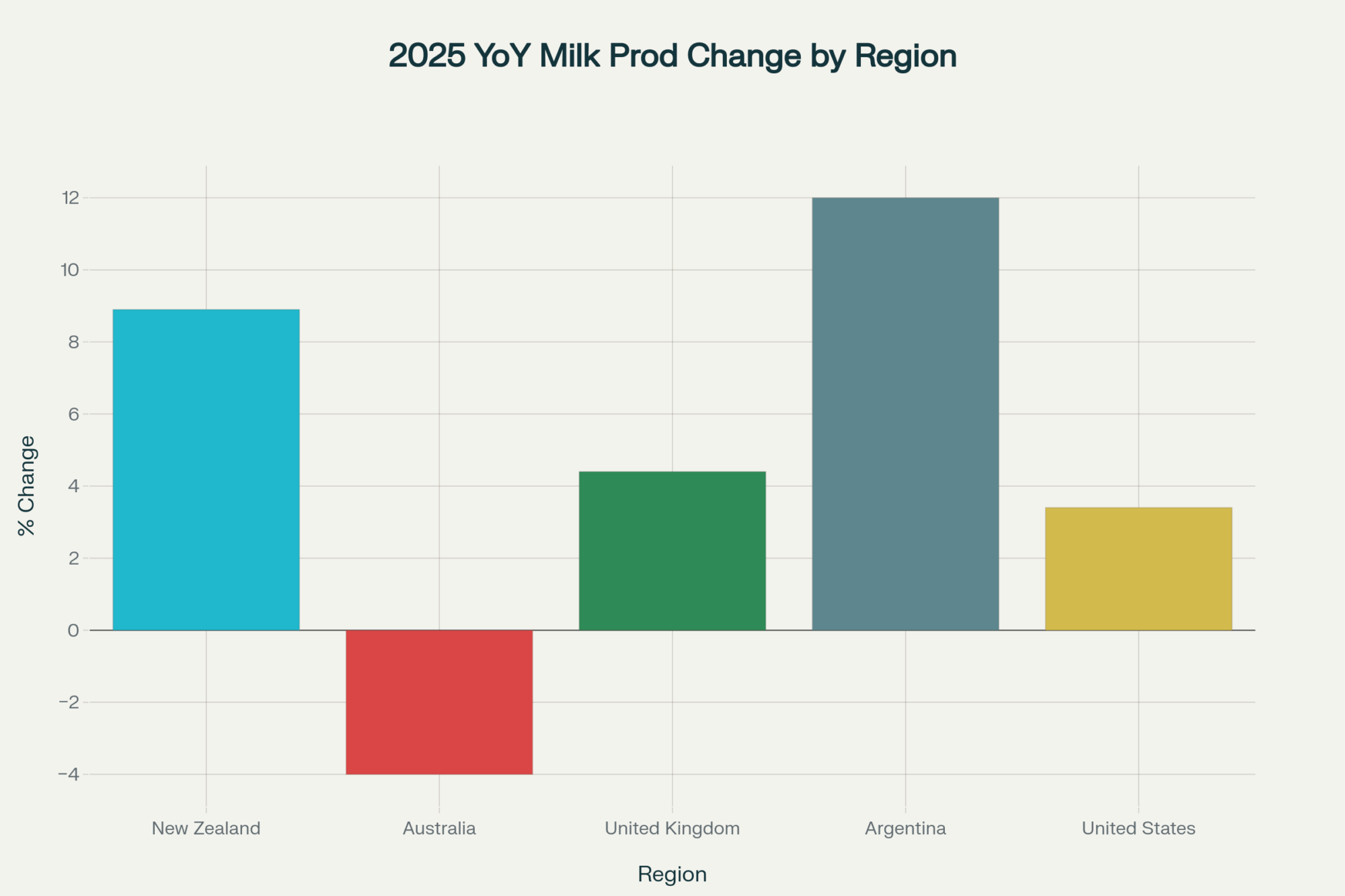

New Zealand’s crushing it with 8.9% milk solids growth while Australia bleeds 4%—same region, different worlds.

