When Greece’s ghost herds stole €20 million, they left every dairy farmer a hard truth: trust without proof costs real money.

Executive Summary: When news broke that Greek fraudsters had stolen €20 million using “ghost herds,” it did more than rattle regulators—it struck a chord with real farmers everywhere. The case proved what every dairy producer already knows: trust only works when it’s backed by proof. This story digs into how Greece’s oversights mirror the challenges in North America’s milk pricing and subsidy systems, where paperwork often outpaces technology. What’s encouraging is that solutions already exist—digital traceability, satellite verification, and data‑driven audits built to protect honest operations. The takeaway? Verification isn’t red tape—it’s the foundation that keeps integrity, transparency, and producer trust alive in modern dairying.

Every dairy farmer knows that our industry runs on trust. That trust sits quietly beneath the bulk tanks, market reports, and cooperative books we rely on every day. So when investigators in Europe uncovered a major subsidy scandal built on phony paperwork and nonexistent herds, it stirred something familiar.

The case out of Greece wasn’t about complex cybercrime—it was about paperwork getting ahead of proof. And that, in its simplest form, is a cautionary tale with lessons we should pay attention to.

Inside Greece’s “Phantom Herds” Scandal

The European Public Prosecutor’s Office (EPPO) reported earlier this year that fraudulent applications for agricultural subsidies had been filed in the years leading up to 2025, totaling more than €20 million in false claims. The scheme was run through OPEKEPE, Greece’s administrative body for EU farm payments, and linked to 324 fake recipients who allegedly invented livestock herds and falsified land records.

The fraud ran long enough to trigger major repercussions. The European Commission fined Greece €400 million for “systemic verification failures,” forcing the country’s Ministry of Rural Development to overhaul its subsidy application checks.

The fallout landed hardest, as it always does, on the honest operators. Many of Greece’s legitimate family dairies—those milking goats and sheep for the country’s Protected Designation of Origin feta—now face extra audits, slower payments, and reputational damage through no fault of their own.

Why This Story Resonates Beyond Europe

What’s interesting here is that while the fraud happened half a world away, the vulnerabilities it exposed look awfully familiar. From milk pooling to subsidy checks, North American dairy runs on systems just as dependent on accurate data—and just as fragile when complexity outweighs clarity.

