66% of US milk money goes to 834 farms. The other 23,000 farms? Fighting for scraps. Which side are you on?

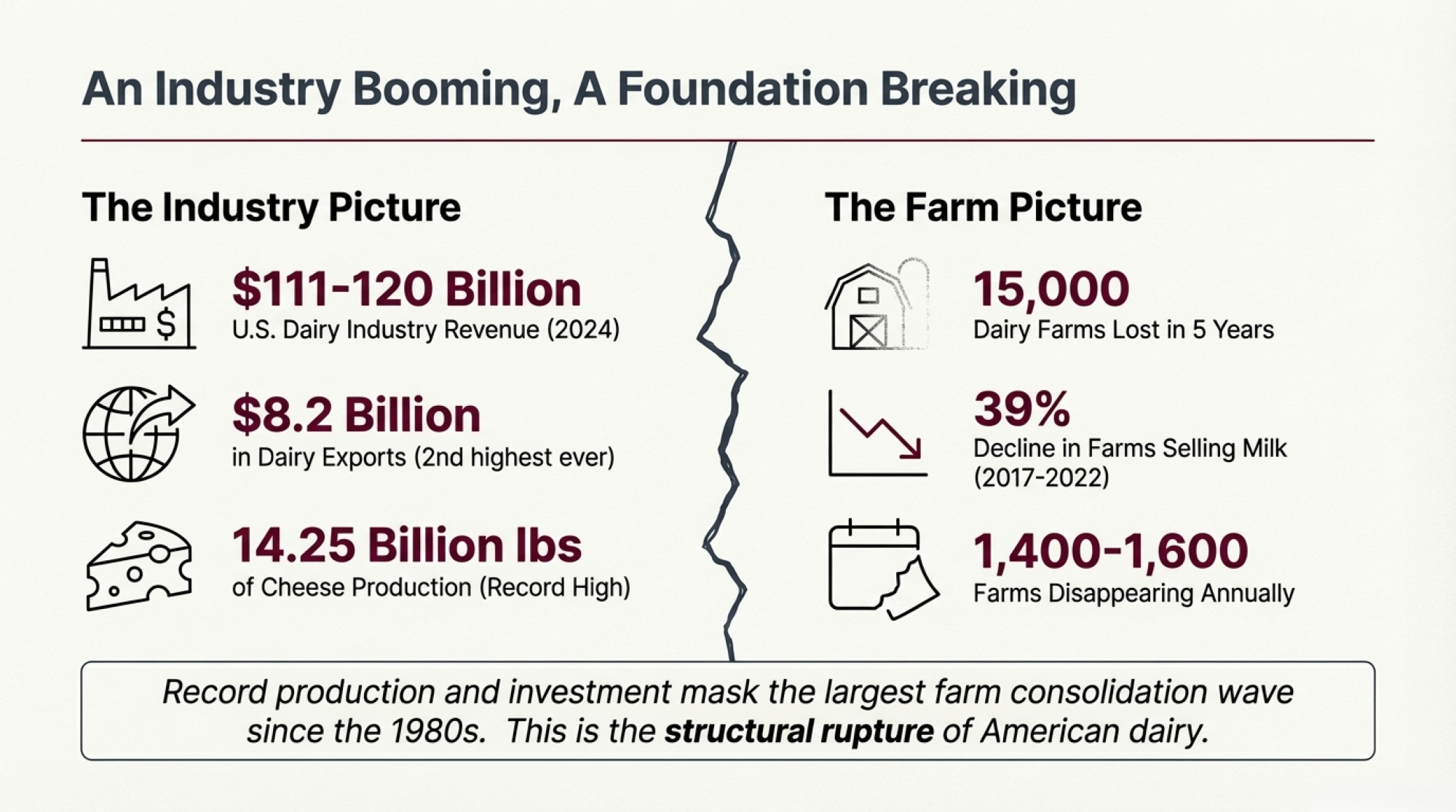

You know, looking at the American dairy landscape right now, you’d think we’re swimming in success. And in some ways, we are. The numbers are massive—we’re talking about a $111-120 billion industry that’s breaking production records while processors pour $11 billion into new facilities through 2028.

But here’s what’s interesting: while the industry gets bigger, the number of farmers running it keeps getting smaller.

The 2024 Dairy Power Rankings: Who Controls Your Milk Check

So let’s talk about who actually controls the milk flowing from America’s farms to consumers’ fridges—and more importantly, what that means for your operation.

