When the median U.S. farm lost money in 2023, it was the job in town—and the person working it—that kept the lights on.

EXECUTIVE SUMMARY: The median U.S. farm lost $900 in 2023. Median off-farm income? Nearly $80,000. And 96% of farm households had someone earning that second paycheck. For dairy families, the job in town isn’t a fallback—it’s often what’s keeping the bulk tank running, the health insurance active, and the show string moving. This piece tackles what happens when the person working that job starts feeling like “just the funding” instead of a partner, and why that identity strain belongs on your risk management whiteboard, right next to milk price and feed costs. Inside: a five-year lookback to tell the difference between bridging a gap and subsidizing a hobby, communication habits that work before resentment calcifies, and the uncomfortable question more couples need to ask—if that town job vanished tomorrow, would you have a dairy business or a very expensive pet? Grounded in AFBF’s April 2025 Market Intel, 2023 USDA ERS data, and a University of Illinois study on farm family mental health, it’s essential reading for anyone whose robot payment, embryo flush, or Madison entry depends on a spouse who’s quietly keeping score.

It’s 6:47 a.m. on a cold Tuesday in March. A heifer in pen three is showing classic hardware-disease signs—off feed, grunting, not right—and the vet is already on the way. Down in the barn, Mike is running the math on magnets, surgery, or a dead heifer, and one more hole in the balance sheet.

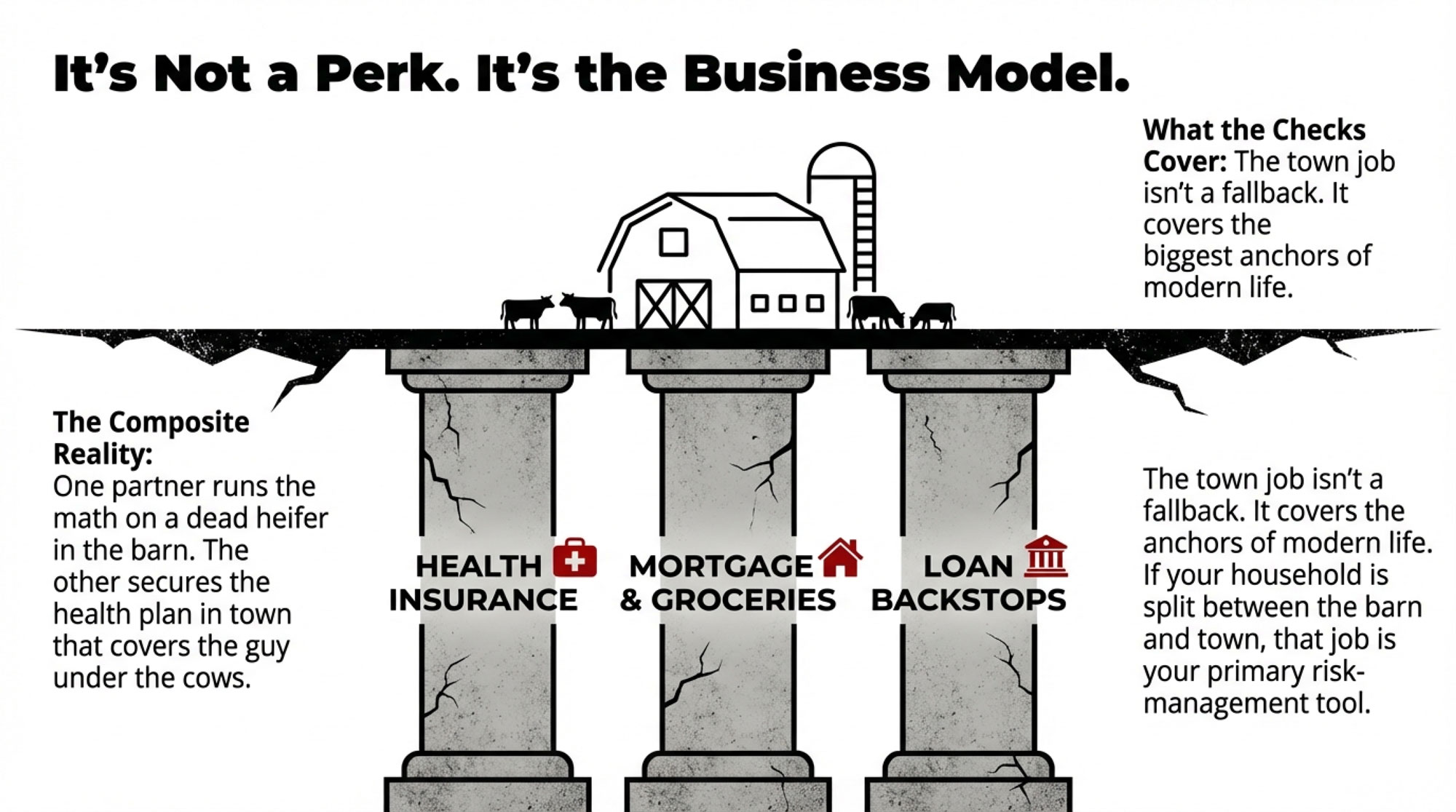

Up at the house, Sarah is standing at the kitchen counter in her work clothes, scrolling through an email from HR. Her employer’s health plan is bumping premiums and jacking up the family deductible again. That plan isn’t a perk. It’s how they insure a guy who spends his days under cows, around PTO shafts, and on cold concrete.

Mike and Sarah are a composite—built from real patterns in current U.S. farm data and the stories we hear from farm families. If your household has one partner in the barn and one driving into town every morning, there’s a good chance you’ll see yourselves here. And in 2025, that split life isn’t a side detail anymore. It’s the backbone of how a lot of U.S. dairy farms survive.

