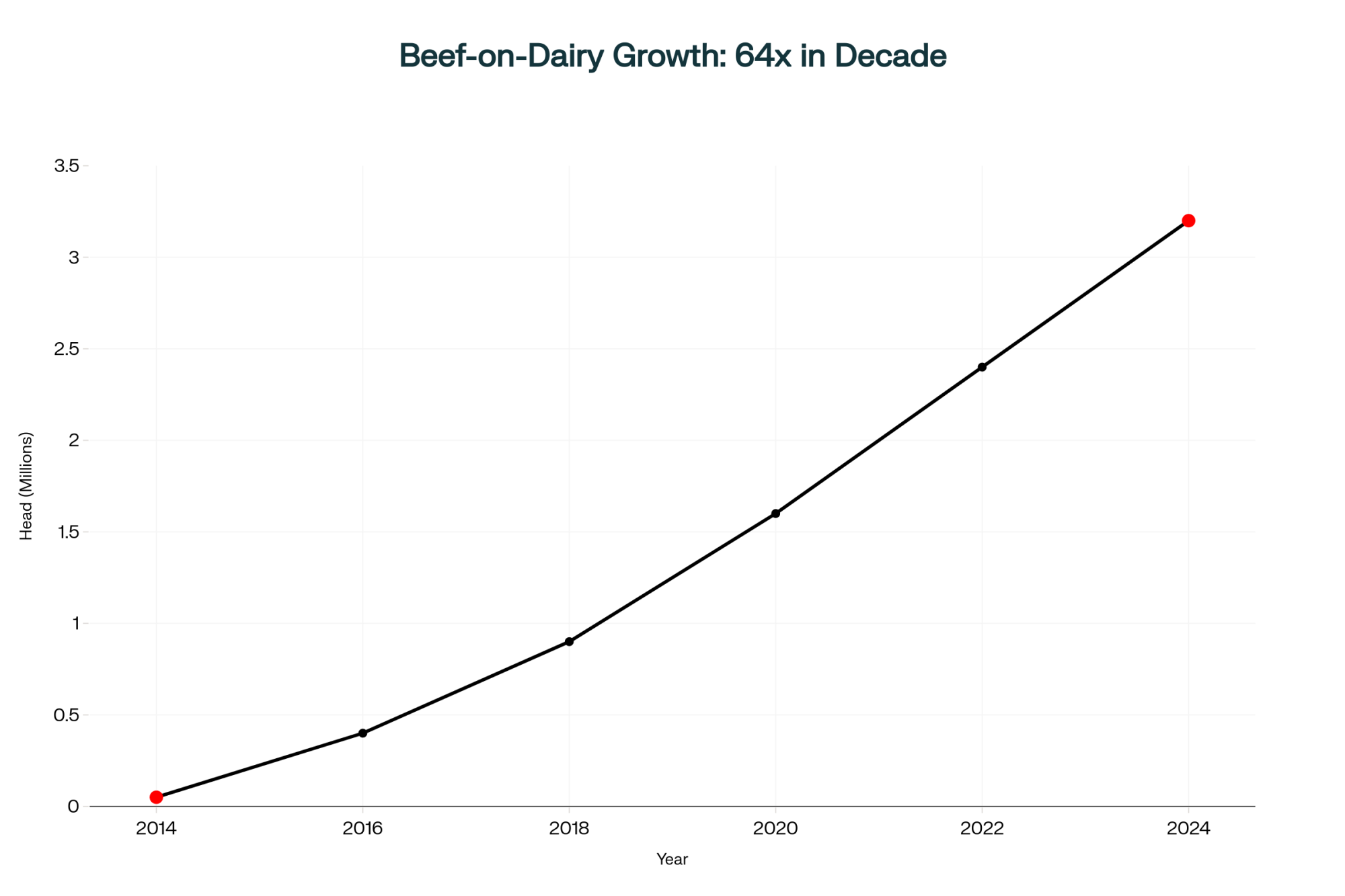

What farmers are discovering: beef-on-dairy breeding jumped from 50K to 3.2M head, boosting calf revenue from 2% to nearly 6% of total farm income

