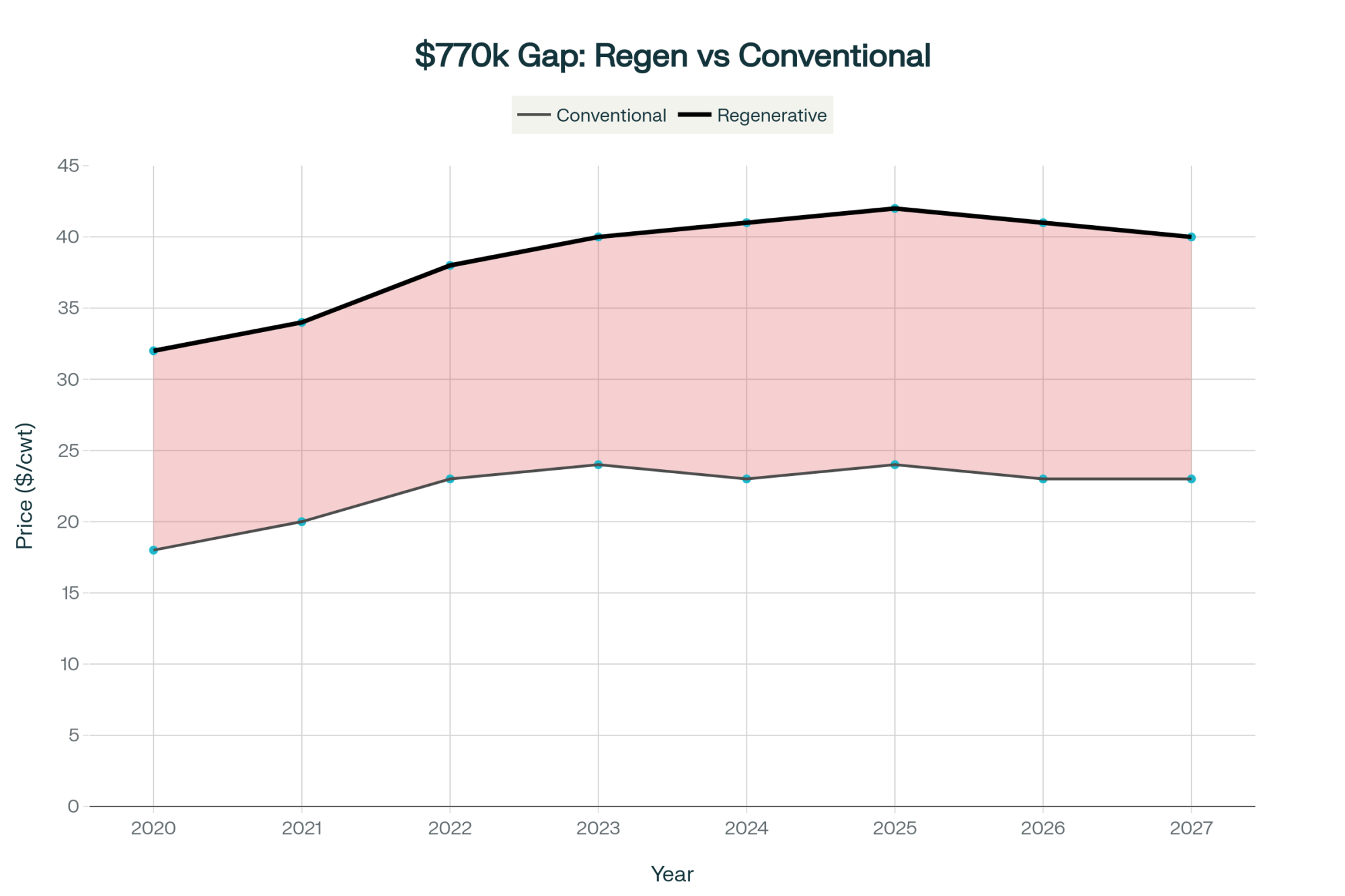

$41/cwt regenerative vs $23/cwt conventional—same Ohio county. The difference? Contract terms most farmers miss. Here are the seven that matter.

