The protein cost explosion that’s reshaping how we think about profitability… and why smart producers are already positioning for what’s coming next

EXECUTIVE SUMMARY: Here’s what’s keeping me up at night, and it should worry you too… feed costs are absolutely crushing dairy margins in ways we haven’t seen since 2012, with soybean meal prices exploding to $285 per ton — that’s an extra $5,250 monthly for a typical 1,000-cow operation. The milk-to-feed ratio has dropped to a dangerous 1.80, which Penn State Extension calls “critical financial territory.”Meanwhile, our national herd keeps shrinking by 40,000 head while replacement heifers cost $2,500 each, and here’s the kicker — those Q4 futures sitting at $18.58 suggest better days ahead, but only if you can survive the squeeze. Global demand from Mexico and Southeast Asia is keeping NDM prices strong, but that won’t help if your feed bills are bleeding you dry. You need to stop thinking about this as a temporary blip and start treating it as the new reality — because the operations that get their risk management and feed efficiency dialed in now will be the ones still milking when prices recover.

KEY TAKEAWAYS

- Slash feed costs by 8-12% through precision ration management — we’re talking $10-15 savings per cow monthly when soybean meal hits these record highs, and every dollar counts with margins this tight

- Lock in your DRP coverage NOW for fall quarters — match your federal order’s class utilization instead of just hedging Class III, because that $1.57 spread between Class IV and III could leave you exposed if you’re not careful

- Focus genetic selection on feed conversion efficiency — Journal of Dairy Science research shows 5% improvements are realistic, meaning more milk from the same (expensive) feed inputs in today’s brutal cost environment

- Monitor that milk-to-feed ratio like your bank account depends on it — anything below 2.0 signals serious financial stress, and at 1.80 we’re already in dangerous territory across most U.S. herds

- Leverage the export strength while it lasts — Mexico buying 50%+ of our NDM exports is creating a price floor, so work with your processor to capture those premiums before trade winds shift

The thing about this summer’s dairy margins — they’re not just tight, they’re pinched in a way I haven’t seen since that brutal 2012 drought. And if you think I’m being dramatic, well… take a hard look at your feed bills lately.

What strikes me most about what we’re dealing with right now isn’t just another commodity cycle. This feels different. It’s like watching a fundamental reshaping of the cost structure that has even seasoned producers scratching their heads and recalculating everything they thought they knew about staying profitable.

While everyone’s been tracking Class III futures holding around $17.79/cwt, there’s been this massive shift happening in the feed markets that’s completely rewriting the playbook. The soybean meal complex? Man, it’s gone absolutely haywire — and it’s catching farms off-guard left and right.

When Feed Costs Start Calling the Shots

You know how we always talk about watching the corn market? Well, forget corn for a minute. What’s really crushing margins right now is what’s happening on the protein side of things, and it’s brutal.

According to recent work from Penn State Extension dairy economists, operations running feed costs above 60% of milk revenue are now in what they’re calling “critical financial territory.” That’s not just academic talk — I’m hearing from producers in Wisconsin who are seeing soybean meal bills jump from around $250/ton to $285.30/ton in what feels like overnight.

Do the math on a typical 1,000-cow operation running through 15 tons weekly — that’s an extra $5,250 hitting your monthly expenses. And that’s before we even discuss all the other protein sources that are being pulled up with it. (This is becoming more common than anyone wants to admit.)

Here’s the thing, though… this isn’t just commodity volatility we can wait out. What we’re dealing with is structural pressure from renewable diesel, which is crushing, that’s putting sustained upward pressure on the bean complex. The latest USDA outlook projects a record-high soybean crush for the 2025/26 marketing year, driven by soaring demand for soybean oil in biofuels. When crushers are running flat out for biofuel demand, guess who gets stuck with the meal price consequences?

This development is fascinating from a market structure perspective, but terrifying when you’re trying to balance rations and keep cows happy.

