Your dairy’s 38.8% turnover rate is costing 1.8% milk yield while robots deliver 60% labor savings—time to automate or evacuate.

EXECUTIVE SUMMARY: Stop treating your 38.8% annual labor turnover as “normal” when it’s literally killing your milk production and profitability. Research confirms that high employee turnover triggers a devastating 1.8% decrease in milk production, 1.7% increase in calf loss, and 1.6% spike in cow death rates—yet most dairies still view workforce instability as an unavoidable cost of doing business. With immigrant workers comprising 51% of the dairy workforce and producing 79% of U.S. milk, policy uncertainty threatens a potential 90% milk price spike if enforcement disrupts operations. Smart operators are responding with strategic automation: the global milking robot market expanded from $2.98 billion to $3.39 billion in 2025 alone, delivering labor time reductions from 5.2 to 2 hours daily while maintaining 24,185 pounds of milk per cow annually. While geographic winners like Kansas (+11.4% production) and Texas (+10.6%) capitalize on favorable labor economics, traditional dairy states face a competitive disadvantage from wage differentials reaching $5.14 per hour between regions. The future belongs to operations that master both workforce retention strategies and automation adoption, because waiting for Washington to solve your labor crisis isn’t a business plan, it’s a bankruptcy strategy.

KEY TAKEAWAYS

- Labor Turnover is Production Poison: Every percentage point of turnover above optimal levels costs operations measurable losses in milk yield (1.8% decrease), calf survival (1.7% increase in losses), and cow mortality (1.6% increase)—making workforce stability a biological imperative, not just an operational preference.

- Automation ROI Accelerating: Robotic milking systems reduce daily management time from 5.2 to 2 hours while the global market growth of 14% annually signals crisis-driven adoption—early implementers report labor cost reductions of 15-20% with breakeven periods shrinking to 5-7 years.

- Geographic Arbitrage Opportunity: Regional production shifts reflect labor cost advantages, with Plains states (Kansas +11.4%, Texas +10.6%) crushing traditional dairy regions through strategic positioning—operations in high-wage states must achieve 24,000+ pounds per cow annually or face competitive obsolescence.

- Policy Uncertainty Demands Self-Reliance: Trump’s undefined “temporary pass” program creates strategic paralysis when 51% immigrant workforce produces 79% of U.S. milk; profitable operations are building workforce strategies that withstand political volatility rather than banking on government solutions.

- Component Quality Premium Capture: With a 2025 milk production forecast at 227.3 billion pounds and butterfat emphasis reaching 31.8% in breeding indexes, operations optimizing components while reducing labor dependency through automation position for maximum profitability in volatile markets.