The Giants: Who Owns the Checkbook?

| Company | 2024 Revenue | The Real Story |

| Lactalis | $31.9 Billion | The Global King: French giant buying everything in sight. |

| DFA | $23 Billion | The Co-op Giant: Your “partner” with 44 processing plants. |

| Land O’Lakes | $16.8 Billion | Diversified Domestic: 23.2% US market share. |

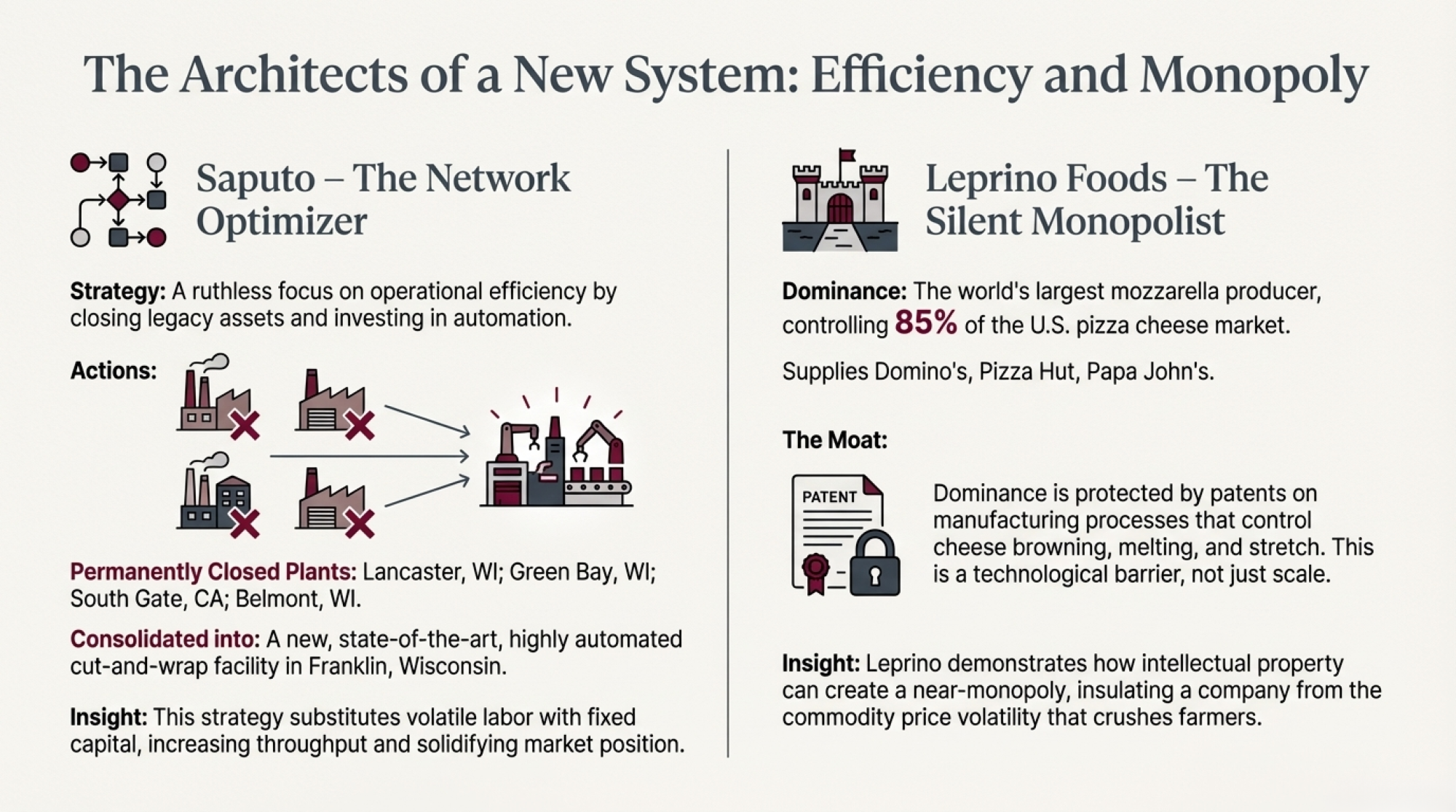

| Saputo | $13.9 Billion | The Aggressive Expander: 8.4% growth, highest in industry. |

| Nestlé N.A. | $6.5-7.5 Billion | The Diversifier: Infant formula to coffee creamers. |