Why the Futures Are Telling a Different Story

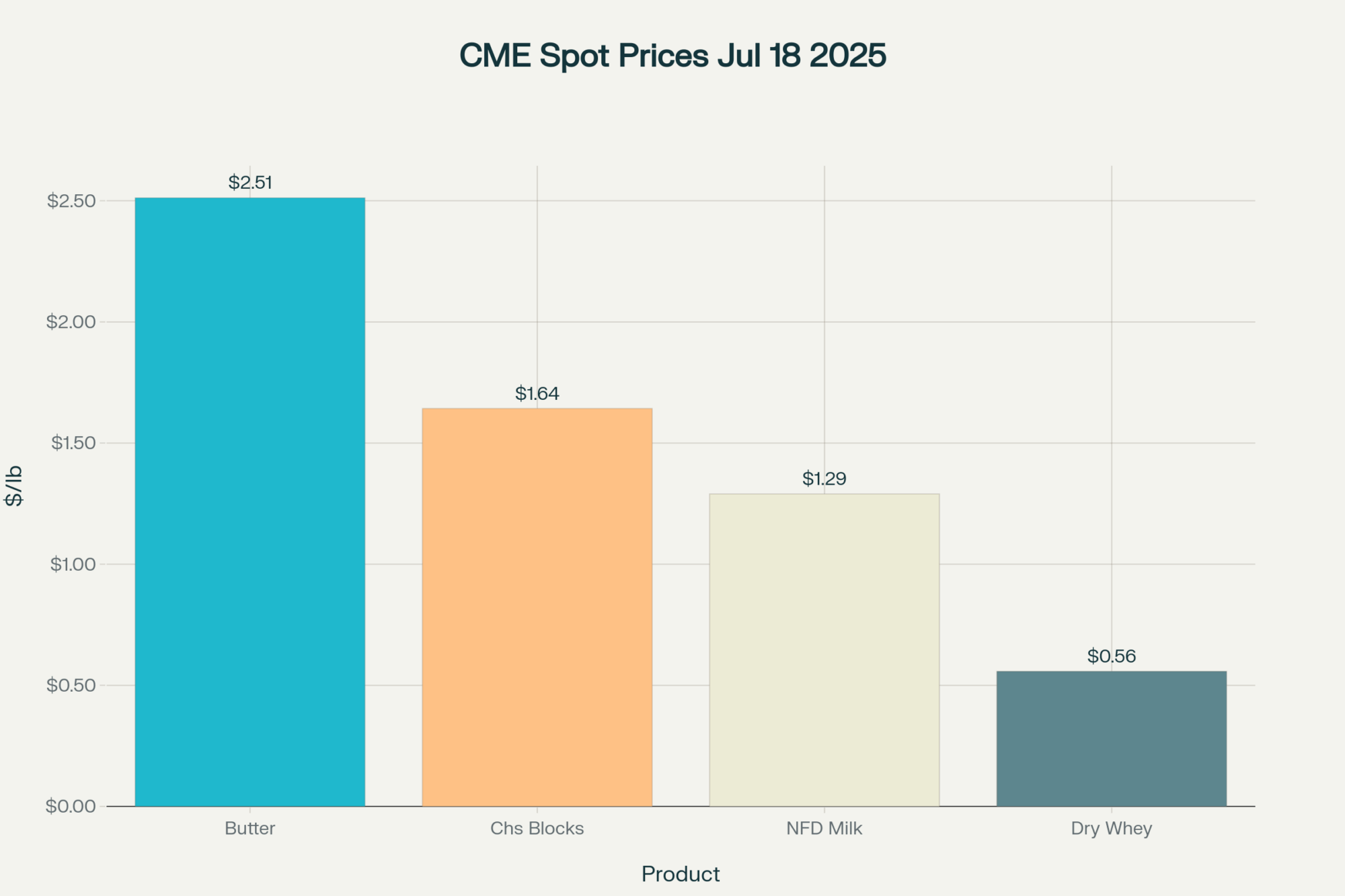

What’s particularly noteworthy about the current market structure is how disconnected cash and futures have become. CME data shows fourth-quarter Class III futures sitting around $18.58 – that’s a pretty healthy premium over where we are today.

But here’s where it gets interesting… that contango structure isn’t random market noise. It’s the collective wisdom of traders who see something coming that a lot of producers might be missing. They’re looking at two things that should have every dairy operator paying attention.

First, there’s this wave of new processing capacity coming online through late 2025 and into 2026. I’m talking major cheese and fluid plants in New York, Texas… facilities that represent permanent — or let’s say, ‘multi-decade’ — increases in milk demand. These aren’t temporary pop-up operations. They’ll need milk, lots of it, for years ahead.

Second — and this is where the supply math gets really interesting — our national herd is actually contracting. The latest USDA data puts us at 9.325 million head, down 40,000 from last year. Even with beef prices at current levels, producers aren’t expanding. Why? Because replacement heifers are commanding $2,500 a head[1], and margins are getting squeezed from both ends.

Think about that dynamic for a minute. New processing demand meeting constrained supply growth? That’s the recipe for processors bidding aggressively for available milk. What’s your operation going to look like when that competition heats up?

The Regional Reality Nobody Wants to Talk About

Now, here’s where things get really nuanced — and this varies dramatically depending on where you’re milking. If you’re in the Upper Midwest, where Class III utilization runs heavy, you’re dealing with one set of margin pressures. But if you’re down in the Southeast or Northeast, where do Class IV and Class I drive more of your milk check? Completely different ballgame.

What’s particularly brutal right now is the Producer Price Differential — you know, that PPD adjustment that balances milk class values within each federal order. With Class IV trading at a $1.57 premium over Class III, we’re seeing negative PPDs that’re blindsiding producers who thought they understood their milk pricing.

