Your banker knows. Your co-op won’t say it. China’s birth crisis means your 300-cow dairy has 90 days to decide its fate. Here’s how.

EXECUTIVE SUMMARY: China’s 42 million tonne milk mountain isn’t temporary—it’s the product of a 48% birth rate collapse that permanently eliminates demand for 5% of global milk production. If you’re running a 200-500 cow dairy, this structural shift means you’re losing $359,609 annually compared to 2,000-cow operations, a gap that superior management cannot close. With milk prices locked at $16.50-18.00/cwt through 2027, you have exactly three viable options: borrow $8-15 million to scale beyond 1,500 cows, pivot to premium markets with guaranteed contracts (organic, A2, grass-fed), or execute a strategic exit that preserves your equity. The difference between acting now and waiting is stark—strategic exit today nets 70-85% of equity ($1.5M), while forced liquidation in 12 months recovers just 30-50% ($700K). Every month of indecision bleeds $23,000-55,000 through operating losses and accelerating asset depreciation. Your Q1 2026 decision isn’t about whether you’re a good farmer—it’s about whether you’ll control your family’s financial future or let market forces decide for you.

Let me share something that’s been on my mind lately—and I think it deserves careful attention from every dairy farmer reading this. China’s sitting on 42 million tonnes of surplus milk, based on their agriculture ministry’s September reports. That’s roughly 5% of global production, just… sitting there. And here’s what’s interesting: this isn’t your typical market cycle that we’ve all weathered before.

You know, I’ve been digging through the data, talking with economists at Cornell and Wisconsin’s dairy programs, and what’s emerging is a picture that’s fundamentally different from anything we’ve navigated since—well, probably since we all switched from hand milking to mechanical systems. Understanding why this time really is different —and knowing what steps to take right now —could make all the difference for your operation over the next 24 months.

Why This Crisis Breaks All the Old Patterns

So I was looking back at my notes from the 2009 downturn the other day. Remember that one? USDA data shows all-milk prices bottomed out at $11.30 per hundredweight in July 2009, then bounced right back within 12 months. The 2016 slump—you remember, when Russia imposed an embargo and the EU eliminated quotas—that stabilized within 18-24 months, according to the dairy network analysis I’ve been reviewing. Even COVID, for all its disruption, saw our sector adapt remarkably well within months. There’s actually some fascinating research in the Journal of Dairy Science from 2021 documenting how quickly we pivoted.

But China? This is something else entirely.

What farmers are discovering—and China’s National Bureau of Statistics backs this—is that we’re dealing with a demographic reality nobody can fix. Their birth rate collapsed from 12.43 per 1,000 people in 2016 to just 6.39 in 2023. That’s a 48% decline, folks. The population of kids aged 0-3… you know, the ones drinking all that infant formula? Down from 47 million to 28 million in just five years. Those babies don’t exist and won’t magically appear if milk prices recover.

Here’s what happened: After that horrific 2008 melamine scandal—six babies died, 300,000 were hospitalized according to World Health Organization reports—Beijing went all-in on dairy self-sufficiency. The Chinese began importing hundreds of thousands of Holstein cattle in 2019, according to the customs data I’ve been reviewing. Average herd sizes grew 40% year-over-year through late 2023, if you can believe it. They hit 85% self-sufficiency, up from about 70%—exactly what they wanted. Problem is, they built all this capacity assuming demand would keep growing.

Now here’s where it gets really unusual. Chinese raw milk prices have been underwater for over two years—sitting at 2.6 yuan per kilogram against production costs of 3.8 yuan, based on China Dairy Industry Association data from October. Farmers there are literally paying to produce milk. Yet production continues, propped up by government subsidies, soft loans from state banks, and political imperatives that… well, they just don’t follow normal market rules.

The Hard Math Behind Mid-Size Dairy Challenges

USDA’s Agricultural Resource Management Survey data reveal a stark cost differential across farm sizes. And this isn’t about who’s a better farmer—it’s about structural economics that management alone can’t overcome.

