Cull cows over $2,000 and beef-on-dairy calves near $1,000—why this 90-day window could make or break your 2026 margins

EXECUTIVE SUMMARY: Fall 2025 delivers an uncommon—and urgent—opportunity for U.S. dairy operators. Strong cull and beef-on-dairy calf prices, reported at $2,000+ and near $1,000 respectively, are keeping many herds afloat amid relentlessly flat $17 milk. University and market economists warn these beef premiums look fleeting, with the cattle cycle and supply signals already tightening for 2026. Recent research shows Midwestern breakevens remain high, while only producers invested in butterfat performance and rigorous herd management capture true component bonuses. Meanwhile, export hopes are dimming—contract premiums are now won on genetics, traceability, and relentless cost control. As lenders prepare for summer’s critical cattle inventory and cash flow reviews, operations with intentional plans—whether expanding, pivoting, or winding down—consistently protect more equity. The next three months are a “use it or lose it” window for turning fleeting beef revenue into sustainable resilience. What farmers are discovering is that asking hard questions, running fresh numbers, and pushing for proactivity can make 2026 a year of opportunity—not regret.

Checking in with producers this fall, there’s one urgent takeaway: this is a critical 90-day window to turn temporary beef premiums into lasting resilience for 2026. The evidence is in the numbers—cull cows clearing $2,000 and beef-on-dairy calves pushing $1,000 (USDA National Weekly Direct Cow and Bull Report, October 2025). These premiums are propping up many milk checks stuck at $17. However, as extension economists and market analysts from the University of Wisconsin and Cornell emphasize, these conditions are shifting. We’re staring down the last weeks of this run before cattle cycles and supply buildup set a new tone for the coming year.

What’s interesting here is seeing smart operators use this moment to shore up their businesses—paying down debt, making pro-active facility investments, and building a cash buffer instead of assuming current premiums will last. This development suggests that treating a tailwind as flexibility—not false security—creates real strategic advantage for the next transition period.

The Math of Survival: Breakevens & Components

| Revenue Source | 2024 Baseline | Fall 2025 | Per Cow Impact | 100-Cow Herd |

|---|---|---|---|---|

| Cull Cows (15% rate) | $1,500/head | $2,000+/head | +$75 | +$7,500 |

| Beef-Dairy Calves (40% births) | $600/head | $1,000/head | +$160 | +$16,000 |

| Component Bonus (3.7%+ protein) | Base milk | +$1.25/cwt | +$31/yr | +$3,100 |

| TOTAL OPPORTUNITY | — | Stack strategies | +$266/cow | +$26,600 |

| 🚨 Baseline (No Action) | Wait for recovery | Miss window | -$50 to -$150 | -$5K to -$15K |