The Hard Math Behind the “Family Farm” Story

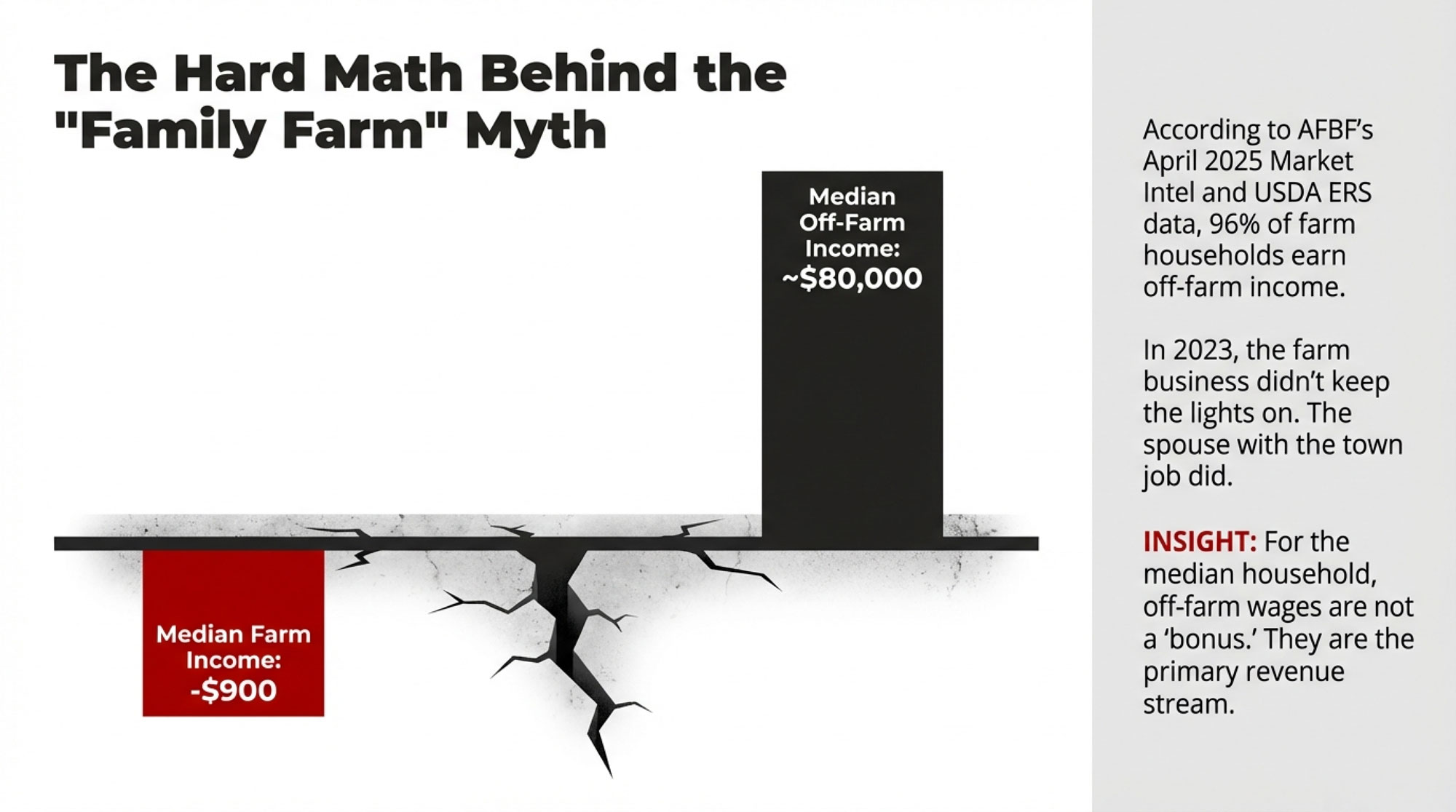

According to AFBF’s April 2025 Market Intel report “The Other Paycheck,” which draws on 2023 USDA Economic Research Service data for U.S. farm households, about 96% of U.S. farm households earned income off the farm that year. On average, roughly 77% of total household income came from off-farm sources, with just 23% from the farm itself.

Here’s the number that should get your attention: those same 2023 U.S. figures showed median farm income around negative $900 from the farm business, while median off-farm income sat close to $80,000. That doesn’t mean every farm lost money. It does mean that, in the middle of the distribution, the farm itself wasn’t paying the household’s way. The off-farm paycheck was.

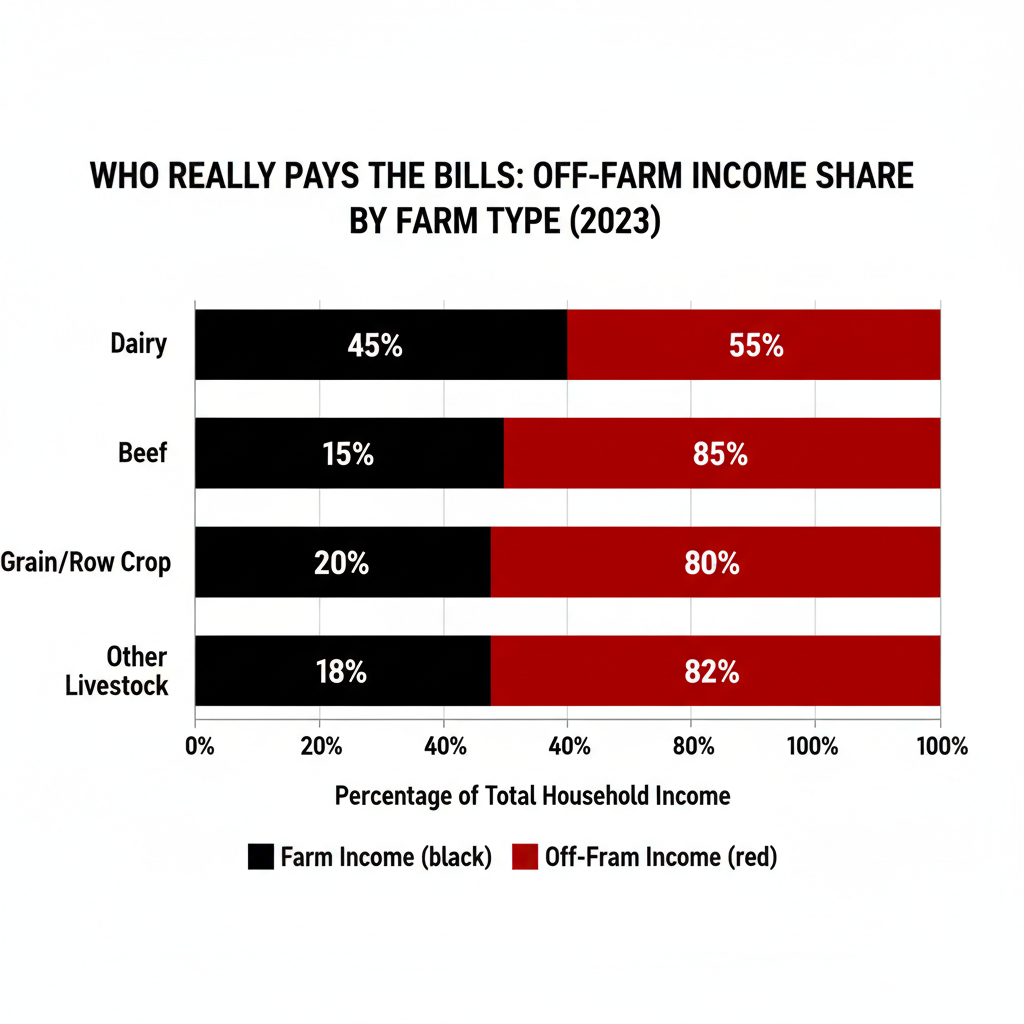

When AFBF’s commodity breakdown looked at income sources by sector, dairy stood out. Dairy households derived a much higher share of their total income directly from the farm business than most other sectors—putting dairy near the top for farm-dependent income in that report. Beef, grain, and “other livestock” operations leaned far more heavily on off-farm wages.

On paper, that sounds like dairy is “more self-reliant.” On the ground, it often looks like this:

- One partner is tied to the herd and facilities around the clock.

- The other is tied to a job in town because that’s where the predictable paycheck and health coverage live.

- Both know they’re one bad injury, one layoff, or one ugly milk-price year away from some uncomfortable conversations about debt, succession, and what happens next.