| Schreiber | $7 Billion | The Hidden Giant: Supplies every major retailer. |

| Danone N.A. | $5.5-6.5 Billion | The Yogurt King: Pushing plant-based hard. |

| Leprino | $3.6 Billion | The Pizza Emperor: Controls 85% of US pizza cheese. |

Lactalis, that French dairy behemoth, sits firmly at the global summit with .9 billion in worldwide dairy sales as of 2024. They’ve been on quite the acquisition spree lately. Just this year, they grabbed General Mills’ US yogurt business for $1.5 billion, and they’re in the process of acquiring Fonterra’s consumer operations for another $2.3 billion. Their Président cheese brand alone jumped 45% in brand value this year to $3.2 billion. That’s… well, that’s a lot of cheese.

Now, Dairy Farmers of America—that’s where things get complicated for American producers. DFA reported $23 billion in total revenue for 2024, making them the third-largest dairy company globally. They marketing milk for over 11,000 members and handle roughly 30% of US milk production. But here’s the rub that’s got farmers talking: DFA now owns 44 processing plants.

Think about what that means. When you’re selling milk to your own cooperative that also owns the processing plants, who’s really benefiting when margins get tight? Industry data shows that when milk prices crashed 30-40% in 2023, processors with integrated operations captured margin expansion while producers absorbed the losses. It’s something worth considering when you’re evaluating your marketing options.

“You’re not their partner; you’re their raw material supplier.”

The Department of Justice had concerns as well. When DFA bought Dean Foods’ assets for $433 million in 2020, they had to agree to strict conditions to prevent market manipulation. That tells you something about the concentration of power we’re dealing with here.

Land O’Lakes rounds out the domestic powerhouses with $16.8 billion in 2023 revenue, though they’ve been navigating tough waters lately. Despite the challenges, they maintain a 23.2% market share in US dairy product production and continue expanding their Tulare, California, facility. You’ve probably noticed their increased focus on value-added products—that’s not accidental.

Foreign Money, American Milk: The International Takeover

What’s fascinating—and maybe a bit concerning—is how foreign companies are carving up the American dairy market. Nestlé North America pulls in around $6.5-7.5 billion, though that includes infant nutrition and coffee creamers alongside traditional dairy. Their global dairy segment has been flat for three years running at about billion. Danone North America generates $5.5-6.5 billion, pretty much dominating the yogurt space while pushing hard into plant-based alternatives.

And then there’s Saputo, the Canadian giant. They posted $13.9 billion in 2024 with an impressive 8.4% growth rate—the highest among the top players, actually. They’re operating 29 US plants and have been particularly aggressive in cheese production and fluid milk processing. Their success shows what focused expansion with strong financial backing can accomplish.

You know what’s interesting about these international players? They often bring different approaches to their relationships with farmers. Many producers in the upper Midwest have mentioned that some of these companies maintain more consistent field presence than we’ve seen from domestic processors in recent years. Whether that translates to better prices… well, that’s another conversation.

The Silent Empire: Why Leprino Controls Your Pizza

Here’s something that might surprise you: America produced a record 14.25 billion pounds of cheese in 2024, with Wisconsin alone cranking out 3.75 billion pounds—that’s 26.3% of the nation’s total. But the real story is who controls that production.

Now, Leprino Foods—they’re the ones you might not hear much about, but they’re actually the world’s largest mozzarella producer with about $3.6 billion in revenue. They control roughly 85% of the US pizza cheese market. Think about that next time you’re eating pizza… pretty much any pizza. Meanwhile, Schreiber Foods, with $7 billion in revenue, is another major player in the cheese game, though they’re more diversified across different cheese types.

Together with Sargento, these companies hold about 30% of the shredded cheese market. Wisconsin might make the cheese, but increasingly, a handful of companies decide its fate.

What’s particularly telling—and this is something many of us have been watching—is that while overall cheese production hit records, output actually fell in three of the top six cheese-producing states last year. Pennsylvania’s production plummeted 11% to 463.5 million pounds, and Iowa dropped 2% to 387.7 million pounds. Here’s what’s happening: processors are consolidating production in states with the largest, most efficient operations. California, which produces about 20% of the nation’s milk, keeps gaining market share while smaller dairy states lose processing capacity. The cheese plants follow the milk, and the milk increasingly comes from fewer, larger farms. It’s geographic consolidation on top of farm consolidation.