EXECUTIVE SUMMARY: The regenerative dairy opportunity is real—some farmers are locking in $41/cwt for five years—but so is the $770,000 gap between what transitions actually cost and what processors pay. With Nestlé and Danone facing potential fines in the hundreds of millions for missing climate targets, farmers have unexpected leverage, but only through 2027. The difference between success and the fate of those 89 farms Danone dropped comes down to seven specific contract provisions that most farmers overlook. Three proven models have emerged: small farms joining networks like Maple Hill, large operations going vertical, and mid-size farms securing cost-plus deals that guarantee margins. Your next 90 days determine your next decade: get three written offers, have an attorney review them, and negotiate absolute protection—because by 2028, regenerative becomes mandatory compliance without the premiums.

You know what’s been interesting lately? I keep hearing the same story from different producers. They’ll spend hours reading through these regenerative dairy contracts, and there’s always this moment when they realize—the brochure promised a partnership, but the contract? That reads like they’re taking all the risk.

I’ve been watching this pattern develop over the past three years as processors roll out their billion-dollar sustainability programs. And here’s what’s caught my attention: the gap between what’s marketed and what’s actually in those contracts is… well, it’s revealing some important lessons for all of us.

The American Farm Bureau has been tracking farm bankruptcies and reports a 13% rise in fiscal year 2024, with that trend continuing into 2025. Meanwhile—and this is what’s fascinating—some regenerative operations are pulling in $40-42 per hundredweight. I’m seeing Ohio producers in regenerative programs achieving those prices while conventional operations two counties over are stuck at $23-24/cwt. The difference? It often comes down to contract negotiation and timing, not whether you believe in the philosophy.

Understanding Why Processors Suddenly Need You

So what’s driving all this? The regulatory landscape shifted fundamentally this year, and it’s worth understanding why. The European Union’s Corporate Sustainability Reporting Directive kicked in January 2025, and it’s changing everything for companies like Nestlé and Danone. They’ve got to report emissions across their entire supply chain now. That includes every farm they buy milk from.

What’s particularly interesting is how different countries are handling penalties. In Germany, non-compliance can mean fines of 0.5% to 2% of annual revenue. France has gone even further—up to €75,000 plus potential director liability. For a company like Nestlé with $95 billion in revenue? We’re talking potential fines in the hundreds of millions.

And California’s not sitting this out. Their Climate Corporate Data Accountability Act—that’s SB 253, signed by Governor Newsom on October 7, 2023—kicks in for any company over $1 billion in revenue starting in 2027. That’s basically every major processor in your rolodex.

Now here’s where it gets interesting for farmers. Nestlé’s 2024 Creating Shared Value Report shows they’re sourcing 21.3% of key ingredients through regenerative programs, but they need to hit 50% by 2030. That’s a massive gap, isn’t it? And right now—this is crucial—they need committed farmers more than farmers need them. But you know how these windows work. They don’t stay open long.

The Real Economics (What They Don’t Put in Brochures)

I’ve been working through transition costs with extension economists from Cornell and Wisconsin, and what we’ve found… well, it deserves your attention. Everyone focuses on the visible stuff—fencing, water systems, maybe a seed drill. But that’s just the start.

Based on current NRCS cost-share estimates and auction activity, a typical 200-cow operation faces infrastructure investment costs of $250,000 to $280,000. Your rotational grazing setup alone—good fencing that meets EQIP standards—typically runs $90,000 to $100,000. Water systems vary by region. Wisconsin Extension engineers report $15,000 to $25,000, depending on your land, and that’s if you’re lucky with topography.

But here’s what really blindsides folks: certification and compliance. Based on USDA National Organic Program data and the various regenerative certification fee structures out there, you’re looking at costs exceeding $100,000 over a full transition. And the working capital crunch when production drops in year two—which it almost always does—that requires serious cash reserves.

