This fall, the leverage flips. Consistency and data—not herd size—are the new currency in Texas milk markets.

Executive Summary: Texas dairy is hitting reset—and this time, producers hold the leverage.” With over $700 million in new investments in ESL processing, the state’s milk market is being rebuilt around consistency, documentation, and proactive negotiation. ESL technologies from universities like Cornell and Cal Poly have proven that milk lasting up to 90 days demands unwavering quality. That’s creating new premiums for farms that deliver predictable performance backed by data. According to USDA and industry experts, the next generation of dairy success won’t be about herd size—it’ll be about reliability. And Texas producers who act now could lock in the best contracts of their careers.

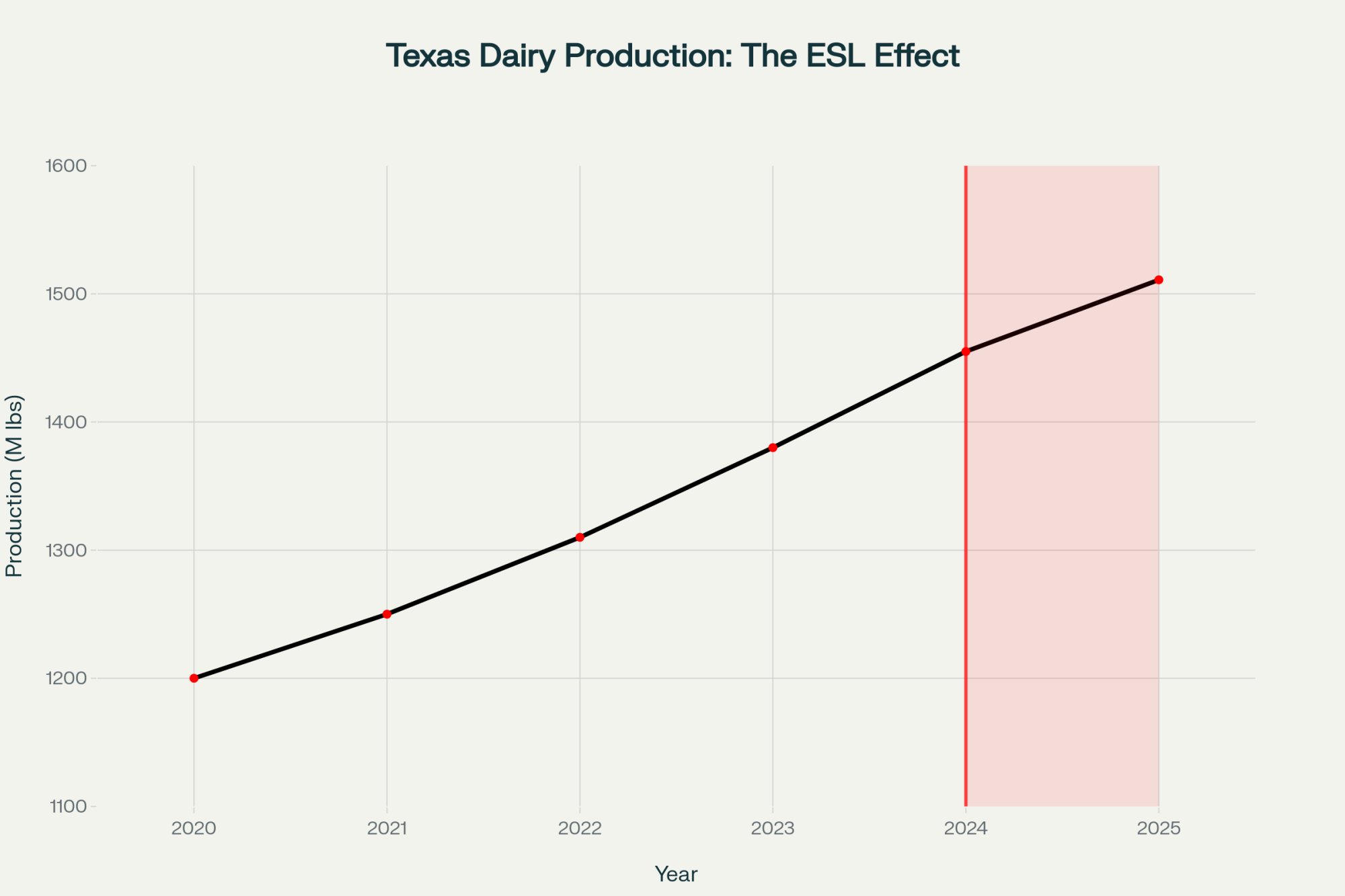

If you’ve been in dairy for more than a decade, you know when the ground shifts. Well, it’s shifting again—this time deep in Texas. With Ninth Avenue Foods investing $200 million in a new extended shelf-life (ESL) facility in Longview, Walmart putting $350 million into its site in Robinson, and Select Milk Producers launching a partnership with Westrock Coffee in Littlefield, the state’s dairy landscape is being reshaped from the ground up.