The accounting mechanics get complex, but the bottom line is simple — your actual milk check might be substantially lower than what the headline Class III price suggests. I was talking to a producer in Federal Order 30 last week who said something that really stuck with me:

“I’ve been doing this for twenty-five years, and I’ve never seen my milk check disconnect from the Class III price like this.”

That’s the PPD effect in action, and it’s not going away anytime soon. Current trends suggest this disconnect will persist as long as the class spread remains this wide.

Are you factoring this into your planning? Because a lot of operations aren’t.

Your Strategic Response Window — And Why It’s Narrowing

Here’s what really concerns me about the current situation. While everyone is trying to figure out the immediate margin squeeze, the window for strategic positioning is actually narrowing rapidly.

Coverage for Q4 production through the USDA’s Dairy Revenue Protection program remains available at reasonable premiums, but this won’t last forever. What’s your coverage strategy looking like right now? Are you even thinking about it?

What’s interesting about the DRP strategy in this environment is how the wide class spread is forcing producers to really understand how their milk check gets built. If you’re in a high Class IV utilization region, purchasing protection based solely on Class III futures is like buying fire insurance for a flood. You end up with a hedge mismatch that could cost you big time.

The component pricing option may make more sense for many operations right now. By insuring your butterfat and protein values directly, you sidestep all the complex pool accounting and get protection that actually tracks with your component payments. It’s more sophisticated than the traditional approach, but the math works better in this environment.

(Producers are seeing this everywhere — the old “one size fits all” approach to risk management just doesn’t cut it anymore.)

What Smart Operators Are Already Doing

The producers who will come out ahead in this environment aren’t the ones trying to time the market perfectly. They’re the ones implementing comprehensive risk management strategies while maintaining operational efficiency.

Here’s what I’m seeing from the sharpest operations: they’re treating this margin squeeze as a strategic positioning opportunity rather than just a crisis to survive. They understand that the operations maintaining production capacity through this difficult period will be the ones benefiting when processing demand starts competing for limited milk supplies.

Feed cost management is becoming increasingly critical. Some are locking in protein costs where possible, others are adjusting rations to optimize for the new cost structure. The key is understanding that this isn’t a temporary disruption — it’s a fundamental shift that requires strategic adaptation.

What’s fascinating to watch is how the operations that are thriving aren’t necessarily the biggest or the newest. They’re the ones who adapted their thinking first. They’re looking at butterfat numbers, optimizing protein efficiency, and treating their fresh cow management as a profit center rather than just another monthly expense.

The Export Story That’s Keeping Things Together

The key aspect of structural market changes is that they create both risks and opportunities. Yes, the current margin environment is brutal. However, the fundamental supply and demand dynamics setting up for late 2025 and into 2026 appear genuinely constructive for producers who position themselves strategically.

Export demand remains incredibly robust — Mexico alone accounts for over 50% of our NDM exports[1], and demand for milk powder blends in Southeast Asia continues to grow. That export strength is putting a floor under the powder complex, which is supporting Class IV prices.

Domestically, the demand picture is mixed but not terrible. Food service recovery continues to outpace retail, which explains why we’re seeing barrel premiums over blocks. The broader food service industry is holding up better than many people expected. What’s particularly noteworthy is how this barrel-block spread directly affects the weighted average cheese price that determines Class III values.

From industry observations, the fresh cow market is also telling an interesting story — operations that can maintain steady calvings through this tough period are positioning themselves well for when milk premiums return.

Bottom Line: The Three Things You Need to Do This Week

Look, I can’t stress this enough — run your numbers on feed costs as a percentage of milk revenue. If you’re pushing above 60%, you need protection strategies in place. Period. Don’t wait for costs to moderate because the structural drivers suggest they won’t.

Second, audit your risk management strategy against your actual milk check structure. Ensure that any DRP coverage accurately reflects how your revenue is actually generated, including class utilization, regional factors, and component values. Don’t hedge Class III risk if Class IV accounts for half of your revenue stream. That’s just throwing money away.

Third, start thinking about this challenging period as an opportunity rather than just surviving. Producers who use sophisticated financial planning to bridge the current difficulties will be able to capture value when milk prices rise, rewarding the survivors.

The market transition is happening whether we’re ready or not. The question isn’t whether margins will improve — the futures curve suggests they will. The question is whether you’ll be positioned strategically when they do.

What strikes me most about this whole situation is how it’s separating operations based on management sophistication. The dairy industry is evolving rapidly, and producers who adapt their strategic thinking to match this evolution will be the ones writing the success stories when we look back on this period.

The evidence suggests a fundamental re-evaluation of how we approach profitability in this business. Are you adapting your approach accordingly? Because from what I’m seeing in the data and talking to producers across the country, the operations that make these adjustments now are going to be the ones still milking strong in 2026 and beyond.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!