A Lancaster County producer I spoke with recently transitioned her 180-cow operation. “We went from 24,000 pounds down to 20,000 pounds annually per cow during adjustment,” she told me. “That’s real milk you’re not shipping, but the bills keep coming.” Labor requirements jumped too—her family tracked 600 extra hours that first year. At market rates, that’s worth tens of thousands, except nobody’s paying it.

All told? You’re looking at close to $900,000 over seven years for a typical 200-cow operation. Are the processors offering these programs? They’re talking about maybe $130,000 in assistance. See the disconnect?

The Seven Contract Provisions That Matter Most

After reviewing contracts with dairy attorneys, here’s what separates good deals from disasters:

1. Contract length: Minimum 5 years with auto-renewal options

2. Price protection: Either cost-plus or guaranteed floor pricing

3. Volume flexibility: No penalties for increased production

4. Termination clarity: Only for material breach with cure periods

5. Upfront support: Actual money, not just technical assistance

6. Verification costs: Processor pays for certification and monitoring

7. Carbon credits: Clear ownership and revenue sharing

Questions to Ask Your Processor Tomorrow

Before signing anything, get clear answers on:

- What happens if I exceed production targets?

- Who pays when verification standards change?

- Can you terminate for “convenience” or only breach?

- What’s my guaranteed minimum price in Year 3?

- Do I keep carbon credit revenues?

Three Models That Are Actually Working

Looking at successful transitions across different regions, three approaches keep emerging, and each offers different lessons depending on your situation.

Model 1: The Network Approach (50-150 cows)

Tim Joseph at Maple Hill Creamery figured out something important early on. Instead of going it alone, he built a network. Today, they’ve got 135 small farms—most around 50 cows—all receiving premium pricing through collective brand ownership.

What I find interesting is that these farms were already doing rotational grazing for economic reasons. As Joseph has explained, “Regenerative kind of came to us.” When Maple Hill formalized these practices and built the market, everyone benefited. They recently secured $20 million through USDA’s Partnership for Climate-Smart Commodities program, with funds flowing directly to member farms. Small operations getting resources usually reserved for the big players? That’s smart collective action.

Upstate New York producers in Maple Hill’s network, with 60-70 cow operations, tell me they couldn’t have transitioned on their own. But with 134 other farms and Maple Hill’s marketing power? They’re making it work.

Model 2: Vertical Integration at Scale (1,000+ cows)

Blake and Stephanie Alexandre, out in Crescent City, California, took a completely different path. They’re milking 4,500 cows across five locations, all on pasture with holistic management. Over 30 years—and this is remarkable—they’ve increased soil organic matter from 2-3% to 8-15%, as verified by their Regenerative Organic Certification documentation.

By controlling processing and retail, they’re getting $6-8 per half gallon for A2 regenerative organic milk. Can most of us replicate this? Probably not. But it shows what’s possible when you control more of the value chain. And here’s what’s encouraging—their butterfat performance stabilized and improved after transition, which addresses a common concern about pasture-based systems.

Model 3: Strategic Partnership with Protection (200-500 cows)

The McCarty family in Rexford, Kansas, offers maybe the most instructive model for mid-size operations. They spent two years—two full years—working with Cargill Dairy Enterprise Group advisors before finalizing their deal with Danone in 2012.

Their arrangement? Cost-plus pricing. Danone covers all production costs plus guarantees a margin. As Dave McCarty has explained in industry interviews, “I have a cost per hundredweight of my milk, and there’s a margin on top of that.” No wondering if you’ll cover feed costs when corn hits $8. That’s real security during transition.

What’s particularly noteworthy here is how they structured fresh cow management during the transition. They maintained separate groups for transitioning animals and closely monitored butterfat levels to adjust rations. Smart management, protected by smart contracts.