1. When Paperwork Outpaces Practice

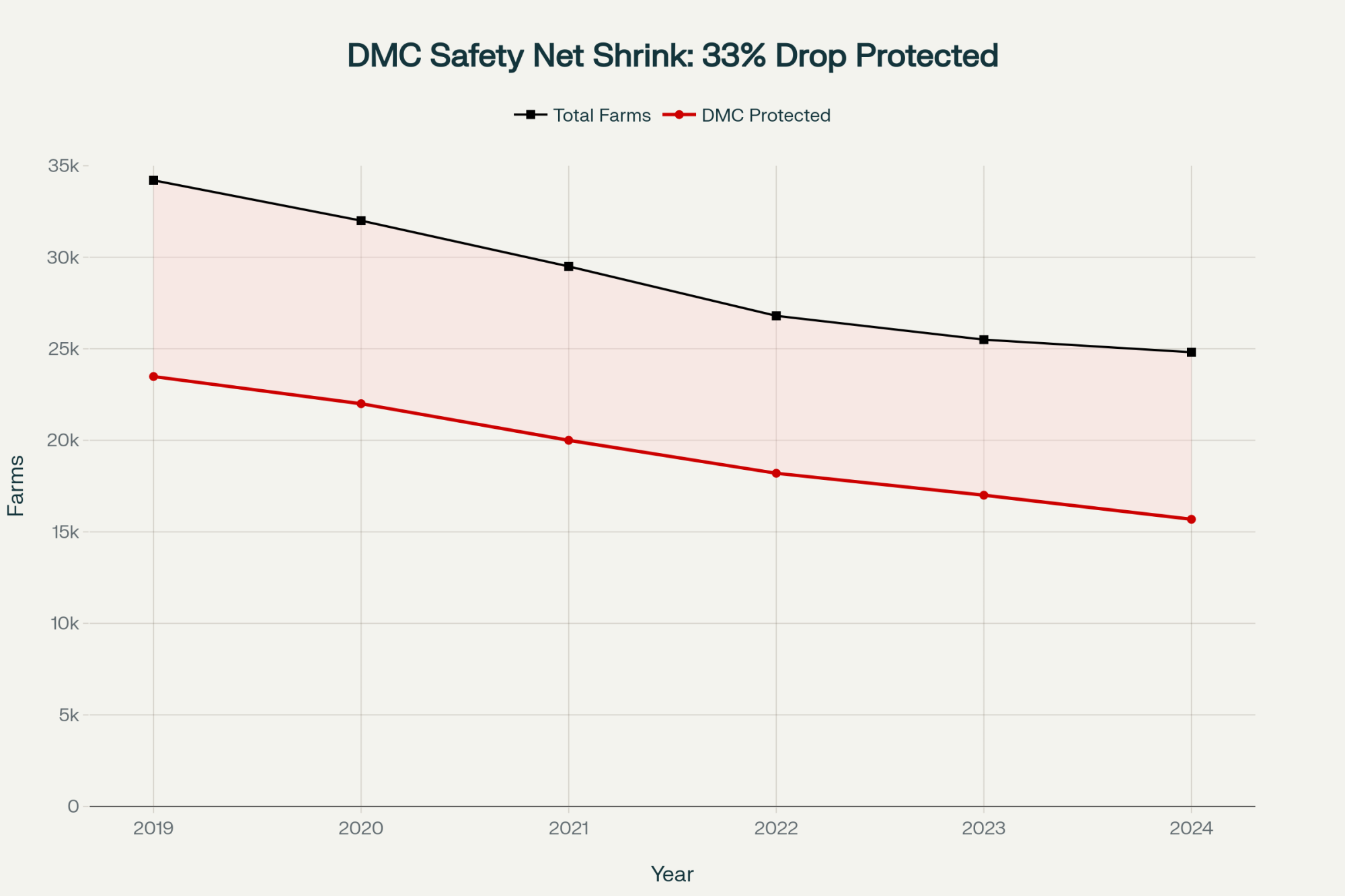

The Dairy Margin Coverage (DMC) program has been a financial lifeline for U.S. producers facing unpredictable feed costs. But much of it still depends on paper applications and self‑verified production data.

The USDA Farm Service Agency (FSA) has made digital reporting available in recent years, yet data integration between programs remains limited. University of Wisconsin research calls it a “trust‑based compliance model” that functions well under normal conditions but leaves room for error when information isn’t seamlessly shared.

Let’s be clear—nobody’s suggesting this is fraud. It’s inefficiency. And inefficiency creates opportunity—for mistakes, for misreporting, or simply for confusion that puts unnecessary strain on both farmers and regulators.

2. When Complexity Creates Confusion

Take the Federal Milk Marketing Order (FMMO) system. It’s designed to bring fairness and balance to milk markets, but even many seasoned operators will tell you that tracking, pooling, and pricing doesn’t always feel transparent.

Milk handlers can legally “de‑pool” their milk—temporarily removing it from the pool to optimize returns—during certain market shifts. According to the USDA Economic Research Service (ERS), de‑pooling between 2021 and 2023 shifted hundreds of millions of dollars across federal orders.

While perfectly legal, this complexity creates an information gap where trust can erode—the same kind of vacuum that allowed outright fraud in the Greek system. When producers can’t fully trace value movement, suspicion grows, even in legitimate markets.

Transparency, plain and simple, is the antidote.

3. Accountability Builds Resilience: The Checkoff Example

Funding mechanisms like national checkoff programs show how transparency can turn obligation into trust. Producer dollars drive research, market development, and promotion—but oversight matters.

A Farm Action audit review in 2024 revealed missing USDA validations across several non‑dairy commodity boards, sparking an industry‑wide conversation about governance standards. Dairy programs weren’t directly involved, but the timing was valuable: it reminded everyone that trust grows where visibility exists.

Producers don’t oppose accountability—they just want assurance that the dollars they contribute continue to build consumer trust, sustain exports, and innovate products for the next generation.