That’s over $700 million in fresh processing investment. But here’s what’s interesting—it’s not just more capacity. It’s a fundamental redefinition of how milk gets valued, marketed, and negotiated.

Understanding What’s Really Changing

Let’s start with the technology itself. ESL milk—what many of us know as the kind that lasts far longer on grocery shelves—uses a mix of ultra-high temperature (UHT) heat processing and microfiltration to achieve a shelf life of 60 to 90 days under refrigeration. Research from the Journal of Dairy Science and studies out of Cornell University’s Dairy Foods Research Lab confirm that this process sharply reduces spoilage bacteria without compromising flavor.

That longer shelf life opens new doors for processors. They can ship products farther, reach larger markets, and reduce waste. But there’s a tradeoff. Longer shelf life transfers more responsibility for milk quality back to the farm. Even small inconsistencies in bacterial counts or SCC can shorten shelf life by weeks.

| Attribute | Conventional Milk | ESL Milk |

|---|---|---|

| Shelf Life | 14-21 days | 60-90 days |

| Processing Temp | 135-145°C (HTST) | 138°C+ (UHT/microfiltration) |

| Bacterial Reduction | ~3 log | 4-5 log |

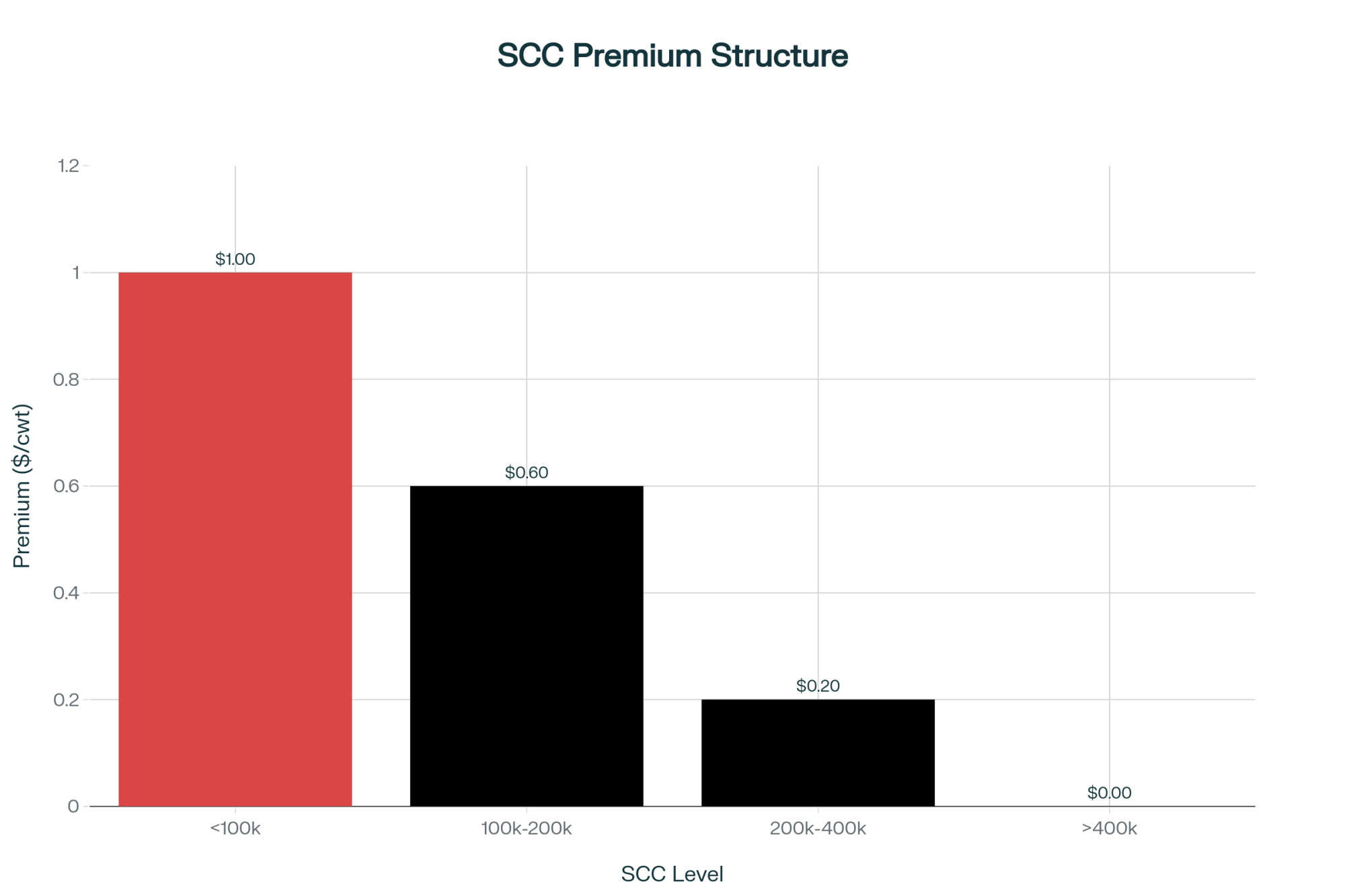

| SCC Requirement | <400,000 cells/mL | <200,000 cells/mL |

| Premium Range | $0.00-0.24/cwt | $0.40-1.00/cwt |

| Contract Duration | Standard pool | Multi-year contracts |

| Quality Monitoring | Monthly testing | Real-time/weekly testing |

| Market Access | Regional markets | National/export markets |

Processors now value predictability every bit as much as butterfat performance. As Cornell’s team often notes, once you’re marketing a 90-day milk, the margin for error in supply quality nearly disappears.

Predictability and the Premium Shift

Here’s what that means practically. Producers delivering consistent milk quality—stable SCC below 200,000 and reliable components—are already seeing premiums of $0.40–$1.00 per hundredweight, based on documented supply data reported through USDA Dairy Market News and several processor programs in the Southwest.

And this focus on consistency doesn’t just reward the biggest herds. Medium and family-sized farms are excelling by proving reliability through recordkeeping and digital traceability. I’ve noticed that some of the most competitive contract negotiators aren’t the high-output herds—they’re the most organized.

One example is Doug Jensen, who milks about 600 Holsteins near Stephenville, Texas. Three years ago, he started keeping digital milk quality logs—SCC, bacterial counts, and butterfat trends—using reports from his cooperative testing system.