Export Boom or Bust: Where Your Milk Really Flies

Let’s talk about the export boom, because this is genuinely exciting for producers near the right facilities. The US hit $8.2 billion in dairy exports in 2024—that’s the second-highest total ever, only behind 2022’s $9.7 billion. Mexico has become America’s dairy lifeline, purchasing $2.47 billion worth—that’s 29% of all our dairy exports. They’re buying 919 million pounds of nonfat dry milk and skim milk powder, plus 352 million pounds of cheese.

But—and there’s always a but, isn’t there?—the processors investing in export-capable facilities are banking on milk from specific types of farms. That $11 billion in planned dairy manufacturing expansions through 2028 isn’t being built for 24,000 small dairies. These facilities need consistent, large-volume supply chains. The new large-scale powder plants being built across the Midwest and West are increasingly working with limited numbers of high-volume suppliers to ensure consistency.

The Brutal Math: 24,000 Farms and Falling

BY THE NUMBERS:

- 15,000 farms lost in 5 years

- 834 farms control 66% of revenue

- $11 billion in new facilities, excluding small farms

- 1,400-1,600 farms are disappearing annually

The 2022 Census of Agriculture laid it bare: America had 24,082 dairy farms, down from 39,303 just five years earlier. We’re losing farms at a breathtaking pace.

But what’s really reshaping the industry—and you probably see this in your own community—is where the milk comes from. Today, 65% of America’s dairy herd lives on farms with 1,000 or more cows. The 834 largest dairies, those with 2,500-plus head, control 66% of US milk sales by value. Meanwhile, 80% of dairy operations have fewer than 500 cows but produce less than 25% of the nation’s milk.

Think about what that means for processor relationships. If you’re running 150 cows in Pennsylvania, you’re competing for processor attention against operations running 5,000 head in New Mexico or Idaho. The processors are making what they see as rational business decisions—it’s more efficient to work with fewer, larger suppliers. But that efficiency comes at the cost of market access for smaller producers.

The $11 Billion Bet Against Small Farms

According to the International Dairy Foods Association, we’re seeing the biggest ag investment surge in US history—$11 billion flowing into 53 new or expanded dairy manufacturing facilities across 19 states between 2025 and 2028. That’s not just expansion; that’s transformation.

These aren’t small cheese plants or local bottling operations. We’re talking about massive facilities designed for export markets, specialized ingredients, and value-added products. They need a consistent, year-round milk supply in volumes that would have seemed impossible a generation ago.

The companies making these investments—DFA, Saputo, Land O’Lakes, and the foreign multinationals—they’re not betting on the current farm structure. They’re betting on continued consolidation. They’re pre-securing milk supply through exclusive contracts with mega-dairies because they know smaller operations will struggle to meet their volume and consistency requirements.

“Solo farms are dead farms.”

| Metric | Small Farms (<200 cows) | Mega-Dairies (2,000+ cows) | Advantage |

|---|---|---|---|

| Cost per cwt | $42.70 | $19.14 | Mega: -$23.56 |

| Annual cost/cow | $8,540 | $3,828 | Mega: -$4,712 |

| Processor relationships | Competing for attention | Direct contracts/premiums | Mega: Priority |

| Export facility access | Minimal | Direct supply agreements | Mega: Locked in |