What Happened to Organic Is Happening Again (With a Twist)

We’ve all watched this before, haven’t we? USDA Agricultural Marketing Service data shows organic premiums compressed from $10-11 down to $3-5 per hundredweight between 2017 and 2022. Large operations in Texas and Colorado flooded the market, squeezing smaller farms.

The same pattern’s emerging with regenerative. Multiple certifications with different standards—this new Regenified program doesn’t even require an organic baseline according to their 2024 standards. Large operations claiming regenerative status with minimal changes. Processors favoring bigger suppliers for “efficiency.”

But there’s a crucial difference this time, and it actually gives me some optimism. The regulatory pressure I mentioned? That creates a floor that the organic never had. When non-compliance means hundreds of millions in fines, companies can’t just walk away when it gets inconvenient.

Based on processor sourcing needs and these regulatory timelines, I see 2025-2027 as the optimal window to secure favorable terms. After that? My guess is that regenerative becomes baseline—required for market access but not compensated with premiums.

Your Strategic Options (Geography and Scale Matter)

What farmers are finding is that opportunities vary considerably by region and operation size. Let me share what’s working in different situations.

For Smaller Operations (50-300 cows)

If you’ve got decent pasture, low debt, and you’re near urban markets, premium capture can work. This especially applies in the Northeast, Upper Midwest, and Pacific coastal areas, where you’ve got longer grazing seasons. Pennsylvania producers working with Origin Milk are reporting positive cash flow by year two—not huge returns, but sustainable progress.

Wisconsin producers transitioning 180-cow operations tell me similar stories. They’re in year three of transition, and while it’s been tough, they’re seeing light at the end of the tunnel. “Butterfat’s back up to 3.9%, and our feed costs are down 30% from where we started,” one told me recently. “If we’d waited another year to start, I don’t think we’d have gotten the contract terms we needed.”

Down in Georgia and the Carolinas? That’s tougher. Heat stress and shorter grazing seasons make pasture-based systems challenging. But I’m hearing about some producers there using silvopasture systems—integrating trees for shade—with interesting results. You’ve got to be realistic about your geography, but sometimes creative solutions work.

For Larger Operations (1,000+ cows)

If you’ve got capital access and management expertise, scaling for efficiency might make sense. UW-Madison’s Center for Dairy Profitability research consistently shows economies of scale advantages above 2,000 cows. But fair warning—current construction costs suggest you’re looking at $3-7 million for meaningful expansion. And you’d better be comfortable managing a business, not just a farm.

For Those Near Retirement

Many Wisconsin producers I know who are 55-60, with kids, unsure about succession, are taking a different approach. They’re maintaining current operations, avoiding major investments, and planning strategic exits to expanding neighbors. Sometimes the smartest move is knowing when not to invest.

As one producer put it to me: “We’re not going regenerative, we’re not expanding, we’re just milking what we have and banking cash. In three years, when our neighbor’s ready to expand, we’ll have a buyer lined up.”

Your 90-Day Action Plan (And Yes, Start Tomorrow)

Here’s what I’d tell any producer considering regenerative transition—this really should start tomorrow morning.

First 30 Days: Don’t respond to that processor brochure yet. Instead, call three different processors or cooperatives. Tell them you want actual contract terms in writing, not marketing materials. Get everything documented. Origin Milk, Maple Hill, Organic Valley—those are good starting points.

Second 30 Days: Take those proposals to an ag attorney. Budget $3,000-5,000—it’s worth it. Have them focus on termination clauses, price adjustments, and who’s obligated for what. Farm Commons has contract review resources specifically for regenerative dairy that are really helpful.

Third 30 Days: Run realistic financial models. Cornell’s Dairy Farm Business Summary provides adaptable scenarios. Model the ugly version—where production drops, expenses rise, and year two nearly breaks you. Make sure you’ve got working capital or credit lines to bridge that valley.

And connect with other farmers who’ve done this. Join NODPA or your regional grazing coalition. The peer learning alone is worth the $100 annual membership.

