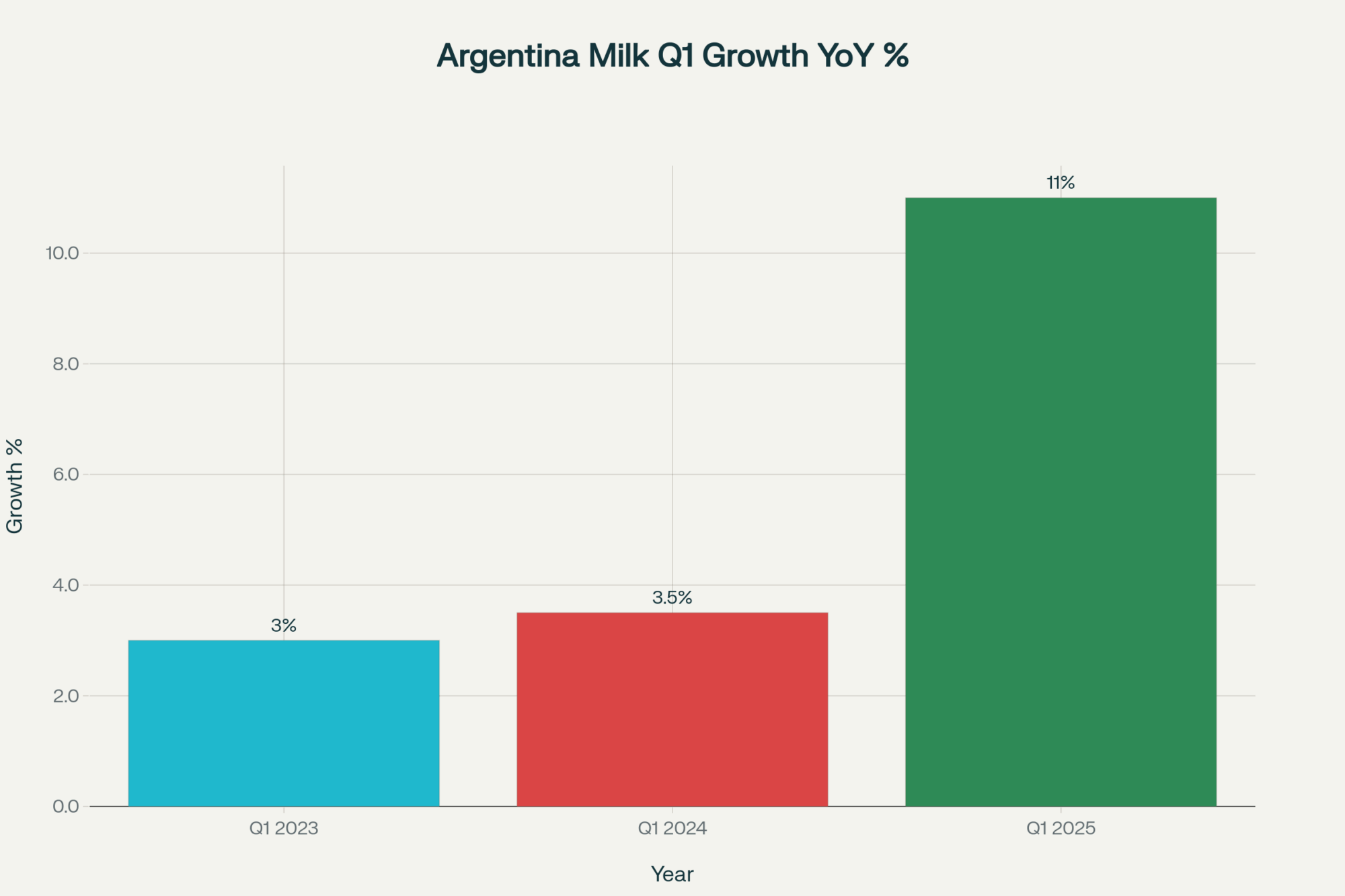

Argentina’s milk output jumped 11% in Q1—that’s reshaping global dairy prices faster than you think.

EXECUTIVE SUMMARY: Here’s what’s really goig on: Argentina just became the world’s fastest-growing major dairy producer with 11% growth in Q1 2025—and that’s going to hit your bottom line whether you like it or not. They scrapped those 9% export duties last August, making their milk powder suddenly way more competitive on global markets. We’re talking about 11.2 billion liters projected for this year, with 73% of their powder heading to Algeria alone. The thing is, while EU and U.S. production stays flat due to environmental regs and costs, Argentina’s ramping up fast with smart tech adoption. If you’re not watching milk powder futures and thinking about your operational efficiency right now, you’re missing the boat. This isn’t just another recovery story—it’s a complete reshuffling of who’s calling the shots in global dairy.

