$177M in robot settlements should tell you something. Energy bills up 50%, with maintenance costing $ 25,000 per year. Time to rethink automation?

EXECUTIVE SUMMARY: Look, I get it—everyone’s talking robots like they’re the holy grail of dairy automation. But here’s what nobody’s telling you at those dealer meetings. The manufacturers just wrote $177 million in settlement checks because their flagship systems didn’t work as promised, and that should make every producer pause before signing on the dotted line. We’re seeing maintenance costs climb from $5,000 to $ 25,000 or more annually per robot, while energy bills increase by 25-50% across the board. Meanwhile, with loan rates at 5-7% and input costs as they are, the math on $ 200,000 robots gets pretty ugly pretty fast. The smart operators I’m talking to? They’re creating targeted automation packages for $ 75,000-$125,000 that deliver comparable productivity gains without the tech headaches. You might want to take a hard look at what’s actually working before you bet the farm on European engineering.

KEY TAKEAWAYS

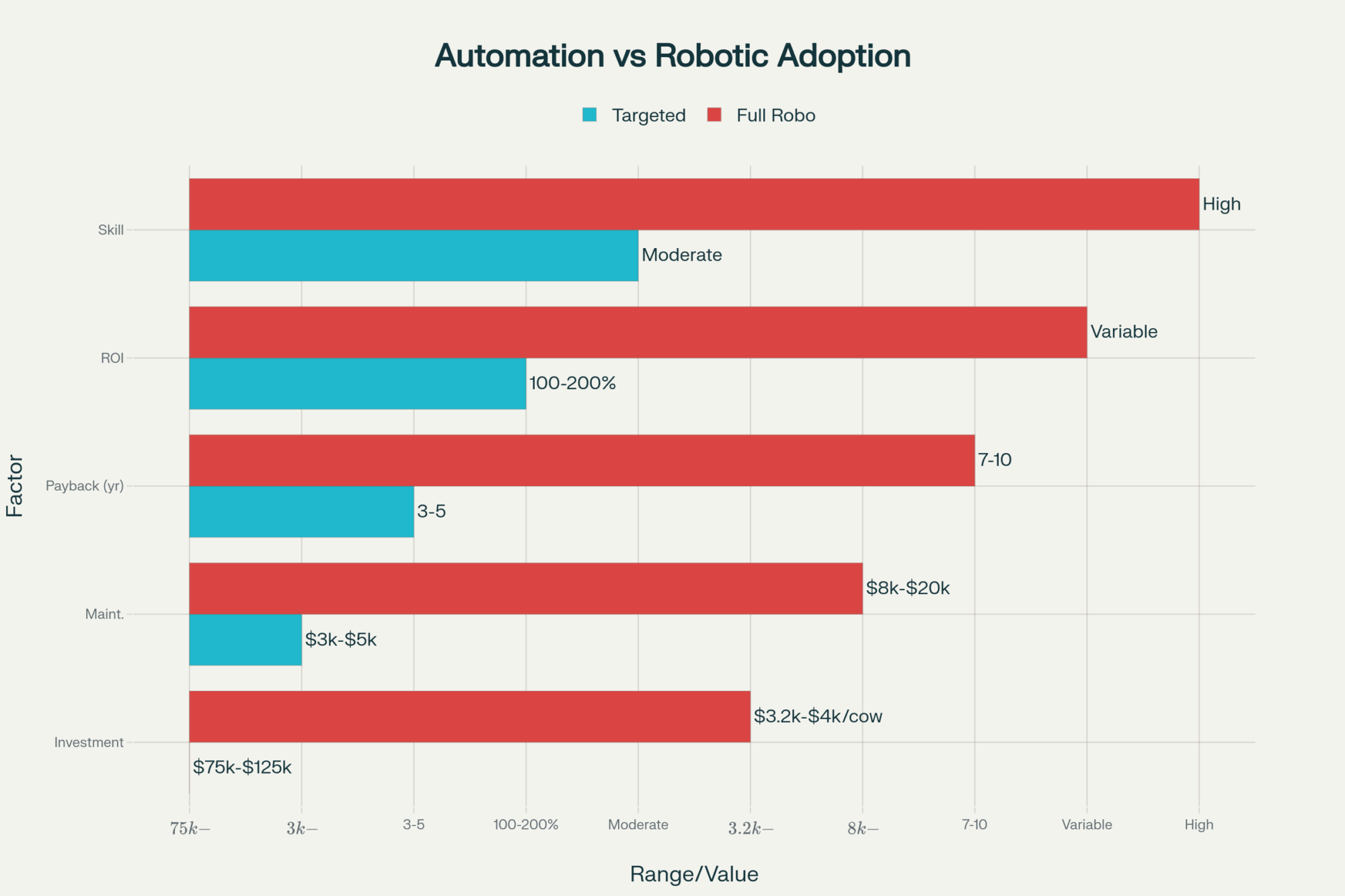

- Cut automation costs by 60-70% with targeted systems – skip the $ 200,000 robots and build $ 75,000-$125,000 automation packages using proven components like automated takeoffs and cow ID systems. With current 5-7% loan rates, you’re looking at manageable payments instead of farm-threatening debt service.

- Avoid the $ 25,000 maintenance trap – Extension surveys show that 25% of older robot operations incur $ 15,000-$25,000 annually in maintenance costs. Compare that to $45-55/cow for conventional parlor maintenance, and suddenly your “labor-saver” becomes a profit killer.

- Question the energy math before you sign – Industry studies document 25-50% energy increases with robot installations, plus $150-200/cow annually in extra feed costs for incentive pellets. Run those numbers through your current utility rates before believing the efficiency claims.

- Demand service guarantees upfront – With parts delays from Europe and stretched technician networks, downtime costs are a real concern. Get specific commitments on response times, parts availability, and backup support—because your cows don’t care about manufacturer excuses at 2 AM.

- Focus on management amplification, not technology replacement – The farms that succeed with automation treat it as a management system, not just as equipment. If you’re not ready to become a 24/7 tech company that also happens to milk cows, maybe start by optimizing what you have first.

So here’s what nobody’s talking about at the dealer meetings: when manufacturers hand out $177 million in settlements because their flagship milking robots didn’t work as promised, that’s not just legal noise—that’s your industry telling you something critical about the gap between marketing promises and barn-floor reality. Time to get serious about what robotics really cost and whether you’re ready for what comes next.

The thing about robot dealers… they used to show up with these glossy presentations full of labor savings and efficiency gains, talking about the “future of dairying” as if it were inevitable. Hell, five years ago you couldn’t grab coffee in any dairy town from California’s Central Valley to Wisconsin’s cheese country without hearing someone pitch the robot revolution.