Looking at production costs per hundredweight from the USDA’s dairy cost and returns estimates:

- Farms with fewer than 200 cows: generally running $23.68-33.54/cwt

- 200-499 cows: around $20.85/cwt

- 500-999 cows: typically $18.93/cwt

- 1,000-1,999 cows: averaging $17.39/cwt

- 2,000+ cows: down to $16.16/cwt

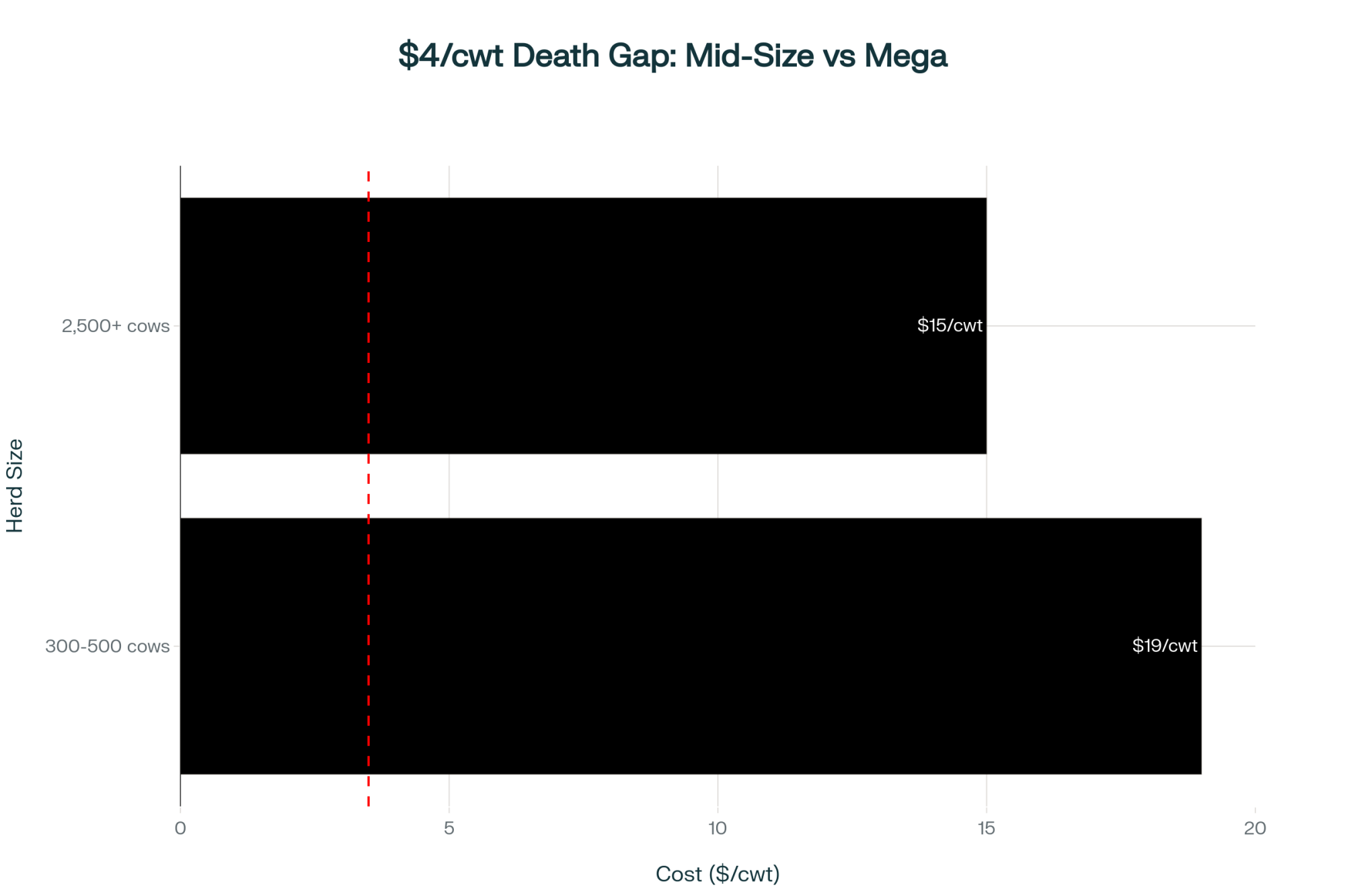

With USDA’s World Agricultural Supply and Demand Estimates showing milk prices at $16.50-18.00/cwt through 2026-2027, you can see the problem pretty clearly. A 300-cow operation faces production costs about $4.69/cwt higherthan a 2,000-cow operation. On annual production of, say, 76,650 cwt, that’s a $359,609 competitive disadvantagebefore you even wake up in the morning.