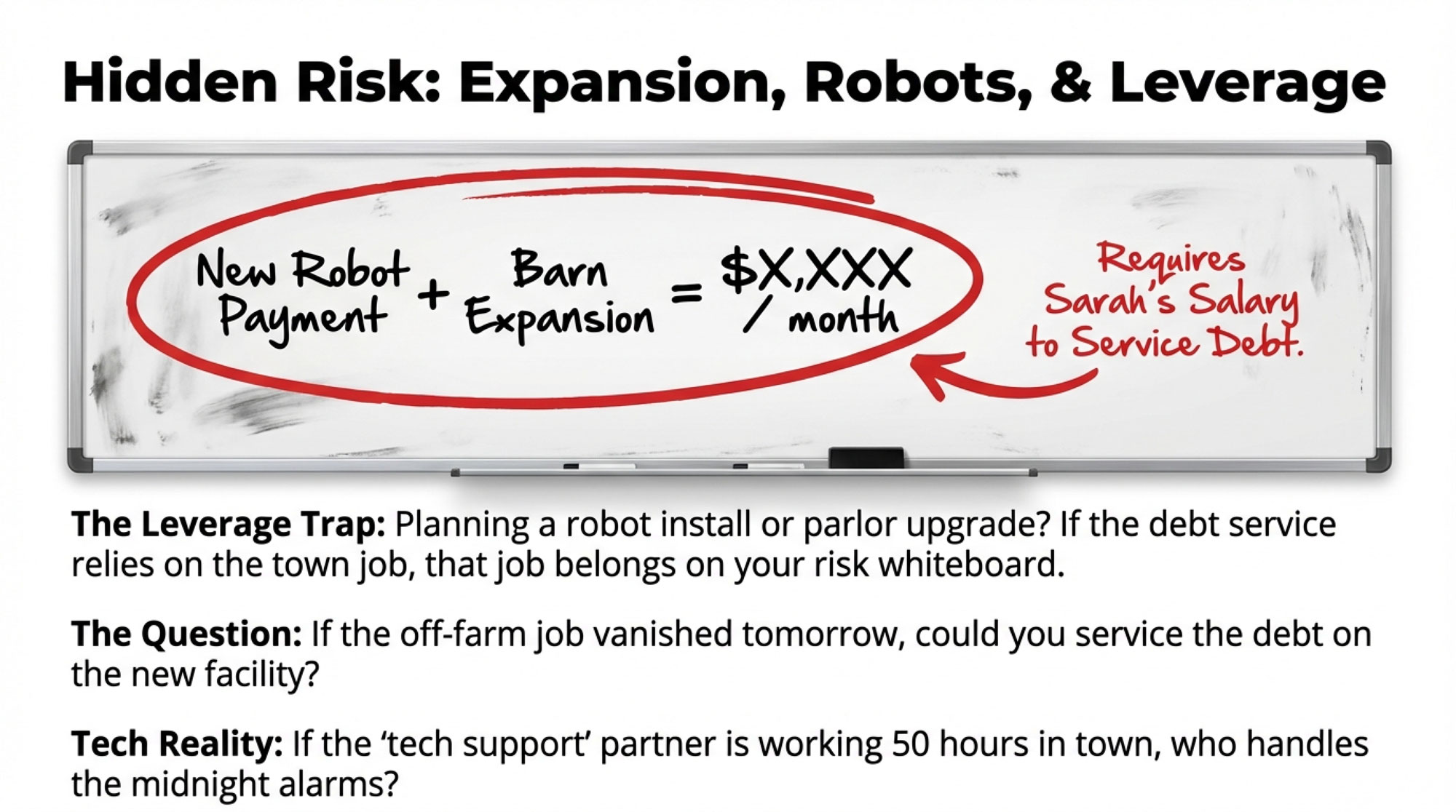

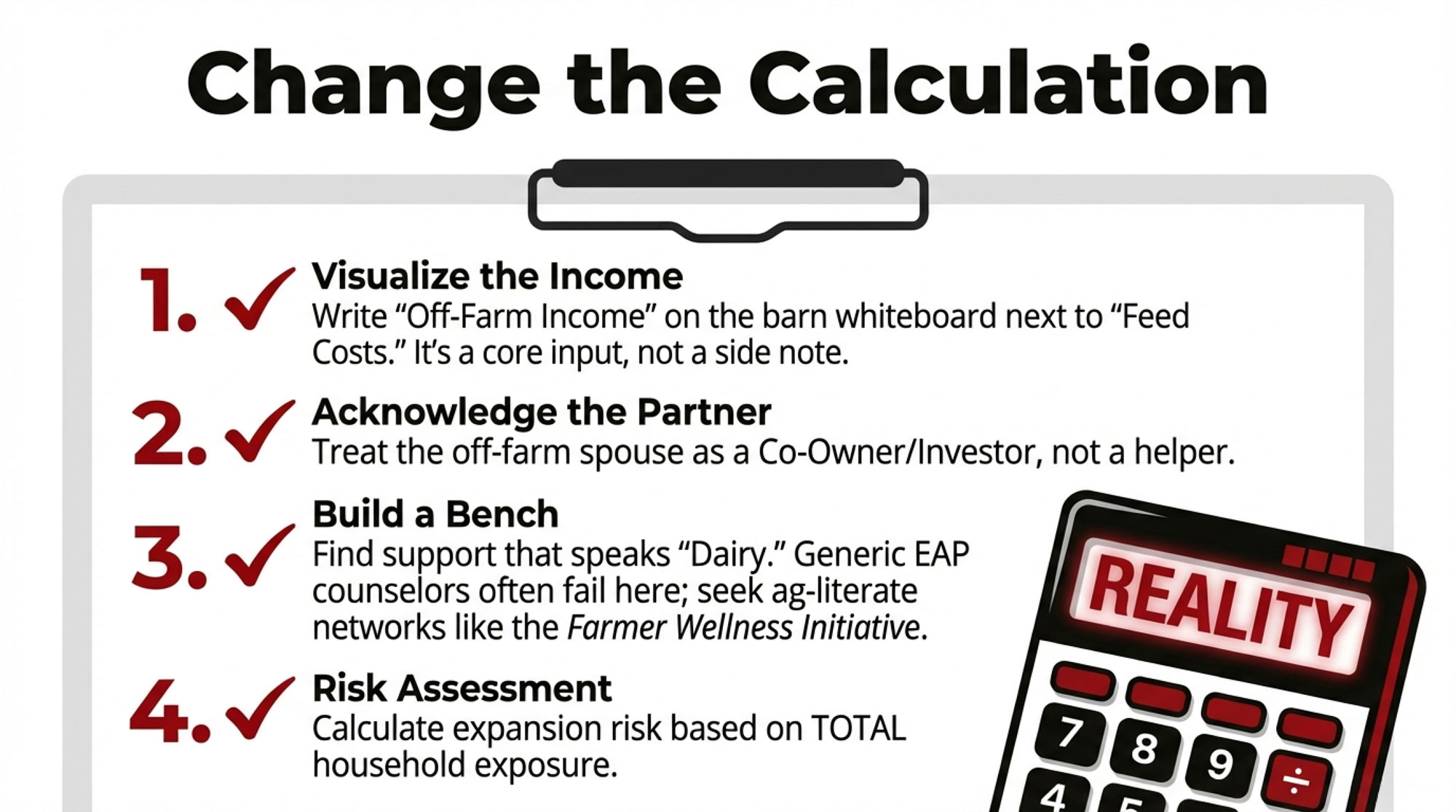

If you’re looking at a robot install, more cows, or a parlor upgrade, that off-farm column needs to be on the same whiteboard as repro, feed, and margin-protection programs like DMC. Planning as if that job and its benefits are guaranteed forever is a risk in itself.