EXECUTIVE SUMMARY: What farmers are discovering is that beef-on-dairy breeding has surged from around 50,000 head in 2014 to over 3.2 million in 2024, driving calf revenue from 2% to nearly 6% of total farm income (NAAB 2024; UW Center 2025). Recent research shows that targeting sires in the top 15% for calving ease and top 20% for marbling can yield $100–$200 more per calf, translating to over $360,000 additional annual profit on a 1,500-cow dairy (Penn State 2024; K-State Extension 2025). This development suggests that building a systematic beef-on-dairy program—complete with rigorous colostrum Brix monitoring and detailed health protocols—will remain profitable even if calf prices normalize to $700 by 2028 (USDA WASDE 2025). Across regions from Pennsylvania to California, securing direct feedlot relationships can command $1,200–$1,250 per calf versus $950 at auction, enhancing cash flow and fresh cow management (UW-Madison 2025). While market cycles will fluctuate, adopting documented genetics evaluation and buyer partnerships today positions farms to thrive through changing conditions. Here’s what this means for your operation: build sustainable systems now to secure lasting profitability.

I recently spoke with a producer outside Dodge City whose operation tells a remarkable story about what’s happening in our industry. Nearly half his total farm revenue—not a supplement to milk income, but half—now comes from selling beef-cross calves. Three years ago, those same bull calves brought maybe $250 on a good day.

The National Association of Animal Breeders documented this transformation in their spring report, showing beef-on-dairy breeding has grown from roughly 50,000 head in 2014 to over 3.2 million today. For those making breeding decisions this week for next spring’s calf crop, understanding what’s really driving this shift has become essential.

What’s particularly noteworthy is what I’ve observed visiting operations from Pennsylvania to Wisconsin recently. The most successful producers aren’t simply riding today’s high prices. They’re building systems that remain profitable even when—but it’ll be when—beef calf values return to more historical levels.

Understanding the Supply Dynamics

Looking at this trend, the numbers tell a big part of the story. USDA’s July cattle inventory report revealed the U.S. beef cow herd at about 28.7 million head—the lowest level since 1961. That’s a generational shift.

Drought from 2020 through last year devastated many cow-calf operations in Texas, Oklahoma, and Kansas. When pastures dried up and feed costs skyrocketed, producers had to liquidate. Now we have about 3.7 million replacement heifers according to the USDA’s latest count, down 3% from two years earlier.

Even with perfect weather tomorrow (which Western Kansas certainly isn’t seeing yet), the biological realities remain unchanged. A heifer bred today won’t calve for nine months, and that calf requires another 18–20 months to hit market weight. That points toward beef supply normalization not before late 2027 or early 2028.

Here’s what’s fascinating: dairy farms have stepped in to fill that gap. NAAB’s data from March shows dairy operations now purchase 84% of all beef semen sold domestically—five times more than traditional beef ranchers. That reversal of historical patterns underscores a major shift.

Fed cattle prices hovering around $214 per hundredweight on the CME are historic. USDA’s World Agricultural Supply and Demand Estimates project we could see $249 next year, with most analysts keeping prices elevated through 2027.

The Genetics Investment That Pays Dividends

What farmers are finding is that sire selection matters more than ever. Many assume that any Angus bull improves on Holstein genetics for beef production. While technically true, practically, that oversimplification can cost hundreds per head.

Penn State’s breed comparison published in the Journal of Animal Science this year shows Angus crosses finish in about 121 days with gains of over 4 pounds daily. Strong. But Limousin crosses require 152 days with gains just over 3 pounds daily—that extra month of feeding means additional costs and lower feedlot bids.

What caught my attention was Simmental: 122-day finish with nearly 4 pounds daily gain, matching Angus performance. Yet many operations haven’t considered this breed simply because Angus has become the default choice.

Michigan State’s Translational Animal Science research shows beef-dairy crosses finish roughly 21 days faster than straight Holsteins, with 20% larger ribeyes and superior yield grades. But—and this is crucial—those gains only materialize with the right genetics.

Wisconsin Extension notes Limousin pregnancies typically last 285–287 days compared to Holstein’s 279 days. Those extra days in the close-up pen, eating expensive pre-fresh rations but not producing milk, can cost $40–$50 per cow. Across 400 breedings, that adds up fast.

Superior Livestock’s auction summaries, compiled by Kansas State Extension this August, indicate the premium for superior genetics versus average bulls at $100–$200 per calf. On 100 calves, saving $6 on semen while losing $100 at sale just doesn’t pencil out.