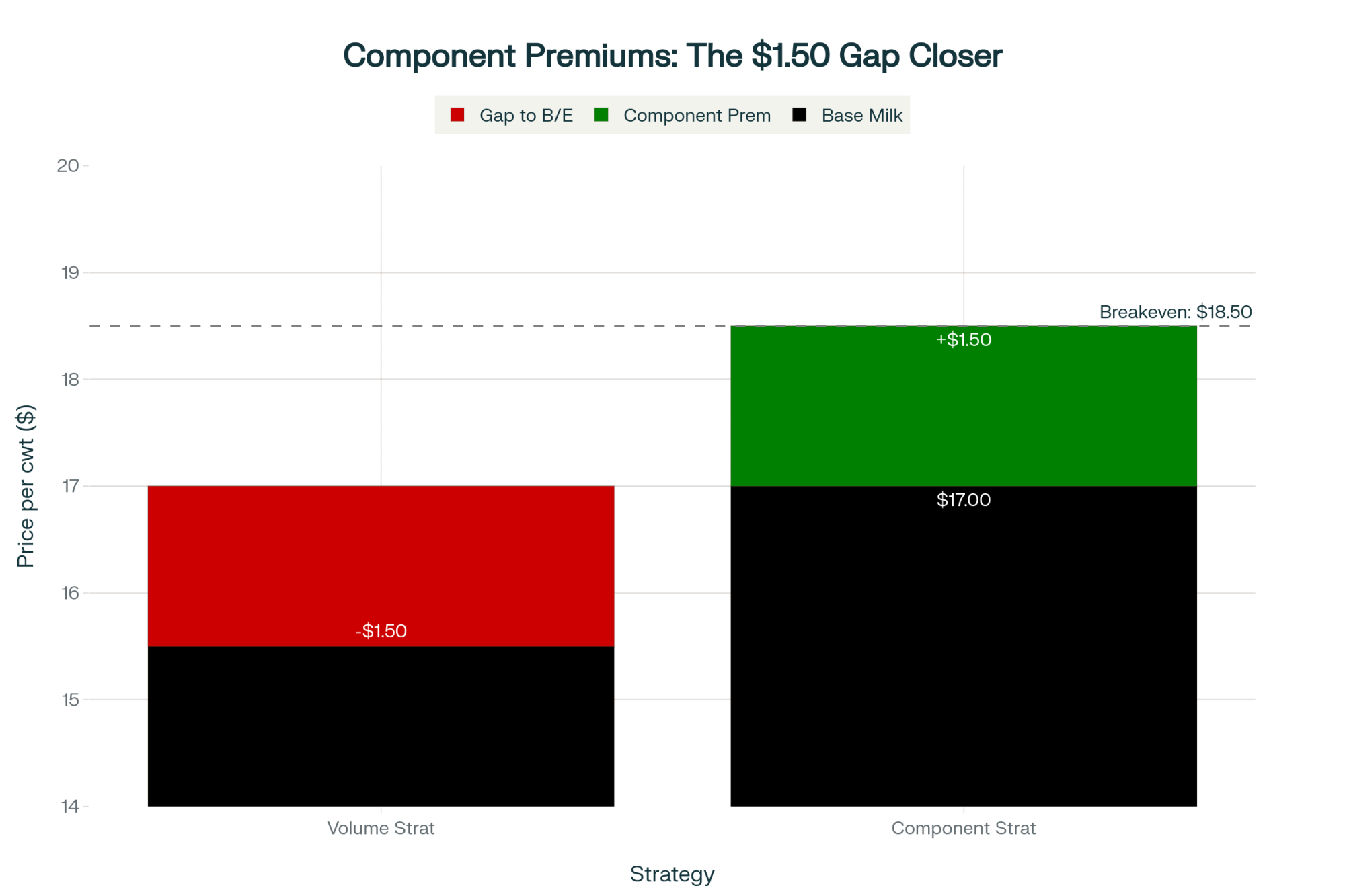

Looking at this trend, most Midwest herds face pre-beef breakevens between $17.50 and $18.50/cwt (UW Center for Dairy Profitability, Fall 2025 Update). Out west, Idaho’s and Texas’s biggest dry lot systems sometimes run at $14–$15/cwt, riding local feed and labor edge. Either way, high butterfat performance is the separating factor. Hitting 3.7% protein or better can mean $1–$1.50/cwt over base—if you’ve invested in genetics, tight fresh cow management, and keep transition periods on track. As many of us have seen, those premiums aren’t accidental; they follow from tough culling decisions and knowing your numbers cold.

Export Hopes, Local Contracts

For years, many of us held out hope that another export surge would save the day—especially from China. But this season’s USDA GAIN trade data and Rabobank’s Dairy Quarterly all show it’s growth in cheese and butter, mostly cornered by New Zealand and Europe, that’s outpacing demand for U.S. powder. In the Midwest and Northeast, plants are hungry for consistent, high-component, specialty contracts. Herds that made early investments in A2, organic, or niche certifications find their milk in demand; others should ask whether fluid or low-component contracts will provide enough margin as the cycle shifts.

July Inventory—Lender Stress & Planning Leverage

It’s no surprise to seasoned managers that the USDA July Cattle Inventory Report is more than an annual headcount. When beef prices soften and heifer retention ticks up, lenders across regions—like those briefed by Minnesota Extension and New York FarmNet—run tougher stress tests on farm finances. Farms sitting right at a 1.25x debt service coverage are fine for now, but that can slip fast. Those who restructure or plot a sale while balance sheets are still strong tend to carve out six-figure equity advantages compared to late, forced exits. The lesson, as risk educators preach, is that deliberate action always beats hoping for a bounce.