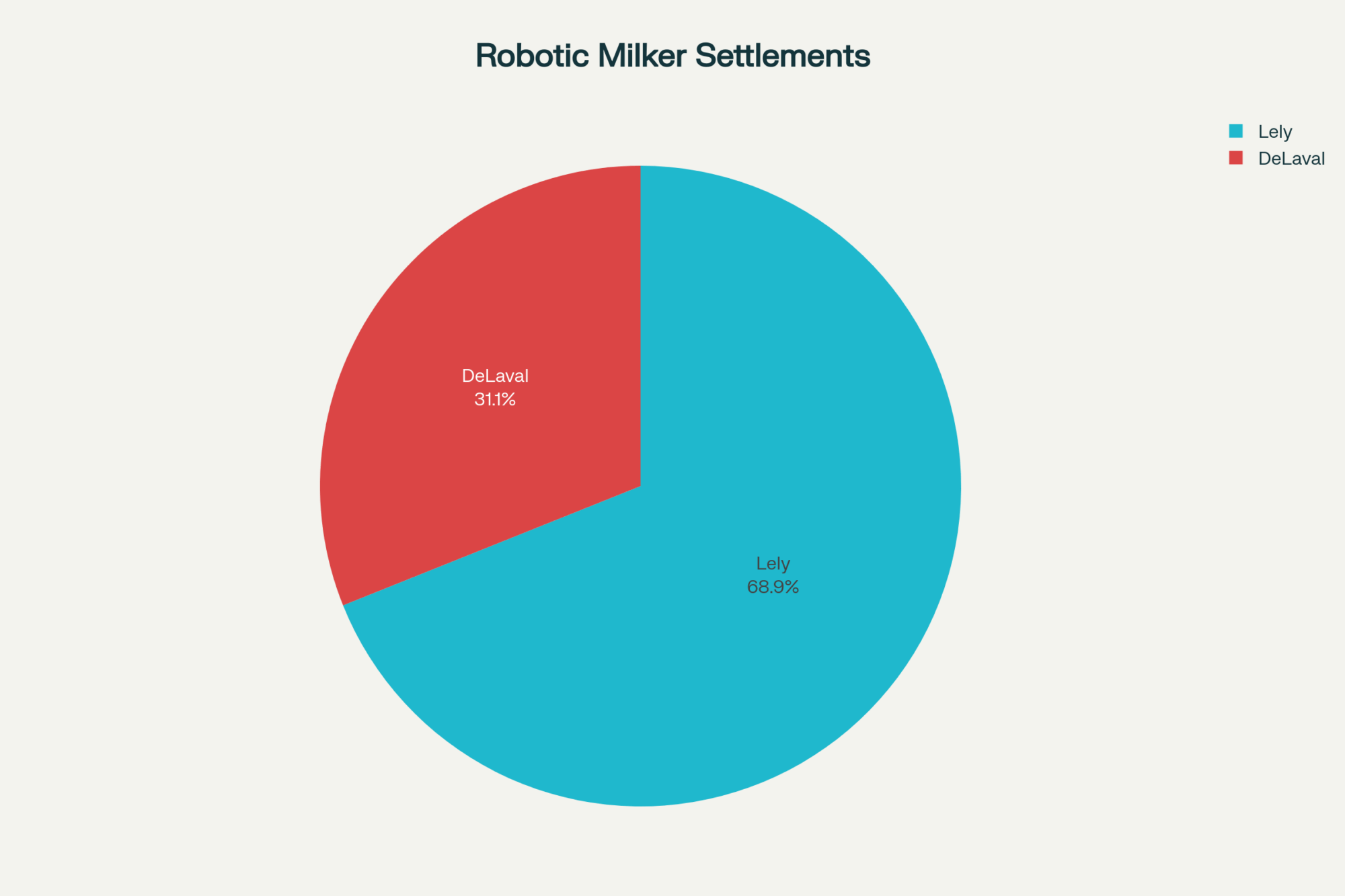

But what’s actually happening now? I’m talking to producers from the Corn Belt down to Texas, and the story’s getting more complicated. Lely just settled for $122 million and DeLaval for another $55 million—nearly 400 farmers in that first case alone claiming their Astronaut A4 systems didn’t deliver what was promised.

That’s not a few unhappy customers. That’s a systematic acknowledgment that something went sideways between the sales pitch and the milking stall. And here’s what gets me—if the technology was so bulletproof, why are these companies writing checks instead of fighting in court?

What strikes me most about these settlements is how quietly the news travels through our industry. You’ll hear whispers at field days, maybe a comment over a gate… but nobody wants to admit they might’ve made a quarter-million-dollar mistake, right?

When Your Electric Bill Becomes the Wake-Up Call

Here’s what producers are actually seeing in their monthly statements—and this is where the rubber meets the road. Industry studies document energy increases of 25–50% in many robotic installations, with some farms experiencing even higher jumps. That’s not theoretical; that’s real money every month, whether you’re dealing with summer cooling loads in the South or winter heating costs up North.

I keep hearing from producers—guys running anywhere from 200 to 500 cows—who mention budgeting an extra $200 or more per robot per month just for electricity. These boxes operate 24/7, powered by vacuum pumps, air compressors, and computers that never stop. Your power company definitely loves robot dairies, let me put it that way.