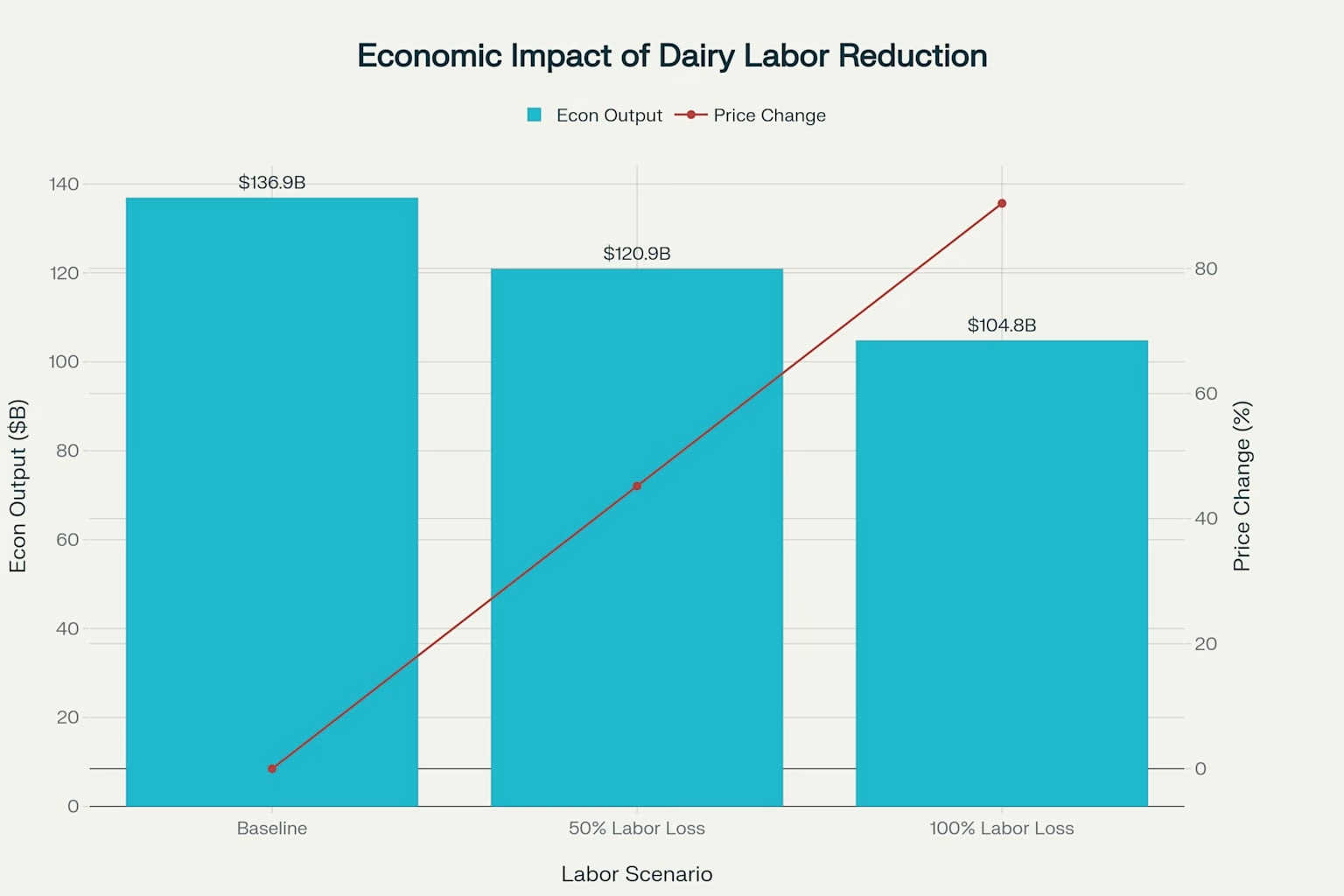

Let’s cut through the noise: Your dairy operation is sitting on a labor time bomb, and President Trump’s proposed “temporary pass” program just lit the fuse. A new comprehensive analysis reveals that the U.S. dairy industry faces a structural labor crisis so severe that policy disruptions could trigger a 90% spike in milk prices and force the closure of over 7,000 dairy farms. But here’s what the industry doesn’t want you to know: this isn’t just another policy debate. This is about survival.

The brutal reality? Your operation’s future depends on workers you likely can’t legally employ, and the proposed solution might make things worse, not better. With the national dairy herd reaching 9.43 million head in April 2025, up 89,000 from April 2024, and milk production in the 24 major states totaling 19.1 billion pounds in May 2025, up 1.7% year-over-year, we’re producing more milk than ever while standing on the shakiest workforce foundation in decades.

Production Metrics Under Pressure: When Record Yields Meet Labor Quicksand

Here’s the uncomfortable truth your industry associations won’t tell you: We’re celebrating record productivity while our workforce foundation crumbles beneath us. Milk production per cow averaged 24,117 pounds annually in 2023, up 29% from 2003, with production per cow forecast at 24,155 pounds for 2025. Texas led regional growth with milk production surging 10.6%, while Kansas posted an 11.4% increase and South Dakota expanded 9.2%.

But ask yourself this: What good are these record yields when you can’t find workers to harvest them?

The dependency numbers are staggering. Immigrant workers comprise 51% of the entire U.S. dairy workforce, and farms employing immigrant labor account for 79% of the nation’s milk supply. Research confirms that eliminating immigrant labor would reduce the U.S. dairy herd by 2.1 million cows and milk production by almost 50 billion pounds, resulting in a 7,000 decrease in the number of dairy farms.

What This Means for Your Operation: If you’re achieving below 24,000 pounds per cow annually, you’re doubly vulnerable. You lack both the efficiency margins to absorb wage pressures AND the workforce stability to maintain consistent output. Your survival depends on fixing at least one of these problems, fast.

The Turnover Time Bomb: Why Your Labor Costs Are Killing Your Margins

Here’s a statistic that should keep you awake at night: The average turnover rate for surveyed dairies was 38.8%. While this is lower than the national private sector average of 47.1%, it’s still devastating when considering that high employee turnover has been linked to a 1.8% decrease in milk production, a 1.7% increase in calf loss, and a 1.6% increase in cow mortality rates.