| Component premiums | $0-2/cwt | $2-4/cwt | Mega: +$2 |

| Survival rate 2017-2022 | -42% | +17% | Mega: Growing |

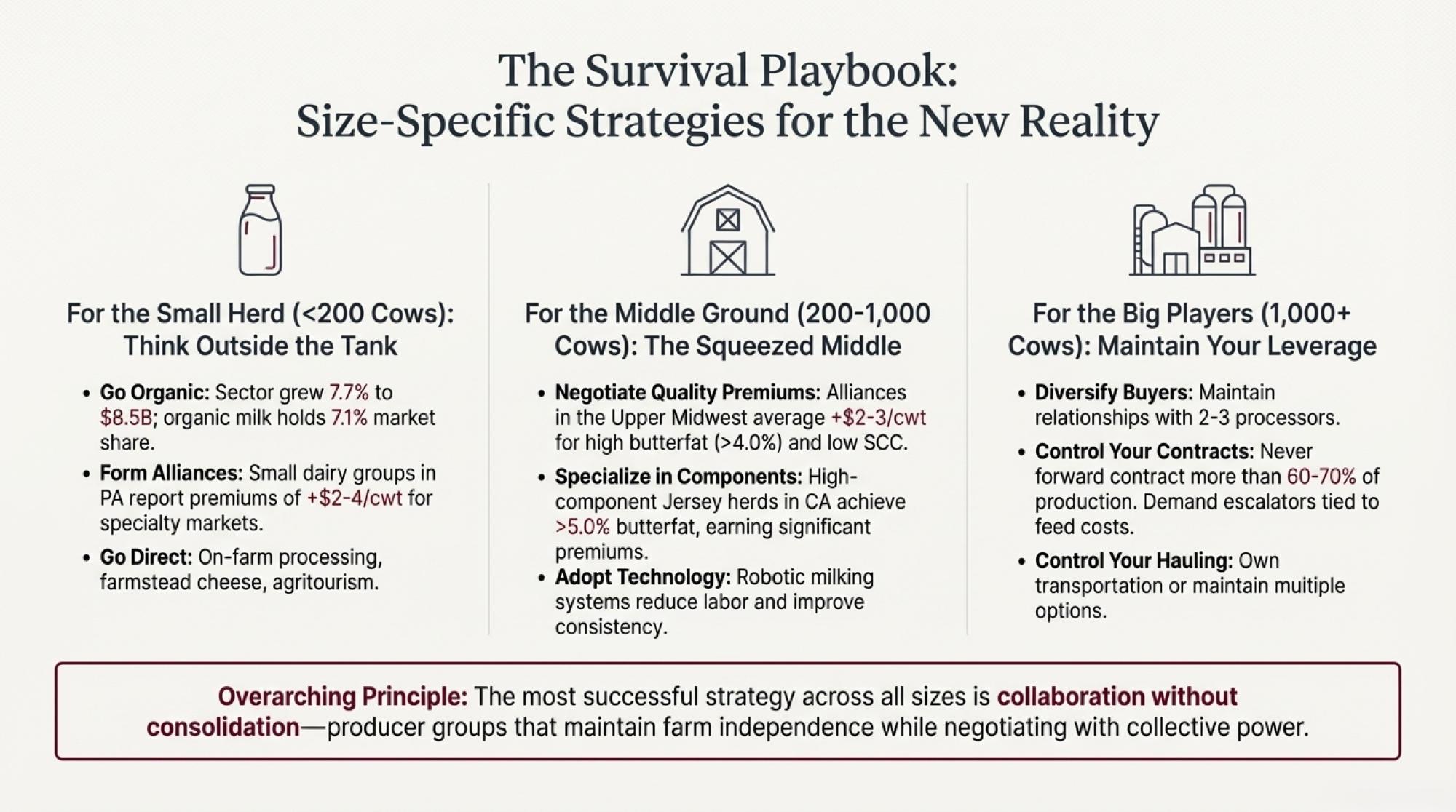

Your Survival Playbook: Size-Specific Strategies That Work

Despite everything, there are reasons for optimism—if you know where to look and how to adapt.

For the Small Herd (<200 Cows): Think Outside the Tank

- Go Organic: The organic dairy sector grew 7.7% to $8.5 billion in 2024, with organic whole milk sales up 13.2%. Organic fluid milk now holds 7.1% market share, up from just 3.3% in 2010.

- Form Strategic Alliances: Regional cooperative marketing efforts have shown promising results, with small dairy groups in Pennsylvania and other states reporting premiums of $2-4/cwt when supplying specialty markets.

- Direct Marketing: On-farm processing, farmstead cheese, agritourism.

- Specialty Production: A2A2 milk, grass-fed certification, local brand development.

For the Middle Ground (200-1,000 Cows): The Tough Spot

- Quality Premiums: Producer quality alliances in the Upper Midwest have successfully negotiated component premiums averaging $2-3/cwt by guaranteeing consistent butterfat above 4.0% and low somatic cell counts.

- Component Specialization: High-component Jersey operations in California consistently achieve butterfat levels above 5.0% and protein above 3.7%, earning substantial component premiums.

- Technology Adoption: Robotic milking systems can significantly reduce labor requirements while improving the milking consistency that processors demand.

- Producer Alliances: Pool milk with similar-sized operations to negotiate directly with processors.

For the Big Players (1,000+ Cows): Maintain Your Leverage

- Contract Flexibility: Never forward contract more than 60-70% of production.

- Transportation Control: Own your hauling or maintain multiple options.

- Price Protection: Demand escalators tied to feed costs in long-term contracts.