“When Ninth Avenue Foods began sourcing for their new plant,” Jensen recalled, “we already had the data. They could see we were steady. That’s what made us worth paying a little more for.”

Because of that agreement, most of his milk now supplies ESL beverage production. Jensen told me it helped finance an updated cooling system and a few automation upgrades. That data discipline effectively turned his milk from a commodity to a contract asset.

And that’s the bigger pattern emerging: consistency has become an independent profit driver.

The Financial Clock Is Ticking

What producers sometimes miss is how much these facilities depend on a quick, dependable supply. Each of these projects—funded in part through USDA Rural Development lending and private capital—operates under strict financial covenants. These typically require plants to operate at 65% utilization and maintain a 1.25 debt service coverage ratio during their first full fiscal year.

You don’t have to be a banker to see what that means. Processors can’t afford uncertainty. They’ll lock in dependable suppliers early, at attractive rates, to assure lenders they can operate efficiently.

Once those supply lists fill, the leverage that returning to farmers today may bring may not return for years.

It reminds me of the Midwest cheese expansions from 2017 to 2021. Early contract holders got consistent premiums. Those who waited ended up taking standard pool prices once the plants filled.

So if you’ve been telling yourself, “I’ll see how the market shakes out first,” it’s worth remembering: by the time it “shakes out,” slots are usually filled.

Building in the Accountability

Extended shelf life might sound like a golden ticket, but it comes with strings. Contracts are only as strong as a herd’s ability to deliver steady quality.

Processors are upfront about this. Industry contracts reviewed by Cornell Dyson School researchers show that during non-compliance—often two consecutive months of missed quality benchmarks—milk can be reclassified into conventional markets without premium payment. Some newer contract models include step-down provisions that reduce premiums until levels recover.

The goal isn’t to penalize—it’s to protect consistency and consumer trust. Cornell’s extension specialists say most processors include remedial review periods and offer technical support if issues arise.

As one Kansas operator who recently entered an ESL supply program put it, “If you fail a bulk tank test or your cows spike from a transition problem, you don’t get dropped—you reset and prove you’re back in range. The discipline is good for everyone.”