What’s really interesting is research by agricultural economists at Wisconsin showing that management quality accounts for only about 22% of the variance in profitability. The other 78%? That comes from herd size and the resulting cost structure. Labor costs alone create roughly a $2.60/cwt difference between mid-size and large operations. Fixed overhead adds another $3.33/cwt disadvantage. Even feed costs—where you’d think everyone’s buying the same corn—show about a $1.40/cwt advantage for large operations through volume purchasing and precision nutrition programs.

You just can’t manage your way out of that kind of structural disadvantage, no matter how good you are. And believe me, I’ve seen some excellent managers struggle with this reality.

Three Paths Forward: Finding Your Best Option

After talking with farm management specialists at Penn State Extension and Farm Credit consultants across the Midwest, three viable paths keep emerging for dairy operations facing this transformation. Each has specific requirements that need honest evaluation.

Path 1: Scale to Competitive Size (1,500-2,500+ cows)

I’ve noticed that farmers considering expansion need to tick quite a few boxes before this makes sense. Agricultural lenders at CoBank and Farm Credit are generally looking for:

- Debt-to-asset ratio below 40% before you even start

- At least $300,000-600,000 in working capital reserves (expansion disrupts cash flow for 12-24 months, as many of us have learned the hard way)

- Access to $8-15 million in financing

- Another 500-800 acres of land are available

- Confirmation from your processor that they can handle the additional volume

As consultants like Tom Villenga in Wisconsin often explain, it typically takes 18-24 months from groundbreaking to positive cash flow. And farmers need to understand—you’re not really farming at that scale anymore. You’re managing 8-15 employees and running a business. It’s a completely different skill set.

Path 2: Pivot to Premium Markets

This development suggests a real opportunity for the right operations. Organic milk premiums are running $8-12/cwt over conventional, based on CROPP Cooperative’s October market reports. But location matters enormously here.

Economists at Cornell’s Dyson School have documented that you need to be within 75 miles of a metro area with a population of 250,000+ to make premium markets work. The affluent consumers who pay those premiums are concentrated in specific geographic areas—that’s just the reality of it.

What farmers are finding crucial: secure your premium buyer contracts before beginning any conversion. I keep hearing stories—you probably have too—of operations that completed expensive organic transitions only to discover no premium buyers existed in their region. That’s a tough spot to be in.

The conversion timeline’s no joke either. It’s a full three years before you see those organic premiums, based on USDA’s National Organic Program guidelines. During that time, you’re incurring organic costs while still selling at conventional prices. Budget $50,000-100,000 for a 300-cow operation to make that transition, based on case studies from Vermont’s sustainable agriculture program.

Path 3: Strategic Exit While Preserving Equity

Nobody likes talking about this option, but sometimes it’s the smartest move. Industry consultants like Gary Sipiorski at Vita Plus, who’s been working with dairy operations for decades, often point out that strategic exit while you’re solvent preserves 70-85% of equity. Forced liquidation after covenant violations? You’re looking at 30-50% if you’re lucky.

Here’s something most farmers don’t know about: Section 1232 of the bankruptcy code can save substantial capital gains taxes for farmers with highly appreciated land. Agricultural bankruptcy attorneys who specialize in this area explain that if appropriately executed before selling assets, farmers can save $200,000-500,000 in capital gains taxes through a strategic Chapter 12 filing. It’s worth understanding these provisions even if you hope never to use them.

The indicators suggesting this path include working capital trending below 6 months of operating expenses, being 55+ without a committed next generation, or simply having no viable path to profitability at forecast milk prices.

The Asset Value Reality Nobody Discusses

What’s particularly concerning—and I don’t hear this discussed nearly enough at co-op meetings—is how quickly farm asset values deteriorate when a region’s dairy sector struggles.

Mark Stephenson at Wisconsin’s Center for Dairy Profitability has done extensive work on this. When dairy becomes structurally unprofitable in a region and multiple farms exit simultaneously, those anticipated liquidation values farmers count on for retirement… they simply evaporate.

Think about it. Land you believe is worth $9,000 per acre based on that sale down the road last year? When 8-12 dairy farms in your county hit the market simultaneously with no qualified buyers, you might see $6,000-6,500. I’ve watched it happen in several Wisconsin counties over the past three years, and it’s heartbreaking.