Three Lanes: Exit, Pivot, or Scale

From kitchen tables in northeast Iowa to group calls with Western Idaho co-ops, three paths are front and center:

- Exit with Intention: Producers looking at high debt or retirement are using strong asset values to secure their family legacies, not just chasing another cycle.

- Premium Niche Pivot: Some are cutting herd size, chasing premium contracts—A2, grassfed, organic, you name it—with a willingness to meet tough specs on components, health, and traceability. This approach works best when paired with deep processor relationships and quick financial routines.

- Expansion: A Tool for the Prepared: Rabobank’s 2025 sector review and extension management profiles agree: disciplined, high-performing herds with fresh cow and labor management dialed in can scale with confidence. For others, fast growth just means fast exposure if things don’t break right.

The north star here? Monthly cost-of-production benchmarking, regular review with lenders, and not waiting to renegotiate contracts until margins are squeezed.

Global Competition & Policy Realities

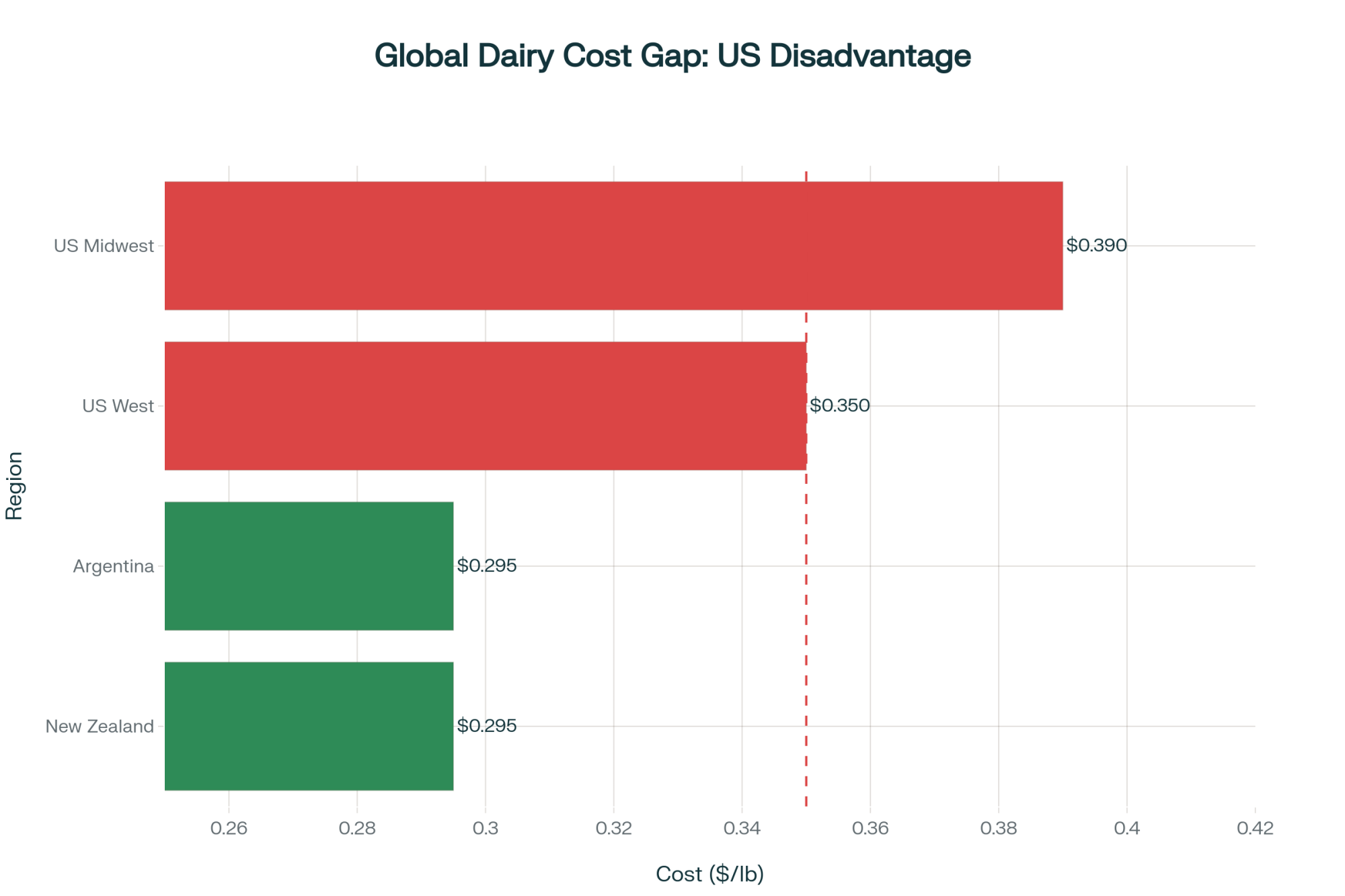

It’s worth noting that IFCN’s 2025 benchmarks put leading New Zealand and Argentina herds at $0.27–$0.32/lb. Even top Western U.S. performers run about $0.35, with most Midwest herds closer to $0.39. The gap isn’t destiny: it reflects differences in feed-to-milk efficiency, heifer survival, and transition consistency. Policy backstops like DMC are valuable, and analysis from Cornell and Wisconsin Extension reinforce this: they help good operators stay afloat but aren’t enough to shore up chronic losses over time.

The Myth of the “Deal of the Century”

As expansion talk returns, recent Rabobank analysis and local case studies ring a familiar bell: the “deal of the century” works out for operations already strong on the basics—cost, herd health, labor discipline. Ramped-up purchases without this foundation rarely yield the hoped-for returns and often accelerate operational headaches.

Action Steps: Navigating the 90-Day Window

Here’s the practical bottom line: This window is closing, not expanding. First, benchmark your cost of production with the latest IFCN and extension tools; don’t trust last year’s averages. Next, proactively arrange a review session with your banker—not to plead for relief, but to present your plan for surviving and thriving into next year. Scrutinize your processor or coop contracts and specialty program agreements—will you be the supplier they prioritize in a shrinking market? And take the time this fall to address transition and herd health; waiting until calving issues flare won’t do.

