1.5 billion wipeout looming — Ireland’s dairy crisis signals what’s coming for all of us

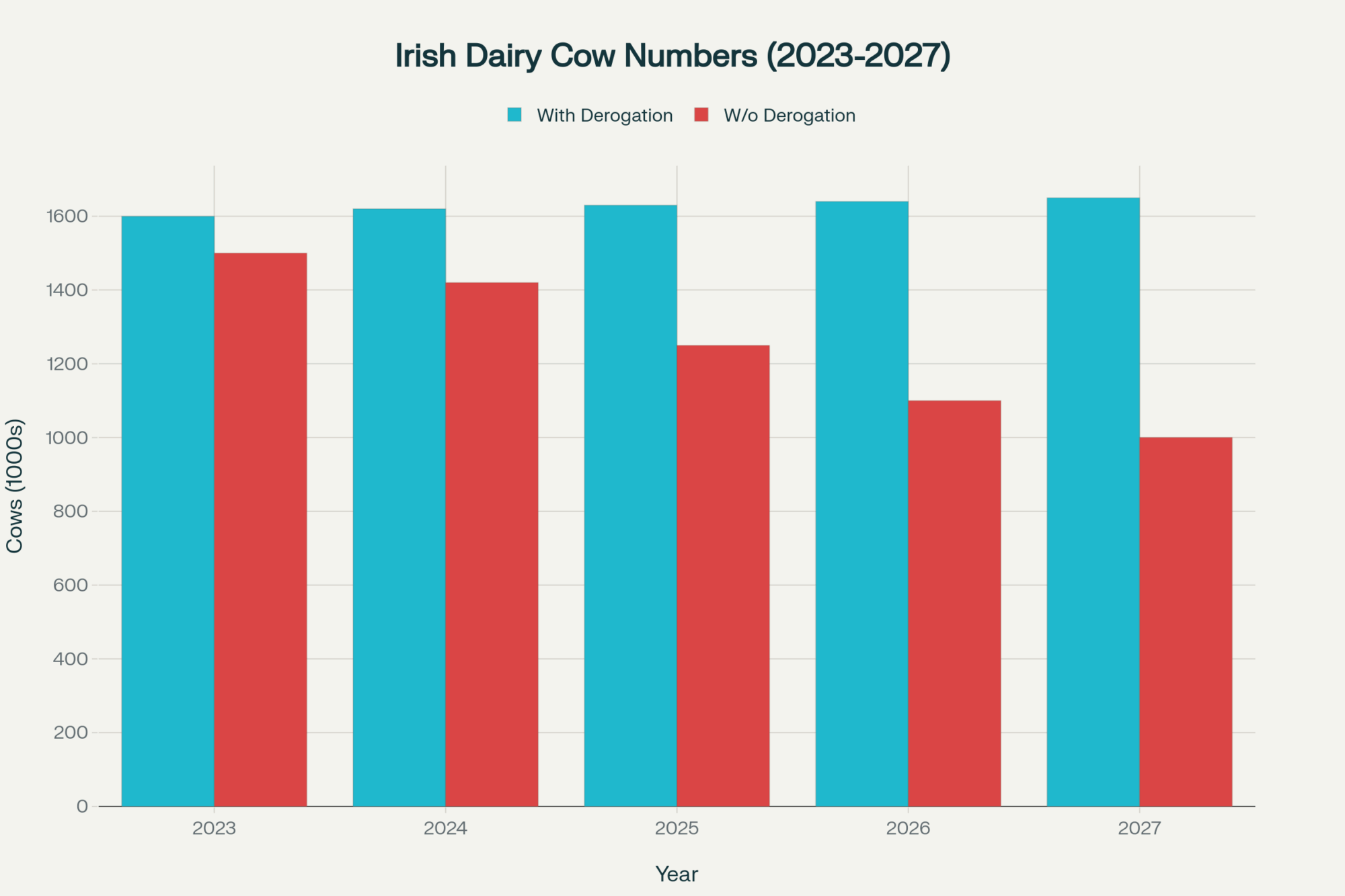

EXECUTIVE SUMMARY: The dairy world’s shifting under our feet, and we’ve got the inside story. Ireland’s facing a €1.5 billion hit with 22% herd cuts and 1.5 billion fewer litres — that’s not just Cork’s problem, that’s a preview of what environmental regulations can do to any of us. Here’s what really gets us fired up: while Irish farmers scramble, smart producers worldwide are positioning for the biggest market shuffle since quotas ended. Our research shows this stems from EU nitrates policy tightening and Ireland’s derogation ending December 2025 — but here’s the kicker, this creates massive opportunities if you’re ready to pivot. We’re seeing New Zealand ramp up capacity, Dutch processors expand, and US operations eyeing those 140+ export markets Ireland might lose. The future belongs to producers who adapt their nitrogen management, diversify markets, and treat environmental compliance as a competitive advantage. Don’t just survive this wave — ride it to profitability.

KEY TAKEAWAYS

- Slash regulatory risk by 22% through proactive nitrogen management — Start mapping your current N usage against tightening limits now, before you’re forced into emergency herd cuts like Irish producers (Teagasc economic modeling shows this prevents €10,000+ annual income hits)

- Capture €6.3 billion in shifting export opportunities — Engage with processors planning 2025-26 capacity expansions while Irish supply contracts; New Zealand’s already positioning with new plants (Dairy Reporter analysis confirms first-movers get premium contracts)

- Turn environmental compliance into profit centers — Invest in precision grazing and fertilization tech that cuts nitrogen waste while boosting efficiency; 55% emissions targets by 2030 aren’t going away, so get ahead of the curve (EPA data shows compliant operations avoid penalty costs AND capture sustainable premiums)

- Build market diversification before you need it — Ireland’s 94% export dependency made them vulnerable; don’t make the same mistake when regulations can change overnight (Bord Bia export data proves diversified operations weather policy shocks better)