Do the math on what turnover is actually costing you. Labor contributes up to 10-15% of the cost to produce milk, making it the second largest expense on your dairy. Every percentage point of turnover costs money you probably can’t afford. Some progressive organizations have reduced turnover from 7% to less than 1% through strategic employee housing programs, demonstrating that effective workforce management delivers measurable returns.

Are you treating labor like a cost center or recognizing it as your most critical investment? Research from multiple dairies shows that stockmanship training alone can increase milk production by 810 kg (1,782 pounds) per lactation. Yet most farms still view training as an expense rather than a profit driver.

What This Means for Your Operation: Stop viewing high turnover as “normal” in dairy. Operations achieving turnover rates below 10% through strategic investments in housing, training, and workforce development are capturing significant competitive advantages while you’re bleeding money on recruitment and retraining.

Regional Production Shifts: The Great Dairy Migration Is Real

While you’ve been debating policy, smart money has been voting with its hooves. The numbers don’t lie about which regions are winning and losing this labor war.

States in the Plains and South are crushing traditional dairy regions. Kansas posted a remarkable 11.4% increase in milk production, while Texas grew 10.6% and South Dakota expanded 9.2%. In contrast, California production contracted 1.8%, and Wisconsin, often referred to as America’s Dairyland, managed only 0.1% growth.

Why is this happening? Labor economics, plain and simple. New York’s AEWR increased to $18.83 per hour, up $1.03 from 2024, while Michigan, Wisconsin, and Minnesota saw rates decline to $18.15, down 35 cents per hour. California maintains one of the highest rates at $19.97 per hour, creating massive competitive disadvantages.

The uncomfortable question nobody’s asking: If labor costs are driving production away from traditional dairy states, what happens when immigration enforcement intensifies? Are you positioned in a winning region, or are you clinging to a sinking ship?

What This Means for Your Operation: Geography is destiny in the new dairy economy. Operations in high-wage states must either achieve significantly higher productivity per worker or accelerate the adoption of automation. There’s no middle ground.

Technology Integration: Why Robots Are Your New Best Employees

Here’s the reality check the equipment dealers won’t give you: Automation isn’t a luxury upgrade anymore, it’s a survival tool. The global milking robot market is experiencing significant growth, projected to increase from $2.98 billion in 2024 to $3.39 billion in 2025, with an annual growth rate of 14.0%.

But are you moving fast enough? Survey data reveals that two-thirds of dairies now use at least one form of feeding technology, with health monitoring collars and ear tags being the most common. Robotic milking systems adoption has been growing at about 25 percent a year and has particularly “taken off” during the past decade.

The economics are compelling: Each robotic milker can handle 60 cows and costs roughly $200,000, but what’s the cost of losing your entire workforce overnight to an ICE raid? Labor savings alone from robotic systems range from 10% to 29%, with time spent on milking management dropping from 5.2 to 2 hours per day on average.

What’s your excuse for not installing robots? Cost? Research shows that 77% of farms using robotic milking indicated labor time savings as a reason for adoption. The lowest-cost milking parlor systems equate to $0.25 to $1 per hundredweight in milking costs, compared to $2 to $3 per hundredweight with robots; however, robots deliver predictability when labor becomes unreliable.

What This Means for Your Operation: Time spent debating automation ROI is time your competitors are using to install systems. Early automation adopters are reporting significant competitive advantages, with some farms achieving breakeven in 5 to 7 years through optimized management.

Economic Impact: The $53.5 Billion Reality Check

Let’s talk numbers that matter to your bottom line. The March 2025 all-milk price averaged $22.00 per cwt, up $1.30 year-over-year. The 2025 all-milk price forecast has been revised upward to $22.75 per cwt, but these prices assume workforce stability that doesn’t exist.

Labor dependency creates massive economic vulnerability. The USDA’s 2025 forecast anticipates a 3.6% increase in agricultural labor costs, reaching a record $53.5 billion. Estimates suggest that nearly half of the agricultural workforce lacks legal authorization, making entire regions vulnerable to immigration enforcement.

The math is brutal: The average turnover rate for U.S. dairies is 38.8%, resulting in farms incurring thousands of dollars in recruitment and training costs. About 90% of dairy workers in the western U.S. are foreign-born, with about 85% of the total coming from Mexico, creating a single point of failure for most operations.

Are you prepared for labor costs that continue to rise? Labor expenses were up 7.3% compared to 2020 across all farms, with dairy ranking second highest in impact after specialty crops.

What This Means for Your Operation: Every percentage point of turnover costs money you probably can’t afford. Labor instability isn’t just an operational headache, it’s a profit killer that’s getting worse, not better.