What This Really Means for Your Operation

Look, I’ve watched plenty of “next big things” come through our industry. BST in the ’90s. Crossbreeding in the 2000s. Robotic milking in the 2010s. Regenerative dairy feels different, though not for the reasons you might think.

The regulatory framework—that’s what’s different. Real financial penalties for corporate non-compliance. Potential investor lawsuits. Mandatory emissions reporting in major markets. This creates structural demand that voluntary programs never had.

For prepared producers, the 2025-2027 window offers a genuine opportunity. But only with proper contracts. Those seven provisions I mentioned? They’re not suggestions. They’re survival requirements are based on the 89 farms Danone dropped in August 2021 and the handful that prospered.

I understand the skepticism—especially after organic’s trajectory. And yes, conventional production remains viable if you’re either scaling big or planning a near-term exit. But that middle ground where most farms operate? It’s getting squeezed from both sides.

If you’re mid-career with succession possibilities, waiting for perfect clarity might mean missing the window. By 2028-2030, regenerative practices could become mandatory baseline requirements without premium compensation. Compliance instead of opportunity.

But here’s what gives me hope: Young farmers are using regenerative contracts with guaranteed premiums to qualify for farm purchase financing. Banks see those five-year price guarantees and approve loans that wouldn’t have worked otherwise. That’s a positive development for industry renewal. And I’m seeing established operations use these transitions to bring the next generation back to the farm—kids who weren’t interested in conventional dairy but are excited about regenerative approaches.

The fundamental question isn’t whether these practices will become standard. It’s whether you’ll be compensated for adopting them.

Get three contract offers. Have an attorney review them. Make your decision based on actual terms, not promises. That single action in the next 90 days matters more than any workshop or YouTube video about soil health.

This transition is happening. The market’s moving whether individual farms are ready or not. Which producers do I see as best positioned for 2035? They’re either embracing regenerative with strong contracts or planning strategic exits. They’re not waiting for perfect information.

Those holding out for complete clarity? Well, in my experience, the market rarely provides perfect information before critical windows close. And hesitation itself… that’s becoming an expensive decision.

But you know what? Whatever path you choose—regenerative, conventional scale-up, or strategic exit—make it with your eyes open and your contracts reviewed. The dairy industry’s always been about adapting to change. This is just the latest chapter, and with the right approach, it doesn’t have to be the last one for your operation. Some of the best dairy stories I know started with farmers facing tough transitions and making smart decisions based on real information, not marketing hype.

The opportunity’s real. So are the risks. But armed with the right information and proper contracts? You can navigate this transition successfully.

Key Takeaways:

- The $770K reality check: Regenerative costs $900K to implement, but processors pay just $130K—only protected contracts bridge this gap successfully.

- 2027 is your deadline: Processors facing hundreds of millions in climate fines need farmers now—after 2027, regenerative becomes mandatory without premiums.

- Seven terms separate $41/cwt from $23/cwt: Contract provisions matter more than farming philosophy—know which ones protect your investment.

- Three proven paths: Small farms network (Maple Hill), large farms integrate (Alexandre), mid-size farms demand cost-plus (McCarty).

- Your 90-day window: Get three written offers → Invest $5K in legal review → Negotiate protection. Wait, and you’ll join the 89 farms Danone terminated.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Decide or Decline: 2025 and the Future of Mid-Size Dairies – Analyzes three viable paths for mid-size herds—expansion, optimization, or exit—providing the critical strategic context you need to determine if a regenerative contract is truly your operation’s best survival mechanism.

- Your 2025 Dairy Gameplan: Three Critical Areas Separating Profit from Loss – Provides immediate protocols for silage and transition cow management that uncover hidden margins. Crucial for generating the working capital needed to bridge the production “dip” during your first years of regenerative transition.

- Is 2025 the Year Dairy Herd Software Delivers for Real Producers? – Demonstrates how to turn mandatory compliance data into a competitive asset. Learn to use herd management software not just for records, but to verify the emissions data required to secure premium regenerative contract incentives.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!