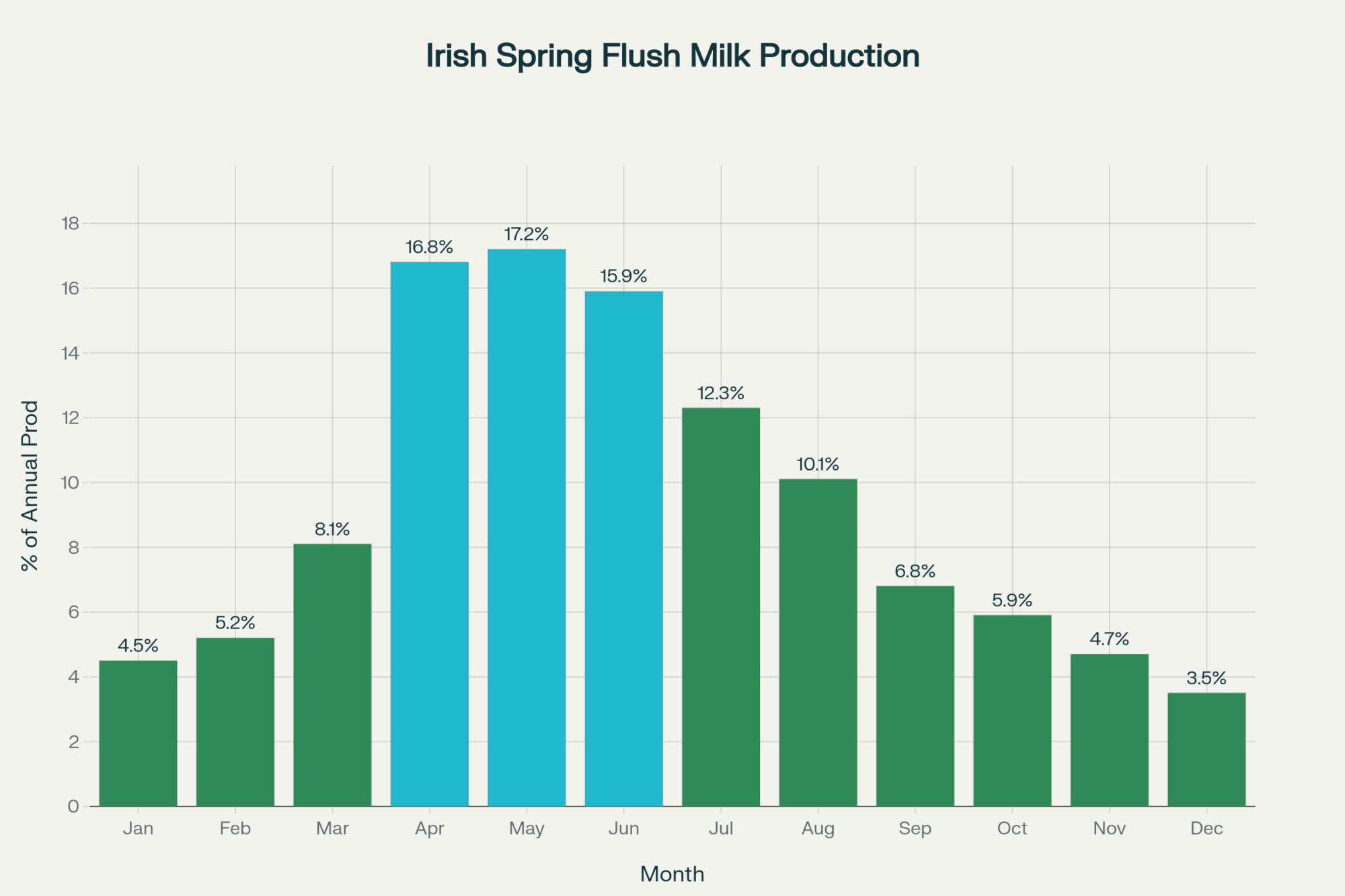

- Monitor spring production patterns like your income depends on it — Ireland’s seasonal flush system amplifies regulatory impacts; understand your own production cycles and processing capacity vulnerabilities before they bite you (AHDB seasonal analysis shows timing matters more than total volume)

I was chatting with a dairy farmer from Cork who runs about 180 cows. Smart as they come — knows his genetics, his feed, and all the quirks of grazing grass. But when I asked about the looming nitrates debacle, he dropped the hammer: “I’m out at least 40 cows if Brussels pulls the plug.”

That’s the brutal reality creeping up on Irish dairy. They face a potential €1.5 billion hit (Bord Bia, 2024), with up to 22% fewer cows and a drop of around 1.5 billion liters in milk production (Teagasc, 2025). With Irish dairy shipped to over 140 countries, this will send shockwaves far beyond Ireland’s shores.

Some might shrug, but trust me, this is a big deal for all of us.

What’s this nitrates stuff all about?

Ireland’s had a bit more breathing room — farms can run up to 250 kg nitrogen per hectare, higher than the EU’s 170 kg limit (Department of Agriculture, 2025). That flexibility has powered their big leap since quotas ended.

But it’s changing fast. Some spots will drop to 220 kg this year, and the whole derogation ends at the close of 2025 (Irish Farmers Journal; Department of Agriculture, 2025).

In farming hubs like Cork and Kerry, many face serious cuts. For example, a farm with 180 cows on 90 hectares pulling 520,000 liters will likely need to reduce to around 140 cows just to stay legal.

The spring rush and the crunch

Milk’s far from steady — half the output floods in during April to June, the famous “spring flush” (AHDB, 2025). This seasonal surge is what makes Ireland’s grass-based system work, but it also creates massive vulnerability.