Why Contracts Matter More Than Ever

If this all sounds complex, it is—but it’s also navigable. And it’s where producers can protect themselves or lose ground fast.

A review from Cornell’s Dyson School of Applied Economics found that “capital retain” and “market stabilization” deductions—when uncapped—reduced producer net returns by 5–8% over prior expansion cycles. Without proper language, those deductions can quietly undermine even premium agreements.

For producers considering ESL contracts, a few guidelines consistently stand out:

- Set Deduction Limits. Agree to annual caps around $0.40/cwt and written notice for changes.

- Include Flexibility Clauses. Seasonal swings—heat stress, fresh cow transition periods—happen. Negotiate at least 20% variance in language.

- Third-Party Verification. When quality scores are disputed, independent testing keeps relationships transparent and healthy.

According to Jennifer Zwagerman, director of the Drake University Agricultural Law Center, modern processors are typically amenable to these clauses. “Clarity cuts risk—for both sides,” she said. “It creates a proactive, trust-based partnership rather than an adversarial one.”

The processors prefer reliable partners. The producers prefer predictable revenue. The paperwork just needs to reflect that alignment.

Two Emerging Milk Markets

What this all signals is a permanent shift toward a two-tier milk economy.

Tier One: Documented, consistent suppliers on multi-year ESL contracts feeding high-value lines—branded milk, protein drinks, specialty ingredients.

Tier Two: Standard pooled supply and spot-market milk providing bulk volume but lacking a premium structure.

Cal Poly’s Dr. Phillip Tong, an authority on dairy processing innovation, says this stratification isn’t likely to reverse. “Once a processor calibrates for specific microbial and compositional norms, changing suppliers midstream creates significant product risk. Continuity is everything.”

From an operational point of view, this mirrors herd management: build routine, sustain consistency, and results compound over time.