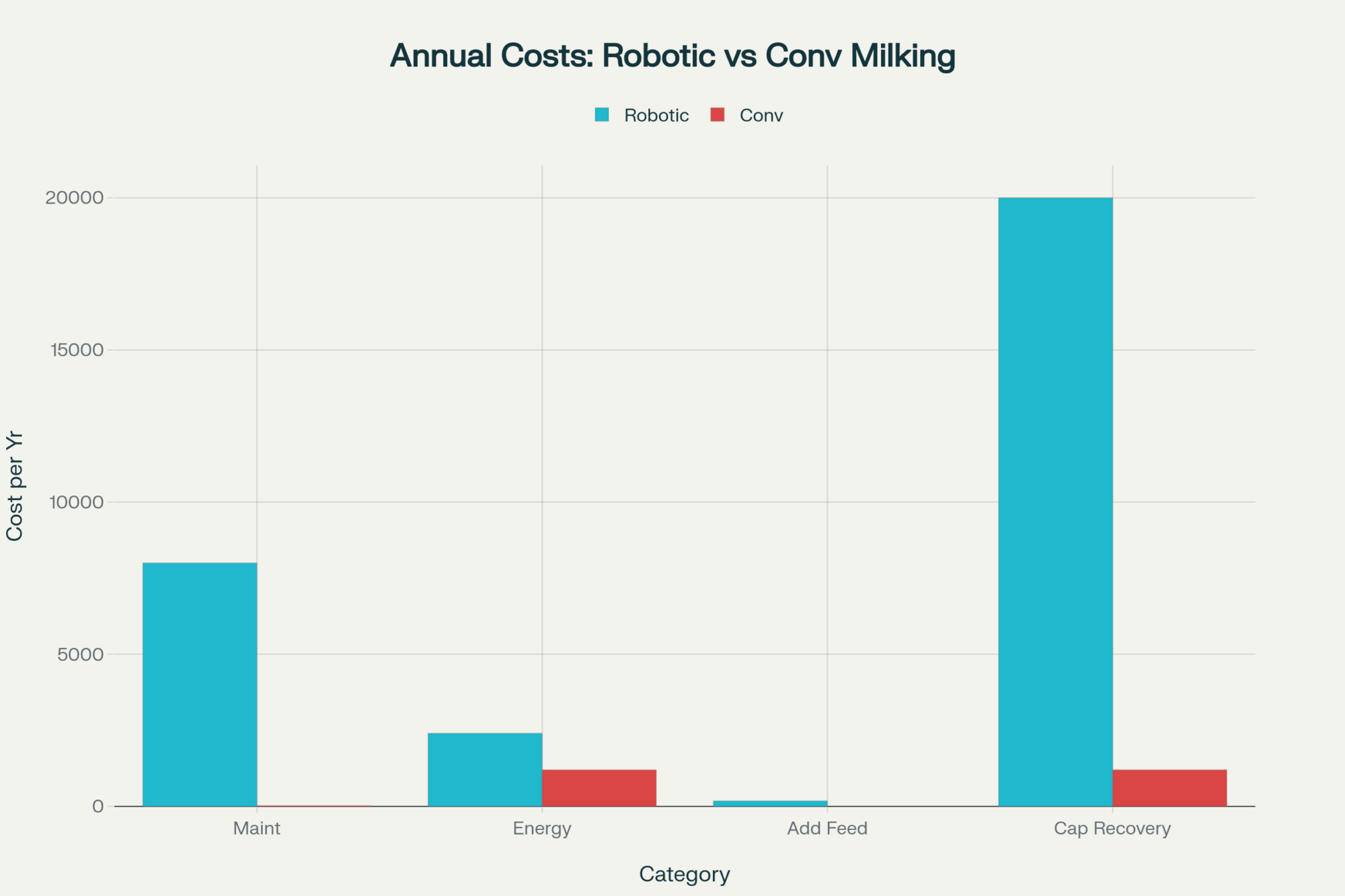

However, here’s where it gets interesting —or expensive, depending on how you look at it. The maintenance aspect is what really catches people off guard. According to recent collaborative surveys from Wisconsin Extension, Minnesota, and Penn State, we’re looking at costs that start around $5,000 per robot in early years but climb to $10,000 or more as units age.

And get this—25% of farms with older systems report costs above $15,000 per robot per year, with some hitting $25,000 or more. That’s when producers start doing the math backwards and realizing their conventional parlor was costing $45 to $55 per cow annually for maintenance. It’s not even close.

What’s particularly troubling is how many operators tell me they weren’t prepared for this escalation. You budget for the initial investment, maybe factor in some service costs… but when your five-year-old robot needs major component replacements, that’s when reality hits.

What 2025 Market Conditions Really Mean for Your Decision

The financial landscape right now? Let’s just say it’s not exactly robot-friendly. Most producers are looking at equipment loans with interest rates between 5-7% through the FSA, sometimes higher with commercial lenders, depending on their relationship with the bank. Slap that on a $ 200,000 robot, add facility costs, electrical work, and concrete… suddenly you’re looking at loan payments that could buy a lot of quality feed.

And input costs? Corn is currently sitting around $4.07 to $4.20, while soybean meal is running in the $270-280 range. Even with decent grain prices, most robot operations are feeding an extra $150–$200 per cow annually just in pellets to keep cows motivated to visit the box. That adds up fast when you’re trying to justify the investment.