Policy Uncertainty: Trump’s “Temporary Pass” Creates Strategic Paralysis

Here’s what President Trump’s farmworker permit proposal really means for your operation: Nothing. And everything. The proposal would allow experienced immigrant workers to remain on farms legally and pay taxes; however, critical details regarding application procedures, eligibility criteria, and the implementation timeline remain undefined.

Trump told Fox News: “We’re working on it right now. We’re going to work it so that some kind of a temporary pass, where people pay taxes, where the farmer can have a little control as opposed to you walk in and take everybody away”. The program would target workers who have been on farms for “15 and 20 years” and who “possibly came in incorrectly”.

But here’s the problem: How do you make investment decisions when your workforce’s legal status depends on a policy that exists only in sound bites? Should you build H-2A compliant housing or invest in robotic milking systems? The uncertainty itself has become a massive cost.

Why isn’t the industry demanding concrete details? The National Milk Producers Federation has lobbied for years to improve dairy industry access to the H-2A program, which remains limited to seasonal work and excludes year-round dairy operations. This “temporary pass” could be their breakthrough, or another false promise.

What This Means for Your Operation: Stop waiting for Washington to solve your labor problems. Make decisions based on what you can control, not on political promises that may never materialize.

Expert Analysis: No Single Solution to Structural Crisis

Let’s be honest about what the experts are really saying. Labor shortages and rising costs aren’t temporary challenges; they’re the new normal. The pool of workers from traditional immigrant source countries is anticipated to shrink due to declining birth rates and improving economic opportunities in those countries.

The demographic cliff is real: The average age of foreign-born farmworkers has increased significantly (from 36 to 42 years for U.S.-born farm employees), creating a workforce that’s aging out with no replacement pipeline. Domestic labor retention remains a challenge, with historical data indicating that only 0.1% of Americans stay for full agricultural seasons.

Research confirms what you already know: Employee turnover has been linked to a 1.8% decrease in milk production, a 1.7% increase in calf loss, and a 1.6% increase in cow death rates. Your labor instability is literally killing your livestock’s profitability.

What This Means for Your Operation: High turnover isn’t just expensive, it’s deadly to animal performance. Investing in workforce stability yields biological dividends that are reflected in every milk check.

The Latest: Crisis Demands Immediate Strategic Response

Here’s what the research confirms that your industry doesn’t want to admit: No single policy solution will resolve the dairy labor crisis. Trump’s “temporary pass” proposal represents more political theater than coherent policy, creating additional uncertainty rather than providing operational relief.

The brutal facts for dairy operators:

- Labor disruptions threaten record productivity gains achieved through genetic advancement and management improvements

- Current wage volatility makes long-term planning nearly impossible without comprehensive risk management strategies

- Strategic investment in both human capital and automation technology has become essential for operational survival

But here’s the opportunity hidden in the crisis: Early automation adopters are reporting significant competitive advantages, with some farms achieving breakeven in 5-7 years through optimized management. Feeding automation alone can save around 112 minutes per day on a 120-cow farm compared to traditional methods.

Are you building for the future or clinging to the past? The USDA is allocating up to $7.7 billion for climate-smart practices and conservation efforts on farms in 2025, providing accessible funding for dairy producers to invest in both workforce development and automation.

What This Means for Your Operation: The future belongs to farms that stop complaining about the labor crisis and start solving it. Develop dual-track strategies that combine competitive employment practices with accelerated technology adoption. The dairy operations dominating by 2030 won’t be those who solved the labor shortage; they’ll be the ones who made it irrelevant.

As immigration policy debates rage on, ask yourself this critical question: Is your operation building workforce strategies that can withstand political volatility while positioning for long-term competitiveness? In an increasingly automated global market, where milk production is forecasted to reach 227.3 billion pounds by 2025, productivity and efficiency determine who survives and who becomes a cautionary tale.

The choice is yours. But the clock is ticking.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Real Cost of Cheap Labor: Why Progressive Dairy Farms Are Investing in People – Reveals practical strategies for slashing turnover from 7% to less than 1% through strategic employee housing and benefits packages that create competitive advantages beyond wage increases alone.

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – Demonstrates how component optimization and strategic processor relationships deliver measurable profit increases while Federal Milk Marketing Order reforms reward progressive operations over volume-focused competitors.

- Why Dairy’s $48 Billion Labor Crisis Exposes Our Innovation Failure – Exposes how robotic milking systems deliver 18-24 month payback periods during labor uncertainty, eliminating workforce dependency while boosting yields 8-12% through crisis-driven automation adoption.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!