The Off-Farm Spouse: Financial Anchor, Often Invisible

On paper, the farm is “the business.” In real life, the AFBF/ERS numbers say something different: for the median U.S. farm household in 2023, the farm business barely broke even—or worse—while the off-farm income kept the household in the black.

In our composite, Sarah’s paycheck covers more than groceries and school clothes. It often backstops loan payments, covers health insurance, and quietly plugs holes when the milk cheque doesn’t stretch far enough. That job is not optional. It’s a core risk-management tool.

The trap is pretty simple. When your family’s health coverage and basic cash flow depend on one off-farm job:

- You can’t take career risks the way your non-farm colleagues do.

- You think twice before pushing back on unreasonable workloads or bad bosses.

- Changing jobs or reducing hours isn’t just a professional decision; it’s a full-farm risk calculation.

What the Research Shows

A 2023 University of Illinois study on farm households in the Midwest found that about 60% of adults and adolescentsin their sample met criteria for at least mild depression, and roughly half of adults met criteria for generalized anxiety disorder. Debt load and financial stress showed clear connections with depressed mood and anxiety in the families they surveyed. This was a specific sample of farm families, not all farms everywhere—but the patterns match what many producers quietly describe.

That stress doesn’t stay in the yard. The off-farm spouse is carrying both worlds—the town job by day, farm stress by night—and often feels like they’re the only one seeing the whole picture. If that sounds familiar, you’re not alone, and there are resources specifically built for farm families.

“You’re the Farmer. I’m the Funding.”

The money isn’t the only thing that hurts. Identity does too.

The cocktail-party test. You see it at 4-H awards nights, weddings, and breed meetings. Someone asks, “So what do you do?”

Mike says, “I’m a dairy farmer.” Immediately, there’s interest—how many cows, what breed, what kind of parlor or robots, what he thinks of beef-on-dairy.

Sarah says, “I’m a nurse,” or “I work in insurance,” or “I’m an accountant.” She gets a polite nod. Maybe “That’s a good job to have.” Then the conversation slides straight back to Mike and the cows.

What the research says. Several studies on farm families in Ireland and other European countries—often through qualitative interviews with farm couples—have picked up a similar pattern: men often anchor their identity on being “the farmer” and “the provider,” while women downplay their own off-farm earning power to protect that identity, especially when the numbers are tight. It doesn’t describe every family, but it’s a pattern researchers see again and again in those interviews.

What it teaches. Over time, that dynamic quietly teaches some off-farm spouses a couple of things:

- “My work isn’t really part of the farm story.”

- “I’m support, not a partner.”

As one off-farm spouse put it to us not long ago:

“You get to be the farmer. I get to be the funding.”

You don’t need to sit in on a sociology seminar to understand why that matters. If the person whose job keeps the farm alive feels like a temporary funding source instead of a co-owner, their incentive to stay in that role for another 10–15 years drops. And you can’t fix a hole that big in your risk plan with a new bull or another 50 cows.

| Dimension | On-Farm Partner (“The Farmer”) | Off-Farm Partner (“The Funding”) | Recognition Gap |

|---|---|---|---|

| Weekly hours worked | 60–80 hrs (barn, field, management) | 40 hrs (town job) + 10–20 hrs (farm support, household) = 50–60 hrs total | Often seen as “helping out,” not working |

| Financial risk carried | Day-to-day farm decisions, herd health, crop timing | Entire household stability if job ends; health coverage; retirement | Risk invisible until crisis hits |

| Career flexibility | High autonomy (within market constraints) | Minimal—can’t job-hop, negotiate, or reduce hours without threatening farm | Trapped by farm dependency; career growth sacrificed |

| Social identity | “Dairy farmer” (respected, interesting, conversation starter) | “Accountant/Nurse/Teacher” (polite nod, conversation shifts back to cows) | Farm contributions erased in public narrative |

| Control over “passion” spending | Show string, genetics, equipment upgrades often farm partner’s domain | Funds it, rarely directs it | Pays for someone else’s dreams |

| Burnout risk | High (physical, market stress) | Extremely high (dual-world stress, no identity payoff, invisible labor) | Stress acknowledged for farmer, dismissed for spouse |

What This Means for Your Passion Projects

Here’s where it gets personal for the show and genetics crowd.