The Broader Picture: Consolidation and Oversight Pressure

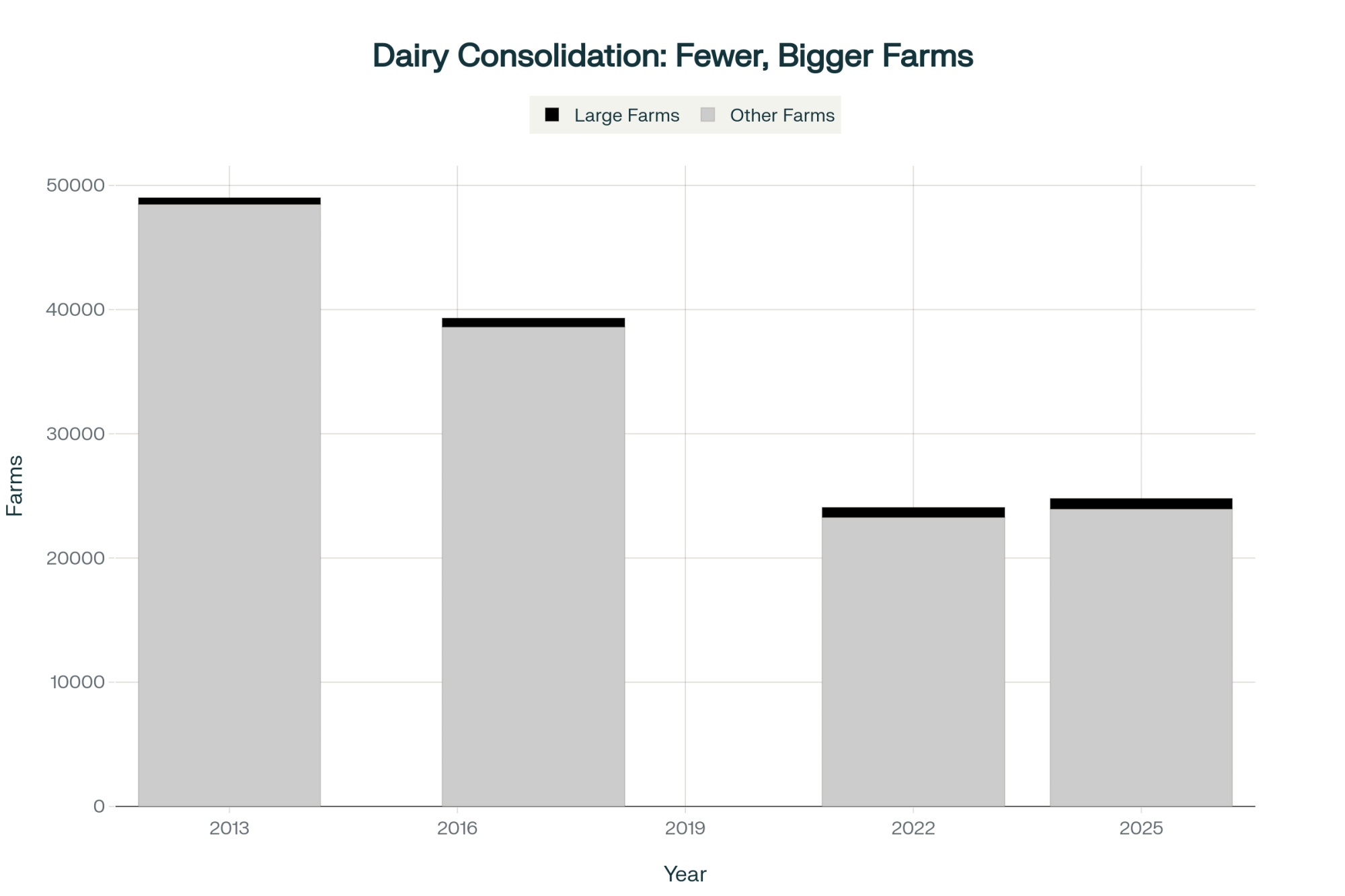

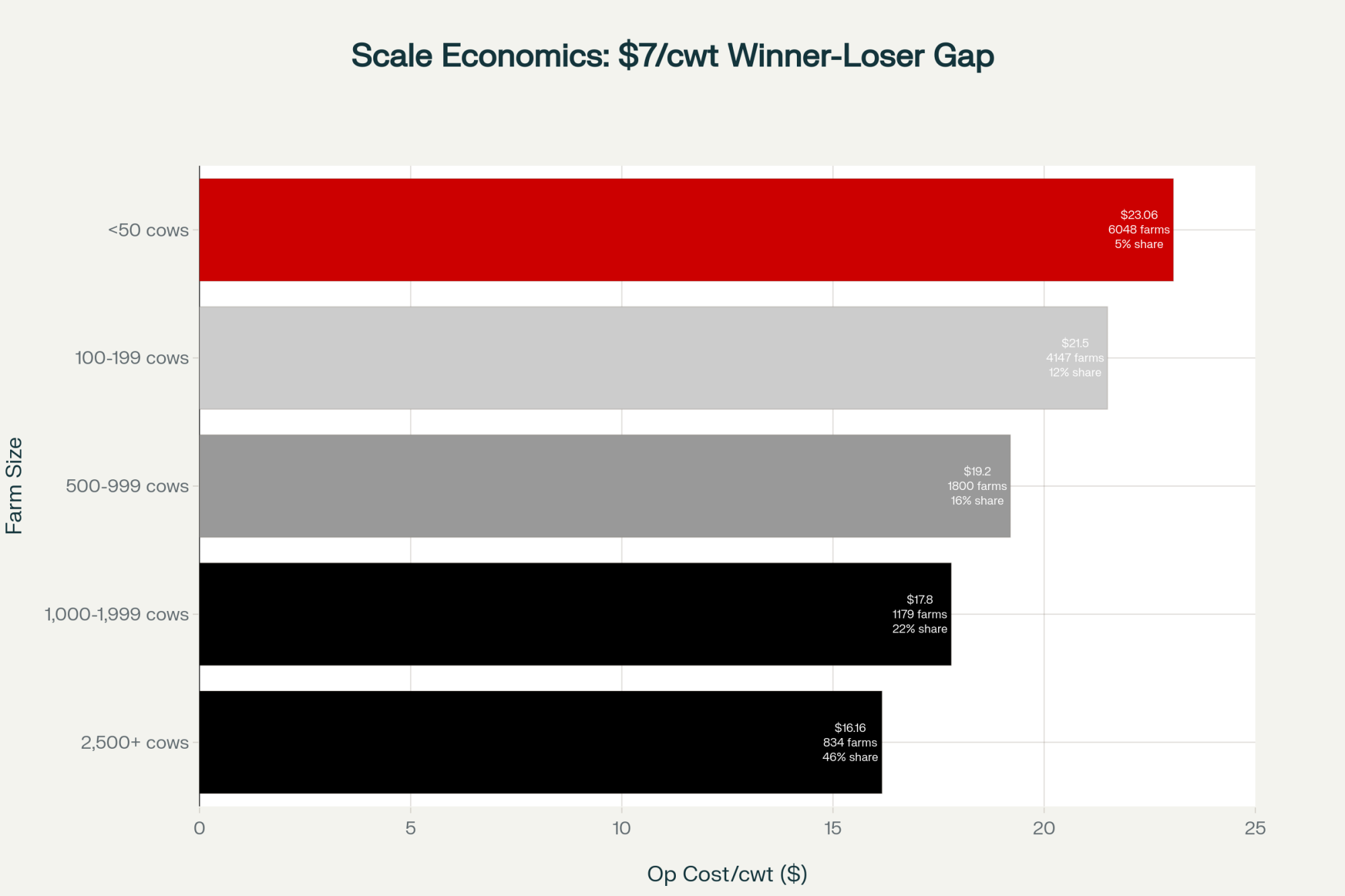

The USDA National Agricultural Statistics Service (NASS) estimates that the U.S. now has about 24,800 licensed herds, down from nearly 49,000 in 2013. Canada’s supply‑managed system counts 9,800 active quota‑holding farmsunder the Dairy Farmers of Canada (DFC).