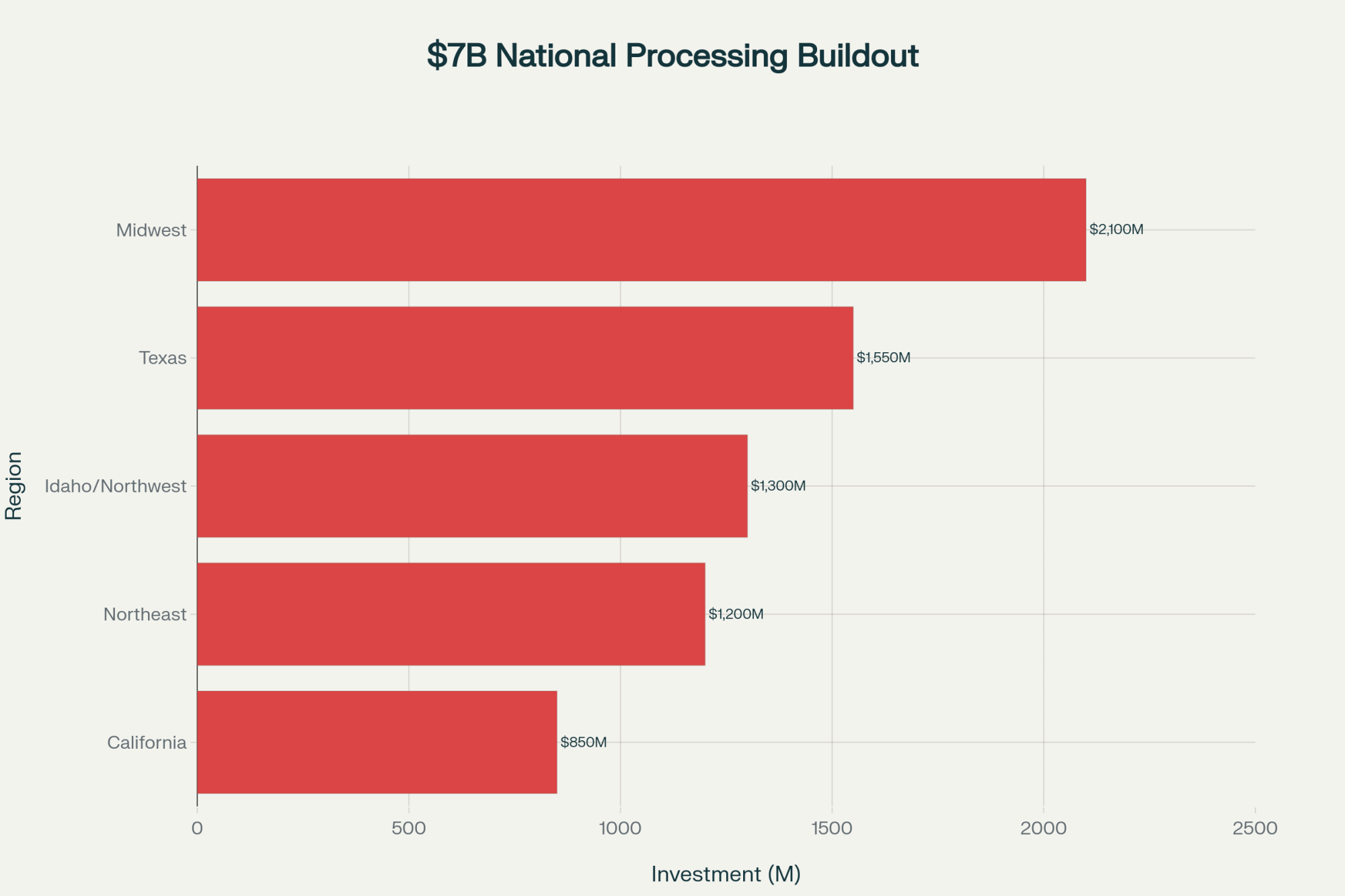

Texas May Be First, But It’s Not Alone

While Texas stands in the spotlight right now, similar ESL rollouts are accelerating elsewhere.

- Leprino Foods’ $870 million Lubbock facility is now a dual-purpose cheese and ESL ingredient plant—one of the largest in the U.S.

- California Dairies Inc. expanded ESL lines through Valley Natural Beverages, reporting major shrink savings.

- Walmart’s processing hubs in Texas and Georgia distribute 60-day milk to more than 700 outlets across the Southeast.

According to the U.S. Dairy Export Council, ESL and shelf-stable beverage exports have been growing by roughly 10% a year since 2023, led by demand from Mexico, the Caribbean, and South Asia. That diversification gives producers a buffer against domestic volatility—a long-awaited stabilizer in milk demand.

Where Producers Should Start

Thinking about joining the ESL supply chain? Here’s what’s working for farms that already have:

- Leverage your data. Two years of consistent results are worth more than the cleanest parlor inspection.

- Audit your cooling systems. ESL contracts typically require milk cooled to strict specifications—usually below 38°F.

- Match your management to expectations. Pay extra attention to bacterial counts during the fresh cow period and late lactation, where fluctuations often spike.

- Review your agreements annually. Contract stability depends on consistent review, not just signatures.

As USDA and state extension advisors have often observed, proactive transparency—not perfection—is what processors prize most.

The Bottom Line

What’s truly striking about this ESL wave is how it rewards fundamentals that producers have practiced for generations: discipline, attention to detail, and pride in steady, high-quality milk.

As Doug Jensen told me, “We’ve been doing the same job for years. The only difference is—now someone’s finally paying for doing it right.”

That’s a milestone worth celebrating—and proof that smarter, data-driven production can help producers regain leverage in a market that hasn’t favored them in a long time.

Key Takeaways:

- ESL is the next defining wave in dairy. Texas’s $700 million processing boom proves long-life milk is transforming demand, contracts, and margins.

- Your consistency is your competitive edge. Farms that are tracking steady SCC, butterfat, and bacterial counts are already earning premium status.

- Contracts are your silent profit maker—or breaker. Demand capped deductions, flexibility protections, and third-party testing rights.

- Leverage has a deadline. Secure your deals before processors hit full capacity and reset terms.

- Data delivers opportunity. Even modest herds can compete head-to-head with big ones when their milk quality is proven, not promised.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Mastitis and Somatic Cell Counts: The True Cost to Your Dairy – This article provides tactical strategies for managing and lowering SCC, a critical quality metric for ESL contracts. It demonstrates how to reduce economic losses and deliver the consistent, high-quality milk that processors are actively rewarding with premiums.

- Navigating the Tides: Key Trends Shaping the Future of the Dairy Industry – Gain a strategic, big-picture view of the market forces driving investments like the ESL boom. This piece explores consumer behavior, sustainability demands, and global trade, helping you position your operation for long-term profitability beyond a single contract.

- The Data-Driven Dairy: How Technology is Reshaping Herd Management – The main article stresses proving consistency with data; this piece shows you how. It reveals the specific on-farm technologies—from sensors to software—that empower producers to track, document, and leverage their performance data for stronger contract negotiations.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!