Regional Market Dynamics and Opportunities

Farmers are also finding huge regional price gaps. New Holland’s Monday sale in Pennsylvania, according to their October reports, sees 75-pound beef-cross calves bringing $1,400–$1,725 per hundredweight. That same calf at Equity Livestock in Stratford, Wisconsin, brings $900–$1,200.

Why the difference? Pennsylvania sits at the heart of America’s veal industry. USDA data shows about 133,000 formula-fed calves processed annually in that region, with Lancaster County a major hub and generations of family-run operations creating steady demand.

Penn State Extension specialists explain that New Holland’s market structure—sales on Monday, Thursday, and Wednesday—creates exceptional liquidity. When veal buyers and feedlot buyers compete, prices naturally rise.

What’s encouraging for producers outside Pennsylvania is the chance to capture similar value through direct feedlot relationships. The University of Wisconsin’s Center for Dairy Profitability reports Wisconsin dairies shipping calves to Kansas earn $1,200–$1,250 when local auctions pay $950.

I recently visited a Wisconsin operation near River Falls that ships about 200 calves annually to a Kansas feedlot. The producer told me, “They pay us a premium because we provide documented genetics, health records, and consistent quality. It’s well worth the extra coordination.”

California dairies facing water and regulatory challenges, and Texas operations dealing with heat stress in transition periods, are also finding beef-dairy diversification boosts cash flow when milk prices are tight.

Financial Realities: A 1,500-Cow Example

Let’s break down what this means for a 1,500-cow dairy breeding 40% to beef:

2022 Baseline (All Dairy Breeding)

- Holstein bull calves: 612 annually

- Revenue at $250 each: $153,000

- Semen costs: $78,000

- Net calf income: $60,000

2025 With 40% Beef Breeding

- Beef crosses: 285 at $1,300 = $370,500

- Holstein bulls: 229 at $600 (reflecting the elevated overall cattle market) = $137,400

- Total calf revenue: $508,200

- Semen costs: $76,000 (as premium conventional beef semen often replaces more costly sexed dairy semen)

- Net profit from calves: $420,000

That’s an improvement of $360,000 annually—profit, not revenue.

The University of Wisconsin’s dairy profitability reports show calf sales jump from 2% to nearly 6% of total revenue. Producers breeding 50–60% to beef are seeing calves represent 8–12% of revenue. That diversification is a welcome buffer when milk prices drop.

Planning for Market Normalization

Nobody expects these prices to last forever. CoBank’s dairy quarterly outlook suggests gradual moderation as supply recovers, though timing remains uncertain.

Economists modeling historical patterns and current fundamentals anticipate:

- 2026: Beef calves near $1,250

- 2027: Approximately $1,100

- 2028: Potentially $950 (base case)

The bear-case scenario—if Mexican imports resume in force, beef herds rebuild quickly, and dairy-beef calves flood the market—could see $700 calves by 2028.

Even at $700, beef-dairy remains more profitable than Holstein bulls alone. The break-even point where beef-dairy loses its edge sits around $145 per calf. Historical prices have never approached that level, even during the 2008–2009 economic downturn.

Cornell’s dairy management specialists caution against expansion decisions based on peak prices. Farms that factored $1,300 calf revenue into projections risk financial stress if markets normalize rapidly.

Implementation Strategies That Work

From visiting dozens of operations, I’ve noticed successful programs share certain practices:

Genetics Evaluation: Review breeding records and consult breed association EPD databases. Bulls outside the top 15% for calving ease and the top 20% for marbling need revaluation.

Feedlot Partnerships: Build relationships with three feedlots within shipping distance. Phone calls often create stronger commitments than emails. Buyers prioritize documented genetics and health records.

Documentation Systems: Recording data at birth takes minutes:

- Birth date and weight

- Dam ID and sire genetics

- Colostrum management (Brix readings >22%)

- Health protocols and treatments

- Sale weight and age

Premium Genetics Investment: Spending $18–$25 on beef semen instead of $10–$12 often earns $100–$200 per calf premium at auction or on contract.

Trial Shipments: Start with batches of 10–20 documented calves. Feedlots track health, average daily gain, and feed conversion, then share that data so dairies can refine protocols.

