Remember 2012? When corn hit $8.43, and half your neighbors went broke? Well, buckle up—La Niña’s back with a vengeance.

EXECUTIVE SUMMARY: Look, La Niña isn’t just another weather pattern—it’s a direct assault on your bottom line. University research shows feed costs can spike $15,000 to $75,000 annually on an 800-cow operation when soybean and corn yields drop 8-12%. Heat stress? It’s stealing up to 40% of your milk production, and recovery takes over ten days each time it hits. Meanwhile, the global dairy game is shifting—New Zealand’s climbing 3.8% while Argentina crashes 6.2%, which affects everyone’s market share. The smart money’s going into cooling systems and precision irrigation right now because they pay for themselves fast. The USDA has billions of dollars in cost-share money available, but the October 3rd deadline remains unchanged. Bottom line: prepare now or watch your competitors pull ahead next summer.

KEY TAKEAWAYS:

- Grab 75% cost-share through EQIP before October 3rd—that $600-900 per cow cooling system suddenly costs you $150-225. Call your NRCS office tomorrow morning.

- Lock in 60% of your feed needs NOW—don’t wait for official La Niña confirmation when corn’s already climbing toward $6+ and panic premiums kick in.

- Regional heat stress varies wildly—California cows stress at THI 78, Wisconsin at 68. Install cooling matched to your zone for an 18-month payback.

- Precision irrigation saves your feed crops—$847-1,156 per acre investment prevents $15,000-50,000 drought losses per field through smart water management.

- Global market shifts amplify local weather impacts—when Argentina’s production drops 6% and yours follows suit, you’re losing market share to prepared competitors.

You know that sinking feeling when drought warnings start popping up across your weather app from the Dakotas down to the Carolinas? NOAA just confirmed what many of us have been dreading—there’s a 53% chance La Niña conditions will develop this fall and stick around through early 2026.

If you lived through 2012, you remember what that means: corn hitting $8.43 per bushel, soybean meal pushing past $600 per ton, and the kind of financial beating that separates survivors from casualties in this business.

La Niña isn’t some quick-moving storm system. It’s the weather pattern that settles in for months, systematically draining soil moisture and cranking up heat stress across dairy country.

“You can’t cheat heat stress,” says Dr. Victor Cabrera from UW-Madison’s dairy management program. “You either prepare months in advance, or you pay the price all season long.”

The Double Whammy: Feed Markets and Heat Stress Hit Together

Here’s what’s already happening: Argentina’s key soybean regions are showing soil moisture levels at critical lows, according to the Buenos Aires Grain Exchange. That’s not just a South American problem—it ripples straight through to your feed bunk.

“When Argentina sneezes, the whole dairy industry catches a cold,” explains Mike Larson, feed procurement manager for Foremost Farms. “Their drought stress shows up in Chicago futures within weeks, and that hits every feed truck rolling into Wisconsin.”