KEY TAKEAWAYS

- Monitor your commodity exposure now—Argentina’s supply surge could drop global milk powder prices by 5-10%, directly impacting your marketing strategy and contract timing.

- Audit your feed efficiency immediately—With new global competition, farms achieving 5-8% efficiency gains through precision monitoring (like Argentina’s Grupo Chiavassa) will separate winners from losers.

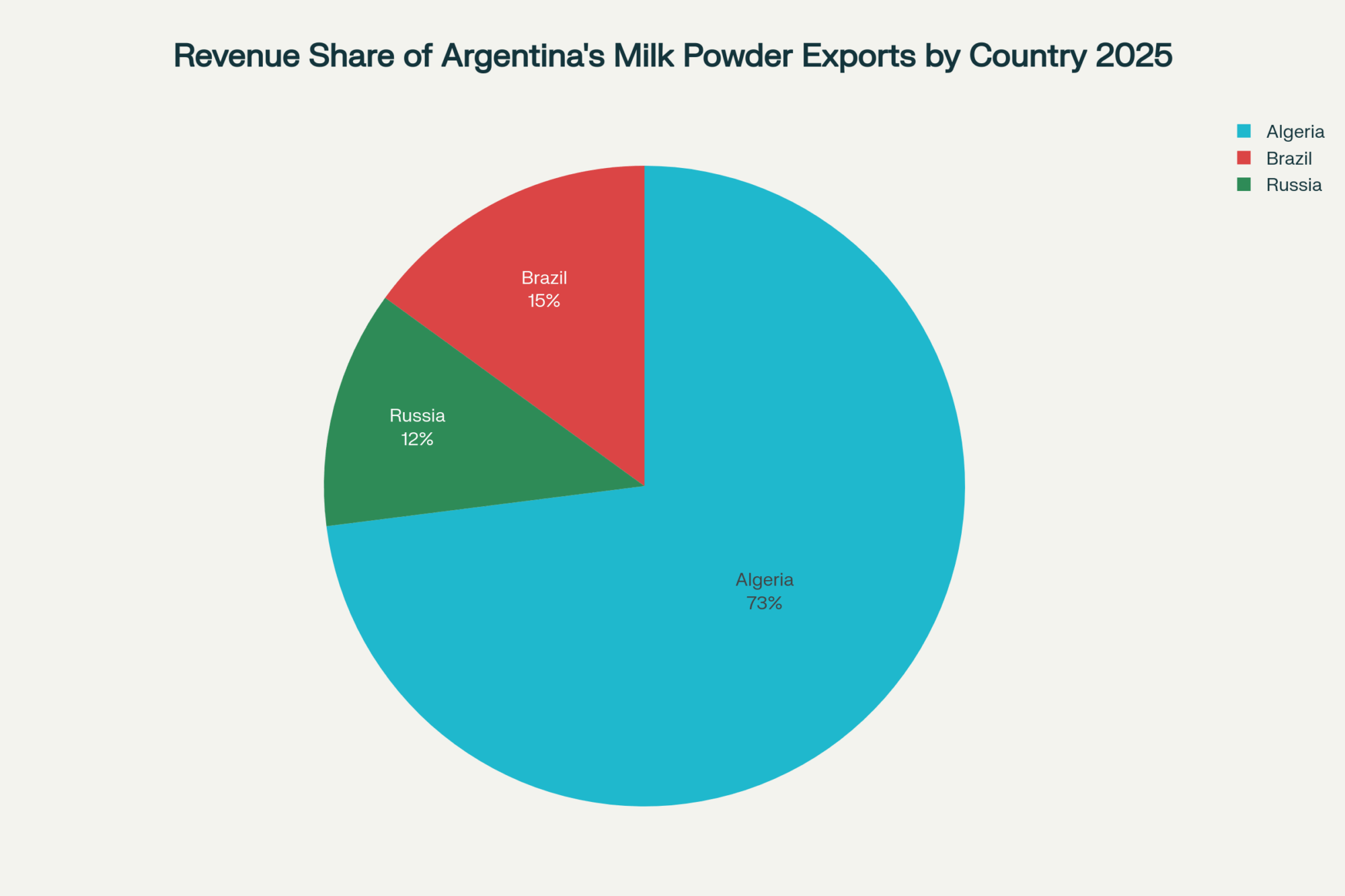

- Review your supply chain positioning—Argentina’s export growth into Algeria, Brazil, and Russia could create opportunities or headaches depending on where your milk goes and what you buy.

- Consider technology investments that boost margins—Argentine producers are using rumination collars and automated health systems to stay competitive; falling behind on farm tech isn’t an option anymore.