- Market Diversification: Don’t depend on a single processor—maintain relationships with 2-3 buyers.

- Component Focus: Invest in genetics and nutrition to maximize component premiums.

What seems to work best across all sizes? Collaboration without consolidation. Producer groups that maintain independence while negotiating collectively are seeing success in various regions. They’re still independent farms, but they’re learning to work together when it makes sense.

Five Questions That Could Save Your Farm

Looking at all this market concentration, here are the critical questions you should be asking:

- What percentage of your milk goes to export markets versus domestic?

- How does your pay price compare to farms of similar size in neighboring states?

- What quality premiums are available, and what’s required to earn them?

- Are there volume commitments that could lock you into unfavorable terms?

- What happens to your market if this processor closes or consolidates facilities?

The Bottom Line

The American dairy industry is being reshaped by forces beyond any individual farm’s control. The players are getting bigger—Lactalis will likely crack $35 billion globally within two years. The processors are getting pickier—they want consistent, large-volume suppliers. The exports are getting more critical—without Mexico and Canada, we’d be drowning in surplus.

Your challenge isn’t just producing quality milk anymore. It’s navigating a market where your cooperative might be competing for the same margins you need, where foreign companies control major segments, where 66% of value comes from 2,000 farms while 22,000 others fight for the remainder.

Knowledge really is power in this environment. Know who you’re selling to. Understand their global strategy. Recognize that the $111-120 billion American dairy industry looks impressive from 30,000 feet, but at ground level, it’s increasingly controlled by fewer hands making bigger bets on a future that might not include every farm—unless farms adapt to their reality or create their own path.

The dairy industry’s future is being written right now in boardrooms from Paris to Kansas City. Make sure you understand the script, because whether you’re milking 50 cows or 5,000, these companies aren’t just buying your milk—they’re determining whether your next generation will have a market at all.

Key Takeaways

- Your Real Competition: It’s not other farmers—it’s your own co-op. DFA owns 44 processing plants, controls 30% of US milk, and profits when farm milk prices crash.

- The 66% Rule: Just 834 mega-dairies now control 66% of all US milk revenue ($73 billion), while 23,000 smaller farms split the remaining $38 billion. Every processor’s future plans assume you won’t exist.

- The Foreign Takeover No One’s Discussing: Lactalis (French, $31.9B), Saputo (Canadian, $13.9B), and Nestlé (Swiss, $6.5B) control more American dairy than you think—and they’re buying more every year.

- Your Three Survival Paths: (1) Scale to 1,000+ cows for processor attention, (2) Capture premiums via organic/specialty markets (+$4-8/cwt), or (3) Form producer alliances to negotiate collectively.

- The 2028 Deadline: $11 billion in new processing capacity comes online by 2028, designed for mega-farms only. If you haven’t adapted by then, you won’t have a market.

Executive Summary:

Your milk check is now controlled by eight companies—three of them foreign—who’ve captured a $111 billion industry while 15,000 American dairy farms vanished in five years. The betrayal runs deep: DFA, your ‘farmer-owned’ cooperative, owns 44 processing plants and pocketed profits as milk prices crashed by 40%, while members lost billions. Today’s reality: 834 mega-farms control 66% of all US milk revenue while 23,000 smaller farms compete for the remaining third. With processors pouring $11 billion into facilities designed exclusively for 1,000+ cow operations, the message is unmistakable. This isn’t market evolution—it’s deliberate elimination of family dairy farms.

Editor’s Note: Market data cited reflects 2024 financial reports and USDA statistics through November 2025. Company revenues include total sales, not exclusively dairy operations. Regional variations apply.

Learn More:

- Shutdown Reality: Why Every Dairy Farmer Faces a $60,000 Decision in the Next 90 Days – Reveals the mathematical cost of indecision ($20k/month equity burn) and details three immediate execution paths—Scale, Premium, or Exit—to preserve remaining farm capital before options vanish.

- The $11 Billion Reality Check: Why Dairy Processors Are Banking on Fewer, Bigger Farms – Exposes the specific economic modeling processors use to justify expansion while farm margins tighten, explaining why 70-80% of future supply is being pre-secured specifically from mega-dairies.

- The Robot Truth: 86% Satisfaction, 28% Profitability – Who’s Really Winning? – Delivers a critical ROI analysis of robotic milking, uncovering the dangerous “profitability gap” for 60-120 cow herds and identifying exactly which operational metrics drive actual financial returns versus just saving labor.