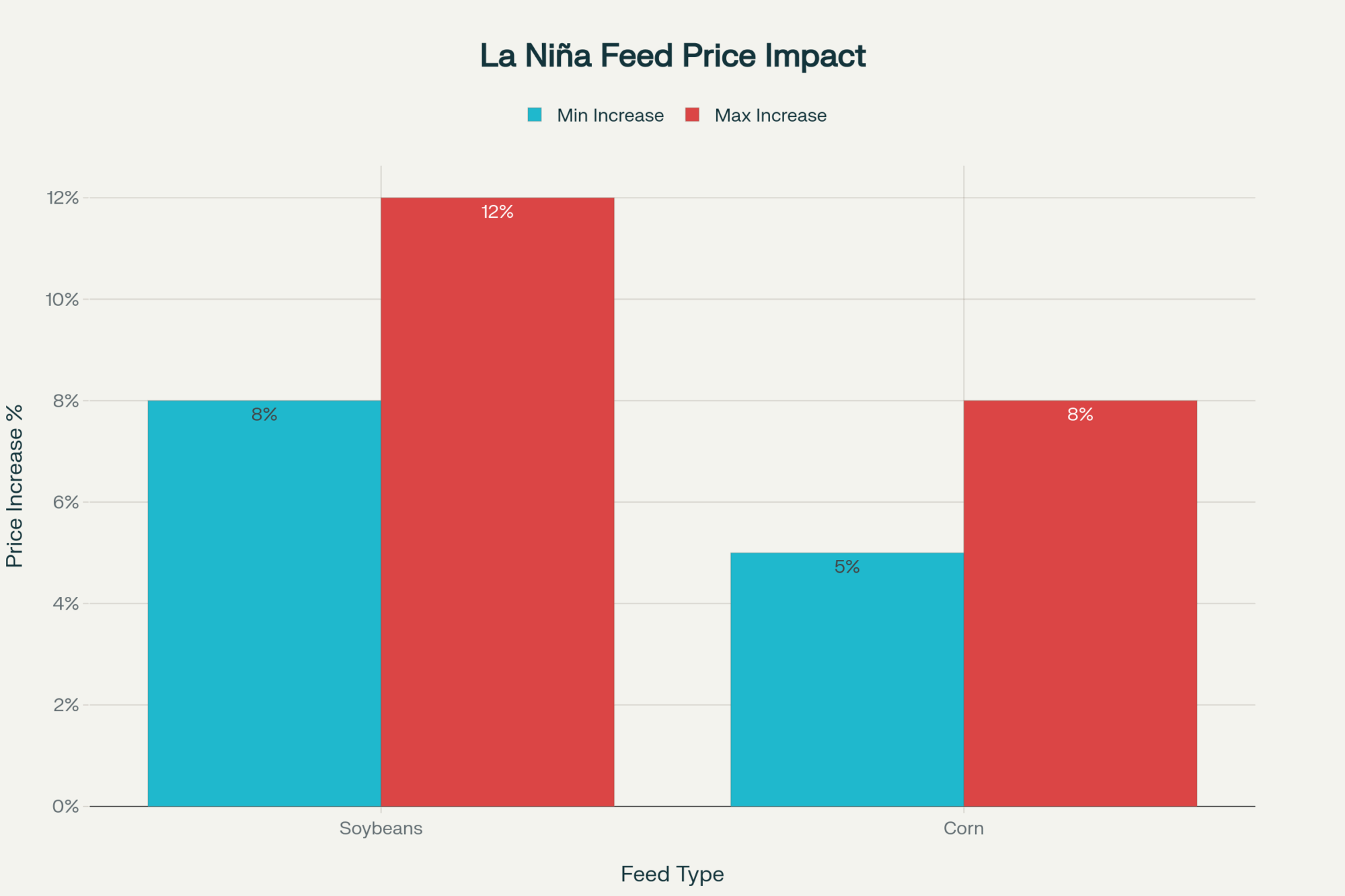

University of Illinois grain marketing analysis confirms the pattern we’ve seen before: yields for soybeans typically drop 8-12% during La Niña events, with corn falling 5-8% across major growing regions. For Midwest operations, that translates to feed cost increases that can range from $15,000 to $75,000 annually, depending on your herd size and feeding program.