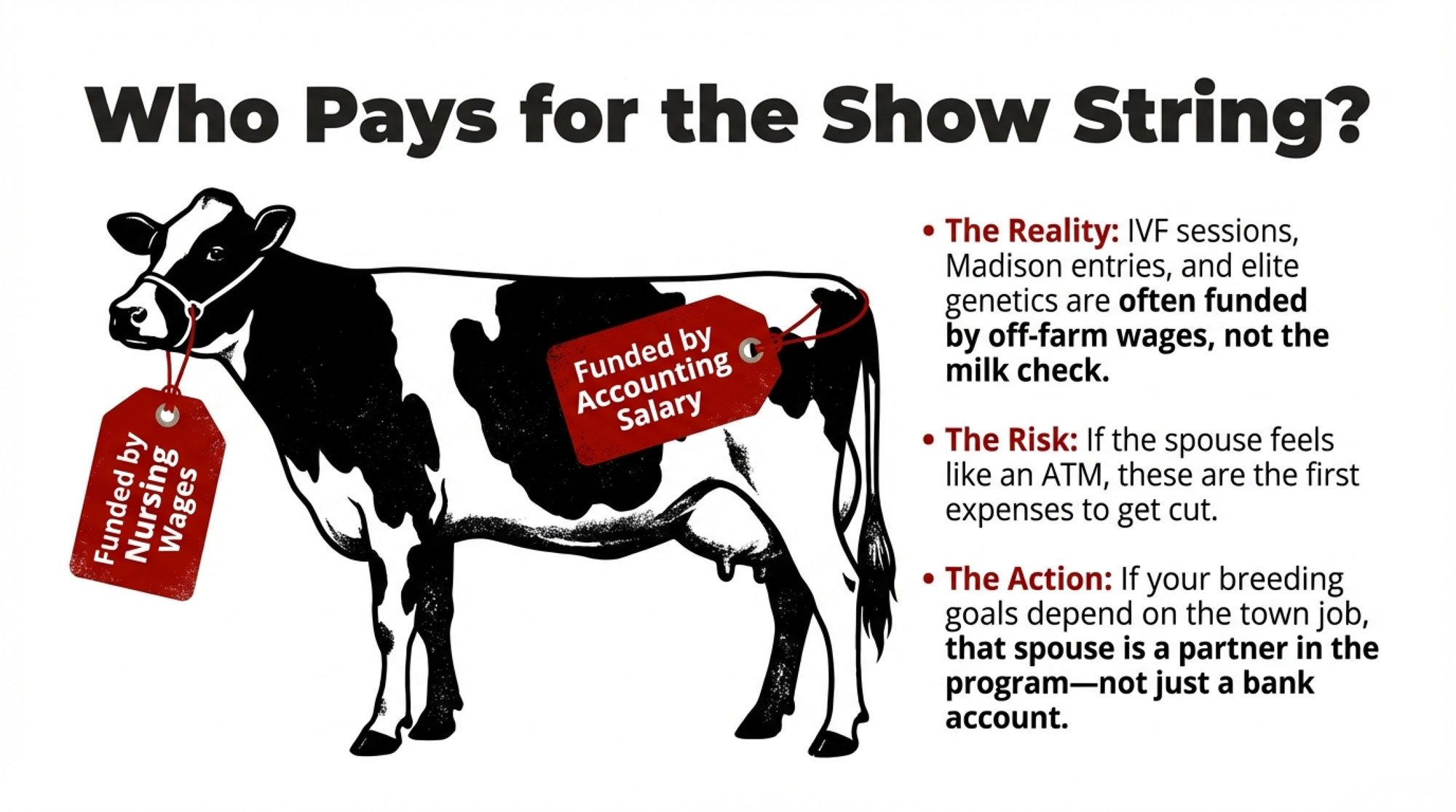

That nursing salary or accounting job isn’t just keeping the lights on and the bulk tank running. It’s often what pays the entry fees for Madison, the IVF session on that “dream” heifer, or the flight to inspect a flush donor you’ve been watching for two years. The show string and the elite genetics program? For many families, those are funded by off-farm income, not the milk cheque.

| What the Off-Farm Paycheck Typically Covers | Monthly/Annual Cost Range | What Gets Cut First If That Job Ends |

|---|---|---|

| Family health insurance (employer plan) | $1,200–2,400/month | Switch to marketplace (if affordable) or go uninsured |

| Robot/parlor equipment lease payment | $3,500–6,000/month | Default risk within 60–90 days |

| Show string expenses (Madison, genetics, hauling) | $15,000–40,000/year | Show program eliminated immediately |

| Family living expenses (groceries, kids, utilities) | $4,000–6,000/month | Household budget slashed; quality of life declines |

| Student loan or vehicle payments | $800–1,500/month | Deferred or default; credit damage |

| Emergency fund / retirement contributions | $500–2,000/month | First to stop; long-term security evaporates |

And here’s the thing: when the off-farm spouse starts feeling like “just the funding,” those passion projects are the first expenses that get cut. Not because they don’t matter, but because they’re the easiest place to draw a line when you’re exhausted and under-appreciated.

If your breeding and show goals depend on that town job, the person working it needs to feel like a partner in the program—not an ATM.

The Conversations That Help vs. the Ones That Blow Up

Add all this up—thin margins, invisible labour, identity pressure—and it’s no surprise that a lot of farm-house conversations go badly.

The protection trap. Most couples try to protect each other. Mike doesn’t want to dump every ugly cash-flow detail on Sarah when she’s already drained from work. Sarah doesn’t want to add her HR nightmares and commute stress to his load. So they both carry more than they should, in silence.

The University of Wisconsin Extension has noted that chronic stress literally makes it harder for your brain to organize thoughts and communicate clearly. So when everything finally boils over, it usually isn’t in a calm, sit-down way. It’s over something minor that turns sideways fast: a comment about a new tractor, a joke about “another long day,” a bill left on the table.

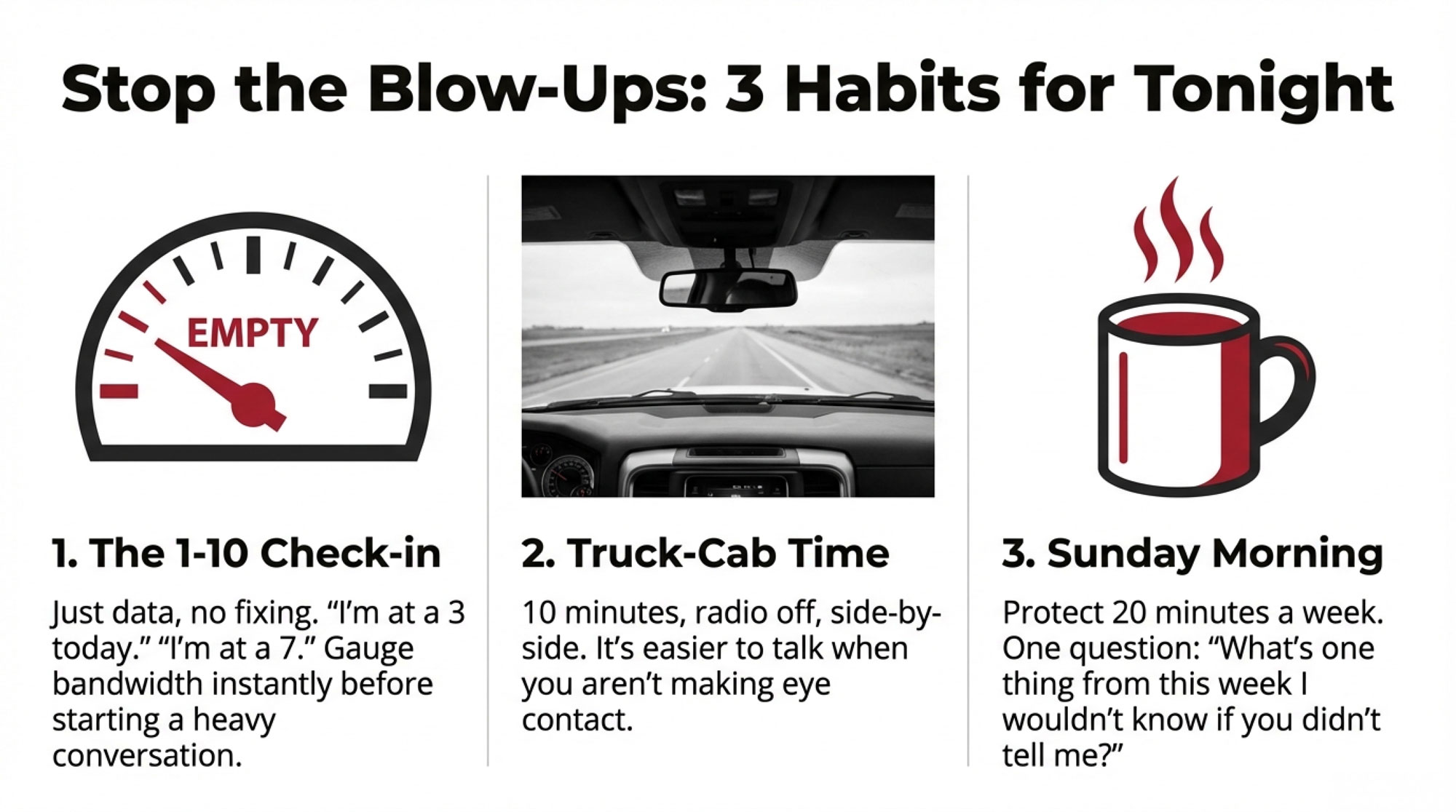

What actually works. The couples who live with similar numbers but stay steadier don’t have magic marriages. They just release steam more often, in small doses. Practical habits look like this:

- The 1–10 daily check-in. Once a day—leaving for work, coming in from chores, before bed—each of you says, “I’m at a 3 today,” or “I’m at a 7.” No explanation required, no fixing, just data. It tells you whether you’re talking to someone who’s barely holding it together or someone with a little more bandwidth.