- Prepare for price volatility through 2025—With traditional powerhouses struggling and Argentina surging, expect more market swings and plan your risk management accordingly.

Look, the bottom line? Argentina went from crisis to global growth leader in 18 months. That kind of speed should wake us all up about how fast things can change in this business. Whether this creates opportunity or problems for your operation depends entirely on how quickly you adapt to the new reality.

Argentina’s dairy industry is sprinting ahead, reshaping the global market in a way that demands serious attention. Production gains reached nearly 11% in the first quarter of 2025, with forecasts suggesting total output close to 11.2 billion liters this year. This rapid expansion signals a significant market shift that could affect operations worldwide.

Argentina’s production surge isn’t just numbers on a chart. It’s a structural recovery driven by policy reforms and operational improvements that will influence global milk flows and pricing. This is critical for producers worldwide.

The turning point? In August 2024, Argentina permanently removed dairy export duties through Government Decree 697/2024. These tariffs—up to 9%—had long been a major drag on competitiveness. Their elimination revitalized Argentina’s position on global dairy markets.

Farm-level optimism is notable, even if expressed cautiously in public. Many producers are reinvesting in their herds. Grupo Chiavassa, a leading dairy in Santa Fe, uses rumination collars and health monitoring tech from Allflex to enhance productivity and animal health. Though exact 2025 numbers aren’t published yet, previous data confirms technology adoption is delivering real benefits.

Weather remains unpredictable. The La Niña pattern caused pasture challenges in southern provinces, but the Pampas largely received adequate rainfall to support production growth.

Key facts worth noting:

- Production growth near 11% in Q1 2025

- Total milk volume projected near 11.2 billion liters for 2025

- Algeria absorbs about 73% of Argentina’s whole milk powder exports, with Brazil and Russia also major markets

- Export duties permanently eliminated in August 2024

Some recent chatter has centered on Nestlé’s Villa Nueva plant, but the major capacity expansion there took place in 2019. The real bottleneck today, as the Argentine Dairy Observatory highlights, is the need for broad upgrades to processing and cold-storage infrastructure across the country.

Farm gate prices have nudged higher, but increasing feed, fertilizer, and land rent costs mean margins remain tight despite growing volumes.

Globally, with growth stalling in the EU and U.S. due to environmental regulations and rising costs, Argentina’s rapid rise creates new competitive dynamics that affect everyone in dairy.

What This Means for Your Operation

Watch milk powder futures closely—Argentina’s rising supply could push prices downward, affecting your margin planning. Audit your operational efficiencies and consider tech investments that might help you stay competitive. If you’re part of a supply chain, whether trading or processing, identify how Argentina’s expanding exports might overlap with your operations.

According to recent Extension work from the University of Minnesota, farms implementing precision monitoring systems are seeing 5-8% improvements in feed efficiency. That’s the kind of edge that matters when global competition intensifies.

What strikes me about Argentina’s transformation is the speed and scale of change. Two years ago, they were struggling with crisis-level inflation and production declines. Now they’re leading global growth and grabbing market share. It’s a powerful reminder that in dairy, staying nimble and informed isn’t just smart—it’s essential for survival.

Argentina’s back, they’re competitive, and they’re rewriting the rules for global dairy markets. Whether that creates opportunity or challenges for your operation depends entirely on how quickly you adapt to this new reality.

Complete references and supporting documentation are available upon request by contacting the editorial team at editor@thebullvine.com.

Learn More:

- 2025 Dairy Market Reality Check: Why Everything You Think You Know About This Year’s Outlook is Wrong – Get the strategic big picture. This article reveals how the U.S. dairy market is shifting from a volume-based to a component-based model, and explains how to align your business with these fundamental changes for higher premiums and better export opportunities.

- The Robotics Revolution: Embracing Technology to Save the Family Dairy Farm – This deep dive into robotic milking systems provides actionable insights on the ROI, labor savings, and production gains of implementing cutting-edge technology. Learn how to evaluate if this investment can boost your farm’s efficiency and competitiveness.

- How to Attract and Retain Exceptional Labor for Your Dairy Farm – A strong team is your ultimate competitive advantage. This guide offers practical strategies for improving employee retention, using technology to simplify scheduling and communication, and building a farm culture that supports long-term profitability.

Join the Revolution!

Join the Revolution!

Join over 30,000 successful dairy professionals who rely on Bullvine Weekly for their competitive edge. Delivered directly to your inbox each week, our exclusive industry insights help you make smarter decisions while saving precious hours every week. Never miss critical updates on milk production trends, breakthrough technologies, and profit-boosting strategies that top producers are already implementing. Subscribe now to transform your dairy operation’s efficiency and profitability—your future success is just one click away.

Join the Revolution!

Join the Revolution!