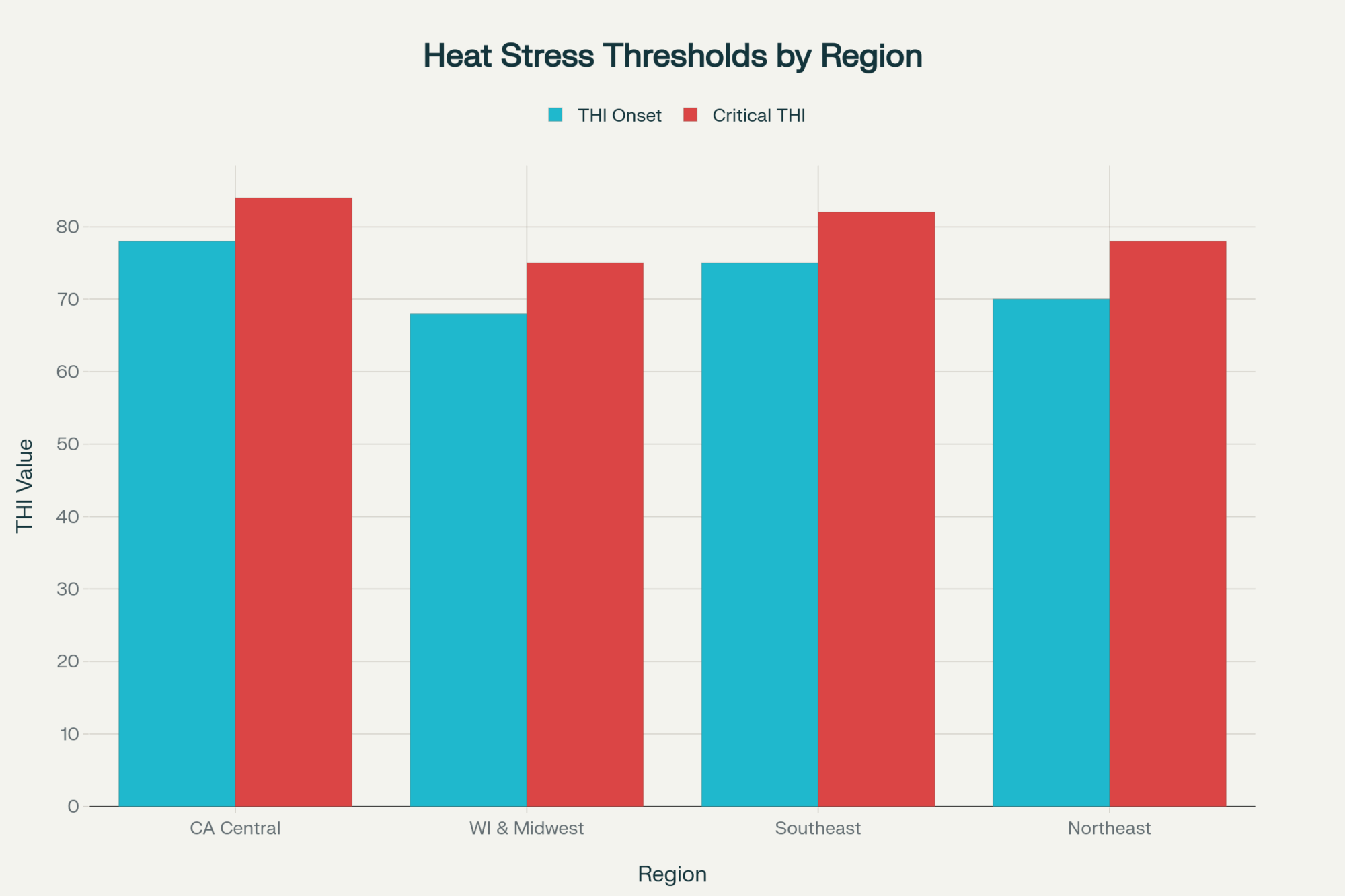

But here’s the killer – heat stress doesn’t just compound problems—it demolishes profit margins while you watch. Dr. Geoff Dahl’s research team at the University of Florida has documented how thermal stress varies dramatically by region. Cows in California’s Central Valley start showing production drops when the Temperature-Humidity Index hits 78, but Wisconsin Holsteins begin flagging at just 68 THI. Recovery time? We’re talking 8-14 days minimum after severe heat events.

Regional Heat Stress Breaking Points & Cooling Strategies

| Region | THI Onset | Critical THI | Recovery Days | Cooling Strategy |

| California Central Valley | 78 | 84 | 10-14 | Misters & High-Volume Fans |

| Wisconsin & Midwest | 68 | 75 | 8-10 | Tunnel Ventilation + Sprinklers |

| Southeast | 75 | 82 | 12-16 | Shade Structures + Forced Air |

| Northeast | 70 | 78 | 8-12 | Cross-Ventilation Systems |

“You can’t treat cow comfort like one-size-fits-all,” Dahl warns. “A Wisconsin Holstein shows heat stress 10 degrees cooler than the same genetics in California.”