- Truck-cab time. Whenever two of you are in the truck—feed run, vet call, supply pick-up—kill the radio for the first 10 minutes. Side-by-side, looking forward, is often the easiest way to bring up something you’ve been avoiding.

- Sunday morning is non-negotiable. Pick the one morning that’s even slightly less insane and protect 20–30 minutes after chores. Same spot, every week. One starter: “What’s one thing from this week I wouldn’t know if you didn’t tell me?”

None of that changes the milk price. But it does keep resentment from calcifying until “we need to talk” turns into “I can’t do this anymore.”

Where Off-Farm Income Quietly Drives Herd Strategy

Now let’s bring it right into your barn office and breeding board.

When a significant chunk of your household stability depends on one off-farm job and benefit package, that changes how much risk you can take inside the operation—even if you don’t write it down. You can see it clearly in three places.

Expansion and leverage. If debt service on more cows, more land, or a parlor upgrade only works as long as Sarah’s paycheck and benefits stay exactly where they are, that’s a big assumption. Before you green-light a major capital project, ask yourselves: “If this off-farm job ended or changed, how many months could we keep our payments current without panicking?” Back-of-the-envelope is better than pretending the risk doesn’t exist.

Robots and labour-saving tech. A robot install, guided-flow barn, or more automation can be a game-changer for labour and lifestyle. But every producer who’s done it will tell you: the install phase and learning curve are not hands-off. If one partner is already working 40–50 hours a week off-farm, be honest about who’s actually going to handle overnight alarms, the software learning curve, and fresh-cow follow-up. It doesn’t mean “don’t do robots.” It means plan for the real human bandwidth you actually have.

Heifers, culling, and slow cash leaks. Off-farm income can be a blessing when it lets you hold extra heifers through a downturn or keep a borderline cow another lactation. It becomes a slow leak when year after year, that town’s paycheck quietly pays for feed and yardage on heifers that won’t ever see a milking unit, or cows that aren’t paying their way.

Labor Substitution. If Sarah is working in town, she isn’t in the parlor. If Mike is doing the work of two people because the farm can’t afford a hired hand, the “burnout” risk is doubled.

Bridging a Gap vs. Subsidizing a Hobby

Let’s be direct about something.