The difference for 2026 will be made by those who act intentionally and aren’t afraid to adjust their course. That’s the mindset that’s kept American dairies resilient through every market twist—and it’s how the smartest operators I know are reading this moment.

KEY TAKEAWAYS

- Farms leveraging this fall’s beef premiums could improve net margins by $100 to $200 per cow, while disciplined herd and transition management opens $1–$1.50/cwt in component bonuses (UW Extension, IFCN, Rabobank).

- Practical action: Benchmark your cost of production now, meet proactively with lenders to review true breakevens, and secure or re-align premium contracts for 2026 before markets tighten.

- Butterfat, protein, and health discipline now outperform volume; herds that master transition periods and component payouts lead in uncertain markets.

- The window for turning “luck” into a long-term strategy is closing. Lenders, markets, and export buyers all point to greater volatility ahead for operations not dialed on costs or value.

- Across Wisconsin, Idaho, and the Northeast, the most resilient producers are those who build trusted advisor relationships and plan ahead—regardless of herd size or business model.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Navigating Today’s Dairy Margin Squeeze: Insights from the Field – This piece provides tactical field insights for optimizing components and feed strategies. It reveals how targeted nutritional adjustments and culling discipline can directly boost per-cow income, offering an immediate action plan for improving the breakeven numbers discussed in our article.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong– Go deeper into the strategic market forces shaping 2026. This analysis challenges conventional wisdom on pricing models and policy risks, demonstrating why a component-based economic strategy and stronger processor relationships are now more critical than ever for long-term survival.

- AI and Precision Tech: What’s Actually Changing the Game for Dairy Farms in 2025? – Explore the innovation and technology driving modern profitability. This article breaks down the real-world ROI for precision tools like AI-driven feeding and automated health monitoring, showing how strategic tech investments can slash input costs and enhance herd efficiency.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!