Let’s Talk Real Numbers

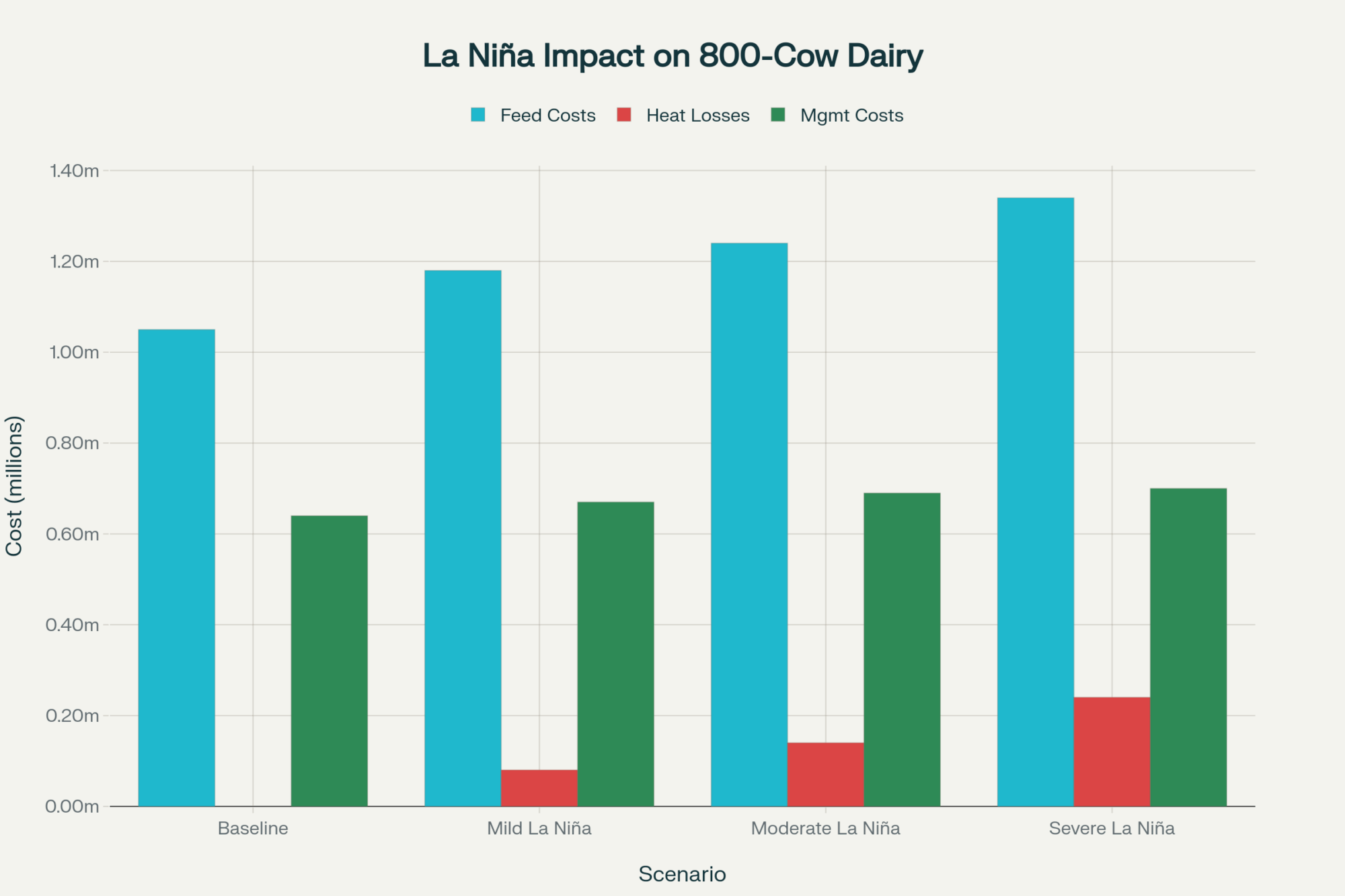

Penn State agricultural economists modeled what La Niña actually costs typical operations. For an 800-cow dairy, here’s the financial reality:

La Niña Economic Impact on 800-Cow Operations

| Scenario | Feed Costs ($M) | Heat Stress Losses ($M) | Management Costs ($M) | Net Margin Impact (%) |

| Baseline | 1.05 | 0 | 0.64 | 0 |

| Mild La Niña | 1.18 | 0.08 | 0.67 | -15 |

| Moderate La Niña | 1.24 | 0.14 | 0.69 | -27 |

| Severe La Niña | 1.34 | 0.24 | 0.70 | -43 |

Source: Penn State Department of Agricultural Economics

That financial reality stems from a two-front battle: soaring feed prices and production losses due to heat stress, as well as rising management costs resulting from increased labor and energy requirements to operate cooling systems.

“Those aren’t just numbers on a spreadsheet,” notes Dr. Jude Capper, livestock sustainability consultant. “That’s the difference between paying bills and taking out operating loans.”

University of Vermont’s Farm Financial Management Program tracked operations through the 2020-2022 La Niña cycle. Farms with climate adaptation technology maintained profit margins within 8% of their normal levels. Conventional operations? They saw a 20-30% margin compression.

Cooling Tech ROI: An Investment, Not an Expense

Cooling infrastructure isn’t optional anymore—it’s survival equipment. The investment varies by region, but the payback is consistent across dairy country.

Based on Wisconsin extension case studies, a mid-size operation near Marshfield installed tunnel ventilation and sprinklers for roughly $540 per cow in spring 2021. During the brutal July 2022 heat wave, production held at 82 pounds per cow while neighboring conventional barns dropped to 68 pounds. The system paid for itself in one season.

Kansas State University Extension tracked cooling system performance across 47 operations between 2018 and 2023. Their data show that farms with comprehensive cooling maintained 85% of their baseline production during extreme heat events. Conventional barns? They dropped to 65% of their normal level.

Precision irrigation is another game-changer. University of Wisconsin Extension puts installation costs at $847-1,156 per acre, but Oklahoma State research across 180 dairy operations shows these systems maintain crop yields within 5% of normal during drought conditions. Conventional farming sees 15-25% reductions.

