Milk yields are up, but did you know using beef-on-dairy strategies could boost your calf check by $400–$800 per head this year?

EXECUTIVE SUMMARY: Alright, let’s cut to it over this coffee. The old “breed everything for the parlor” playbook doesn’t pencil out in 2025. We’re sitting in a year where using beef semen on the bottom 60% of your cows—while protecting your genomics up top—can turn a $200 calf into an $800 windfall if you nail the timing and the market. The numbers are right there: this year’s bred replacements are averaging $2,660 a head, and some are clearing $4,000 at select Midwest barns. Meanwhile, global herd efficiency is tightening—herds that invest in sexed semen and genomic testing are shaving breeding costs and pulling ahead in ROI. Every market move from Ontario to Oklahoma says the same thing: if you’re not flexing with these tools, you’re losing ground. Give this strategy a hard look. It’s not just new—it’s smart, and it’s making some neighbors quietly profitable.

KEY TAKEAWAYS

- Boost per-calf revenue up to $800:

Start breeding lower-merit cows with Angus or SimAngus beef semen. Track market demand—2025 beef cross premiums are strong, especially when regional feeders are short. - Cut replacement costs by 20%:

Roll out genomic testing (like Clarifide) and reserve sexed semen for your top 30–40% cows. Fewer home-grown replacements, but higher quality and less cash bled on average heifers. - Improve feed efficiency by $30–$45/head:

Target beef-on-dairy calves for feedlot—Texas Tech and USDA numbers say these crosses gain faster and finish with better feed-to-gain than straight Holstein steers. - Use herd monitors (CowManager, Afimilk) for faster ROI:

Tighten up open days and hit better conception with AI—smart heat detection is the easiest thing you’ll do this year for more predictable calf crops. - Plan for price swings and replacements:

Don’t get caught chasing auction highs—model worst-case heifer shortages so your beef breeding never comes back to haunt you when the next drought zaps the market.

The thing about running numbers on a July night—long after the last fresh cow’s been checked and while tomorrow’s ration is still running through your mind—is you realize just how easily the whole game can tilt. One extra beef calf on the truck might mean an $800 check at Saturday’s sale… or leave you scrambling for a replacement heifer and wondering which one hurts worse: missing genetics or missing cash.

