EU dairy, we’ve seen it with New Zealand when they need to clear inventory. The difference here is scale and timing.

Looking at the Bigger Picture

Despite all the trade friction, the numbers tell an interesting story. Since USMCA took effect, U.S. dairy exports to Canada have grown by approximately 34%. That’s not the “quadrupled” figure you sometimes hear, but it’s solid growth in a heavily regulated market.

Those quotas are still managed with an iron fist by Canada’s supply management system—the Canadian Milk Supply Management Committee and Dairy Commission calling every shot. They’ve got this down to a science.

What This Means for Your Operation

Look, if you’re running a dairy operation and thinking about opportunities, here’s what I’d be watching closely:

Keep your ear to the ground on any shifts in U.S.-Canada trade policy, especially as the 2026 USMCA review approaches. That’s when the real horse-trading happens.

Pay attention to quota allocations. If we start seeing more import licenses going to retailers and food service companies instead of processors, that changes the entire game.

Watch protein markets like a hawk. Whether you’re selling domestically or internationally, those Canadian export practices are affecting your ingredient values.

And here’s the thing most producers miss—those 241% tariffs only kick in if you exceed quota limits. Since we’re not even filling a quarter of our allocated quotas, there’s actually room to grow within the existing framework if the allocation system gets straightened out.

Regional Realities Matter

This isn’t uniform across U.S. dairy regions either. Upper Midwest producers with established logistics networks might be better positioned if barriers fall. West Coast operations could find angles in specialty cheese markets. Northeast producers—especially in New York and Vermont—have proximity advantages for premium fluid milk markets.

I’ve been talking to producers from different regions, and the perspectives vary quite a bit. A guy running 800 head in Wisconsin sees this as potentially huge for his cooperative’s powder exports. Meanwhile, a family operation in Pennsylvania is more interested in what it might mean for their organic fluid milk premiums.

Bottom Line

Here’s my take after watching this industry for more years than I care to count: this feels like a rare opportunity for American dairy to crack into a premium market that’s been artificially protected for decades. But it won’t be easy, and it definitely won’t happen overnight.

The Canadian dairy fortress is real, and those political winds up north can shift faster than a July thunderstorm. Success will come to producers who stay informed, build the right relationships, and are ready to move when opportunities open up.

What’s got me optimistic is the combination of sustained political pressure, upcoming trade reviews, and the simple economics of the situation. When you’ve got American producers sitting on unused quota while Canadian consumers pay premium prices for milk, something’s eventually got to give.

The question isn’t whether change is coming to North American dairy trade—it’s whether your operation will be positioned to benefit when it does. This trade battle is going to define the next decade of North American dairy economics.

Your move: Start building relationships with export-focused cooperatives now. Monitor quota utilization reports. Keep tabs on processing capacity in border regions. Because when those barriers start coming down—and they will—the producers who moved first will capture the biggest opportunities.

What do you think? Are you ready to step up when those market barriers start cracking, or are you planning to wait and see how things shake out?

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Unlocking Dairy Profits: The Top 5 Genetic Traits That Actually Make You Money – This article provides tactical strategies for boosting your operation’s core profitability. It complements the main article’s market focus by revealing how to strengthen your herd’s genetic foundation for resilience and efficiency, regardless of shifting trade winds.

- Global Dairy Outlook 2025: Navigating a Buyer’s Market – While the main article zeroes in on Canada, this piece delivers a crucial strategic overview of the entire global dairy landscape. It’s essential reading for understanding how the Canadian situation fits into broader world market trends and risks.

- Beyond the Bulk Tank: How A2 Milk and Value-Added Products Are Reshaping Dairy Revenue – This piece explores innovative ways to break free from commodity price cycles. It demonstrates how to create new, high-margin revenue streams on-farm, providing a proactive strategy to counter the market volatility discussed in the main article.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.