Documented standard operating procedures—breeding protocols, calf care standards, health programs—ensure consistency. Regular check-ins with buyers build relationships that drive premiums. As Dairy Herd Management noted this September, “Producers earning top prices aren’t just selling cattle—they’re selling confidence through consistent quality.”

The 2030 Outlook

By 2030, analysts expect two distinct tiers in the beef-dairy market:

- Top 15–20% of producers, with systematic quality programs and relationships, commanding $900–$1,100 per calf

- Remaining producers selling commodity calves for $600–$750, facing typical market swings

University of Illinois consultants predict the quality premium will widen from $300–$400 today to $500–$700. Quality will move from an important differentiator to the primary driver of value.

Technology adoption—genomic testing to allocate dairy vs. beef breeding—continues accelerating. While sophisticated, these data-driven approaches deliver tangible returns.

Quick Implementation Reference

Key Genetic Thresholds:

- Calving ease: Top 15% of the breed

- Marbling: Top 20% of breed

- Birth weight: Below breed average

- Ribeye area: Above breed average

Financial Break-Even Points:

- Current beef-cross value: $1,300

- Projected 2028 base case: $950

- Projected 2028 bear case: $700

- Mathematical break-even: $145

Documentation Essentials:

- Birth date and weight

- Dam ID and sire genetics

- Colostrum management (Brix >22%)

- Health protocols and treatments

- Sale weight and age

Timeline Considerations:

- Beef supply recovery: 2027–2028

- Market normalization: 2026–2027

- Quality premium expansion: Through 2030

The Bottom Line

As you consider breeding strategies, ask yourself:

- Does your program remain viable at $700 calves? If not, you’re speculating, not building a system.

- Are you building documented quality systems or chasing today’s highs? Systems endure cycles.

- Does beef-dairy complement your dairy operation or add complexity? UW-Madison specialists emphasize that it should boost butterfat performance and fresh cow management, not distract from core milk production.

What we’re witnessing transcends temporary price spikes. The dairy industry is discovering systematic value creation from calves that once had minimal worth. But long-term success rewards disciplined, sustainable approaches over opportunistic plays.

For operations willing to invest in quality genetics, develop robust documentation, and cultivate real buyer partnerships, beef-dairy can generate $200,000 to $400,000 in additional annual profit. That’s transformational for most dairies.

Those simply riding current market waves without building sustainable systems may find 2027 to 2028 challenging.

The opportunity is genuine. The transformation is occurring now. How each operation responds will determine its role in this evolving market dynamic.

KEY TAKEAWAYS

- Beef-on-dairy breeding lifted calf revenue from 2% to nearly 6% of total farm income, adding $360,000 net annually for a 1,500-cow herd (NAAB 2024; UW Center 2025).

- Use top 15% calving-ease and top 20% marbling sires to capture $100–$200 premium per calf, offsetting extended dry-period costs (Penn State 2024; K-State Extension 2025).

- Establish direct feedlot contracts to earn $1,200–$1,250 per calf vs. $950 at auction, smoothing cash flow and supporting butterfat performance in 2025 markets (UW-Madison 2025).

- Implement calf documentation—colostrum Brix >22%, health and treatment records—to boost buyer confidence, improve fresh cow management, and command relationship premiums.

- Monitor USDA heifer inventory and fed cattle futures to adjust breeding rates strategically, ensuring profitability even if calf prices fall to $700 by 2028.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- The Ultimate Guide to Finishing Beef-on-Dairy Calves for Maximum Returns – This guide provides a tactical blueprint for the critical finishing phase. It details actionable strategies for nutrition, health protocols, and stress reduction to help you maximize the value and meat quality of every beef-cross calf you raise.

- Transform Your Dairy Economics: How Beef-on-Dairy Crossbreeding Delivers 200% ROI – Go beyond simple premiums with this strategic financial analysis. The article unpacks the complete ROI calculation for a beef-on-dairy program, revealing often-overlooked profit centers and operational efficiencies that compound to boost your bottom line.

- Beef-on-Dairy in 2025: Turning Calf Premiums into Real Profit (Without Blowing Up Your Herd) – This piece demonstrates how to use low-cost genomic testing and DHI data to drive profitability. It provides an innovative framework for making precise breeding decisions, ensuring you effectively segment your herd without compromising your replacement pipeline.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!