Mid-Thought, Mid-Shift: How the Beef-on-Dairy Boom Is Rewriting the Old Playbook

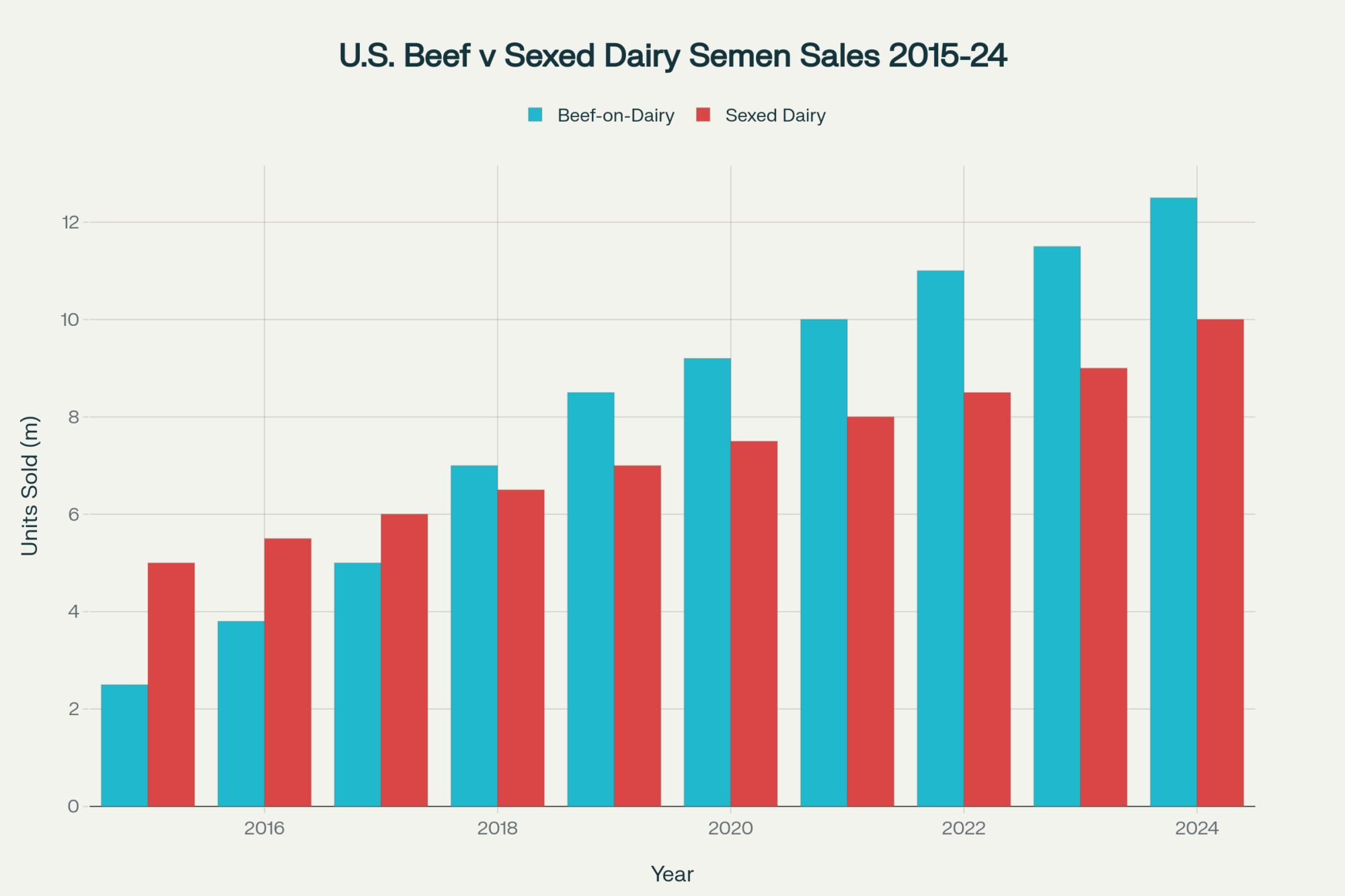

So, what’s really happening out here, across barns from the Texas Panhandle to upstate New York? The latest NAAB data shows U.S. dairies snapped up about 7.9 million units of beef-on-dairy semen in 2024—yep, another record, and it’s not some flash-in-the-pan. From what Hoard’s Dairyman and regional summaries are flagging, herds with 120 cows and 2,500 cows are both picking—and betting—on the same fork in the road. The truth is, whether you’re at the Michigan Milk Producers meeting or a WhatsApp group with Mennonite neighbors, the question is no longer “should we do beef-on-dairy?” anymore. It’s “how much beef, how fast, and on which end of the herd?”

What the Numbers—and the Auction Barn—Are Really Telling Us

This development is fascinating, precisely because it’s rooted in both economics and genetics. Recent USDA and Hoard’s Dairyman calf market data confirm regular $200–$400 premiums for beef crosses over straight dairy bull calves. At the better barn sales, that premium climbs—$600, sometimes even $800—for crossbred calves out of Holstein cows on a standard ration, especially with the right Angus or SimAngus bulls in the mix. But be careful: those numbers spike mostly when regional feedlot buyers jump in for supply. For most of us, the average falls lower.

What strikes me is how quickly individual auction highs can tempt an operation into risky territory. That’s classic “don’t bet the farm on a neighbor’s best day” stuff.

Meanwhile, heifer prices have become a true pain point. USDA’s spring report shows bred replacements average $2,660 and higher nationally, and $3,500 isn’t unusual in Ontario sales or California’s most competitive barns. Midwest producers are feeling the pain, and Canadian operators are taking note. Some springers—particularly if they have the genomics and look—have been going for $4,000. Is that sustainable? Probably not forever, but nobody expects a collapse soon.

This growing divergence between calf value and replacement cost is the core economic driver of the entire trend. The data from the last several years makes the math undeniable:

Comparison of U.S. Replacement Heifer Prices and Beef-on-Dairy Calf Premiums (2018–2025)

| Year | Replacement Heifer Price ($/head) | Beef-on-Dairy Calf Premium ($/head) |

|---|---|---|

| 2018 | 1,200 | 150 |

| 2019 | 1,450 | 200 |

| 2020 | 1,800 | 300 |

| 2021 | 2,300 | 400 |

| 2022 | 2,500 | 500 |

| 2023 | 2,700 | 600 |

| 2024 | 2,800 | 650 |

| 2025 | 2,900 | 700 |

The widening gap between soaring replacement heifer costs and rising crossbred calf premiums illustrates the powerful economic engine driving the beef-on-dairy strategy across North America.

Cutting to the Chase: Who Gets Bred to What (and Why)

Here’s how the best operations are acting, from what I see and hear. Genomic testing (Clarifide and similar) now sorts the top 30–40% for sexed dairy semen; the rest of the string typically receives proven calving-ease beef, often from Angus or Simmental breeds. Limousin? That’s popping up in some Western Canada barns this summer, too.

However, I must bring some nuance to this. There is no single playbook. A South Dakota dry lot might approach replacement math differently than a Wisconsin tie-stall or a New Mexico freestyle that can pivot to raise more young stock. Feed costs, labor availability, proximity to a progressive feeder—all of it matters.

Where real value shows up is in precision management. Herds using CowManager or Afimilk, or even just loyal pedometer tags, are shaving off open days, boosting conception rates, and matching cross-calves to premium buyers rather than just flooding the local calf market. One Vermont operation reported that they trimmed replacement costs by 20% in one spring simply by linking heat detection to more targeted breeding. That seems to be the trend everywhere—flexibility pays, not blanket strategy.