Equipment values face the same compression. That 2018 John Deere you figure is worth $75,000? When six similar tractors are at auction within 50 miles, you might get $48,000. And dairy-specific infrastructure—milking parlors, freestall barns—they become nearly worthless without other dairy farmers to buy them.

Based on Farm Financial Standards Council accounting principles, farms in declining dairy regions face combined monthly wealth destruction of $23,000- $ 55,000 from operating losses and asset depreciation. Your farm’s value isn’t static—it’s changing every month based on regional dynamics.

What Co-ops Are Saying vs. Market Reality

Comparing cooperative messaging against actual market data reveals… well, let’s call it a disconnect.

When co-ops say “market conditions will stabilize by late 2026,” they’re technically correct—USDA projects Class III prices around $18-19/cwt. But here’s what they’re not emphasizing: that’s still below breakeven for operations under 1,000 cows while remaining profitable for 2,000+ cow operations. In other words, “stabilization” actually accelerates consolidation rather than providing relief.

This disconnect partly stems from structural conflicts within the cooperative model itself. Market analysts like Phil Plourd at Blimling and Associates have documented how co-ops need maximum milk volume to spread fixed processing costs. They have an incentive to keep members producing, even at a loss—it’s just the nature of the cooperative structure.

What really caught my attention was data from the National Milk Producers Federation showing that DFA lost over 500 member farms in 2023. They’re anticipating shrinking from current levels to around 5,100 farms by 2030. That’s roughly a 9-10% annual attrition rate among their membership. If co-ops are successfully supporting family farms, why are 280+ farms leaving each year?

Looking Ahead: The 2028 Dairy Landscape

Based on consolidation trends documented by Rabobank’s dairy research group and factoring in China’s sustained market pressure, here’s what I think we’re looking at:

Total U.S. dairy farms will likely decline from today’s roughly 31,000 to somewhere around 20,000-22,000 by 2028—that’s a 29-35% reduction. But the distribution shift is even more dramatic.

Operations with 2,000+ cows, currently about 800 farms producing 46% of U.S. milk, will probably expand to 1,200-1,400 farms producing 60-65%. Meanwhile, that middle tier—200-999 cow operations in commodity production—faces a 75-85% reduction. It’s stark, but that’s what the data suggests.

What’s emerging are essentially three viable farm types:

- Industrial-scale operations (2,000-5,000+ cows) competing on efficiency

- Premium/niche producers (100-800 cows) capturing substantial price premiums

- Lifestyle farms (<100 cows) subsidized by off-farm income

The middle? It’s disappearing. And that’s a huge change for our industry.

Your Action Plan: Practical Steps for Right Now

For farmers reading this in late 2025, your window for strategic decision-making is measured in months, not years. Here’s what I’d suggest doing immediately:

This week: Calculate your true working capital per cow. Take current assets minus current liabilities, divide by cow count. If you’re below $800 per cow, you need to act fast.

Schedule a frank conversation with your banker about exactly where you stand relative to loan covenants. Don’t wait for them to call you—be proactive about it.

Have an honest family discussion about the farm’s actual financial position. I know these conversations are tough, but they’re essential.

And listen, if stress is affecting your sleep, relationships, or wellbeing, please reach out for help. The National Suicide Prevention Lifeline at 988, Farm Aid at 1-800-FARM-AID, and Iowa Concern at 1-800-447-1985 all have counselors who understand what you’re going through. There’s no shame in needing support—we all do sometimes.

Within 30 days: Engage an independent agricultural consultant—not your co-op field rep—for an honest viability assessment. Yes, it’ll cost $2,000-5,000, but it could save you hundreds of thousands in the long run.

Meet with an agricultural attorney who understands Section 1232 provisions and strategic options. Get real liquidation values for your assets from agricultural appraisers, not optimistic book values.

Develop three scenarios with your family: scale up, premium pivot, or strategic exit. Run the numbers on each. Be honest about what’s realistic for your situation.

The Success Story: Learning from Those Who’ve Navigated Change

Let me share a story about a family I’ll call the Johnsons—they represent what I’m seeing across eastern Iowa and similar situations throughout the Midwest. Third-generation dairy farmers with 380 cows faced this exact decision in early 2024, when working capital started to dwindle.