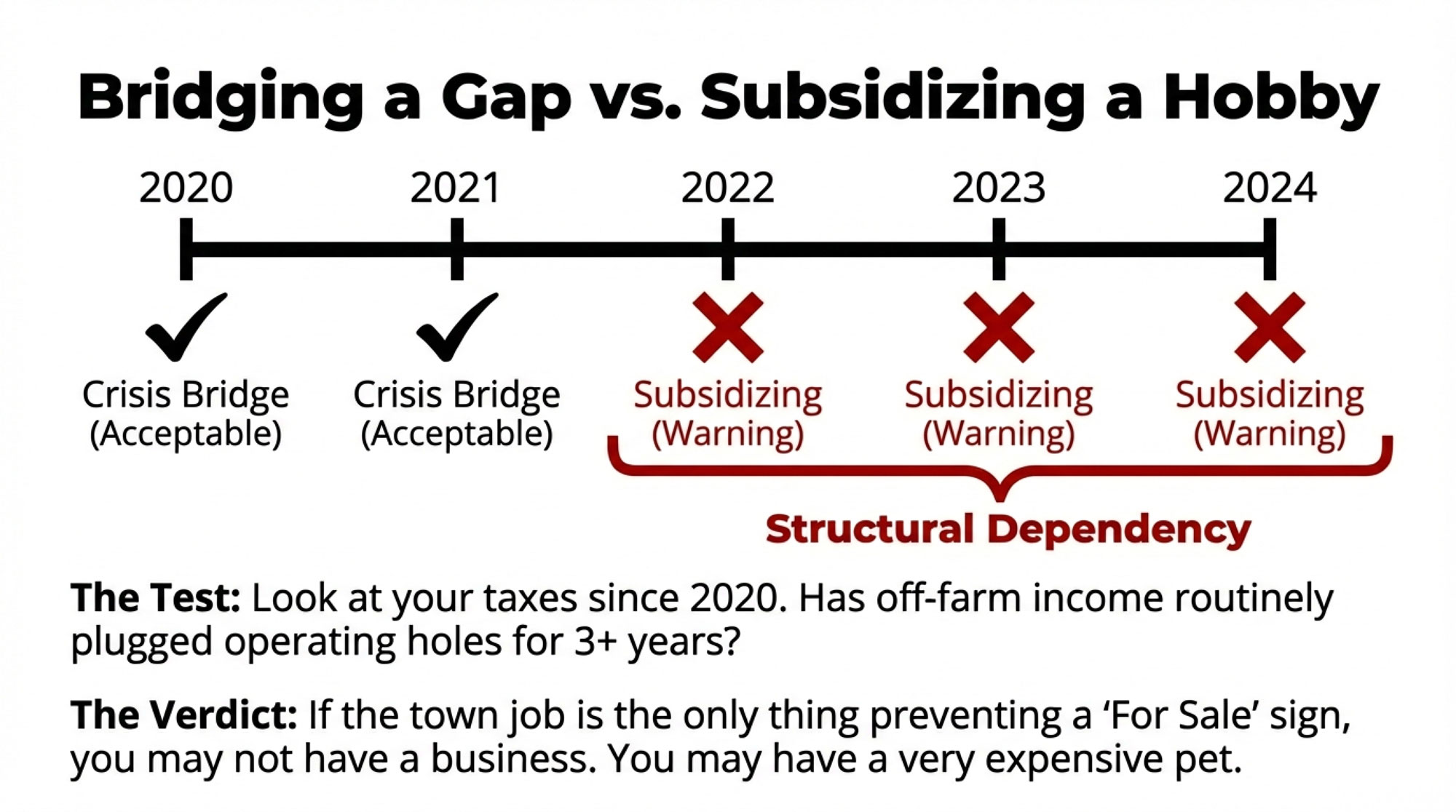

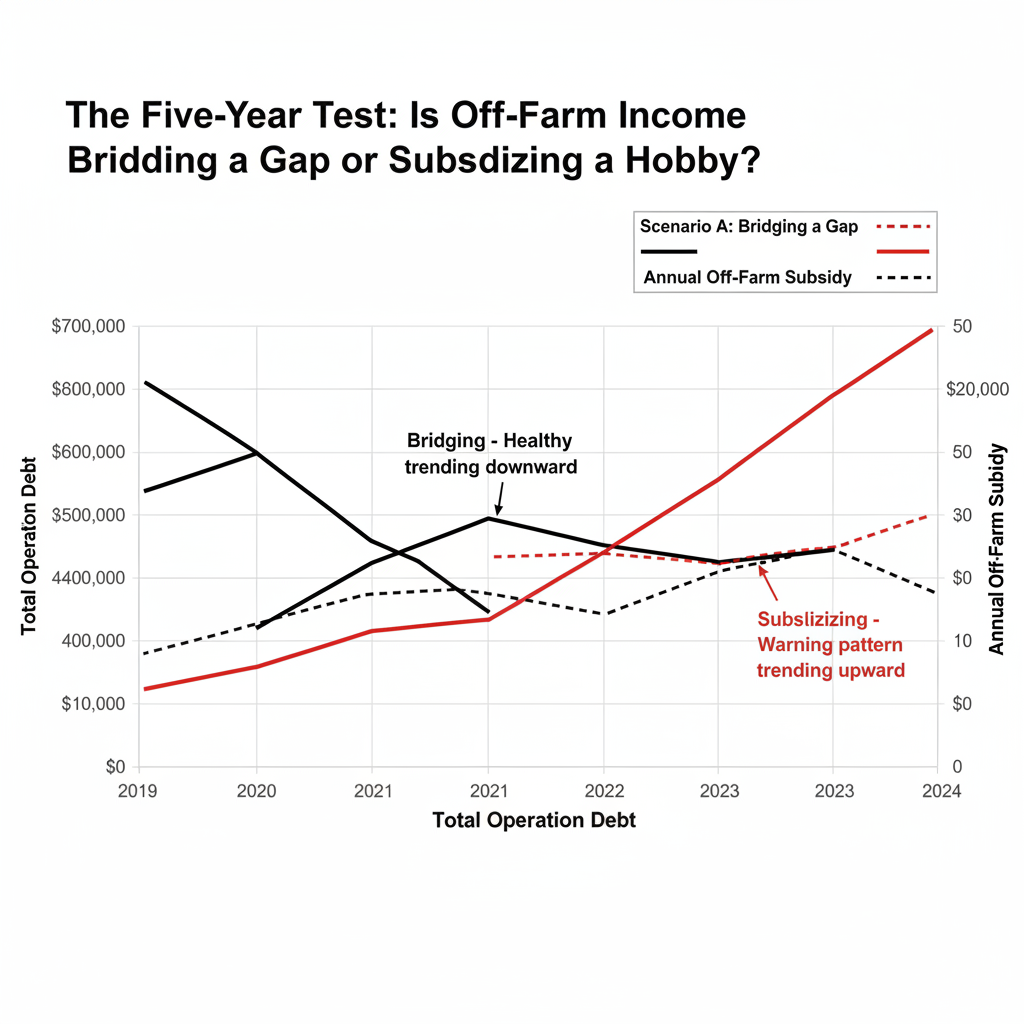

There’s a big difference between using off-farm income to bridge a gap—a bad milk-price year, a facility upgrade that takes time to pay off, a drought—and using it to subsidize an operation that doesn’t pencil out permanently.

If you look back over the last five years and see a pattern in which off-farm money routinely plugs farm operating holes rather than building savings or paying down debt, that’s not “just a tough stretch.” That’s structural.

And here’s the uncomfortable truth: if the town job is the only thing keeping the farm from a “For Sale” sign, it’s worth asking whether you still have a viable dairy business—or whether you’ve slid into keeping a very expensive, high-maintenance pet.

That’s not a judgment. Plenty of families consciously choose to subsidize a farm because it’s home, it’s a legacy, it’s where the kids learn to work. But it should be a choice you’re making with your eyes open—not something you stumble into because nobody wanted to look at the numbers.

Building a Support Bench That Actually Speaks “Dairy”

When an off-farm spouse like Sarah finally hits the wall and admits, “I can’t carry all of this by myself,” the obvious support options often disappoint.

Some traditional “farm wife” groups revolve around on-farm roles: parlor help, calf chores, and field meals. Those are important jobs, but they don’t match the stress of someone shouldering a full-time town job plus farm finances. On the flip side, generic workplace EAP lines and urban counselors often don’t understand why “just find a less stressful job” isn’t realistic when that job is literally underwriting the farm’s survival and health coverage.

What tends to help more looks like this:

- Ag-literate support. In the U.S., organizations like Farm Aid offer farmer hotlines and connections to counselors who understand seasonal stress, income swings, and farm culture. In Canada, the Farmer Wellness Initiative in Ontario and other provincial programs are building similar networks with counselors trained specifically for agriculture. The difference between “Tell me how you feel” and “I understand why this HR email feels like a barn fire” is huge.

- One or two peers in the same boat. These often come through your vet, nutritionist, milk hauler, or school contacts. Someone who knows exactly what “premium hike plus vet bill” feels like and will pick up the phone at 10 p.m. when you send a short, panicked text.

- One space that isn’t about cows or spreadsheets. A rec hockey team, book club, choir, or church group where you—or your spouse—show up as a person, not “the farmer” or “the farm wife/husband.” Research keeps coming back to the same point: isolation magnifies stress in farm families. One night a month that isn’t about the farm isn’t indulgence. It’s maintenance.

Picking up that phone or walking into that first appointment can feel like admitting you can’t hack it. Most people expect to feel judged. What they actually feel, more often than not, is relief—because the person on the other end finally gets it.

When “Managing Stress” Becomes Tolerating the Unmanageable

There’s a line where better stress management isn’t enough.

Communication habits, counseling, and support networks can make life in a tight system more livable. They don’t change the fundamental math. At some point, “We’re getting better at handling stress” can quietly turn into “We’re getting better at tolerating a structure that doesn’t work.”

You’re getting close to that line when:

- Off-farm income regularly pays core farm operating expenses, not just household needs.

- Total debt—farm plus household—is noticeably higher today than it was five years ago, despite everyone working flat-out.

- One or both of you are clearly more worn down, short-tempered, or checked-out than you were a few years ago, even after adding support.

- Kids’ stability and opportunities are taking repeated hits, so the farm can hang on.

- There’s essentially nothing going into retirement; every available dollar keeps going back into the operation.