Data Meets Packing Plant: The Carcass Analysis Nobody Saw Coming

If you’d asked me in 2020 whether packers—or even feeders—would care about beef-on-dairy genetic lines, I’d have been skeptical. Now, conversations at packing plants often involve marbling, color, and dressing percentage—sometimes even ahead of component tests. According to recent work by Dr. Dale Woerner at Texas Tech, crosses are often graded Choice or better, up to 95% of the time, and the number hitting Prime is inching higher each year.

Want proof? USDA and Kansas State feedout analysis shows that crossbred steers often save $30–$45 in feed compared to Holstein peers, although local price swings and ration costs can alter that number. The feed-to-gain advantage? That’s what makes these calves easier to place; current trends suggest that crossbreds pencil out cleaner than straight Holstein steers without sacrificing much in daily gain, although results vary by region and season.

And as more herds adopt the Feed Saved trait, you’re not only chasing beef premiums but reducing feed cost per cwt of gain—good for the wallet and sustainability numbers.

The Downside: Genetics, Starvation, and Chasing Your Own Tail

Here’s where things turn dicey. Some folks get too excited about beef premiums, and the replacement pipeline dries up quickly. Suddenly, it’s a $4,000 invoice—or worse, settling for lower-genetic heifers that don’t boost production.

As Dr. Mark Stephenson of UW-Madison has warned, skipping in-house replacements means paying more and losing ground. Your milk yield, fertility, and even animal health can decline, and the genetic deficit can persist for years. That’s not just an American story. Canadian herd advisors echo the same thing: preserve elite genetics for the next generation, crossbreed only those cows unlikely to move your herd forward, and know your market backward and forward before that next breeding season.

What’s Brewing North of the Border?

Don’t overlook what’s unfolding up north. In Ontario and Quebec, barn space is tight, and the local veal market sets a high floor for crossbred calf prices. Semex’s Beef Up program is prevalent in those provinces, with some special sales reaching C$1,100–1,200 per top calf—although most prices are lower if supply surges.

Alberta, Manitoba, Saskatchewan? They’re betting on enough Holstein replacements but swinging hard on beef crosses heading for U.S. and Alberta lots. However, here’s the curveball: currency volatility, uncertainty among feeder buyers, and demands for traceability. Each province’s playbook is tailored to its specific market, not the national average.

| Region | Strategy Focus | Top Beef Sires | Typical Calf Premium ($) |

|---|---|---|---|

| Midwest U.S. | Replacement shortage, beef cross | Angus, SimAngus | 600–800 |

| Ontario/Quebec | Veal, tight barn space | Angus, Simmental | 900–1,200 CAD |

| Western Canada | Export markets, traceability | Limousin, Angus | 500–900 CAD |

| Texas/West U.S. | Feedlot linkage, heat tolerance | Angus, Beefmaster | 500–700 |

Bottom Line Box: Don’t Let the Premiums Blind You

Here’s the take-home, no matter where you milk:

Genomic test and prioritize your best cows—keep your replacements coming, don’t just chase beef checks.

Use beef on the bottom cows only if you can place every calf with a buyer you trust.

Run the numbers—include the ugly scenarios too. Don’t rely on a few standout sales to support your budget.

Monitoring tools are a force multiplier, but nothing beats a sharp herdsman who knows the pen and the market calendar.

Pay attention to shifts in both local and cross-border premiums; Canadian feeder play and Midwest calf demand can rapidly fluctuate prices.

Count on averages, not outliers—don’t chase unicorns.

Plan for tight spots: if replacements get scarce, your only “golden calf” might be an invoice.

This trend isn’t going away. The herds that keep their heads—wide awake to the risks, but willing to flex as markets and genetics shift—are the ones writing the new rules.

What strikes me about all this? We’re living through a real-time rewrite of dairy economics. Ten years ago, the “bull calf problem” was just a cost of milking cows; now, the right crossbred can write a check—even as the wrong math can bounce the next year’s herd into trouble.

So, keep probing, keep running your own numbers, and stay skeptical of quick fixes. Because in this business, adaptability and discipline—not trends—pay the bills.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beef on Dairy: More Than Just a Black Calf – Go beyond just picking a black bull. This tactical guide breaks down the critical EPDs—from calving ease to carcass merit—to help you select beef sires that truly boost profitability without compromising the health of your dairy herd.

- Don’t Let Short-Term Gains Ruin Your Long-Term Genetic Strategy – Before you go all-in on beef, read this. It outlines a strategic framework for protecting your dairy herd’s long-term genetic progress and profitability, ensuring today’s beef premium doesn’t become tomorrow’s genetic and financial deficit.

- The Genomic Revolution: Are You Making Data-Driven Culling Decisions? – Maximize the value of your beef-on-dairy strategy with this deep dive into applied genomics. Learn how to precisely identify your lowest-ranking animals for beef breeding, improving overall herd efficiency and ensuring only elite genetics create your next generation.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!