Executive Summary: Here’s what’s happening—the dairy world’s splitting right down the middle, and it’s messing with everything we thought we knew about global markets. New Zealand farms are banking serious cash with an 8.9% milk solids surge and farmgate prices dancing between NZ$7.25-$8.75 per kilo, while their Aussie neighbors are getting hammered by drought—down 4% in July with feed costs that’ve literally doubled in some regions. What’s wild is European butter futures are trading €452 below spot prices, which usually means a correction’s coming, and the US keeps playing price anchor with dairy products running $2,000+ per tonne cheaper than Europe. The bottom line? Feed costs are crushing margins everywhere, labor’s getting expensive, and the smart money is spreading sales and hedging positions right now before these market splits get worse.

Key Takeaways:

- Lock in your milk solids advantage—New Zealand’s 8.9% jump shows how seasonal tracking can boost cash per liter when you time it right

- Beat the butter price drop—stagger your fat purchases over 60-90 days since European futures are screaming “correction coming”

- Survive the feed cost explosion—Australian operators facing doubled hay costs need alternative feed strategies and tighter budgeting now

- Watch tomorrow’s GDT auction like a hawk—21,145 tonnes of powder hitting the market will tell you where prices are headed

- Find your niche before the US flood hits—with American exports running $2,000/tonne under Europe, you need value-add products to stay competitive

The thing about markets right now—it feels like the dairy world’s split in two. Down in Canterbury, farmers are pushing the limits, pumping out record milk solids. Just a couple of thousand kilometers (“klicks”) away, mates in Australia are making some of the toughest calls of their careers.

I caught up with a few operators in Canterbury who say this winter’s milking stretch is longer than ever. And why not? Fonterra’s latest report shows that milk solids in July jumped 2.2% from the same period last year, and the season-to-date increase is 8.9%. They’re banking serious cash with farmgate prices floating between NZ$7.25 and $8.75, even as feed supplies grow tight.

But hop across the ditch and it’s a different story entirely. Australia’s milk production in July dropped 4%, with Victoria down 5.1%, South Australia experiencing a 9.6% decline, and Tasmania not far behind at 6.1% lower. Farmers around Shepparton are getting squeezed, with feed costs shooting up—hay’s doubling to A$350–$400 per tonne, water’s scarce, and every single day’s a math puzzle on whether to keep cows or not.

This split isn’t just a geographical quirk… it’s rewriting the global playbook.

The Market’s Tale of Two Hemispheres

Last week, the European Energy Exchange saw over 3,000 tonnes of dairy futures change hands, with butter alone accounting for half of that volume, according to EEX trading data. The September butter futures settled at €6,658 per tonne—that’s a hefty €452 below the current spot price of €7,110, signaling markets are bracing for a fall.

For processors, that’s your cue. Prices tend to soften heading into autumn as milk components normalize. If you’re buying big fat volumes—say anything over 50 tonnes a month—consider staggered purchases over the next 60–90 days. Don’t bet on the dip being deeper.

Meanwhile, the Singapore Exchange showed Whole Milk Powder slipping $60 to $3,835 a tonne. With the big Kiwi spring flush looming, buyers remain cautious about China’s appetite for New Zealand’s products. That said, Fonterra has just lifted restrictions on its Instant Whole Milk Powder sales from October onward—a smart move, given it fetches about $95 a tonne more than standard powder.

America Holds the Line

Stateside, it’s full steam ahead. July production climbed 3.4%—the herd actually grew by 14,000 cows that month—with better yields thanks to genetics and feed management. StoneX data points to a 4.7% rise in component-adjusted milk solids.

The knock-on? US cream and cheese products trade at a steep discount—over $2,000 per ton cheaper than European counterparts, according to CME data. That pricing is driving exports and helping prop up US milk prices.