Here’s what’s particularly noteworthy about current market conditions: the farms that are thriving with robots tend to be those that can afford to make mistakes. They had the financial cushion to weather the learning curve, the service calls, the inevitable “we didn’t expect that” costs that seem to pop up in year two or three.

Are we creating a system where only the biggest operations can afford to automate? Because that’s what the numbers are starting to suggest…

The “Management Amplifier” Reality Check

I keep hearing industry observers describe robots as “management amplifiers,” and honestly, that might be the most accurate description out there. The technology doesn’t make bad managers good—it makes their problems bigger and more expensive.

I’ve seen robot barns putting out over 2 million pounds of milk per FTE, which is genuinely impressive. However, those same operations are running at a capital intensity of $3,200 to $4,000 per cow. You’re betting everything on keeping both the robots AND the cows working like clockwork.

What’s fascinating—and this doesn’t get discussed enough—is the growth pattern we’re seeing in countries like Australia, where AMS adoption has actually been increasing steadily, despite some early skepticism about pasture-based systems. Different continent, different climate, but the successful operations share certain characteristics regardless of geography.

The common thread? Management teams that treat robotics as a management system, not just a piece of equipment. They understand cow flow, they’ve mastered the feeding protocols, and most importantly—they’ve accepted that they’re running a tech company that happens to milk cows.

Are you buying the robot… or are you buying the promise? Because there’s a difference, and it matters more than most people want to admit.

The Service Reality Nobody Puts in the Brochure

| Service Factor | Robotic Systems | Conventional Parlors |

|---|---|---|

| Parts Availability | 3-7 days (Europe shipping) | Same day (local suppliers) |

| Technician Availability | Limited, specialized | Widely available |

| Downtime Impact | Complete milking shutdown | Partial operation possible |

| Emergency Response | Manufacturer-dependent | Local service network |

The thing about service delays is that they’re becoming more common, not less. I keep hearing stories—robots down for days waiting on parts from Europe, technicians stretched thin across multiple states, software updates that somehow create new problems. Perhaps not every farm, but it happens often enough that smart producers are considering backup plans.

And the labor piece? Remember when robots were supposed to solve our people problems? Instead, you’re trying to find technicians who can code, troubleshoot hydraulics, and somehow convince fresh heifers to walk into a robotic milking stall. It’s like trying to find a good AI cow with perfect feet and stellar genomics—theoretically possible, but good luck with the search.

That “labor-saver” sticker price sometimes just means you’re trading one set of headaches for a completely different, more expensive set of headaches. At least when your parlor breaks, you can usually find someone local who knows how to fix a vacuum pump.

What Smart Money’s Actually Doing (And Why It Matters)

Here’s what’s quietly happening across a lot of successful operations: targeted automation instead of wholesale robot adoption. Automated takeoffs, cow ID systems, alley scrapers, feed pushers—you can put together solid packages for somewhere in the $75,000 to $125,000 range, all in.

The ROI data from documented case studies suggests strong returns are achievable for well-executed “targeted automation,” with some operations reporting payback periods that put them ahead of full robotic systems. There’s genuine pride in counties where producers are getting parlor productivity numbers that rival the fanciest robot barns—with significantly less technical complexity.

Here’s How the Numbers Actually Stack Up:

| Investment Type | Initial Cost | Annual Maintenance | Break-Even Years | 10-Year ROI |

|---|---|---|---|---|

| Full Robotic ($200k/robot) | $200,000 | $8,000-$20,000 | 7-10 years | Variable |

| Targeted Automation | $75,000-$125,000 | $3,000-$5,000 | 3-5 years | 100-200% |

| Optimized Conventional | $25,000-$50,000 | $2,000-$3,000 | 2-3 years | 150-300% |

When considering investment per cow, the differences become quite stark. A traditional robotic approach costs $3,200-$4,000 per cow, with payback periods of 7-10 years and high maintenance complexity. Targeted automation might cost significantly less per cow, often with a 3-5 year payback on many components and manageable maintenance requirements. Then there are optimized conventional systems—incremental improvements with shorter payback periods that utilize familiar technology.

The question becomes: what matches your management style, your financial situation, and your long-term goals? Because at the end of the day, there’s no one-size-fits-all answer. And frankly, that’s what scares a lot of dealers.