Smart Money Moves

Don’t wait for meteorologists to confirm La Niña before locking feed prices. When panic hits commodity markets, historical data shows premiums can spike 40-60% above normal within weeks.

“Hedge at least 60% of your corn and soybean meal needs while prices stay below $5.50 for corn and $450 for soybean meal,” advises Dr. Marin Bozic, University of Minnesota agricultural economist. “Waiting for official confirmation means paying crisis prices.”

USDA’s Livestock Gross Margin insurance provides some protection, but here’s the critical detail—coverage specifically excludes weather-related feed cost increases. That’s exactly the risk La Niña creates.

Government Programs Worth Your Time

The USDA’s Environmental Quality Incentives Program offers 50-75% cost-sharing for cooling and irrigation investments. Dr. Jennifer Tucker, NRCS national dairy specialist, explains the urgency: “Demand exceeds funding by 2-3 times annually. Applications submitted now get reviewed for 2026 implementation.”

Critical deadline: EQIP funding for cooling and irrigation systems is often allocated on a first-come, first-served basis. Applications for 2026 funding close October 3, 2025. Contact your county NRCS office immediately.

The $2.8 billion Partnerships for Climate-Smart Commodities program specifically targets weather resilience practices, including advanced cooling infrastructure and precision agriculture technology.

La Niña doesn’t just hit North America—it reshuffles dairy markets worldwide. International Dairy Federation data from the 2020-2022 cycle shows dramatic regional swings. New Zealand increased production by 3.8% while Argentina crashed 6.2%. European operations face the double challenge of weather stress plus increasingly strict environmental regulations, making adaptation even more critical.

What This Means for Your Region

Upper Midwest (Wisconsin, Minnesota, Iowa): Your soil’s about to turn to concrete. Start monitoring now or pay later and incur storage fees. La Niña typically brings 15-20% below-normal precipitation from June through August. Start NRCS applications now.

California Central Valley: Heat stress mitigation becomes critical. THI values will likely exceed 78 for 40+ days during La Niña summers. Invest in high-capacity cooling systems before April 2025.

Southeast (Georgia, Florida, North Carolina): Prepare for extended heat and humidity. Focus on shade structures and air movement systems that handle both heat and moisture.

Northeast (New York, Vermont, Pennsylvania): Variable impacts require flexible management. Install cooling systems rated for THI levels above 78 and prepare for irregular precipitation patterns.

Your Action Plan: Three Moves This Week

Move #1: Lock Government Support Call your county NRCS office today. EQIP funding allocates on a first-come, first-served basis. The October 3, 2025, deadline is approaching fast.

Move #2: Secure Feed Prices. Contact your nutritionist and grain merchandiser by Friday. Hedge a minimum of 60% of your 2025 corn and soybean meal needs before La Niña confirmation sends prices through the roof.

Move #3: Deploy Monitoring Technology. Install soil moisture sensors on critical feed acres this month. University extension trials show that $300-500 sensor investments can prevent $15,000-50,000 in drought losses per field through optimized irrigation timing.

Bottom line: La Niña’s coming whether we’re ready or not. The question isn’t if it’ll impact your operation—it’s whether you’ll be positioned to thrive while others struggle.

“The producers who prepare for La Niña’s return will capture market share while their neighbors struggle with production losses and margin compression,” concludes Penn State’s Dr. Charles Nicholson. “Climate patterns don’t wait for perfect cash flow or ideal timing. Neither should your adaptation strategy.”

The thing is… we’ve seen this movie before in 2012. The producers who got ready early didn’t just survive—they thrived while others struggled. Your move.

Keep your cows cool, your feed costs locked, and your eyes on the forecast.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Beat The Heat: The Importance of Heat Abatement in Today’s Dairy Operation – This article provides tactical strategies for optimizing your cooling systems. It moves beyond ROI to detail the operational impact of heat stress on fresh cows and reproduction, revealing practical methods for maximizing herd health and productivity during extreme weather events.

- Navigating The Highs and Lows of Feed Costs – Go deeper into the market dynamics driving your feed bill. This piece offers a strategic framework for managing price volatility, demonstrating how to build a resilient feeding program that protects your margins regardless of unpredictable weather or market swings.

- Robots and Beyond: The High-Tech Tools Redefining Modern Dairy Farming – Explore innovative technologies that build long-term climate resilience. This article showcases how automation, advanced sensors, and data analytics are creating hyper-efficient operations that can better withstand environmental and economic shocks, revealing opportunities to invest in future-proofing your dairy.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!