Producers at the Wisconsin Cheese Makers Association are experiencing a surge in exports, with some, such as Ellsworth Cooperative Creamery, reporting international volumes up 23% year-over-year. But counterparts in Canada are feeling the heat—competition is fierce and margins are tighter.

Europe’s Mixed Bag: Regulation, Weather, and Red-Hot Cheese Markets

UK dairy is holding pace—with volumes up 4.4%, butterfat at 4.15%, and protein climbing to 3.36%, per AHDB data.

However, the story is more complex on a continental scale. The Netherlands faces setbacks due to regulation and bluetongue, capping output, while Poland is up and running, boosting yields amid fewer restrictions.

Italy wasn’t spared summer’s wrath. Heat waves reduced production by 10–15%, resulting in approximately 1.8 million litres lost daily, as confirmed by ISTAT data.

Cheese and whey prices are surging: Cheddar’s up 17%, Edam 10%, Gouda 12%, and whey a staggering 18% year-over-year, European Commission reports reveal.

Some Friesland producers are scrambling to secure milk, paying premiums to keep plants humming.

What It Means for Your Milk Check

Butter’s in tight supply, pushing prices up, while protein is squeezed by global supply and discounting. Cheese producers are bidding fiercely to grab milk flows.

Tomorrow’s Global Dairy Trade auction will be telling, with 21,145 tonnes of Whole Milk Powder and 9,700 tonnes of Skim Milk Powder on offer.

Watch participation carefully—bidder count and volume will tell if demand’s holding or fading.

Play It Smart This September

If you’re buying fat, especially over 20 tonnes per month, start hedging now in tranches. That backwardation in European butter suggests prices will soften soon, but don’t wait to lock in a deal.

Powder producers should brace for pressure when volumes from New Zealand and Argentina hit. Focus on higher-margin streams.

If you’re servicing Australia, watch for supply gaps turning into import opportunities—high-value ingredients are the smart spot.

Beyond The Percentages: The Real Cost Behind Production

Victorian producers aren’t just losing volume; they’re getting hit by a surge in input costs, as documented by Dairy Australia:

- Quality Hay: A$350–$400 per tonne (up from A$180–$200)

- Water Allocation: Prices are 250% above 2024 levels

- Grain Supplements: Costs have risen 20–30% across most categories

Meanwhile, Kiwi operators report wage pressures of more than 15% as they stretch labor through extended milking seasons.

Weather’s Still a Wild Card

La Niña may prolong Aussie droughts, while early autumn chills might boost European butterfat and protein.

Stay Sharp, Stay Connected

Markets are messy and fractured. What works for your mate 10 klicks away might not fit your setup.

Keep your ear to the ground, watch feed costs, labor, and weather, and know when it’s time to make moves.

September will be the month to separate the clever from the late movers.

Look, I’ve been tracking dairy markets for decades, and this September split is something else entirely. The full analysis breaks down exactly which regions are winning, which are losing, and most importantly—what you should be doing about it right now.

Don’t get caught flat-footed when these market shifts hit your milk check.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- Tackling High Feed Costs: 5 Unconventional Strategies That Actually Work – This article provides immediate, practical tactics to combat the rising input costs mentioned in the market report. It details actionable methods for optimizing rations and sourcing alternative feeds to protect your margins when market volatility hits your bottom line.

- Genetics In A Volatile Market: Breeding For Resilience, Not Just Raw Production – Shift your focus from short-term market swings to long-term stability. This piece outlines a strategic breeding philosophy for creating a resilient, efficient herd that can maintain profitability even when feed costs are high and milk prices are unpredictable.

- Beyond The Robots: How AI Is Quietly Revolutionizing Dairy Herd Management – To gain an edge in the fractured market described above, you need better data. This article explores how top producers are using AI and predictive analytics to optimize health, reproduction, and component yields, future-proofing their operations against market uncertainty.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!