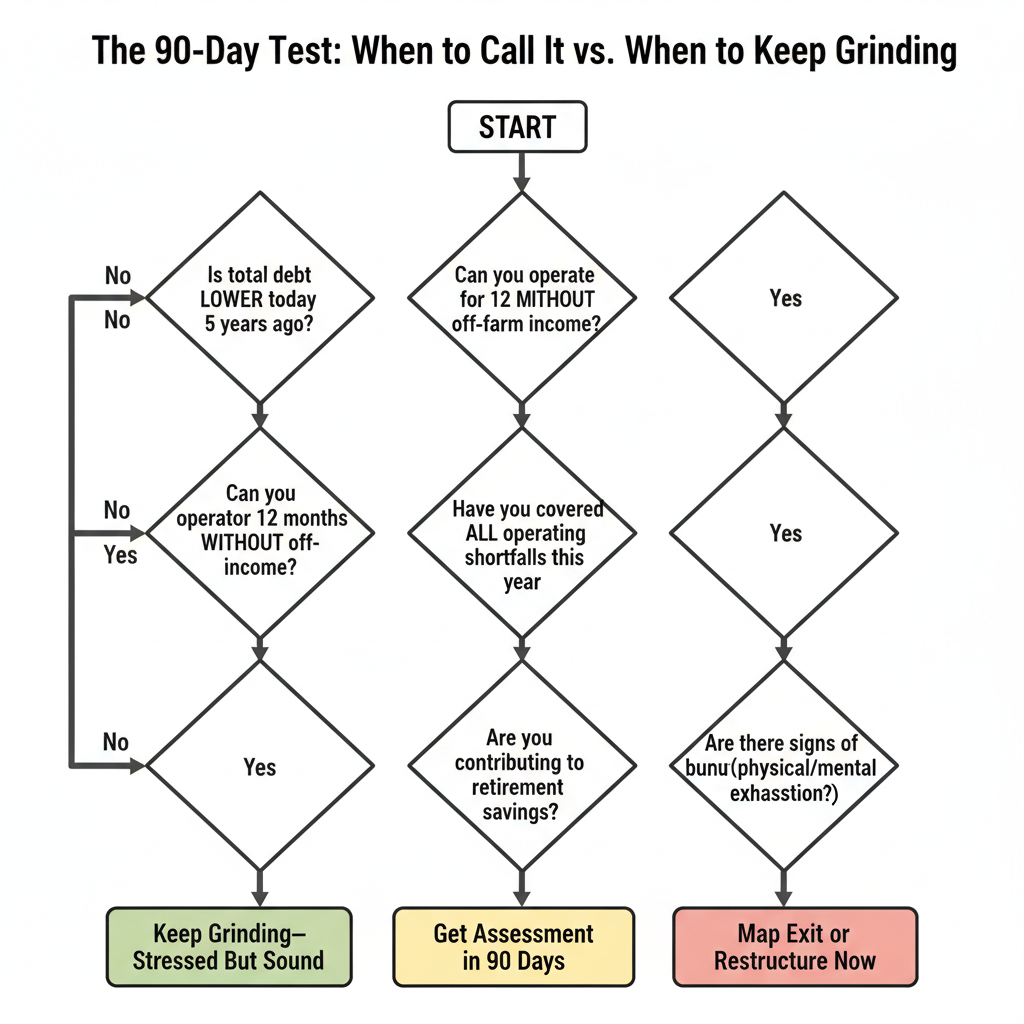

At that point, the key question isn’t, “Are we tough enough to keep grinding?” If you’ve kept a dairy going through the last five years, you’ve already proven you’re tough.

The more honest question is, “Is the system we’re holding together actually worth what it’s costing us?”

That’s not a question for midnight after a bad day. It’s a question for a scheduled sit-down—with numbers, not just feelings. And it gets a lot easier to ask when you’ve already built some trust through those small daily check-ins, rather than waiting until something explodes. If you’re starting to have those conversations, here’s how other families have approached the transition question.

What This Means for Your Operation

You don’t need another think-piece telling you dairy is hard. You need checks you can run against your own reality. Here’s a practical way to start.

Put off-farm income on the planning board. Next time you’re talking expansion, a robot install, or a parlor upgrade, write “off-farm income” and “health benefits” on the same whiteboard as feed, repro, and labour. If the plan only works as long as one job in town stays exactly the same, say that out loud before you sign.

Do a rough five-year lookback. Circle a date in the next month and sit down with your partner. Pull tax summaries, lender statements, or even just your memory and a notepad. Look at the last five years: How often did off-farm money cover farm operating shortfalls? Is total debt higher or lower than it was five years ago? One simple gut-check some advisors use: if you can point to several years—say, three or more out of the last five—where off-farm income bailed out farm operating losses, that’s a strong hint you’re dealing with a structural problem, not just “we’ve been tight.” There’s no official threshold, but that pattern should make you ask harder questions.

Ask who’s really carrying the risk. If losing the off-farm job would put you in serious trouble within a few months, that reality has to shape how aggressive you get on cow numbers, land base, and capital projects. That’s not fear. That’s responsible risk management.

Test one small communication habit for a month. Pick the 1–10 check-in, Sunday coffee, or truck-cab time and commit to it for four weeks. If it makes conversations about money and the farm easier, keep it. If it doesn’t move the needle at all, that’s useful information—it may mean the problem is structural, not just emotional.

Bring a third set of eyes into the picture. If your five-year lookback and your gut both say, “This is tight,” it’s time to sit down with an accountant, lender, or farm business advisor who understands dairy. Ask for a clear picture of your options: stay roughly where you are with guardrails; scale down; lease out; bring in a partner; or map a 5–10-year transition. You don’t have to decide that day. You do need to see what’s possible.

Give yourselves permission to ask, “Are we still doing this?” Not as a threat. Not as a weapon in an argument. As owners and parents asking whether the life you’re building around this herd still makes sense for your health, your kids, and your long-term security.

A note for Canadian readers: The exact numbers look different under quota, and income stability from supply management changes the calculus. But the questions—about who’s carrying risk, how the off-farm job fits into the whole picture, and whether the structure is sustainable—apply just as much north of the border.

Key Takeaways

- Off-farm income—and the person earning it—are no longer “extras” in U.S. dairy households. Based on 2023 AFBF/ERS data, they’re central to your risk-management plan.

- If your expansion, robot, or facility plans quietly assume the off-farm job and benefits will never change, you’re underestimating one of your biggest risk variables.

- Your show string and genetics program probably depend on that town paycheck, too. If the off-farm spouse feels like “just the funding,” those passion projects are the first things to go.

- There’s a difference between bridging a gap and subsidizing a hobby. Know which one you’re doing—and make it a conscious choice.

- Small, regular check-ins beat one big “we need to talk” blow-up every time. They won’t fix bad numbers, but they’ll help you spot bad patterns before they turn into crises.

- Real toughness isn’t just grinding out another year. It’s being willing to look at the whole structure—herd, land, debt, off-farm job, family—and decide whether it’s actually delivering the life you want for the people you love.

The Bottom Line

The cows don’t care where the mortgage payment comes from. But you and your family do. The sooner you pull the off-farm side of the ledger into full view, the more control you’ll have over how your dairy—and your life around it—look in five or ten years.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More

- Same Cows, $15,000 Apart: Class III Milk Price, DRP, and Your Spring 2026 Risk Plan – Secure your spring margins by executing a precision-driven risk plan that accounts for Class III volatility. This guide delivers immediate steps to safeguard your milk cheque, ensuring your barn operations stop cannibalizing your off-farm savings.

- 1,100 Cows in One Night: How Dairy Neighbors Became the Best Risk‑Management Plan on the Farm – Gain a long-term tactical advantage by integrating community-based resilience into your 5-year plan. It exposes how social capital functions as a structural safety net, protecting your family’s legacy when conventional financial tools fall short.

- Stop Tubing Every Mastitis Cow: The $15 Strip Cup Playbook That Beats Blanket Treatment – and Your Robot Alerts – on Cost and Cure – Slash operating costs and improve herd longevity by ditching blanket antibiotic protocols for a smarter $15 solution. It reveals how low-tech disruptions can out-perform expensive robot alerts and keep more cash in your household’s pocket.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!