Processors like those in Mitchellstown and Charleville work around the clock during these months. Industry experts note serious concerns about potential processing capacity underutilization during production declines, though specific utilization rates remain confidential to individual processors.

Talked to a feed guy near Macroom, and he told me — when you lose 40 cows, there’s more than just fewer udders. Feed plans, labor demands, and cash flows all get tangled up.

A shifty game with hungry players

That €6.3 billion export haul stretches across 140 countries (Bord Bia Export Performance Report, 2024). When Irish flows shrink, others are ready to swoop.

New Zealand’s gearing up with new processing capacity ready by 2026 (Dairy Reporter, 2025). Dutch processors are edging forward, careful but ready to capitalize on Ireland’s regulatory chaos.

Markets like China and the US won’t flip overnight — brand loyalty runs deep — but cracks will open when supply gaps appear.

The green challenge

Irish waters? Not exactly pristine — about 30% of monitoring sites exceed nitrate limits (EPA Ireland, 2024). That’s Brussels’ leverage in this whole mess.

Then add the EU’s Green Deal vision for a 55% greenhouse gas reduction by 2030 (European Commission, 2024), and you see why the tightrope keeps getting thinner.

Ireland’s challenge is balancing milk production with environmental compliance — a dance every progressive dairy operation worldwide is learning.

The rare unity

In September 2024, six heavy-hitters — including IFA, ICOS, and Macra na Feirme — banded together in a joint declaration to protect the derogation (IFA, 2024).

With 17,500 farms and 55,000 jobs on the line, that’s serious muscle when Irish farm organizations usually can’t agree on the weather.

What’s your next move?

Whether you’re milking 30 or 300, in Wexford or Donegal — it’s time to hustle and prepare.

Some Irish farmers are already adapting: trimming herds strategically, adjusting calving patterns, or investing in tech to lower nitrogen outputs (Teagasc, 2025). Others are outsourcing youngstock rearing and tightening up feed efficiency.

Processors are crunching worst-case scenarios, especially for spring flush volume declines.

Across the Atlantic, US and Canadian firms watch keenly, ready to capture market share if Irish supply contracts (Dairy Reporter, 2025).

How to stay ahead

- Don’t put all your eggs in one market or policy basket — diversify your risk

- Overachieve on compliance; meeting minimums isn’t enough anymore

- Invest in genetics and nutrition programs that maximize efficiency

- Keep your ear to the ground — policy changes directly affect your bottom line

Ignore this advice at your peril.

The Bottom Line

Ireland’s dairy saga is more than a local crisis. It’s a wake-up call for dairy producers worldwide.

Markets are reshuffling fast. Capital moves even faster. Environmental regulations are becoming competitive differentiators rather than universal burdens.

The early birds will capture the opportunities this creates.

So get chatting — with your neighbors, your vet, your feed advisor. Position your operation for what’s coming.

The shift’s already here.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Viva! Takedown: A New Playbook for Defending Your Dairy – This article provides a tactical playbook for turning environmental compliance into a competitive advantage. It reveals how to use precision feeding technology and data-driven genetics to cut nitrogen emissions by 20% and boost profitability under tightening regulations.

- Why the Global Dairy Market is Making Waves in 2025 (and What That Means for You) – Go deeper into the market shifts mentioned in the main article. This strategic analysis breaks down the global supply contractions and export opportunities, showing you where to find premium pricing and how to hedge against market volatility.

- 5 Technologies That Will Make or Break Your Dairy Farm in 2025 – Explore the innovative hardware that offers a direct response to regulatory pressures. This piece details the ROI on technologies like wearable sensors and automated feeding systems that increase efficiency, reduce waste, and build a more resilient operation.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.

Every week, thousands of producers, breeders, and industry insiders open Bullvine Weekly for genetics insights, market shifts, and profit strategies they won’t find anywhere else. One email. Five minutes. Smarter decisions all week.

The Sunday Read Dairy Professionals Don’t Skip.

The Sunday Read Dairy Professionals Don’t Skip.