Smaller farms, particularly those milking under 250 cows, shoulder nearly the same compliance burden as 3,000‑cow operations but without full‑time administrative help. It’s no wonder producers often say that paperwork feels heavier than feed costs.

In Ontario, for example, DFC’s ProAction program integrates animal care, milk quality, and traceability standards under one unified verification system. While not perfect, it exemplifies how structured oversight with predictable audits can reduce anxiety rather than increase it. ProAction is proof that structured transparency works when it strengthens—not slows—good farms.

That’s the irony lost in Greece’s cautionary tale: good verification shouldn’t slow down honest farms—it should set them free to focus on milk quality, breeding, and butterfat performance instead of bureaucracy.

Technology Is Catching Up

Across both continents, smarter verification is becoming the norm rather than the exception.

- Digital traceability: European and North American cooperatives are piloting blockchain‑linked milk collection logs. Each load records location, timing, and solids data that can’t be altered—preventing both miscommunication and tampering.

- Satellite audits: Agriculture and Agri‑Food Canada (AAFC) now uses satellite imagery to confirm environmental compliance, reducing site visits for farms with clean records.

- Risk‑based oversight: USDA trials for targeted auditing focus on outlier data, lowering the frequency of reviews for consistently accurate producers.

The result? Stronger systems that reward accuracy instead of punishing transparency.

Farmers Taking the Lead

Producers themselves are proving that transparency works best when it starts from within.

Dairy Profit Teams in Wisconsin, Minnesota, and Michigan bring herds together to confidentially share cost and performance benchmarks. Meanwhile, sustainability benchmarking programs in British Columbia and Manitobaallow farms to compare nutrient efficiency and environmental metrics anonymously.

One producer from Manitoba summed it up perfectly: “Once you see objective numbers, you stop making assumptions about who’s ahead and who’s behind. We realized we were all fine—we just measured differently.”

That’s how farms thrive, not through secrecy but through collaboration supported by data.

The Bottom Line

Greece’s subsidy scandal didn’t happen because its farmers were dishonest—it happened because oversight systems lagged behind operational reality. In contrast, North American dairy has the chance to stay ahead by modernizing without losing what matters most: integrity.

Here’s what’s encouraging. Our farms already excel at measurement. From fresh‑cow management to feed conversion tracking, we live in data every day. The next step is ensuring that the data already being collected automatically backs the trust our industry deserves.

Because as Greece’s experience reminds us, trust without verification isn’t sustainable—and verification, when done right, doesn’t add work. It proves value.

In the end, the gap between compliance and corruption is only as wide as the space between trust and verification. Closing that gap isn’t just good governance—it’s how dairy protects its reputation, one verified record at a time.

Key Takeaways

- Greece’s €20 million “ghost herd” scandal showed what happens when oversight trust outpaces proof—and real farmers pay the price.

- Programs like DMC and milk pooling work best when transparency keeps pace with technology, not when paperwork piles up.

- New tools—from blockchain milk traceability to AAFC satellite audits—are helping verify what good farms already do right.

- Verification doesn’t add work; it protects yours. Solid data is today’s best defense against both fraud and doubt.

- In the end, trust still drives dairy—but in 2025, trust needs evidence to stay strong.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Unlocking Dairy Profitability: The Power of Financial Benchmarking – This guide provides a practical framework for financial benchmarking. It reveals how to use your farm’s own data to identify performance gaps, enhance profitability, and build the verifiable operational integrity discussed in the main article.

- FMMO Reform: What’s Really on the Table for Dairy Producers? – This analysis breaks down the complex FMMO reform debate. It clarifies how proposed policy changes could directly impact your milk check, increase market transparency, and address the pricing confusion highlighted as a major industry vulnerability.

- Beyond the Hype: Is Blockchain the Future of Dairy Traceability? – This piece moves past theory to explore blockchain’s real-world potential. It demonstrates how immutable digital ledgers can enhance supply chain traceability, guarantee product integrity, and provide the automated proof needed to prevent future fraud.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!