What Those Settlement Numbers Actually Mean (The Part Nobody Wants to Discuss)

Here’s something to consider… when manufacturers settle lawsuits for this kind of money, they’re not admitting guilt, but they’re acknowledging a gap between what was promised and what was delivered. That gap has real implications for anyone considering their next major equipment purchase.

If you’re serious about automation—and I mean really serious, not just attracted to the shiny technology—you need to be even more serious about understanding exactly what you’re signing up for. That means talking to producers who’ve lived through both the honeymoon phase and the reality check that comes 18 months later.

The manufacturers settling these cases aren’t going anywhere. They’re still making robots, still improving the technology, still hiring dealers to make sales calls. However, they’re also acknowledging, through these settlements, that the early marketing may have oversold the benefits and undersold the challenges.

What does that mean for your decision? Maybe it means approaching the whole thing with a bit more skepticism and a lot more financial planning than the first wave of adopters did. Maybe it means asking different questions at the dealer meeting.

The Questions You Should Be Asking (But Probably Aren’t)

Before you sign any contracts or shake any hands, ask yourself—honestly—are you prepared to become a 24/7 tech support operation? Because that’s what successful robot dairies really are. Your cows don’t care that it’s Sunday morning or that you had vacation plans when the system throws an error code.

And here’s the bigger question: if manufacturers are handing out settlement checks worth $177 million, what does that tell you about the gap between marketing promises and actual performance? Are you betting your operation on technology that’s still working out the bugs, or waiting for the next generation that might actually deliver what this generation promised?

But let’s get practical here. What questions should you actually be asking your dealer? Try these: What happens when it breaks down at 2 AM on Christmas morning? Who fixes it, how fast, and what does that cost? What’s your parts availability track record over the past 24 months? Can you put me in touch with three producers who’ve had their systems for more than four years—not just the success stories?

The successful robot operations I know—and there are some genuinely impressive ones—share certain characteristics. They had financial cushions. They had technical aptitude or hired it. They approached the transition systematically, not emotionally. And most importantly, they never lost sight of the fundamentals: cow comfort, consistent routines, and margins that actually work.

Your Real Decision Framework (Cut Through the Marketing Noise)

Look, robots aren’t disappearing from our industry. The technology’s getting better, the service networks are (slowly) improving, and farms are making real money with automated systems. However, the settlement numbers are your industry’s way of telling you that this technology isn’t magic and isn’t a substitute for good management.

Here’s what I think you need to consider—really consider—before making this jump:

Can you honestly handle being a technology company that happens to milk cows? Because that’s what you’re signing up for. Every dairy automation decision should start with that question. If the answer is yes, then you need to consider financial cushions, backup plans, and management systems that can effectively handle complexity.

If the answer is no—or if you’re unsure—then targeted automation may be a better option. Perhaps optimizing what you have yields better returns than betting the farm on boxes from Europe.

The real winners in the next five years? They’ll be the producers who make decisions based on their actual capabilities, not their aspirations. Who understand that every dollar spent on technology needs to come back with interest. Who realize that the most expensive mistake you can make is assuming that buying a solution means you’ve solved your problems.

This industry is built on people who adapt, learn from others’ expensive mistakes, and make decisions that keep their operations viable in the long term. The manufacturers who just wrote those settlement checks? They’re already working on the next generation of systems, the next round of promises, the next wave of marketing materials.

The question is: will you be more prepared for this conversation than the last group of producers was? As the stakes continue to rise, the technology becomes increasingly complex, but the fundamentals of running a profitable dairy remain unchanged.

Keep asking the hard questions. That’s how we all get better at this.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Boosting Dairy Farm Efficiency: How Robotic Milking Transforms Workflow and Reduces Labor – Reveals practical strategies for optimizing barn design, cow traffic management, and scheduling protocols to maximize labor savings and minimize the operational headaches that derail robotic milking success.

- Robotic Milking Revolution: Why These Money Machines Are Crushing Traditional Parlors – Demonstrates how successful operations achieve 15-20% production increases and 7-year ROI timelines, providing the financial benchmarks and performance metrics you need to evaluate investment alternatives.

- Robotic Milking Revolution: Why Modern Dairy Farms Are Choosing Automation in 2025 – Explores emerging AI integration, predictive health monitoring, and next-generation efficiency metrics that forward-thinking producers are using to gain competitive advantages in an evolving marketplace.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!