After careful analysis with their consultant, they executed a strategic exit in May 2024, using Section 1232 provisions to preserve an additional $180,000 in capital gains taxes. Today? They’re debt-free. The husband works as a herd manager for a 2,500-cow operation nearby. They kept their house and 40 acres. Their adult daughter started veterinary school this fall.

But let me be honest about something—when he talked with me about it, he said it was the hardest year of his life. “Watching that auction… seeing our cows loaded on someone else’s trailer… I couldn’t watch. Had to walk away.” His voice caught a bit. “Four generations of Johnsons milked those cows. Four generations.”

The identity crisis is real. The sense of failure—even when you’re making the smart financial decision—it’s overwhelming. He told me he didn’t go to the coffee shop for three months because he couldn’t face the questions. Couldn’t face being “the Johnson who lost the farm,” even though he’d actually saved his family’s financial future.

“But you know what?” he continued, “Looking at our grandkids playing in the yard, knowing they’ll have college funds, knowing we can sleep at night without worrying about milk prices… we made the right call. Hardest thing I ever did. Also, the smartest.”

That’s the kind of brutal honesty we need right now. Strategic exit isn’t failure—it’s protecting what matters most. But that doesn’t make it easy.

Key Takeaways for Your Decision

What this all boils down to is understanding that we’re experiencing a structural transformation, not a typical cyclical downturn. China’s demographic shift and production surplus represent permanent changes to global dairy demand—at least for the foreseeable future.

The $3-5/cwt cost advantage that 2,000+ cow operations enjoy over 200-500 cow farms simply can’t be overcome through better management. It’s structural, and we need to accept that reality.

Every month of delay in stressed markets costs not just operating losses but also substantial asset-value deterioration—that hidden wealth destruction that nobody talks about at the coffee shop.

Three paths remain viable for most operations: scaling to 1,500+ cows if you have the resources, pivoting to premium markets with guaranteed contracts, or executing a strategic exit while preserving equity.

The window for making these decisions strategically rather than under duress is closing. Industry dynamics suggest farmers need to commit to their chosen path by the end of Q1 2026.

And please, remember this: with farmer suicide rates running 3.5 times the national average according to CDC data, no amount of farm equity is worth sacrificing your wellbeing or family relationships. Your family needs you more than they need the farm.

The dairy industry’s undergoing its most significant transformation in generations. Like that shift from hand milking to mechanical systems, this change will determine which farms exist in 2028 and which become memories. The farmers who acknowledge this reality and act decisively—whether scaling up, pivoting to premium, or strategically exiting—will be the ones sharing stories of resilience rather than regret.

The choice, and the timeline, are yours. But that window for making the choice? It’s closing faster than most of us realize. What matters now is making an informed decision while you still have options.

KEY TAKEAWAYS:

- This is structural, not cyclical: China’s 42 million tonne surplus reflects permanent demand loss from a 48% birth rate collapse—recovery isn’t coming

- Your management can’t fix physics: 300-cow dairies face an automatic $359,609 annual disadvantage versus 2,000-cow operations at any skill level

- Three paths remain viable: Scale past 1,500 cows ($8-15M investment), pivot to premium markets with secured contracts, or execute strategic exit today at 70-85% equity (vs. 30-50% in forced liquidation)

- Every month costs $23,000-55,000: Operating losses plus hidden asset depreciation are turning $1.5M farms into $700K distressed sales

- Control your exit or it controls you: Make your decision by Q1 2026 while you have options—after that, loan covenants decide your fate

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The $228,000 Exit Strategy Reshaping Dairy: Inside the 55% Surge in Strategic Bankruptcies – This is the deep-dive implementation guide for “Path 3: Strategic Exit.” It reveals the exact financial mechanics of using Section 1232 to preserve hundreds of thousands more in equity compared to a traditional farm sale.

- Seven Sellers, No Buyers: The Dairy Market Signal Every Producer Must Understand Now – This article provides the critical financial benchmarks to help you choose your path. It uses your debt-to-asset ratio to argue whether you are in a position to expand, must cut costs, or need to exit immediately.

- Forget Feed Costs: The 3 Survival Strategies Defining Dairy’s Future as 12,000 Farms Face Exit by 2030 – This piece provides a tactical breakdown for “Path 1: Scale” and “Path 2: Pivot.” It details the $25k-$35k per-cow investment required for large-scale operations versus the $35-$50/cwt premiums captured by successful niche producers.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.